Key Insights

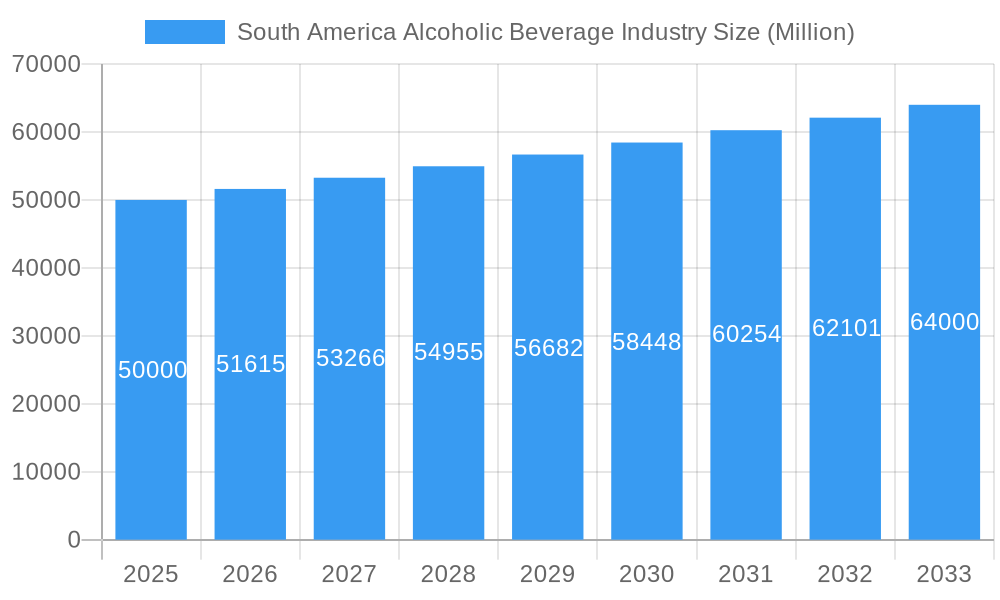

The South American alcoholic beverage market, projected to reach $38.04 billion by 2025, is poised for robust expansion, forecasting a Compound Annual Growth Rate (CAGR) of 4.46% between 2025 and 2033. This upward trajectory is propelled by several significant factors. Escalating disposable incomes, especially among the expanding middle class in Brazil and Argentina, are driving increased expenditure on premium alcoholic drinks. Concurrently, evolving consumer tastes are fueling demand for craft beers, fine wines, and novel spirits, thereby creating fertile ground for both established industry leaders and innovative new entrants. The on-trade sector, encompassing restaurants and bars, is anticipated to be a primary contributor to market expansion, particularly with the resurgence of tourism and increased social engagements. Nevertheless, the market faces certain impediments, including regional economic instability and volatile currency exchange rates, which can affect import expenses. Additionally, stringent regulations governing alcohol consumption and promotion present limitations to market growth.

South America Alcoholic Beverage Industry Market Size (In Billion)

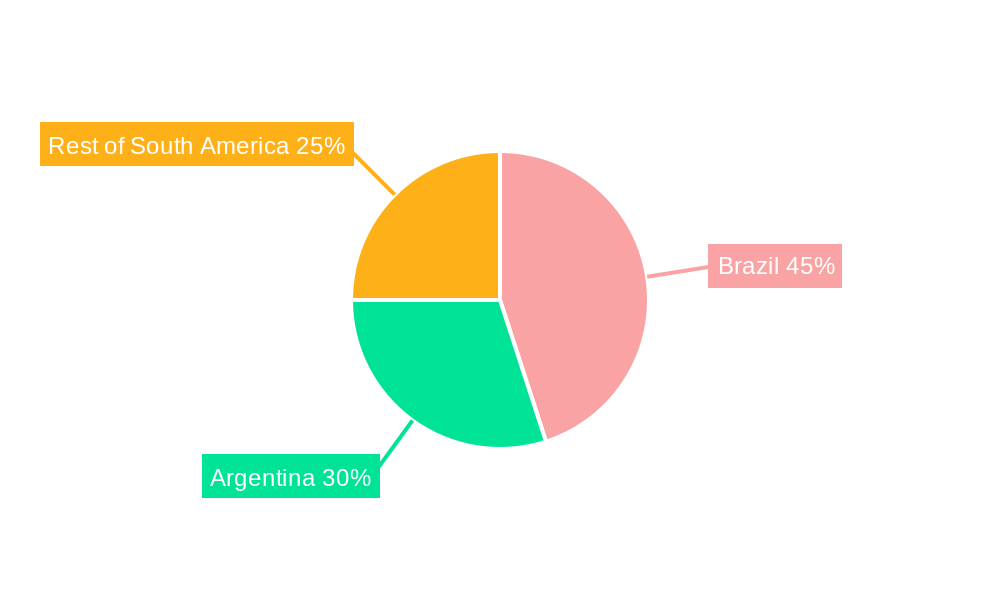

Segmentation analysis reveals that the beer category currently holds the leading market share, attributed to its widespread appeal and accessibility. However, the wine and spirits segments are demonstrating accelerated growth, propelled by growing consumer sophistication and a willingness to explore diverse offerings. The off-trade channel, including retail outlets and supermarkets, is also experiencing an upward trend, largely supported by the surge in e-commerce and the convenience of home delivery services. Prominent industry participants such as Grupo Penaflor, Anheuser-Busch InBev, and Diageo are capitalizing on their established brand equity and extensive distribution infrastructure to secure their market dominance. Nonetheless, they are encountering heightened competition from smaller, artisanal breweries and distilleries that cater to specific consumer preferences. Regional market dynamics within South America exhibit variations; Brazil and Argentina stand out as the largest markets, while the "Rest of South America" segment presents substantial, though less developed, growth opportunities.

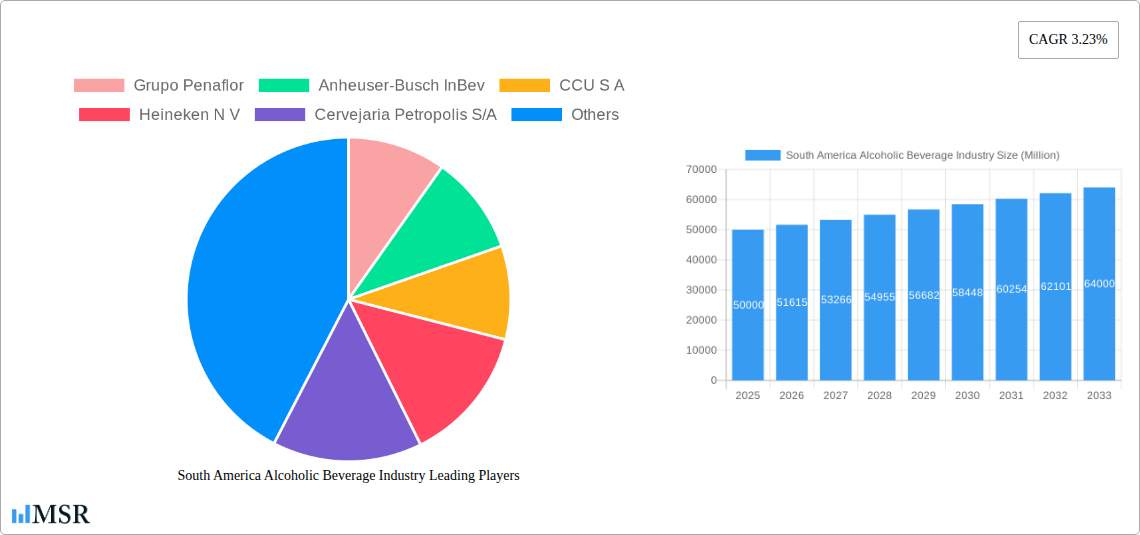

South America Alcoholic Beverage Industry Company Market Share

South America Alcoholic Beverage Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the South America alcoholic beverage industry, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and market entrants seeking to understand the market dynamics, growth drivers, and future opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to paint a clear picture of the current market landscape and future projections. The study period covers 2019–2024 (Historical Period), with 2025 as the base and estimated year, and a forecast period spanning 2025–2033.

South America Alcoholic Beverage Industry Market Concentration & Dynamics

The South American alcoholic beverage market exhibits a moderately concentrated structure, dominated by a mix of multinational corporations and regional players. Key players such as Anheuser-Busch InBev, Diageo, Heineken N.V., and CCU S.A. hold significant market share, often exceeding 20% in specific segments. However, a vibrant ecosystem of smaller breweries, wineries, and distilleries contributes to market diversity.

Market Share: Anheuser-Busch InBev and Diageo are estimated to collectively hold around xx% of the total market share in 2025, with CCU S.A and Heineken N.V following closely. Smaller players collectively constitute the remaining xx%.

M&A Activity: The industry has witnessed a notable increase in mergers and acquisitions (M&A) activity in recent years, with an estimated xx deals annually over the historical period. This is primarily driven by strategies for market expansion, portfolio diversification, and access to new technologies. For example, Diageo's acquisition of Balcones Distilling highlights the ongoing consolidation within the premium spirits segment.

Innovation Ecosystems: South America is seeing the emergence of diverse innovation clusters, particularly in craft brewing and artisanal spirits. These are significantly influencing consumer preferences and driving product diversification.

Regulatory Frameworks: Varying regulatory environments across South American countries influence market access, pricing, and product labeling. These regulations are crucial factors in determining market entry strategies and overall industry performance.

Substitute Products: The rise of non-alcoholic beverages and other leisure activities poses a moderate competitive threat to the traditional alcoholic beverage market.

End-User Trends: Shifting consumer preferences towards premiumization, health-conscious options (e.g., low-calorie beers and hard seltzers), and unique flavors are reshaping the product landscape.

South America Alcoholic Beverage Industry Industry Insights & Trends

The South American alcoholic beverage market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and changing consumption patterns. The market size is estimated to reach $xx Million in 2025, with a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include:

Premiumization: Consumers are increasingly willing to spend more on premium and super-premium products, creating opportunities for brands to innovate and capture this segment.

E-commerce Growth: Online sales of alcoholic beverages are gradually gaining traction, offering new distribution channels and market access.

Craft Beverage Boom: The burgeoning craft beer, wine, and spirits sector is adding dynamism and diversity to the overall market.

Health-Conscious Products: Growing health awareness is driving demand for low-calorie, low-carbohydrate, and functional alcoholic beverages.

Technological disruptions, such as advanced brewing techniques, improved winemaking processes, and innovative packaging solutions, are constantly improving efficiency and expanding product variety. Evolving consumer preferences, influenced by global trends and local tastes, are shaping product development and marketing strategies across all segments.

Key Markets & Segments Leading South America Alcoholic Beverage Industry

Brazil remains the dominant market in South America, accounting for a significant portion of overall consumption. However, other countries, like Argentina, Chile, and Mexico show strong growth potential.

Dominant Segments:

Product Type: Beer holds the largest market share, followed by spirits and wine. The beer segment is further segmented into premium, mainstream, and craft beers.

Distribution Channel: The on-trade (bars, restaurants) and off-trade (retail stores, supermarkets) channels both contribute significantly to sales. The off-trade channel exhibits faster growth due to expansion of retail networks and increasing convenience.

Drivers for Dominance:

Brazil: Strong economic growth, a large population, and a well-established distribution network make Brazil a critical market.

Argentina: A significant wine production industry and a growing preference for premium spirits contribute to Argentina’s market strength.

Chile: Its established wine export capabilities and expanding domestic market contribute to this country's position.

South America Alcoholic Beverage Industry Product Developments

Recent product innovations center around premiumization, health-conscious offerings, and ready-to-drink (RTD) beverages. Grupo Peñaflor's launch of Mingo Hard Seltzer showcases the market's response to changing consumer preferences, focusing on convenience and health. Grupo Petrópolis's new Itaipava 100% malt beer highlights the premiumization trend in the beer segment. Technological advancements in brewing, distilling, and winemaking enhance product quality and efficiency.

Challenges in the South America Alcoholic Beverage Industry Market

The South American alcoholic beverage industry faces various challenges, including stringent regulatory frameworks that vary widely across countries, impacting production, distribution, and marketing. Supply chain disruptions due to infrastructure limitations and economic volatility can affect the availability and cost of raw materials. Intense competition, especially from large multinational players, adds to the pressure on smaller players. These factors collectively influence the profitability and sustainability of companies in this industry. The estimated annual impact of these challenges on overall revenue is xx Million.

Forces Driving South America Alcoholic Beverage Industry Growth

The South American alcoholic beverage market's growth is propelled by several key forces. Rising disposable incomes, particularly among the young and middle-classes, are directly impacting spending on alcoholic beverages. Urbanization is leading to increased opportunities for market penetration in densely populated areas. Government initiatives supporting local producers stimulate innovation and diversification within the industry. Government tax policies influence pricing and market penetration for domestic and imported brands.

Challenges in the South America Alcoholic Beverage Industry Market

Long-term growth will depend on addressing existing challenges and capitalizing on emerging opportunities. Strategic partnerships between local producers and international companies can lead to knowledge sharing, technological advancements, and enhanced market access. Market expansion into untapped segments, such as non-alcoholic alternatives and functional beverages, is key.

Emerging Opportunities in South America Alcoholic Beverage Industry

The growing demand for craft beverages provides a fertile ground for new entrants and small players. The emergence of new markets, like e-commerce platforms, expands the distribution channels. Furthermore, the rise of health-conscious consumers creates exciting opportunities for developing and marketing low-calorie, low-sugar, and organic options.

Leading Players in the South America Alcoholic Beverage Industry Sector

- Anheuser-Busch InBev

- CCU S.A

- Heineken N.V.

- Cervejaria Petropolis S/A

- Diageo

- Brown-Forman

- Molson Coors Beverage Company

- Companhia Muller de Bebidas

- Pernod Ricard

- Grupo Penaflor

Key Milestones in South America Alcoholic Beverage Industry Industry

- November 2022: Diageo Plc acquired Balcones Distilling, expanding its presence in the premium American Single Malt Whisky market.

- February 2022: Grupo Peñaflor launched Mingo Hard Seltzer, targeting the growing RTD market with a health-conscious offering.

- November 2021: Grupo Petrópolis launched a 100% malt edition of its Itaipava beer, strengthening its position in the premium beer segment.

Strategic Outlook for South America Alcoholic Beverage Industry Market

The South American alcoholic beverage industry shows immense growth potential, driven by evolving consumer preferences and market expansion. Strategic partnerships, product diversification, technological advancements, and addressing supply chain challenges will be crucial to capitalizing on future opportunities. The market is expected to experience consistent growth and become increasingly sophisticated in terms of product offerings and consumer demand.

South America Alcoholic Beverage Industry Segmentation

-

1. Product Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-trade

- 2.2. Off-trade

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Alcoholic Beverage Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Alcoholic Beverage Industry Regional Market Share

Geographic Coverage of South America Alcoholic Beverage Industry

South America Alcoholic Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Brazil Dominates the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beer

- 6.1.2. Wine

- 6.1.3. Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beer

- 7.1.2. Wine

- 7.1.3. Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beer

- 8.1.2. Wine

- 8.1.3. Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Grupo Penaflor

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Anheuser-Busch InBev

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CCU S A

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Heineken N V

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cervejaria Petropolis S/A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Diageo

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Brown-Forman

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Molson Coors Beverage Company*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Companhia Muller de Bebidas

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Pernod Ricard

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Grupo Penaflor

List of Figures

- Figure 1: South America Alcoholic Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Alcoholic Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 7: South America Alcoholic Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Alcoholic Beverage Industry Volume liter Forecast, by Region 2020 & 2033

- Table 9: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 11: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 15: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

- Table 17: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 19: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 23: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

- Table 25: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 27: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 31: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Alcoholic Beverage Industry?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the South America Alcoholic Beverage Industry?

Key companies in the market include Grupo Penaflor, Anheuser-Busch InBev, CCU S A, Heineken N V, Cervejaria Petropolis S/A, Diageo, Brown-Forman, Molson Coors Beverage Company*List Not Exhaustive, Companhia Muller de Bebidas, Pernod Ricard.

3. What are the main segments of the South America Alcoholic Beverage Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Brazil Dominates the Region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

November 2022: Diageo Plc announced the acquisition of Balcones Distilling ('Balcones'), a Texas Craft Distiller. Balcones is one of the leading producers of American Single Malt Whisky.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Alcoholic Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Alcoholic Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Alcoholic Beverage Industry?

To stay informed about further developments, trends, and reports in the South America Alcoholic Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence