Key Insights

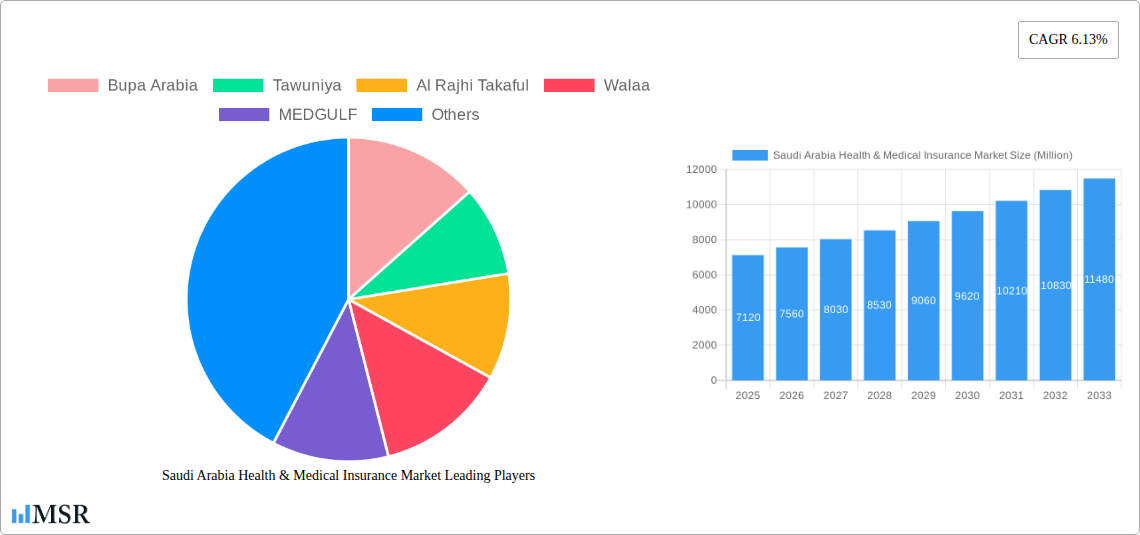

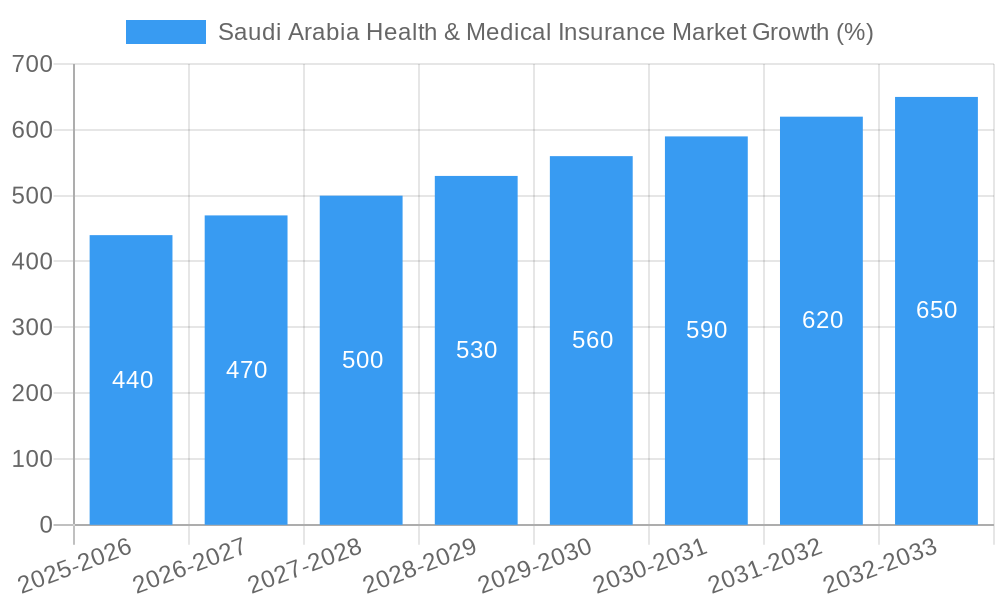

The Saudi Arabian health and medical insurance market, valued at $7.12 billion in 2025, is projected to experience robust growth, driven by a rising population, increasing healthcare expenditure, and government initiatives promoting health insurance coverage. The Compound Annual Growth Rate (CAGR) of 6.13% from 2025 to 2033 indicates a significant expansion, reaching an estimated $12.5 billion by 2033. Key drivers include the Saudi Vision 2030's emphasis on improving healthcare infrastructure and accessibility, coupled with a growing awareness of the importance of health insurance among the population. The market is witnessing a shift towards technologically advanced solutions, such as telemedicine and digital health platforms, enhancing efficiency and convenience. Furthermore, the increasing prevalence of chronic diseases and a growing elderly population contribute to the rising demand for health insurance. However, challenges remain, including potential regulatory hurdles and the need for ongoing education to increase insurance penetration rates. Major players like Bupa Arabia, Tawuniya, Al Rajhi Takaful, and others are actively shaping the market landscape through strategic partnerships, product diversification, and technological investments.

The competitive landscape is dynamic, with both established international players and domestic insurers vying for market share. This competition fosters innovation and drives down costs, benefitting consumers. Future trends indicate a growing preference for comprehensive health plans that offer broader coverage, including preventative care and wellness programs. The market is ripe for opportunities for insurers who can effectively leverage technology, enhance customer service, and tailor products to meet the evolving needs of the Saudi Arabian population. The government's continued support for health insurance initiatives will be crucial in driving further market penetration and ensuring sustainable growth in the coming years. This growth will likely be seen across segments including individual, family, and corporate health insurance plans.

Saudi Arabia Health & Medical Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia health and medical insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a complete picture of market dynamics, trends, and future opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Saudi Arabia Health & Medical Insurance Market Concentration & Dynamics

The Saudi Arabian health and medical insurance market exhibits a moderately concentrated landscape, with key players like Bupa Arabia, Tawuniya, Al Rajhi Takaful, Walaa, MEDGULF, AXA Cooperative, Malath Insurance, Wataniya Insurance, Al Etihad Cooperative, SAICO, and Amana Insurance holding significant market share. However, the market is witnessing increased competition due to new entrants and mergers & acquisitions (M&A) activities. The regulatory framework, driven by the Council of Cooperative Health Insurance (CCHI), plays a crucial role in shaping market dynamics. Innovation in digital health technologies, telemedicine, and data analytics is transforming the sector. Furthermore, changing consumer preferences towards comprehensive coverage and value-added services are reshaping the competitive landscape.

- Market Share: The top five players collectively hold approximately xx% of the market share (2024 estimate).

- M&A Activity: The market witnessed xx M&A deals in the historical period (2019-2024), reflecting a trend towards consolidation.

- Innovation Ecosystem: The market shows a growing focus on digital health solutions and data-driven approaches to improve efficiency and customer experience.

- Regulatory Framework: The CCHI's regulations significantly influence pricing, coverage, and market access for insurers.

- Substitute Products: Limited substitutes exist, primarily self-insurance for a small segment of the population.

Saudi Arabia Health & Medical Insurance Market Industry Insights & Trends

The Saudi Arabian health and medical insurance market is experiencing robust growth fueled by several factors. Government initiatives aimed at improving healthcare access and coverage, such as the expansion of the National Health Insurance Program, are key drivers. Rising healthcare costs and an increasing awareness of health insurance benefits among the population also contribute to market expansion. Technological advancements, including the adoption of telehealth and digital health platforms, are reshaping service delivery models. Changes in consumer behavior, marked by a greater demand for personalized and value-based healthcare solutions, are influencing product development strategies. The market size in 2024 was estimated to be xx Million.

Key Markets & Segments Leading Saudi Arabia Health & Medical Insurance Market

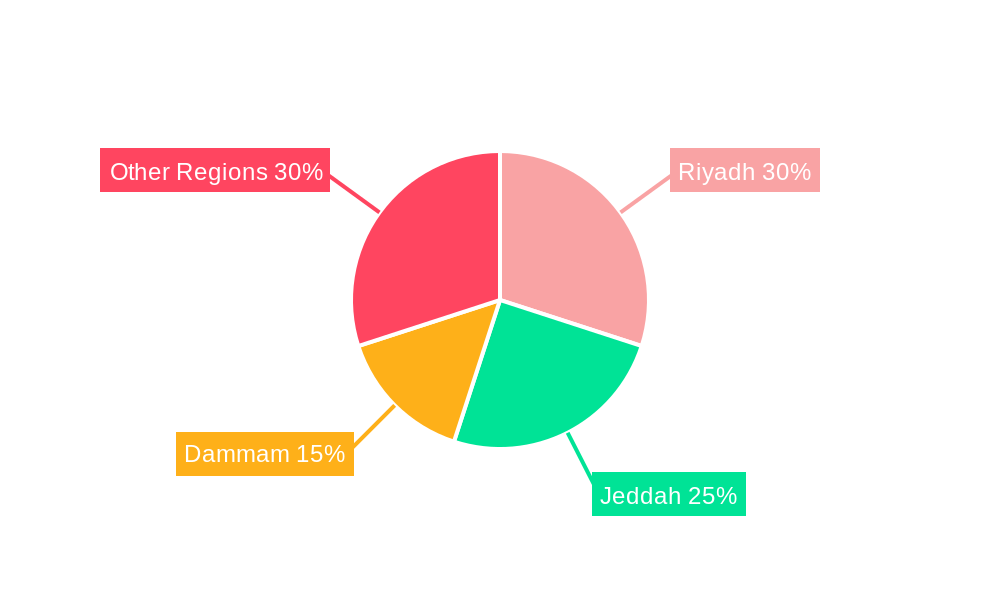

The Saudi Arabian health and medical insurance market is primarily driven by the urban areas, with major cities like Riyadh, Jeddah, and Dammam showing the highest demand for health insurance products. The private sector accounts for the largest segment of the market.

- Drivers:

- Economic Growth: Rising disposable incomes and increased government spending on healthcare.

- Expanding Population: A growing population, particularly in urban areas, fuels demand for health insurance.

- Government Initiatives: The National Health Insurance Program and other policies designed to improve access to healthcare.

- Infrastructure Development: Investments in healthcare infrastructure enhance the delivery of health services.

The dominance of urban areas stems from higher incomes, greater awareness of health insurance benefits, and better access to healthcare facilities. The private sector’s larger share reflects the increasing preference for comprehensive coverage and superior service quality offered by private insurers.

Saudi Arabia Health & Medical Insurance Market Product Developments

Recent product developments focus on incorporating telehealth services, digital health platforms, and value-added benefits into insurance plans. Insurers are adopting data analytics to personalize offerings and improve risk assessment. This trend reflects a wider move towards providing customer-centric solutions and leveraging technology for efficiency gains. The incorporation of wellness programs and preventive care initiatives is becoming increasingly popular, aiming to reduce overall healthcare expenses and improve customer health outcomes.

Challenges in the Saudi Arabia Health & Medical Insurance Market Market

The Saudi Arabian health and medical insurance market faces challenges such as the relatively low health insurance penetration rate compared to other developed nations. Furthermore, regulatory complexities and the need for continuous improvement in healthcare infrastructure pose significant hurdles. The intense competition among insurers, coupled with pricing pressures, can also impact profitability. These factors present significant obstacles to market expansion and sustainability. The impact is estimated to reduce the market growth by xx% in the next 5 years.

Forces Driving Saudi Arabia Health & Medical Insurance Market Growth

Key growth drivers include government initiatives promoting health insurance coverage, rapid technological advancements in healthcare, a growing and increasingly affluent population, and the government’s vision to improve healthcare access and quality. The growing emphasis on preventive care and wellness programs, coupled with the increasing adoption of digital health technologies, also contributes positively. These factors collectively point towards a sustained and upward trajectory for market expansion.

Long-Term Growth Catalysts in Saudi Arabia Health & Medical Insurance Market

Long-term growth will be driven by continued investment in healthcare infrastructure, further adoption of innovative technologies such as AI and big data in healthcare management, increased collaborations between public and private sectors, and expansion into underserved rural areas. Strategic partnerships and M&A activities will play a crucial role in accelerating market growth and enhancing service delivery capabilities.

Emerging Opportunities in Saudi Arabia Health & Medical Insurance Market

Emerging opportunities include the growing demand for specialized health insurance products, such as those catering to chronic diseases and expatriate populations. There’s a significant potential for growth in the digital health space, including telehealth services and online claims processing. Furthermore, the expansion of health insurance coverage to previously underserved segments of the population presents considerable growth opportunities for insurers.

Leading Players in the Saudi Arabia Health & Medical Insurance Market Sector

- Bupa Arabia

- Tawuniya

- Al Rajhi Takaful

- Walaa

- MEDGULF

- AXA Cooperative

- Malath Insurance

- Wataniya Insurance

- Al Etihad Cooperative

- SAICO

- Amana Insurance

Key Milestones in Saudi Arabia Health & Medical Insurance Market Industry

- February 2023: Cigna Worldwide Insurance Company received a branch license to operate in Saudi Arabia, signifying increased foreign investment and competition.

- October 2022: Walaa Cooperative Insurance Company merged with SABB Takaful Company, leading to increased market consolidation and potential synergies.

- October 2022: Walaa Insurance partnered with Software AG, indicating a strategic shift towards leveraging technology to enhance customer experience and product offerings.

Strategic Outlook for Saudi Arabia Health & Medical Insurance Market Market

The Saudi Arabian health and medical insurance market holds significant long-term growth potential, driven by ongoing government support, technological advancements, and evolving consumer preferences. Strategic focus on digital transformation, personalized products, and expansion into underserved segments will be crucial for success. Companies that effectively adapt to changing market dynamics and leverage innovative technologies will be well-positioned for significant market share gains.

Saudi Arabia Health & Medical Insurance Market Segmentation

-

1. Type of Insurance Provider

- 1.1. Public Sector Insurers

- 1.2. Private Sector Insurers

- 1.3. Standalone Health Insurance Companies

-

2. Type of Customer

- 2.1. Corporate

- 2.2. Non-Corporate

-

3. Type of Coverage

- 3.1. Individual Insurance Coverage

- 3.2. Family or Floater (Group)Insurance Coverage

-

4. Product Type

- 4.1. Disease- Specific Insurance

- 4.2. General Insurance

-

5. Demographics

- 5.1. Minors

- 5.2. Adults

- 5.3. Senior Citizens

-

6. Distribution Channel

- 6.1. Direct to Customers

- 6.2. Brokers

- 6.3. Individual Agents

- 6.4. Corporate Agents

- 6.5. Online

- 6.6. Bancassurance

- 6.7. Other Distribution Channels

Saudi Arabia Health & Medical Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Health & Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth

- 3.3. Market Restrains

- 3.3.1. Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Cost of Medical Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Health & Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance Provider

- 5.1.1. Public Sector Insurers

- 5.1.2. Private Sector Insurers

- 5.1.3. Standalone Health Insurance Companies

- 5.2. Market Analysis, Insights and Forecast - by Type of Customer

- 5.2.1. Corporate

- 5.2.2. Non-Corporate

- 5.3. Market Analysis, Insights and Forecast - by Type of Coverage

- 5.3.1. Individual Insurance Coverage

- 5.3.2. Family or Floater (Group)Insurance Coverage

- 5.4. Market Analysis, Insights and Forecast - by Product Type

- 5.4.1. Disease- Specific Insurance

- 5.4.2. General Insurance

- 5.5. Market Analysis, Insights and Forecast - by Demographics

- 5.5.1. Minors

- 5.5.2. Adults

- 5.5.3. Senior Citizens

- 5.6. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.6.1. Direct to Customers

- 5.6.2. Brokers

- 5.6.3. Individual Agents

- 5.6.4. Corporate Agents

- 5.6.5. Online

- 5.6.6. Bancassurance

- 5.6.7. Other Distribution Channels

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bupa Arabia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tawuniya

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Rajhi Takaful

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Walaa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MEDGULF

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXA Cooperative

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Malath Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wataniya Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Etihad Cooperative

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAICO

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amana Insurance**List Not Exhaustive 6 3 MARKET OPPORTUNTIES AND FUTURE TRENDS6 4 DISCLAIMER AND ABOUT U

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bupa Arabia

List of Figures

- Figure 1: Saudi Arabia Health & Medical Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Health & Medical Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Insurance Provider 2019 & 2032

- Table 4: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Insurance Provider 2019 & 2032

- Table 5: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Customer 2019 & 2032

- Table 6: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Customer 2019 & 2032

- Table 7: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Coverage 2019 & 2032

- Table 8: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Coverage 2019 & 2032

- Table 9: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 12: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Demographics 2019 & 2032

- Table 13: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 15: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 17: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Insurance Provider 2019 & 2032

- Table 18: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Insurance Provider 2019 & 2032

- Table 19: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Customer 2019 & 2032

- Table 20: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Customer 2019 & 2032

- Table 21: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Coverage 2019 & 2032

- Table 22: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Coverage 2019 & 2032

- Table 23: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 25: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 26: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Demographics 2019 & 2032

- Table 27: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 29: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Health & Medical Insurance Market?

The projected CAGR is approximately 6.13%.

2. Which companies are prominent players in the Saudi Arabia Health & Medical Insurance Market?

Key companies in the market include Bupa Arabia, Tawuniya, Al Rajhi Takaful, Walaa, MEDGULF, AXA Cooperative, Malath Insurance, Wataniya Insurance, Al Etihad Cooperative, SAICO, Amana Insurance**List Not Exhaustive 6 3 MARKET OPPORTUNTIES AND FUTURE TRENDS6 4 DISCLAIMER AND ABOUT U.

3. What are the main segments of the Saudi Arabia Health & Medical Insurance Market?

The market segments include Type of Insurance Provider, Type of Customer, Type of Coverage, Product Type, Demographics, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth.

6. What are the notable trends driving market growth?

Rising Cost of Medical Services.

7. Are there any restraints impacting market growth?

Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Cigna Worldwide Insurance Company announced that it has received an official branch license from the Saudi Central Bank (SAMA) to operate as a health insurer in the Kingdom of Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Health & Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Health & Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Health & Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Health & Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence