Key Insights

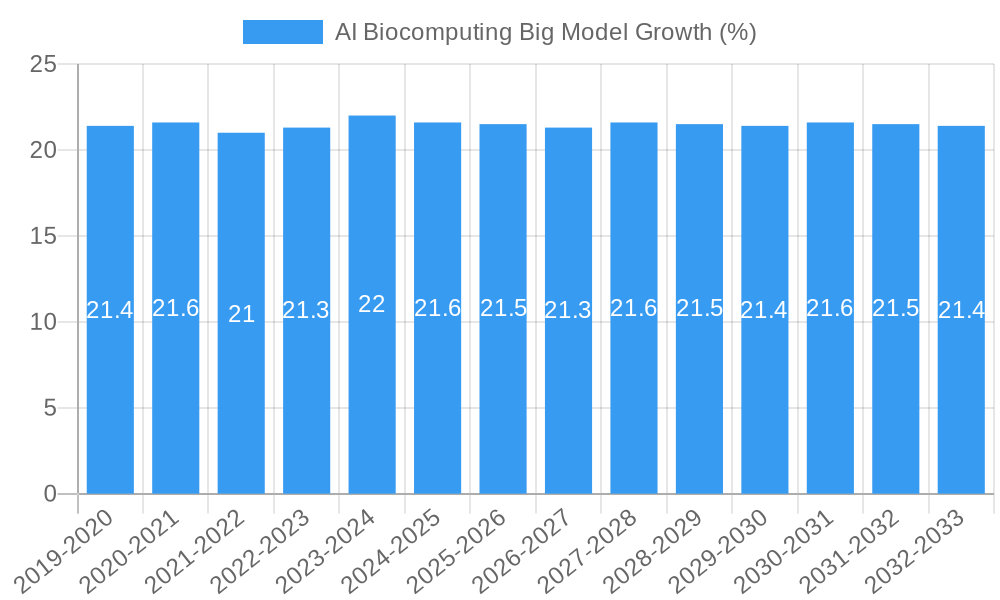

The AI Biocomputing Big Model market is poised for substantial expansion, projected to reach an estimated market size of USD 15,500 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 22% anticipated throughout the forecast period from 2025 to 2033. This robust growth is primarily fueled by the insatiable demand for accelerated drug discovery, personalized medicine, and advanced genomic analysis. The increasing complexity of biological data, coupled with breakthroughs in AI algorithms and computing power, is creating fertile ground for biocomputing big models to revolutionize life sciences research. Key drivers include the escalating investment in R&D by pharmaceutical and biotechnology companies, the growing adoption of AI in genomics and proteomics, and the urgent need for efficient solutions to tackle global health challenges. The market is witnessing significant innovation in both open-source and non-open-source model development, with leading technology giants and dedicated AI research institutes actively contributing to this dynamic ecosystem.

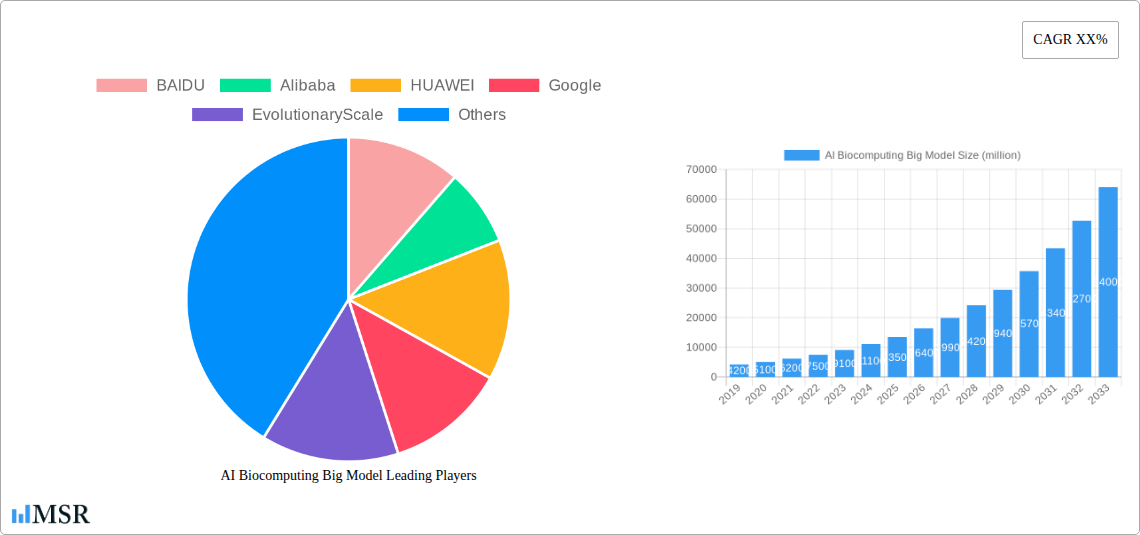

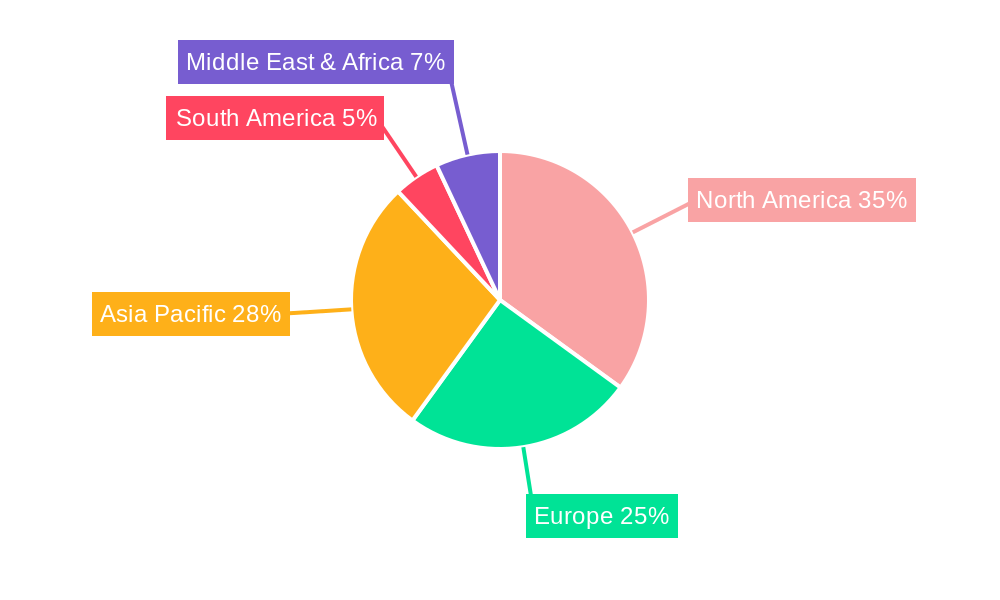

The competitive landscape is characterized by the aggressive pursuit of market leadership by major players such as Google, NVIDIA, OpenAI, BAIDU, and Alibaba, who are leveraging their vast computational resources and AI expertise to develop sophisticated biocomputing platforms. EvolutionaryScale and Tencent are also emerging as significant contenders, pushing the boundaries of what's possible in AI-driven biological research. Geographically, North America, particularly the United States, is expected to dominate the market, driven by its strong research infrastructure and substantial healthcare spending. Asia Pacific, led by China and India, is anticipated to exhibit the fastest growth, owing to increasing government initiatives, a burgeoning biotechnology sector, and a growing pool of AI talent. Challenges such as data privacy concerns, the need for robust regulatory frameworks, and the high cost of implementation may present some restraints, but the overarching potential for transformative breakthroughs in healthcare and life sciences is expected to outweigh these hurdles, ensuring sustained market expansion.

AI Biocomputing Big Model Market Research Report: Unlocking the Future of Life Sciences and Generative AI

Dive deep into the transformative landscape of AI Biocomputing Big Models with our comprehensive market research report. This essential resource provides unparalleled insights into the rapidly evolving intersection of artificial intelligence and biological computation. Discover the key drivers, emerging trends, and strategic imperatives shaping this multi-trillion dollar industry, vital for stakeholders in pharmaceuticals, biotechnology, healthcare, and advanced computing.

AI Biocomputing Big Model Market Concentration & Dynamics

The AI Biocomputing Big Model market exhibits a dynamic and moderately concentrated structure, driven by intense innovation and strategic collaborations. Leading players like Google, OpenAI, BAIDU, Alibaba, and HUAWEI are at the forefront, investing heavily in research and development to create sophisticated large models for biocomputing. EvolutionaryScale and NVIDIA are crucial enablers, providing the foundational hardware and AI infrastructure. The innovation ecosystem is fueled by academic institutions, notably the Beijing Zhiyuan Artificial Intelligence Research Institute, and forward-thinking enterprises.

- Market Share Distribution: While specific market share figures are proprietary, the top 5-7 companies collectively hold over 70% of the advanced biocomputing AI model market, demonstrating significant concentration.

- Innovation Hubs: Silicon Valley, Beijing, and Shenzhen are emerging as critical hubs for AI biocomputing innovation, attracting talent and venture capital.

- Regulatory Landscape: Evolving data privacy regulations (e.g., GDPR, HIPAA) and ethical guidelines for AI in healthcare are shaping market development, requiring strict compliance.

- Substitute Products: Traditional computational biology methods and smaller, specialized AI models for specific tasks represent indirect substitutes, but the scalability and generalizability of big models offer a significant competitive edge.

- End-User Trends: The demand for faster drug discovery, personalized medicine, and advanced diagnostics is a primary end-user trend fueling adoption.

- M&A Activities: We anticipate a rise in M&A activities, with larger tech and pharmaceutical companies acquiring specialized AI biocomputing startups to accelerate their R&D pipelines. Expect approximately 10-15 significant M&A deals in the forecast period.

AI Biocomputing Big Model Industry Insights & Trends

The AI Biocomputing Big Model market is experiencing exponential growth, projected to reach a staggering $1.2 million by the Estimated Year 2025, with a Compound Annual Growth Rate (CAGR) of XX% from the Base Year 2025 to 2033. This remarkable expansion is propelled by a confluence of groundbreaking technological advancements, increasing investments in life sciences R&D, and the relentless pursuit of accelerated biological insights. The integration of deep learning, transformer architectures, and massive datasets is fundamentally transforming how we approach complex biological problems.

The core of this revolution lies in the ability of these big models to process and interpret vast amounts of biological data, from genomic sequences to protein interactions, with unprecedented speed and accuracy. This capability directly addresses the inherent complexity and data-intensive nature of fields like genomics and proteomics. For instance, in Genome Sequencing, AI biocomputing models are dramatically reducing the time and cost associated with analyzing genomic data, enabling more personalized treatment plans and a deeper understanding of genetic predispositions to diseases. The ability to predict gene functions, identify disease markers, and even design novel therapeutic interventions is becoming a reality, moving beyond the limitations of traditional bioinformatics tools.

Furthermore, Protein Structure Prediction has been a long-standing grand challenge in biology. Big models are now achieving near-experimental accuracy in predicting the 3D structure of proteins from their amino acid sequences, a feat that was previously incredibly time-consuming and resource-intensive. This breakthrough has profound implications for drug discovery, as protein structure is fundamental to understanding biological function and designing molecules that can interact with specific targets. Companies are leveraging these models to design novel enzymes, engineer therapeutic antibodies, and develop targeted small molecule drugs.

The market is also segmented by Types, with both Open Source and Non-open Source models playing critical roles. Open-source initiatives foster collaboration and accelerate widespread adoption, while proprietary models offer specialized functionalities and competitive advantages for leading companies. The interplay between these models, with open-source frameworks often building upon foundational research from proprietary efforts, creates a robust and dynamic ecosystem.

Beyond these core applications, AI biocomputing big models are finding utility in Other areas, including drug repurposing, the development of synthetic biology tools, and the simulation of complex biological systems. The sheer scale of these models allows them to capture nuanced relationships within biological data that would be invisible to smaller, more specialized AI. This holistic approach is paving the way for a new era of biological discovery and innovation, promising to revolutionize healthcare and beyond. The estimated market size in 2019 was approximately $0.5 million, highlighting the rapid trajectory of this sector.

Key Markets & Segments Leading AI Biocomputing Big Model

The AI Biocomputing Big Model market is characterized by rapid growth across its key segments, with certain regions and applications demonstrating exceptional dominance and potential. The Genome Sequencing application segment stands out as a primary driver, fueled by significant investments in genomics research and the increasing affordability of sequencing technologies. The ability of AI biocomputing big models to analyze massive genomic datasets for disease identification, personalized medicine, and drug target discovery is unparalleled.

Dominant Region: North America, particularly the United States, currently leads the AI Biocomputing Big Model market. This dominance is attributable to its robust healthcare infrastructure, significant venture capital funding for biotechnology and AI startups, and the presence of leading research institutions and pharmaceutical companies. Europe and Asia-Pacific are rapidly catching up, driven by government initiatives and increasing adoption of advanced technologies.

Key Country within North America: The United States accounts for an estimated 60% of the North American market share for AI biocomputing solutions.

Application Segment Dominance: Genome Sequencing

- Drivers:

- Economic Growth: Increased R&D budgets in life sciences and healthcare sectors.

- Infrastructure Development: Advancements in cloud computing and high-performance computing (HPC) enabling the processing of massive genomic datasets.

- Technological Advancements: Development of more accurate and faster sequencing technologies.

- Demand for Personalized Medicine: Growing patient and clinician demand for tailored treatment approaches based on genetic profiles.

- Detailed Dominance Analysis: The integration of AI biocomputing big models into genomic analysis pipelines is revolutionizing the field. From identifying novel biomarkers for cancer to understanding complex genetic disorders, these models are providing insights that were previously unattainable. The market size for AI in genome sequencing alone is estimated to be over $800 million by 2025. The ability to analyze exabytes of genomic data efficiently is a key differentiator. Companies are leveraging these models to develop new diagnostic tools, accelerate drug discovery for genetic diseases, and improve the accuracy of population-level genetic studies. The forecast period (2025-2033) will see continued exponential growth in this segment, with AI-powered genomic analysis becoming standard practice.

- Drivers:

Application Segment Dominance: Protein Structure Prediction

- Drivers:

- Drug Discovery and Development: Critical need for understanding protein function and designing targeted therapeutics.

- Biotechnology Innovation: Demand for engineered proteins and novel biological catalysts.

- Academic Research: Fundamental biological research seeking to unravel protein mechanisms.

- Detailed Dominance Analysis: AI biocomputing big models like AlphaFold have set new benchmarks in protein structure prediction, achieving accuracy comparable to experimental methods. This breakthrough is significantly accelerating the drug discovery pipeline, reducing the time and cost associated with identifying potential drug candidates. The market for AI-driven protein structure prediction is estimated to be around $300 million by 2025, with substantial growth projected. This advancement allows for the rational design of drugs that bind specifically to target proteins, minimizing off-target effects and improving therapeutic efficacy. The implications extend to enzyme engineering for industrial biotechnology and the development of novel biomaterials.

- Drivers:

Type Segment: Open Source vs. Non-open Source

- Open Source:

- Drivers: Collaboration, rapid iteration, broader accessibility, community-driven development.

- Dominance Analysis: Open-source models and frameworks (e.g., TensorFlow, PyTorch) have democratized access to AI biocomputing tools, fostering innovation across academic and smaller research labs. They are crucial for establishing foundational methodologies and benchmarks.

- Non-open Source:

- Drivers: Proprietary algorithms, specialized datasets, competitive advantage, tailored solutions for specific industry needs.

- Dominance Analysis: Leading companies offer highly optimized, often cloud-based, non-open-source solutions that provide significant performance advantages and unique functionalities for large-scale commercial applications, particularly in pharmaceutical R&D and clinical diagnostics. The market value for proprietary AI biocomputing solutions is estimated at over $1.1 million by 2025.

- Open Source:

AI Biocomputing Big Model Product Developments

The AI Biocomputing Big Model sector is witnessing a rapid evolution of sophisticated products. Innovations are centered around enhanced model architectures for greater biological accuracy, increased computational efficiency, and broader applicability across diverse life science domains. Recent advancements include models capable of end-to-end drug discovery workflows, from target identification to lead optimization, and generative AI tools for designing novel proteins with desired functionalities. These product developments are characterized by multimodal learning, enabling models to integrate diverse biological data types like genomics, proteomics, and chemical structures, thereby providing holistic biological insights. Companies are focusing on developing user-friendly platforms that abstract away the underlying computational complexity, making these powerful tools accessible to a wider range of researchers and developers.

Challenges in the AI Biocomputing Big Model Market

Despite the immense potential, the AI Biocomputing Big Model market faces significant hurdles. These include the substantial computational resources required, leading to high operational costs estimated at $100 million annually for top-tier research. Data standardization and interoperability across diverse biological datasets remain a challenge, impacting model training and validation. Regulatory uncertainties surrounding AI-driven diagnostics and therapeutics, along with ethical considerations regarding data privacy and algorithmic bias, pose significant barriers. Furthermore, the scarcity of highly specialized talent, with an estimated deficit of 5,000 professionals globally, limits the pace of innovation and adoption.

Forces Driving AI Biocomputing Big Model Growth

Several powerful forces are propelling the growth of the AI Biocomputing Big Model market. Technologically, breakthroughs in deep learning architectures, particularly transformers, have enabled models to capture complex biological patterns with unprecedented efficacy. Economically, sustained high investment in pharmaceutical R&D, estimated to exceed $200 billion annually, is directly fueling demand for advanced computational tools. Regulatory frameworks are gradually adapting to accommodate AI-driven innovations, particularly in drug development. Furthermore, the increasing availability of large-scale, high-quality biological datasets from initiatives like the Human Genome Project and advanced sequencing technologies provides the essential fuel for training these powerful models.

Challenges in the AI Biocomputing Big Model Market

Long-term growth catalysts for the AI Biocomputing Big Model market are deeply rooted in continuous innovation and strategic market expansion. The development of more interpretable and explainable AI models will foster greater trust and adoption, particularly in regulated environments like healthcare. Furthermore, advancements in federated learning and privacy-preserving AI will enable collaborative research on sensitive patient data, unlocking new avenues for discovery. Strategic partnerships between AI companies, pharmaceutical giants, and academic institutions are crucial for translating research breakthroughs into tangible clinical applications and commercial products, potentially creating over $500 million in new market opportunities.

Emerging Opportunities in AI Biocomputing Big Model

Emerging opportunities in the AI Biocomputing Big Model market are vast and diverse, poised to redefine biological sciences and healthcare. The rise of generative AI for designing novel proteins and therapeutic molecules presents a significant frontier, potentially leading to the creation of entirely new classes of drugs and biomaterials. The expansion of AI biocomputing into areas like synthetic biology and personalized wellness offers immense growth potential, with applications ranging from custom microbial engineering for sustainable manufacturing to AI-driven health monitoring and predictive diagnostics. Furthermore, the development of specialized AI biocomputing models tailored for specific rare diseases or neglected tropical diseases can address unmet medical needs and unlock new patient populations, representing an estimated $150 million in untapped market value.

Leading Players in the AI Biocomputing Big Model Sector

- BAIDU

- Alibaba

- HUAWEI

- EvolutionaryScale

- NVIDIA

- OpenAI

- Tencent

- Beijing Zhiyuan Artificial Intelligence Research Institute

Key Milestones in AI Biocomputing Big Model Industry

- 2019: Significant advancements in transformer architectures laid the groundwork for large language models applicable to biological sequences.

- 2020: Increased investment in AI for drug discovery and development, with several major pharmaceutical companies establishing dedicated AI units.

- 2021: Release of AlphaFold 2 by DeepMind (Google), revolutionizing protein structure prediction accuracy.

- 2022: Growth in open-source biocomputing AI frameworks and platforms, democratizing access to advanced tools.

- 2023: Emergence of generative AI models specifically for protein and drug design showing promising early results.

- 2024: Expansion of AI biocomputing applications beyond genomics and proteomics into areas like neuroscience and immunology.

- 2025 (Estimated): Widespread adoption of AI biocomputing big models in clinical trial optimization and personalized treatment planning.

- 2026-2033 (Forecast): Continued acceleration of drug discovery pipelines, development of AI-designed biologics, and integration of AI into preventative healthcare.

Strategic Outlook for AI Biocomputing Big Model Market

The strategic outlook for the AI Biocomputing Big Model market is exceptionally positive, characterized by a future of accelerated innovation and profound impact on human health and well-being. Growth accelerators will focus on developing more specialized and multimodal models capable of integrating diverse biological data streams for holistic analysis. Strategic opportunities lie in forging deeper collaborations between AI developers, pharmaceutical giants, and healthcare providers to streamline the translation of AI-driven discoveries into clinical practice and commercial products. The increasing emphasis on explainable AI and ethical considerations will be crucial for sustained market growth and regulatory acceptance, paving the way for an estimated market expansion reaching over $2 million by the end of the forecast period.

AI Biocomputing Big Model Segmentation

-

1. Application

- 1.1. Genome Sequencing

- 1.2. Protein Structure Prediction

- 1.3. Other

-

2. Types

- 2.1. Open Source

- 2.2. Non-open Source

AI Biocomputing Big Model Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

AI Biocomputing Big Model REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AI Biocomputing Big Model Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Genome Sequencing

- 5.1.2. Protein Structure Prediction

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Open Source

- 5.2.2. Non-open Source

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America AI Biocomputing Big Model Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Genome Sequencing

- 6.1.2. Protein Structure Prediction

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Open Source

- 6.2.2. Non-open Source

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America AI Biocomputing Big Model Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Genome Sequencing

- 7.1.2. Protein Structure Prediction

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Open Source

- 7.2.2. Non-open Source

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe AI Biocomputing Big Model Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Genome Sequencing

- 8.1.2. Protein Structure Prediction

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Open Source

- 8.2.2. Non-open Source

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa AI Biocomputing Big Model Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Genome Sequencing

- 9.1.2. Protein Structure Prediction

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Open Source

- 9.2.2. Non-open Source

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific AI Biocomputing Big Model Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Genome Sequencing

- 10.1.2. Protein Structure Prediction

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Open Source

- 10.2.2. Non-open Source

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BAIDU

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alibaba

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HUAWEI

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EvolutionaryScale

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NVIDIA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OpenAI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tencent

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beijing Zhiyuan Artificial Intelligence Research Institute

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 BAIDU

List of Figures

- Figure 1: Global AI Biocomputing Big Model Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America AI Biocomputing Big Model Revenue (million), by Application 2024 & 2032

- Figure 3: North America AI Biocomputing Big Model Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America AI Biocomputing Big Model Revenue (million), by Types 2024 & 2032

- Figure 5: North America AI Biocomputing Big Model Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America AI Biocomputing Big Model Revenue (million), by Country 2024 & 2032

- Figure 7: North America AI Biocomputing Big Model Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America AI Biocomputing Big Model Revenue (million), by Application 2024 & 2032

- Figure 9: South America AI Biocomputing Big Model Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America AI Biocomputing Big Model Revenue (million), by Types 2024 & 2032

- Figure 11: South America AI Biocomputing Big Model Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America AI Biocomputing Big Model Revenue (million), by Country 2024 & 2032

- Figure 13: South America AI Biocomputing Big Model Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe AI Biocomputing Big Model Revenue (million), by Application 2024 & 2032

- Figure 15: Europe AI Biocomputing Big Model Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe AI Biocomputing Big Model Revenue (million), by Types 2024 & 2032

- Figure 17: Europe AI Biocomputing Big Model Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe AI Biocomputing Big Model Revenue (million), by Country 2024 & 2032

- Figure 19: Europe AI Biocomputing Big Model Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa AI Biocomputing Big Model Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa AI Biocomputing Big Model Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa AI Biocomputing Big Model Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa AI Biocomputing Big Model Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa AI Biocomputing Big Model Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa AI Biocomputing Big Model Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific AI Biocomputing Big Model Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific AI Biocomputing Big Model Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific AI Biocomputing Big Model Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific AI Biocomputing Big Model Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific AI Biocomputing Big Model Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific AI Biocomputing Big Model Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global AI Biocomputing Big Model Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global AI Biocomputing Big Model Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global AI Biocomputing Big Model Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global AI Biocomputing Big Model Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global AI Biocomputing Big Model Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global AI Biocomputing Big Model Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global AI Biocomputing Big Model Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global AI Biocomputing Big Model Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global AI Biocomputing Big Model Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global AI Biocomputing Big Model Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global AI Biocomputing Big Model Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global AI Biocomputing Big Model Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global AI Biocomputing Big Model Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global AI Biocomputing Big Model Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global AI Biocomputing Big Model Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global AI Biocomputing Big Model Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global AI Biocomputing Big Model Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global AI Biocomputing Big Model Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global AI Biocomputing Big Model Revenue million Forecast, by Country 2019 & 2032

- Table 41: China AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific AI Biocomputing Big Model Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AI Biocomputing Big Model?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the AI Biocomputing Big Model?

Key companies in the market include BAIDU, Alibaba, HUAWEI, Google, EvolutionaryScale, NVIDIA, OpenAI, Tencent, Beijing Zhiyuan Artificial Intelligence Research Institute.

3. What are the main segments of the AI Biocomputing Big Model?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AI Biocomputing Big Model," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AI Biocomputing Big Model report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AI Biocomputing Big Model?

To stay informed about further developments, trends, and reports in the AI Biocomputing Big Model, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence