Key Insights

The South American weight management products market, including meal replacements, beverages, and supplements, is poised for substantial expansion. Driven by escalating health consciousness and the rising incidence of obesity and related conditions across Brazil, Argentina, and the wider region, the market is expected to reach $163.13 billion by 2024, with a projected compound annual growth rate (CAGR) of 8.3%.

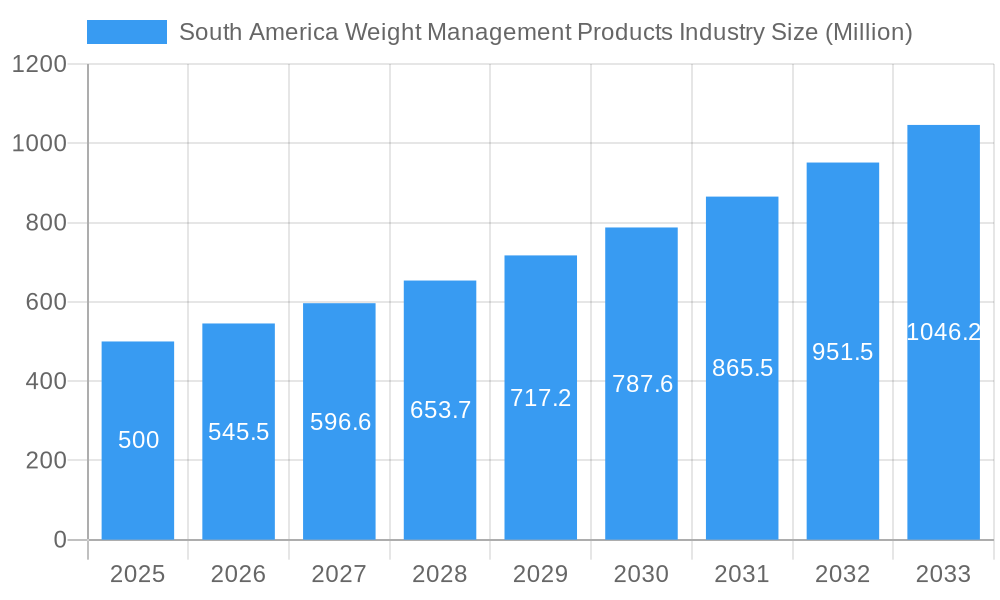

South America Weight Management Products Industry Market Size (In Billion)

Key growth catalysts include rising disposable incomes, heightened awareness of healthy lifestyles fostered by targeted marketing and enhanced online information access, and the expanding availability of diverse product offerings through multiple distribution channels. While hypermarkets and supermarkets remain dominant, online retail is experiencing rapid expansion, mirroring evolving consumer preferences and increased e-commerce penetration.

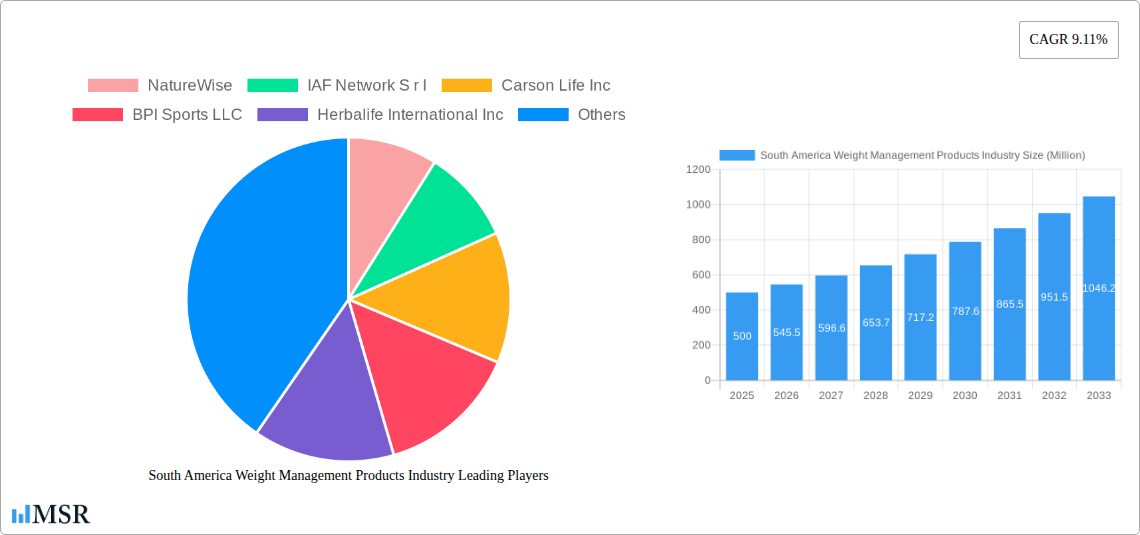

South America Weight Management Products Industry Company Market Share

Segmentation by product type reveals distinct growth trajectories, with supplements anticipated to lead due to their targeted benefits and convenience. The competitive landscape is robust, featuring prominent international players such as Nestlé and Herbalife alongside strong regional brands.

Market expansion is influenced by factors such as product pricing, varying consumer purchasing power, and potential regulatory considerations regarding labeling and safety standards. Misinformation and consumer skepticism surrounding weight management products also present ongoing challenges. To address these, industry players are prioritizing the development of high-quality, scientifically validated products with transparent labeling, complemented by marketing strategies that alleviate consumer concerns and promote sustainable weight management.

Effective consumer engagement through social media, personalized health guidance, and community building initiatives are proving instrumental. Future growth will be contingent upon skillfully navigating these challenges while capitalizing on opportunities presented by evolving consumer demands and technological advancements in the health and wellness sector.

South America Weight Management Products Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the South America weight management products industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. It delves into market dynamics, key segments, leading players, and emerging trends, equipping readers with the knowledge to navigate this dynamic market successfully. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

South America Weight Management Products Industry Market Concentration & Dynamics

The South American weight management products market exhibits a moderately concentrated landscape, with a few large multinational corporations holding significant market share alongside numerous smaller regional players. Market share data from 2024 suggests that Nestlé SA and Herbalife International Inc. are among the leading players, collectively controlling approximately xx% of the market. However, the market is characterized by dynamic competition and a high level of innovation, driven by evolving consumer preferences and technological advancements.

- Market Concentration: Moderate, with leading players holding significant, but not dominant, market share.

- Innovation Ecosystem: Robust, with a considerable focus on natural ingredients, functional foods, and personalized nutrition solutions.

- Regulatory Framework: Varied across South American countries, impacting product approvals and marketing strategies. Further research is needed into specific regulatory environments of each country.

- Substitute Products: Traditional weight loss methods, including diet and exercise, continue to compete with weight management products.

- End-User Trends: Growing awareness of health and wellness, increasing disposable incomes in some regions, and a rise in lifestyle-related diseases are major drivers of market growth.

- M&A Activities: The acquisition of Puravida by Nestlé Health Science in May 2022 showcases the strategic importance of acquisitions in expanding market presence and product portfolios. The number of M&A deals in the period 2019-2024 was estimated to be xx.

South America Weight Management Products Industry Industry Insights & Trends

The South American weight management products market is experiencing robust growth, fueled by several key factors. Rising health consciousness among consumers, coupled with increasing disposable incomes in certain regions, is driving demand for convenient and effective weight management solutions. The market is witnessing a surge in the popularity of natural and organic products, as consumers are increasingly seeking healthier and more sustainable options. Technological advancements, such as personalized nutrition plans and advanced supplement formulations, are also contributing to market expansion. Furthermore, the increasing prevalence of obesity and related health issues across the region presents a significant opportunity for growth. The market size in 2024 was approximately XX Million, exhibiting substantial growth compared to the previous years. This growth is anticipated to continue, with the market projected to reach XX Million by 2033.

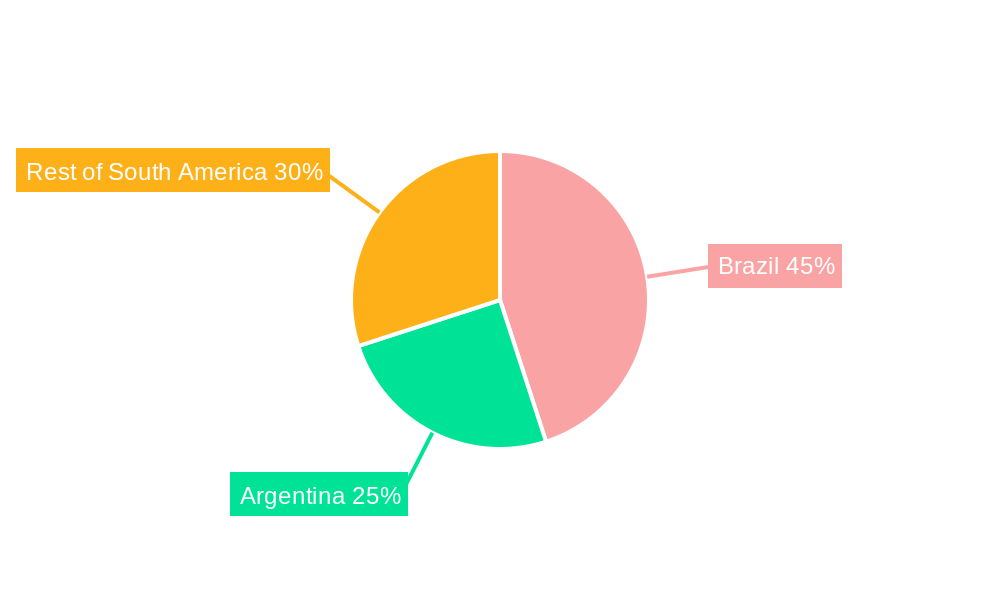

Key Markets & Segments Leading South America Weight Management Products Industry

Brazil represents the dominant market within South America for weight management products, driven by a large population, increasing health awareness, and a growing middle class with higher disposable incomes. Other significant markets include Argentina, Colombia, and Chile. The supplements segment currently holds the largest market share by type, reflecting the preference for convenient and targeted solutions. However, the meal replacement and beverage segments are showing strong growth potential, driven by innovation in product formulation and marketing strategies. The online retail channel is experiencing rapid expansion, facilitated by increased internet penetration and consumer preference for online shopping.

- Dominant Region: Brazil

- Dominant Segment (by Type): Supplements

- Dominant Segment (by Distribution Channel): Hypermarkets/Supermarkets (currently), with Online Retail Stores showing the fastest growth.

Drivers for Brazil's Dominance:

- Large population base

- Rising health consciousness and disposable incomes

- Well-established retail infrastructure.

South America Weight Management Products Industry Product Developments

Recent years have witnessed significant innovation in weight management products, with a focus on natural ingredients, personalized nutrition, and technologically advanced formulations. Companies are increasingly incorporating clinically proven ingredients, such as the prickly pear cactus fiber used in Herbalife's new product, to enhance efficacy and consumer confidence. The development of convenient and palatable products, such as ready-to-drink beverages and meal replacements, is also driving market growth. Furthermore, the integration of technology, such as digital health platforms and personalized nutrition plans, is enhancing the consumer experience and improving product effectiveness.

Challenges in the South America Weight Management Products Industry Market

The South American weight management products market faces several challenges. Regulatory inconsistencies across different countries can hinder product approvals and create complexities for companies operating across the region. Supply chain disruptions, especially given the global economic climate and reliance on raw material imports, can impact product availability and pricing. Intense competition, both from established multinational corporations and smaller regional players, necessitates continuous innovation and effective marketing strategies. These factors collectively exert a negative impact on market growth estimated at around xx% currently.

Forces Driving South America Weight Management Products Industry Growth

The South American weight management products market is projected to experience sustained growth driven by several factors. The rising prevalence of obesity and related health issues presents a significant market opportunity. Increased health awareness and a growing preference for preventive healthcare are driving demand for weight management solutions. Technological advancements in product formulation and personalized nutrition are enhancing product effectiveness and consumer appeal. Additionally, economic growth in certain regions is increasing disposable incomes, allowing consumers to spend more on health and wellness products.

Challenges in the South America Weight Management Products Industry Market

Long-term growth in the South American weight management market hinges on overcoming several challenges. Maintaining consistent product quality and supply chain stability while adapting to evolving consumer preferences is crucial. Investing in research and development to deliver innovative and effective products is essential to stay ahead of the competition. Strengthening partnerships with healthcare professionals and building consumer trust through evidence-based marketing is critical for long-term success. Finally, navigating the complexities of varying regulatory environments across the region is also vital.

Emerging Opportunities in South America Weight Management Products Industry

The South American weight management products market presents several emerging opportunities. The growing demand for natural and organic products creates an opportunity for companies to develop and market sustainable and ethically sourced products. The integration of digital health technologies, including personalized nutrition plans and wearable fitness trackers, presents new avenues for enhancing product efficacy and engagement. Expanding into underserved markets within South America, through targeted marketing and distribution strategies, can also unlock significant growth potential. Furthermore, developing products addressing specific health concerns, such as metabolic syndrome, presents a unique opportunity.

Leading Players in the South America Weight Management Products Industry Sector

- NatureWise

- IAF Network S r l

- Carson Life Inc

- BPI Sports LLC

- Herbalife International Inc

- Nestle SA

- The Hut com Limited (Myprotein)

- Ultimate Nutrition inc

- N V Perricone LLC

- California Medical Weight Management LLC

Key Milestones in South America Weight Management Products Industry Industry

- May 2022: Nestlé Health Science acquired Puravida in Brazil, significantly expanding its market presence.

- July 2022: Herbalife launched a new weight management product featuring prickly pear cactus fiber, based on clinical trials.

- April 2023: Herbalife unveiled 106 innovative wellness products globally, including in Brazil, addressing various aspects of well-being.

Strategic Outlook for South America Weight Management Products Industry Market

The South American weight management products market exhibits strong long-term growth potential. Continuous innovation in product formulation, marketing, and distribution strategies will be crucial for success. Strategic partnerships, collaborations, and acquisitions will play a significant role in expanding market share and reach. Addressing regulatory challenges and ensuring product quality and supply chain resilience are vital for sustainable growth. The market's future is bright, particularly given the increasing health awareness and evolving consumer preferences across the region.

South America Weight Management Products Industry Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of the South America

South America Weight Management Products Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of the South America

South America Weight Management Products Industry Regional Market Share

Geographic Coverage of South America Weight Management Products Industry

South America Weight Management Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Incidence and Weight Consciousness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of the South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of the South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of the South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of the South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of the South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 NatureWise

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 IAF Network S r l

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Carson Life Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BPI Sports LLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Herbalife International Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nestle SA*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Hut com Limited (Myprotein)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ultimate Nutrition inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 N V Perricone LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 California Medical Weight Management LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 NatureWise

List of Figures

- Figure 1: South America Weight Management Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Weight Management Products Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Weight Management Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Weight Management Products Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the South America Weight Management Products Industry?

Key companies in the market include NatureWise, IAF Network S r l, Carson Life Inc, BPI Sports LLC, Herbalife International Inc, Nestle SA*List Not Exhaustive, The Hut com Limited (Myprotein), Ultimate Nutrition inc, N V Perricone LLC, California Medical Weight Management LLC.

3. What are the main segments of the South America Weight Management Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Rising Obesity Incidence and Weight Consciousness.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Herbalife unveiled 106 innovative Wellness Products on a global scale, catering to a diverse audience spanning 95 markets where the company maintains a strong presence, including Brazil. These new product additions are strategically designed to address various facets of well-being, including nutrient supplementation, weight management, digestion, and other essential segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Weight Management Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Weight Management Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Weight Management Products Industry?

To stay informed about further developments, trends, and reports in the South America Weight Management Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence