Key Insights

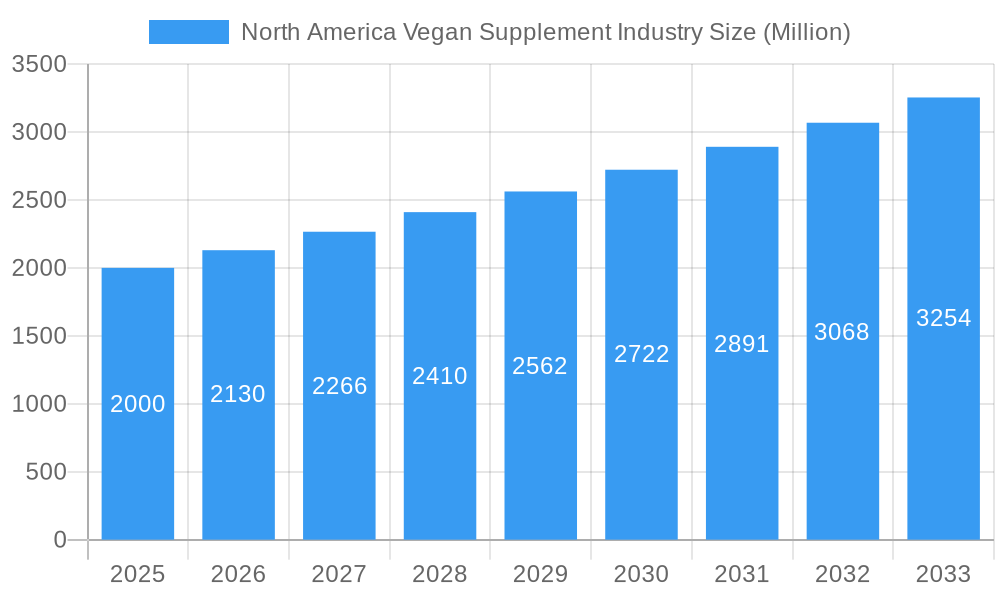

The North American vegan supplement market, valued at $27.52 billion in the base year of 2025, is poised for significant expansion. Projections indicate the market will reach approximately $3.5 billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 6.5%. This growth is primarily attributed to the escalating adoption of vegan and plant-based lifestyles, driven by heightened health consciousness, environmental advocacy, and ethical consumerism. Increased consumer awareness regarding potential nutritional deficiencies in vegan diets is spurring demand for supplements that ensure adequate intake of essential nutrients such as proteins, vitamins, and omega-3 fatty acids. The rising incidence of chronic diseases, coupled with a preference for natural health solutions, further accelerates market growth. The market is segmented by supplement type (protein, vitamins, omega-3s, other vegan supplements), distribution channel (pharmacies, supermarkets, online, others), and geography (United States, Canada, Mexico, Rest of North America). The United States leads the market, owing to its substantial vegan population and advanced wellness sector.

North America Vegan Supplement Industry Market Size (In Billion)

Key industry players, including Nestlé, NOW Health Group, Canopy Growth Corporation (Biosteel), and Ora Organic, are actively engaged in product innovation, brand development, and strategic collaborations. However, regulatory challenges concerning supplement claims and ingredient quality, alongside sourcing concerns, present potential market restraints. Future market success will depend on addressing these challenges, enhancing transparency, and consistently delivering innovative, effective vegan supplements to meet evolving consumer needs. The burgeoning online retail sector offers substantial growth opportunities, while robust supply chain management will be critical for sustained expansion. The integration of personalized nutrition and targeted supplementation strategies will further shape the market's future trajectory.

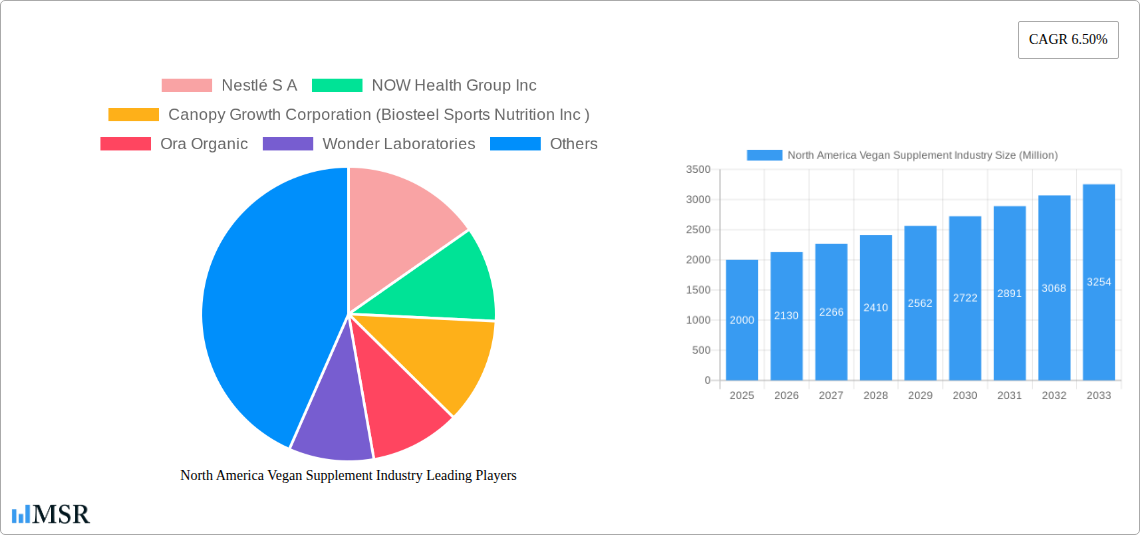

North America Vegan Supplement Industry Company Market Share

North America Vegan Supplement Industry: Market Analysis and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the North American vegan supplement industry, covering market size, growth drivers, key segments, prominent players, and future projections. The analysis focuses on the period from 2025 to 2033, with 2025 serving as the base year. This detailed study is essential for stakeholders, investors, and businesses seeking to understand and leverage opportunities within the expanding vegan supplement market. The market is projected to reach $3.5 billion by 2033, exhibiting a CAGR of 6.5%. The market size is $27.52 billion, with a CAGR of 9%. The base year is 2025, and the market size unit is billion.

North America Vegan Supplement Industry Market Concentration & Dynamics

The North America vegan supplement market is experiencing dynamic growth, driven by increasing consumer demand for plant-based alternatives and health-conscious lifestyles. Market concentration is moderate, with several key players holding significant market share, but also room for smaller companies to innovate and compete. Nestlé S.A., NOW Health Group Inc., and Canopy Growth Corporation (Biosteel Sports Nutrition Inc.) are among the major players, although their exact market share requires further proprietary analysis. The industry demonstrates a moderately high level of innovation, with frequent product launches focusing on enhanced formulations and sustainability. Regulatory frameworks vary across North America, presenting both challenges and opportunities for businesses. Substitute products, such as whole foods, pose some competitive pressure, while mergers and acquisitions (M&A) activities have been relatively frequent, reflecting the industry's consolidation trend. The total number of M&A deals in the period of 2019-2024 was xx, with a total value of xx Million. End-user trends show a preference for transparent, ethically sourced, and scientifically validated products.

North America Vegan Supplement Industry Industry Insights & Trends

The North America vegan supplement market is experiencing robust growth, fueled by several key factors. The market size reached xx Million in 2024, and it is projected to reach xx Million by 2033, exhibiting a compelling CAGR of xx%. Key growth drivers include the rising popularity of veganism and vegetarianism, increased awareness of the health benefits of plant-based diets, and growing concerns about animal welfare and environmental sustainability. Technological advancements in vegan supplement formulation and production are further driving innovation. Consumer behavior increasingly reflects a preference for high-quality, sustainably sourced products with transparent labeling and verifiable certifications. Evolving consumer preferences for personalized nutrition and functional foods are also contributing significantly to market expansion. Technological disruptions are primarily in the areas of ingredient sourcing, formulation, and delivery systems.

Key Markets & Segments Leading North America Vegan Supplement Industry

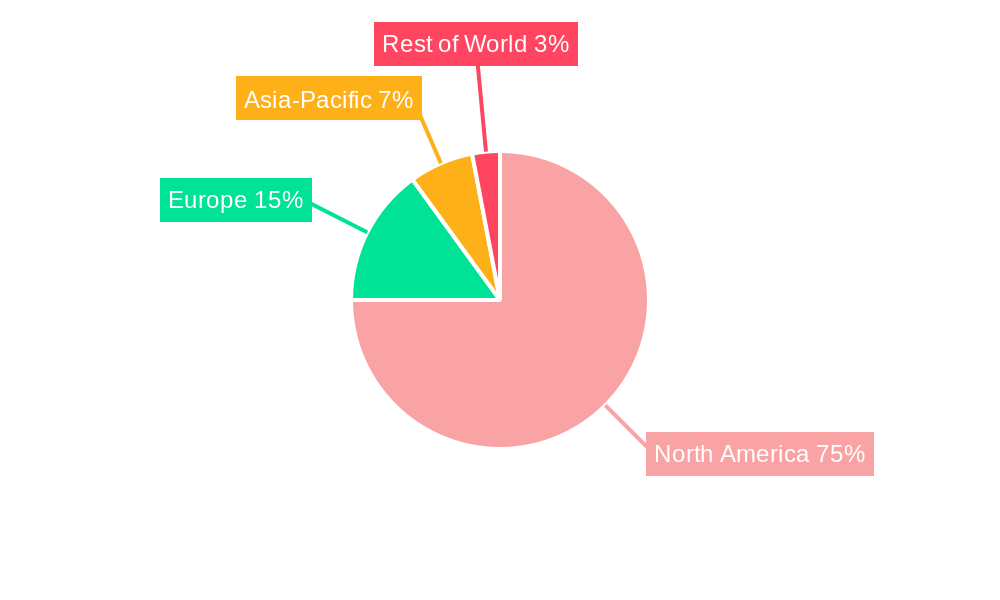

The United States holds the largest market share within North America, followed by Canada and Mexico. The "Rest of North America" segment contributes significantly but at a smaller scale.

Key Market Drivers:

- United States: High consumer awareness of health and wellness, strong purchasing power, and well-established distribution channels.

- Canada: Increasing adoption of vegan lifestyles and a focus on sustainable products.

- Mexico: Growing middle class and increasing disposable incomes driving demand for premium health products.

Dominant Segments:

- Type: Protein supplements currently represent the largest segment, followed by vitamins and omega-3 supplements. Other vegan supplements (e.g., probiotics, adaptogens) are showing strong growth potential.

- Distribution Channel: Online channels are rapidly gaining popularity, driven by convenience and wider product availability. Pharmacies & drug stores and supermarkets & hypermarkets remain important distribution channels.

North America Vegan Supplement Industry Product Developments

Recent product developments showcase innovation in vegan supplement formulations. For instance, advancements in algae-based omega-3 supplements provide effective plant-based alternatives to fish oil. The focus is on creating products with enhanced bioavailability, improved efficacy, and sustainable sourcing practices. Companies are actively incorporating cutting-edge technologies to improve product quality, expand functionalities, and offer personalized nutrition solutions. This focus on innovation is critical for gaining a competitive edge and catering to evolving consumer demands.

Challenges in the North America Vegan Supplement Industry Market

The North America vegan supplement market faces several challenges. Regulatory inconsistencies across different regions can create complexities for manufacturers. Supply chain disruptions and fluctuations in raw material prices can impact profitability. Intense competition from established players and new entrants requires continuous innovation and effective marketing strategies. Furthermore, consumer concerns about product quality, authenticity, and potential side effects need to be addressed through robust quality control and transparency initiatives. These challenges cumulatively impact market growth by xx% annually.

Forces Driving North America Vegan Supplement Industry Growth

Key growth drivers include the increasing adoption of veganism and plant-based diets, rising consumer awareness of health and wellness, and growing demand for sustainable and ethically sourced products. Technological advancements in supplement formulation and production contribute to the development of innovative and effective products. Favorable regulatory environments in certain regions facilitate market expansion, while proactive marketing and educational campaigns raise awareness and drive consumer demand. The increasing prevalence of chronic diseases is also a driver, as consumers seek plant-based alternatives to conventional medicines.

Long-Term Growth Catalysts in the North America Vegan Supplement Industry

Long-term growth hinges on continued innovation in supplement formulations, exploring new plant-based ingredients and delivery systems. Strategic partnerships with key retailers and distributors will broaden market reach. Expanding into new markets both domestically and internationally, particularly those with growing health-conscious consumer bases, is essential. Investment in research and development to support evidence-based product claims will build consumer trust and drive demand.

Emerging Opportunities in North America Vegan Supplement Industry

Emerging trends such as personalized nutrition, functional foods, and customized supplement blends offer significant opportunities. The integration of technology, such as AI-powered health trackers and personalized supplement recommendations, will further enhance market growth. Expanding into niche segments, such as sports nutrition or specific health conditions, can yield high returns. Capitalizing on the growing interest in sustainable and transparent sourcing practices will attract ethically conscious consumers.

Leading Players in the North America Vegan Supplement Industry Sector

- Nestlé S.A.

- NOW Health Group Inc.

- Canopy Growth Corporation (Biosteel Sports Nutrition Inc.)

- Ora Organic

- Wonder Laboratories

- Future Kind

- FORGE Supplements

- Country Life LLC

- Blueroot Health

- Life Extension

- BrainMD Health

Key Milestones in North America Vegan Supplement Industry Industry

- September 2021: Life Extension launched a new plant-based multivitamin.

- April 2022: Blueroot Health brand Vital Nutrients launched Ultra Pure Vegan Omega SPM+.

- August 2022: BrainMD Health launched an EPA/DHA vegan omega-3 supplement.

Strategic Outlook for North America Vegan Supplement Industry Market

The North America vegan supplement market holds immense potential for future growth. Continued innovation, strategic partnerships, and expansion into new markets will be crucial for success. Focusing on personalized nutrition, sustainable sourcing, and transparent labeling will attract and retain customers. Companies that effectively adapt to evolving consumer preferences and leverage technological advancements will be best positioned to capitalize on the market's long-term growth trajectory. The market's future growth will be significantly influenced by continued improvements in product quality and efficacy.

North America Vegan Supplement Industry Segmentation

-

1. Type

- 1.1. Protein

- 1.2. Vitamins

- 1.3. Omega Supplements

- 1.4. Other Vegan Supplements

-

2. Distribution Channel

- 2.1. Pharmacies & Drug Stores

- 2.2. Supermarkets & Hypermarkets

- 2.3. Online Channels

- 2.4. Others

- 2.5. Convenience Food

- 2.6. Other Distribution Channels

North America Vegan Supplement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vegan Supplement Industry Regional Market Share

Geographic Coverage of North America Vegan Supplement Industry

North America Vegan Supplement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Veganism in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vegan Supplement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Protein

- 5.1.2. Vitamins

- 5.1.3. Omega Supplements

- 5.1.4. Other Vegan Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Pharmacies & Drug Stores

- 5.2.2. Supermarkets & Hypermarkets

- 5.2.3. Online Channels

- 5.2.4. Others

- 5.2.5. Convenience Food

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NOW Health Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Canopy Growth Corporation (Biosteel Sports Nutrition Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ora Organic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wonder Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Future Kind

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 FORGE Supplements

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Country Life LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blueroot Health*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Life Extension

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BrainMD Health

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Nestlé S A

List of Figures

- Figure 1: North America Vegan Supplement Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Vegan Supplement Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Vegan Supplement Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Vegan Supplement Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Vegan Supplement Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Vegan Supplement Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Vegan Supplement Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Vegan Supplement Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Vegan Supplement Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Vegan Supplement Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Vegan Supplement Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vegan Supplement Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the North America Vegan Supplement Industry?

Key companies in the market include Nestlé S A, NOW Health Group Inc, Canopy Growth Corporation (Biosteel Sports Nutrition Inc ), Ora Organic, Wonder Laboratories, Future Kind, FORGE Supplements, Country Life LLC, Blueroot Health*List Not Exhaustive, Life Extension, BrainMD Health.

3. What are the main segments of the North America Vegan Supplement Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Veganism in the Region.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: BrainMD Health, a leader in premium-quality, science-based nutraceuticals, launched an EPA/DHA vegan omega-3 supplement. The product was made using sustainable and certified marine algae.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vegan Supplement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vegan Supplement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vegan Supplement Industry?

To stay informed about further developments, trends, and reports in the North America Vegan Supplement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence