Key Insights

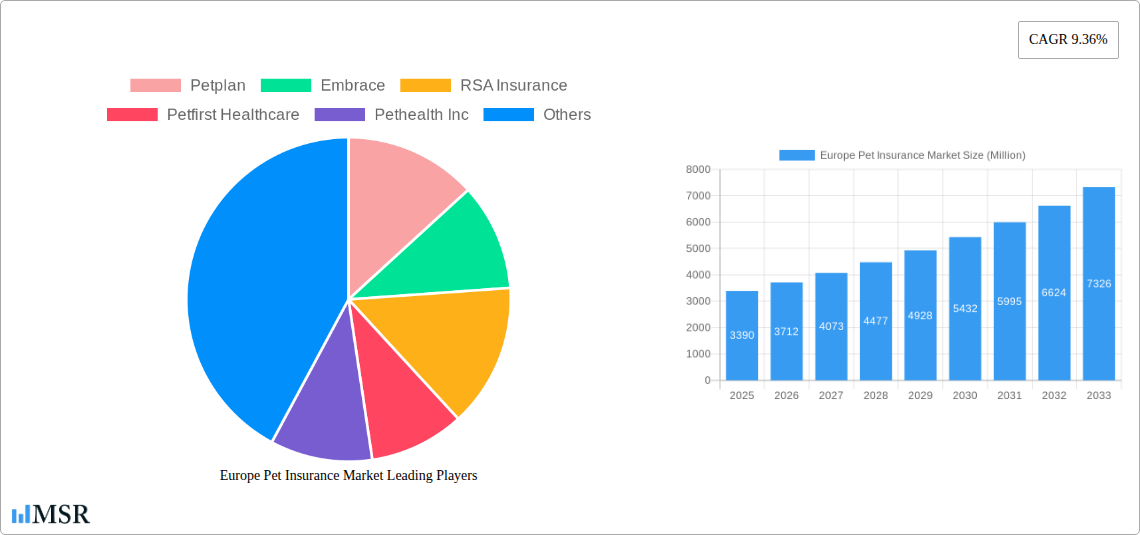

The European pet insurance market, valued at €3.39 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.36% from 2025 to 2033. This surge is driven by several key factors. Increasing pet ownership across Europe, coupled with rising pet humanization—treating pets as family members—is a significant driver. Owners are increasingly willing to invest in their pets' health and well-being, leading to higher adoption of insurance plans covering veterinary expenses, which can be substantial. Furthermore, enhanced awareness of pet insurance benefits, fueled by targeted marketing campaigns and positive customer experiences, is contributing to market expansion. The rising prevalence of chronic diseases in pets also plays a role, as owners seek financial protection against potentially costly treatments. Market segmentation reveals a varied landscape, with different insurance providers catering to specific pet types (dogs, cats, etc.) and offering diverse coverage options, from basic accident plans to comprehensive health insurance packages. Competitive intensity is high, with key players like Petplan, Embrace, and RSA Insurance vying for market share through innovative product offerings and improved customer service.

Europe Pet Insurance Market Market Size (In Billion)

The market's growth is not without its challenges. Economic downturns can impact consumer spending on non-essential items like pet insurance, representing a potential restraint. Regulatory changes impacting insurance pricing and coverage could also influence market dynamics. However, the long-term outlook remains positive, driven by the enduring trend of pet humanization and the increasing affordability of pet insurance plans. The market is likely to witness innovation in areas like telehealth for pets, integrated wellness programs, and personalized insurance options, further stimulating growth and attracting new customer segments. Regional variations in pet ownership rates and insurance penetration will continue to shape market performance across different European countries. Future growth will likely be influenced by factors such as evolving consumer preferences, technological advancements, and the ability of insurance providers to effectively adapt to changing market conditions.

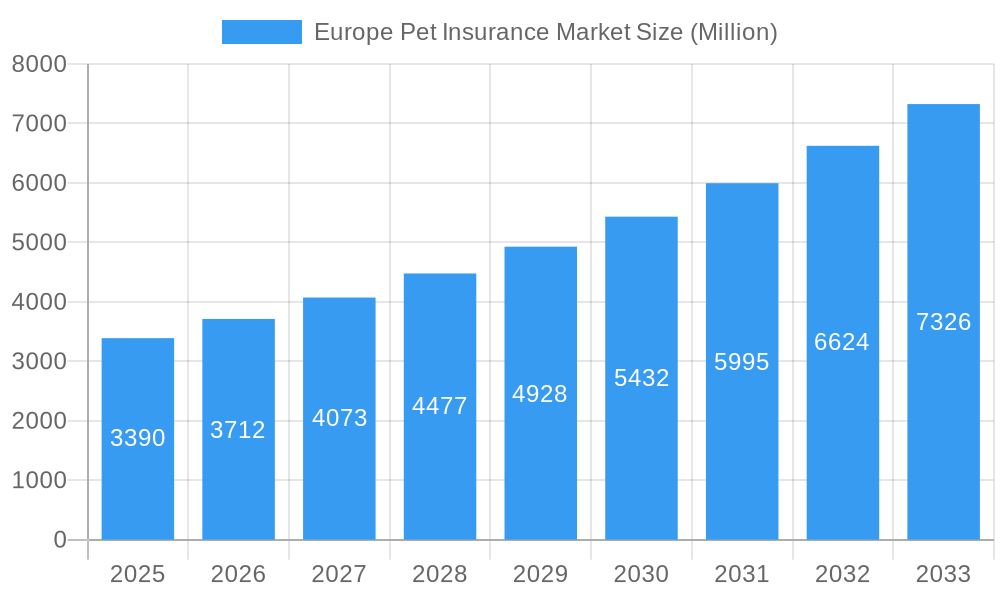

Europe Pet Insurance Market Company Market Share

Europe Pet Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Pet Insurance Market, covering the period 2019-2033, with a focus on market dynamics, industry trends, key players, and future growth opportunities. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects market trends until the estimated year (2025) and forecast period (2025-2033). This in-depth analysis is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this rapidly evolving market. The report values are presented in Millions.

Europe Pet Insurance Market Concentration & Dynamics

This section assesses the competitive landscape of the European pet insurance market, examining market concentration, innovation, regulations, substitute products, consumer trends, and M&A activity. The market is characterized by a mix of large multinational players and smaller, regional insurers.

Market Concentration: The market exhibits moderate concentration, with the top 5 players holding an estimated xx% market share in 2025. However, the presence of numerous smaller, specialized providers contributes to a dynamic and competitive environment.

Innovation Ecosystems: Innovation is driven by technological advancements in data analytics, telematics, and personalized pet health management. This leads to more tailored insurance products and improved customer experience.

Regulatory Frameworks: Varying regulatory frameworks across European countries impact market access and product offerings. Harmonization efforts are ongoing, but inconsistencies remain a challenge.

Substitute Products: Limited substitutes exist, making pet insurance relatively unique. However, increasing consumer awareness of pet savings plans and alternative financing options pose a potential indirect competitive threat.

End-User Trends: Growing pet ownership, increasing human-animal bonds, and greater awareness of pet healthcare costs are key drivers of market growth. Consumers are increasingly seeking comprehensive coverage and value-added services.

M&A Activities: The number of M&A deals in the sector has seen a notable increase in recent years, reflecting consolidation trends and strategic expansion efforts. An estimated xx M&A deals occurred between 2019 and 2024. Examples include Trupanion's acquisition of PetExpert (November 2022).

Europe Pet Insurance Market Industry Insights & Trends

The European pet insurance market is experiencing significant growth, driven by several factors. The market size reached approximately xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising pet ownership, increased pet healthcare costs, and a growing understanding of the financial risks associated with unexpected veterinary expenses. Technological disruptions, such as the use of telemedicine and wearable pet trackers, are further enhancing the market's capabilities and attracting new customer segments. Furthermore, shifting consumer behaviors, with a growing emphasis on pet well-being and proactive healthcare, are positively impacting market expansion.

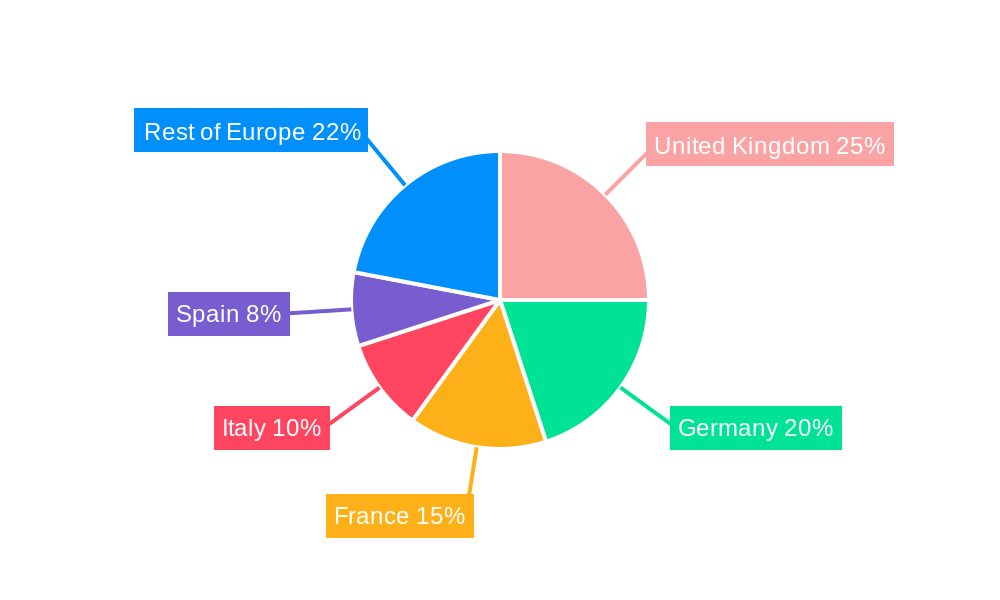

Key Markets & Segments Leading Europe Pet Insurance Market

The UK, Germany, and France represent the largest markets within Europe, collectively accounting for an estimated xx% of the total market value in 2025. The dog insurance segment holds the largest market share, followed by cat insurance.

Drivers of Dominance in Key Markets:

- UK: High pet ownership rates, strong consumer awareness of pet insurance, and a well-developed insurance sector.

- Germany: Growing pet ownership, increasing disposable incomes, and a rising trend of pet humanization.

- France: Similar trends to Germany, with increasing pet ownership and a focus on pet well-being.

Segment Analysis: The dog insurance segment's dominance is due to higher veterinary costs associated with larger breeds and a greater likelihood of requiring more extensive medical care.

Europe Pet Insurance Market Product Developments

Recent product innovations focus on enhanced coverage options, such as wellness plans, preventative care, and behavioral therapy. Technological advancements, such as telehealth integration and data-driven risk assessment, allow for more personalized and cost-effective insurance products. These innovations provide competitive advantages by attracting price-sensitive and value-seeking customers.

Challenges in the Europe Pet Insurance Market

The market faces challenges such as stringent regulatory requirements, varying insurance penetration rates across countries, and intense competition from established and emerging players. These factors, combined with potential supply chain disruptions impacting veterinary services, can constrain market growth. Furthermore, the need to balance affordability with comprehensive coverage remains a significant challenge.

Forces Driving Europe Pet Insurance Market Growth

Several factors are driving market expansion. Firstly, the increasing humanization of pets and the growing awareness of pet health are increasing demand for insurance coverage. Secondly, economic growth in several European countries translates into higher disposable incomes, allowing pet owners to afford insurance premiums. Finally, the favorable regulatory environment in many markets encourages market participation and expansion.

Long-Term Growth Catalysts in Europe Pet Insurance Market

Long-term growth will be fueled by continued technological advancements in pet healthcare and insurance technology. Strategic partnerships between insurers and veterinary providers are also expected to play a crucial role. Expansion into new markets with lower pet insurance penetration will further drive growth.

Emerging Opportunities in Europe Pet Insurance Market

Emerging opportunities include the development of niche insurance products tailored to specific breeds or pet health conditions. The growing use of telematics and wearable devices offers opportunities for innovative risk assessment and personalized pricing. Moreover, expanding into underserved markets and offering value-added services presents further opportunities for growth.

Leading Players in the Europe Pet Insurance Market Sector

- Petplan

- Embrace

- RSA Insurance

- Petfirst Healthcare

- Pethealth Inc

- Protectapet

- AGILA

- Petsecure

- Hartville Group

- NSM Insurance Group

- List Not Exhaustive

Key Milestones in Europe Pet Insurance Market Industry

- November 2022: Trupanion acquires Royal Blue s.r.o. (PetExpert), furthering its European expansion.

- February 2023: Agria Petinsure launches in Ireland, aiming to increase pet insurance penetration.

Strategic Outlook for Europe Pet Insurance Market

The Europe Pet Insurance Market exhibits substantial growth potential. Strategic investments in technology, expansion into new markets, and the development of innovative products will be crucial for achieving sustainable growth. The focus should be on providing affordable, comprehensive coverage while leveraging technological advancements to enhance customer experience and operational efficiency. The market is poised for significant expansion, driven by changing consumer behavior and an increasingly pet-centric society.

Europe Pet Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Accident & Illness

- 1.2. Accident Only

-

2. Policy Type

- 2.1. Lifetime Coverage

- 2.2. Non-Lifetime Coverage

-

3. Animal Type

- 3.1. Dogs

- 3.2. Cats

- 3.3. Other Animal Types

-

4. Provider

- 4.1. Public

- 4.2. Private

-

5. Distribution Channel

- 5.1. Insurance Agency

- 5.2. Bancassurance

- 5.3. Brokers

- 5.4. Direct Sales

Europe Pet Insurance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pet Insurance Market Regional Market Share

Geographic Coverage of Europe Pet Insurance Market

Europe Pet Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing trend of Dog Insurance Premiums in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Accident & Illness

- 5.1.2. Accident Only

- 5.2. Market Analysis, Insights and Forecast - by Policy Type

- 5.2.1. Lifetime Coverage

- 5.2.2. Non-Lifetime Coverage

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Dogs

- 5.3.2. Cats

- 5.3.3. Other Animal Types

- 5.4. Market Analysis, Insights and Forecast - by Provider

- 5.4.1. Public

- 5.4.2. Private

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Insurance Agency

- 5.5.2. Bancassurance

- 5.5.3. Brokers

- 5.5.4. Direct Sales

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Petplan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Embrace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RSA Insurance

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petfirst Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pethealth Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Protectapet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGILA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petsecure

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hartville Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NSM Insurance Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Petplan

List of Figures

- Figure 1: Europe Pet Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pet Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pet Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Europe Pet Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Europe Pet Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 4: Europe Pet Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 5: Europe Pet Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Europe Pet Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 7: Europe Pet Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 8: Europe Pet Insurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 9: Europe Pet Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Pet Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Pet Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Europe Pet Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 13: Europe Pet Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 14: Europe Pet Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 15: Europe Pet Insurance Market Revenue Million Forecast, by Policy Type 2020 & 2033

- Table 16: Europe Pet Insurance Market Volume Billion Forecast, by Policy Type 2020 & 2033

- Table 17: Europe Pet Insurance Market Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Europe Pet Insurance Market Volume Billion Forecast, by Animal Type 2020 & 2033

- Table 19: Europe Pet Insurance Market Revenue Million Forecast, by Provider 2020 & 2033

- Table 20: Europe Pet Insurance Market Volume Billion Forecast, by Provider 2020 & 2033

- Table 21: Europe Pet Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Pet Insurance Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Pet Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Pet Insurance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: France Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Pet Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Pet Insurance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pet Insurance Market?

The projected CAGR is approximately 9.36%.

2. Which companies are prominent players in the Europe Pet Insurance Market?

Key companies in the market include Petplan, Embrace, RSA Insurance, Petfirst Healthcare, Pethealth Inc, Protectapet, AGILA, Petsecure, Hartville Group, NSM Insurance Group**List Not Exhaustive.

3. What are the main segments of the Europe Pet Insurance Market?

The market segments include Insurance Type, Policy Type, Animal Type, Provider, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing trend of Dog Insurance Premiums in Europe.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: The new brand Agria Petinsure, formerly Petinsure, is entering the Irish market with a clear mission. Currently, the insurance rate for dogs in the Irish market is approximately 10%-15%, while the rate for cats is approximately 5%. It is estimated that 90% of dogs and 50% of cats in Sweden have pet insurance. Agria Petinsure believes that the same safety should be available for all Irish pets, and pet owners should enjoy peace of mind if their pet needs medical treatment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pet Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pet Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pet Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Pet Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence