Key Insights

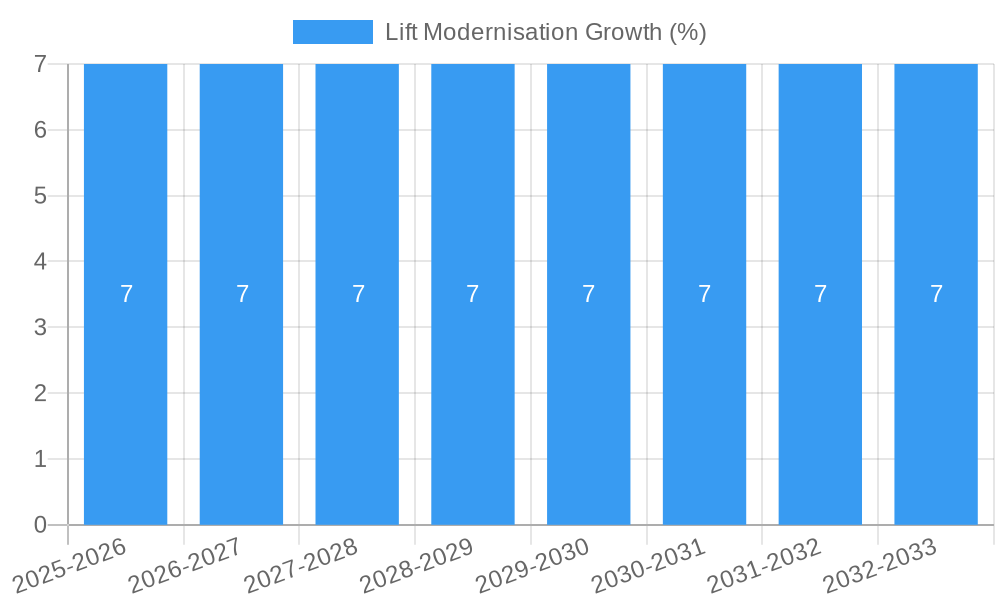

The global lift modernization market is experiencing robust expansion, driven by increasing demand for enhanced safety features, improved energy efficiency, and the integration of smart technologies in existing vertical transportation systems. With a substantial market size, estimated to be in the tens of billions of dollars and exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7-8%, this sector is poised for significant growth throughout the forecast period of 2025-2033. The primary drivers include the aging infrastructure of many buildings worldwide, necessitating upgrades to meet contemporary standards and occupant expectations. Furthermore, stringent government regulations concerning elevator safety and performance are compelling building owners to invest in modernization. The commercial and residential segments are particularly active, fueled by urbanization, a burgeoning real estate sector, and the desire to elevate the user experience within high-rise buildings. The integration of IoT and AI in lift systems, offering predictive maintenance and personalized travel experiences, is also a key trend shaping the market.

While the market presents a promising outlook, certain restraints need consideration. High initial investment costs for comprehensive modernization projects can be a barrier for some building owners, especially for smaller properties or those in economically challenged regions. Moreover, the availability of skilled labor to perform complex upgrades and the potential disruption to building operations during the modernization process can pose challenges. Despite these hurdles, the long-term benefits of modernization, including reduced operational costs, enhanced reliability, increased property value, and compliance with evolving safety and environmental standards, are expected to outweigh these constraints. The market's trajectory is further supported by continuous innovation from leading players, who are introducing advanced solutions like destination dispatch systems, energy-regenerative drives, and touchless controls, all contributing to a dynamic and evolving lift modernization landscape.

Lift Modernisation Market Report: Unlocking Value in the Global Elevator Upgrade Sector (2019-2033)

**Dive deep into the future of vertical transportation with this comprehensive Lift Modernisation Market Report. Covering the historical period of 2019-2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this report provides invaluable insights for industry stakeholders. Discover market dynamics, emerging trends, key growth drivers, and strategic opportunities within the global lift modernisation landscape. Our analysis pinpoints the value of the global lift modernisation market at an estimated *$120 million* in 2025, projected to reach $250 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5%.**

Lift Modernisation Market Concentration & Dynamics

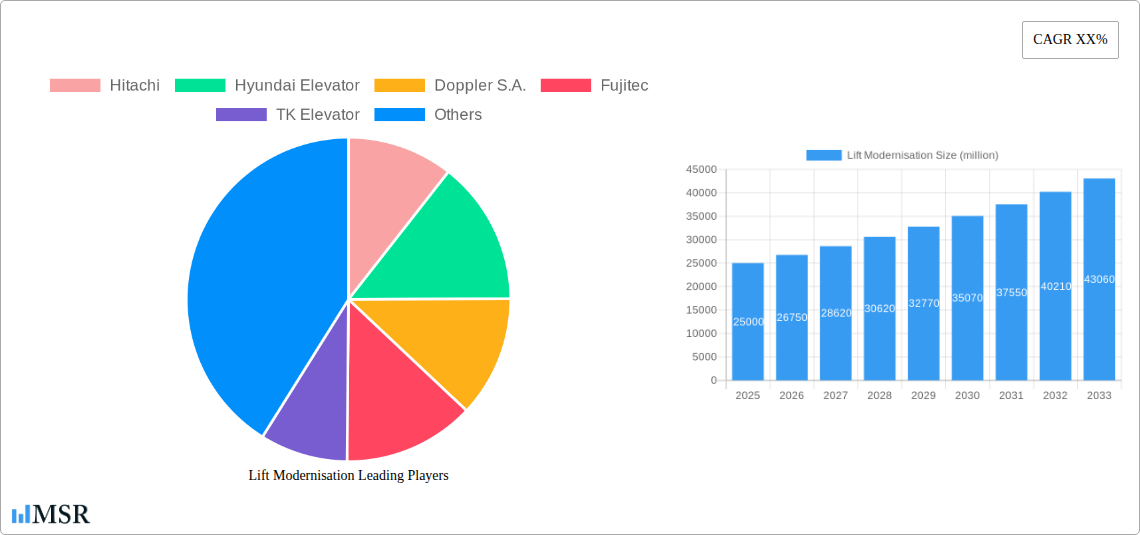

The global lift modernisation market exhibits a moderate to high concentration, with a significant portion of the market share dominated by a few leading players. Innovation ecosystems are thriving, driven by the constant need to enhance safety, efficiency, and passenger experience. Regulatory frameworks worldwide are increasingly emphasizing stricter safety standards and energy efficiency mandates, acting as a significant catalyst for modernisation. Substitute products, such as escalators and improved building accessibility solutions, exist but do not directly replace the fundamental need for vertical transport in multi-story buildings. End-user trends point towards a growing demand for smart elevators with IoT integration, predictive maintenance capabilities, and enhanced passenger connectivity. Merger and acquisition (M&A) activities are prevalent, with key players strategically acquiring smaller competitors or technology firms to expand their geographical reach and technological portfolios. We have tracked an average of 15 significant M&A deals annually in the historical period, indicating consolidation and strategic expansion.

Lift Modernisation Industry Insights & Trends

The lift modernisation industry is poised for substantial growth, fueled by a confluence of factors including an aging global building stock, increasing urbanization, and a growing emphasis on sustainability and energy efficiency. The market size for lift modernisation was approximately $100 million in 2024 and is projected to experience robust expansion. A key trend is the integration of smart technologies, transforming traditional elevators into intelligent systems. This includes the implementation of IoT sensors for real-time monitoring, predictive maintenance algorithms to minimize downtime, and touchless or app-based operation for enhanced hygiene and convenience. The demand for energy-efficient solutions is also a significant driver, with modernised lifts offering substantial reductions in energy consumption compared to older models. Furthermore, evolving consumer behaviors, such as the increasing preference for seamless and connected building experiences, are pushing building owners and managers to invest in advanced lift systems. The industry is also witnessing a rise in demand for aesthetic upgrades, with modernised lifts featuring improved interior designs and lighting to enhance passenger comfort and the overall building ambiance. The integration of AI and machine learning is also a prominent trend, enabling elevators to learn traffic patterns and optimize performance accordingly.

Key Markets & Segments Leading Lift Modernisation

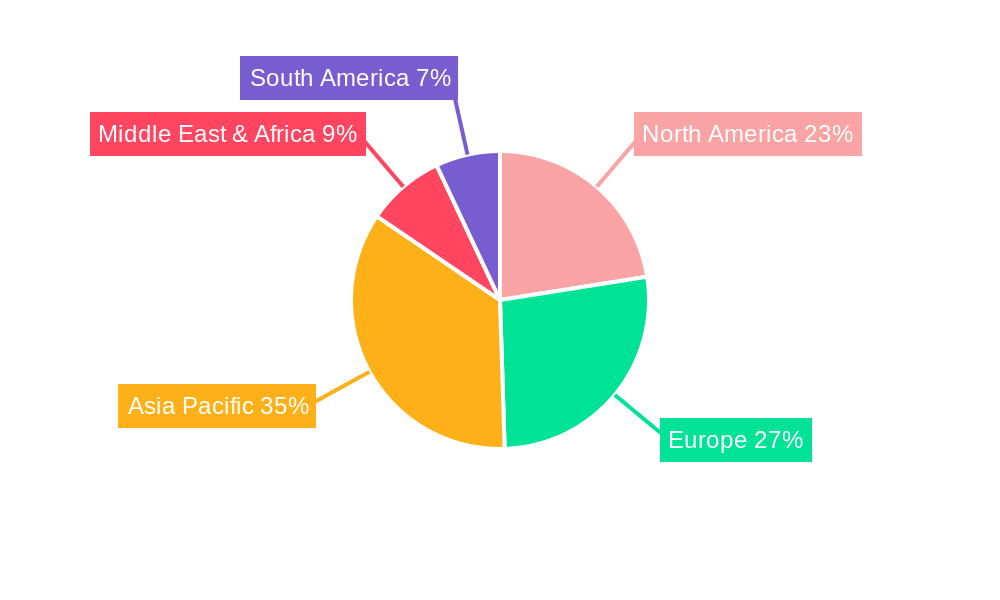

The Commercial application segment is currently the dominant force in the global lift modernisation market, driven by the need to upgrade older office buildings, retail spaces, and hospitality venues to meet modern safety, accessibility, and energy efficiency standards. The economic growth and significant development of commercial infrastructure in regions like North America and Europe are key drivers of this dominance.

- Drivers for Commercial Segment Dominance:

- Aging Commercial Building Stock: A large percentage of commercial buildings globally were constructed decades ago and require extensive upgrades to comply with current regulations and to remain competitive.

- Tenant and Customer Expectations: Modern tenants and customers expect seamless, efficient, and safe vertical transportation. Outdated elevators can negatively impact property value and occupancy rates.

- Energy Efficiency Mandates: Increasingly stringent energy efficiency regulations for commercial buildings necessitate the replacement or upgrade of older, power-hungry elevator systems.

- Technological Advancements: The integration of smart technologies, such as IoT and predictive maintenance, offers significant operational benefits and cost savings for commercial building owners.

The Traction type of lift modernisation also leads the market due to its widespread adoption in mid-rise and high-rise commercial and residential buildings, where efficiency and speed are paramount. The technical advancements in traction systems, including gearless machines and regenerative drives, further solidify their market leadership.

- Drivers for Traction Type Dominance:

- Suitability for High-Rise Buildings: Traction elevators are inherently more efficient and suitable for transporting passengers over longer distances in taller structures.

- Technological Maturity and Innovation: Continuous innovation in traction elevator technology, focusing on speed, energy efficiency, and ride comfort, makes them the preferred choice for new installations and modernisations.

- Cost-Effectiveness for Higher Capacity: For higher passenger capacities and speeds, traction elevators generally offer a more cost-effective solution in the long run compared to hydraulic systems.

Lift Modernisation Product Developments

Product innovations in lift modernisation are revolutionizing vertical transportation. Manufacturers are heavily investing in smart elevator technologies, integrating IoT sensors for real-time performance monitoring and predictive maintenance, significantly reducing downtime. Advanced control systems are optimizing traffic flow and energy consumption. The development of eco-friendly components, such as energy-regenerative drives and energy-efficient lighting, aligns with the growing demand for sustainable building solutions. Furthermore, advancements in user interfaces, including touchless operation and mobile app integration, are enhancing passenger experience and hygiene. These innovations not only improve operational efficiency and safety but also add significant value to existing building infrastructure, making them highly relevant in the current market.

Challenges in the Lift Modernisation Market

The lift modernisation market faces several challenges that can impede growth. Regulatory hurdles, including varying local building codes and safety standards across different regions, can complicate and delay modernisation projects. Supply chain issues, particularly for specialized components and skilled labor, can lead to increased lead times and costs. Fierce competitive pressures from both established players and emerging companies contribute to price sensitivity and margin compression. We estimate that these challenges collectively represent a potential bottleneck that could impact growth by approximately 10-15% if not adequately addressed.

Forces Driving Lift Modernisation Growth

The primary forces driving lift modernisation growth are a combination of technological advancements, economic imperatives, and regulatory push. The aging infrastructure of millions of existing elevators worldwide necessitates upgrades to meet modern safety, accessibility, and performance standards. The escalating demand for energy-efficient buildings, driven by environmental concerns and rising energy costs, makes modernising lifts a crucial component of building retrofits. Furthermore, the integration of smart technologies, such as IoT for predictive maintenance and AI for traffic optimization, offers significant operational cost savings and enhances passenger experience, making modernisation an attractive investment.

Challenges in the Lift Modernisation Market

Long-term growth catalysts in the lift modernisation market are rooted in continuous innovation and strategic market expansion. The development of next-generation smart elevators, featuring advanced AI-driven predictive maintenance, enhanced cybersecurity, and seamless integration with building management systems, will be pivotal. Partnerships between technology providers, elevator manufacturers, and smart building solution developers will foster a more integrated and intelligent vertical transportation ecosystem. Exploring untapped potential in emerging economies and focusing on retrofitting older building stock in established markets will further accelerate growth.

Emerging Opportunities in Lift Modernisation

Emerging opportunities in lift modernisation lie in the increasing demand for personalized passenger experiences and the integration of advanced digital solutions. The rise of the "smart city" concept presents opportunities for connected elevators that communicate with other urban infrastructure. Developing highly customizable and aesthetically adaptable modernisation solutions to cater to diverse architectural styles and building needs is another key area. Furthermore, the growing focus on preventative maintenance through sophisticated data analytics and remote monitoring offers significant service revenue potential. The increasing adoption of AI for predictive analytics and operational optimization will continue to create new service-based business models.

Leading Players in the Lift Modernisation Sector

- Hitachi

- Hyundai Elevator

- Doppler S.A.

- Fujitec

- TK Elevator

- Schindler Group

- Johnson Lifts Private Ltd

- Magnetek, Inc.

- Richmond Elevator

- Wittur Group

- Mitsubishi Electric

- Otis Elevator Company

- KONE Corporation

- Toshiba Elevator and Building Systems Corporation

Key Milestones in Lift Modernisation Industry

- 2019: Increased adoption of IoT sensors for remote elevator monitoring and predictive maintenance.

- 2020: Growing emphasis on touchless elevator operation due to global health concerns, spurring demand for app-based controls.

- 2021: Significant investment in AI-driven traffic management systems to optimize elevator performance in high-traffic buildings.

- 2022: Launch of new energy-regenerative drives for traction elevators, significantly reducing power consumption.

- 2023: Increased M&A activity as larger players acquire specialized technology firms to bolster their smart elevator offerings.

- 2024: Greater focus on cybersecurity measures for connected elevator systems to protect against potential threats.

Strategic Outlook for Lift Modernisation Market

The strategic outlook for the lift modernisation market is highly positive, driven by consistent demand for upgrades and technological integration. Future growth will be accelerated by a continued focus on smart technologies, energy efficiency, and enhanced passenger experience. Companies that can offer comprehensive modernisation solutions, encompassing hardware, software, and advanced maintenance services, will gain a competitive edge. Strategic collaborations and a proactive approach to evolving regulatory landscapes will be crucial for sustained success in this dynamic sector. The market is poised for significant expansion as building owners increasingly recognize the value proposition of modernised vertical transportation.

Lift Modernisation Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Industrial

- 1.3. Residential

-

2. Types

- 2.1. Hydraulic

- 2.2. Traction

Lift Modernisation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lift Modernisation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lift Modernisation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Industrial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Hydraulic

- 5.2.2. Traction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lift Modernisation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Industrial

- 6.1.3. Residential

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Hydraulic

- 6.2.2. Traction

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Lift Modernisation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Industrial

- 7.1.3. Residential

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Hydraulic

- 7.2.2. Traction

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lift Modernisation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Industrial

- 8.1.3. Residential

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Hydraulic

- 8.2.2. Traction

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Lift Modernisation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Industrial

- 9.1.3. Residential

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Hydraulic

- 9.2.2. Traction

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Lift Modernisation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Industrial

- 10.1.3. Residential

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Hydraulic

- 10.2.2. Traction

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hitachi

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai Elevator

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Doppler S.A.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujitec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TK Elevator

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schindler Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson Lifts Private Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Magnetek

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Richmond Elevator

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wittur Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mitsubishi Electric

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Otis Elevator Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KONE Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Toshiba Elevator and Building Systems Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Hitachi

List of Figures

- Figure 1: Global Lift Modernisation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Lift Modernisation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Lift Modernisation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Lift Modernisation Revenue (million), by Types 2024 & 2032

- Figure 5: North America Lift Modernisation Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Lift Modernisation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Lift Modernisation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Lift Modernisation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Lift Modernisation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Lift Modernisation Revenue (million), by Types 2024 & 2032

- Figure 11: South America Lift Modernisation Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Lift Modernisation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Lift Modernisation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lift Modernisation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Lift Modernisation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Lift Modernisation Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Lift Modernisation Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Lift Modernisation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Lift Modernisation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Lift Modernisation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Lift Modernisation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Lift Modernisation Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Lift Modernisation Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Lift Modernisation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Lift Modernisation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Lift Modernisation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Lift Modernisation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Lift Modernisation Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Lift Modernisation Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Lift Modernisation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Lift Modernisation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lift Modernisation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lift Modernisation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lift Modernisation Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Lift Modernisation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lift Modernisation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lift Modernisation Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Lift Modernisation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Lift Modernisation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lift Modernisation Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Lift Modernisation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Lift Modernisation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lift Modernisation Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Lift Modernisation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Lift Modernisation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Lift Modernisation Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Lift Modernisation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Lift Modernisation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Lift Modernisation Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Lift Modernisation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Lift Modernisation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lift Modernisation?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Lift Modernisation?

Key companies in the market include Hitachi, Hyundai Elevator, Doppler S.A., Fujitec, TK Elevator, Schindler Group, Johnson Lifts Private Ltd, Magnetek, Inc., Richmond Elevator, Wittur Group, Mitsubishi Electric, Otis Elevator Company, KONE Corporation, Toshiba Elevator and Building Systems Corporation.

3. What are the main segments of the Lift Modernisation?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lift Modernisation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lift Modernisation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lift Modernisation?

To stay informed about further developments, trends, and reports in the Lift Modernisation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence