Key Insights

The European vegan supplement market is experiencing significant expansion, propelled by the increasing adoption of veganism and plant-based diets across the continent. This demand surge is attributed to heightened consumer focus on health and wellness, a growing preference for natural and sustainable products, and an identified rise in essential nutrient deficiencies among plant-based consumers. The market is segmented by product type, including vitamins, protein powders, omega-3s, and specialized vegan formulations, and by distribution channels such as specialty stores, supermarkets, and online retail. Key contributing markets include Germany, France, the UK, and Italy. With a projected Compound Annual Growth Rate (CAGR) of 7%, the market is expected to reach $45.75 billion by 2025, building upon its strong growth trajectory. The competitive arena features both established corporations and innovative startups, with future growth anticipated to be driven by product diversification, e-commerce expansion, and adherence to sustainable sourcing and transparent labeling practices. This dynamic landscape presents substantial opportunities for market participants.

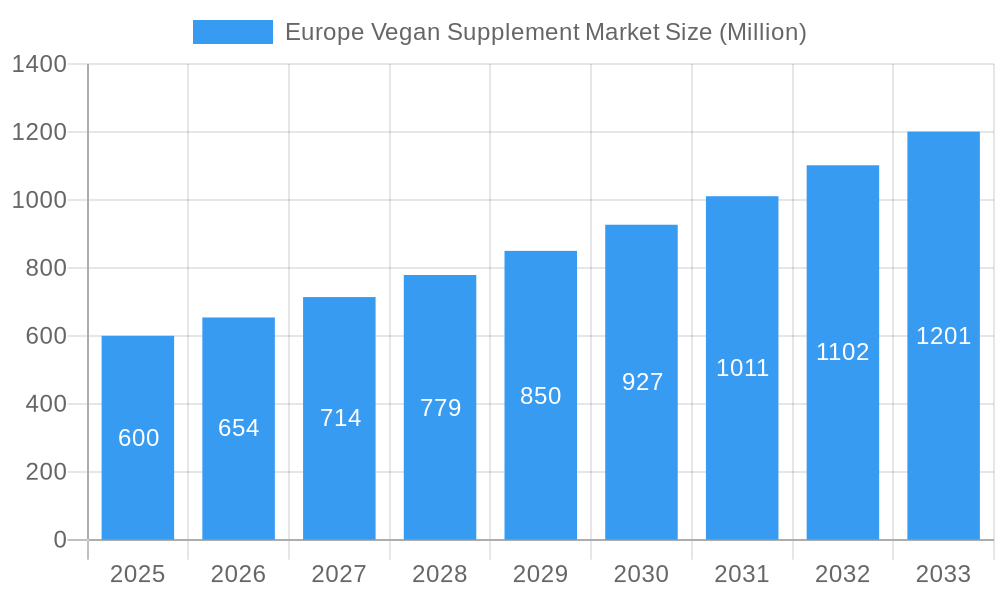

Europe Vegan Supplement Market Market Size (In Billion)

Europe Vegan Supplement Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Europe vegan supplement market, offering crucial insights for industry stakeholders, investors, and market entrants. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. Expect detailed market sizing, segmentation, and competitive analysis, including a granular examination of key players and emerging trends. This report is essential for navigating the complexities and unlocking the immense potential of this rapidly growing market segment.

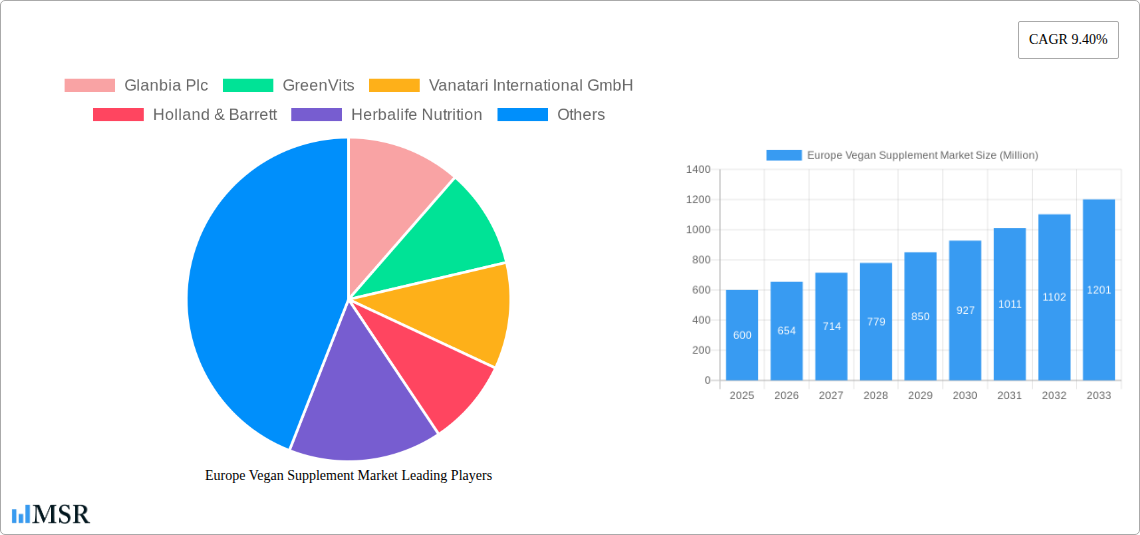

Europe Vegan Supplement Market Company Market Share

Europe Vegan Supplement Market Concentration & Dynamics

The European vegan supplement market exhibits a moderately consolidated structure, with a few dominant players and a multitude of smaller, niche competitors. Market share is concentrated amongst established brands like Glanbia Plc, Herbalife Nutrition, and Holland & Barrett, but a growing number of smaller, specialized companies are disrupting the market with innovative product offerings and focused marketing strategies. Innovation is driven by increasing consumer demand for specialized vegan supplements catering to various health and wellness needs. This includes a growing focus on functional supplements addressing specific health concerns. The regulatory landscape in Europe, while generally supportive of the dietary supplement industry, presents ongoing challenges. The complexity of regulations, particularly regarding labelling and claims, requires constant vigilance. Substitute products, including plant-based whole foods and traditional herbal remedies, compete with the convenience and concentrated nutrient profile of supplements. However, the continued rise in health consciousness and the increasing awareness of nutrient deficiencies within vegan diets contribute positively. Recent M&A activity indicates a trend of consolidation among established players seeking to expand their product portfolio and market reach. We estimate the number of M&A deals within the period 2019-2024 to be around xx, indicating significant industry consolidation. The increasing number of vegan consumers and the associated heightened demand for effective and convenient supplements drive a promising outlook for this dynamic market.

Europe Vegan Supplement Market Industry Insights & Trends

The Europe vegan supplement market is experiencing robust growth, driven by several key factors. The shift towards plant-based diets across Europe is a significant catalyst, with increasing numbers of consumers adopting veganism for ethical, environmental, and health reasons. This trend directly fuels demand for supplements that ensure adequate intake of essential nutrients often lacking in vegan diets. The market size in 2025 is estimated at xx Million, with a Compound Annual Growth Rate (CAGR) projected to reach xx% during the forecast period (2025-2033). Technological advancements in supplement formulation and delivery systems, such as the development of more bioavailable and palatable vegan products, further enhance market appeal. Evolving consumer preferences, prioritizing natural, organic, and sustainably sourced ingredients, also shape the industry landscape. This creates opportunities for companies emphasizing transparency, traceability, and ethical sourcing in their products. Furthermore, the increasing online penetration of the supplement retail market provides a crucial platform for both established and emerging brands to reach a wider consumer base, fueling growth and increasing market competition. Growing consumer awareness of the importance of personalized nutrition further propels growth as brands adopt targeted marketing strategies and offer customized solutions. The market is also experiencing a growing trend towards functional foods and supplements with specific health benefits, contributing significantly to market growth.

Key Markets & Segments Leading Europe Vegan Supplement Market

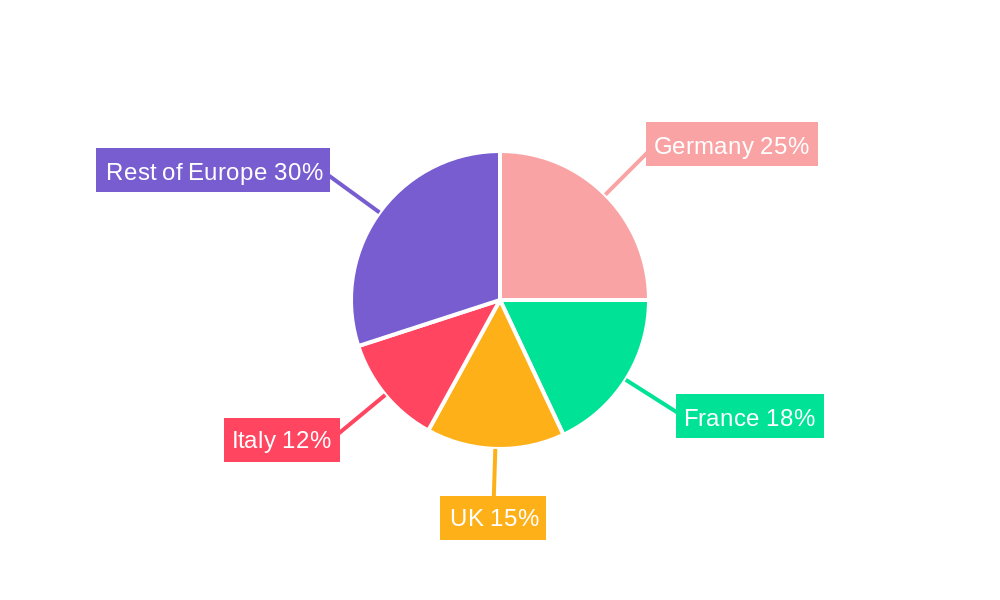

Germany, the United Kingdom, and France represent the largest national markets within the Europe vegan supplement market. These countries demonstrate higher adoption rates of veganism and a stronger emphasis on health and wellness, translating to greater demand for vegan supplements.

By Product Type:

- Vitamins: This segment currently dominates the market, fueled by the necessity of supplementing essential vitamins often lacking in vegan diets, such as vitamin B12, D, and iron.

- Protein: High protein intake is crucial for vegans and athletes, boosting the popularity of plant-based protein powders and supplements within this segment.

- Omega Supplements: The demand for Omega-3 fatty acids, typically derived from fish oil, drives growth in vegan alternatives like algae-based Omega-3 supplements.

- Other Vegan Supplements: This segment includes diverse options such as creatine, probiotics, and other specialized supplements catering to specific health needs.

By Distribution Channel:

- Online Retail Stores: The ease of access and convenience of online shopping contribute significantly to the dominance of this channel.

- Specialty and Drug Stores: These channels serve as trusted sources for health-conscious consumers seeking informed advice and high-quality supplements.

- Supermarkets/Hypermarkets: The increasing accessibility of vegan supplements in mainstream retail outlets broadens market reach and consumer access.

Drivers:

- Strong emphasis on health and wellness in several European countries.

- Growing awareness of nutritional deficiencies within vegan diets.

- Expanding retail networks facilitating accessibility of vegan supplements.

- Increasing focus on organic, sustainably-sourced ingredients.

Europe Vegan Supplement Market Product Developments

Recent years have seen significant innovation in vegan supplement formulation. Advancements in extraction techniques and ingredient processing have led to the development of more bioavailable and effectively absorbed vegan supplements. This includes the introduction of more palatable formulations, addressing a common consumer concern. Companies are also focusing on delivering targeted solutions, developing vegan supplements addressing specific health conditions or dietary needs. The integration of cutting-edge technologies in supplement production and delivery contributes to the development of enhanced, more potent and easily assimilated vegan supplement products. This continuous drive towards innovation gives companies a competitive edge and fuels market growth.

Challenges in the Europe Vegan Supplement Market Market

The Europe vegan supplement market faces certain challenges. Strict regulatory frameworks in several European countries, particularly related to labeling and claims, necessitate compliance efforts and can increase production costs. The variability in raw material sourcing and potential supply chain disruptions can impact production and profitability. Intense competition from both established brands and new entrants, often with price pressures, necessitates effective differentiation strategies. Lastly, consumer skepticism regarding the efficacy and quality of some vegan supplements can also pose a significant challenge, requiring transparency and rigorous quality control measures. These challenges, if left unaddressed, may pose an impediment to the healthy growth of the market.

Forces Driving Europe Vegan Supplement Market Growth

Technological advancements in product formulation and bio-availability enhancement represent significant growth drivers. The increasing popularity of veganism and plant-based lifestyles, coupled with improved understanding of dietary needs in these lifestyles, fuels high demand. Furthermore, favourable regulatory environments in many European countries encourage innovation and market entry. These factors collectively propel growth. The growing trend towards personalized nutrition and functional supplements provides further momentum to market expansion.

Long-Term Growth Catalysts in the Europe Vegan Supplement Market

Strategic partnerships between supplement manufacturers and health technology companies promise a significant boost to long-term market growth. Continued innovation in product formulation, focusing on efficacy and consumer preference, is key. Expanding distribution channels, particularly through online platforms, will broaden market reach. Further growth is expected with the launch of new, specialized products and the entrance of new players offering unique products and value propositions. The focus on sustainability and ethical sourcing throughout the supply chain is also an important catalyst.

Emerging Opportunities in Europe Vegan Supplement Market

The growing interest in personalized nutrition offers considerable opportunity for customized supplement solutions and targeted marketing. The increasing demand for organic, non-GMO, and sustainably-sourced vegan supplements creates a niche for brands emphasizing transparency and ethical sourcing. Moreover, the expansion into new markets within Europe and the development of novel product formats (such as functional foods incorporating supplements) promise further growth. A focus on educating consumers about the importance of vegan supplementation can improve market adoption rates.

Leading Players in the Europe Vegan Supplement Market Sector

- Glanbia Plc

- GreenVits

- Vanatari International GmbH

- Holland & Barrett

- Herbalife Nutrition

- MONK Nutrition Europe

- Vitamin Buddy Limited

- Deva Nutrition LLC

- Sylphar N V (Nutravita Limited)

Key Milestones in Europe Vegan Supplement Market Industry

- 2020: Increased consumer interest in plant-based products accelerates demand for vegan supplements.

- 2021: Several major players launch innovative new vegan supplement formulations, enhancing market competition.

- 2022: Regulations regarding supplement labeling and claims become more stringent in several European countries.

- 2023: Increased focus on sustainability in the sourcing of raw materials for vegan supplements.

- 2024: Several mergers and acquisitions consolidate market share among major industry players.

Strategic Outlook for Europe Vegan Supplement Market Market

The Europe vegan supplement market is poised for sustained growth, driven by persistent consumer demand for healthy alternatives, innovation in product development, and expanding distribution channels. The strategic focus on personalized nutrition and product differentiation offers significant potential for future market leaders. Sustained investment in research and development, combined with proactive regulatory compliance, will be crucial for long-term success. Expanding into new markets and exploring new product formats will unlock further growth opportunities within this dynamic and rapidly expanding market.

Europe Vegan Supplement Market Segmentation

-

1. Product Type

- 1.1. Vitamins

- 1.2. Protein

- 1.3. Omega Supplements

- 1.4. Other Vegan Supplements

-

2. Distribution Channel

- 2.1. Specialty and Drug Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channel

Europe Vegan Supplement Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Italy

- 6. Rest of Europe

Europe Vegan Supplement Market Regional Market Share

Geographic Coverage of Europe Vegan Supplement Market

Europe Vegan Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health & Wellness Trends; Strategic Initiatives By Key Players

- 3.3. Market Restrains

- 3.3.1. Cost Considerations Coupled With Availability Of Alternatives

- 3.4. Market Trends

- 3.4.1. Increasing Preference for Vegan Vitamin Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vitamins

- 5.1.2. Protein

- 5.1.3. Omega Supplements

- 5.1.4. Other Vegan Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty and Drug Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Italy

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vitamins

- 6.1.2. Protein

- 6.1.3. Omega Supplements

- 6.1.4. Other Vegan Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Specialty and Drug Stores

- 6.2.2. Supermarkets/Hypermarkets

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vitamins

- 7.1.2. Protein

- 7.1.3. Omega Supplements

- 7.1.4. Other Vegan Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Specialty and Drug Stores

- 7.2.2. Supermarkets/Hypermarkets

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vitamins

- 8.1.2. Protein

- 8.1.3. Omega Supplements

- 8.1.4. Other Vegan Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Specialty and Drug Stores

- 8.2.2. Supermarkets/Hypermarkets

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vitamins

- 9.1.2. Protein

- 9.1.3. Omega Supplements

- 9.1.4. Other Vegan Supplements

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Specialty and Drug Stores

- 9.2.2. Supermarkets/Hypermarkets

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Vitamins

- 10.1.2. Protein

- 10.1.3. Omega Supplements

- 10.1.4. Other Vegan Supplements

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Specialty and Drug Stores

- 10.2.2. Supermarkets/Hypermarkets

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Europe Vegan Supplement Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Vitamins

- 11.1.2. Protein

- 11.1.3. Omega Supplements

- 11.1.4. Other Vegan Supplements

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Specialty and Drug Stores

- 11.2.2. Supermarkets/Hypermarkets

- 11.2.3. Online Retail Stores

- 11.2.4. Other Distribution Channel

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Glanbia Plc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GreenVits

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vanatari International GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Holland & Barrett

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Herbalife Nutrition

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MONK Nutrition Europe

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Vitamin Buddy Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Deva Nutrition LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sylphar N V (Nutravita Limited)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Glanbia Plc

List of Figures

- Figure 1: Europe Vegan Supplement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Vegan Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Vegan Supplement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Vegan Supplement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Vegan Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Vegan Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 15: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Vegan Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Vegan Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 21: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Vegan Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Vegan Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Vegan Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Vegan Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 33: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Vegan Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Vegan Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Europe Vegan Supplement Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe Vegan Supplement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 39: Europe Vegan Supplement Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Vegan Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Vegan Supplement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Vegan Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Vegan Supplement Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Europe Vegan Supplement Market?

Key companies in the market include Glanbia Plc, GreenVits, Vanatari International GmbH, Holland & Barrett, Herbalife Nutrition, MONK Nutrition Europe, Vitamin Buddy Limited, Deva Nutrition LLC, Sylphar N V (Nutravita Limited).

3. What are the main segments of the Europe Vegan Supplement Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health & Wellness Trends; Strategic Initiatives By Key Players.

6. What are the notable trends driving market growth?

Increasing Preference for Vegan Vitamin Supplements.

7. Are there any restraints impacting market growth?

Cost Considerations Coupled With Availability Of Alternatives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Vegan Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Vegan Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Vegan Supplement Market?

To stay informed about further developments, trends, and reports in the Europe Vegan Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence