Key Insights

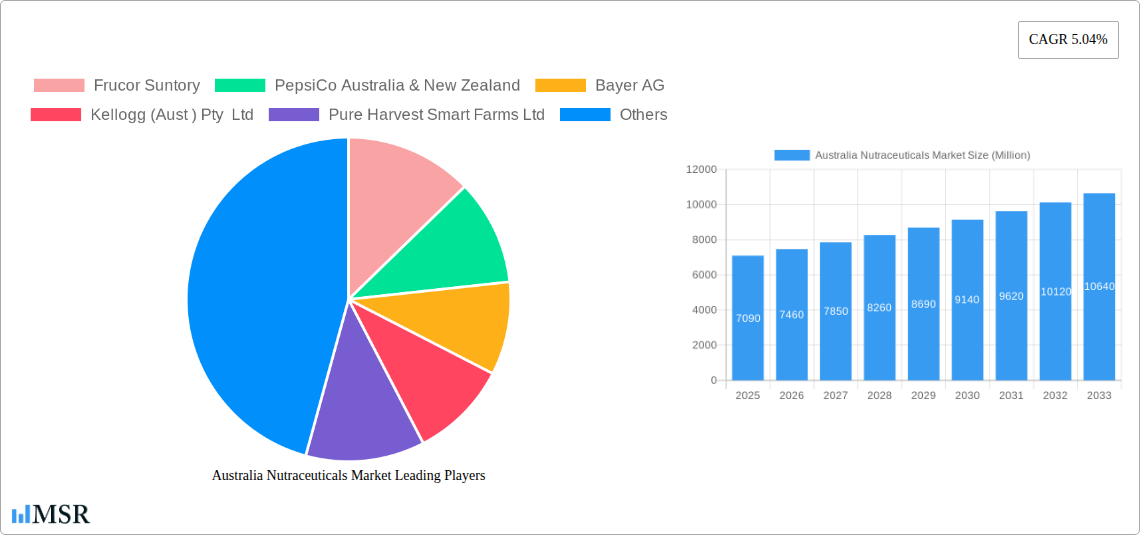

The Australian nutraceuticals market, valued at $7.09 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.04% from 2025 to 2033. This expansion is fueled by several key factors. Rising health consciousness among Australians, coupled with increasing prevalence of chronic diseases like heart disease and diabetes, is driving demand for functional foods and dietary supplements. The aging population also contributes significantly, as older adults represent a key consumer segment for nutraceuticals. Furthermore, the growing popularity of preventative healthcare and wellness initiatives, along with increased consumer disposable incomes, supports market growth. Distribution channels are diversifying, with online retail experiencing significant growth alongside traditional channels such as supermarkets, pharmacies, and specialty stores. The market is segmented by product type, with functional foods (including functional beverages) and dietary supplements holding significant market share. Competitive intensity is high, with both multinational corporations and local players vying for market dominance. Challenges include stringent regulatory requirements and maintaining consumer trust amidst concerns about product quality and efficacy. However, the long-term outlook for the Australian nutraceuticals market remains positive, driven by ongoing demographic shifts and evolving consumer preferences.

Australia Nutraceuticals Market Market Size (In Billion)

The market's performance will likely be influenced by factors such as government regulations impacting the nutraceuticals industry, fluctuations in raw material prices, and evolving consumer awareness regarding health and nutrition. The strategic focus of major players will involve product innovation, targeted marketing campaigns emphasizing health benefits, and establishing strong distribution networks to reach the expanding consumer base. Emerging trends such as personalized nutrition and the use of natural and organic ingredients are shaping product development and driving consumer preference. Companies are likely to invest in research and development to support claims of efficacy and safety, addressing consumer concerns regarding product quality and authenticity. The Asia-Pacific region, particularly Australia, plays a significant role in the global nutraceuticals market, representing a substantial market segment with considerable growth potential over the forecast period.

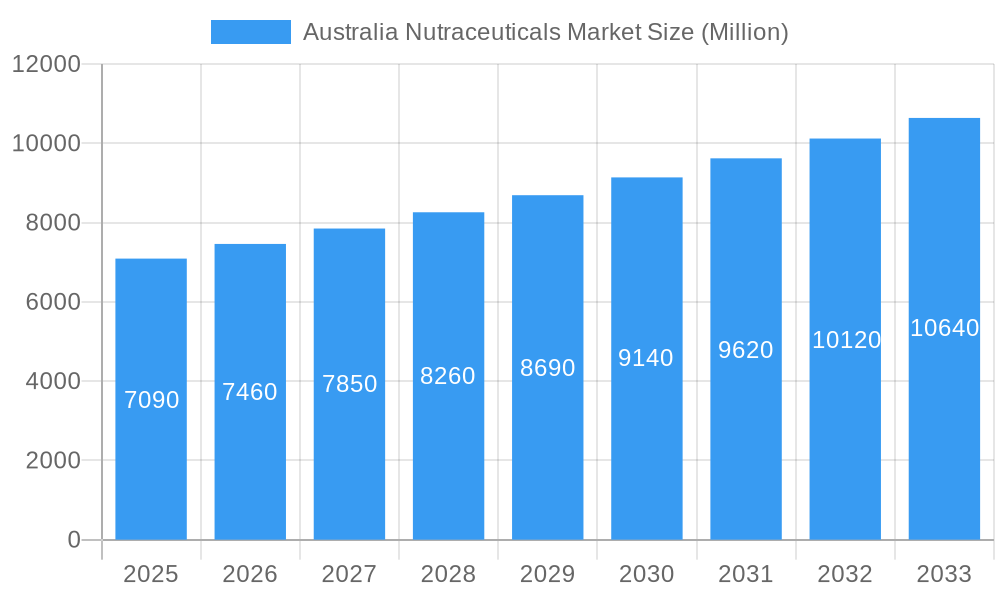

Australia Nutraceuticals Market Company Market Share

Australia Nutraceuticals Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australia Nutraceuticals Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report meticulously examines key segments, leading players including Frucor Suntory, PepsiCo Australia & New Zealand, Bayer AG, and more, and emerging opportunities within this rapidly evolving sector.

Australia Nutraceuticals Market Market Concentration & Dynamics

The Australian nutraceutical market exhibits a moderately concentrated landscape, with several multinational corporations and established local players holding significant market share. Market leader estimates (xx%) currently dominate, while smaller players actively compete. This dynamic is influenced by a vibrant innovation ecosystem, with continuous product development in functional foods and beverages, dietary supplements, and other functional food categories. The regulatory framework, although generally supportive of innovation, presents challenges in navigating approval processes for new products. Substitute products, including traditional foods and over-the-counter medications, pose competitive pressure. Consumer trends towards health and wellness, fueled by rising health consciousness, are driving market growth. M&A activity within the sector has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. However, strategic acquisitions are anticipated to increase as larger players seek to consolidate their market position.

Australia Nutraceuticals Market Industry Insights & Trends

The Australian nutraceuticals market is experiencing robust growth, driven by a confluence of factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2025, showcasing significant potential. Key growth drivers include the increasing prevalence of chronic diseases, rising disposable incomes enabling consumers to afford premium health products, and a growing awareness of preventative healthcare. Technological disruptions, such as personalized nutrition and advanced delivery systems (e.g., nanotechnology), are transforming the market landscape. Evolving consumer behaviors, marked by a preference for natural and organic products, clean labels, and personalized nutrition solutions, are influencing product development and marketing strategies. The market is witnessing a surge in demand for functional beverages, driven by the convenience and perceived health benefits. The demand for dietary supplements remains strong, particularly those targeting specific health concerns like immunity, gut health, and cognitive function.

Key Markets & Segments Leading Australia Nutraceuticals Market

Dominant Distribution Channels: Supermarkets/Hypermarkets hold the largest market share, providing extensive reach to consumers. Specialty stores cater to a more discerning customer base seeking specialized products. Online retail stores are experiencing rapid growth, offering convenience and a wider product selection.

Dominant Product Types: Functional foods constitute the largest segment, encompassing a broad range of products fortified with added nutrients or beneficial components. Functional beverages, particularly those positioned as healthy alternatives to sugary drinks, are experiencing substantial growth. Dietary supplements, with a focus on targeted health benefits, continue to be a significant segment.

Regional Dominance: The major metropolitan areas of Australia, including Sydney, Melbourne, and Brisbane, demonstrate the highest consumption of nutraceuticals, driven by higher disposable incomes and greater awareness of health and wellness.

Drivers for Growth across Segments:

- Economic Growth: Rising disposable incomes empower consumers to invest in health and wellness.

- Health Consciousness: Increasing awareness of chronic diseases fuels demand for preventative health measures.

- Technological Advancements: Innovations in product formulation and delivery systems create new opportunities.

- Government Initiatives: Regulatory support for the nutraceutical industry encourages growth.

Australia Nutraceuticals Market Product Developments

Recent years have witnessed significant innovation in the Australian nutraceutical market. Companies are focusing on developing products with clean labels, natural ingredients, and functional benefits tailored to specific health needs. Technological advancements, such as microencapsulation and liposomal delivery systems, are enhancing product efficacy and bioavailability. This focus on innovation, coupled with effective marketing strategies highlighting health benefits, differentiates products and creates a competitive edge.

Challenges in the Australia Nutraceuticals Market Market

The Australian nutraceuticals market faces several challenges, including stringent regulatory requirements that can delay product launches and increase costs. Supply chain disruptions and fluctuations in raw material prices can impact profitability and product availability. Intense competition from both established and emerging players necessitates continuous innovation and differentiation to maintain market share. Moreover, consumer skepticism and misinformation surrounding certain products present a significant hurdle to overcome.

Forces Driving Australia Nutraceuticals Market Growth

Several factors drive the long-term growth of the Australian nutraceuticals market. Increased consumer awareness of the link between nutrition and health is a primary driver. Technological advancements in formulation and delivery systems enhance product effectiveness and appeal. Favorable government policies encouraging preventative healthcare initiatives contribute to market expansion. Rising disposable incomes and a growing health-conscious population further fuel demand for premium health products.

Challenges in the Australia Nutraceuticals Market Market

Continued long-term growth hinges on addressing regulatory hurdles to facilitate faster product launches and reduce costs. Sustained investment in research and development is crucial for developing innovative, high-quality products. Strategic partnerships and collaborations can enhance market reach and access to new technologies. Expanding into new market segments and exploring export opportunities will unlock further growth potential.

Emerging Opportunities in Australia Nutraceuticals Market

Emerging opportunities include the growing demand for personalized nutrition solutions, driven by genetic testing and tailored recommendations. The expansion of e-commerce platforms provides significant potential for market expansion, providing access to wider customer bases. The development of sustainable and ethically sourced ingredients is gaining traction, appealing to environmentally conscious consumers. Finally, increasing interest in plant-based and vegan nutraceutical products presents a significant market expansion opportunity.

Leading Players in the Australia Nutraceuticals Market Sector

- Frucor Suntory

- PepsiCo Australia & New Zealand

- Bayer AG

- Kellogg (Aust ) Pty Ltd

- Pure Harvest Smart Farms Ltd

- Pharmacare Laboratories Pty Ltd

- Remedy Drinks

- General Mills Australia Pty Ltd

- GlaxoSmithKline Plc

- Health & Happiness (H&H) International Holdings Ltd

- Herbalife Australia

- Nestle Australia Ltd

Key Milestones in Australia Nutraceuticals Market Industry

- October 2022: Remedy Drinks launched Remedy K! CK, a clean energy drink, expanding into the functional beverage market.

- July 2022: PureHarvest launched four new plant-based milk varieties, capitalizing on the growing plant-based food trend.

- June 2021: V Energy launched its "Can You Feel It" campaign, boosting brand awareness and engaging consumers.

Strategic Outlook for Australia Nutraceuticals Market Market

The Australian nutraceuticals market is poised for sustained growth, driven by favorable demographics, increasing health awareness, and ongoing technological advancements. Strategic opportunities exist in developing personalized nutrition solutions, leveraging e-commerce platforms, and focusing on sustainable and ethically sourced ingredients. Companies that effectively address consumer demand for natural, clean-label products and tailor their offerings to specific health concerns will be well-positioned to capture significant market share.

Australia Nutraceuticals Market Segmentation

-

1. Product Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverage

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

- 1.2.5. Other Functional Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

Australia Nutraceuticals Market Segmentation By Geography

- 1. Australia

Australia Nutraceuticals Market Regional Market Share

Geographic Coverage of Australia Nutraceuticals Market

Australia Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Elderly Population boosting Nutraceuticals Market in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverage

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.2.5. Other Functional Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frucor Suntory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Australia & New Zealand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kellogg (Aust ) Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pure Harvest Smart Farms Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pharmacare Laboratories Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remedy Drinks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills Australia Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GlaxoSmithKline Plc*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Health & Happiness (H&H) International Holdings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Herbalife Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nestle Australia Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Frucor Suntory

List of Figures

- Figure 1: Australia Nutraceuticals Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Nutraceuticals Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Nutraceuticals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australia Nutraceuticals Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Nutraceuticals Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Australia Nutraceuticals Market?

Key companies in the market include Frucor Suntory, PepsiCo Australia & New Zealand, Bayer AG, Kellogg (Aust ) Pty Ltd, Pure Harvest Smart Farms Ltd, Pharmacare Laboratories Pty Ltd, Remedy Drinks, General Mills Australia Pty Ltd, GlaxoSmithKline Plc*List Not Exhaustive, Health & Happiness (H&H) International Holdings Ltd, Herbalife Australia, Nestle Australia Ltd.

3. What are the main segments of the Australia Nutraceuticals Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Increasing Elderly Population boosting Nutraceuticals Market in the Country.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

In October 2022, Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - Blackberry, Lemon Lime, and Mango Pineapple.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the Australia Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence