Key Insights

The European Textured Vegetable Protein (TVP) market is poised for significant expansion, driven by escalating consumer adoption of plant-based diets and heightened awareness of sustainable and health-conscious food choices. The market is projected to reach 636.5 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.95%. Key growth catalysts include the widespread embrace of vegan, vegetarian, and flexitarian lifestyles, coupled with continuous innovation from prominent industry players. Favorable government initiatives supporting sustainable food systems and dedicated R&D investments further invigorate market dynamism. The competitive arena is shaped by strategic partnerships and consolidations, enhancing product offerings and global market penetration.

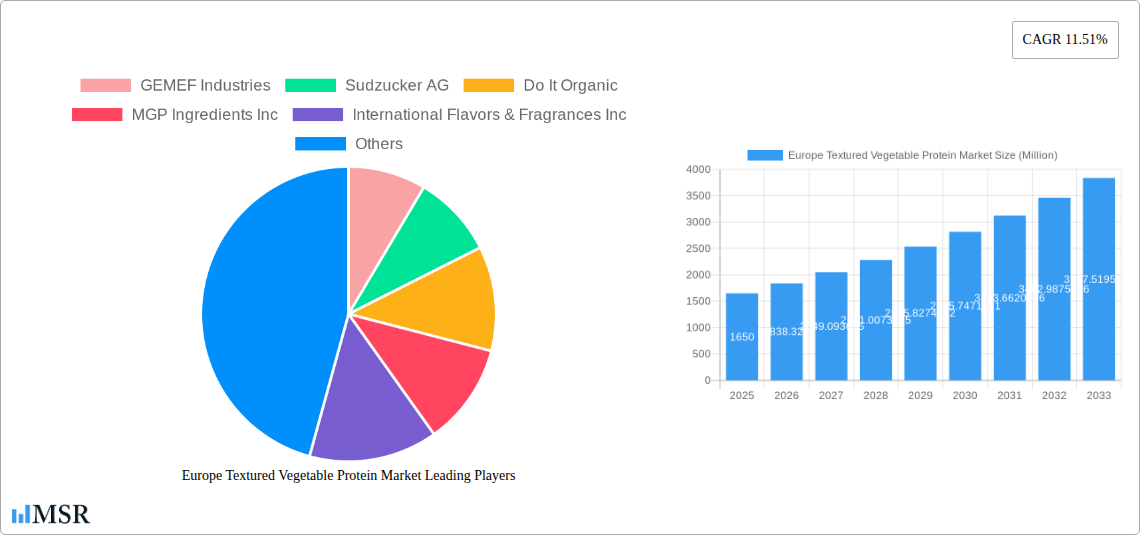

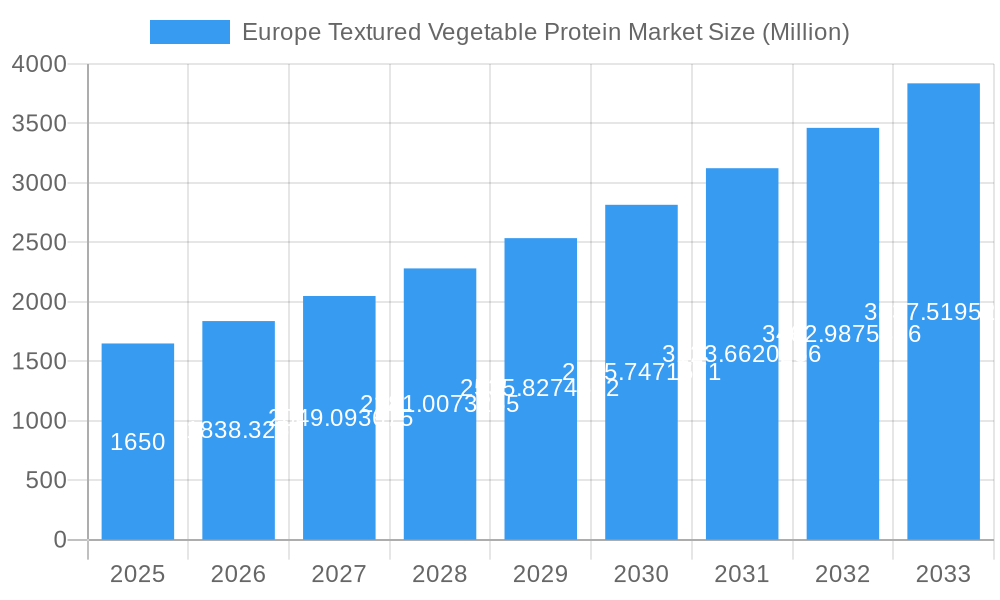

Europe Textured Vegetable Protein Market Market Size (In Million)

Evolving consumer preferences for healthier, ethically produced food options are a primary growth driver. TVP, derived from sustainable sources such as soy, pea, and wheat, provides a cost-effective protein alternative with a meat-like texture, ideal for plant-based meat and dairy substitutes, and processed food applications. The off-trade distribution segment, particularly online retail and supermarkets, leads market penetration due to increasing demand for convenient at-home consumption. The food service sector also demonstrates growing demand as establishments integrate more plant-based menu items. Emerging trends encompass the exploration of novel protein sources, refinement of processing technologies for superior texture and flavor, and a focus on clean-label products. While the market shows strong upward trajectory, potential challenges such as raw material price volatility and the imperative for consumer education on TVP benefits necessitate strategic approaches for sustained, inclusive European market growth.

Europe Textured Vegetable Protein Market Company Market Share

Europe Textured Vegetable Protein Market: Comprehensive Market Analysis & Growth Forecast (2019-2033)

This in-depth report offers a definitive analysis of the Europe Textured Vegetable Protein (TVP) market, covering the historical period (2019-2024), base year (2025), estimated year (2025), and a detailed forecast period (2025-2033). Gain critical insights into market dynamics, industry trends, key segment performance, product innovations, challenges, and emerging opportunities that are shaping the future of plant-based protein solutions across Europe. This research is indispensable for food manufacturers, ingredient suppliers, investors, and industry stakeholders seeking to capitalize on the burgeoning demand for sustainable and healthy food alternatives. The report delves into market size estimations, CAGR projections, and competitive landscapes, providing actionable intelligence for strategic decision-making.

Europe Textured Vegetable Protein Market Market Concentration & Dynamics

The Europe Textured Vegetable Protein market exhibits a moderate to high concentration, with a few key players dominating significant market share. Innovation ecosystems are vibrant, driven by increasing consumer demand for novel plant-based ingredients and ongoing research and development by leading companies. Regulatory frameworks, while evolving to support food innovation, also play a role in market access and product development. Substitute products, such as mycoprotein and lab-grown meat, present a growing competitive landscape, influencing market strategies. End-user trends are strongly skewed towards health-conscious consumers, flexitarians, and vegans seeking protein-rich, meat-free options, particularly within the convenience food and ready-to-eat segments. Mergers & Acquisitions (M&A) activities are observed as companies seek to expand their product portfolios, gain market access, and enhance technological capabilities. For instance, the ICL Group's investment in Arkeon signifies a strategic move to integrate cutting-edge bio-fermentation technologies. The market share of key players is estimated to be significantly influenced by their investment in R&D and product diversification. The M&A deal count in the European plant-based protein sector has seen a steady increase over the past three years, indicating consolidation and strategic expansion.

Europe Textured Vegetable Protein Market Industry Insights & Trends

The Europe Textured Vegetable Protein market is experiencing robust growth, driven by a confluence of powerful trends. The escalating demand for plant-based diets, fueled by environmental concerns, ethical considerations, and perceived health benefits, is the primary catalyst. Consumers are increasingly seeking meat alternatives that offer comparable taste, texture, and nutritional profiles to traditional meat products. This has led to significant investments in the research and development of novel plant-based ingredients, including advanced extrusion technologies to improve the texture and mouthfeel of TVP. Technological disruptions, such as advancements in protein isolation and texturization techniques, are enabling the creation of more versatile and appealing TVP products. The market size for Europe's TVP is projected to reach approximately USD 4,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% forecasted through 2033. Evolving consumer behaviors are also playing a crucial role. There is a growing preference for clean-label products with fewer artificial ingredients, pushing manufacturers to develop TVP derived from natural sources like soy, pea, and wheat. The focus on sustainable sourcing and production is also gaining traction, with consumers actively seeking products that minimize their environmental footprint. The convenience sector, including ready meals and snacks, is a major beneficiary of these trends, as TVP offers a cost-effective and versatile protein source for these applications. The convenience stores and online channel segments are witnessing particularly rapid adoption.

Key Markets & Segments Leading Europe Textured Vegetable Protein Market

The Europe Textured Vegetable Protein market is led by Western European countries, with Germany, the United Kingdom, and France at the forefront. This dominance is attributed to a combination of factors, including higher disposable incomes, greater consumer awareness of health and environmental issues, and well-established retail infrastructure that supports the proliferation of plant-based products. Within the Distribution Channel segment, Off-Trade channels are significantly outperforming On-Trade.

- Off-Trade Dominance Drivers:

- Convenience Stores: Growing demand for quick and healthy meal solutions and snacks drives TVP inclusion in packaged goods.

- Online Channel: The rapid expansion of e-commerce platforms for groceries and specialized food products facilitates easy access to a wide variety of TVP options.

- Supermarkets and Hypermarkets: These retailers offer extensive selections of plant-based products, catering to mainstream consumer adoption.

- Others (Specialty Stores): Dedicated health food stores and vegan shops contribute to niche market growth.

The Online Channel is exhibiting the highest growth rate within the Off-Trade segment, driven by its convenience and ability to reach a broader consumer base. Supermarkets and Hypermarkets still hold the largest market share due to their extensive reach and ability to cater to a wide demographic. The On-Trade segment, encompassing restaurants and food service providers, is also showing promising growth as more establishments incorporate plant-based menu options, influenced by shifting consumer preferences and the availability of versatile TVP ingredients. The UK, in particular, stands out for its progressive adoption of plant-based diets, translating into a substantial market share for TVP. Germany's strong emphasis on sustainability and its robust food manufacturing industry also positions it as a key growth region.

Europe Textured Vegetable Protein Market Product Developments

Recent product developments in the Europe Textured Vegetable Protein market highlight a strong focus on enhancing sensory attributes and functional properties. Companies are investing in advanced processing technologies to create TVP with improved bite, texture, and neutrality in flavor and color, making it more versatile for a wider range of applications. For example, International Flavors & Fragrances Inc.'s SUPRO® TEX offers high-process tolerance and neutral flavor, unlocking extensive product design opportunities. Furthermore, the exploration of alternative protein sources and innovative production methods, such as ICL Group's investment in Arkeon's fermentation bioprocess, signifies a move towards customized and sustainable protein ingredients, positioning these advancements as key competitive edges.

Challenges in the Europe Textured Vegetable Protein Market Market

Despite the positive growth trajectory, the Europe Textured Vegetable Protein market faces several challenges. Regulatory hurdles related to novel food ingredients and labeling can slow down product innovation and market entry. Supply chain complexities for sourcing specific plant proteins, coupled with potential price volatility, can impact profitability. Intense competition from established meat producers and emerging plant-based alternatives necessitates continuous innovation and aggressive marketing strategies to maintain market share. The perception of processed foods among a segment of consumers also presents a challenge, requiring clear communication about the natural origins and benefits of TVP.

Forces Driving Europe Textured Vegetable Protein Market Growth

Several key forces are propelling the growth of the Europe Textured Vegetable Protein market. The escalating consumer demand for healthy and sustainable food options, driven by environmental consciousness and a growing awareness of the health benefits associated with plant-based diets, is a primary driver. Technological advancements in food processing and ingredient innovation, enabling the creation of TVP with improved taste, texture, and nutritional value, are crucial. Supportive government initiatives and policies promoting plant-based consumption and sustainable agriculture further bolster market expansion. The increasing availability of TVP in various food applications, from convenience foods to gourmet dishes, broadens its appeal and accessibility to a wider consumer base.

Challenges in the Europe Textured Vegetable Protein Market Market

Long-term growth catalysts for the Europe Textured Vegetable Protein market are rooted in continued innovation and strategic market expansion. The development of TVP from novel, underutilized plant sources can open new market avenues and diversify supply chains. Partnerships between ingredient manufacturers and food service providers will accelerate the adoption of TVP in restaurant menus and institutional catering. Investments in consumer education campaigns to address potential misconceptions about plant-based proteins and highlight their nutritional completeness will further solidify market acceptance. The ongoing pursuit of cost-effective production methods will also be critical for widespread affordability and accessibility.

Emerging Opportunities in Europe Textured Vegetable Protein Market

Emerging opportunities in the Europe Textured Vegetable Protein market are abundant and diverse. The burgeoning demand for personalized nutrition presents an opportunity for TVP tailored to specific dietary needs and preferences. The expansion of the pet food industry's interest in plant-based protein alternatives offers a significant new market segment. Furthermore, the development of TVP with enhanced functional properties, such as emulsification or gelling capabilities, can unlock its potential in a broader range of food applications. The growing emphasis on circular economy principles within the food industry could also lead to the development of TVP from agricultural by-products, further enhancing its sustainability profile.

Leading Players in the Europe Textured Vegetable Protein Market Sector

- GEMEF Industries

- Sudzucker AG

- Do It Organic

- MGP Ingredients Inc

- International Flavors & Fragrances Inc

- Ingredion Inc

- ICL Group Ltd

- Associated British Foods PLC

- Univar Solutions Inc

- Axiom Foods Inc

- Roquette Freres

Key Milestones in Europe Textured Vegetable Protein Market Industry

- June 2023: Roquette Freres announced the opening of Roquette’s Food Innovation Center to provide formulators with a large range of capabilities, including technical and R&D support, cutting-edge equipment, labs and scale-up testing with an ultimate goal of fostering innovation and to accelerate the go-to-market of new products.

- March 2023: International Flavors & Fragrances Inc. launched its new plant-based protein SUPRO® TEX which offers endless product design and formulation opportunities with its high-process tolerance, neutral flavor and color. SUPRO® TEX is based on soy protein.

- January 2023: ICL Group's AgriFood innovation and investment platform, ICL Planet Startup Hub, has invested USD 3 million in Arkeon, GmbH. The investment will support Arkeon’s innovative and sustainable one-step fermentation bioprocess, which creates completely customizable protein ingredients by capturing the greenhouse gas carbon dioxide (CO2) and converting it into the 20 proteinogenic amino acids. The project will also help ICL group to innovate their product portfolio.

Strategic Outlook for Europe Textured Vegetable Protein Market Market

The strategic outlook for the Europe Textured Vegetable Protein market is overwhelmingly positive, characterized by sustained growth and evolving consumer preferences. Key growth accelerators include continued investment in research and development to enhance the sensory and nutritional profiles of TVP, alongside the exploration of novel plant protein sources. Strategic partnerships between ingredient manufacturers, food companies, and retailers will be crucial for expanding distribution networks and driving consumer adoption. The market is poised to benefit from increasing global awareness regarding the environmental impact of traditional protein sources, further solidifying the position of plant-based alternatives. Companies that can effectively leverage technological advancements, focus on sustainability, and respond to dynamic consumer demands will be well-positioned for long-term success.

Europe Textured Vegetable Protein Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Channel

- 1.1.3. Supermarkets and Hypermarkets

- 1.1.4. Others

- 1.2. On-Trade

-

1.1. Off-Trade

Europe Textured Vegetable Protein Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Textured Vegetable Protein Market Regional Market Share

Geographic Coverage of Europe Textured Vegetable Protein Market

Europe Textured Vegetable Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. The United Kingdom is dominating the market with an increasing young population that follows flexitarian diets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Textured Vegetable Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Channel

- 5.1.1.3. Supermarkets and Hypermarkets

- 5.1.1.4. Others

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GEMEF Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sudzucker AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Do It Organic

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MGP Ingredients Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Flavors & Fragrances Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingredion Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ICL Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Associated British Foods PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Univar Solutions Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axiom Foods Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Roquette Freres

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 GEMEF Industries

List of Figures

- Figure 1: Europe Textured Vegetable Protein Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Textured Vegetable Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Textured Vegetable Protein Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Textured Vegetable Protein Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Europe Textured Vegetable Protein Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Textured Vegetable Protein Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: France Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Textured Vegetable Protein Market?

The projected CAGR is approximately 10.95%.

2. Which companies are prominent players in the Europe Textured Vegetable Protein Market?

Key companies in the market include GEMEF Industries, Sudzucker AG, Do It Organic, MGP Ingredients Inc, International Flavors & Fragrances Inc, Ingredion Inc, ICL Group Ltd, Associated British Foods PLC, Univar Solutions Inc, Axiom Foods Inc, Roquette Freres.

3. What are the main segments of the Europe Textured Vegetable Protein Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 636.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

The United Kingdom is dominating the market with an increasing young population that follows flexitarian diets.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

June 2023: Roquette Freres announced the opening of Roquette’s Food Innovation Center to provide formulators with a large range of capabilities, including technical and R&D support, cutting-edge equipment, labs and scale-up testing with an ultimate goal of fostering innovation and to accelerate the go-to-market of new products.March 2023: International Flavors & Fragrances Inc. launched its new plant-based protein SUPRO® TEX which offers endless product design and formulation opportunities with its high-process tolerance, neutral flavor and color. SUPRO® TEX is based on soy protein.January 2023: ICL Group's AgriFood innovation and investment platform, ICL Planet Startup Hub, has invested USD 3 million in Arkeon, GmbH. The investment will support Arkeon’s innovative and sustainable one-step fermentation bioprocess, which creates completely customizable protein ingredients by capturing the greenhouse gas carbon dioxide (CO2) and converting it into the 20 proteinogenic amino acids. The project will also help ICL group to innovate their product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Textured Vegetable Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Textured Vegetable Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Textured Vegetable Protein Market?

To stay informed about further developments, trends, and reports in the Europe Textured Vegetable Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence