Key Insights

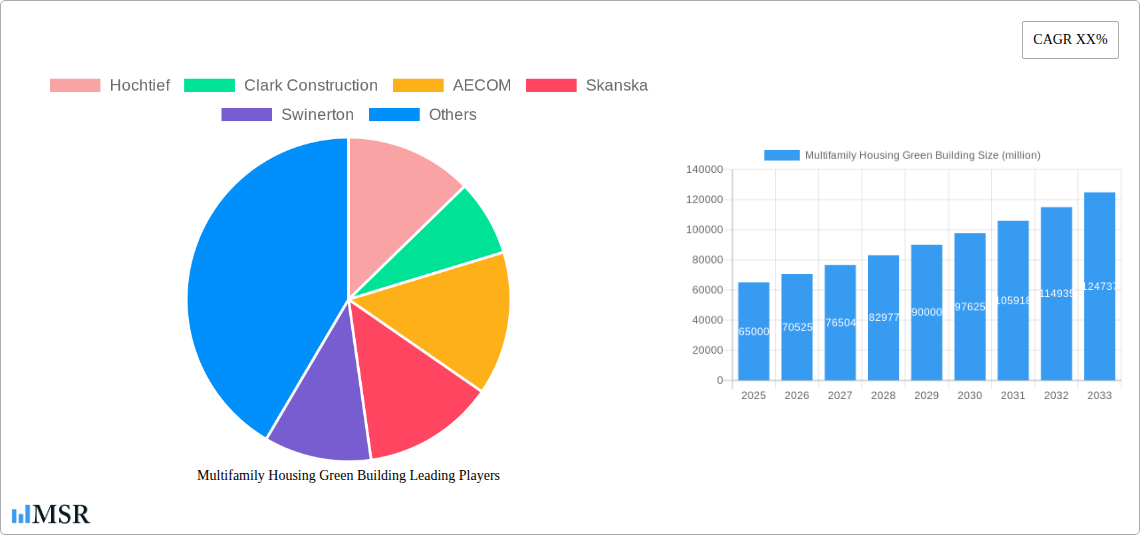

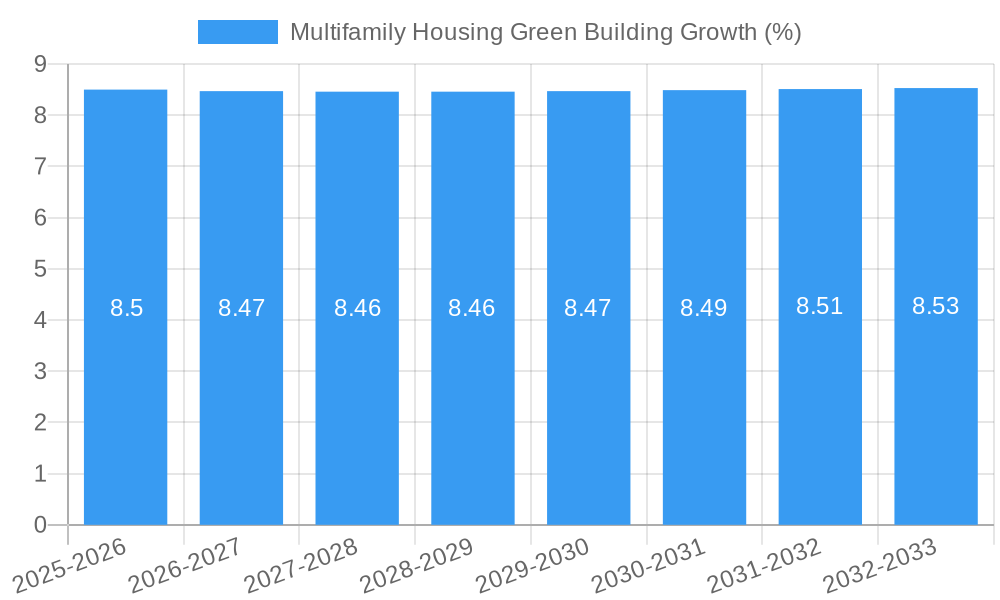

The Multifamily Housing Green Building market is poised for significant expansion, projected to reach an impressive market size of approximately $65,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 8.5% anticipated throughout the forecast period ending in 2033. This substantial growth is fueled by a confluence of powerful drivers, prominently including escalating environmental awareness among both consumers and developers, stringent government regulations and incentives promoting sustainable construction practices, and the undeniable economic advantages associated with energy-efficient buildings, such as reduced operational costs. The increasing demand for healthier living spaces, coupled with advancements in green building technologies and materials, further bolsters this upward trajectory. Key applications span across individual residential units, commercial developments, and municipal projects, while new constructions and extensive remodeling projects represent the dominant types driving market penetration.

Several key trends are shaping the multifamily housing green building landscape. The integration of smart home technologies for optimized energy management, the widespread adoption of renewable energy sources like solar panels on multifamily properties, and the growing preference for sustainable and recycled materials are all contributing to market dynamism. Furthermore, a heightened focus on water conservation through innovative plumbing and landscaping solutions is becoming a critical differentiator. However, the market is not without its challenges. High upfront construction costs for some green technologies, a potential shortage of skilled labor trained in green building techniques, and the need for robust policy frameworks to ensure widespread adoption represent significant restraints. Despite these hurdles, the compelling long-term benefits of reduced environmental impact and enhanced building performance are expected to drive continued innovation and investment, solidifying the importance of the multifamily housing green building sector in the global construction industry.

This comprehensive report, "Multifamily Housing Green Building: Market Dynamics, Trends, and Future Outlook," offers an in-depth analysis of the rapidly expanding global market for sustainable multifamily developments. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report leverages historical data from 2019–2024 to provide actionable insights for industry stakeholders.

The market is witnessing significant growth driven by increasing environmental consciousness, stringent regulations, and demand for energy-efficient, cost-effective housing solutions. This report delves into market concentration, key industry trends, dominant segments, product innovations, challenges, growth drivers, emerging opportunities, leading players, and crucial historical milestones. Expect to find granular data on market size, CAGR, and the strategic initiatives of major companies shaping the future of green multifamily construction.

Multifamily Housing Green Building Market Concentration & Dynamics

The multifamily housing green building market exhibits a XX% market concentration, characterized by a mix of established construction giants and innovative specialized firms. The study period of 2019–2033 reveals a dynamic landscape where innovation ecosystems are fostering rapid advancements in sustainable materials and construction techniques. Regulatory frameworks are increasingly mandating green building standards, acting as a significant driver. Substitute products, such as prefabricated modular green components, are gaining traction, offering cost and time efficiencies. End-user trends are heavily influenced by a growing preference for healthy living environments and reduced utility costs, impacting project design and material selection. Mergers and acquisitions (M&A) activities, with an estimated XX M&A deal count during the forecast period, indicate a consolidation trend as larger entities seek to integrate green building expertise and expand their market reach. Key players like Hochtief, Clark Construction, and AECOM are at the forefront, strategically acquiring or partnering with innovative green tech companies to maintain a competitive edge.

Multifamily Housing Green Building Industry Insights & Trends

The global multifamily housing green building market size is projected to reach approximately $XXX million by 2025, exhibiting a robust XX% Compound Annual Growth Rate (CAGR) from 2019 to 2033. This substantial growth is fueled by a confluence of compelling market drivers. Increasingly stringent environmental regulations and government incentives worldwide are compelling developers to adopt sustainable building practices. A significant catalyst is the escalating demand for energy-efficient and cost-effective housing solutions from environmentally conscious consumers and tenants, who are keenly aware of long-term utility savings and the health benefits associated with green building materials. Technological disruptions are playing a pivotal role, with advancements in smart building technologies, renewable energy integration (such as solar panels and geothermal systems), and the development of novel, low-carbon construction materials like cross-laminated timber (CLT) and recycled aggregates revolutionizing construction methodologies. The integration of Building Information Modeling (BIM) and Artificial Intelligence (AI) is optimizing design, construction, and operational efficiency, further driving market expansion. Evolving consumer behaviors, characterized by a heightened awareness of climate change and a desire for sustainable lifestyles, are translating into a preference for green-certified multifamily properties. This shift in consumer demand is creating a competitive advantage for developers who prioritize sustainability in their projects, from initial design to material sourcing and end-of-life considerations. The industry is witnessing a paradigm shift from a niche market to a mainstream imperative, with a projected market size of $XXX million by 2033.

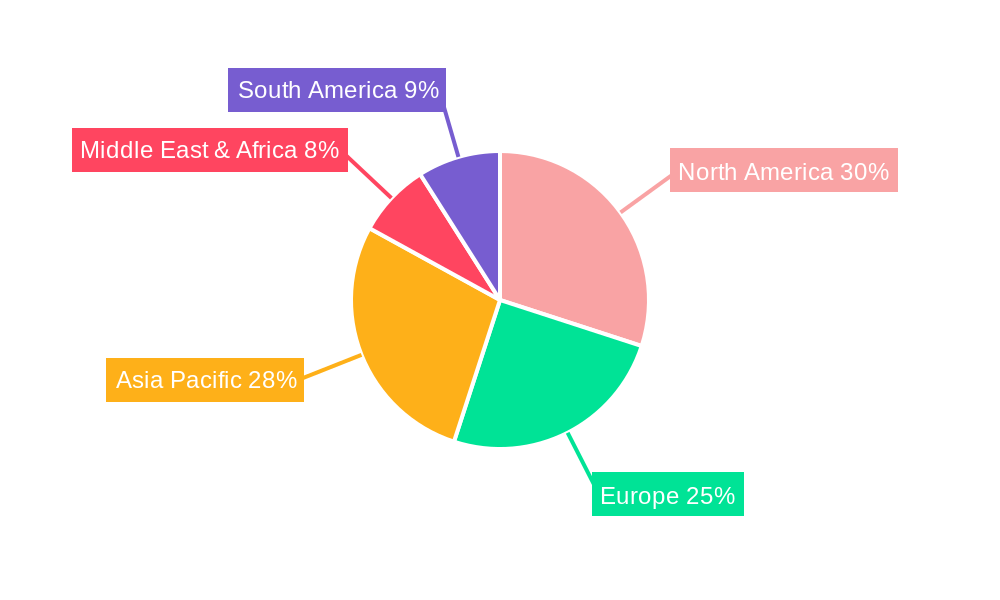

Key Markets & Segments Leading Multifamily Housing Green Building

The North America region currently dominates the multifamily housing green building market, driven by robust economic growth, proactive government policies promoting sustainability, and a high consumer demand for eco-friendly residential options. Within this region, the United States stands out as a leading market, with cities like Seattle, Denver, and New York spearheading green building initiatives.

Dominant Segments:

Application:

- Individual: Growing demand for sustainable and healthy living spaces in apartments and condos, driven by increased awareness of occupant well-being and energy savings.

- Commercial: Integration of green building principles into large-scale multifamily complexes that also incorporate commercial spaces, aiming for higher energy efficiency and tenant attraction.

- Municipal: Government-led affordable housing projects increasingly incorporating green building standards to reduce long-term operational costs and meet sustainability targets.

Types:

- New Constructions: This segment is the primary driver of market growth, with developers incorporating green building technologies and materials from the ground up. This allows for optimal integration of sustainable systems and design principles, leading to higher energy performance and reduced environmental impact. The focus here is on maximizing energy efficiency, water conservation, and utilizing sustainable materials from inception.

- Remodeling Projects: As existing building stock ages, there is a significant opportunity in retrofitting and remodeling to meet modern green building standards. This segment focuses on improving insulation, upgrading HVAC systems, installing energy-efficient windows, and incorporating renewable energy sources to enhance the sustainability of older multifamily properties. The drivers here include compliance with evolving regulations, reducing operational costs for property owners, and increasing the market value of existing assets.

Application:

- Individual: Growing demand for sustainable and healthy living spaces in apartments and condos, driven by increased awareness of occupant well-being and energy savings.

- Commercial: Integration of green building principles into large-scale multifamily complexes that also incorporate commercial spaces, aiming for higher energy efficiency and tenant attraction.

- Municipal: Government-led affordable housing projects increasingly incorporating green building standards to reduce long-term operational costs and meet sustainability targets.

Types:

- New Constructions: This segment is the primary driver of market growth, with developers incorporating green building technologies and materials from the ground up. This allows for optimal integration of sustainable systems and design principles, leading to higher energy performance and reduced environmental impact. The focus here is on maximizing energy efficiency, water conservation, and utilizing sustainable materials from inception.

- Remodeling Projects: As existing building stock ages, there is a significant opportunity in retrofitting and remodeling to meet modern green building standards. This segment focuses on improving insulation, upgrading HVAC systems, installing energy-efficient windows, and incorporating renewable energy sources to enhance the sustainability of older multifamily properties. The drivers here include compliance with evolving regulations, reducing operational costs for property owners, and increasing the market value of existing assets.

The dominance of New Constructions is attributed to the ability to integrate cutting-edge green technologies and design from the initial stages. However, the Remodeling Projects segment is rapidly gaining traction as a cost-effective and impactful way to improve the sustainability of the vast existing multifamily building stock. Economic growth in key metropolitan areas, coupled with significant infrastructure investments in renewable energy and smart city initiatives, further solidifies the leading position of these segments.

Multifamily Housing Green Building Product Developments

Recent product developments in multifamily housing green building are centered on enhancing energy efficiency, improving indoor air quality, and reducing embodied carbon. Innovations include advanced insulation materials with higher R-values, smart windows that dynamically adjust tinting for optimal solar heat gain, and high-efficiency HVAC systems with integrated air filtration. The market is also seeing a rise in sustainable material alternatives, such as low-VOC paints, recycled content flooring, and sustainably sourced timber. Furthermore, the integration of smart home technology for energy monitoring and control is becoming standard, allowing residents to actively manage their consumption and contributing to overall building performance. These advancements are not only making buildings more environmentally friendly but also more comfortable and cost-effective for occupants.

Challenges in the Multifamily Housing Green Building Market

Despite robust growth, the multifamily housing green building market faces several challenges. Initial upfront costs for green materials and technologies can be higher than conventional options, although long-term savings often offset this. Regulatory hurdles and inconsistent building codes across different jurisdictions can create complexities for developers. Supply chain issues for specialized green materials can lead to delays and increased costs. Furthermore, a lack of skilled labor experienced in green building techniques poses a significant restraint, impacting project timelines and quality. Competitive pressures from conventional construction methods also continue to exist, requiring ongoing education and advocacy for the benefits of green building.

Forces Driving Multifamily Housing Green Building Growth

Several key forces are propelling the growth of the multifamily housing green building market. Technological advancements in renewable energy solutions, smart building systems, and sustainable materials are making green construction more accessible and efficient. Economic factors, including rising energy prices and the long-term cost savings associated with energy-efficient buildings, are creating strong financial incentives for developers and residents. Government policies and regulations, such as carbon emission targets, green building certifications (e.g., LEED, BREEAM), and tax incentives for sustainable construction, are creating a favorable market environment. The increasing consumer demand for healthier, environmentally responsible living spaces further amplifies these drivers.

Challenges in the Multifamily Housing Green Building Market

Long-term growth catalysts for the multifamily housing green building market are deeply rooted in sustained innovation and strategic market expansion. Continued research and development in areas like carbon-sequestering materials, advanced energy storage solutions, and circular economy principles within construction will be crucial. Strategic partnerships between developers, material manufacturers, and technology providers will accelerate the adoption of new solutions. Furthermore, market expansion into emerging economies where green building is gaining traction presents significant long-term growth potential. The ongoing integration of green building principles into urban planning and smart city initiatives will also serve as a continuous catalyst for market evolution and widespread adoption.

Emerging Opportunities in Multififamily Housing Green Building

Emerging opportunities in the multifamily housing green building sector are diverse and promising. The growing trend of net-zero energy buildings presents a significant avenue for innovation in renewable energy generation and storage. The increasing focus on resilience and climate adaptation is driving demand for green buildings that can withstand extreme weather events, creating opportunities in sustainable infrastructure integration. Furthermore, the rise of the circular economy in construction is fostering opportunities in deconstruction, material reuse, and the development of innovative recycling processes for building materials. The growing emphasis on health and wellness within living spaces is creating demand for products and designs that improve indoor air quality and occupant well-being, opening doors for advanced air filtration and biophilic design solutions.

Leading Players in the Multifamily Housing Green Building Sector

- Hochtief

- Clark Construction

- AECOM

- Skanska

- Swinerton

- Hensel Phelps

- Lendlease

- Webcor Builders

- Holder Construction

- The Walsh Group Ltd

- Obayashi Corporation

- Gilbane Building Company

Key Milestones in Multifamily Housing Green Building Industry

- 2019: Increased adoption of stringent energy efficiency standards by several municipalities, driving demand for green building materials and techniques.

- 2020: Growing awareness and adoption of indoor air quality standards for multifamily residences due to global health concerns.

- 2021: Significant advancements in cross-laminated timber (CLT) technology, enabling its wider application in mid-rise multifamily construction.

- 2022: Introduction of new government incentives and tax credits for green building projects in major markets, stimulating investment.

- 2023: Expansion of smart building technology integration in multifamily units, focusing on energy management and resident comfort.

- 2024: Increased focus on embodied carbon reduction in construction materials, leading to the development and adoption of low-carbon alternatives.

Strategic Outlook for Multifamily Housing Green Building Market

The strategic outlook for the multifamily housing green building market is exceptionally positive, driven by an accelerating shift towards sustainability as a core requirement rather than an option. Growth accelerators include the continuous development of cost-effective and high-performance green materials, alongside the widespread adoption of digital construction technologies like AI and IoT for enhanced building management. Future market potential lies in the deep integration of renewable energy sources and energy storage solutions directly into multifamily developments, moving towards grid independence. Strategic opportunities will emerge in retrofitting existing building stock to meet advanced green standards and in expanding into developing regions with growing urbanization and a nascent but rapidly developing focus on environmental responsibility.

Multifamily Housing Green Building Segmentation

-

1. Application

- 1.1. Individual

- 1.2. Commercial

- 1.3. Municipal

-

2. Types

- 2.1. New Constructions

- 2.2. Remodeling Projects

Multifamily Housing Green Building Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Multifamily Housing Green Building REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Multifamily Housing Green Building Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individual

- 5.1.2. Commercial

- 5.1.3. Municipal

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. New Constructions

- 5.2.2. Remodeling Projects

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Multifamily Housing Green Building Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individual

- 6.1.2. Commercial

- 6.1.3. Municipal

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. New Constructions

- 6.2.2. Remodeling Projects

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Multifamily Housing Green Building Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individual

- 7.1.2. Commercial

- 7.1.3. Municipal

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. New Constructions

- 7.2.2. Remodeling Projects

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Multifamily Housing Green Building Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individual

- 8.1.2. Commercial

- 8.1.3. Municipal

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. New Constructions

- 8.2.2. Remodeling Projects

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Multifamily Housing Green Building Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individual

- 9.1.2. Commercial

- 9.1.3. Municipal

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. New Constructions

- 9.2.2. Remodeling Projects

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Multifamily Housing Green Building Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individual

- 10.1.2. Commercial

- 10.1.3. Municipal

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. New Constructions

- 10.2.2. Remodeling Projects

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hochtief

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clark Construction

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AECOM

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Skanska

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Swinerton

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hensel Phelps

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lendlease

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Webcor Builders

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Holder ConstructionHolder Construction

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Walsh Group Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Obayashi Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Gilbane Building Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hochtief

List of Figures

- Figure 1: Global Multifamily Housing Green Building Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Multifamily Housing Green Building Revenue (million), by Application 2024 & 2032

- Figure 3: North America Multifamily Housing Green Building Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Multifamily Housing Green Building Revenue (million), by Types 2024 & 2032

- Figure 5: North America Multifamily Housing Green Building Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Multifamily Housing Green Building Revenue (million), by Country 2024 & 2032

- Figure 7: North America Multifamily Housing Green Building Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Multifamily Housing Green Building Revenue (million), by Application 2024 & 2032

- Figure 9: South America Multifamily Housing Green Building Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Multifamily Housing Green Building Revenue (million), by Types 2024 & 2032

- Figure 11: South America Multifamily Housing Green Building Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Multifamily Housing Green Building Revenue (million), by Country 2024 & 2032

- Figure 13: South America Multifamily Housing Green Building Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Multifamily Housing Green Building Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Multifamily Housing Green Building Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Multifamily Housing Green Building Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Multifamily Housing Green Building Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Multifamily Housing Green Building Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Multifamily Housing Green Building Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Multifamily Housing Green Building Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Multifamily Housing Green Building Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Multifamily Housing Green Building Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Multifamily Housing Green Building Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Multifamily Housing Green Building Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Multifamily Housing Green Building Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Multifamily Housing Green Building Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Multifamily Housing Green Building Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Multifamily Housing Green Building Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Multifamily Housing Green Building Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Multifamily Housing Green Building Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Multifamily Housing Green Building Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Multifamily Housing Green Building Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Multifamily Housing Green Building Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Multifamily Housing Green Building Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Multifamily Housing Green Building Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Multifamily Housing Green Building Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Multifamily Housing Green Building Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Multifamily Housing Green Building Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Multifamily Housing Green Building Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Multifamily Housing Green Building Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Multifamily Housing Green Building Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Multifamily Housing Green Building Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Multifamily Housing Green Building Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Multifamily Housing Green Building Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Multifamily Housing Green Building Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Multifamily Housing Green Building Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Multifamily Housing Green Building Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Multifamily Housing Green Building Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Multifamily Housing Green Building Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Multifamily Housing Green Building Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Multifamily Housing Green Building Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Multifamily Housing Green Building?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Multifamily Housing Green Building?

Key companies in the market include Hochtief, Clark Construction, AECOM, Skanska, Swinerton, Hensel Phelps, Lendlease, Webcor Builders, Holder ConstructionHolder Construction, The Walsh Group Ltd, Obayashi Corporation, Gilbane Building Company.

3. What are the main segments of the Multifamily Housing Green Building?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Multifamily Housing Green Building," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Multifamily Housing Green Building report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Multifamily Housing Green Building?

To stay informed about further developments, trends, and reports in the Multifamily Housing Green Building, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence