Key Insights

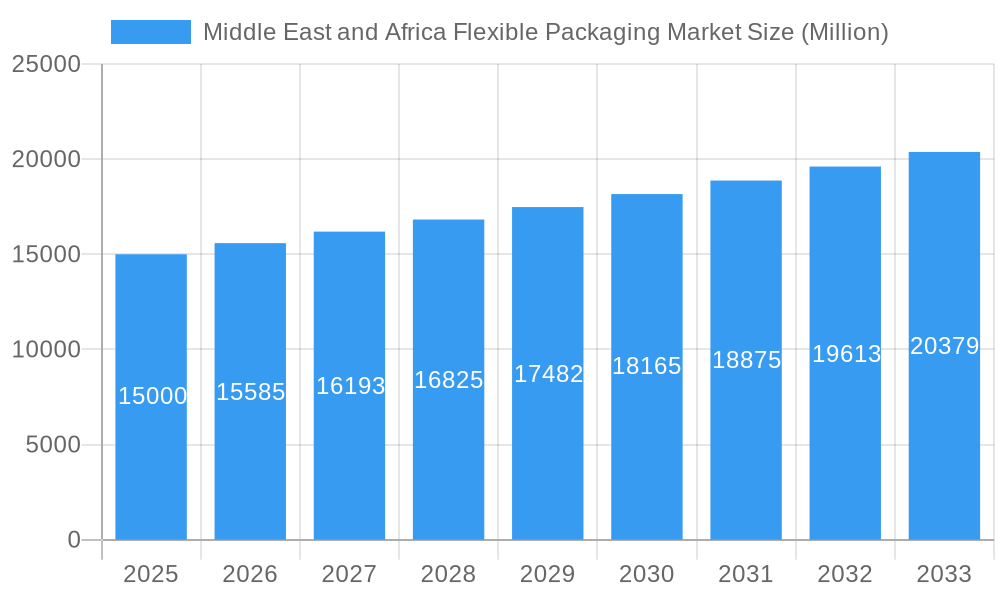

The Middle East and Africa (MEA) flexible packaging market is poised for significant expansion, propelled by escalating demand for packaged food and beverages, a growing consumer preference for convenience, and the widespread development of organized retail. This growth trajectory is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.2%. The market is anticipated to reach a size of 301.2 billion by 2025. Key market segments driving this expansion include various types of pouches (retort and stand-up), bags (gusseted and wicketed), and specialized packaging films, primarily serving the robust food industry. Notable growth drivers are identified in the UAE, Saudi Arabia, Nigeria, and South Africa, attributed to their expanding populations and evolving consumer lifestyles. The inherent advantages of flexible packaging, such as its lightweight nature, cost-efficiency, and enhanced product shelf life, are key stimulants for market proliferation. While Polyethylene (PE) and Bi-oriented Polypropylene (BOPP) currently lead in resin types, other materials like CPP, PVC, and PET are gaining prominence due to the increasing demand for tailored packaging solutions. Leading entities such as Amcor, Uflex Limited, and Huhtamaki Group are instrumental in shaping market dynamics through strategic initiatives including expansions, technological innovations, and mergers and acquisitions.

Middle East and Africa Flexible Packaging Market Market Size (In Billion)

Despite the promising outlook, the MEA flexible packaging market navigates challenges such as volatile raw material pricing, stringent regulations governing packaging materials, and the potential for substitution by alternative packaging formats. Nevertheless, the long-term growth forecast remains optimistic, supported by ongoing urbanization, rising disposable incomes, and sustained demand for effective and aesthetically pleasing packaging solutions across the region. The increasing emphasis on sustainability and eco-friendly packaging materials presents both a challenge and a significant opportunity for market participants to pioneer innovative solutions aligned with consumer and regulatory expectations. Market consolidation is anticipated in the coming years, with larger enterprises likely to acquire smaller competitors to broaden their market presence and product offerings.

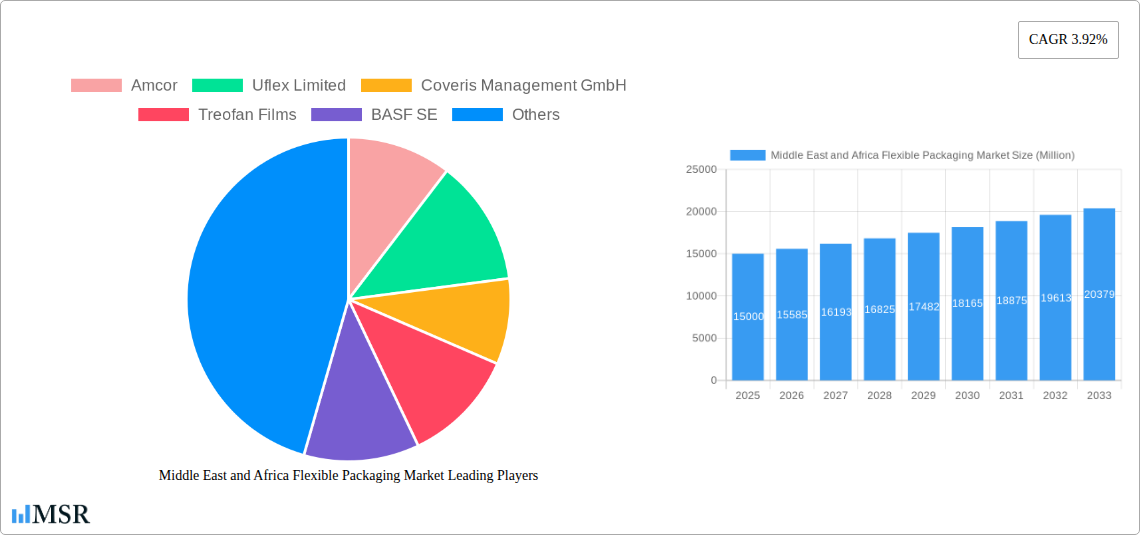

Middle East and Africa Flexible Packaging Market Company Market Share

Middle East and Africa Flexible Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) flexible packaging market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, trends, and future opportunities across various segments. Expect detailed analysis of key players like Amcor, Uflex Limited, Coveris Management GmbH, Treofan Films, BASF SE, Huhtamaki Group, Napco Group, Gulf Packaging Industries Limited, Mondi Plc, and DowDuPont (list not exhaustive), within the context of regional variations and product types. The report is essential for strategic decision-making, investment planning, and understanding the competitive landscape within the rapidly evolving MEA flexible packaging sector.

Middle East and Africa Flexible Packaging Market Concentration & Dynamics

The MEA flexible packaging market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, regional players and smaller specialized firms also contribute significantly, especially in niche segments. The market is characterized by a dynamic interplay of factors including:

Market Concentration: The top 5 players likely hold approximately xx% of the market share in 2025, while the remaining share is distributed among numerous smaller companies.

Innovation Ecosystems: Ongoing investments in R&D are driving innovation, particularly in sustainable and recyclable packaging solutions, echoing global trends. This includes advancements in materials science, printing technologies, and barrier properties.

Regulatory Frameworks: Government regulations regarding food safety, material recyclability, and labeling are influencing material choices and manufacturing practices, increasing the demand for eco-friendly options.

Substitute Products: Competition exists from rigid packaging formats (e.g., glass, metal cans), but flexible packaging retains a dominant position due to cost-effectiveness, versatility, and lightweight properties.

End-User Trends: The rising popularity of convenience foods, e-commerce, and changing consumer preferences are driving demand for diverse flexible packaging solutions.

M&A Activities: The MEA region has witnessed a significant number of mergers and acquisitions (M&A) in recent years (xx deals between 2019 and 2024). These activities are driven by the need to expand market reach, access new technologies, and enhance product portfolios. A key example is Huhtamaki's acquisition of Elif in 2021.

Middle East and Africa Flexible Packaging Market Industry Insights & Trends

The Middle East and Africa (MEA) flexible packaging market is experiencing a period of dynamic expansion, propelled by a confluence of evolving consumer behaviors, robust economic development, and a heightened focus on sustainability. The market size, valued at approximately XX Million USD in 2024, is projected to ascend to a considerable XX Million USD by 2033, demonstrating a strong compound annual growth rate (CAGR) of approximately XX% during the forecast period of 2025-2033.

Key growth catalysts underpinning this upward trajectory include:

-

Rising Disposable Incomes and Evolving Lifestyles: An expanding middle class across the MEA region translates to increased purchasing power. This, in turn, fuels a greater demand for a wider array of packaged consumer goods, from convenience foods and beverages to personal care items, directly boosting the need for flexible packaging solutions.

-

Expansion of Organized Retail and Modern Trade: The proliferation of supermarkets, hypermarkets, and convenience stores across urban and even semi-urban areas of MEA is transforming the retail landscape. These modern retail formats prioritize product presentation, shelf appeal, and consumer convenience, necessitating attractive, functional, and protective flexible packaging.

-

The E-commerce Revolution: The burgeoning e-commerce sector in MEA is a significant driver. The need for packaging that can withstand the rigors of logistics and ensure product integrity during transit for online orders is paramount. Flexible packaging's lightweight nature and adaptability make it an ideal choice for shipping a diverse range of products.

-

Technological Advancements in Materials and Printing: Continuous innovation in flexible packaging technology is enhancing both its performance and aesthetic appeal. The adoption of advanced printing techniques such as high-definition flexography and sophisticated gravure printing allows for more vibrant branding and intricate designs. Furthermore, advancements in barrier film technology are crucial for extending product shelf-life and preserving product quality, especially for food and pharmaceutical applications.

-

Pervasive Shift Towards Sustainability: Growing environmental consciousness among consumers and regulatory bodies is a powerful force shaping the MEA flexible packaging market. There is an increasing demand for eco-friendly alternatives, including the use of recyclable mono-materials, bio-based polymers derived from renewable resources, and compostable films. Manufacturers are actively investing in developing and adopting these sustainable solutions to meet market demands and comply with evolving environmental regulations.

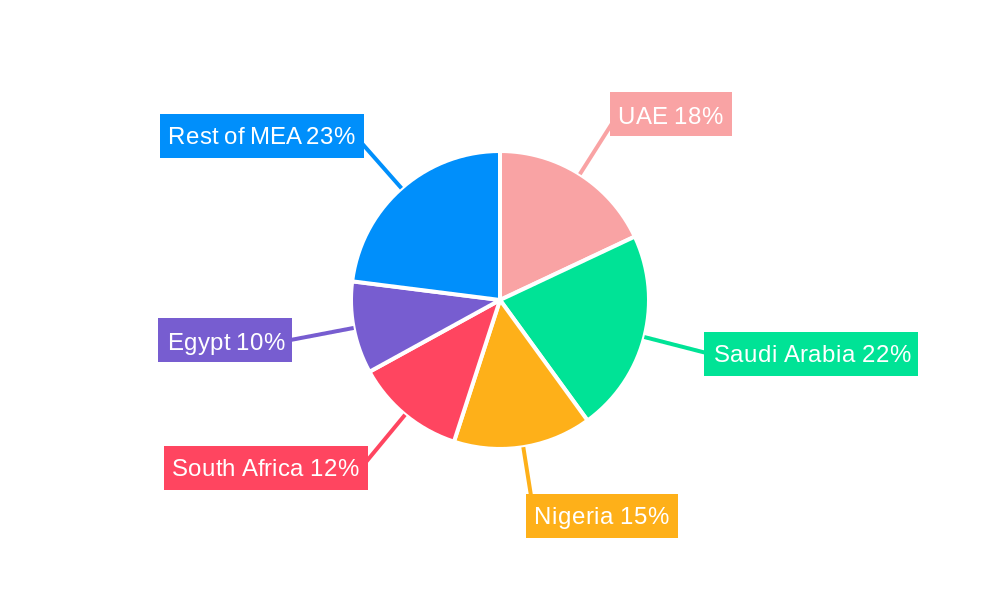

Key Markets & Segments Leading Middle East and Africa Flexible Packaging Market

The MEA flexible packaging market is characterized by a diverse landscape, with segmentation across key geographic regions, resin types, product formats, and end-user industries. The most prominent segments shaping the market dynamics include:

-

Dominant Geographic Markets: The United Arab Emirates (UAE), Saudi Arabia, and South Africa stand out as the leading contributors to the MEA flexible packaging market. Their dominance is attributed to strong economic foundations, well-developed infrastructure, high per capita spending, and significant foreign investment. Nigeria and Egypt are also emerging as crucial growth hubs, exhibiting substantial market expansion, albeit potentially at a more measured pace compared to the top three.

-

Leading Resin Types: Polyethylene (PE) and Bi-oriented Polypropylene (BOPP) continue to command a significant market share due to their inherent cost-effectiveness, excellent processability, and versatility across a broad spectrum of applications. However, there is a discernible and growing demand for specialized polymers such as Cast Polypropylene (CPP), Polyethylene Terephthalate (PET), and Ethylene Vinyl Alcohol (EVOH). These materials are increasingly sought after for their unique properties, including superior barrier capabilities, enhanced strength, and suitability for niche applications requiring specific performance attributes.

-

Prominent Product Formats: Pouches, particularly retort pouches and stand-up pouches, along with various types of bags such as gusseted and wicketed bags, represent the largest and most rapidly growing product segments. This trend is a direct reflection of the escalating consumer preference for convenient, easy-to-use, and resealable packaging formats. Flexible packaging films also maintain a substantial market presence, serving as a foundational component for many of these finished products.

-

Dominant End-User Industries: The food and beverage sector unequivocally holds the largest share of the MEA flexible packaging market. This is driven by the region's large population and increasing consumption of processed and packaged food products. However, the market is witnessing notable growth in other vital end-user segments, including the pharmaceutical and healthcare industries, driven by the demand for sterile and protective packaging, as well as the personal care and cosmetics sector, where aesthetic appeal and product preservation are key.

Underlying Drivers for Segment Growth:

- Sustained Economic Growth: The robust economic expansion observed in many MEA nations directly translates into higher disposable incomes for consumers, thereby amplifying the demand for packaged goods across all categories.

- Infrastructure Development: Continuous investment in infrastructure, including logistics networks and transportation systems, is crucial for enhancing supply chain efficiency, reducing transit times, and facilitating wider market penetration for packaged products.

- Demographic Dividend: The region's consistently high population growth rate ensures a perpetually expanding consumer base, thus creating an ongoing and increasing demand for essential consumer goods that rely on flexible packaging.

Middle East and Africa Flexible Packaging Market Product Developments

Recent innovations focus on sustainable materials, improved barrier properties, and enhanced printing technologies. This includes advancements in recyclable and compostable films, along with smart packaging solutions that incorporate sensors and traceability features. Such developments are enhancing the value proposition of flexible packaging while addressing environmental concerns and meeting the evolving demands of consumers.

Challenges in the Middle East and Africa Flexible Packaging Market Market

The MEA flexible packaging market faces challenges such as:

Fluctuating raw material prices: The prices of key raw materials, particularly polymers, are subject to volatility, impacting production costs.

Supply chain disruptions: Logistical hurdles and infrastructure limitations in some parts of the region can lead to supply chain disruptions.

Stringent regulations: Compliance with increasingly strict food safety and environmental regulations necessitates investment in advanced technologies and processes.

Forces Driving Middle East and Africa Flexible Packaging Market Growth

The significant momentum in the MEA flexible packaging market is being propelled by a synergistic combination of factors:

-

Pioneering Technological Advancements: The continuous innovation in material science, including the development of high-performance films and sustainable alternatives, coupled with advancements in printing and converting technologies, is leading to packaging solutions that offer superior functionality, enhanced shelf-life, and improved sustainability profiles.

-

Broad-Based Economic Expansion: Strong and sustained economic growth across numerous countries in the MEA region is a fundamental driver. This economic prosperity fuels increased consumer spending power, directly translating into higher demand for a diverse range of packaged goods and, consequently, flexible packaging.

-

Supportive Government Policies and Investments: Governments across the MEA region are increasingly implementing policies that encourage local manufacturing, attract foreign direct investment, and promote the adoption of advanced technologies. These supportive measures create a favorable business environment for the flexible packaging industry, fostering growth and expansion.

Long-Term Growth Catalysts in the Middle East and Africa Flexible Packaging Market

Long-term growth hinges on continued innovation, strategic partnerships, and market expansion into new segments and geographies. The increasing adoption of sustainable and eco-friendly packaging materials is expected to be a significant growth driver in the years to come.

Emerging Opportunities in Middle East and Africa Flexible Packaging Market

Emerging opportunities include:

Growth of e-commerce: The expanding online retail sector provides immense opportunities for specialized e-commerce packaging solutions.

Demand for sustainable packaging: The growing awareness of environmental concerns drives demand for eco-friendly packaging alternatives.

Expansion into new markets: Untapped potential exists in several less-developed countries within MEA.

Leading Players in the Middle East and Africa Flexible Packaging Market Sector

- Amcor

- Uflex Limited

- Coveris Management GmbH

- Treofan Films

- BASF SE

- Huhtamaki Group

- Napco Group

- Gulf Packaging Industries Limited

- Mondi Plc

- DowDuPont

Key Milestones in Middle East and Africa Flexible Packaging Market Industry

-

September 2021: Huhtamaki, a global leader in sustainable packaging solutions, strategically acquired Elif, a prominent flexible packaging manufacturer. This acquisition significantly bolstered Huhtamaki's product portfolio with an extensive range of nearly recyclable flexible packaging options and cemented its market leadership position within the Middle East and Africa region. The transaction underscored the growing industry emphasis and investment in sustainable packaging innovations.

Strategic Outlook for Middle East and Africa Flexible Packaging Market Market

The MEA flexible packaging market presents substantial growth potential, driven by favorable demographics, economic expansion, and evolving consumer preferences. Companies focused on innovation, sustainability, and efficient supply chains are well-positioned to capitalize on the numerous opportunities within this dynamic market. Strategic partnerships and investments in advanced technologies will be crucial for long-term success.

Middle East and Africa Flexible Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Polyethylene Terephthalate (PET )

- 1.1.4. Other Plastics (PVC, PA, etc.)

- 1.2. Paper

- 1.3. Aluminum

- 1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches And Bags

-

2.2. Films And Wraps

- 2.2.1. Thermoforming Film

- 2.2.2. Stretch Films

- 2.2.3. Shrink Film

- 2.2.4. Cling Film

- 2.3. Labels And Sleeves

- 2.4. Lidding And Liners

- 2.5. Blister Packaging

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Pharmaceuticals

- 3.4. Cosmetics And Personal Care

- 3.5. Household Care

- 3.6. Pet Care

- 3.7. Tobacco

- 3.8. Other En

Middle East and Africa Flexible Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Flexible Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Flexible Packaging Market

Middle East and Africa Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand

- 3.3. Market Restrains

- 3.3.1. Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Polyethylene Terephthalate (PET )

- 5.1.1.4. Other Plastics (PVC, PA, etc.)

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches And Bags

- 5.2.2. Films And Wraps

- 5.2.2.1. Thermoforming Film

- 5.2.2.2. Stretch Films

- 5.2.2.3. Shrink Film

- 5.2.2.4. Cling Film

- 5.2.3. Labels And Sleeves

- 5.2.4. Lidding And Liners

- 5.2.5. Blister Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Pharmaceuticals

- 5.3.4. Cosmetics And Personal Care

- 5.3.5. Household Care

- 5.3.6. Pet Care

- 5.3.7. Tobacco

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uflex Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Management GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Treofan Films

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huhtamaki Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Napco Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gulf Pakcaging Industries Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DowDuPont*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Flexible Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Flexible Packaging Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Middle East and Africa Flexible Packaging Market?

Key companies in the market include Amcor, Uflex Limited, Coveris Management GmbH, Treofan Films, BASF SE, Huhtamaki Group, Napco Group, Gulf Pakcaging Industries Limited, Mondi Plc, DowDuPont*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Flexible Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products.

8. Can you provide examples of recent developments in the market?

September 2021-Huhtamaki acquired Elif, a flexible packaging company with nearly recyclable products. Flexo printing and polyethylene (PE) film production technologies round out the company portfolio across Europe, the Middle East, and Africa. The acquisition aligned with the company's goals of promoting talent and sustainability and aided the company's growth and competitiveness plan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence