Key Insights

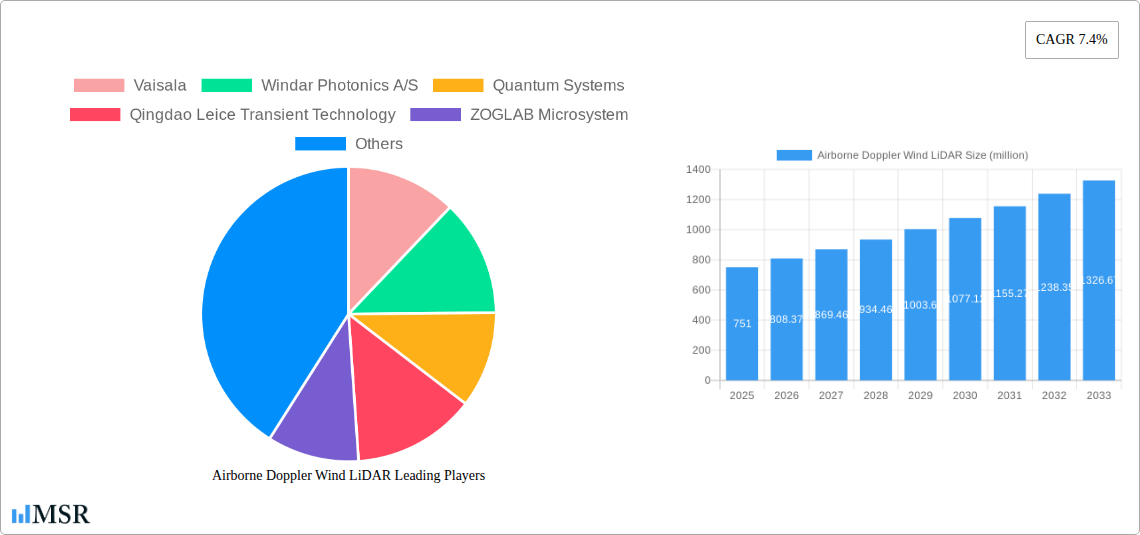

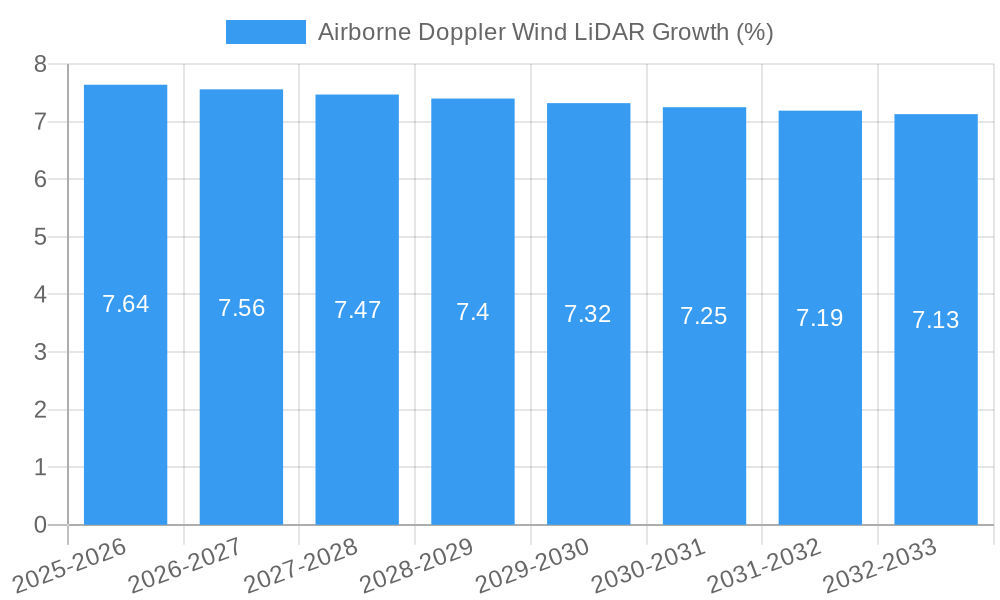

The Airborne Doppler Wind LiDAR market is poised for robust expansion, projected to reach a significant valuation from its 2025 base year and grow at a Compound Annual Growth Rate (CAGR) of 7.4% through 2033. This upward trajectory is primarily fueled by the increasing demand for accurate and real-time wind data in critical aviation applications. Unmanned Aerial Vehicles (UAVs) are emerging as a key growth segment, driven by advancements in drone technology and their expanding roles in surveillance, aerial surveying, and atmospheric research. Manned aviation continues to be a cornerstone, with airlines and air traffic control agencies prioritizing enhanced safety and operational efficiency through precise wind measurements, particularly during take-off, landing, and in turbulent weather conditions. The market is characterized by technological innovation, with companies continually striving to enhance detection distances and improve the accuracy and reliability of Doppler Wind LiDAR systems, catering to a diverse range of operational needs.

The market's growth is further stimulated by a confluence of favorable trends, including the accelerating integration of LiDAR technology into sophisticated weather forecasting models and the growing adoption of remote sensing solutions for environmental monitoring and climate studies. The development of more compact, cost-effective, and versatile LiDAR systems is making them accessible to a wider array of users, from large-scale aerospace manufacturers to specialized research institutions. While significant opportunities exist, the market also faces certain restraints. These include the high initial investment costs associated with advanced LiDAR systems and the specialized expertise required for their operation and data interpretation. Regulatory hurdles and the need for extensive testing and certification for airborne applications can also present challenges. Despite these factors, the relentless pursuit of enhanced aviation safety, improved meteorological predictions, and novel applications in defense and research is expected to propel the Airborne Doppler Wind LiDAR market to new heights, with key players actively investing in research and development to address these challenges and capitalize on emerging opportunities across diverse geographical regions.

Airborne Doppler Wind LiDAR Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a detailed examination of the Airborne Doppler Wind LiDAR market, offering critical insights for stakeholders across the aviation and environmental monitoring sectors. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis delves into market concentration, industry trends, key segments, product developments, challenges, growth drivers, emerging opportunities, leading players, and strategic outlook.

Airborne Doppler Wind LiDAR Market Concentration & Dynamics

The Airborne Doppler Wind LiDAR market exhibits a moderate level of concentration, with a few key players dominating innovation and market share, which is estimated to be in the hundreds of millions of dollars. Established companies are investing heavily in research and development, fostering innovation ecosystems focused on enhancing detection range, accuracy, and integration with unmanned aerial vehicles (UAVs) and manned aviation platforms. Regulatory frameworks are evolving to accommodate the increasing deployment of these advanced remote sensing technologies, particularly in aviation safety and meteorological forecasting. While substitute products exist, such as ground-based weather stations and traditional anemometers, Airborne Doppler Wind LiDAR offers unparalleled advantages in real-time, high-resolution wind profiling. End-user trends indicate a growing demand for precise wind data in applications ranging from flight path optimization and wind farm assessment to severe weather detection and atmospheric research. Mergers and acquisitions (M&A) activity, while not extensive currently, is anticipated to increase as companies seek to consolidate expertise and expand their market reach, with a projected M&A deal count of approximately 5-10 significant transactions over the forecast period.

- Key Market Dynamics:

- Increasing R&D investment by major players.

- Development of robust regulatory guidelines for deployment.

- Growing adoption in aviation safety and renewable energy sectors.

- Potential for consolidation through strategic M&A.

Airborne Doppler Wind LiDAR Industry Insights & Trends

The global Airborne Doppler Wind LiDAR market is poised for significant expansion, driven by a confluence of technological advancements, increasing demand for precise meteorological data, and the burgeoning aerospace industry. The market size is projected to reach several hundred million dollars by the forecast period's end. Growth drivers include the critical need for enhanced aviation safety through real-time wind shear detection and turbulence forecasting, the optimization of wind energy resource assessment for offshore and onshore wind farms, and the growing requirements for accurate atmospheric profiling in climate research and weather modeling. Technological disruptions are primarily focused on miniaturization, cost reduction, and improved performance of LiDAR systems, enabling seamless integration with UAVs for aerial surveys and remote sensing. Evolving consumer behaviors, particularly within the aviation sector, are emphasizing predictive capabilities and data-driven decision-making, making Doppler Wind LiDAR an indispensable tool. The compound annual growth rate (CAGR) is expected to be robust, estimated between 15-20% over the forecast period.

- Market Growth Drivers:

- Enhanced aviation safety protocols and air traffic management.

- Demand for precise wind resource assessment in renewable energy.

- Advancements in atmospheric science and weather forecasting.

- Growing capabilities of UAVs for aerial data acquisition.

Key Markets & Segments Leading Airborne Doppler Wind LiDAR

The Airborne Doppler Wind LiDAR market is experiencing rapid growth across various segments, with distinct regional and application-based leadership emerging. The Application: UAV segment is particularly dominant, fueled by the rapid expansion of the drone industry for diverse applications, including environmental monitoring, agricultural surveying, and aerial logistics. The increasing sophistication of UAVs equipped with advanced sensor payloads makes them ideal platforms for deploying Doppler Wind LiDAR systems, offering unprecedented mobility and accessibility for wind data collection in remote or hazardous areas.

Within the Types categorization, systems with a Maximum Detection Distance: Above 700 Meters are gaining traction due to their capability to provide comprehensive wind profiles for aviation and large-scale meteorological studies. These high-performance systems are critical for detecting distant atmospheric phenomena and ensuring safe flight operations at higher altitudes.

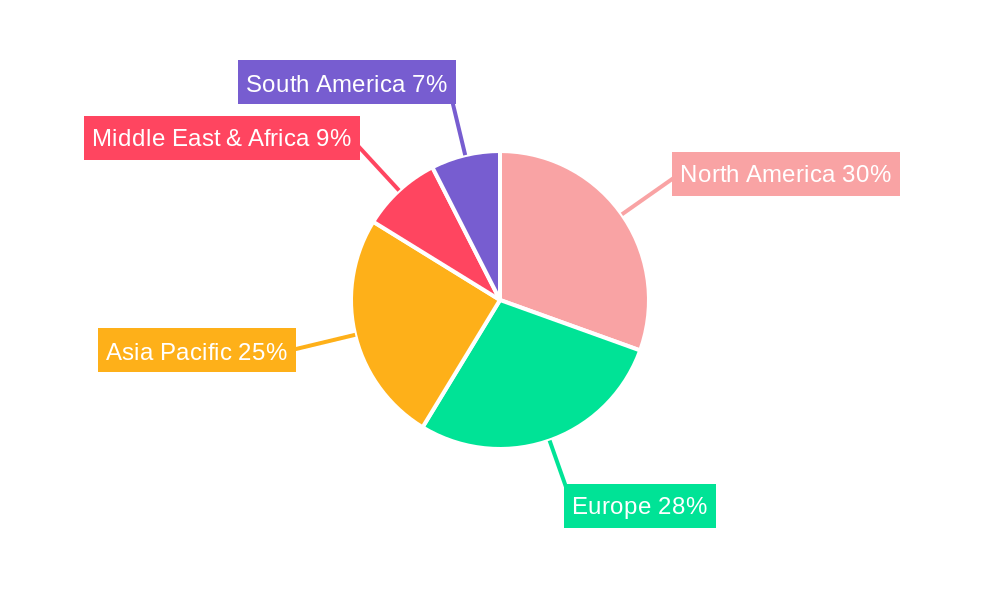

Geographically, North America and Europe are currently leading the market, driven by substantial investments in aviation infrastructure, stringent safety regulations, and a mature renewable energy sector actively seeking efficient wind resource assessment. The economic growth and increasing adoption of advanced technologies in Asia-Pacific, particularly in China, are also contributing significantly to market expansion.

- Dominant Segments & Drivers:

- Application: UAV: Driven by the expanding drone market, cost-effectiveness for remote sensing, and versatility in data acquisition.

- Types: Maximum Detection Distance: Above 700 Meters: Essential for advanced aviation safety, long-range weather forecasting, and comprehensive wind energy site assessments.

- Regional Dominance (North America & Europe): Fueled by substantial investments in aviation, strong regulatory mandates for safety, and advanced renewable energy infrastructure.

Airborne Doppler Wind LiDAR Product Developments

Product innovation in Airborne Doppler Wind LiDAR is characterized by advancements in miniaturization, increased power efficiency, and enhanced data processing capabilities. Companies are developing more compact and lightweight systems for seamless integration onto a wide range of UAV platforms, expanding their accessibility and deployment flexibility. Furthermore, improvements in laser technology and signal processing are leading to higher accuracy and greater detection ranges. These developments are crucial for applications such as real-time wind shear detection for aviation safety, precise wind resource mapping for renewable energy projects, and detailed atmospheric studies. The competitive edge lies in offering robust, reliable, and user-friendly systems that deliver actionable wind data in diverse environmental conditions, with ongoing efforts to reduce the overall cost of ownership and operation.

Challenges in the Airborne Doppler Wind LiDAR Market

The Airborne Doppler Wind LiDAR market faces several challenges that can impact its growth trajectory. Regulatory hurdles, particularly concerning airspace management and operational approvals for UAV-mounted systems, can create deployment delays. Supply chain vulnerabilities for specialized components and the high initial capital investment required for sophisticated LiDAR systems can also pose significant barriers. Furthermore, intense competition from established players and the emergence of novel sensing technologies necessitate continuous innovation and cost optimization to maintain market relevance. The projected impact of these challenges on market growth could lead to a temporary slowdown in adoption rates, estimated at 5-10% over the short term.

- Key Challenges:

- Navigating complex airspace regulations and certification processes.

- Managing the cost of advanced sensor technology and system integration.

- Ensuring a stable and reliable supply chain for critical components.

- Addressing the high initial capital expenditure for many end-users.

Forces Driving Airborne Doppler Wind LiDAR Growth

Several key forces are propelling the growth of the Airborne Doppler Wind LiDAR market. Technological advancements in laser systems, signal processing, and miniaturization are making these instruments more effective and accessible. The increasing global focus on renewable energy, particularly wind power, necessitates precise wind resource assessment, a core application for Doppler Wind LiDAR. Furthermore, a heightened emphasis on aviation safety, driven by the need to mitigate risks associated with turbulence and wind shear, is creating substantial demand for real-time wind profiling capabilities. Economic factors, such as government incentives for green energy and investments in smart aviation infrastructure, also play a significant role in market expansion.

Challenges in the Airborne Doppler Wind LiDAR Market

Long-term growth catalysts for the Airborne Doppler Wind LiDAR market are rooted in continuous innovation and strategic market expansion. The development of more autonomous and AI-driven data interpretation capabilities will enhance the value proposition for end-users. Strategic partnerships between LiDAR manufacturers, aviation companies, and renewable energy developers will accelerate adoption and create new application niches. Furthermore, the expanding geographical reach into developing economies with growing aviation and energy sectors presents a significant opportunity for market penetration and sustained growth. The development of standardized data formats and interoperability protocols will also foster wider market acceptance.

Emerging Opportunities in Airborne Doppler Wind LiDAR

Emerging opportunities in the Airborne Doppler Wind LiDAR market are abundant and diverse. The burgeoning urban air mobility (UAM) sector presents a significant new frontier, requiring precise wind data for safe and efficient operations of eVTOL aircraft. Advancements in AI and machine learning are enabling predictive maintenance and enhanced forecasting capabilities, creating new service-based revenue streams. The integration of Doppler Wind LiDAR with other sensor technologies, such as atmospheric composition sensors, offers the potential for multi-functional aerial survey platforms. Furthermore, the growing demand for environmental monitoring in sectors like agriculture and forestry for microclimate analysis and hazard assessment opens up novel market segments.

Leading Players in the Airborne Doppler Wind LiDAR Sector

- Vaisala

- Windar Photonics A/S

- Quantum Systems

- Qingdao Leice Transient Technology

- ZOGLAB Microsystem

- Emgo Tech

- Qingdao Huahang Seaglet Environmental Technology

- ZephIR Lidar

- Leviayhan

- Wuhan LuoJiaYiYun Optoelectronic Technology

- Shallow Sea

- Beijing AZUP International

Key Milestones in Airborne Doppler Wind LiDAR Industry

- 2019: Increased adoption of compact Doppler Wind LiDAR for UAV-based wind resource assessment.

- 2020: Advancements in signal processing leading to improved accuracy in challenging atmospheric conditions.

- 2021: Emergence of new players focusing on specialized UAV integration and niche applications.

- 2022: Enhanced regulatory frameworks in select regions to accommodate airborne LiDAR deployment for aviation safety.

- 2023: Significant investments in R&D for higher detection ranges and multi-purpose LiDAR systems.

- 2024: Growing interest in Doppler Wind LiDAR for maritime wind resource assessment and offshore wind farm development.

Strategic Outlook for Airborne Doppler Wind LiDAR Market

The strategic outlook for the Airborne Doppler Wind LiDAR market is exceptionally positive, driven by a persistent demand for accurate and real-time wind data across multiple critical industries. Growth accelerators include the ongoing miniaturization and cost reduction of LiDAR systems, making them more accessible for a wider range of applications, particularly within the rapidly expanding UAV sector. Furthermore, the global push towards sustainable energy solutions and enhanced aviation safety protocols will continue to fuel market expansion. Strategic opportunities lie in developing integrated solutions that combine wind data with other meteorological parameters, fostering strategic alliances with key industry players, and expanding into emerging geographical markets where advanced atmospheric sensing is becoming increasingly vital. The market is poised for sustained growth and innovation in the coming years.

Airborne Doppler Wind LiDAR Segmentation

-

1. Application

- 1.1. UAV

- 1.2. Manned Aviation

-

2. Types

- 2.1. Maximum Detection Distance: 400 Meters

- 2.2. Maximum Detection Distance: 400-700 Meters

- 2.3. Maximum Detection Distance: Above 700 Meters

Airborne Doppler Wind LiDAR Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Airborne Doppler Wind LiDAR REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airborne Doppler Wind LiDAR Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. UAV

- 5.1.2. Manned Aviation

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Maximum Detection Distance: 400 Meters

- 5.2.2. Maximum Detection Distance: 400-700 Meters

- 5.2.3. Maximum Detection Distance: Above 700 Meters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Airborne Doppler Wind LiDAR Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. UAV

- 6.1.2. Manned Aviation

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Maximum Detection Distance: 400 Meters

- 6.2.2. Maximum Detection Distance: 400-700 Meters

- 6.2.3. Maximum Detection Distance: Above 700 Meters

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Airborne Doppler Wind LiDAR Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. UAV

- 7.1.2. Manned Aviation

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Maximum Detection Distance: 400 Meters

- 7.2.2. Maximum Detection Distance: 400-700 Meters

- 7.2.3. Maximum Detection Distance: Above 700 Meters

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Airborne Doppler Wind LiDAR Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. UAV

- 8.1.2. Manned Aviation

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Maximum Detection Distance: 400 Meters

- 8.2.2. Maximum Detection Distance: 400-700 Meters

- 8.2.3. Maximum Detection Distance: Above 700 Meters

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Airborne Doppler Wind LiDAR Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. UAV

- 9.1.2. Manned Aviation

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Maximum Detection Distance: 400 Meters

- 9.2.2. Maximum Detection Distance: 400-700 Meters

- 9.2.3. Maximum Detection Distance: Above 700 Meters

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Airborne Doppler Wind LiDAR Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. UAV

- 10.1.2. Manned Aviation

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Maximum Detection Distance: 400 Meters

- 10.2.2. Maximum Detection Distance: 400-700 Meters

- 10.2.3. Maximum Detection Distance: Above 700 Meters

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Vaisala

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Windar Photonics A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quantum Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Qingdao Leice Transient Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZOGLAB Microsystem

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emgo Tech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingdao Huahang Seaglet Environmental Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZephIR Lidar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leviayhan

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wuhan LuoJiaYiYun Optoelectronic Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shallow Sea

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Beijing AZUP International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Vaisala

List of Figures

- Figure 1: Global Airborne Doppler Wind LiDAR Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Airborne Doppler Wind LiDAR Revenue (million), by Application 2024 & 2032

- Figure 3: North America Airborne Doppler Wind LiDAR Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Airborne Doppler Wind LiDAR Revenue (million), by Types 2024 & 2032

- Figure 5: North America Airborne Doppler Wind LiDAR Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Airborne Doppler Wind LiDAR Revenue (million), by Country 2024 & 2032

- Figure 7: North America Airborne Doppler Wind LiDAR Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Airborne Doppler Wind LiDAR Revenue (million), by Application 2024 & 2032

- Figure 9: South America Airborne Doppler Wind LiDAR Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Airborne Doppler Wind LiDAR Revenue (million), by Types 2024 & 2032

- Figure 11: South America Airborne Doppler Wind LiDAR Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Airborne Doppler Wind LiDAR Revenue (million), by Country 2024 & 2032

- Figure 13: South America Airborne Doppler Wind LiDAR Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Airborne Doppler Wind LiDAR Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Airborne Doppler Wind LiDAR Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Airborne Doppler Wind LiDAR Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Airborne Doppler Wind LiDAR Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Airborne Doppler Wind LiDAR Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Airborne Doppler Wind LiDAR Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Airborne Doppler Wind LiDAR Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Airborne Doppler Wind LiDAR Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Airborne Doppler Wind LiDAR Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Airborne Doppler Wind LiDAR Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Airborne Doppler Wind LiDAR Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Airborne Doppler Wind LiDAR Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Airborne Doppler Wind LiDAR Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Airborne Doppler Wind LiDAR Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Airborne Doppler Wind LiDAR Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Airborne Doppler Wind LiDAR Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Airborne Doppler Wind LiDAR Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Airborne Doppler Wind LiDAR Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Airborne Doppler Wind LiDAR Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Airborne Doppler Wind LiDAR Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airborne Doppler Wind LiDAR?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Airborne Doppler Wind LiDAR?

Key companies in the market include Vaisala, Windar Photonics A/S, Quantum Systems, Qingdao Leice Transient Technology, ZOGLAB Microsystem, Emgo Tech, Qingdao Huahang Seaglet Environmental Technology, ZephIR Lidar, Leviayhan, Wuhan LuoJiaYiYun Optoelectronic Technology, Shallow Sea, Beijing AZUP International.

3. What are the main segments of the Airborne Doppler Wind LiDAR?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 751 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airborne Doppler Wind LiDAR," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airborne Doppler Wind LiDAR report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airborne Doppler Wind LiDAR?

To stay informed about further developments, trends, and reports in the Airborne Doppler Wind LiDAR, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence