Key Insights

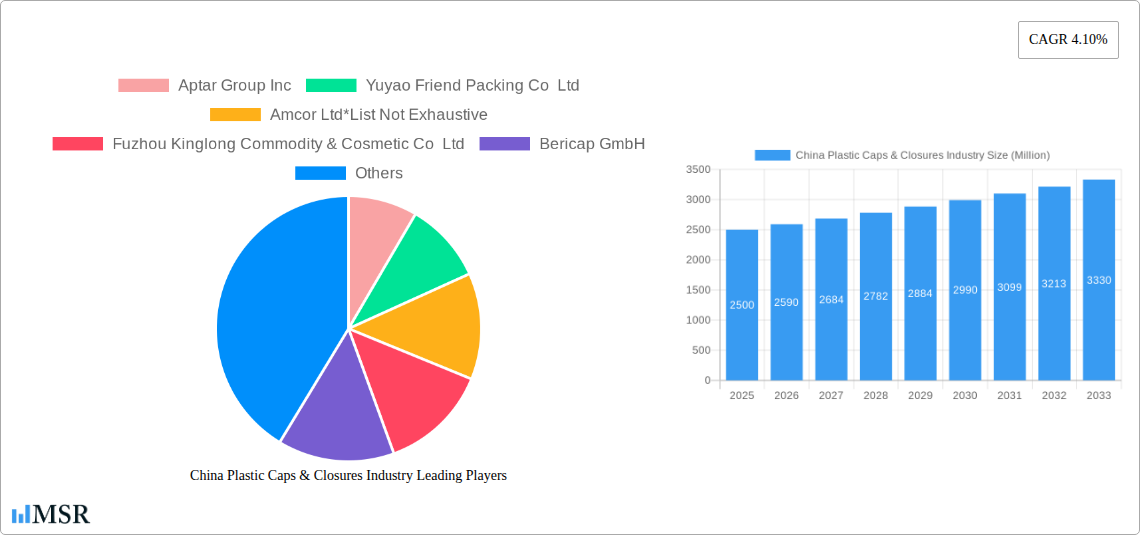

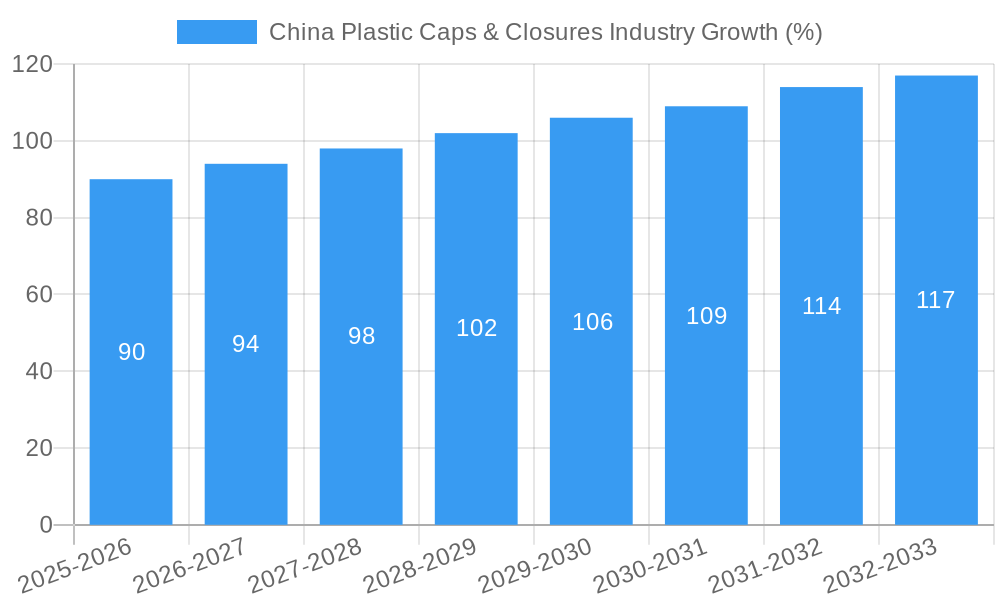

The China plastic caps and closures market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning food and beverage industry in China, coupled with increasing demand for pharmaceutical and cosmetic products, fuels significant consumption of plastic caps and closures. Furthermore, the rising adoption of convenient packaging solutions across various sectors, including household goods and automotive, contributes to market growth. Technological advancements in materials science, leading to the development of lighter, more durable, and recyclable plastic caps, further enhance market appeal. While the prevalence of polyethylene terephthalate (PET) and polypropylene currently dominates the raw material segment, a growing interest in sustainable packaging is fostering increased utilization of biodegradable alternatives, presenting new opportunities for manufacturers. However, stringent environmental regulations concerning plastic waste management and fluctuating raw material prices pose significant challenges to market expansion. The market is segmented by raw material type (PET, PP, HDPE, LDPE, PVCs, and biodegradable options) and industry vertical (food, beverages, pharmaceuticals, cosmetics, household, automotive, and agriculture). Key players like Aptar Group Inc, Amcor Ltd, and Berry Global Inc are actively shaping the market landscape through innovation and strategic partnerships. The forecast period (2025-2033) anticipates continued growth, although the rate might slightly fluctuate due to economic conditions and regulatory changes. Competition is fierce, requiring companies to focus on product differentiation, cost efficiency, and sustainability initiatives to maintain a competitive edge.

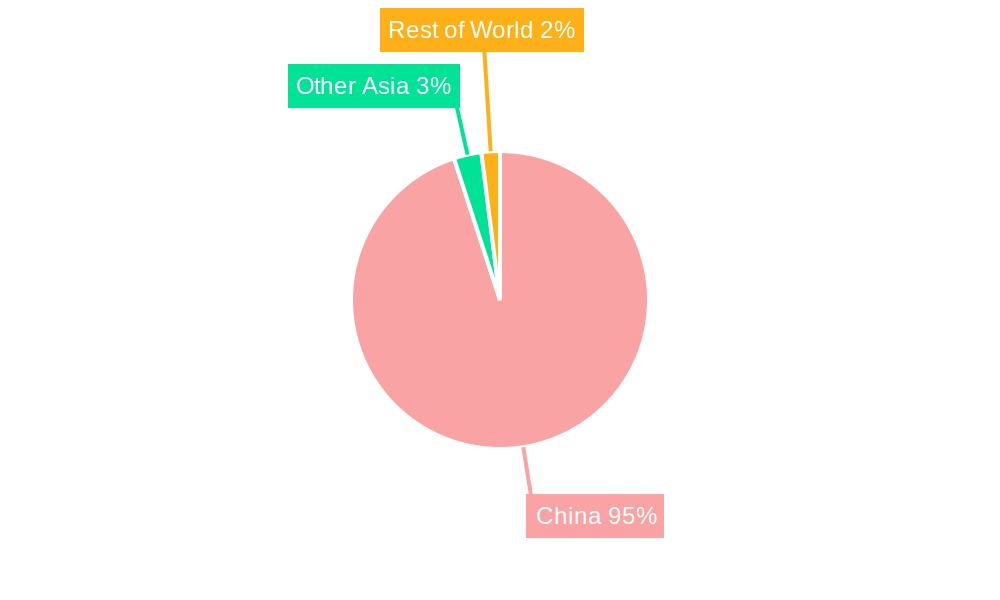

China's dominance in manufacturing and its expanding consumer base positions it as a key market for plastic caps and closures. The regional concentration of manufacturing facilities influences pricing and supply chain dynamics. The historical period (2019-2024) likely witnessed fluctuating growth due to external factors like the COVID-19 pandemic. The future growth trajectory depends significantly on the government's environmental policies, consumer preferences toward sustainable packaging, and the overall economic health of the country. Companies are increasingly investing in research and development to enhance the recyclability and biodegradability of their products to comply with evolving environmental standards. This focus on sustainability will likely drive innovation and influence market segmentation in the coming years. The ongoing expansion of e-commerce and the associated demand for convenient packaging also contribute positively to the market’s future prospects.

China Plastic Caps & Closures Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the booming China plastic caps & closures industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market size and CAGR to key players and emerging trends, this report covers all aspects, providing a robust foundation for strategic decision-making. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report includes detailed segmentation by raw material (Polyethylene Terephthalate, Polypropylene, HDPE and LDPE, Other Raw Materials (PVCs and Bio-degradable Plastic Films)) and industry vertical (Food, Beverages, Pharmaceutical, Cosmetics and Household, Other Industry Verticals (Automotive and Agriculture)), offering granular market understanding. Leading companies like Aptar Group Inc, Yuyao Friend Packing Co Ltd, and Amcor Ltd are analyzed, alongside many others. The report is meticulously researched and offers actionable insights for informed business strategies. Expect detailed analysis of market concentration, technological disruptions, regulatory frameworks, and numerous other vital factors.

China Plastic Caps & Closures Industry Market Concentration & Dynamics

The China plastic caps & closures market exhibits a moderately concentrated landscape, with several multinational and domestic players holding significant market share. While exact market share figures are proprietary to the full report, we observe a dynamic interplay between established players and emerging companies. The industry's innovation ecosystem is marked by ongoing R&D efforts focusing on sustainable materials and advanced closure technologies. Stringent regulatory frameworks, particularly concerning food safety and environmental regulations, influence manufacturing practices and material choices. Substitute products, such as metal or glass closures, exist but face challenges in terms of cost and practicality for many applications. End-user trends toward convenience, sustainability, and tamper-evident packaging are shaping product development strategies.

Key Market Dynamics:

- Market Concentration: Moderate, with a few major players dominating. Market share analysis available in the full report.

- Innovation: Focus on sustainable materials (biodegradable plastics) and smart packaging technologies (QR codes).

- Regulatory Framework: Strict regulations impacting material selection and manufacturing processes.

- Substitute Products: Limited competition from alternative closure materials.

- End-User Trends: Growing demand for convenient, sustainable, and tamper-evident packaging.

- M&A Activity: Significant M&A activity observed, with xx deals recorded between 2019 and 2024.

China Plastic Caps & Closures Industry Industry Insights & Trends

The China plastic caps & closures market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at xx Million USD, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by the expanding food and beverage, pharmaceutical, and cosmetics industries. Technological disruptions, such as the adoption of smart closures incorporating QR codes and RFID technology, are enhancing product traceability and consumer engagement. Evolving consumer behaviors, including a preference for convenient and sustainable packaging, are creating new opportunities for innovative products. The increasing adoption of e-commerce is further driving demand for tamper-evident and secure closures.

Key Markets & Segments Leading China Plastic Caps & Closures Industry

The China plastic caps & closures market is geographically diverse, with significant growth observed across various regions. However, coastal regions and major industrial hubs demonstrate the highest demand. The market is predominantly driven by the food and beverage sector due to large-scale production and consumption.

By Raw Material:

- Polyethylene Terephthalate (PET): Dominant segment due to its cost-effectiveness and suitability for various applications.

- Polypropylene (PP): Significant segment, favored for its heat resistance and versatility.

- HDPE and LDPE: Widely used, particularly for packaging liquids and semi-liquids.

- Other Raw Materials (PVCs and Bio-degradable Plastic Films): Growing segment driven by environmental concerns and regulatory pressures. Growth is expected to accelerate in the next decade driven by government subsidies and consumer demand.

By Industry Vertical:

- Food and Beverages: Largest segment due to high consumption and diverse packaging needs.

- Pharmaceuticals: Significant segment, demanding high standards of safety and hygiene.

- Cosmetics and Household: Growing segment, influenced by trends in packaging aesthetics and functionality.

- Other Industry Verticals (Automotive and Agriculture): Niche segments with moderate growth potential.

Drivers:

- Rapid economic growth in China.

- Expansion of the manufacturing and processing industries.

- Rising disposable incomes and changing consumer preferences.

- Government initiatives promoting industrial development.

China Plastic Caps & Closures Industry Product Developments

Recent product innovations include the integration of tamper-evident features, child-resistant closures, and smart packaging solutions with embedded QR codes or RFID tags. These advancements enhance product security and provide consumers with greater access to product information. The market is witnessing increased demand for sustainable and eco-friendly closures made from recycled or biodegradable materials, reflecting the growing awareness of environmental concerns. Companies are investing heavily in R&D to develop innovative closure technologies that offer superior performance and enhanced consumer experience.

Challenges in the China Plastic Caps & Closures Industry Market

The China plastic caps & closures industry faces several challenges, including stringent environmental regulations limiting the use of certain plastics and increasing raw material costs. Supply chain disruptions, particularly in the wake of global events, have caused production delays and increased costs. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. These factors, collectively, can lead to reductions in profitability if not managed effectively. The estimated negative impact on the industry is estimated to be xx Million USD annually.

Forces Driving China Plastic Caps & Closures Industry Growth

Key growth drivers include the increasing demand for packaged goods, rising consumer disposable incomes, and robust growth in the food and beverage, pharmaceuticals, and cosmetics sectors. Government support for manufacturing and industrial development creates favorable conditions for the industry. Technological advancements, including the adoption of sustainable materials and smart packaging, are driving innovation and efficiency gains.

Challenges in the China Plastic Caps & Closures Industry Market

Long-term growth hinges on overcoming challenges such as maintaining cost-competitiveness amidst rising raw material prices, adapting to environmental regulations, and continuing innovation in sustainable and functional packaging. Strategic partnerships and investments in R&D will be essential for long-term success. Expansion into new markets and product diversification will also be crucial for sustained growth.

Emerging Opportunities in China Plastic Caps & Closures Industry

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging, smart packaging solutions with enhanced functionality, and the increasing adoption of e-commerce. Expansion into niche markets, such as specialized pharmaceutical or cosmetic packaging, offers further growth potential. Companies that successfully embrace these trends are well-positioned for future success.

Leading Players in the China Plastic Caps & Closures Industry Sector

- Aptar Group Inc

- Yuyao Friend Packing Co Ltd

- Amcor Ltd

- Fuzhou Kinglong Commodity & Cosmetic Co Ltd

- Bericap GmbH

- Albea Group

- Silgan White Cap (Shanghai) Co

- Shandong Haishengyu Plastics Industry Co Ltd

- Crown Asia Pacific Holdings Limited

- Berry Global Inc

Key Milestones in China Plastic Caps & Closures Industry Industry

- May 2022: Carlyle's planned acquisition of HCP, a significant player in cosmetic packaging, signals consolidation and investment in R&D within the industry. This will likely lead to innovation in the cosmetic segment.

- August 2021: Nestle's successful launch of QR code closures in Vietnam, following a successful trial in China, highlights the growing trend of smart packaging and its potential to improve consumer engagement and brand loyalty.

Strategic Outlook for China Plastic Caps & Closures Industry Market

The China plastic caps & closures market is poised for continued growth, driven by factors like increasing consumption, rising disposable incomes, and technological advancements in sustainable and smart packaging. Strategic investments in R&D, focusing on sustainable materials and innovative closure designs, will be crucial for companies to maintain competitiveness. A focus on meeting evolving consumer preferences for convenient, environmentally friendly, and secure packaging will determine long-term success. The market offers substantial opportunities for both established players and new entrants to capitalize on the expanding demand for innovative and high-quality packaging solutions.

China Plastic Caps & Closures Industry Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate

- 1.2. Polypropylene

- 1.3. HDPE and LDPE

- 1.4. Other Ra

-

2. Industry Vertical

- 2.1. Food

- 2.2. Beverages

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Household

- 2.5. Other In

China Plastic Caps & Closures Industry Segmentation By Geography

- 1. China

China Plastic Caps & Closures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Single Serve Beverages; Growing Demand from Cosmetic Industry

- 3.3. Market Restrains

- 3.3.1. Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Caps & Closures Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate

- 5.1.2. Polypropylene

- 5.1.3. HDPE and LDPE

- 5.1.4. Other Ra

- 5.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Household

- 5.2.5. Other In

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aptar Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yuyao Friend Packing Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuzhou Kinglong Commodity & Cosmetic Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bericap GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Albea Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan White Cap (Shanghai) Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Haishengyu Plastics Industry Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Crown Asia Pacific Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berry Global Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Aptar Group Inc

List of Figures

- Figure 1: China Plastic Caps & Closures Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Plastic Caps & Closures Industry Share (%) by Company 2024

List of Tables

- Table 1: China Plastic Caps & Closures Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Plastic Caps & Closures Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 3: China Plastic Caps & Closures Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 4: China Plastic Caps & Closures Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Plastic Caps & Closures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Plastic Caps & Closures Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 7: China Plastic Caps & Closures Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: China Plastic Caps & Closures Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Caps & Closures Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the China Plastic Caps & Closures Industry?

Key companies in the market include Aptar Group Inc, Yuyao Friend Packing Co Ltd, Amcor Ltd*List Not Exhaustive, Fuzhou Kinglong Commodity & Cosmetic Co Ltd, Bericap GmbH, Albea Group, Silgan White Cap (Shanghai) Co, Shandong Haishengyu Plastics Industry Co Ltd, Crown Asia Pacific Holdings Limited, Berry Global Inc.

3. What are the main segments of the China Plastic Caps & Closures Industry?

The market segments include Raw Material, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Single Serve Beverages; Growing Demand from Cosmetic Industry.

6. What are the notable trends driving market growth?

Food and Beverage Industry to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives.

8. Can you provide examples of recent developments in the market?

May 2022: Carlyle plans to acquire China-based cosmetic packaging company HCP. HCP works with more than 250 leading cosmetics, skincare, and fragrance brands, including Estée Lauder, L'Oréal, and Shiseido. Carlyle will work with HCP through strategic acquisitions to strengthen the company's research and development (R&D) capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Caps & Closures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Caps & Closures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Caps & Closures Industry?

To stay informed about further developments, trends, and reports in the China Plastic Caps & Closures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence