Key Insights

The global pea starch market is projected to reach $194.32 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.33% from the base year 2025. This expansion is propelled by the escalating consumer preference for natural, clean-label ingredients and a heightened awareness of pea starch's diverse functional benefits across multiple industries. The strong "clean label" movement, which prioritizes transparency and minimal processing, positions pea starch as a favorable alternative to chemically modified starches, thus meeting the demand from food and beverage manufacturers seeking healthier, sustainable options. Its non-GMO and gluten-free characteristics are significant growth catalysts, appealing to health-conscious consumers and individuals with specific dietary needs. Expanding applications in bakery, snacks, and dairy products, alongside its use in animal feed and personal care, highlight its broad market applicability. Advances in processing technologies further enhance pea starch quality and cost-efficiency, reinforcing market growth.

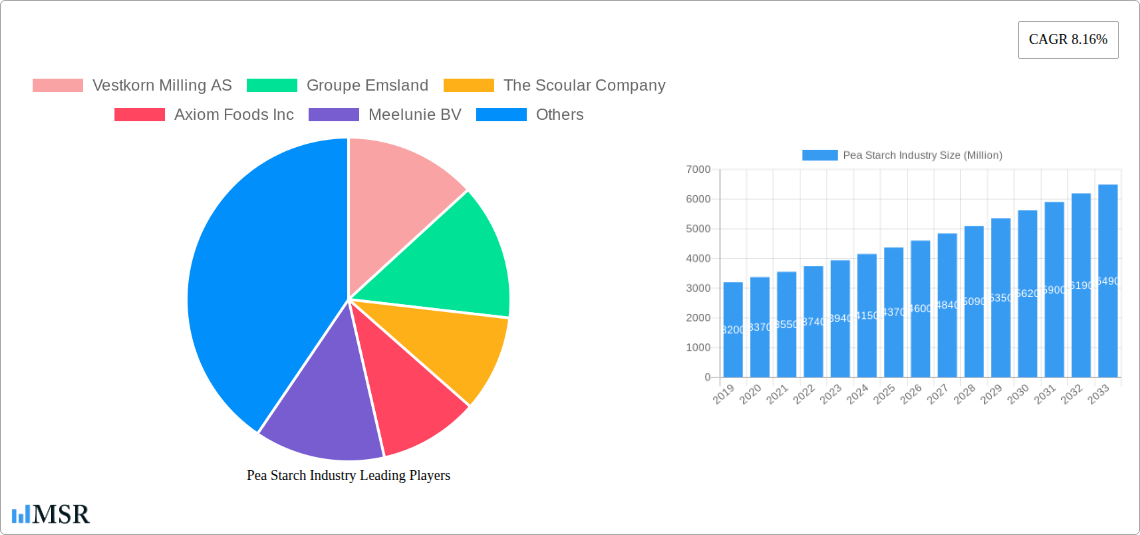

Pea Starch Industry Market Size (In Million)

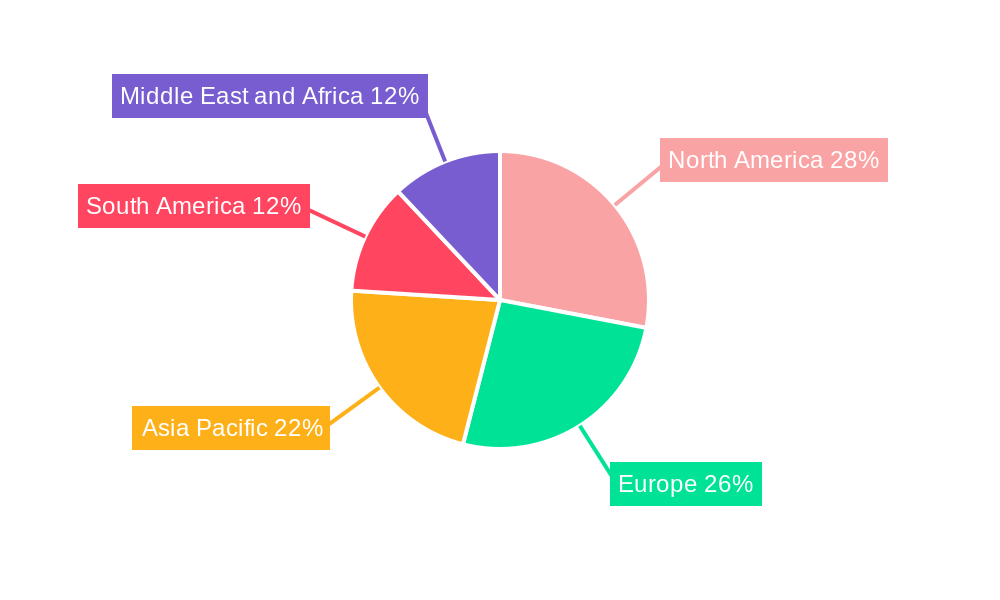

The market is shaped by strategic initiatives such as expansions, mergers, and acquisitions undertaken by leading players to bolster production capacity and market penetration. Key companies are actively investing in research and development to discover novel applications and refine existing ones. North America and Europe demonstrate robust market presence due to established food sectors and a high demand for natural ingredients. However, the Asia Pacific region, particularly China and India, is emerging as a key growth hub, driven by large populations, rising disposable incomes, and an increasing emphasis on health and wellness. While challenges like raw material price volatility and competition from alternative starches exist, technological innovations and strategic sourcing are mitigating these factors. The pea starch market outlook is highly positive, anticipating sustained growth and continuous innovation.

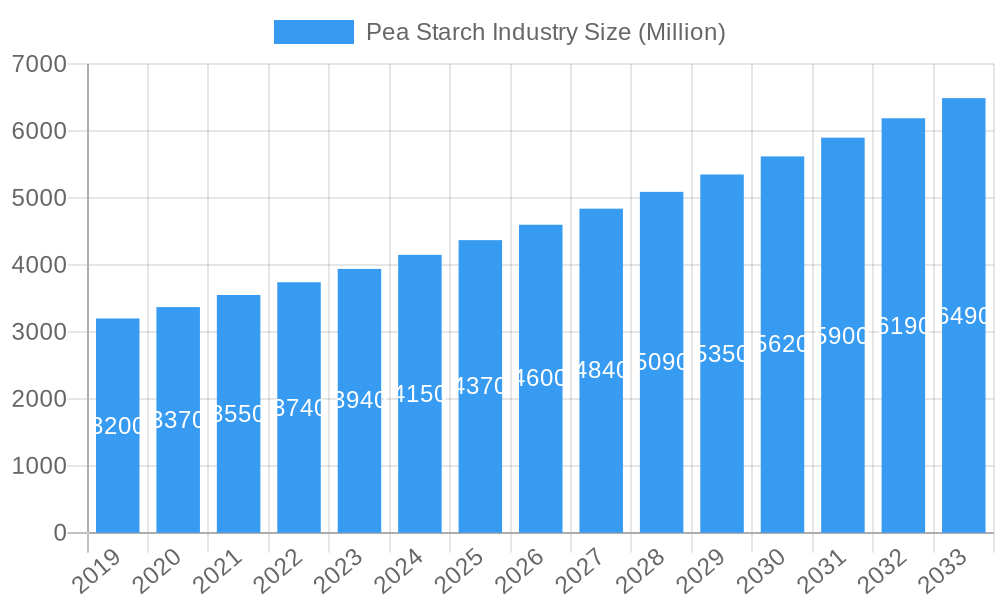

Pea Starch Industry Company Market Share

Pea Starch Industry Report: Unlocking Sustainable Growth in Plant-Based Ingredients

This comprehensive report dives deep into the global pea starch market, a rapidly expanding sector driven by surging demand for plant-based ingredients, clean-label food solutions, and sustainable sourcing. Analyzing the market from 2019 to 2033, with a base year of 2025, this research offers actionable insights for industry stakeholders seeking to capitalize on the pea starch market size, CAGR, and emerging opportunities. Explore market dynamics, key players, product innovations, and strategic outlooks essential for navigating the evolving food and beverage industry, animal feed, and personal care and cosmetics sectors.

Pea Starch Industry Market Concentration & Dynamics

The pea starch industry exhibits a moderately concentrated market structure, characterized by a mix of established global players and emerging regional manufacturers. Innovation is a key differentiator, with companies investing heavily in research and development to enhance the functional properties of pea starch, such as improved texture, emulsification, and binding capabilities. The innovation ecosystem is fueled by collaborations between ingredient suppliers and end-users, particularly in the food and beverage sector. Regulatory frameworks, while generally supportive of plant-based alternatives, require adherence to stringent quality and safety standards, impacting organic pea starch production and conventional pea starch offerings. Substitute products, including corn starch, tapioca starch, and wheat starch, pose a competitive challenge, though pea starch's unique selling propositions – including its non-GMO and gluten-free attributes – provide a distinct advantage. End-user trends are heavily influenced by consumer preference for healthier, more sustainable, and allergen-free options, driving demand for pea starch in bakery products, soups and sauces, snacks and cereals, meat and meat products, and dairy alternatives. Mergers and acquisitions (M&A) activity remains a strategic imperative for consolidating market share and expanding product portfolios. For instance, recent M&A activities within the broader plant-based protein and starch sector indicate a trend towards strategic integration to leverage economies of scale and enhance supply chain resilience. Market share is increasingly influenced by companies that can demonstrably offer sustainable sourcing and transparent production processes for both organic and conventional pea starch.

Pea Starch Industry Industry Insights & Trends

The pea starch industry is poised for substantial growth, projected to reach an estimated market size of USD XX Billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% during the 2025–2033 forecast period. This robust expansion is underpinned by a confluence of influential market growth drivers. Evolving consumer behaviors globally are increasingly prioritizing health and wellness, leading to a heightened demand for plant-based ingredients, gluten-free foods, and products with clean-label attributes. Pea starch, with its inherent nutritional profile and allergen-free characteristics, directly addresses these consumer preferences, positioning it as a preferred alternative to traditional starches. Technological disruptions are also playing a pivotal role, with advancements in pea processing and extraction techniques leading to the development of novel pea starch varieties offering superior functional properties. These include improved texture modulation, enhanced emulsification, and better stability in various processing conditions. Furthermore, the growing awareness and adoption of sustainable agricultural practices and eco-friendly ingredient sourcing are significant tailwinds for the pea starch market. Pea cultivation is generally considered more sustainable than some other crop alternatives, requiring less water and nitrogen, which resonates strongly with environmentally conscious consumers and food manufacturers. The rising popularity of plant-based diets and flexitarianism further amplifies the demand for pea starch as a versatile ingredient in a wide array of food applications. From plant-based meat analogues and dairy alternatives to baked goods and processed foods, pea starch's ability to provide desired textures, mouthfeel, and binding properties makes it an indispensable component. The animal feed and pet food sectors are also witnessing a steady increase in pea starch utilization due to its digestibility and nutritional benefits, further contributing to market growth. The continuous innovation in product development and application research ensures that pea starch remains at the forefront of ingredient solutions.

Key Markets & Segments Leading Pea Starch Industry

The global pea starch market is experiencing dominance from specific regions and segments, driven by distinct economic, social, and technological factors.

North America emerges as a leading market, fueled by a highly health-conscious consumer base, a mature food processing industry, and strong government support for sustainable agriculture and plant-based innovation. The United States, in particular, demonstrates significant demand across various pea starch applications.

- Drivers in North America:

- High consumer adoption of plant-based diets and gluten-free products.

- Extensive research and development in food technology and ingredient innovation.

- Well-established supply chains and robust manufacturing infrastructure.

- Growing preference for organic and sustainably sourced ingredients.

Europe also represents a critical market, characterized by stringent regulations promoting healthier food options and a strong emphasis on sustainability and clean-label food products.

- Drivers in Europe:

- Increasing consumer demand for natural and minimally processed foods.

- Supportive regulatory environment for functional food ingredients.

- Strong presence of major European food manufacturers and ingredient suppliers.

- Focus on organic farming and traceability in the food supply chain.

Dominant Segments:

- Source: Both Organic and Conventional pea starch segments are experiencing robust growth. The Organic segment, while smaller in volume, commands a premium price and is driven by discerning consumers seeking certified natural and sustainably produced ingredients. Conventional pea starch, on the other hand, benefits from wider availability and competitive pricing, catering to large-scale industrial applications.

- Application: Food and Beverage: This remains the largest and most dynamic segment for pea starch.

- Bakery Products: Pea starch is crucial for achieving desired textures, improving crumb structure, and enhancing shelf-life in gluten-free and conventional baked goods.

- Soups and Sauces: Its thickening and stabilizing properties make it ideal for a wide range of soups and sauces, contributing to desirable viscosity and mouthfeel.

- Snacks and Cereals: Pea starch plays a vital role in the texture, crispiness, and binding of snacks and cereals, particularly in extruded products.

- Meat and Meat Products: In processed meat and meat products, it acts as a binder, moisture retainer, and texturizer, improving yield and product quality.

- Dairy: With the rise of dairy alternatives, pea starch is extensively used in plant-based cheese, yogurts, and other dairy-like products to mimic texture and mouthfeel.

- Other Food and Beverage Applications: This includes confectionery, beverages, and ready-to-eat meals, where pea starch offers versatile functional benefits.

- Animal Feed and Pet Food: This segment is growing significantly due to the demand for high-quality, digestible protein and carbohydrate sources. Pea starch contributes to improved palatability and nutrient absorption in animal diets.

- Personal Care and Cosmetics: Pea starch finds application as a natural thickener, absorbent, and texturizer in cosmetic formulations, aligning with the trend towards natural ingredients in this sector.

Pea Starch Industry Product Developments

Product developments in the pea starch industry are intensely focused on enhancing functionality and expanding application versatility. Companies are innovating to produce pea starches with tailored properties for specific needs, such as improved heat stability, modified texture for plant-based alternatives, and enhanced binding capabilities. The emphasis on clean-label and organic ingredients is driving the development of highly purified and naturally processed pea starches. For example, the introduction of native pea starch variants that offer clean-label appeal and versatility for applications like plant-based cheese and gelatin-free confectionery showcases this trend. Technological advancements are enabling the creation of specialty pea starches that can effectively replace or complement other starches, offering a competitive edge in terms of cost, sustainability, and allergen management.

Challenges in the Pea Starch Industry Market

Despite robust growth, the pea starch industry faces several challenges that can impact market expansion.

- Supply Chain Volatility: Fluctuations in pea crop yields due to weather patterns, pest outbreaks, and geopolitical factors can lead to price volatility and supply inconsistencies.

- Competition from Substitutes: Established starches like corn and tapioca offer cost advantages and widespread availability, posing a continuous competitive threat.

- Consumer Perception and Education: While the demand for plant-based is rising, some consumers may still require further education on the benefits and diverse applications of pea starch compared to more familiar ingredients.

- Processing Costs: Achieving high purity, especially for organic pea starch, can involve higher processing costs, impacting its overall price competitiveness against conventional alternatives.

Forces Driving Pea Starch Industry Growth

The pea starch industry is propelled by a powerful set of forces that are reshaping the food and ingredient landscape. A primary driver is the escalating global demand for plant-based ingredients, fueled by growing health consciousness, ethical considerations, and environmental awareness. This trend directly benefits pea starch as a versatile and sustainable alternative.

- Technological Advancements: Innovations in processing and extraction technologies are yielding pea starches with enhanced functionalities, such as superior texture, emulsification, and stability, opening new application avenues.

- Clean-Label and Health Trends: Consumers are actively seeking products with fewer artificial ingredients and clearer labeling. Pea starch, being a natural and gluten-free ingredient, aligns perfectly with this movement.

- Sustainability Initiatives: The environmentally friendly nature of pea cultivation, requiring less water and nitrogen compared to other crops, makes pea starch an attractive option for manufacturers committed to sustainability.

- Dietary Restrictions: The increasing prevalence of gluten intolerance and celiac disease drives demand for gluten-free ingredients, making pea starch a preferred choice in a wide range of food products.

Challenges in the Pea Starch Industry Market

Long-term growth in the pea starch industry is significantly influenced by ongoing innovations and strategic market expansions.

- Continued R&D Investment: Sustained investment in research and development to uncover novel applications and improve the functional properties of pea starch will be critical for maintaining its competitive edge.

- Strategic Partnerships: Collaborations between pea starch manufacturers, food product developers, and end-users can accelerate product innovation and market penetration.

- Geographic Market Expansion: Tapping into emerging markets with growing demand for plant-based and healthier food options will be crucial for sustained global growth.

- Vertical Integration: Companies that can achieve greater control over their supply chains, from pea cultivation to final starch production, may gain a competitive advantage in terms of cost and quality assurance.

Emerging Opportunities in Pea Starch Industry

The pea starch market is rife with emerging opportunities, driven by evolving consumer preferences and technological advancements.

- Expansion in Alternative Proteins: As the market for plant-based meat and dairy alternatives continues to boom, pea starch's role as a texturizer and binder will become even more critical.

- Nutraceutical and Pharmaceutical Applications: Exploring the potential of pea starch in specialized applications within the nutraceutical and pharmaceutical industries, such as drug delivery systems or as a prebiotic fiber, presents a significant growth avenue.

- Development of Specialty Starches: Creating highly customized pea starch variants with unique functionalities for niche applications, such as specific textures in confectionery or improved stability in beverages, can open new high-value markets.

- Leveraging Organic Demand: The growing consumer demand for certified organic products offers a premium market segment for pea starch producers who can meet stringent organic certification standards.

Leading Players in the Pea Starch Industry Sector

- Vestkorn Milling AS

- Groupe Emsland

- The Scoular Company

- Axiom Foods Inc

- Meelunie BV

- Ingredion Incorporated

- Cosucra- Groupe Warcoing

- Roquette Freres

- Puris Foods

- Yantai Shuangta Food Co Ltd

Key Milestones in Pea Starch Industry Industry

- October 2022: Roquette Freres, a plant-based ingredients company, launched a new line of organic pea ingredients, i.e., pea starch and organic pea protein. The products are available in North America, Mexico, and Europe.

- May 2021: Gillco Ingredients and Cosucra Inc. entered a distribution agreement. Gillco will be distributing specialty ingredients like Nastar native pea starch to end customers across multiple consumer sectors in the United States.

- March 2021: Ingredion added two new ingredients to its plant-based portfolio, VitessensePulse 1853 pea protein isolate and Purity P 1002 pea starch. Both ingredients are 100% sustainably sourced from North American farms. Purity P 1002 native pea starch combines versatility and clean-label appeal to deliver the just-right texture for applications as diverse as plant-based cheese, gelatin-free confectionery, and gluten-free baked goods.

Strategic Outlook for Pea Starch Industry Market

The strategic outlook for the pea starch industry remains exceptionally positive, driven by sustained consumer preference for plant-based, sustainable, and clean-label ingredients. Key growth accelerators include continued innovation in product development, focusing on enhanced functionalities and specialized applications across food, feed, and personal care sectors. Strategic partnerships and potential M&A activities will likely play a role in consolidating market leadership and expanding global reach. The increasing demand for organic pea starch presents a significant opportunity for premium market penetration. Manufacturers who can effectively address supply chain resilience and communicate the sustainability benefits of pea starch will be well-positioned for long-term success. The future market potential is substantial, fueled by ongoing dietary shifts and technological advancements in ingredient processing.

Pea Starch Industry Segmentation

-

1. Source

- 1.1. Organic

- 1.2. Conventional

-

2. Application

-

2.1. Food and Beverage

- 2.1.1. Bakery Products

- 2.1.2. Soups and Sauces

- 2.1.3. Snacks and Cereals

- 2.1.4. Meat and Meat Products

- 2.1.5. Dairy

- 2.1.6. Other Food and Beverage Applications

- 2.2. Animal Feed and Pet Food

- 2.3. Personal Care and Cosmetics

-

2.1. Food and Beverage

Pea Starch Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Pea Starch Industry Regional Market Share

Geographic Coverage of Pea Starch Industry

Pea Starch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness About Insect & Other Alternative Proteins; Increasing Applications Surge Demand for Insect Protein

- 3.3. Market Restrains

- 3.3.1. Augmenting Market Penetration of Other Proteins

- 3.4. Market Trends

- 3.4.1. Consumer Preference for Free-from Food is Driving the Pea Starch Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pea Starch Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Organic

- 5.1.2. Conventional

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.1.1. Bakery Products

- 5.2.1.2. Soups and Sauces

- 5.2.1.3. Snacks and Cereals

- 5.2.1.4. Meat and Meat Products

- 5.2.1.5. Dairy

- 5.2.1.6. Other Food and Beverage Applications

- 5.2.2. Animal Feed and Pet Food

- 5.2.3. Personal Care and Cosmetics

- 5.2.1. Food and Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Pea Starch Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Organic

- 6.1.2. Conventional

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.1.1. Bakery Products

- 6.2.1.2. Soups and Sauces

- 6.2.1.3. Snacks and Cereals

- 6.2.1.4. Meat and Meat Products

- 6.2.1.5. Dairy

- 6.2.1.6. Other Food and Beverage Applications

- 6.2.2. Animal Feed and Pet Food

- 6.2.3. Personal Care and Cosmetics

- 6.2.1. Food and Beverage

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Pea Starch Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Organic

- 7.1.2. Conventional

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.1.1. Bakery Products

- 7.2.1.2. Soups and Sauces

- 7.2.1.3. Snacks and Cereals

- 7.2.1.4. Meat and Meat Products

- 7.2.1.5. Dairy

- 7.2.1.6. Other Food and Beverage Applications

- 7.2.2. Animal Feed and Pet Food

- 7.2.3. Personal Care and Cosmetics

- 7.2.1. Food and Beverage

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Pea Starch Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Organic

- 8.1.2. Conventional

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.1.1. Bakery Products

- 8.2.1.2. Soups and Sauces

- 8.2.1.3. Snacks and Cereals

- 8.2.1.4. Meat and Meat Products

- 8.2.1.5. Dairy

- 8.2.1.6. Other Food and Beverage Applications

- 8.2.2. Animal Feed and Pet Food

- 8.2.3. Personal Care and Cosmetics

- 8.2.1. Food and Beverage

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Pea Starch Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Organic

- 9.1.2. Conventional

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.1.1. Bakery Products

- 9.2.1.2. Soups and Sauces

- 9.2.1.3. Snacks and Cereals

- 9.2.1.4. Meat and Meat Products

- 9.2.1.5. Dairy

- 9.2.1.6. Other Food and Beverage Applications

- 9.2.2. Animal Feed and Pet Food

- 9.2.3. Personal Care and Cosmetics

- 9.2.1. Food and Beverage

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Pea Starch Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Organic

- 10.1.2. Conventional

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.1.1. Bakery Products

- 10.2.1.2. Soups and Sauces

- 10.2.1.3. Snacks and Cereals

- 10.2.1.4. Meat and Meat Products

- 10.2.1.5. Dairy

- 10.2.1.6. Other Food and Beverage Applications

- 10.2.2. Animal Feed and Pet Food

- 10.2.3. Personal Care and Cosmetics

- 10.2.1. Food and Beverage

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vestkorn Milling AS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Groupe Emsland

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Scoular Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Axiom Foods Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Meelunie BV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ingredion Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cosucra- Groupe Warcoing

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roquette Freres

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Puris Foods*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yantai Shuangta Food Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Vestkorn Milling AS

List of Figures

- Figure 1: Global Pea Starch Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Pea Starch Industry Revenue (million), by Source 2025 & 2033

- Figure 3: North America Pea Starch Industry Revenue Share (%), by Source 2025 & 2033

- Figure 4: North America Pea Starch Industry Revenue (million), by Application 2025 & 2033

- Figure 5: North America Pea Starch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Pea Starch Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America Pea Starch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pea Starch Industry Revenue (million), by Source 2025 & 2033

- Figure 9: Europe Pea Starch Industry Revenue Share (%), by Source 2025 & 2033

- Figure 10: Europe Pea Starch Industry Revenue (million), by Application 2025 & 2033

- Figure 11: Europe Pea Starch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Pea Starch Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Pea Starch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pea Starch Industry Revenue (million), by Source 2025 & 2033

- Figure 15: Asia Pacific Pea Starch Industry Revenue Share (%), by Source 2025 & 2033

- Figure 16: Asia Pacific Pea Starch Industry Revenue (million), by Application 2025 & 2033

- Figure 17: Asia Pacific Pea Starch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Pea Starch Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pea Starch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Pea Starch Industry Revenue (million), by Source 2025 & 2033

- Figure 21: South America Pea Starch Industry Revenue Share (%), by Source 2025 & 2033

- Figure 22: South America Pea Starch Industry Revenue (million), by Application 2025 & 2033

- Figure 23: South America Pea Starch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Pea Starch Industry Revenue (million), by Country 2025 & 2033

- Figure 25: South America Pea Starch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Pea Starch Industry Revenue (million), by Source 2025 & 2033

- Figure 27: Middle East and Africa Pea Starch Industry Revenue Share (%), by Source 2025 & 2033

- Figure 28: Middle East and Africa Pea Starch Industry Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Pea Starch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Pea Starch Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Pea Starch Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pea Starch Industry Revenue million Forecast, by Source 2020 & 2033

- Table 2: Global Pea Starch Industry Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Pea Starch Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Pea Starch Industry Revenue million Forecast, by Source 2020 & 2033

- Table 5: Global Pea Starch Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Pea Starch Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Global Pea Starch Industry Revenue million Forecast, by Source 2020 & 2033

- Table 12: Global Pea Starch Industry Revenue million Forecast, by Application 2020 & 2033

- Table 13: Global Pea Starch Industry Revenue million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Germany Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Spain Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Russia Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Pea Starch Industry Revenue million Forecast, by Source 2020 & 2033

- Table 22: Global Pea Starch Industry Revenue million Forecast, by Application 2020 & 2033

- Table 23: Global Pea Starch Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: China Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Japan Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: India Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Australia Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global Pea Starch Industry Revenue million Forecast, by Source 2020 & 2033

- Table 30: Global Pea Starch Industry Revenue million Forecast, by Application 2020 & 2033

- Table 31: Global Pea Starch Industry Revenue million Forecast, by Country 2020 & 2033

- Table 32: Brazil Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Global Pea Starch Industry Revenue million Forecast, by Source 2020 & 2033

- Table 36: Global Pea Starch Industry Revenue million Forecast, by Application 2020 & 2033

- Table 37: Global Pea Starch Industry Revenue million Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Pea Starch Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pea Starch Industry?

The projected CAGR is approximately 8.33%.

2. Which companies are prominent players in the Pea Starch Industry?

Key companies in the market include Vestkorn Milling AS, Groupe Emsland, The Scoular Company, Axiom Foods Inc, Meelunie BV, Ingredion Incorporated, Cosucra- Groupe Warcoing, Roquette Freres, Puris Foods*List Not Exhaustive, Yantai Shuangta Food Co Ltd.

3. What are the main segments of the Pea Starch Industry?

The market segments include Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 194.32 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness About Insect & Other Alternative Proteins; Increasing Applications Surge Demand for Insect Protein.

6. What are the notable trends driving market growth?

Consumer Preference for Free-from Food is Driving the Pea Starch Demand.

7. Are there any restraints impacting market growth?

Augmenting Market Penetration of Other Proteins.

8. Can you provide examples of recent developments in the market?

In October 2022, Roquette Freres, a plant-based ingredients company, launched a new line of organic pea ingredients, i.e., pea starch and organic pea protein. The products are available in North America, Mexico, and Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pea Starch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pea Starch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pea Starch Industry?

To stay informed about further developments, trends, and reports in the Pea Starch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence