Key Insights

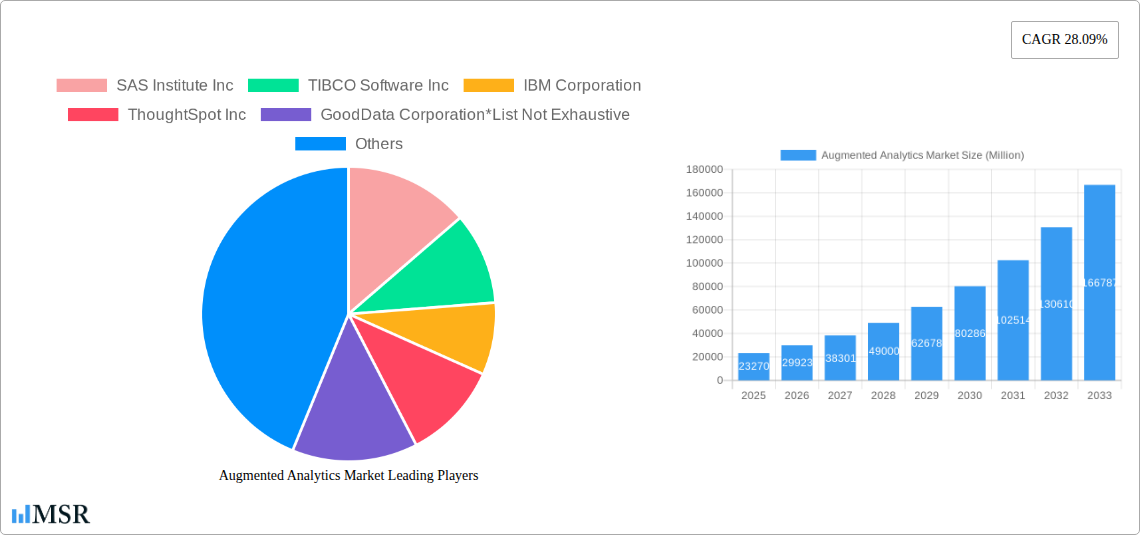

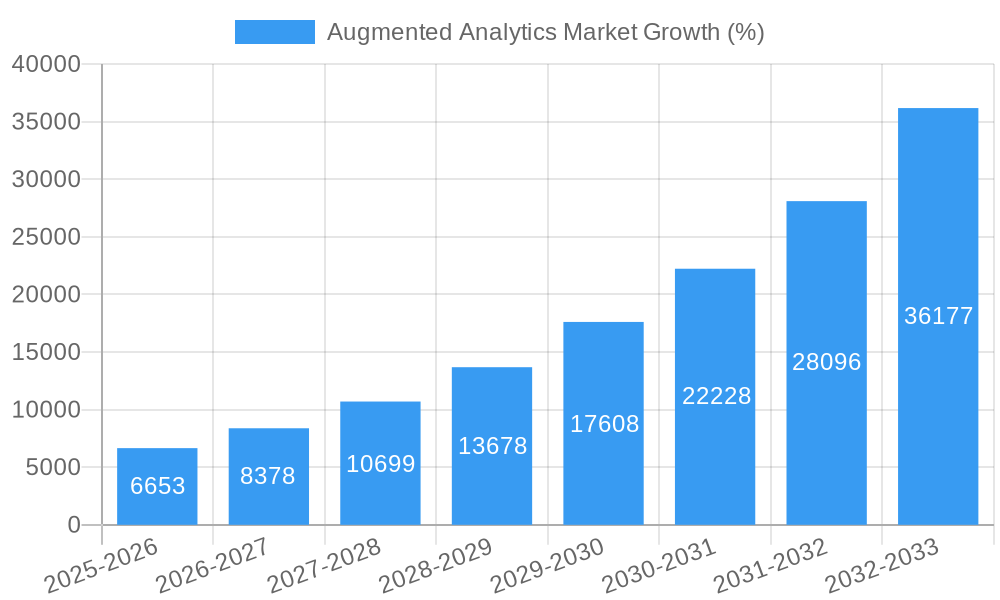

The Augmented Analytics market is experiencing robust growth, projected to reach \$23.27 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 28.09% from 2025 to 2033. This expansion is fueled by several key factors. The increasing volume and complexity of data generated across various industries necessitate efficient and insightful data analysis, a need perfectly addressed by augmented analytics' capabilities of automating data preparation, feature engineering, and model building. Furthermore, the rising adoption of cloud-based solutions offers scalability, accessibility, and cost-effectiveness, further accelerating market growth. Businesses across sectors like BFSI, Telecom & IT, and Retail are leveraging augmented analytics to gain actionable insights for improved decision-making, optimized operations, and enhanced customer experiences. The integration of advanced technologies like AI and machine learning within augmented analytics platforms is driving innovation and expanding the functionalities offered, creating further market opportunities. While the market faces challenges like data security concerns and the need for skilled professionals, the overall positive momentum and the increasing reliance on data-driven decision-making suggest sustained growth trajectory in the coming years.

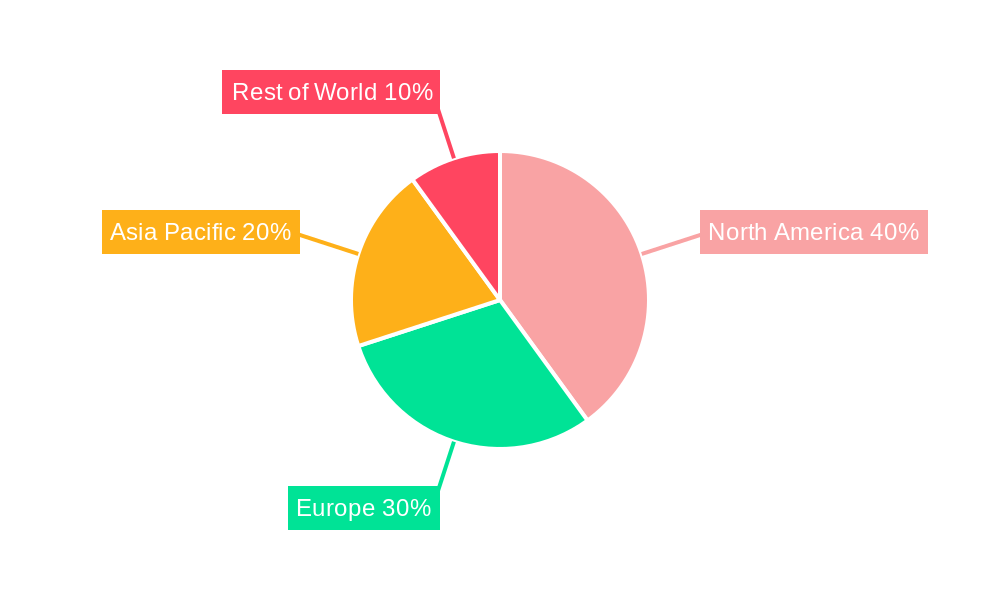

The competitive landscape is characterized by a mix of established players like SAS Institute, IBM, and Microsoft, alongside emerging technology companies such as ThoughtSpot and Sisense. These vendors are constantly innovating to provide advanced features, such as natural language processing for intuitive data exploration and automated insights generation. The market is segmented by deployment (on-premise and cloud) and end-user industry, reflecting the diverse applications of augmented analytics across various sectors. Geographical expansion is another key driver, with North America currently holding a significant market share, but the Asia Pacific region is projected to witness rapid growth due to increasing digitalization and technological advancements. The continued development and adoption of augmented analytics will likely transform how businesses leverage data for informed decision-making, leading to ongoing market expansion throughout the forecast period.

Unlock the Potential of the Augmented Analytics Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the Augmented Analytics Market, providing invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and emerging opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Augmented Analytics Market Market Concentration & Dynamics

The Augmented Analytics market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share figures for each company are proprietary and require further research, the leading players include SAS Institute Inc, TIBCO Software Inc, IBM Corporation, ThoughtSpot Inc, GoodData Corporation, Microsoft Corporation, QlikTech International AB, Sisense Inc, SAP SE, MicroStrategy Inc, and Salesforce.com inc. The market is characterized by intense competition, fueled by continuous innovation and product development.

- Market Concentration: The top 5 players likely account for approximately xx% of the market share in 2025, with the remaining share distributed amongst numerous smaller players.

- Innovation Ecosystems: Robust R&D investments and strategic partnerships are driving innovation, focusing on AI-powered insights, enhanced data visualization, and improved user experience.

- Regulatory Frameworks: Data privacy regulations (GDPR, CCPA) significantly influence market dynamics, particularly concerning data security and compliance.

- Substitute Products: Traditional business intelligence (BI) tools and self-service data analysis platforms pose competitive threats, though augmented analytics offers distinct advantages in automation and insight generation.

- End-User Trends: The increasing adoption of cloud-based solutions, the demand for real-time insights, and the growing need for data-driven decision-making are driving market growth.

- M&A Activities: The number of mergers and acquisitions in the Augmented Analytics market has been steadily increasing in recent years, with an estimated xx M&A deals closed in 2024. These activities are driven by strategic expansions and consolidation efforts.

Augmented Analytics Market Industry Insights & Trends

The Augmented Analytics market is experiencing substantial growth, driven by factors such as the rising volume and variety of data, the increasing need for faster and more accurate insights, and the growing adoption of cloud-based analytics platforms. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025. Technological advancements, such as advancements in artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) are fueling market expansion. Businesses across various industries are embracing augmented analytics to improve operational efficiency, enhance decision-making, and gain a competitive advantage. Evolving consumer behaviors, including a preference for user-friendly and intuitive analytics tools, are further boosting demand for augmented analytics solutions. This translates to a robust projected CAGR of xx% from 2025 to 2033.

Key Markets & Segments Leading Augmented Analytics Market

The Cloud segment dominates the deployment model within the Augmented Analytics market, driven by its scalability, cost-effectiveness, and accessibility. The BFSI (Banking, Financial Services, and Insurance) sector is currently the leading end-user industry, due to its high reliance on data-driven insights for risk management, fraud detection, and customer relationship management.

Drivers by Segment:

- Cloud Deployment: Scalability, cost efficiency, and accessibility.

- BFSI: Need for real-time insights, regulatory compliance, and risk mitigation.

- Telecom & IT: Demand for network optimization, customer churn prediction, and fraud detection.

- Retail: Improved customer experience, inventory management, and supply chain optimization.

- Healthcare: Advanced diagnostics, personalized medicine, and patient care optimization.

- Manufacturing: Predictive maintenance, supply chain management, and process optimization.

Dominance Analysis:

The Cloud segment's dominance is attributable to its flexibility and accessibility, enabling businesses of all sizes to leverage the power of augmented analytics without significant upfront investments. The BFSI sector's leadership stems from the industry's reliance on data analytics for critical functions such as risk management and fraud detection. Other sectors are rapidly adopting augmented analytics, though at different rates depending on their data maturity and digital transformation strategies.

Augmented Analytics Market Product Developments

Significant advancements in augmented analytics are witnessed through the incorporation of AI/ML algorithms for automating data preparation, insightful data visualization, and the creation of predictive models. Natural Language Processing (NLP) capabilities allow users to interact with data using natural language queries, making the analytics process more intuitive and accessible to a broader range of users. These innovations have significantly improved the accessibility and usability of augmented analytics, expanding the market's reach across various industry segments. The incorporation of these advancements provides competitive advantages by enabling faster insight generation and more accurate predictions, leading to better decision-making across organizations.

Challenges in the Augmented Analytics Market Market

The Augmented Analytics market faces challenges including high implementation costs, the need for specialized skills, and concerns regarding data security and privacy. The complexity of implementing augmented analytics solutions and the need for skilled professionals can impede wider adoption. Addressing data privacy regulations and ensuring data security are also paramount challenges for vendors and end-users. These factors, along with competitive pressures from established BI vendors, can affect market growth to an estimated xx% annually in the short-term.

Forces Driving Augmented Analytics Market Growth

The market is propelled by factors like the exponential growth of data, the demand for real-time insights, and the increasing adoption of cloud-based solutions. Government initiatives promoting digital transformation and the growing adoption of AI and machine learning across various sectors further contribute to market expansion. These technologies allow businesses to process and analyze massive datasets, identify trends and patterns, and make data-driven decisions faster and more accurately than traditional methods.

Challenges in the Augmented Analytics Market Market (Long-Term Growth Catalysts)

Long-term growth is fueled by the continuous development of innovative AI-powered analytics tools, the rise of strategic partnerships between analytics providers and industry-specific companies, and the expansion of augmented analytics applications into new and emerging markets. These factors are expected to drive substantial market growth over the long term.

Emerging Opportunities in Augmented Analytics Market

Emerging opportunities lie in the development of specialized augmented analytics solutions for niche industries, the integration of augmented analytics with other technologies (IoT, blockchain), and the expansion into developing economies. The increasing availability of affordable and accessible augmented analytics tools is also creating new opportunities for small and medium-sized businesses.

Leading Players in the Augmented Analytics Market Sector

- SAS Institute Inc

- TIBCO Software Inc

- IBM Corporation

- ThoughtSpot Inc

- GoodData Corporation

- Microsoft Corporation

- QlikTech International AB

- Sisense Inc

- SAP SE

- MicroStrategy Inc

- Salesforce.com inc

Key Milestones in Augmented Analytics Market Industry

- May 2023: TrinityLife Sciences and WhizAI partnered to integrate AI-driven insights into life sciences commercialization. This partnership exemplifies the increasing integration of augmented analytics into specialized industries.

- January 2023: Seerist Inc. enhanced its augmented analytics solution for threat and security professionals, adding contextual intelligence and customization options. This highlights the ongoing innovation and development within the augmented analytics space.

Strategic Outlook for Augmented Analytics Market Market

The Augmented Analytics market holds immense potential for future growth, driven by technological advancements, increasing data volumes, and the growing need for real-time insights across industries. Strategic partnerships, focused product development, and expansion into new markets will be key factors in determining market leadership and success in the coming years. The market’s continued expansion hinges on addressing challenges related to data security, accessibility, and the skills gap, while capitalizing on emerging opportunities in specialized sectors and technological integrations.

Augmented Analytics Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. End-user Industry

- 2.1. BFSI

- 2.2. Telecom & IT

- 2.3. Retail

- 2.4. Healthcare

- 2.5. Manufacturing

- 2.6. Media & Entertainment

- 2.7. Other End-user Industries

Augmented Analytics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Augmented Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 28.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand to Cater Complex Business Data; Huge Adoption of Business Intelligence Tools

- 3.3. Market Restrains

- 3.3.1. Resistance Due to Replacement of Human Intelligence

- 3.4. Market Trends

- 3.4.1. Retail Sector is Expected to Have a Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. BFSI

- 5.2.2. Telecom & IT

- 5.2.3. Retail

- 5.2.4. Healthcare

- 5.2.5. Manufacturing

- 5.2.6. Media & Entertainment

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. BFSI

- 6.2.2. Telecom & IT

- 6.2.3. Retail

- 6.2.4. Healthcare

- 6.2.5. Manufacturing

- 6.2.6. Media & Entertainment

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. BFSI

- 7.2.2. Telecom & IT

- 7.2.3. Retail

- 7.2.4. Healthcare

- 7.2.5. Manufacturing

- 7.2.6. Media & Entertainment

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. BFSI

- 8.2.2. Telecom & IT

- 8.2.3. Retail

- 8.2.4. Healthcare

- 8.2.5. Manufacturing

- 8.2.6. Media & Entertainment

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of the World Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. BFSI

- 9.2.2. Telecom & IT

- 9.2.3. Retail

- 9.2.4. Healthcare

- 9.2.5. Manufacturing

- 9.2.6. Media & Entertainment

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. North America Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Augmented Analytics Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 SAS Institute Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 TIBCO Software Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 IBM Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 ThoughtSpot Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 GoodData Corporation*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Microsoft Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 QlikTech International AB

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Sisense Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 SAP SE

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 MicroStrategy Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Salesforce com inc

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Augmented Analytics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Augmented Analytics Market Revenue (Million), by Deployment 2024 & 2032

- Figure 11: North America Augmented Analytics Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 12: North America Augmented Analytics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Augmented Analytics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Augmented Analytics Market Revenue (Million), by Deployment 2024 & 2032

- Figure 17: Europe Augmented Analytics Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 18: Europe Augmented Analytics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Augmented Analytics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Augmented Analytics Market Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Asia Pacific Augmented Analytics Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Asia Pacific Augmented Analytics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific Augmented Analytics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Augmented Analytics Market Revenue (Million), by Deployment 2024 & 2032

- Figure 29: Rest of the World Augmented Analytics Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 30: Rest of the World Augmented Analytics Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of the World Augmented Analytics Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of the World Augmented Analytics Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Augmented Analytics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Augmented Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Augmented Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Augmented Analytics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Augmented Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Augmented Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Augmented Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Augmented Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Augmented Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Augmented Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Global Augmented Analytics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Augmented Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 17: Global Augmented Analytics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Augmented Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 20: Global Augmented Analytics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Augmented Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 23: Global Augmented Analytics Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Augmented Analytics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Augmented Analytics Market?

The projected CAGR is approximately 28.09%.

2. Which companies are prominent players in the Augmented Analytics Market?

Key companies in the market include SAS Institute Inc, TIBCO Software Inc, IBM Corporation, ThoughtSpot Inc, GoodData Corporation*List Not Exhaustive, Microsoft Corporation, QlikTech International AB, Sisense Inc, SAP SE, MicroStrategy Inc, Salesforce com inc.

3. What are the main segments of the Augmented Analytics Market?

The market segments include Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand to Cater Complex Business Data; Huge Adoption of Business Intelligence Tools.

6. What are the notable trends driving market growth?

Retail Sector is Expected to Have a Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Resistance Due to Replacement of Human Intelligence.

8. Can you provide examples of recent developments in the market?

May 2023: TrinityLife Sciences, a leader in global life sciences commercialization solutions, and WhizAI, a leader in AI-powered analytics for life sciences and healthcare, announced a strategic partnership that allows life sciences companies to quickly and easily generate and share AI-driven insights. WhizAI’s augmented analytics can be layered on Trinity’s enterprise reporting platforms to bring insights to more organizational stakeholders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Augmented Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Augmented Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Augmented Analytics Market?

To stay informed about further developments, trends, and reports in the Augmented Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence