Key Insights

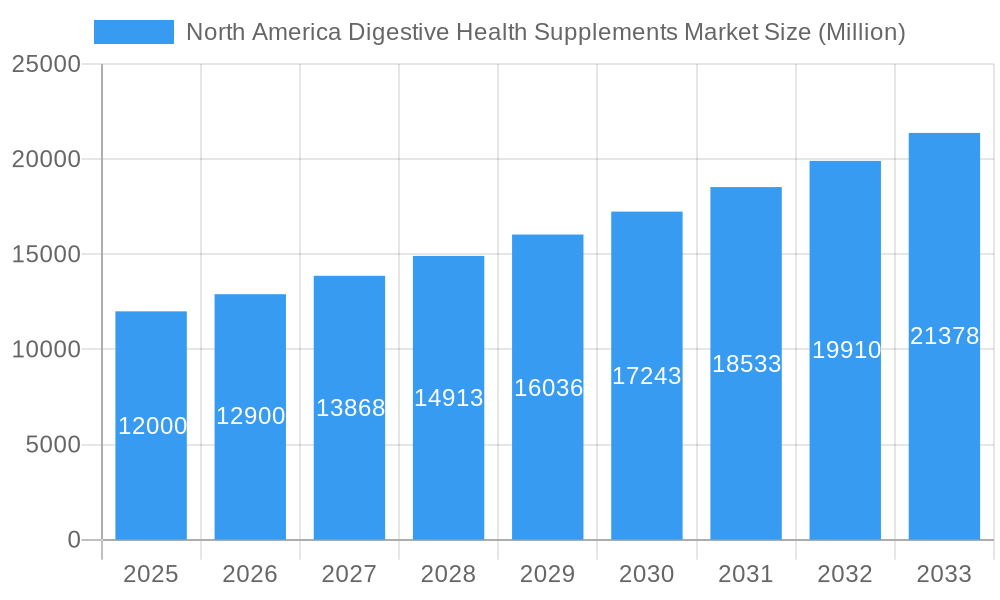

The North American digestive health supplements market is poised for significant expansion, driven by escalating consumer awareness of gut health and the increasing incidence of digestive ailments. The market is projected to achieve a compound annual growth rate (CAGR) of 6%, reaching an estimated market size of $19.3 billion by 2025. This robust growth is underpinned by several key drivers. Consumers are increasingly seeking natural and functional food-derived supplements, with probiotics, prebiotics, and digestive enzymes representing the leading market segments. The convenience of e-commerce and the expanding availability of supplements through pharmacies and supermarkets further facilitate market penetration.

North America Digestive Health Supplements Market Market Size (In Billion)

Key factors influencing the market include growing consumer demand for scientifically backed digestive health solutions and an aging population experiencing higher rates of digestive issues. While regulatory scrutiny and concerns regarding product efficacy present potential challenges, innovation in product development and enhanced consumer education are expected to mitigate these restraints. The competitive landscape features established global healthcare giants and agile, specialized nutraceutical companies, all focused on research and development to introduce novel formulations and improve existing product lines. Strategic marketing emphasizing the holistic benefits of digestive health and ensuring product quality will be critical for sustained market leadership. Expansion into emerging distribution channels and strategic collaborations will play a pivotal role in market share dynamics. The continued recognition of the gut microbiome's importance in overall wellness by healthcare professionals and consumers alike will serve as a substantial growth catalyst.

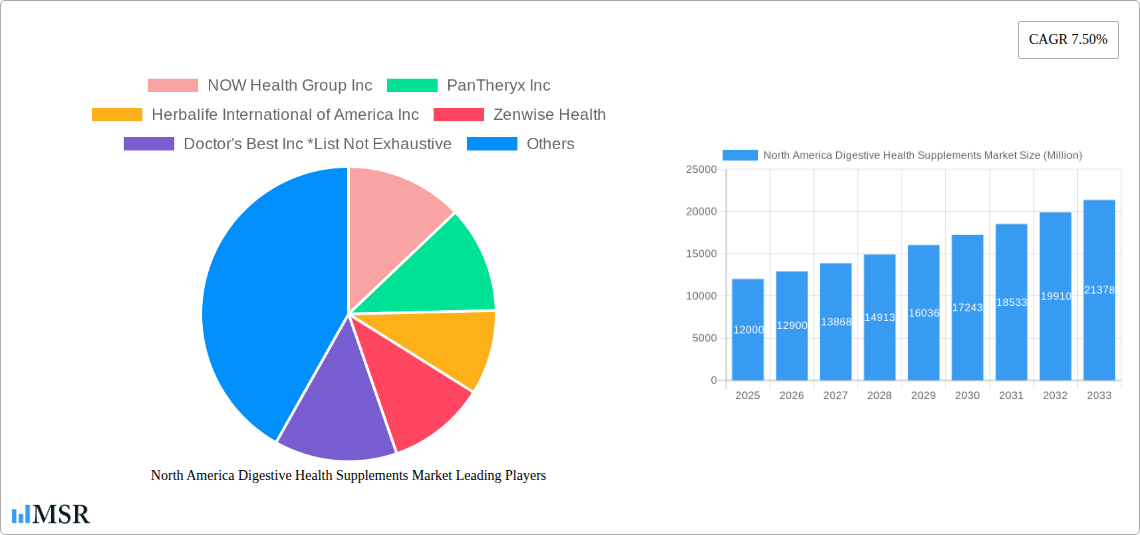

North America Digestive Health Supplements Market Company Market Share

North America Digestive Health Supplements Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Digestive Health Supplements Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a robust understanding of historical trends, current market dynamics, and future growth projections. The market is segmented by type (Prebiotics, Probiotics, Enzymes, Other Types) and distribution channel (Supermarkets/Hypermarkets, Pharmacies and Drugstores, Online Retailers, Other Distribution Channels), providing a granular view of market performance. Key players like NOW Health Group Inc, PanTheryx Inc, Herbalife International of America Inc, Zenwise Health, Doctor's Best Inc, Bayer AG, GlaxoSmithKline Plc, The Nature's Bounty Co (Puritan's Pride Inc), Koninklijke DSM NV, and General Nutrition Centers Inc are analyzed, among others. The total market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Digestive Health Supplements Market Concentration & Dynamics

The North America digestive health supplements market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller companies and startups fosters competition and innovation. The market is characterized by a dynamic innovation ecosystem, with continuous development of novel formulations, delivery systems, and targeted products addressing specific digestive health needs. Regulatory frameworks, particularly regarding labeling and claims, influence product development and market entry. Substitute products, such as traditional remedies and functional foods, pose some competition, but the convenience and targeted benefits of supplements drive significant demand. End-user trends, including increasing health awareness, rising prevalence of digestive disorders, and growing preference for natural and functional foods, are key growth drivers. Mergers and acquisitions (M&A) activity in the sector remains moderate, with strategic partnerships playing a more significant role. For example, in the last five years, there have been approximately xx M&A deals, resulting in a market concentration ratio (CR4) of approximately xx%.

North America Digestive Health Supplements Market Industry Insights & Trends

The North America digestive health supplements market is experiencing robust growth, driven by several factors. The market size in 2024 was estimated at xx Million, and is projected to reach xx Million by 2033. This growth is fueled by increasing consumer awareness about gut health's importance, the rising prevalence of digestive disorders like irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD), and a growing preference for natural health solutions. Technological advancements in supplement formulations, such as targeted delivery systems and microbiome-focused products, are driving innovation and expanding market opportunities. Changing consumer behaviors, including increased online purchasing and a focus on personalized nutrition, are reshaping distribution channels and product offerings. The market also witnesses the rise of personalized nutrition, fueled by advancements in genomics and microbiome analysis, leading to tailored supplement recommendations. E-commerce growth has significantly influenced the market, expanding accessibility to a broader range of products and brands, increasing the market size and improving accessibility.

Key Markets & Segments Leading North America Digestive Health Supplements Market

The United States dominates the North America digestive health supplements market, followed by Canada and Mexico. Within the market segmentation:

By Type: Probiotics lead the market due to their well-established benefits and widespread consumer understanding. Prebiotics are experiencing rapid growth, driven by increased scientific awareness of their importance in gut health. Enzymes are a niche segment but are experiencing steady growth due to their role in digestive support. Other types, such as fiber supplements and herbal remedies, contribute to the overall market size.

By Distribution Channel: Online retailers are witnessing a significant surge in market share due to the convenience and broader product selection they offer. Supermarkets and hypermarkets maintain significant market share due to their extensive reach and established customer base. Pharmacies and drugstores also hold substantial market share, benefiting from consumer trust and professional advice accessibility.

Drivers for growth in key segments:

- Probiotics: Rising awareness of gut-brain connection, increasing research on specific probiotic strains and their applications in disease management.

- Prebiotics: Growing understanding of the prebiotic's role in supporting beneficial gut microbiota and overall gut health.

- Online Retailers: Convenience, wider product selection, targeted advertising, and competitive pricing are key drivers for growth in online retail.

North America Digestive Health Supplements Market Product Developments

Recent years have witnessed significant innovations in digestive health supplements. New product formulations focus on targeted delivery systems to improve absorption and efficacy, utilizing technologies such as microencapsulation and liposomal delivery. The increasing use of scientifically backed ingredients and strains and emphasis on clinically proven benefits enhances product credibility and market appeal. The development of personalized supplement recommendations based on individual gut microbiome profiles is also transforming the market, allowing for more targeted and effective approaches to digestive health management.

Challenges in the North America Digestive Health Supplements Market

The North America digestive health supplements market faces several challenges. Stringent regulatory requirements, particularly concerning labeling and health claims, increase product development and market entry costs. Maintaining consistent supply chain operations amidst potential disruptions and fluctuations in raw material costs pose significant challenges. Furthermore, intense competition among established brands and emerging players requires sustained innovation and effective marketing strategies to maintain market share. These factors, combined, constrain the overall growth rate and require manufacturers to implement effective mitigation strategies.

Forces Driving North America Digestive Health Supplements Market Growth

Several factors drive the growth of the North America digestive health supplements market. The increasing prevalence of digestive disorders necessitates effective treatment options, driving demand for supplements. Rising consumer awareness of gut health's importance contributes significantly. Technological advancements lead to innovative product formulations with improved efficacy and targeted benefits, leading to increased market penetration. Favorable regulatory environments support market expansion. Finally, proactive marketing campaigns focusing on educating consumers about the benefits of digestive health supplements further enhance market growth.

Long-Term Growth Catalysts in North America Digestive Health Supplements Market

Long-term growth in the North America digestive health supplements market will be driven by sustained innovation, strategic partnerships, and market expansion into new segments. The development of personalized and precision-based supplements, leveraging advanced technologies like AI and big data, holds tremendous potential. Collaborations between supplement manufacturers, researchers, and healthcare providers will strengthen the market's credibility and effectiveness. Expanding into new markets, including niche segments (e.g., pediatric digestive health), and exploring international expansion will open new growth avenues.

Emerging Opportunities in North America Digestive Health Supplements Market

Emerging opportunities lie in the development of personalized supplement solutions, leveraging microbiome analysis and personalized nutrition approaches. The use of novel delivery systems, including targeted release and advanced encapsulation technologies, offers improved efficacy and bioavailability. Addressing specific unmet medical needs, such as developing supplements for specific digestive disorders or demographic groups, presents considerable growth potential. Exploring new ingredients with scientifically proven benefits will also create new product opportunities.

Leading Players in the North America Digestive Health Supplements Market Sector

- NOW Health Group Inc

- PanTheryx Inc

- Herbalife International of America Inc

- Zenwise Health

- Doctor's Best Inc

- Bayer AG

- GlaxoSmithKline Plc

- The Nature's Bounty Co (Puritan's Pride Inc)

- Koninklijke DSM NV

- General Nutrition Centers Inc

Key Milestones in North America Digestive Health Supplements Market Industry

- September 2021: FrieslandCampina Ingredients and Lallemand Health Solutions partnered to launch PRO-Digest Health Shot and PRO-Digest Bowel Support.

- September 2021: Wedderspoon launched Manuka Honey Digestive Gummies (Tropical and Berry).

- August 2022: Megalabs USA launched Glutapak R, a probiotic glutamine supplement.

Strategic Outlook for North America Digestive Health Supplements Market

The North America digestive health supplements market holds significant future potential, driven by continued growth in consumer demand for natural health solutions and advances in product innovation. Strategic opportunities lie in personalized nutrition, leveraging scientific advancements and targeted marketing strategies. Expanding into new geographic markets and creating innovative products tailored to specific unmet needs will further accelerate market growth. The focus should be on demonstrating efficacy through rigorous clinical trials and building strong partnerships with healthcare professionals to build consumer trust and credibility.

North America Digestive Health Supplements Market Segmentation

-

1. Type

- 1.1. Prebiotics

- 1.2. Probiotics

- 1.3. Enzymes

- 1.4. Other Types

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Drugstores

- 2.3. Online Retailers

- 2.4. Other Distribution Channels

-

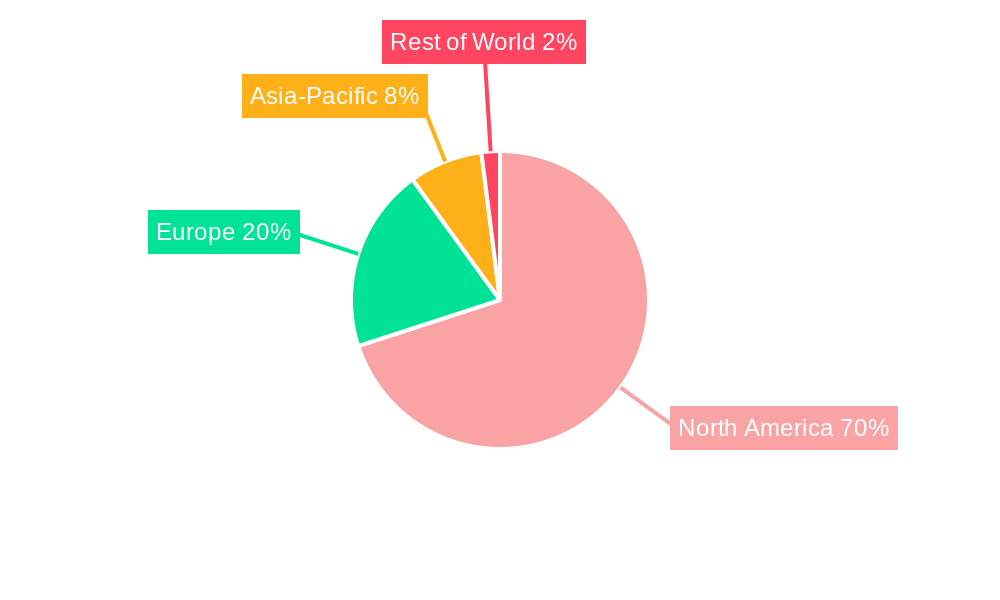

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Digestive Health Supplements Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Digestive Health Supplements Market Regional Market Share

Geographic Coverage of North America Digestive Health Supplements Market

North America Digestive Health Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Rise in Awareness about Digestive Health

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prebiotics

- 5.1.2. Probiotics

- 5.1.3. Enzymes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Drugstores

- 5.2.3. Online Retailers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Prebiotics

- 6.1.2. Probiotics

- 6.1.3. Enzymes

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies and Drugstores

- 6.2.3. Online Retailers

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Prebiotics

- 7.1.2. Probiotics

- 7.1.3. Enzymes

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies and Drugstores

- 7.2.3. Online Retailers

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Prebiotics

- 8.1.2. Probiotics

- 8.1.3. Enzymes

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies and Drugstores

- 8.2.3. Online Retailers

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Prebiotics

- 9.1.2. Probiotics

- 9.1.3. Enzymes

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies and Drugstores

- 9.2.3. Online Retailers

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 NOW Health Group Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PanTheryx Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Herbalife International of America Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zenwise Health

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Doctor's Best Inc *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bayer AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GlaxoSmithKline Plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Nature's Bounty Co (Puritan's Pride Inc )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Koninklijke DSM NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 General Nutrition Centers Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 NOW Health Group Inc

List of Figures

- Figure 1: North America Digestive Health Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Digestive Health Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: North America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 3: North America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 5: North America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 7: North America Digestive Health Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Digestive Health Supplements Market Volume k tons Forecast, by Region 2020 & 2033

- Table 9: North America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 11: North America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 12: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 13: North America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 15: North America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

- Table 17: North America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 19: North America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 20: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 21: North America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 23: North America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

- Table 25: North America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 27: North America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 28: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 29: North America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 31: North America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

- Table 33: North America Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2020 & 2033

- Table 35: North America Digestive Health Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 36: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2020 & 2033

- Table 37: North America Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2020 & 2033

- Table 39: North America Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digestive Health Supplements Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Digestive Health Supplements Market?

Key companies in the market include NOW Health Group Inc, PanTheryx Inc, Herbalife International of America Inc, Zenwise Health, Doctor's Best Inc *List Not Exhaustive, Bayer AG, GlaxoSmithKline Plc, The Nature's Bounty Co (Puritan's Pride Inc ), Koninklijke DSM NV, General Nutrition Centers Inc.

3. What are the main segments of the North America Digestive Health Supplements Market?

The market segments include Type, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Rise in Awareness about Digestive Health.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

In August 2022, Megalabs USA, a subsidiary of Megalabs Inc., that manufactures, markets, and distributes pharmaceutical products and nutritional supplements throughout the Americas, launched Glutapak R, a probiotic glutamine supplement for gut health and intestinal healing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in k tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digestive Health Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digestive Health Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digestive Health Supplements Market?

To stay informed about further developments, trends, and reports in the North America Digestive Health Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence