Key Insights

The European Ready-to-Drink (RTD) coffee market is projected to reach 2.81 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 7.8% from 2025 to 2033. This substantial growth is driven by escalating consumer demand for convenient, on-the-go beverage solutions, particularly among busy European demographics. The market is further invigorated by a growing preference for premium coffee experiences, with innovative offerings such as cold brew and iced coffee variants gaining significant traction. Additionally, RTD coffee's positioning as a healthier alternative to traditional sugary soft drinks contributes to its appeal. Advanced aseptic packaging solutions are also supporting market expansion by extending shelf life and enhancing product preservation. Key industry players, including Nestlé, PepsiCo, and Coca-Cola, are strategically investing in product development and expanding distribution channels across both on-trade and off-trade sectors. The competitive environment is characterized by the presence of both major corporations and specialized coffee brands, fostering continuous innovation.

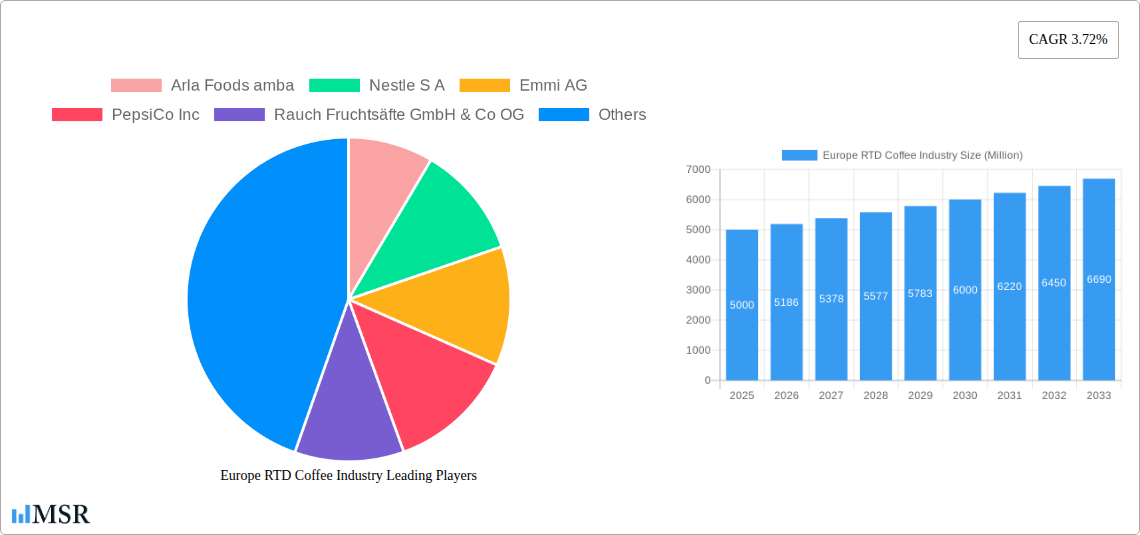

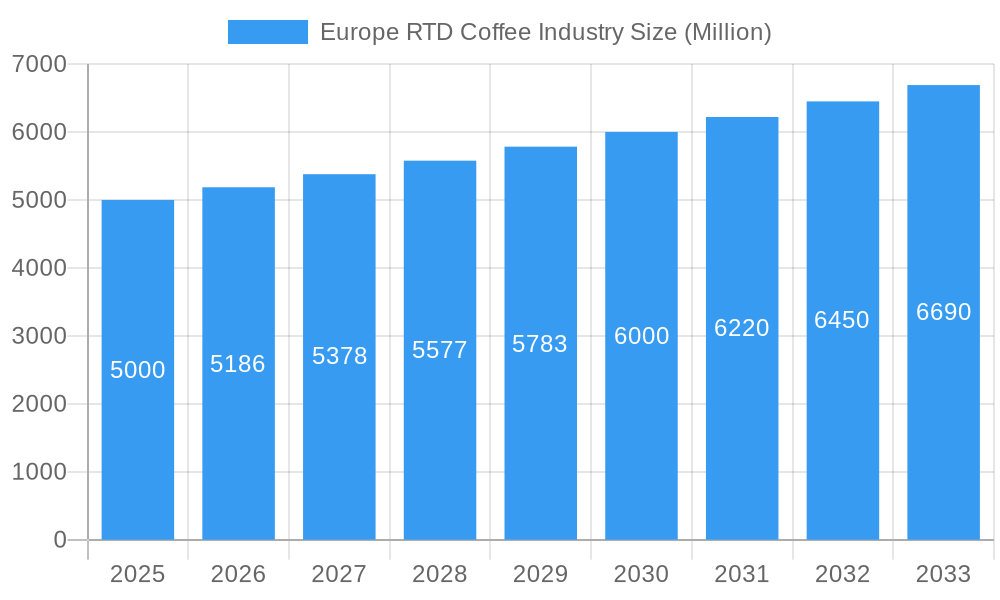

Europe RTD Coffee Industry Market Size (In Billion)

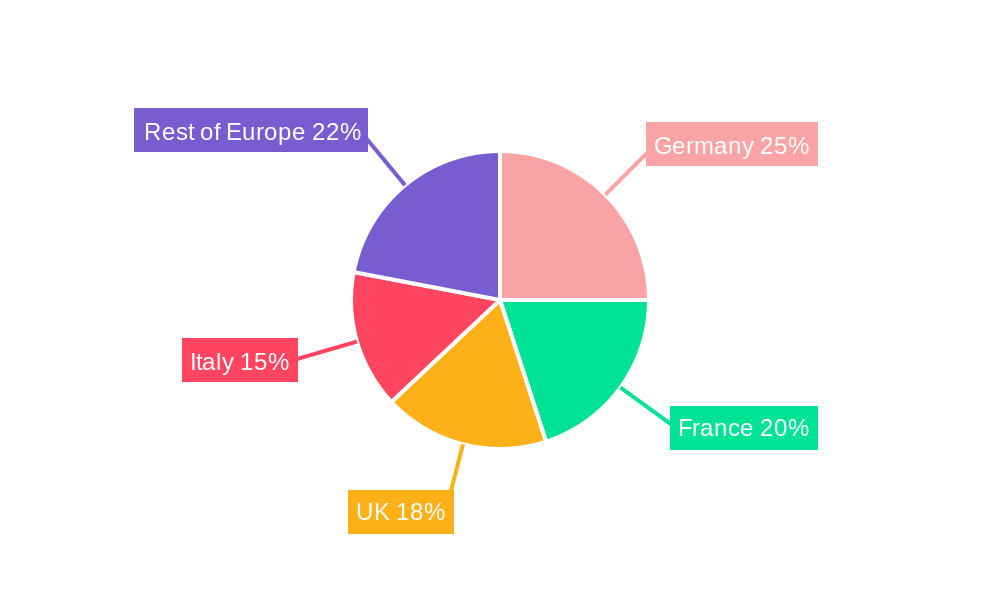

Market segmentation highlights diverse growth avenues. While PET bottles currently lead in packaging, there is a discernible shift towards sustainable options like glass bottles. The on-trade channel retains a dominant share, driven by café and restaurant consumption. Concurrently, the off-trade segment is experiencing rapid expansion, fueled by convenience and broader retail accessibility. Geographically, Germany, France, the UK, and Italy represent key markets, with emerging potential in nations like the Netherlands and Sweden. Challenges include price volatility of coffee beans, environmental concerns surrounding packaging waste, and evolving consumer preferences. Nevertheless, the European RTD coffee market outlook remains highly positive, propelled by consistent consumer demand and ongoing product innovation.

Europe RTD Coffee Industry Company Market Share

This comprehensive report offers an in-depth analysis of the European Ready-to-Drink (RTD) coffee industry, providing crucial insights for stakeholders navigating this dynamic market. Based on historical data from 2019-2024 and a base year of 2025, the forecast period (2025-2033) details market concentration, key trends, leading segments, and emerging opportunities. Expect actionable data and strategic recommendations to guide market entry and expansion. The European RTD coffee market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe RTD Coffee Industry Market Concentration & Dynamics

This section analyzes the competitive landscape, innovative activities, regulatory environment, and market dynamics within the European RTD coffee market. The market exhibits a moderately concentrated structure, with key players like Nestle S.A., PepsiCo Inc., and The Coca-Cola Company holding significant market share, estimated at xx Million, xx Million, and xx Million respectively in 2025. However, smaller, innovative brands are also emerging, driving competition and product diversification.

- Market Share: The top 5 players account for approximately xx% of the total market.

- M&A Activity: The industry has witnessed xx M&A deals in the last 5 years, indicating consolidation and strategic expansion within the sector. A notable example is Britvic PLC's USD 300 Million acquisition of Jimmy's, highlighting the ongoing investment in the RTD coffee space.

- Innovation Ecosystems: Significant investments in RTD coffee innovation are evident, particularly in sustainable packaging, new flavor profiles, and functional additions (e.g., added protein or vitamins).

- Regulatory Frameworks: EU regulations concerning food safety, labeling, and sustainability are key factors influencing product development and market access.

- Substitute Products: The RTD coffee market competes with other beverage categories, such as bottled water, juices, and energy drinks, affecting overall market growth and share.

- End-User Trends: Growing demand for convenient, premium, and healthier RTD coffee options is driving market growth.

Europe RTD Coffee Industry Industry Insights & Trends

The European RTD coffee market is experiencing robust growth, driven by several key factors. The increasing popularity of coffee, coupled with busy lifestyles and the demand for convenient consumption, fuels this expansion. Technological advancements in packaging (e.g., aseptic packaging for extended shelf life) and innovative product development (e.g., cold brew and nitro-infused coffee) are also key contributors to the market's upward trajectory. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. The increasing availability of RTD coffee in various distribution channels, from supermarkets to cafes, further boosts market accessibility and consumption. Shifting consumer preferences towards healthier options with natural ingredients and reduced sugar content influence product formulations and marketing strategies. The market growth is also influenced by the growing adoption of online grocery shopping and home delivery services.

Key Markets & Segments Leading Europe RTD Coffee Industry

The RTD coffee market exhibits diverse segmentation across packaging types, distribution channels, and product variants.

- Packaging Type: PET bottles dominate the market, accounting for xx% of total sales in 2025, driven by their cost-effectiveness and recyclability. Aseptic packaging is showing substantial growth due to its extended shelf life.

- Distribution Channel: The off-trade segment (supermarkets, convenience stores) holds a larger market share (xx%) compared to the on-trade (cafes, restaurants). The rise of e-commerce channels is steadily expanding the off-trade’s reach.

- Soft Drink Type: Iced coffee is currently the leading segment, capturing xx% of the market, followed by cold brew coffee. The "Other RTD Coffee" category includes innovative offerings like nitro cold brew and coffee-based energy drinks, exhibiting rapid growth.

Drivers:

- Economic growth: Increased disposable income boosts spending on premium beverages.

- Infrastructure: Efficient distribution networks facilitate widespread product availability.

- Changing lifestyles: Busy lifestyles drive the demand for convenient beverage choices.

Europe RTD Coffee Industry Product Developments

Recent product innovations focus on premiumization, health and wellness, and sustainable packaging. New product launches include functional RTD coffees with added nutrients, organic and fair-trade options, and innovative packaging formats emphasizing sustainability. Companies are adopting new technologies like nitrogen infusion to enhance the taste and texture of cold brew coffee, leading to enhanced consumer appeal and premium pricing.

Challenges in the Europe RTD Coffee Industry Market

The European RTD coffee industry faces several challenges, including intense competition, fluctuations in raw material prices, stringent regulatory requirements, and the need to maintain a sustainable supply chain. The market also faces the challenge of addressing growing consumer concerns regarding sugar content and artificial additives. This requires innovative product development and marketing strategies.

Forces Driving Europe RTD Coffee Industry Growth

Key growth drivers include rising disposable incomes, increasing urbanization, the growing preference for convenient beverages, and the expanding distribution channels. Technological advancements in packaging and product development further enhance market growth. Favorable government policies and regulations promoting sustainable practices within the industry also boost market expansion.

Long-Term Growth Catalysts in the Europe RTD Coffee Industry Market

Long-term growth will be driven by continuous product innovation, strategic partnerships to expand distribution, and penetration into new markets. Investment in sustainable packaging and marketing strategies highlighting health and wellness benefits will also be crucial in sustaining long-term growth. Expanding into emerging markets within Europe and exploring new product variations will also play a major role.

Emerging Opportunities in Europe RTD Coffee Industry

Emerging opportunities include the growing demand for functional RTD coffees with added health benefits (e.g., protein, vitamins), the expanding popularity of plant-based coffee alternatives, and the increasing adoption of sustainable packaging solutions. Exploring niche markets and customizing products to cater to specific consumer preferences (e.g., low-sugar, organic) also present significant market opportunities.

Leading Players in the Europe RTD Coffee Industry Sector

- Arla Foods amba

- Nestle S A

- Emmi AG

- PepsiCo Inc

- Rauch Fruchtsäfte GmbH & Co OG

- Crediton Dairy Ltd

- Luigi Lavazza S p A

- The Coca-Cola Company

- Britvic PLC

- illycaffè S p A

- Sodiaal Union

- The Fayrefield Group Limite

Key Milestones in Europe RTD Coffee Industry Industry

- July 2023: Britvic PLC expands its portfolio with the USD 300 Million acquisition of Jimmy's, the UK's fastest-growing RTD iced coffee brand. This significantly strengthens Britvic's position in the RTD coffee market.

- January 2023: Columbus Café & Co. and Sodiaal Cooperative partner to launch a range of iced lattes, broadening product availability and distribution channels.

- August 2022: Sodiaal Union and Columbus Café & Co. collaborate on innovative RTD coffee beverages (cappuccino, latte, chocolate), expanding product offerings and brand collaborations.

Strategic Outlook for Europe RTD Coffee Industry Market

The European RTD coffee market presents significant growth potential, driven by consumer demand for convenience, premiumization, and health-conscious choices. Strategic opportunities lie in innovation, sustainable practices, and effective brand building within a competitive landscape. Companies should focus on investing in new product development, expanding distribution networks, and leveraging digital marketing to capture market share and drive sustainable growth.

Europe RTD Coffee Industry Segmentation

-

1. Soft Drink Type

- 1.1. Cold Brew Coffee

- 1.2. Iced coffee

- 1.3. Other RTD Coffee

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Specialty Stores

- 3.1.4. Supermarket/Hypermarket

- 3.1.5. Others

- 3.2. On-trade

-

3.1. Off-trade

Europe RTD Coffee Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe RTD Coffee Industry Regional Market Share

Geographic Coverage of Europe RTD Coffee Industry

Europe RTD Coffee Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. High Competition From Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe RTD Coffee Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Cold Brew Coffee

- 5.1.2. Iced coffee

- 5.1.3. Other RTD Coffee

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Specialty Stores

- 5.3.1.4. Supermarket/Hypermarket

- 5.3.1.5. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arla Foods amba

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emmi AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PepsiCo Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rauch Fruchtsäfte GmbH & Co OG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Crediton Dairy Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Luigi Lavazza S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Britvic PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 illycaffè S p A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sodiaal Union

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Fayrefield Group Limite

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Arla Foods amba

List of Figures

- Figure 1: Europe RTD Coffee Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe RTD Coffee Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe RTD Coffee Industry Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Europe RTD Coffee Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Europe RTD Coffee Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe RTD Coffee Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe RTD Coffee Industry Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Europe RTD Coffee Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Europe RTD Coffee Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe RTD Coffee Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe RTD Coffee Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe RTD Coffee Industry?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Europe RTD Coffee Industry?

Key companies in the market include Arla Foods amba, Nestle S A, Emmi AG, PepsiCo Inc, Rauch Fruchtsäfte GmbH & Co OG, Crediton Dairy Ltd, Luigi Lavazza S p A, The Coca-Cola Company, Britvic PLC, illycaffè S p A, Sodiaal Union, The Fayrefield Group Limite.

3. What are the main segments of the Europe RTD Coffee Industry?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition From Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

July 2023: Britvic expands its portfolio with the addition of the UK’s fastest growing ‘ready to drink’ iced coffee brand Jimmy's with a deal of USD 300 million.January 2023: Columbus Café & Co. and Sodiaal Cooperative signed a partnership to launch a range of iced lattes made up of 4 gourmet recipes in a resealable 25 cl brick, easy to taste and transport with its resealable bio-based plastic cap. The drinks will be sold in supermarkets, as well as in bakeries, Relay stores, or on the highways.August 2022: Sodiaal Union's Candia marketing & innovation teams, together with Columbus Café & Co., the French coffee shop network, developed a range of innovative RTD coffee beverages (cappuccino, latte, chocolate, and It offers latte, the signature of the chain, flavored with Speculoos)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe RTD Coffee Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe RTD Coffee Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe RTD Coffee Industry?

To stay informed about further developments, trends, and reports in the Europe RTD Coffee Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence