Key Insights

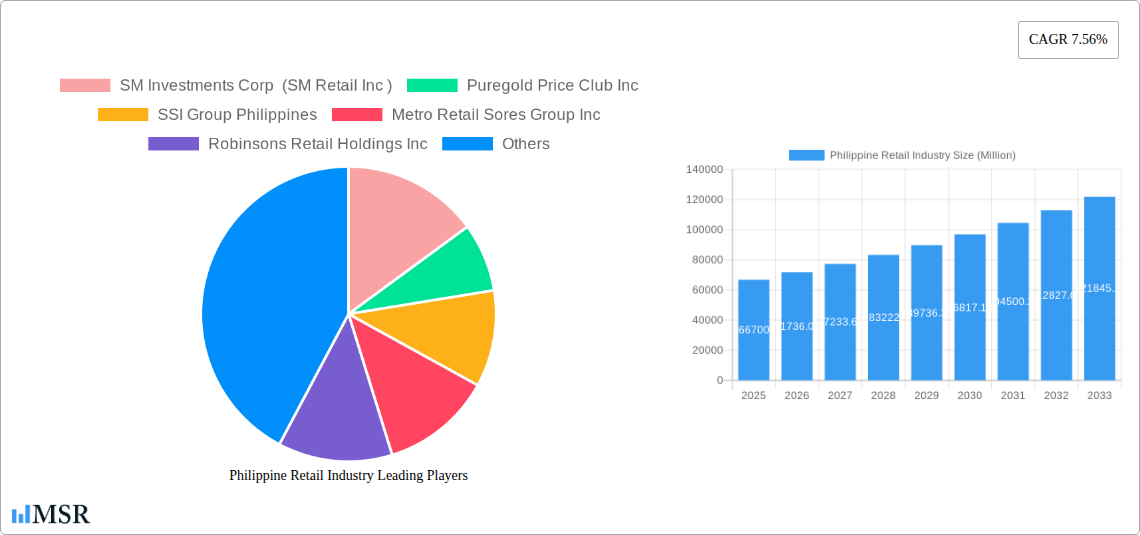

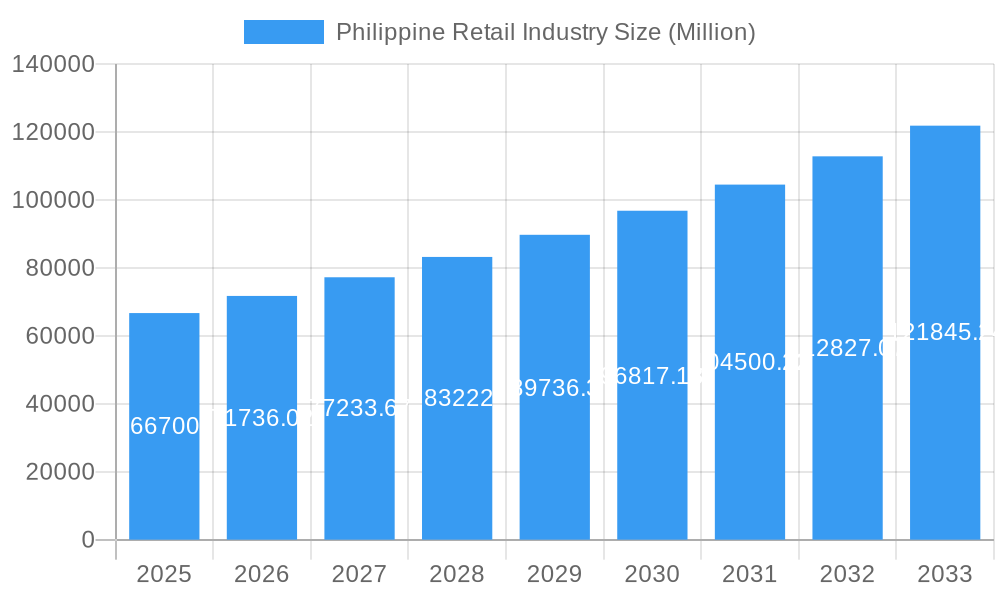

The Philippine retail industry, valued at $66.70 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.56% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, fueled by a growing middle class and increasing urbanization, are boosting consumer spending. The proliferation of e-commerce platforms and the increasing adoption of digital payment methods are transforming the retail landscape, offering both convenience and accessibility to a wider customer base. Furthermore, the strategic expansion of major retail chains into underserved areas and the introduction of innovative retail formats, like hypermarkets and convenience stores catering to diverse consumer needs, are contributing to market expansion. However, challenges remain. Inflationary pressures and fluctuations in commodity prices can impact consumer purchasing power. Intense competition among established players and the emergence of new entrants necessitates continuous innovation and adaptation to maintain market share.

Philippine Retail Industry Market Size (In Billion)

The competitive landscape is dominated by established players like SM Investments Corp (SM Retail Inc.), Puregold Price Club Inc., and Robinsons Retail Holdings Inc., alongside international brands like 7-Eleven and Alfamart. These companies are engaging in aggressive expansion strategies, focusing on omnichannel approaches to cater to evolving consumer preferences. The industry’s future trajectory hinges on adapting to evolving consumer behavior, embracing technological advancements, effectively managing supply chain complexities, and strategically responding to economic fluctuations. Successful players will be those that prioritize customer experience, leverage data analytics for informed decision-making, and invest in sustainable and ethical business practices. The next decade will likely witness further consolidation and a heightened focus on enhancing the online and offline shopping experience for Filipino consumers.

Philippine Retail Industry Company Market Share

Philippine Retail Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Philippine retail industry, covering market dynamics, key players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for investors, industry stakeholders, and businesses operating within or seeking to enter the vibrant Philippine retail landscape. The report leverages data from the historical period (2019-2024) and incorporates recent developments to provide a current and forward-looking perspective. The projected market size in 2025 is estimated at xx Million, with a compound annual growth rate (CAGR) of xx% for the forecast period.

Philippine Retail Industry Market Concentration & Dynamics

The Philippine retail market exhibits a moderately concentrated structure, dominated by a few large players like SM Investments Corp (SM Retail Inc), Puregold Price Club Inc, and Robinsons Retail Holdings Inc. However, a significant number of smaller players and emerging brands contribute to its dynamism. Market share data indicates SM Retail holds approximately xx% of the market, while Puregold and Robinsons Retail hold approximately xx% and xx%, respectively (2024 estimates). The industry displays a robust innovation ecosystem, particularly in e-commerce and omnichannel strategies. Regulatory frameworks, while generally supportive of business growth, present some challenges related to taxation and permits. Substitute products, particularly from informal retail sectors, pose a considerable competitive pressure on organized retail. Consumer trends show a growing preference for convenience, value, and online shopping experiences. The M&A activity within the sector has been relatively active in recent years, with an estimated xx M&A deals completed between 2019 and 2024, primarily driven by expansion strategies and consolidation efforts.

- Market Share (2024 Estimate):

- SM Retail Inc: xx%

- Puregold Price Club Inc: xx%

- Robinsons Retail Holdings Inc: xx%

- Others: xx%

- M&A Deal Count (2019-2024): xx

- Key Regulatory Factors: Tax policies, licensing requirements, competition laws.

- Significant Consumer Trends: Growing preference for online shopping, value-driven purchases, focus on convenience.

Philippine Retail Industry Industry Insights & Trends

The Philippine retail industry experienced robust growth in the historical period (2019-2024), driven primarily by a rising middle class, increasing urbanization, and expanding consumer spending. Technological disruptions, particularly the rise of e-commerce and digital payments, have significantly reshaped the competitive landscape. Evolving consumer behaviors, characterized by a greater adoption of online shopping and mobile payments, necessitate retailers to embrace omnichannel strategies. The market size in 2024 reached approximately xx Million, reflecting a healthy growth trajectory. The projected CAGR of xx% for the forecast period (2025-2033) reflects optimistic expectations fueled by sustained economic growth, increasing digital literacy, and the ongoing expansion of e-commerce. This growth, however, faces challenges like inflation and global economic uncertainties. The continued advancement of digital technologies will be a key driver in shaping the industry's future landscape, necessitating robust digital transformation strategies for retailers.

Key Markets & Segments Leading Philippine Retail Industry

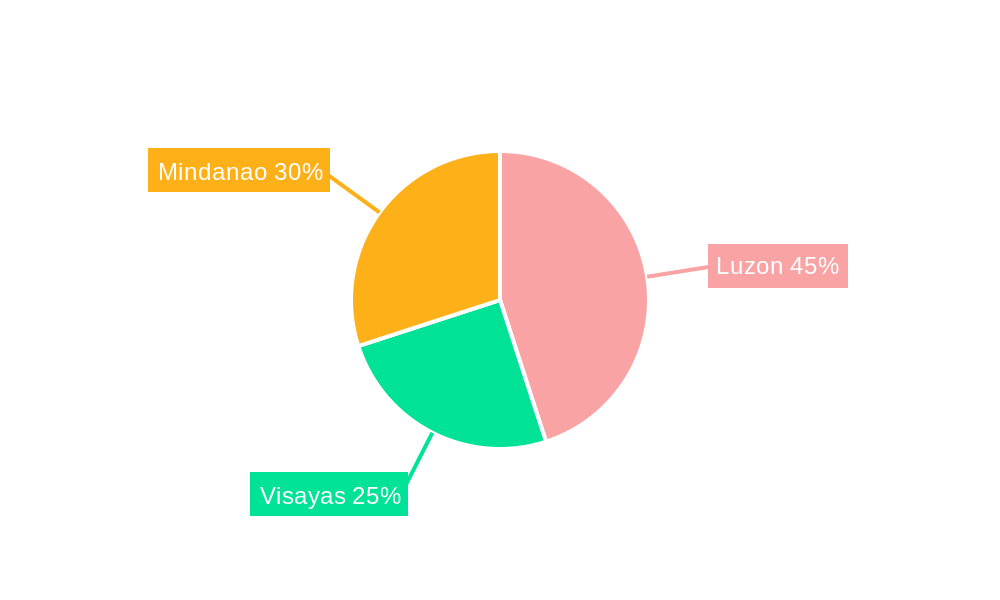

The National Capital Region (NCR) remains the dominant market for retail in the Philippines, owing to its high population density, high disposable incomes, and established infrastructure. However, other regions, particularly those experiencing rapid economic growth and urbanization, are showing significant potential.

- Drivers of NCR Dominance:

- High population density.

- High disposable income levels.

- Well-developed retail infrastructure.

- Strong consumer spending.

- Emerging Regional Markets: Cebu, Davao, and other key urban centers show significant promise. Improved infrastructure and rising consumer spending contribute to this growth.

The grocery and food retail segment, followed by apparel and fashion, and health and beauty sectors, are the largest revenue generators within the Philippine retail industry. These segments demonstrate resilience and adapt to changing consumer preferences through innovation. The dominance of these segments is sustained by increased consumer spending power and the necessity of staple goods and personal care products.

Philippine Retail Industry Product Developments

Product innovations are characterized by increased focus on personalized experiences, omnichannel accessibility, and enhanced convenience. Technological advancements like AI-powered recommendations and personalized marketing campaigns are gaining traction. Retailers are increasingly focusing on private labels, offering competitive pricing and differentiation strategies. The emphasis on sustainable products and environmentally friendly packaging reflects growing consumer awareness and demand for ethical and responsible consumption.

Challenges in the Philippine Retail Industry Market

The Philippine retail industry faces significant challenges, including regulatory hurdles that impact operational efficiency, supply chain disruptions that affect product availability and costs, and intensifying competition, particularly from e-commerce giants. These challenges cumulatively impact profitability and necessitate robust mitigation strategies from retailers. For instance, supply chain disruptions in 2022-2023 led to an estimated xx Million loss in revenue for the industry (an approximate figure based on industry-wide impacts).

Forces Driving Philippine Retail Industry Growth

Key growth drivers include strong economic growth, increasing disposable incomes, expanding middle class, and the rapid adoption of digital technologies. Government initiatives supporting infrastructure development and digitalization further boost the industry's growth trajectory. The rise of e-commerce and the expansion of digital payment systems are transforming consumer behavior, creating significant opportunities for growth.

Long-Term Growth Catalysts in the Philippine Retail Industry

Long-term growth hinges on innovation in retail formats, strategic partnerships, and expansion into new markets. Investments in technology, such as AI and data analytics, are crucial for optimizing operations and enhancing customer experience. Collaborations with fintech companies are vital for seamless digital payments and loyalty programs. Expanding into underserved areas and tapping into the potential of emerging market segments will unlock significant future growth.

Emerging Opportunities in Philippine Retail Industry

The increasing adoption of mobile commerce, the growth of the gig economy, and the rising demand for sustainable and ethically sourced products represent key opportunities. Leveraging data analytics for personalized marketing and inventory management offers considerable potential for optimizing operations. The expansion into omnichannel retail strategies to cater to evolving consumer preferences will be essential for sustained success.

Leading Players in the Philippine Retail Industry Sector

- SM Investments Corp (SM Retail Inc)

- Puregold Price Club Inc

- SSI Group Philippines

- Metro Retail Stores Group Inc

- Robinsons Retail Holdings Inc

- Rustan Supercenters Inc

- Alfamart

- 7-Eleven

- Golden ABC Inc

- Mercury Drug Corp

Key Milestones in Philippine Retail Industry

- February 2024: Rose Pharmacy inaugurates its 400th store, showcasing a partnership with Guardian health and wellness brand. This signifies expansion in the healthcare retail sector and introduction of new product lines.

- January 2024: Robinsons Retail partners with DFI Retail to launch Meadows, a premium brand, in the Philippines. This strategic move expands product offerings within the grocery and lifestyle retail sector.

Strategic Outlook for Philippine Retail Industry Market

The Philippine retail industry exhibits strong growth potential driven by favorable demographics, increasing consumer spending, and technological advancements. Strategic opportunities include focusing on omnichannel strategies, leveraging data analytics, and fostering strategic partnerships. Embracing sustainability and ethical sourcing will be critical for long-term success. The industry's future is characterized by innovation, adaptation, and a focus on providing superior customer experiences.

Philippine Retail Industry Segmentation

-

1. Products

- 1.1. Food and Beverage

- 1.2. Personal and Household Care

- 1.3. Apparel

- 1.4. Footwear and Accessories

- 1.5. Furniture

- 1.6. Toys and Hobbies

- 1.7. Electronic and Household Appliances

- 1.8. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Department Stores

- 2.4. Specialty Stores

- 2.5. Online

- 2.6. Other Distribution Channels

Philippine Retail Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Philippine Retail Industry Regional Market Share

Geographic Coverage of Philippine Retail Industry

Philippine Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel

- 3.2.2 Cosmetics

- 3.2.3 Footwear

- 3.2.4 Watches

- 3.2.5 Beverages

- 3.2.6 and Food

- 3.3. Market Restrains

- 3.3.1 The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel

- 3.3.2 Cosmetics

- 3.3.3 Footwear

- 3.3.4 Watches

- 3.3.5 Beverages

- 3.3.6 and Food

- 3.4. Market Trends

- 3.4.1. The Philippines' Food and Beverage Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Food and Beverage

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel

- 5.1.4. Footwear and Accessories

- 5.1.5. Furniture

- 5.1.6. Toys and Hobbies

- 5.1.7. Electronic and Household Appliances

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Department Stores

- 5.2.4. Specialty Stores

- 5.2.5. Online

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products

- 6.1.1. Food and Beverage

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel

- 6.1.4. Footwear and Accessories

- 6.1.5. Furniture

- 6.1.6. Toys and Hobbies

- 6.1.7. Electronic and Household Appliances

- 6.1.8. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Department Stores

- 6.2.4. Specialty Stores

- 6.2.5. Online

- 6.2.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Products

- 7. South America Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products

- 7.1.1. Food and Beverage

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel

- 7.1.4. Footwear and Accessories

- 7.1.5. Furniture

- 7.1.6. Toys and Hobbies

- 7.1.7. Electronic and Household Appliances

- 7.1.8. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Department Stores

- 7.2.4. Specialty Stores

- 7.2.5. Online

- 7.2.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Products

- 8. Europe Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products

- 8.1.1. Food and Beverage

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel

- 8.1.4. Footwear and Accessories

- 8.1.5. Furniture

- 8.1.6. Toys and Hobbies

- 8.1.7. Electronic and Household Appliances

- 8.1.8. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Department Stores

- 8.2.4. Specialty Stores

- 8.2.5. Online

- 8.2.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Products

- 9. Middle East & Africa Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products

- 9.1.1. Food and Beverage

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel

- 9.1.4. Footwear and Accessories

- 9.1.5. Furniture

- 9.1.6. Toys and Hobbies

- 9.1.7. Electronic and Household Appliances

- 9.1.8. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Department Stores

- 9.2.4. Specialty Stores

- 9.2.5. Online

- 9.2.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Products

- 10. Asia Pacific Philippine Retail Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products

- 10.1.1. Food and Beverage

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel

- 10.1.4. Footwear and Accessories

- 10.1.5. Furniture

- 10.1.6. Toys and Hobbies

- 10.1.7. Electronic and Household Appliances

- 10.1.8. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Department Stores

- 10.2.4. Specialty Stores

- 10.2.5. Online

- 10.2.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Products

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SM Investments Corp (SM Retail Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Puregold Price Club Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SSI Group Philippines

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metro Retail Sores Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Robinsons Retail Holdings Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rustan Supercenters Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alfamart

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 7-Eleven

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Golden ABC Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mercury Drug Corp **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SM Investments Corp (SM Retail Inc )

List of Figures

- Figure 1: Global Philippine Retail Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Philippine Retail Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 4: North America Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 5: North America Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 6: North America Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 7: North America Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 9: North America Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 16: South America Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 17: South America Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 18: South America Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 19: South America Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 21: South America Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 28: Europe Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 29: Europe Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 30: Europe Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 31: Europe Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 33: Europe Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 40: Middle East & Africa Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 41: Middle East & Africa Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 42: Middle East & Africa Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 43: Middle East & Africa Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Philippine Retail Industry Revenue (Million), by Products 2025 & 2033

- Figure 52: Asia Pacific Philippine Retail Industry Volume (Billion), by Products 2025 & 2033

- Figure 53: Asia Pacific Philippine Retail Industry Revenue Share (%), by Products 2025 & 2033

- Figure 54: Asia Pacific Philippine Retail Industry Volume Share (%), by Products 2025 & 2033

- Figure 55: Asia Pacific Philippine Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Philippine Retail Industry Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Philippine Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Philippine Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Philippine Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Philippine Retail Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Philippine Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Philippine Retail Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 2: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 3: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Philippine Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Philippine Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 8: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 9: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 20: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 21: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 32: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 33: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 56: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 57: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Philippine Retail Industry Revenue Million Forecast, by Products 2020 & 2033

- Table 74: Global Philippine Retail Industry Volume Billion Forecast, by Products 2020 & 2033

- Table 75: Global Philippine Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Philippine Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Philippine Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Philippine Retail Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Philippine Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Philippine Retail Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippine Retail Industry?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the Philippine Retail Industry?

Key companies in the market include SM Investments Corp (SM Retail Inc ), Puregold Price Club Inc, SSI Group Philippines, Metro Retail Sores Group Inc, Robinsons Retail Holdings Inc, Rustan Supercenters Inc, Alfamart, 7-Eleven, Golden ABC Inc, Mercury Drug Corp **List Not Exhaustive.

3. What are the main segments of the Philippine Retail Industry?

The market segments include Products, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.70 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel. Cosmetics. Footwear. Watches. Beverages. and Food.

6. What are the notable trends driving market growth?

The Philippines' Food and Beverage Sector: A Key Pillar of the Nation's Economy.

7. Are there any restraints impacting market growth?

The Rising Demand for Packaged and Ready to Eat Food is Driving the Market; Increase in the Demand for Branded Goods Categories such as Apparel. Cosmetics. Footwear. Watches. Beverages. and Food.

8. Can you provide examples of recent developments in the market?

February 2024: Rose Pharmacy, a prominent player in the Philippine healthcare retail sector, marked a significant milestone on January 29, 2024, with the inauguration of its 400th store. Strategically located at Nustar Resort and Casino in Cebu City, this new outlet stands as a comprehensive destination for health and wellness needs. Beyond offering a diverse range of medicines, Rose Pharmacy's newest store showcases an array of products from Guardian, a leading Southeast Asian health and wellness brand. Notably, Guardian is under the ownership of DFI Retail and enjoys exclusive distribution through Rose Pharmacy in the Philippines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippine Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippine Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippine Retail Industry?

To stay informed about further developments, trends, and reports in the Philippine Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence