Key Insights

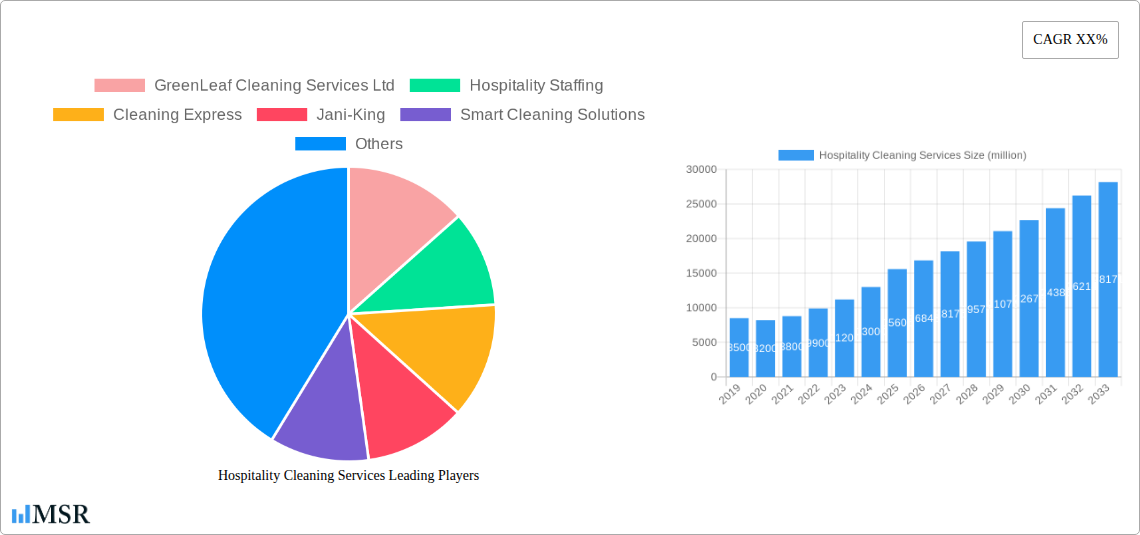

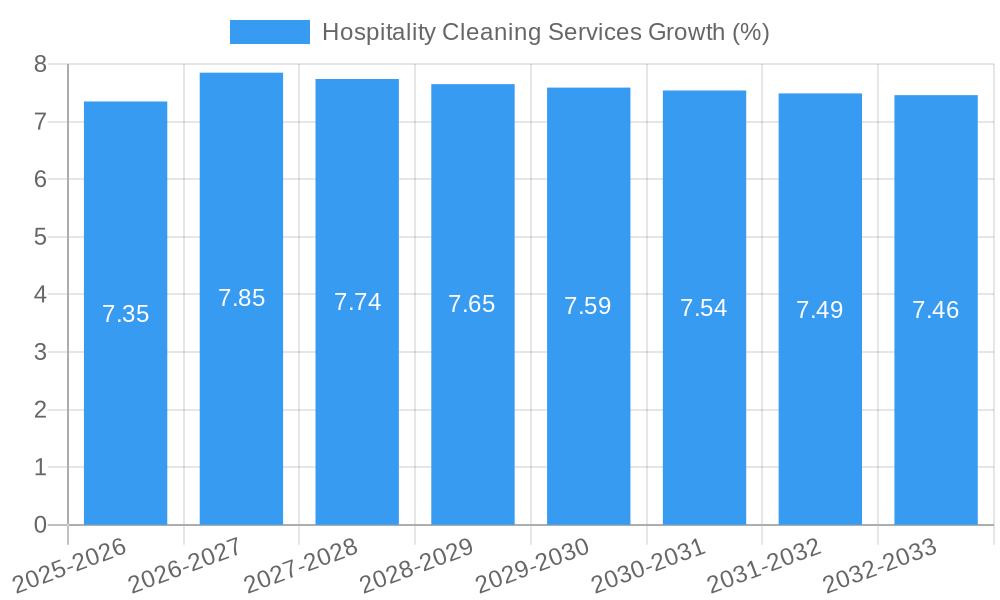

The global Hospitality Cleaning Services market is poised for significant expansion, projected to reach an estimated market size of $15,600 million by 2025. This growth is propelled by an anticipated Compound Annual Growth Rate (CAGR) of 8.5% throughout the forecast period of 2025-2033. This robust expansion is primarily driven by the escalating demand for pristine and hygienic environments in hotels, resorts, and other hospitality establishments, directly correlating with the recovery and resurgence of the global tourism and travel industry post-pandemic. Factors such as increasing guest expectations for cleanliness, coupled with the growing emphasis on stringent hygiene protocols by regulatory bodies, are further bolstering market growth. Furthermore, the rising number of hotel openings and renovations worldwide, particularly in emerging economies, creates sustained demand for professional cleaning services.

The market is segmented by application into exterior and interior cleaning, with the interior segment, encompassing guest rooms and public areas, holding a dominant share due to the higher frequency of cleaning required. Key players such as GreenLeaf Cleaning Services Ltd, Hospitality Staffing, and Cleaning Express are actively innovating and expanding their service portfolios to cater to diverse client needs. The competitive landscape is characterized by a focus on sustainable cleaning practices, advanced cleaning technologies, and customized service offerings. While the market exhibits strong growth potential, certain restraints, such as the high operational costs associated with specialized equipment and eco-friendly cleaning solutions, and the potential for labor shortages in certain regions, could pose challenges. However, strategic partnerships, technological advancements in cleaning automation, and a growing awareness of the long-term benefits of professional cleaning are expected to mitigate these constraints.

Hospitality Cleaning Services Market Concentration & Dynamics

The global hospitality cleaning services market exhibits a moderate to high concentration, with several key players dominating significant portions of the landscape. Leading companies like GreenLeaf Cleaning Services Ltd, Jani-King, and Smart Cleaning Solutions have established extensive networks and brand recognition, securing market shares in the hundreds of millions. The innovation ecosystem is dynamic, driven by advancements in eco-friendly cleaning solutions, smart cleaning technologies, and specialized services for diverse hospitality sectors. Regulatory frameworks, while varying by region, primarily focus on health, safety, and environmental standards, influencing operational practices and the adoption of sustainable cleaning methods. Substitute products, such as in-house cleaning by hotel staff or DIY cleaning solutions, pose a continuous challenge, though the professionalization and efficiency offered by specialized service providers often outweigh these alternatives, especially for larger establishments. End-user trends are increasingly leaning towards hygiene assurance, contactless services, and sustainable practices, pushing service providers to adapt their offerings. Mergers and acquisitions (M&A) activities have been noted, with an estimated XX M&A deals occurring between 2019 and 2024, indicating consolidation efforts and strategic expansions. These activities, along with partnerships, are shaping the competitive landscape and enhancing the capabilities of market leaders.

- Market Share: Dominant players hold market shares in the hundreds of millions, reflecting significant industry penetration.

- M&A Activity: XX M&A deals were recorded in the historical period (2019-2024), indicative of market consolidation and strategic growth.

- Innovation Ecosystem: Driven by eco-friendly solutions, smart technologies, and specialized services.

- Regulatory Impact: Focus on health, safety, and environmental standards influences operational practices.

- End-User Demands: Growing emphasis on hygiene, contactless services, and sustainability.

Hospitality Cleaning Services Industry Insights & Trends

The hospitality cleaning services market is poised for substantial growth, projected to reach a market size of over one trillion by 2033. This expansion is fueled by a multitude of factors, including the consistent demand from the burgeoning global hospitality industry, encompassing hotels, resorts, restaurants, and event venues. The average annual growth rate (CAGR) is estimated to be in the range of XX%, indicating a robust and expanding market. Technological disruptions are playing a pivotal role, with the integration of AI-powered scheduling, robotic cleaning solutions for high-traffic areas, and advanced antimicrobial surface treatments becoming increasingly prevalent. These innovations not only enhance efficiency and reduce labor costs but also elevate hygiene standards, a critical concern for the post-pandemic travel landscape. Evolving consumer behaviors are also significant drivers; travelers and diners now have heightened expectations regarding cleanliness and safety. This has led to an increased demand for specialized cleaning protocols, such as deep cleaning, electrostatic disinfection, and enhanced sanitation services for guest rooms and public areas. The economic recovery and resurgence of travel and tourism post-2020 have further amplified the need for professional hospitality cleaning services. Furthermore, the growing awareness and regulatory emphasis on hygiene and public health are compelling businesses to invest more in comprehensive cleaning solutions. The market also benefits from the rise of niche segments, such as boutique hotels and specialized accommodations, which often require tailored cleaning strategies. Industry developments like the adoption of sustainable cleaning agents and waste reduction initiatives are not just meeting regulatory requirements but also appealing to an environmentally conscious clientele. The continuous innovation in cleaning equipment, from advanced HEPA filtration systems to UV-C light disinfection, is setting new benchmarks for hygiene. The service-based nature of hospitality cleaning also fosters long-term contracts and recurring revenue streams, contributing to market stability and predictable growth. The increasing complexity of modern hospitality establishments, with diverse materials and sensitive environments, necessitates specialized expertise that professional cleaning services provide.

Key Markets & Segments Leading Hospitality Cleaning Services

The Interior application segment is the dominant force within the hospitality cleaning services market, driven by the critical need for pristine conditions in guest rooms and public areas. This dominance is further amplified by the sustained demand for specialized cleaning within Guest Rooms, which represent the core of the guest experience and are subject to the most rigorous hygiene standards. The Public Areas segment also contributes significantly, encompassing lobbies, restaurants, bars, and conference rooms, all of which require frequent and thorough cleaning to maintain brand reputation and guest satisfaction.

- Dominant Application: Interior

- Drivers:

- Direct impact on guest satisfaction and repeat bookings.

- Higher frequency of cleaning requirements compared to exterior areas.

- Necessity for deep cleaning and disinfection protocols.

- Influence of online reviews and social media on perceived cleanliness.

- Technological advancements in interior cleaning equipment and solutions.

- Drivers:

The Interior segment's leadership is underpinned by several key factors. The paramount importance of guest room cleanliness cannot be overstated; it directly influences customer reviews, loyalty, and ultimately, revenue. Hotels and other hospitality establishments invest heavily in ensuring that guest rooms are not only aesthetically pleasing but also impeccably sanitized. This includes meticulous attention to high-touch surfaces, linens, bathrooms, and overall air quality.

- Dominant Type: Guest Rooms

- Drivers:

- Direct correlation with guest experience and perceived hygiene.

- Stringent hygiene standards and regulatory compliance.

- High turnover of guests necessitating frequent and thorough cleaning.

- Demand for specialized disinfection services.

- Impact on online reviews and reputation management.

- Drivers:

The Public Areas segment, while perhaps receiving slightly less individual guest attention than guest rooms, is crucial for the overall impression of a hospitality establishment. Lobbies, corridors, restaurants, and common areas are constantly in use and require consistent cleaning to maintain a welcoming and hygienic environment. The scale of these areas, coupled with their high foot traffic, demands efficient and effective cleaning strategies.

- Significant Segment: Public Areas

- Drivers:

- High volume of foot traffic and constant usage.

- Impact on the overall ambiance and brand perception.

- Need for frequent sanitization of high-touch surfaces.

- Catering to diverse guest activities (dining, meetings, relaxation).

- Integration of advanced cleaning technologies for large spaces.

- Drivers:

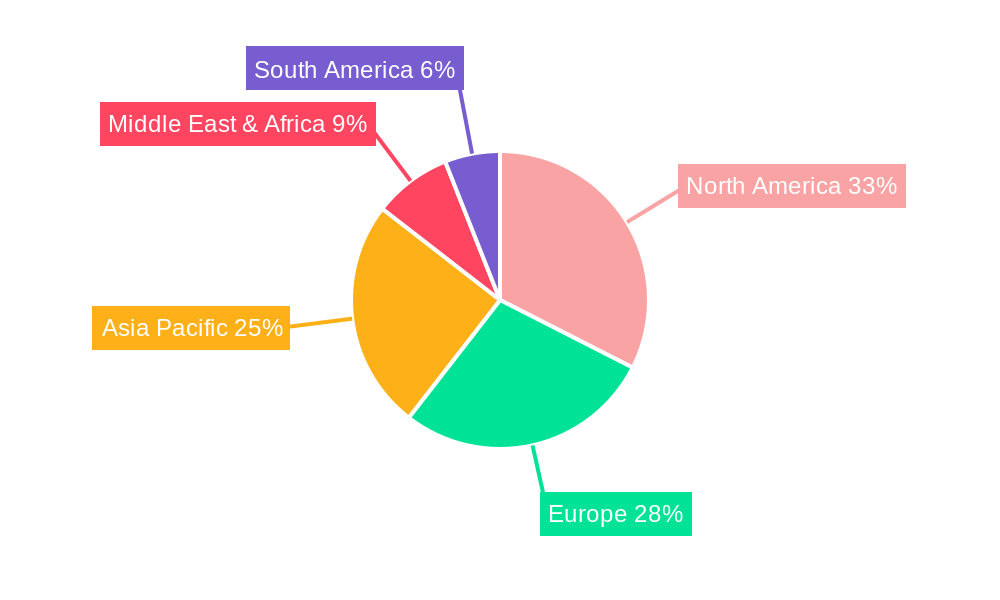

Geographically, North America and Europe currently hold significant market shares due to their mature hospitality sectors and higher disposable incomes, leading to substantial investments in cleaning services. However, the Asia-Pacific region is emerging as a high-growth market, driven by rapid tourism expansion and increasing awareness of hygiene standards, particularly in countries like China, India, and Southeast Asian nations. The growth in these regions is propelled by infrastructure development, a rising middle class, and increasing foreign investment in the hospitality sector. Economic growth and increased disposable incomes are fundamental drivers across all leading markets, enabling hospitality businesses to prioritize and invest in premium cleaning services. Furthermore, government initiatives promoting tourism and hospitality infrastructure development are creating fertile ground for the expansion of cleaning service providers. The adoption of advanced cleaning technologies, such as electrostatic sprayers and UV-C disinfection, is also a key trend shaping the market across these leading regions.

Hospitality Cleaning Services Product Developments

Product developments in hospitality cleaning services are largely centered on enhancing efficacy, sustainability, and safety. Innovations include the introduction of biodegradable and eco-friendly cleaning agents that minimize environmental impact, catering to the growing demand for green hospitality. Advanced antimicrobial coatings and disinfectants are being developed to provide longer-lasting protection against pathogens, crucial for public health. Furthermore, smart cleaning solutions are emerging, integrating sensors and AI to optimize cleaning schedules and identify high-traffic areas requiring immediate attention. The development of specialized equipment, such as autonomous cleaning robots for large spaces and high-efficiency particulate air (HEPA) filter systems, is also a significant trend, offering improved performance and reduced labor costs. These product innovations are directly addressing the evolving needs of the industry for cleaner, safer, and more sustainable hospitality environments.

Challenges in the Hospitality Cleaning Services Market

The hospitality cleaning services market faces several challenges. Labor shortages and high employee turnover remain persistent issues, impacting service consistency and operational efficiency, potentially leading to increased operational costs in the millions. Price sensitivity among some clients can limit the adoption of premium or technologically advanced cleaning solutions. Varying regulatory landscapes across different regions can create complexity for service providers operating internationally. Furthermore, maintaining consistent quality standards across numerous locations and service teams requires robust training and quality control mechanisms. The impact of economic downturns on the hospitality sector directly affects demand for cleaning services.

- Labor Shortages & Turnover: Affecting service consistency and increasing operational costs.

- Price Sensitivity: Limiting the adoption of advanced solutions.

- Regulatory Variations: Creating complexity for international operations.

- Quality Control: Ensuring consistent standards across diverse teams and locations.

- Economic Sensitivity: Downturns in hospitality directly impact demand.

Forces Driving Hospitality Cleaning Services Growth

Several key forces are propelling the growth of the hospitality cleaning services market. The resurgence of global travel and tourism post-pandemic is a primary driver, increasing occupancy rates and the demand for comprehensive cleaning. Heightened awareness of hygiene and public health concerns has led to a permanent shift in expectations, making professional cleaning services indispensable. Technological advancements, such as robotics and AI-driven solutions, are enhancing efficiency and efficacy, attracting investment. Stringent regulatory mandates related to sanitation and health standards are also compelling businesses to invest in professional cleaning. Furthermore, the growing emphasis on sustainability and eco-friendly practices is driving innovation and demand for green cleaning solutions.

Challenges in the Hospitality Cleaning Services Market

Long-term growth catalysts in the hospitality cleaning services market are rooted in continuous innovation and strategic market expansion. The development and adoption of next-generation cleaning technologies, including advanced disinfection methods and smart monitoring systems, will redefine industry standards and create new revenue streams. Strategic partnerships and collaborations with hotel chains, technology providers, and regulatory bodies will foster market penetration and service integration. The expansion into emerging markets, driven by rapid tourism growth and increasing disposable incomes, presents significant untapped potential. Furthermore, the focus on specialized cleaning services, catering to niche segments like luxury resorts, eco-lodges, or medical tourism facilities, will offer higher margins and sustained growth.

Emerging Opportunities in Hospitality Cleaning Services

Emerging opportunities in the hospitality cleaning services market are diverse and promising. The integration of AI and IoT for predictive cleaning and real-time monitoring offers a significant leap in operational efficiency and client reporting, creating value in the millions. The growing demand for contactless cleaning solutions and advanced disinfection technologies, such as UV-C light and electrostatic spraying, presents a substantial growth avenue. The focus on health and wellness tourism is creating opportunities for specialized cleaning services that cater to allergy-sensitive guests or those with specific health requirements. Furthermore, the increasing adoption of sustainability and green cleaning practices by hotels is opening doors for providers offering eco-friendly certifications and solutions. There is also an emerging opportunity in providing comprehensive hygiene consulting services, guiding hospitality businesses on best practices.

Leading Players in the Hospitality Cleaning Services Sector

- GreenLeaf Cleaning Services Ltd

- Hospitality Staffing

- Cleaning Express

- Jani-King

- Smart Cleaning Solutions

- Fibercare

- Hotel Cleaning Services

- Green Fox

- JB Cleaning

- ProCleans

- KBS

- Kempston Cleaning

- Whitespot Cleaning

Key Milestones in Hospitality Cleaning Services Industry

- 2019: Increased adoption of eco-friendly cleaning products and practices across the industry.

- 2020 (Early): Global pandemic leads to an unprecedented surge in demand for deep cleaning and disinfection services.

- 2020 (Mid): Introduction and rapid adoption of electrostatic disinfection technology in various hospitality settings.

- 2021: Growth in demand for specialized cleaning protocols for guest rooms and high-touch surfaces.

- 2022: Increased investment in robotic cleaning solutions for large public areas in hotels and convention centers.

- 2023: Growing emphasis on certifications and verifiable hygiene standards for hospitality venues.

- 2024 (Forecast): Continued integration of smart technologies for optimized cleaning schedules and real-time monitoring.

Strategic Outlook for Hospitality Cleaning Services Market

The strategic outlook for the hospitality cleaning services market is exceptionally positive, characterized by sustained growth and evolving service offerings. Key accelerators include the ongoing global recovery of the travel and tourism sector, which will continue to drive demand for professional cleaning. The persistent focus on hygiene and safety standards, amplified by recent global health events, will ensure that cleaning services remain a critical operational component for all hospitality businesses, with potential for service upgrades valued in the tens of millions. Furthermore, the increasing integration of innovative technologies, such as AI-powered route optimization and robotic cleaners, will lead to greater efficiency and cost-effectiveness, attracting more businesses to outsource their cleaning needs. Strategic opportunities lie in catering to the growing demand for sustainable and eco-friendly cleaning solutions, as well as expanding into niche markets and offering specialized services for emerging hospitality segments. Partnerships with technology providers and hospitality brands will be crucial for market penetration and maintaining a competitive edge.

Hospitality Cleaning Services Segmentation

-

1. Application

- 1.1. Exterior

- 1.2. Interior

-

2. Types

- 2.1. Guest Rooms

- 2.2. Public Areas

Hospitality Cleaning Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Cleaning Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Cleaning Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Exterior

- 5.1.2. Interior

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Guest Rooms

- 5.2.2. Public Areas

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hospitality Cleaning Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Exterior

- 6.1.2. Interior

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Guest Rooms

- 6.2.2. Public Areas

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hospitality Cleaning Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Exterior

- 7.1.2. Interior

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Guest Rooms

- 7.2.2. Public Areas

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hospitality Cleaning Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Exterior

- 8.1.2. Interior

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Guest Rooms

- 8.2.2. Public Areas

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hospitality Cleaning Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Exterior

- 9.1.2. Interior

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Guest Rooms

- 9.2.2. Public Areas

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hospitality Cleaning Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Exterior

- 10.1.2. Interior

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Guest Rooms

- 10.2.2. Public Areas

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GreenLeaf Cleaning Services Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hospitality Staffing

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cleaning Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jani-King

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smart Cleaning Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fibercare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hotel Cleaning Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Green Fox

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 JB Cleaning

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ProCleans

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KBS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kempston Cleaning

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Whitespot Cleaning

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 GreenLeaf Cleaning Services Ltd

List of Figures

- Figure 1: Global Hospitality Cleaning Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hospitality Cleaning Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hospitality Cleaning Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hospitality Cleaning Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Hospitality Cleaning Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Hospitality Cleaning Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hospitality Cleaning Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hospitality Cleaning Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hospitality Cleaning Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hospitality Cleaning Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Hospitality Cleaning Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Hospitality Cleaning Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hospitality Cleaning Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hospitality Cleaning Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hospitality Cleaning Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hospitality Cleaning Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Hospitality Cleaning Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Hospitality Cleaning Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hospitality Cleaning Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hospitality Cleaning Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hospitality Cleaning Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hospitality Cleaning Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Hospitality Cleaning Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Hospitality Cleaning Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hospitality Cleaning Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hospitality Cleaning Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hospitality Cleaning Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hospitality Cleaning Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Hospitality Cleaning Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Hospitality Cleaning Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hospitality Cleaning Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hospitality Cleaning Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hospitality Cleaning Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hospitality Cleaning Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Hospitality Cleaning Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hospitality Cleaning Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hospitality Cleaning Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Hospitality Cleaning Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hospitality Cleaning Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hospitality Cleaning Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Hospitality Cleaning Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hospitality Cleaning Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hospitality Cleaning Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Hospitality Cleaning Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hospitality Cleaning Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hospitality Cleaning Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Hospitality Cleaning Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hospitality Cleaning Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hospitality Cleaning Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Hospitality Cleaning Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hospitality Cleaning Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Cleaning Services?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Hospitality Cleaning Services?

Key companies in the market include GreenLeaf Cleaning Services Ltd, Hospitality Staffing, Cleaning Express, Jani-King, Smart Cleaning Solutions, Fibercare, Hotel Cleaning Services, Green Fox, JB Cleaning, ProCleans, KBS, Kempston Cleaning, Whitespot Cleaning.

3. What are the main segments of the Hospitality Cleaning Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Cleaning Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Cleaning Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Cleaning Services?

To stay informed about further developments, trends, and reports in the Hospitality Cleaning Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence