Key Insights

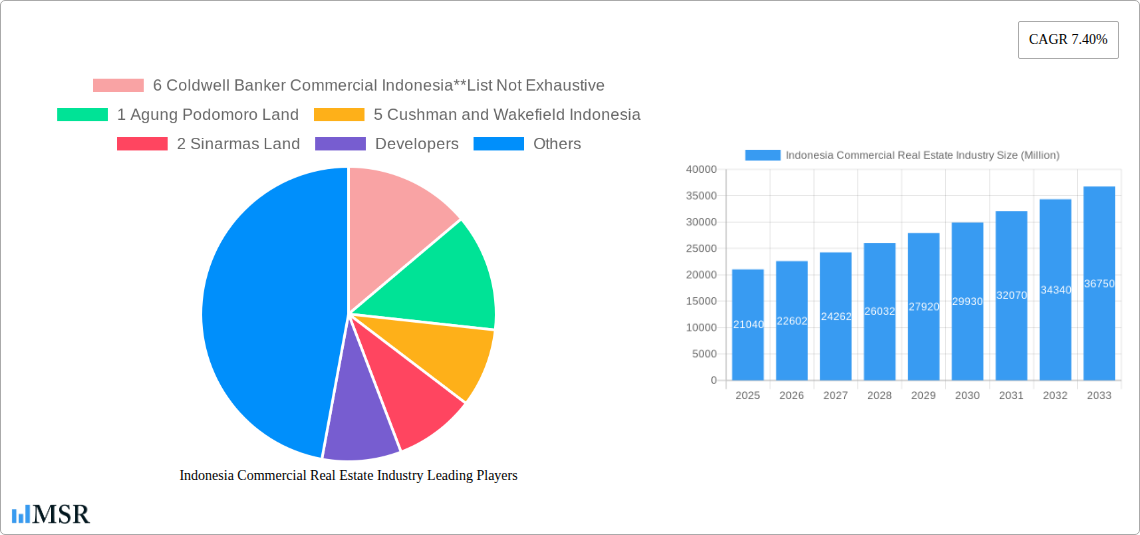

The Indonesian commercial real estate market, valued at $21.04 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.40% from 2025 to 2033. This growth is fueled by several key factors. Rapid urbanization, particularly in major cities like Jakarta, Surabaya, and Semarang, is driving increased demand for office, retail, and industrial spaces. Furthermore, the burgeoning e-commerce sector is significantly boosting the logistics and warehousing segments. Government initiatives promoting infrastructure development and foreign investment also contribute positively to market expansion. The diverse segment composition, including offices, retail, industrial, logistics, multi-family dwellings, and hospitality, offers various investment opportunities. Leading players such as Agung Podomoro Land, Sinarmas Land, Ciputra Group, and Lippo Karawaci, alongside international firms like Cushman & Wakefield Indonesia and Coldwell Banker Commercial Indonesia, are shaping the market landscape. However, potential challenges include economic fluctuations, regulatory hurdles, and competition among developers. The market's resilience, despite these challenges, highlights its long-term growth potential, attracting both domestic and international investors.

Indonesia Commercial Real Estate Industry Market Size (In Billion)

The forecast for the Indonesian commercial real estate market indicates continued expansion throughout the 2025-2033 period. The 7.40% CAGR suggests significant value appreciation across all segments. The strong presence of established developers and international players signifies investor confidence. The continued focus on infrastructure improvements and government support will likely mitigate potential risks, ensuring consistent growth. While specific segmental growth rates aren't provided, it's reasonable to assume that logistics and e-commerce-related spaces will exhibit particularly strong performance, mirroring global trends. The concentration of growth in key cities points to strategic opportunities for developers focused on high-density, mixed-use projects that cater to diverse urban needs. Further research into specific sub-markets within these cities (e.g., CBD vs. suburban areas) could reveal even more granular investment opportunities.

Indonesia Commercial Real Estate Industry Company Market Share

Indonesia Commercial Real Estate Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia commercial real estate industry, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, key trends, leading players, and future growth prospects. The report incorporates detailed analysis of market segments (Offices, Retail, Industrial, Logistics, Multi-family, Hospitality) across key cities like Jakarta, Surabaya, and Semarang. Expect detailed data-driven analysis on market size (in Millions), CAGR, and market share, backed by real-world examples and recent industry developments.

Indonesia Commercial Real Estate Industry Market Concentration & Dynamics

The Indonesian commercial real estate market exhibits a moderate level of concentration, with several large players dominating key segments. Market share data reveals that Agung Podomoro Land, Sinarmas Land, and Ciputra Group hold significant positions, while a considerable number of smaller developers and real estate agencies contribute to the overall market activity. The innovation ecosystem is developing, with the emergence of startups like GoWork and UnionSpace introducing flexible workspace solutions. Regulatory frameworks, though improving, still present certain challenges. Substitute products, primarily in the form of alternative office spaces and remote working solutions, are impacting market dynamics. End-user trends show a growing demand for sustainable and technologically advanced properties. Mergers and acquisitions (M&A) activity has been notable, particularly in the technology-enabled real estate space. The report estimates that xx M&A deals were recorded between 2019 and 2024, contributing to increased market consolidation.

- Top 3 Market Share Holders (Estimated 2025): Agung Podomoro Land (xx%), Sinarmas Land (xx%), Ciputra Group (xx%).

- M&A Activity (2019-2024): xx deals, indicating a trend towards consolidation.

- Emerging Trends: Increased demand for flexible workspaces and sustainable buildings.

Indonesia Commercial Real Estate Industry Industry Insights & Trends

The Indonesian commercial real estate market is experiencing robust growth, driven by a burgeoning economy, expanding middle class, and increasing foreign investment. The market size in 2025 is estimated at xx Million USD, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, including the rise of PropTech and the adoption of smart building technologies, are transforming the sector. Evolving consumer behaviors reflect a preference for sustainable, technologically integrated, and flexible workspaces. The strong growth in e-commerce is also significantly boosting the demand for logistics and warehousing facilities. Furthermore, the government's infrastructure development initiatives are creating additional opportunities within the market.

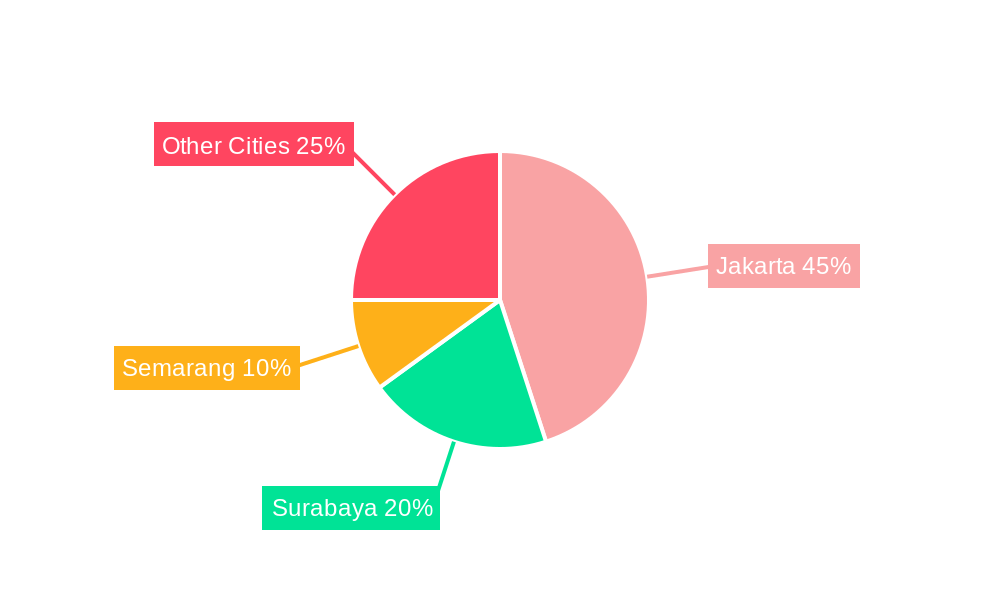

Key Markets & Segments Leading Indonesia Commercial Real Estate Industry

Jakarta remains the dominant market for commercial real estate in Indonesia, driven by its status as the nation's economic and financial hub. Strong economic growth, substantial foreign direct investment, and extensive infrastructure development fuel this dominance. Surabaya and Semarang also contribute significantly, albeit on a smaller scale. In terms of segmental dominance, the office sector currently holds the largest market share, fueled by the expansion of businesses and increasing demand for flexible workspaces. However, the logistics and industrial sectors are experiencing rapid growth, driven by e-commerce expansion and rising manufacturing activity.

- Dominant Region: Jakarta

- Dominant Segment: Offices (2025)

- Key Growth Drivers:

- Jakarta: Strong economic growth, high foreign investment, and robust infrastructure development.

- Surabaya & Semarang: Expanding industrial sectors and improving connectivity.

- Office Sector: Business expansion and demand for flexible workspace.

- Logistics & Industrial: E-commerce boom and manufacturing growth.

Indonesia Commercial Real Estate Industry Product Developments

Significant product innovations are shaping the Indonesian commercial real estate sector. Smart building technologies, enhancing energy efficiency and operational efficiency, are gaining traction. Sustainable design and construction practices are increasingly adopted, aligning with global ESG (Environmental, Social, and Governance) standards. The integration of technology for property management and tenant engagement is improving efficiency and enhancing the user experience. These innovations provide competitive advantages, attracting both investors and tenants.

Challenges in the Indonesia Commercial Real Estate Industry Market

The Indonesian commercial real estate market faces several challenges. Regulatory hurdles, particularly in land acquisition and building permits, can cause delays and increase costs. Supply chain disruptions, particularly related to construction materials, can affect project timelines and profitability. Intense competition among developers and real estate agencies puts pressure on pricing and profitability. These factors have contributed to xx Million USD in estimated project delays from 2020-2024.

Forces Driving Indonesia Commercial Real Estate Industry Growth

Several factors are driving growth in the Indonesian commercial real estate market. Strong economic growth, fueled by a growing middle class and increasing foreign investment, is a major catalyst. Government initiatives promoting infrastructure development and creating favorable investment conditions are further boosting the sector's growth. Technological advancements, including the adoption of PropTech and smart building technologies, are increasing efficiency and attracting investors. Furthermore, the increasing demand for sustainable and technologically advanced properties is shaping market trends.

Long-Term Growth Catalysts in the Indonesia Commercial Real Estate Industry

Long-term growth in the Indonesian commercial real estate market is projected to be propelled by continued economic expansion, robust infrastructure development, and the ongoing adoption of PropTech solutions. Strategic partnerships between developers and technology companies will play a crucial role in driving innovation and efficiency. The expansion of e-commerce and the growth of the manufacturing sector will further fuel demand for logistics and industrial spaces. Furthermore, the increasing focus on sustainable development will shape future construction and property management practices.

Emerging Opportunities in Indonesia Commercial Real Estate Industry

Emerging opportunities abound in the Indonesian commercial real estate sector. The growing demand for flexible workspaces, driven by a changing work culture, presents significant opportunities for developers. The rise of e-commerce is creating substantial demand for warehousing and logistics facilities. Investing in sustainable and green buildings is becoming increasingly attractive, aligning with global ESG trends. Finally, the expansion into secondary and tertiary cities presents promising prospects for developers looking to tap into underserved markets.

Leading Players in the Indonesia Commercial Real Estate Industry Sector

- 6 Coldwell Banker Commercial Indonesia

- 1 Agung Podomoro Land

- 5 Cushman and Wakefield Indonesia

- 2 Sinarmas Land

- Developers

- 4 UnionSpace

- 3 GoWork

- Other Companies (Real Estate Agencies Startups Associations etc )

- 4 Ciputra Group

- 5 RDTX Group

- 2 CoHive

- 7 Dutta Angada Realty

- 1 Carigudang

- 6 PP Properti

- 3 Lippo Karawaci

Key Milestones in Indonesia Commercial Real Estate Industry Industry

- October 2022: Equinix, Inc. announces a USD 74 Million investment in a Jakarta data center, signifying growing demand for digital infrastructure and highlighting the potential of the Indonesian market for technology-related commercial real estate.

- January 2022: EMPG acquires OLX Indonesia property assets, showcasing consolidation and investment in the online property market, signaling a shift towards digital property transactions.

Strategic Outlook for Indonesia Commercial Real Estate Industry Market

The Indonesian commercial real estate market presents a promising outlook for long-term growth. Continued economic expansion, robust infrastructure development, and the increasing adoption of technology will drive demand for high-quality, sustainable, and technologically integrated properties. Strategic partnerships and investments in emerging technologies will play a vital role in shaping the future of the sector. The market offers substantial opportunities for investors and developers who can capitalize on these trends and adapt to evolving consumer preferences.

Indonesia Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Jakarta

- 2.2. Surabaya

- 2.3. Semarang

Indonesia Commercial Real Estate Industry Segmentation By Geography

- 1. Indonesia

Indonesia Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Indonesia Commercial Real Estate Industry

Indonesia Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Fluctuating Construction Materials Costs

- 3.4. Market Trends

- 3.4.1. The demand for office remains strong in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Jakarta

- 5.2.2. Surabaya

- 5.2.3. Semarang

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 Coldwell Banker Commercial Indonesia**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 1 Agung Podomoro Land

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 5 Cushman and Wakefield Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Sinarmas Land

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Developers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 UnionSpace

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3 GoWork

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Other Companies (Real Estate Agencies Startups Associations etc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 4 Ciputra Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 5 RDTX Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 2 CoHive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Dutta Angada Realty

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 1 Carigudang

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 6 PP Properti

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 3 Lippo Karawaci

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 6 Coldwell Banker Commercial Indonesia**List Not Exhaustive

List of Figures

- Figure 1: Indonesia Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Indonesia Commercial Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Commercial Real Estate Industry?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Indonesia Commercial Real Estate Industry?

Key companies in the market include 6 Coldwell Banker Commercial Indonesia**List Not Exhaustive, 1 Agung Podomoro Land, 5 Cushman and Wakefield Indonesia, 2 Sinarmas Land, Developers, 4 UnionSpace, 3 GoWork, Other Companies (Real Estate Agencies Startups Associations etc ), 4 Ciputra Group, 5 RDTX Group, 2 CoHive, 7 Dutta Angada Realty, 1 Carigudang, 6 PP Properti, 3 Lippo Karawaci.

3. What are the main segments of the Indonesia Commercial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives Promoting Affordable Housing; Economic Growth and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

The demand for office remains strong in the country.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Fluctuating Construction Materials Costs.

8. Can you provide examples of recent developments in the market?

October 2022: Global digital infrastructure company Equinix., Inc. has announced its expansion into Indonesia with a planned approximately USD 74 million International Business Exchange (IBX®) data center in the heart of Jakarta. With this expansion, Equinix will enable Indonesian companies and multinationals based in Indonesia to leverage its proven platform to consolidate and connect the underlying infrastructure of their business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Indonesia Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence