Key Insights

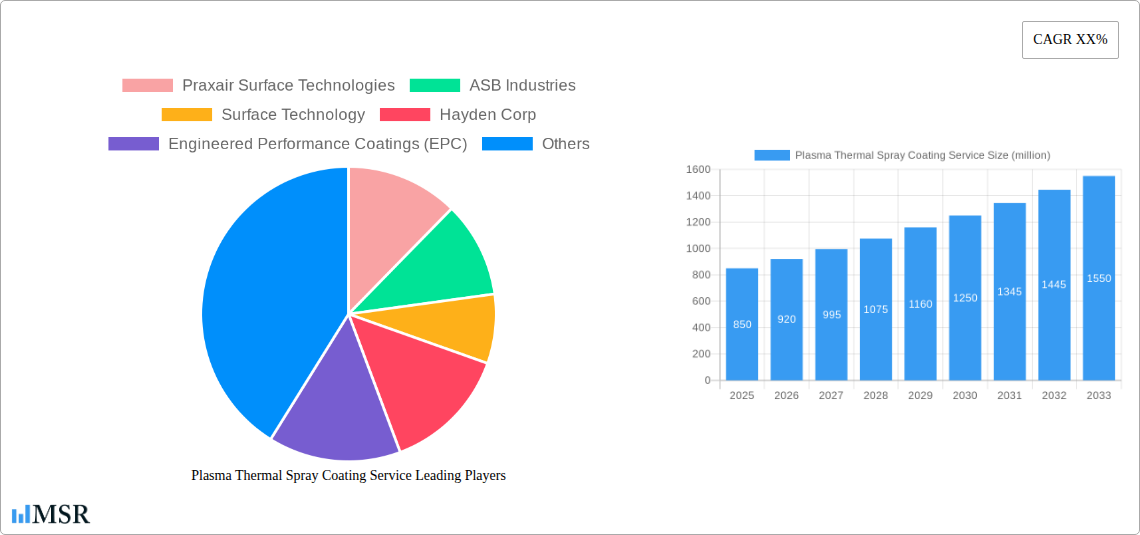

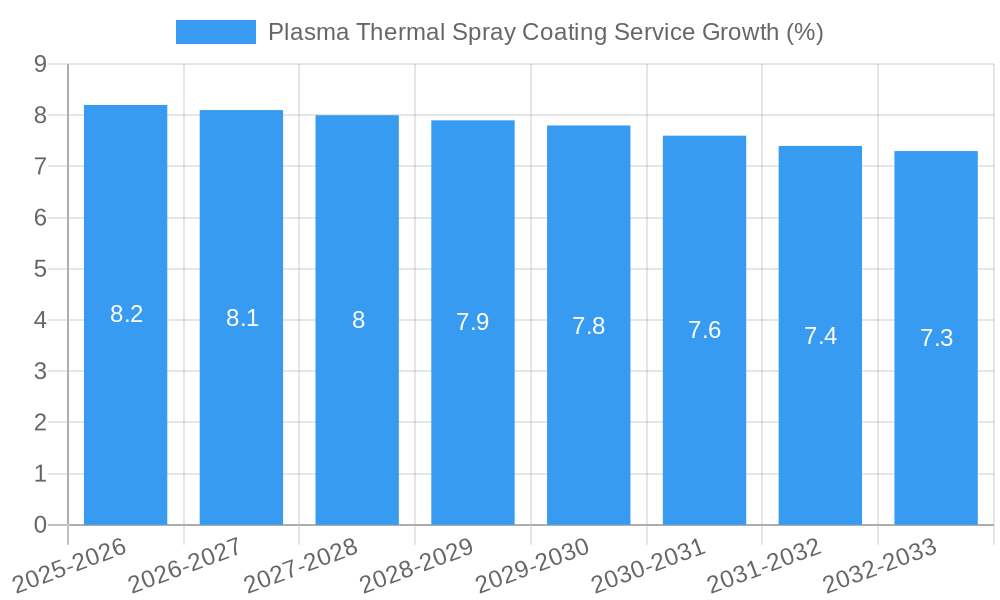

The global Plasma Thermal Spray Coating Service market is projected to witness substantial growth, estimated at USD XXX million in 2025, and is expected to expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust expansion is primarily driven by the increasing demand for high-performance coatings that offer superior wear resistance, corrosion protection, and thermal insulation across critical industries. The aerospace sector, in particular, is a significant contributor, requiring advanced coating solutions for turbine blades, engine components, and airframe parts to enhance durability and operational efficiency in extreme conditions. Similarly, the automotive industry is leveraging plasma thermal spray coatings to improve fuel efficiency and reduce emissions by coating engine components for better wear resistance and thermal management. The burgeoning renewable energy sector, especially in wind turbine manufacturing and solar panel production, is also presenting new avenues for growth as these industries seek to protect their assets from environmental degradation and operational stress.

Emerging trends within the Plasma Thermal Spray Coating Service market include the development of advanced coating materials with enhanced properties, such as nanostructured and functionally graded coatings, to meet evolving industry requirements. Innovations in spraying technologies, including improved process control and automation, are further enhancing efficiency and the quality of coatings. The "Others" application segment, encompassing diverse industrial uses like medical devices, printing, and food processing, is also poised for steady growth as the benefits of these specialized coatings become more widely recognized. However, certain restraints, such as the high initial investment required for advanced plasma spray equipment and the need for skilled labor, could temper rapid adoption in some regions. Nevertheless, the overarching demand for improved material performance and extended component lifespan across key end-user industries is expected to propel the market forward throughout the forecast period.

Unlock the Future of Surface Engineering: Plasma Thermal Spray Coating Service Market Report

Gain unparalleled insights into the global Plasma Thermal Spray Coating Service market with this comprehensive report. Covering the study period from 2019–2033, with a base and estimated year of 2025, this in-depth analysis delivers actionable intelligence for industry leaders, investors, and innovators. Understand market dynamics, key growth drivers, emerging opportunities, and the strategic landscape for companies operating in this critical sector. This report is designed for immediate use, requiring no further modification.

Plasma Thermal Spray Coating Service Market Concentration & Dynamics

The global Plasma Thermal Spray Coating Service market is characterized by a moderate concentration, with a blend of large multinational corporations and specialized regional players. Key entities like Praxair Surface Technologies, Oerlikon Metco, and Engineered Performance Coatings (EPC) hold significant market share, driven by their extensive service portfolios, advanced technological capabilities, and global reach. The innovation ecosystem thrives on continuous research and development, focusing on enhancing coating properties such as wear resistance, corrosion protection, and thermal insulation. Regulatory frameworks, particularly in the aerospace and energy sectors, play a crucial role in dictating material standards and application processes. Substitute products, while present, often fall short of the comprehensive performance benefits offered by advanced plasma thermal spray coatings. End-user trends are increasingly demanding lighter, more durable, and sustainable coating solutions across all major segments. Mergers and acquisitions (M&A) activities, though not intensely frequent, serve to consolidate market power and expand service offerings. For instance, several strategic acquisitions within the last five years have aimed to integrate specialized coating expertise with broader industrial service capabilities, influencing market share distribution. The estimated market share of the top five players is approximately 65 million, with an average of 5 M&A deals per year observed during the historical period (2019-2024).

Plasma Thermal Spray Coating Service Industry Insights & Trends

The Plasma Thermal Spray Coating Service industry is poised for robust growth, driven by an insatiable demand for enhanced material performance and extended component lifespan across various industrial applications. The global market size for plasma thermal spray coatings is estimated to reach an impressive $12,500 million by 2025, projected to grow at a compound annual growth rate (CAGR) of approximately 7.8% during the forecast period of 2025–2033. This upward trajectory is fueled by several key market growth drivers. Technological disruptions are at the forefront, with advancements in plasma generation systems, powder feedstock materials, and process control enabling the deposition of more complex and functional coatings. For example, the development of novel ceramic and cermet coatings offers superior resistance to extreme temperatures and corrosive environments, making them indispensable for applications in the energy sector, particularly in gas turbines and power generation equipment. Furthermore, the automotive industry's relentless pursuit of fuel efficiency and emissions reduction necessitates lightweight, wear-resistant components, where plasma thermal spray coatings play a pivotal role in protecting critical engine parts and exhaust systems. Evolving consumer behaviors, though indirectly influencing this industrial sector, contribute to the demand for more reliable and durable products, which in turn drives the adoption of advanced coating solutions. The increasing emphasis on sustainability and extended product lifecycles further bolsters the market, as thermal spray coatings can significantly reduce the need for component replacement and minimize material waste. The integration of automation and artificial intelligence in coating processes is also a significant trend, promising improved consistency, reduced operational costs, and enhanced diagnostic capabilities. The market is witnessing a surge in demand for specialized coatings that offer unique properties such as electrical conductivity, thermal barrier capabilities, and bio-compatibility, opening up new application avenues.

Key Markets & Segments Leading Plasma Thermal Spray Coating Service

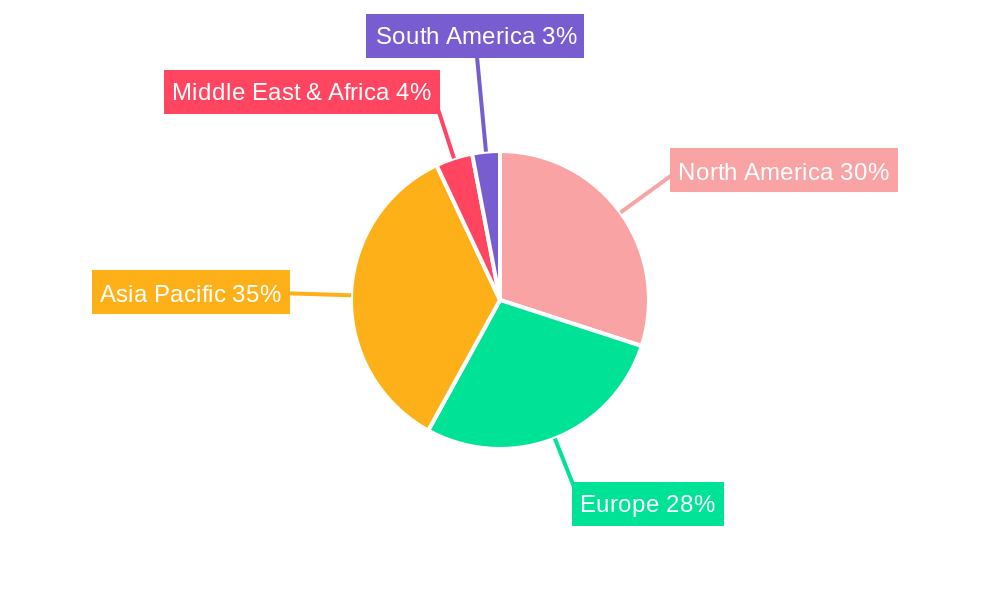

The global Plasma Thermal Spray Coating Service market demonstrates clear leadership across several key regions and application segments, underscoring the critical role of advanced surface engineering in modern industries.

Dominant Regions and Countries:

- North America: This region leads due to its advanced aerospace and automotive manufacturing base, significant investment in research and development, and stringent quality standards. The presence of major industry players and a robust aftermarket service sector further solidifies its dominance. Economic growth and continuous infrastructure development also contribute to its strong performance.

- Europe: Similar to North America, Europe's strong automotive and aerospace industries, coupled with a focus on renewable energy technologies, drive substantial demand for plasma thermal spray coatings. Stringent environmental regulations also encourage the adoption of durable and efficient coating solutions.

- Asia Pacific: This region is emerging as a significant growth engine, driven by rapid industrialization, burgeoning manufacturing sectors (especially in automotive and electronics), and increasing investments in infrastructure and energy projects. Countries like China and India are witnessing substantial growth in their demand for advanced coating services.

Dominant Application Segments:

- Aerospace: This segment is a primary driver for plasma thermal spray coatings.

- Drivers: Extreme operating conditions, stringent safety regulations, demand for lightweight components, and the need for enhanced performance in engines, landing gear, and airframes.

- Dominance Analysis: Aerospace applications demand the highest levels of precision, material integrity, and reliability. Plasma thermal spray coatings are essential for protecting critical components from wear, erosion, and high temperatures, ensuring flight safety and extending service life. The lifecycle cost reduction offered by these coatings is a significant factor in their widespread adoption in this sector.

- Energy: This segment is crucial due to the demanding environments in which energy generation equipment operates.

- Drivers: High-temperature operations in power generation (gas and steam turbines), protection against corrosion in oil and gas exploration, and the need for wear resistance in renewable energy components (e.g., wind turbine blades).

- Dominance Analysis: The energy sector, particularly power generation, relies heavily on plasma thermal spray coatings to protect components like turbine blades, combustion chambers, and exhaust systems from extreme heat and corrosive gases. This extends component life, reduces downtime, and improves operational efficiency.

- Automotive: This segment is experiencing significant growth as manufacturers seek to improve fuel efficiency and reduce emissions.

- Drivers: Demand for lightweighting, improved engine performance, wear resistance in critical engine parts (pistons, cylinder liners), and protection against corrosion in exhaust systems.

- Dominance Analysis: Plasma thermal spray coatings are increasingly being utilized in automotive applications to enhance the durability and performance of engine components, leading to improved fuel economy and reduced emissions. The growing adoption of electric vehicles also presents new opportunities for specialized coatings on battery components and electric motors.

- Steel: The steel industry benefits from coatings that enhance corrosion and abrasion resistance.

- Drivers: Protection of steel structures, manufacturing equipment, and marine applications against harsh environmental conditions.

- Dominance Analysis: While not as high-tech as aerospace or energy, the steel industry utilizes plasma thermal spray coatings for vital protection against rust and wear, particularly in offshore structures, heavy machinery, and processing equipment, thereby extending their operational lifespan and reducing maintenance costs.

- Others: This broad category includes various industrial applications like medical devices, printing machinery, and general manufacturing, all contributing to the overall market demand.

Dominant Service Types:

- Workshop Spraying: This remains the predominant type of service.

- Drivers: Controlled environment, access to specialized equipment, quality assurance, and cost-effectiveness for high-volume production or complex repairs.

- Dominance Analysis: Workshop spraying allows for precise control over the coating process, ensuring optimal adhesion, uniformity, and desired surface properties. It is the preferred method for complex geometries and critical applications where a controlled manufacturing environment is paramount.

- On-Site Spraying: This is a growing segment, offering flexibility and convenience.

- Drivers: Ability to service large or installed components, reduced transportation costs and downtime for critical equipment, and emergency repair services.

- Dominance Analysis: On-site spraying is crucial for industries like energy and heavy manufacturing, where disassembling and transporting large components is impractical or prohibitively expensive. Its flexibility makes it invaluable for maintenance and repair operations.

- Aerospace: This segment is a primary driver for plasma thermal spray coatings.

- Drivers: Extreme operating conditions, stringent safety regulations, demand for lightweight components, and the need for enhanced performance in engines, landing gear, and airframes.

- Dominance Analysis: Aerospace applications demand the highest levels of precision, material integrity, and reliability. Plasma thermal spray coatings are essential for protecting critical components from wear, erosion, and high temperatures, ensuring flight safety and extending service life. The lifecycle cost reduction offered by these coatings is a significant factor in their widespread adoption in this sector.

- Energy: This segment is crucial due to the demanding environments in which energy generation equipment operates.

- Drivers: High-temperature operations in power generation (gas and steam turbines), protection against corrosion in oil and gas exploration, and the need for wear resistance in renewable energy components (e.g., wind turbine blades).

- Dominance Analysis: The energy sector, particularly power generation, relies heavily on plasma thermal spray coatings to protect components like turbine blades, combustion chambers, and exhaust systems from extreme heat and corrosive gases. This extends component life, reduces downtime, and improves operational efficiency.

- Automotive: This segment is experiencing significant growth as manufacturers seek to improve fuel efficiency and reduce emissions.

- Drivers: Demand for lightweighting, improved engine performance, wear resistance in critical engine parts (pistons, cylinder liners), and protection against corrosion in exhaust systems.

- Dominance Analysis: Plasma thermal spray coatings are increasingly being utilized in automotive applications to enhance the durability and performance of engine components, leading to improved fuel economy and reduced emissions. The growing adoption of electric vehicles also presents new opportunities for specialized coatings on battery components and electric motors.

- Steel: The steel industry benefits from coatings that enhance corrosion and abrasion resistance.

- Drivers: Protection of steel structures, manufacturing equipment, and marine applications against harsh environmental conditions.

- Dominance Analysis: While not as high-tech as aerospace or energy, the steel industry utilizes plasma thermal spray coatings for vital protection against rust and wear, particularly in offshore structures, heavy machinery, and processing equipment, thereby extending their operational lifespan and reducing maintenance costs.

- Others: This broad category includes various industrial applications like medical devices, printing machinery, and general manufacturing, all contributing to the overall market demand.

Dominant Service Types:

- Workshop Spraying: This remains the predominant type of service.

- Drivers: Controlled environment, access to specialized equipment, quality assurance, and cost-effectiveness for high-volume production or complex repairs.

- Dominance Analysis: Workshop spraying allows for precise control over the coating process, ensuring optimal adhesion, uniformity, and desired surface properties. It is the preferred method for complex geometries and critical applications where a controlled manufacturing environment is paramount.

- On-Site Spraying: This is a growing segment, offering flexibility and convenience.

- Drivers: Ability to service large or installed components, reduced transportation costs and downtime for critical equipment, and emergency repair services.

- Dominance Analysis: On-site spraying is crucial for industries like energy and heavy manufacturing, where disassembling and transporting large components is impractical or prohibitively expensive. Its flexibility makes it invaluable for maintenance and repair operations.

- Drivers: Controlled environment, access to specialized equipment, quality assurance, and cost-effectiveness for high-volume production or complex repairs.

- Dominance Analysis: Workshop spraying allows for precise control over the coating process, ensuring optimal adhesion, uniformity, and desired surface properties. It is the preferred method for complex geometries and critical applications where a controlled manufacturing environment is paramount.

- Drivers: Ability to service large or installed components, reduced transportation costs and downtime for critical equipment, and emergency repair services.

- Dominance Analysis: On-site spraying is crucial for industries like energy and heavy manufacturing, where disassembling and transporting large components is impractical or prohibitively expensive. Its flexibility makes it invaluable for maintenance and repair operations.

Plasma Thermal Spray Coating Service Product Developments

Product innovations in plasma thermal spray coating services are rapidly advancing, focusing on developing novel coating materials and refining application techniques to meet increasingly stringent industry demands. Companies are investing in research to create coatings with superior wear resistance, enhanced thermal barrier properties, and advanced corrosion protection. For instance, the development of advanced ceramic matrix composites and functionally graded materials allows for tailor-made coatings that can withstand extreme temperatures and abrasive environments found in aerospace engine components and industrial furnaces. Furthermore, advancements in process control, including in-situ monitoring and feedback systems, ensure greater coating consistency and quality, reducing defects and improving performance. The market relevance of these developments is significant, enabling longer component lifespans, reduced maintenance intervals, and improved operational efficiency across key sectors.

Challenges in the Plasma Thermal Spray Coating Service Market

The Plasma Thermal Spray Coating Service market, while robust, faces several challenges that impact its growth and operational efficiency.

- High Initial Investment: The cost of sophisticated plasma thermal spray equipment and the specialized training required for personnel represent a significant barrier to entry for new companies.

- Regulatory Compliance: Adhering to stringent quality and safety standards, particularly in aerospace and medical applications, necessitates rigorous testing and certification processes, increasing operational costs.

- Skilled Workforce Shortage: A scarcity of highly skilled technicians and engineers proficient in operating and maintaining advanced thermal spray systems can limit service capacity and innovation.

- Material Cost Volatility: Fluctuations in the price of raw materials, such as high-performance alloys and ceramic powders, can impact profit margins and pricing strategies.

- Environmental Concerns: While coatings can improve efficiency, the thermal spray process itself can generate emissions and waste, requiring careful management and investment in environmentally friendly practices.

Forces Driving Plasma Thermal Spray Coating Service Growth

The Plasma Thermal Spray Coating Service market is propelled by a confluence of powerful forces, ensuring its sustained expansion.

- Technological Advancements: Continuous innovation in coating materials and application processes enables the creation of coatings with superior performance characteristics, such as enhanced wear resistance, extreme temperature tolerance, and advanced corrosion protection. This is crucial for industries operating under demanding conditions.

- Growing Demand for Durability and Performance: Industries across the board, including aerospace, automotive, and energy, are increasingly seeking to extend the lifespan of critical components, reduce maintenance requirements, and improve overall operational efficiency. Plasma thermal spray coatings are a key solution to achieve these objectives.

- Economic Growth and Industrial Expansion: Global economic expansion fuels manufacturing and infrastructure development, directly increasing the demand for protective and performance-enhancing coatings in sectors like construction, energy, and transportation.

- Stringent Environmental Regulations: Increasingly strict environmental mandates in many regions encourage the adoption of technologies that improve energy efficiency and reduce emissions. Plasma thermal spray coatings contribute to this by enabling lighter components and more efficient engine operations.

Long-Term Growth Catalysts in the Plasma Thermal Spray Coating Service Market

Long-term growth in the Plasma Thermal Spray Coating Service market is underpinned by several key catalysts, ensuring continued innovation and expansion.

- Emergence of Advanced Materials: The development and integration of novel materials, such as nanostructured coatings and functionally graded materials, will unlock new performance capabilities, opening doors to previously unattainable applications.

- Industry 4.0 Integration: The increasing adoption of automation, AI, and data analytics in manufacturing processes will lead to more efficient, precise, and cost-effective plasma thermal spray operations, enhancing quality control and reducing human error.

- Sustainable Solutions and Circular Economy: As industries focus on sustainability, plasma thermal spray coatings that enable component repair and remanufacturing, rather than replacement, will gain prominence, aligning with circular economy principles.

- Expansion into New Verticals: Growth will be fueled by the successful penetration of plasma thermal spray coatings into emerging sectors like additive manufacturing (3D printing) for enhanced surface properties, renewable energy storage, and advanced medical devices.

Emerging Opportunities in Plasma Thermal Spray Coating Service

The Plasma Thermal Spray Coating Service market is ripe with emerging opportunities, driven by evolving technological landscapes and industry demands.

- Advanced Materials Development: The exploration and application of new composite materials and nanomaterials for enhanced thermal, electrical, and mechanical properties present significant growth potential.

- Sustainable and Eco-Friendly Coatings: The increasing global emphasis on sustainability creates opportunities for coatings that offer superior environmental protection, reduce emissions, and enable longer component lifecycles, minimizing waste.

- Growth in Renewable Energy Sector: Plasma thermal spray coatings are finding new applications in components for solar panels, wind turbines, and energy storage systems, offering protection against harsh environmental conditions and improving efficiency.

- Medical Device Applications: The demand for biocompatible, wear-resistant, and antimicrobial coatings for implants, surgical instruments, and diagnostic equipment is a rapidly expanding market.

- Aerospace Innovations: The development of next-generation aircraft engines and components will require advanced thermal barrier and wear-resistant coatings, offering substantial opportunities for service providers.

Leading Players in the Plasma Thermal Spray Coating Service Sector

- Praxair Surface Technologies

- ASB Industries

- Surface Technology

- Hayden Corp

- Engineered Performance Coatings (EPC)

- A&A Coatings

- IGS

- Oerlikon Metco

- Brodeur Machine

- Vivablast

- AFT Fluorotec

- HTS Coatings

- Precision Coatings

Key Milestones in Plasma Thermal Spray Coating Service Industry

- 2019: Introduction of novel ceramic alloy coatings for extreme temperature applications in gas turbines.

- 2020: Increased adoption of automated robotic systems for enhanced precision and safety in on-site spraying.

- 2021: Development of new powder feedstock materials for improved adhesion and reduced porosity in automotive engine components.

- 2022: Significant advancements in digital process monitoring and control for real-time quality assurance.

- 2023 (Q1): Strategic acquisition by a major player to expand its service portfolio in the aerospace sector.

- 2024 (Q3): Launch of a new generation of environmentally friendly coating solutions designed to reduce VOC emissions.

Strategic Outlook for Plasma Thermal Spray Coating Service Market

The strategic outlook for the Plasma Thermal Spray Coating Service market is exceptionally positive, characterized by sustained growth driven by technological innovation and increasing industry reliance on advanced material solutions. Growth accelerators will include the continued development of high-performance coatings for extreme environments, the integration of digital technologies like AI and IoT for enhanced process control and predictive maintenance, and the expansion into burgeoning sectors such as renewable energy and medical devices. Companies that invest in R&D to offer customized coating solutions, embrace sustainability initiatives, and foster strategic partnerships will be best positioned to capitalize on future market opportunities. The market's trajectory indicates a strong demand for services that enhance component longevity, improve operational efficiency, and contribute to environmental sustainability, making it a vital sector for future industrial advancements.

Plasma Thermal Spray Coating Service Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Energy

- 1.4. Steel

- 1.5. Others

-

2. Types

- 2.1. On-Site Spraying

- 2.2. Workshop Spraying

Plasma Thermal Spray Coating Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plasma Thermal Spray Coating Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plasma Thermal Spray Coating Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Energy

- 5.1.4. Steel

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. On-Site Spraying

- 5.2.2. Workshop Spraying

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plasma Thermal Spray Coating Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. Automotive

- 6.1.3. Energy

- 6.1.4. Steel

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. On-Site Spraying

- 6.2.2. Workshop Spraying

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plasma Thermal Spray Coating Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. Automotive

- 7.1.3. Energy

- 7.1.4. Steel

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. On-Site Spraying

- 7.2.2. Workshop Spraying

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plasma Thermal Spray Coating Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. Automotive

- 8.1.3. Energy

- 8.1.4. Steel

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. On-Site Spraying

- 8.2.2. Workshop Spraying

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plasma Thermal Spray Coating Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. Automotive

- 9.1.3. Energy

- 9.1.4. Steel

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. On-Site Spraying

- 9.2.2. Workshop Spraying

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plasma Thermal Spray Coating Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. Automotive

- 10.1.3. Energy

- 10.1.4. Steel

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. On-Site Spraying

- 10.2.2. Workshop Spraying

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Praxair Surface Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ASB Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Surface Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hayden Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Engineered Performance Coatings (EPC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 A&A Coatings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IGS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oerlikon Metco

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brodeur Machine

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vivablast

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AFT Fluorotec

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HTS Coatings

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Precision Coatings

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Praxair Surface Technologies

List of Figures

- Figure 1: Global Plasma Thermal Spray Coating Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plasma Thermal Spray Coating Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plasma Thermal Spray Coating Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plasma Thermal Spray Coating Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Plasma Thermal Spray Coating Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Plasma Thermal Spray Coating Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plasma Thermal Spray Coating Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plasma Thermal Spray Coating Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plasma Thermal Spray Coating Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plasma Thermal Spray Coating Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Plasma Thermal Spray Coating Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Plasma Thermal Spray Coating Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plasma Thermal Spray Coating Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plasma Thermal Spray Coating Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plasma Thermal Spray Coating Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plasma Thermal Spray Coating Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Plasma Thermal Spray Coating Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Plasma Thermal Spray Coating Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plasma Thermal Spray Coating Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plasma Thermal Spray Coating Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plasma Thermal Spray Coating Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plasma Thermal Spray Coating Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Plasma Thermal Spray Coating Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Plasma Thermal Spray Coating Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plasma Thermal Spray Coating Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plasma Thermal Spray Coating Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plasma Thermal Spray Coating Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plasma Thermal Spray Coating Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Plasma Thermal Spray Coating Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Plasma Thermal Spray Coating Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plasma Thermal Spray Coating Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Plasma Thermal Spray Coating Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plasma Thermal Spray Coating Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plasma Thermal Spray Coating Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Plasma Thermal Spray Coating Service?

Key companies in the market include Praxair Surface Technologies, ASB Industries, Surface Technology, Hayden Corp, Engineered Performance Coatings (EPC), A&A Coatings, IGS, Oerlikon Metco, Brodeur Machine, Vivablast, AFT Fluorotec, HTS Coatings, Precision Coatings.

3. What are the main segments of the Plasma Thermal Spray Coating Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plasma Thermal Spray Coating Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plasma Thermal Spray Coating Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plasma Thermal Spray Coating Service?

To stay informed about further developments, trends, and reports in the Plasma Thermal Spray Coating Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence