Key Insights

The Asia-Pacific office real estate market is poised for substantial growth, fueled by rapid urbanization, expanding economies, and robust foreign direct investment in key nations such as China, Japan, India, and Australia. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 6.6%, estimating a market size of $2,198.1 billion in the base year of 2024. Emerging trends include the increasing adoption of flexible workspaces, a growing preference for sustainable building certifications, and the integration of advanced technologies in office design and management. Navigating potential challenges such as economic volatility, geopolitical uncertainties, and evolving occupancy rates post-pandemic will be crucial for sustained market expansion. China and Japan currently lead market share, with India and South Korea emerging as significant growth drivers.

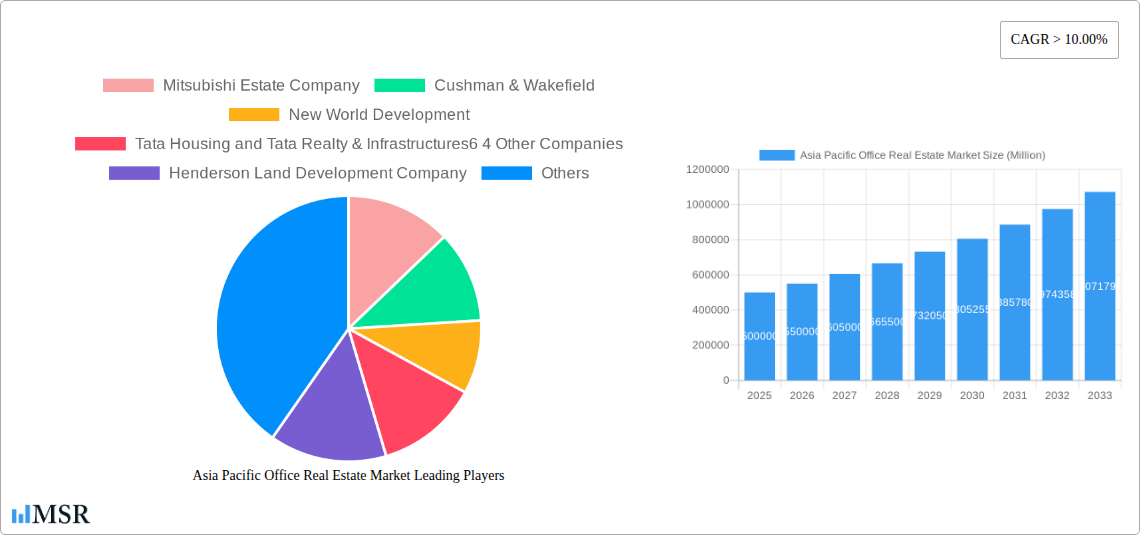

Asia Pacific Office Real Estate Market Market Size (In Million)

A competitive landscape featuring both global leaders and regional developers stimulates innovation in property quality, location, and amenities. Government-led infrastructure development and foreign investment incentives further bolster the market's positive outlook. Strategic analysis of country-specific regulations, economic policies, and evolving workplace demands is essential for stakeholders to capitalize on opportunities within this dynamic sector. Long-term forecasts indicate continued positive market trajectory, with growth rates varying across the Asia-Pacific region due to distinct economic and demographic factors.

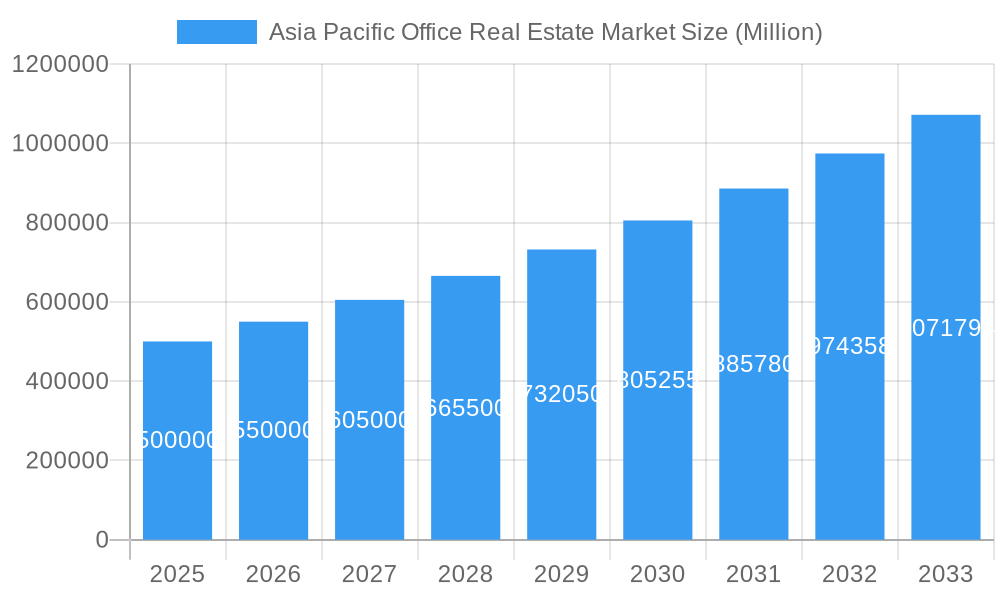

Asia Pacific Office Real Estate Market Company Market Share

Asia Pacific Office Real Estate Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Asia Pacific office real estate market, offering valuable insights for investors, developers, and industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, and future growth potential across major Asia-Pacific countries. The report incorporates data from the historical period (2019-2024) and leverages projected figures where necessary. Key players analyzed include Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures, Henderson Land Development Company, Frasers Property, JLL, CDL, Colliers, and CBRE.

Asia Pacific Office Real Estate Market Concentration & Dynamics

The Asia Pacific office real estate market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Mitsubishi Estate Company and other major players like CBRE hold substantial shares, particularly in Japan and China. The market is characterized by an increasingly innovative ecosystem, driven by technological advancements in smart building technologies and proptech solutions. Regulatory frameworks vary significantly across countries, influencing investment decisions and development strategies. Substitute products, such as co-working spaces and flexible office solutions, are gaining traction, particularly among startups and smaller businesses. End-user trends show a shift towards sustainable and technologically advanced office spaces, impacting demand. M&A activity remains substantial, with a significant number of deals (xx) recorded between 2019 and 2024. Market share data suggests a concentration ratio (CR5) of approximately xx%, reflecting a moderate level of concentration.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Deal Count (2019-2024): xx deals, showing a robust level of consolidation.

- Innovation Ecosystem: Strong focus on green building certifications and smart building technologies.

- Regulatory Framework: Significant variations across countries, creating complexities for investors.

Asia Pacific Office Real Estate Market Industry Insights & Trends

The Asia Pacific office real estate market is experiencing robust growth, driven by factors like rapid urbanization, expanding economies, and increasing foreign direct investment (FDI). Market size in 2024 is estimated at USD xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected between 2025 and 2033. Technological disruptions, including the adoption of proptech solutions and remote working options, are impacting market dynamics. The pandemic has accelerated the adoption of flexible workspace models and increased the focus on workplace wellness and employee experience. Consumer behaviors are evolving, demanding more sustainable and technologically advanced office environments. This has led to a growing demand for green buildings and smart office spaces. The sector also faces challenges such as geopolitical uncertainties and economic fluctuations, which can affect real estate investment decisions. Further technological advancements continue to reshape the dynamics of the industry.

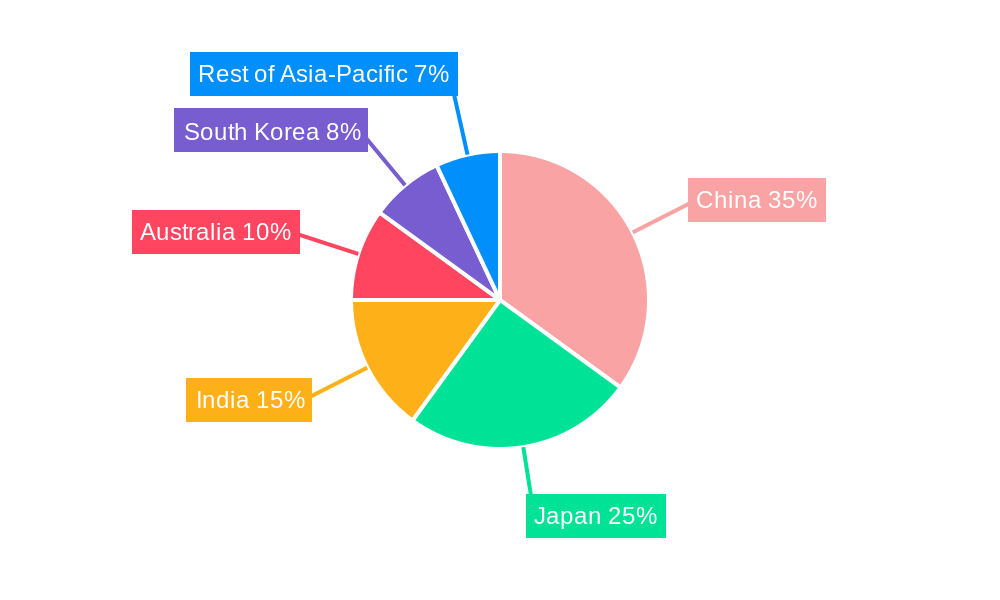

Key Markets & Segments Leading Asia Pacific Office Real Estate Market

China and Japan represent the most dominant markets within the Asia Pacific region, driven by robust economic growth and substantial infrastructure development. India’s market shows significant potential for rapid expansion due to its growing technology sector.

China:

- Drivers: Strong economic growth, robust FDI, expansion of technology and finance sectors, and large-scale infrastructure projects.

Japan:

- Drivers: Mature economy, high concentration of multinational corporations, and a focus on redevelopment projects in major cities like Tokyo.

India:

- Drivers: Rapid growth in the IT sector, attracting significant investment in commercial real estate.

Other Key Markets:

- Australia and South Korea are also experiencing significant office market growth, albeit at a slower rate than China and Japan.

- The "Rest of Asia-Pacific" segment offers emerging opportunities with pockets of high growth concentrated in specific cities and sectors.

Dominance Analysis: China and Japan currently lead in market size and investment, but India is poised for significant growth in the coming years, particularly driven by the expansion of its technology sector and burgeoning start-up ecosystem.

Asia Pacific Office Real Estate Market Product Developments

The Asia Pacific office real estate market witnesses continuous product innovations, driven by technological advancements. Smart building technologies, integrating IoT sensors and data analytics, improve efficiency and energy management. Flexible office solutions and co-working spaces cater to evolving workplace needs. Sustainable building practices, focusing on energy efficiency and reduced carbon footprint, are gaining prominence, responding to increasing environmental concerns and regulatory requirements. These innovations provide competitive edges for developers and attract tenants seeking modern and efficient workplaces.

Challenges in the Asia Pacific Office Real Estate Market Market

The Asia Pacific office real estate market faces challenges such as regulatory hurdles that vary considerably across different countries, hindering investment and development. Supply chain disruptions and inflationary pressures impact construction costs. Intense competition from established players and new entrants puts pressure on margins and return on investments. These factors collectively create uncertainty in the market. Specifically, rising interest rates impact financing costs, potentially reducing the volume of transactions.

Forces Driving Asia Pacific Office Real Estate Market Growth

Several factors fuel the growth of the Asia Pacific office real estate market. Technological advancements in building management systems and workspace design drive efficiency and appeal. Strong economic growth in many Asian countries creates demand for office space. Government initiatives promoting infrastructure development and FDI further stimulate investment in commercial real estate.

Long-Term Growth Catalysts in the Asia Pacific Office Real Estate Market

Long-term growth is fueled by continuous innovations in building technology, fostering energy efficiency and smart building features. Strategic partnerships between developers and technology companies accelerate the adoption of cutting-edge solutions. Market expansion into secondary and tertiary cities with growing economies offers significant untapped potential.

Emerging Opportunities in Asia Pacific Office Real Estate Market

Emerging trends highlight opportunities in sustainable and green building certifications, attracting environmentally conscious tenants. Growth in the technology sector, particularly in India and other Southeast Asian countries, drives demand for modern office spaces. Increased adoption of flexible workspace models caters to evolving work styles and enhances the appeal of the market to a wider range of tenants.

Leading Players in the Asia Pacific Office Real Estate Market Sector

- Mitsubishi Estate Company

- Cushman & Wakefield

- New World Development

- Tata Housing and Tata Realty & Infrastructures

- Henderson Land Development Company

- Frasers Property

- JLL

- CDL

- Colliers

- CBRE

Key Milestones in Asia Pacific Office Real Estate Market Industry

- February 2022: Hulic and Japan Excellent's USD 25.4 Million Shintomicho Building transaction signals continued investment in prime Tokyo office space.

- July 2022: Google's 1.3 Million sq. ft. lease in Bengaluru highlights India's burgeoning tech sector and its impact on office space demand.

Strategic Outlook for Asia Pacific Office Real Estate Market Market

The Asia Pacific office real estate market presents significant long-term growth potential, driven by sustained economic growth, technological advancements, and evolving workplace trends. Strategic opportunities lie in developing sustainable and technologically advanced office spaces that cater to the needs of a diverse tenant base. Focusing on prime locations in key growth centers and leveraging innovative technologies to enhance building efficiency will be key success factors for investors and developers.

Asia Pacific Office Real Estate Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Office Real Estate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Office Real Estate Market Regional Market Share

Geographic Coverage of Asia Pacific Office Real Estate Market

Asia Pacific Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Coworking Spaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Estate Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cushman & Wakefield

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 New World Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tata Housing and Tata Realty & Infrastructures6 4 Other Companies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Henderson Land Development Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Frasers Property

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JLL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CDL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colliers

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CBRE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Estate Company

List of Figures

- Figure 1: Asia Pacific Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia Pacific Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia Pacific Office Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Office Real Estate Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Asia Pacific Office Real Estate Market?

Key companies in the market include Mitsubishi Estate Company, Cushman & Wakefield, New World Development, Tata Housing and Tata Realty & Infrastructures6 4 Other Companies, Henderson Land Development Company, Frasers Property, JLL, CDL, Colliers, CBRE.

3. What are the main segments of the Asia Pacific Office Real Estate Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2198.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Rise in Demand for Coworking Spaces.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

February 2022 - Real estate firm Hulic and Japan Excellent executed a purchase agreement to exchange trust beneficiary rights in the Shintomicho Building for JPY 3.1 billion (USD 25.4 million). Japan Excellent mostly invests in office buildings in Tokyo. Two phases will be involved in the transfer of the Trust Beneficiary Rights in the Shintomicho Building: the first phase will involve the transfer of 40% ownership for JPY 1,24 billion (USD 10.1 million), and the second phase will involve the transfer of the remaining 60% ownership for JPY 1.86 billion (USD 15.3 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence