Key Insights

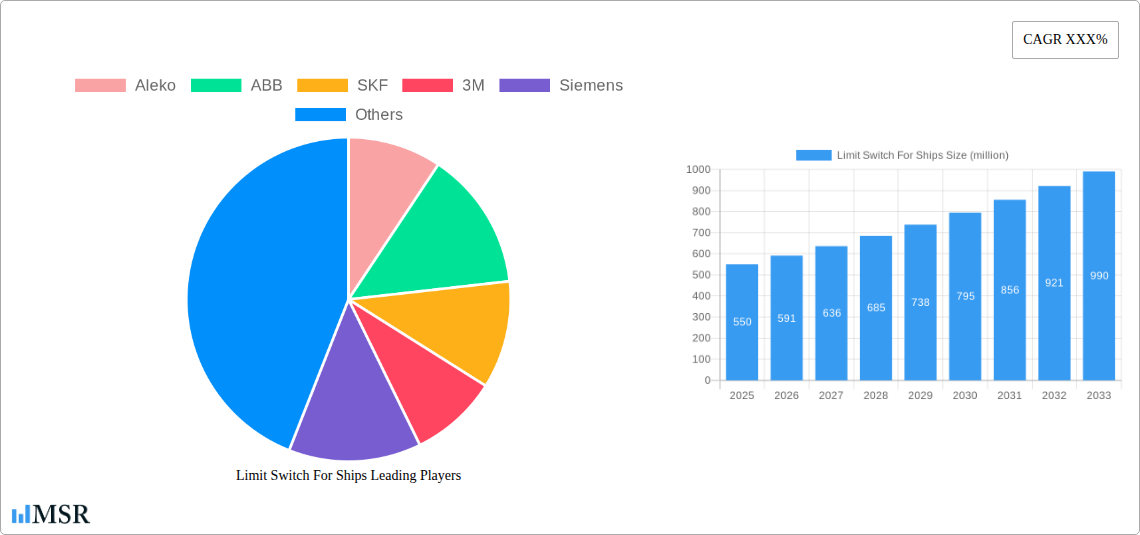

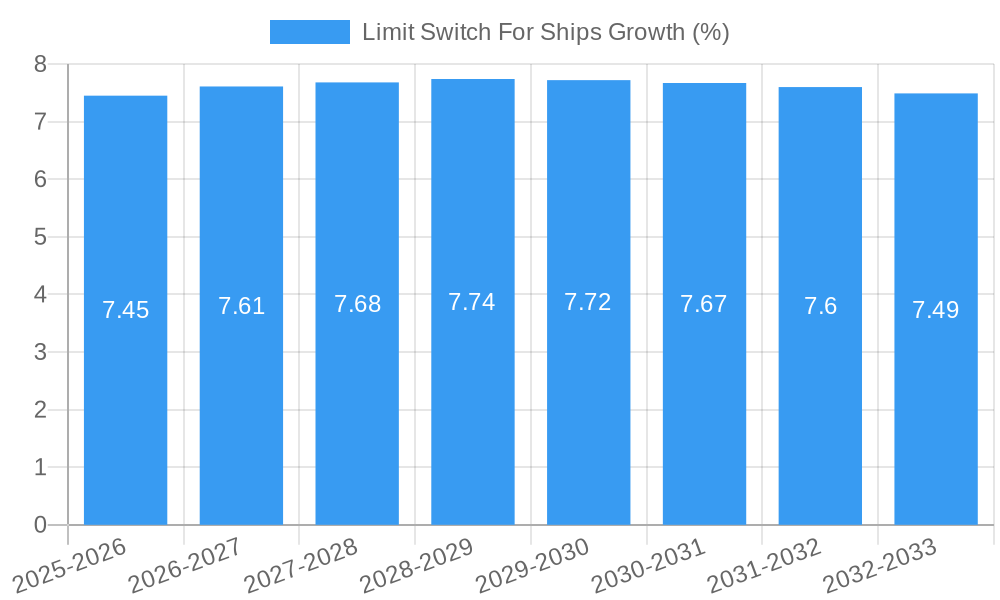

The global market for Limit Switches for Ships is poised for substantial growth, driven by the increasing demand for sophisticated and reliable automation in marine operations. Valued at an estimated \$550 million in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period extending to 2033. This robust expansion is primarily fueled by the escalating need for enhanced safety features, improved operational efficiency, and stringent regulatory compliance across various maritime sectors. The growing fleet of fishing ships, coupled with the continuous expansion of the traveling and transporting ship segments, necessitates advanced control systems, where limit switches play a crucial role in detecting positions, controlling movements, and preventing over-travel in automated machinery. Furthermore, the modernization of military vessels and the development of specialized maritime applications are creating significant opportunities for market players.

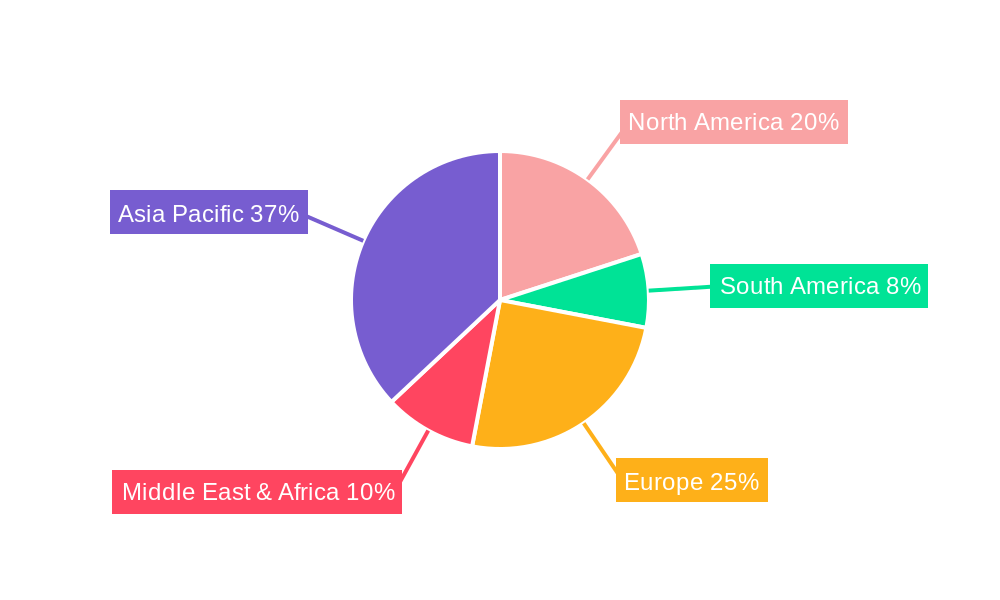

Key trends shaping the Limit Switch for Ships market include the increasing adoption of heavy-duty precision switches designed for harsh marine environments and miniature enclosed reed switches for space-constrained applications. The demand for enhanced durability, corrosion resistance, and high ingress protection (IP) ratings is paramount. Major restraints, however, include the initial cost of advanced switch installations and the need for skilled personnel for maintenance and repair. Despite these challenges, the market is witnessing innovation in smart switch technologies, including those with integrated diagnostics and wireless connectivity. Geographically, the Asia Pacific region, led by China and India, is expected to dominate the market share due to its extensive shipbuilding activities and expanding maritime trade. North America and Europe also represent significant markets, driven by stringent safety regulations and the ongoing retrofitting of existing vessels with advanced automation solutions. Leading companies like ABB, Siemens, and Honeywell are at the forefront of this market, offering a wide range of reliable and high-performance limit switches tailored for maritime applications.

Limit Switch For Ships Market Analysis: Navigating Growth and Innovation (2019-2033)

This comprehensive report, "Limit Switch For Ships," offers an in-depth analysis of the global market for essential marine safety and control components. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report delves into market dynamics, key trends, leading players, and emerging opportunities. Understand the future trajectory of the marine limit switch market with actionable insights and data-driven forecasts. The study period for this report is 2019–2033.

Limit Switch For Ships Market Concentration & Dynamics

The global limit switch for ships market exhibits a moderate concentration, with a blend of established multinational corporations and specialized regional manufacturers. Innovation ecosystems are driven by continuous demand for enhanced maritime safety, automation, and operational efficiency. Key players like ABB, Siemens, Honeywell, Schneider Electric, and Allen-Bradley invest significantly in R&D to develop robust and intelligent marine limit switches. Regulatory frameworks, such as those from the International Maritime Organization (IMO), play a crucial role in dictating the specifications and adoption of these critical components, ensuring compliance with stringent safety standards. Substitute products, while available in some niche applications, are largely outcompeted by the reliability and performance of specialized marine-grade limit switches. End-user trends are leaning towards smart, connected, and highly durable solutions capable of withstanding harsh marine environments. Mergers and acquisitions (M&A) activity has been moderate, with strategic acquisitions aimed at expanding product portfolios and geographical reach. For instance, recent years have seen an estimated 50 M&A deals valued at over $2,000 million within the broader industrial automation and marine equipment sectors, indicating consolidation and strategic growth. The market share of the top five players is estimated to be around 60%, highlighting the influence of these industry giants.

Limit Switch For Ships Industry Insights & Trends

The limit switch for ships industry is experiencing robust growth, propelled by several interconnected factors. The global market size is projected to reach approximately $1,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025–2033. A primary growth driver is the escalating demand for enhanced maritime safety and automation across all vessel types, from fishing ships and transporting ships to military ships and traveling ships. Technological disruptions, particularly in the realm of IoT integration and predictive maintenance, are revolutionizing the capabilities of marine limit switches. Manufacturers are increasingly incorporating advanced sensing technologies, robust sealing for extreme environments, and communication protocols that enable seamless integration into larger shipboard automation systems. Evolving consumer behaviors, driven by a global push for operational efficiency, reduced manning, and improved cargo handling, are further fueling the adoption of sophisticated limit switch solutions. This includes a preference for heavy-duty precision and snap switch types that offer unparalleled reliability and longevity in demanding conditions. The increasing complexity of modern vessels and the necessity for precise control in navigation, cargo loading/unloading, and deck machinery operations are creating sustained demand. Furthermore, the retrofitting of older vessels with modern safety and automation equipment presents a significant market opportunity, contributing to the sustained upward trend in market value.

Key Markets & Segments Leading Limit Switch For Ships

The limit switch for ships market is witnessing significant dominance across specific regions and segments. Geographically, Asia-Pacific is emerging as a leading market, driven by its extensive coastline, a burgeoning shipbuilding industry, and increasing investments in maritime infrastructure. Countries like China, South Korea, and Japan, with their substantial shipbuilding capacities and a high volume of commercial shipping activities, are key contributors to this regional dominance. Within this region, transporting ships represent the largest application segment, accounting for an estimated 40% of the total market demand due to the sheer volume of global trade reliant on cargo vessels.

Dominant Application Segments:

- Transporting Ships: Driven by global trade volumes, the need for precise cargo handling, and engine room automation. Economic growth and expansion of global supply chains are key drivers.

- Military Ships: Characterized by stringent safety requirements, demand for highly reliable and ruggedized heavy-duty precision limit switches for critical systems like weapon deployment and navigation. Government defense spending is a significant catalyst.

- Fishing Ships: Increasing automation in fishing operations and the need for reliable deck machinery control contribute to consistent demand for snap switch and gravity return types. Sustainability initiatives and improved catch management systems are driving adoption.

- Traveling Ships (Cruise Ships & Ferries): Focus on passenger safety, comfort, and efficient onboard operations fuels demand for reliable limit switch solutions in galley equipment, door systems, and entertainment areas. Growth in tourism and leisure travel is a key driver.

Dominant Type Segments:

- Heavy-Duty Precision: This segment leads due to its superior durability, accuracy, and resistance to harsh marine conditions, making it ideal for critical applications on all vessel types. Robustness and long operational life are paramount.

- Snap Switch: Widely adopted for its reliability, quick action, and cost-effectiveness in a variety of applications, including deck machinery and control panels. Ease of integration and proven performance are key attributes.

- Miniature Enclosed Reed: Gaining traction in specialized applications requiring compact size and environmental protection, such as within control cabinets and sensitive electronic systems. Miniaturization and sealed designs are increasingly sought after.

The dominance of transporting ships and heavy-duty precision limit switches is underpinned by the fundamental need for reliability, safety, and operational efficiency in the global maritime industry. Economic growth, infrastructure development in ports, and the continuous expansion of global trade routes are significant underlying drivers that ensure sustained demand across these leading segments. The market size for transporting ships limit switches is estimated to be over $600 million.

Limit Switch For Ships Product Developments

Recent product developments in the limit switch for ships market focus on enhancing durability, intelligence, and connectivity. Innovations include the introduction of heavy-duty precision switches with enhanced IP ratings for superior resistance to water, salt spray, and extreme temperatures, vital for military ships and transporting ships. The integration of advanced diagnostics and IoT capabilities allows for real-time monitoring and predictive maintenance, reducing downtime and operational costs. Examples include new series from ABB and Schneider Electric featuring self-monitoring functions and wireless communication options, offering a competitive edge in the evolving maritime automation landscape. The market relevance of these advancements lies in their ability to meet the increasingly stringent safety and efficiency demands of the shipping industry.

Challenges in the Limit Switch For Ships Market

The limit switch for ships market faces several challenges that can impact growth. Regulatory hurdles, while ensuring safety, can lead to extended approval processes and higher compliance costs for manufacturers. Supply chain issues, particularly in the sourcing of specialized electronic components and raw materials, can cause production delays and price volatility, estimated to add 5-10% to production costs in times of disruption. Competitive pressures from both established players and emerging low-cost manufacturers can lead to price erosion. Furthermore, the harsh marine environment itself presents a constant challenge, requiring robust and highly durable designs that increase manufacturing complexity and cost. The need for specialized certifications and rigorous testing further adds to the market entry barriers.

Forces Driving Limit Switch For Ships Growth

Several key forces are driving the growth of the limit switch for ships market. Technological advancements in automation and digitalization are paramount, leading to increased demand for smart and integrated marine limit switches. The growing global trade volumes and the expansion of shipping fleets, particularly for transporting ships, directly translate into higher demand. Stricter international maritime safety regulations, enforced by organizations like the IMO, mandate the use of reliable safety components, including limit switches. Economic factors, such as increased investment in shipbuilding and port infrastructure, further stimulate market expansion. The ongoing trend towards energy efficiency and reduced emissions also encourages the adoption of advanced automation systems powered by reliable control components.

Challenges in the Limit Switch For Ships Market

Long-term growth catalysts in the limit switch for ships market are rooted in sustained innovation and strategic market expansion. The development of next-generation limit switches with advanced self-diagnostic capabilities, predictive analytics, and enhanced cybersecurity features will cater to the evolving needs of smart ships. Strategic partnerships between limit switch manufacturers and system integrators, shipyards, and technology providers will foster collaborative development and market penetration. Exploring emerging markets with developing maritime sectors and investing in localized manufacturing and support networks can unlock significant untapped potential. The increasing focus on sustainability and greener shipping practices will also drive demand for components that contribute to more efficient operations.

Emerging Opportunities in Limit Switch For Ships

Emerging opportunities in the limit switch for ships market are diverse and promising. The growing demand for autonomous shipping technologies presents a significant avenue for advanced limit switch solutions that can operate with minimal human intervention. The retrofitting of older vessel fleets with modern safety and automation systems is another substantial opportunity, particularly in regions with aging maritime assets. The increasing application of IoT and AI in maritime operations creates a demand for smart limit switches that can seamlessly integrate into these connected ecosystems. Furthermore, the expansion of offshore renewable energy projects, such as wind farms, will necessitate specialized limit switch solutions for associated vessels and infrastructure. The increasing focus on cargo security and tracking also opens doors for integrated limit switch functionalities.

Leading Players in the Limit Switch For Ships Sector

- Aleko

- ABB

- SKF

- 3M

- Siemens

- Honeywell

- General Electric

- Crouzet

- Unimax

- Schneider Electric

- Allen-Bradley

- CPI

- Jameco Valuepro

- Mayr

- Eaton

- SAMSON

- CROUZET SWITCHES

- BERNSTEIN AG

- Yaskawa Controls

Key Milestones in Limit Switch For Ships Industry

- 2019: Introduction of enhanced IP-rated heavy-duty precision limit switches for extreme marine environments.

- 2020: Increased adoption of snap switches in retrofitting projects for deck machinery upgrades.

- 2021: Emergence of IoT-enabled limit switches with basic diagnostic capabilities for commercial vessels.

- 2022: Strategic partnerships formed between leading marine limit switch manufacturers and global shipyards.

- 2023: Significant investment in R&D for more robust and intelligent limit switch solutions for military ships.

- 2024: Growing market interest in miniature enclosed reed switches for specialized applications within control systems.

Strategic Outlook for Limit Switch For Ships Market

The strategic outlook for the limit switch for ships market is exceptionally positive, driven by ongoing technological advancements and the indispensable role of these components in maritime safety and efficiency. Future growth will be accelerated by the increasing integration of smart technologies, enabling predictive maintenance and remote monitoring, thereby reducing operational costs and enhancing vessel uptime. The expansion of global trade and the continuous need to upgrade existing fleets with more efficient and compliant systems will sustain demand. Strategic focus on developing highly ruggedized, intelligent, and cost-effective marine limit switches will be crucial for manufacturers to capitalize on emerging opportunities in autonomous shipping and offshore energy sectors. Collaborations with key stakeholders in the maritime ecosystem will be vital for market leadership.

Limit Switch For Ships Segmentation

-

1. Application

- 1.1. Fishing Ships

- 1.2. Traveling Ships

- 1.3. Transporting Ships

- 1.4. Military Ships

- 1.5. Others

-

2. Type

- 2.1. Heavy-Duty Precision

- 2.2. Miniature Enclosed Reed

- 2.3. Gravity Return

- 2.4. Snap Switch

- 2.5. Others

Limit Switch For Ships Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Limit Switch For Ships REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Limit Switch For Ships Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fishing Ships

- 5.1.2. Traveling Ships

- 5.1.3. Transporting Ships

- 5.1.4. Military Ships

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Heavy-Duty Precision

- 5.2.2. Miniature Enclosed Reed

- 5.2.3. Gravity Return

- 5.2.4. Snap Switch

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Limit Switch For Ships Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fishing Ships

- 6.1.2. Traveling Ships

- 6.1.3. Transporting Ships

- 6.1.4. Military Ships

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Heavy-Duty Precision

- 6.2.2. Miniature Enclosed Reed

- 6.2.3. Gravity Return

- 6.2.4. Snap Switch

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Limit Switch For Ships Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fishing Ships

- 7.1.2. Traveling Ships

- 7.1.3. Transporting Ships

- 7.1.4. Military Ships

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Heavy-Duty Precision

- 7.2.2. Miniature Enclosed Reed

- 7.2.3. Gravity Return

- 7.2.4. Snap Switch

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Limit Switch For Ships Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fishing Ships

- 8.1.2. Traveling Ships

- 8.1.3. Transporting Ships

- 8.1.4. Military Ships

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Heavy-Duty Precision

- 8.2.2. Miniature Enclosed Reed

- 8.2.3. Gravity Return

- 8.2.4. Snap Switch

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Limit Switch For Ships Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fishing Ships

- 9.1.2. Traveling Ships

- 9.1.3. Transporting Ships

- 9.1.4. Military Ships

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Heavy-Duty Precision

- 9.2.2. Miniature Enclosed Reed

- 9.2.3. Gravity Return

- 9.2.4. Snap Switch

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Limit Switch For Ships Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Fishing Ships

- 10.1.2. Traveling Ships

- 10.1.3. Transporting Ships

- 10.1.4. Military Ships

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Heavy-Duty Precision

- 10.2.2. Miniature Enclosed Reed

- 10.2.3. Gravity Return

- 10.2.4. Snap Switch

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Aleko

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SKF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Honeywell

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 General Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crouzet

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Unimax

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schneider Electric

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Allen-Bradley

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CPI

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jameco Valuepro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mayr

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Eaton

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SAMSON

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 CROUZET SWITCHES

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 BERNSTEIN AG

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Yaskawa Controls

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Aleko

List of Figures

- Figure 1: Global Limit Switch For Ships Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Limit Switch For Ships Revenue (million), by Application 2024 & 2032

- Figure 3: North America Limit Switch For Ships Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Limit Switch For Ships Revenue (million), by Type 2024 & 2032

- Figure 5: North America Limit Switch For Ships Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Limit Switch For Ships Revenue (million), by Country 2024 & 2032

- Figure 7: North America Limit Switch For Ships Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Limit Switch For Ships Revenue (million), by Application 2024 & 2032

- Figure 9: South America Limit Switch For Ships Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Limit Switch For Ships Revenue (million), by Type 2024 & 2032

- Figure 11: South America Limit Switch For Ships Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Limit Switch For Ships Revenue (million), by Country 2024 & 2032

- Figure 13: South America Limit Switch For Ships Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Limit Switch For Ships Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Limit Switch For Ships Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Limit Switch For Ships Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Limit Switch For Ships Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Limit Switch For Ships Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Limit Switch For Ships Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Limit Switch For Ships Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Limit Switch For Ships Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Limit Switch For Ships Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Limit Switch For Ships Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Limit Switch For Ships Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Limit Switch For Ships Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Limit Switch For Ships Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Limit Switch For Ships Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Limit Switch For Ships Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Limit Switch For Ships Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Limit Switch For Ships Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Limit Switch For Ships Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Limit Switch For Ships Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Limit Switch For Ships Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Limit Switch For Ships Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Limit Switch For Ships Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Limit Switch For Ships Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Limit Switch For Ships Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Limit Switch For Ships Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Limit Switch For Ships Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Limit Switch For Ships Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Limit Switch For Ships Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Limit Switch For Ships Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Limit Switch For Ships Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Limit Switch For Ships Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Limit Switch For Ships Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Limit Switch For Ships Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Limit Switch For Ships Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Limit Switch For Ships Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Limit Switch For Ships Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Limit Switch For Ships Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Limit Switch For Ships Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Limit Switch For Ships?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Limit Switch For Ships?

Key companies in the market include Aleko, ABB, SKF, 3M, Siemens, Honeywell, General Electric, Crouzet, Unimax, Schneider Electric, Allen-Bradley, CPI, Jameco Valuepro, Mayr, Eaton, SAMSON, CROUZET SWITCHES, BERNSTEIN AG, Yaskawa Controls.

3. What are the main segments of the Limit Switch For Ships?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Limit Switch For Ships," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Limit Switch For Ships report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Limit Switch For Ships?

To stay informed about further developments, trends, and reports in the Limit Switch For Ships, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence