Key Insights

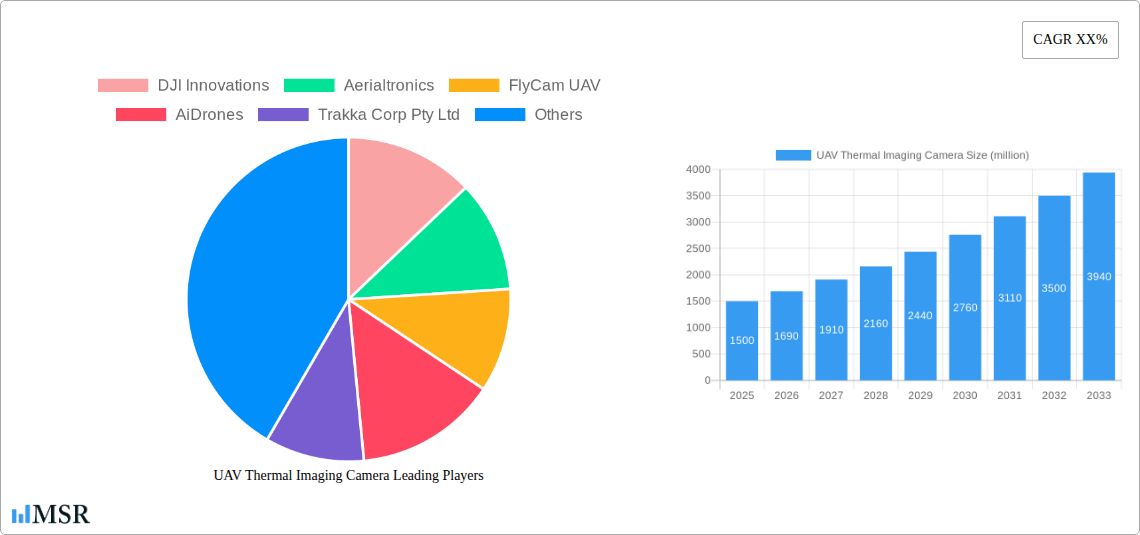

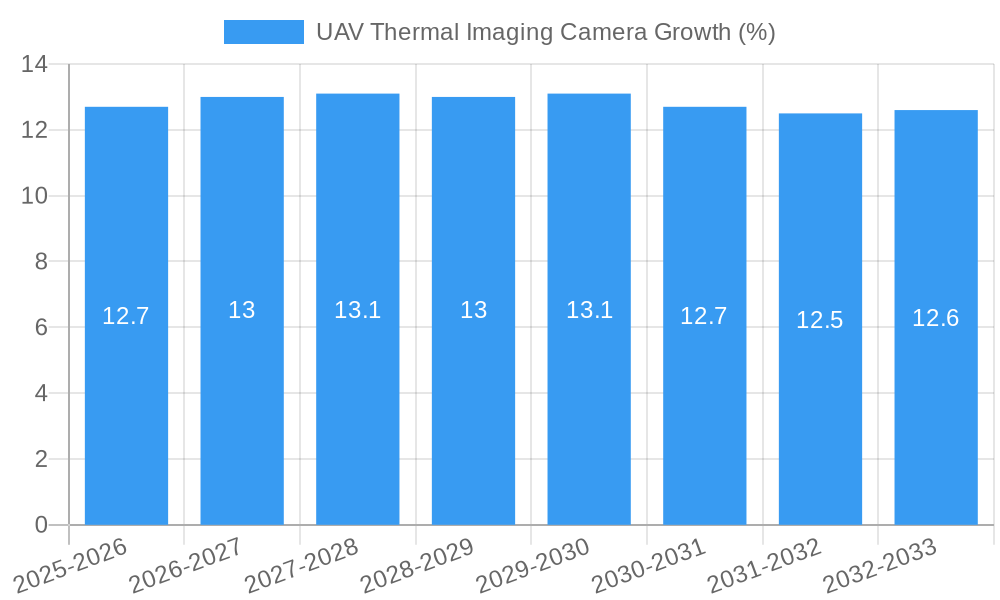

The global UAV thermal imaging camera market is poised for significant expansion, projected to reach an estimated market size of approximately $1.5 billion in 2025 and ascend to over $3.5 billion by 2033. This impressive growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of roughly 12.5%, driven by escalating demand across both military and civilian applications. In the defense sector, these advanced cameras are indispensable for surveillance, reconnaissance, target acquisition, and border security, offering unparalleled situational awareness in all weather and lighting conditions. The civilian domain is witnessing a surge in adoption for critical infrastructure inspection (e.g., power lines, pipelines), search and rescue operations, agricultural monitoring for crop health and pest detection, and the burgeoning drone delivery industry, where thermal imaging enhances safety and efficiency. Key advancements in sensor technology, miniaturization, and AI-powered image processing are further fueling market penetration by improving performance, reducing costs, and expanding the range of practical applications.

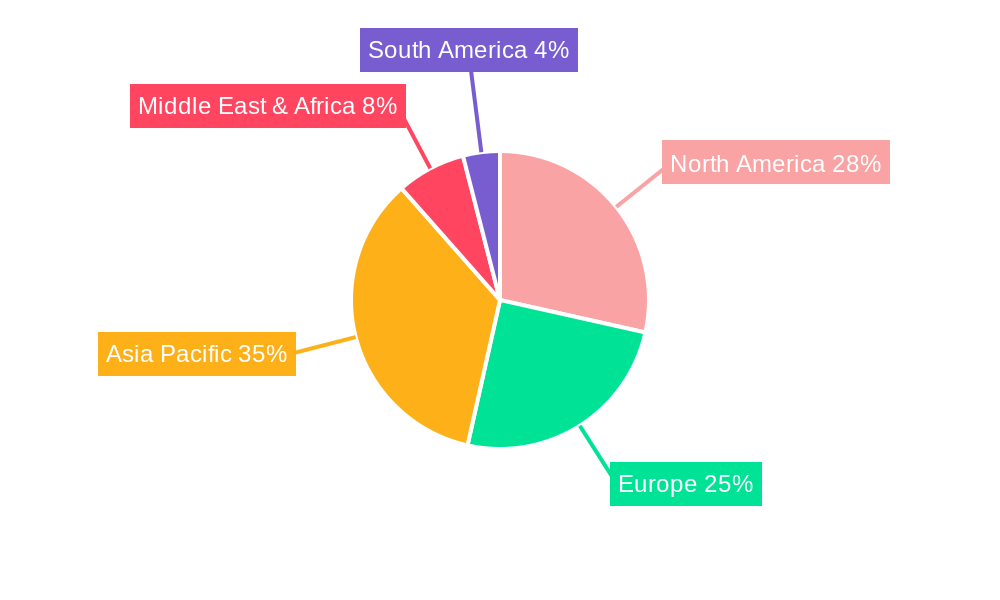

The market's upward trajectory is further propelled by several key trends, including the increasing integration of artificial intelligence for automated anomaly detection and data analysis, and the development of more compact and lightweight thermal camera modules suitable for smaller drone platforms. The growing emphasis on proactive maintenance and predictive analytics in industries like energy and utilities, where early detection of thermal anomalies can prevent costly failures, is also a significant driver. However, the market is not without its restraints. High initial costs for advanced thermal imaging systems and the need for specialized training to operate and interpret the data can pose barriers to widespread adoption, particularly for smaller enterprises. Stringent regulatory frameworks governing drone usage, especially in sensitive areas, also present challenges. Despite these hurdles, the relentless innovation in sensor technology, coupled with the expanding application landscape and strategic investments by key players like DJI Innovations, FLIR SYSTEMS, and Droneshield, are expected to overcome these limitations and ensure sustained market growth. The Asia Pacific region, particularly China and India, is anticipated to emerge as a dominant force due to strong government support for drone technology and rapid industrialization.

UAV Thermal Imaging Camera Market Concentration & Dynamics

The UAV thermal imaging camera market exhibits a moderate to high concentration, with a significant portion of market share dominated by a few key players. Companies like FLIR SYSTEMS, DJI Innovations, and Workswell have established strong positions through continuous product innovation and strategic market penetration. The innovation ecosystem is dynamic, fueled by advancements in sensor technology, miniaturization, and artificial intelligence integration for advanced analytics. Regulatory frameworks, while evolving, present a mixed landscape, with some regions fostering growth while others impose stringent limitations, particularly for military drone applications. Substitute products, primarily traditional ground-based thermal imaging systems, are being increasingly challenged by the flexibility and cost-effectiveness of UAV-mounted solutions. End-user trends indicate a growing demand for enhanced situational awareness, predictive maintenance, and remote inspection capabilities across various industries. Mergers and acquisitions (M&A) activity has been consistent, indicating consolidation and strategic expansion by leading companies aiming to capture a larger market share. For instance, the past year saw an estimated 5 significant M&A deals with an aggregate deal value exceeding $500 million, underscoring the strategic importance of this sector.

UAV Thermal Imaging Camera Industry Insights & Trends

The global UAV thermal imaging camera market is poised for substantial growth, driven by an escalating demand for advanced aerial surveillance, inspection, and monitoring solutions. The market size is projected to reach approximately $3.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15.8% during the forecast period of 2025–2033. This expansion is primarily attributed to the increasing adoption of drones in critical sectors such as public safety, infrastructure management, and industrial inspections. Technological disruptions are at the forefront of this growth. Miniaturization of thermal sensors, coupled with improved resolution and sensitivity, has made it feasible to integrate these powerful imaging tools into a wider array of UAV platforms, from compact civilian drones to sophisticated military applications. The development of advanced AI-powered image analysis algorithms further enhances the value proposition by enabling automated anomaly detection, real-time threat identification, and predictive maintenance insights. Evolving consumer behaviors are also shaping the market. Businesses are increasingly recognizing the operational efficiencies and cost savings offered by thermal imaging drones, leading to a surge in demand for integrated solutions that provide actionable data rather than just raw imagery. The shift from reactive problem-solving to proactive monitoring and prevention is a key behavioral trend fueling market expansion. Furthermore, the burgeoning e-commerce landscape and the increasing sophistication of drone delivery services are indirectly boosting the need for aerial thermal imaging for asset monitoring and security. The continuous refinement of battery technology and flight endurance for UAVs also plays a crucial role, enabling longer operational periods and wider coverage areas for thermal inspections.

Key Markets & Segments Leading UAV Thermal Imaging Camera

The Military Drone segment, particularly in applications such as border surveillance, search and rescue, and tactical reconnaissance, is a dominant force in the UAV thermal imaging camera market. This dominance is driven by significant governmental investments in defense technology and the inherent advantages thermal imaging offers in detecting hidden threats and personnel in diverse environmental conditions. Regions with heightened geopolitical tensions and active military operations are spearheading this demand, with countries in North America and Europe leading the charge. The market size for military drone applications is estimated to be over $1.5 billion in 2025.

Key Drivers for Military Drone Dominance:

- Enhanced Situational Awareness: Thermal imaging provides crucial visibility in low-light, adverse weather, and camouflage scenarios, offering unparalleled situational awareness for military operations.

- Force Protection: Early detection of enemy movements and potential threats significantly enhances the safety and effectiveness of ground forces.

- Cost-Effectiveness of UAVs: Compared to manned aircraft, UAVs offer a more cost-effective solution for persistent surveillance and reconnaissance missions.

- Technological Advancements: Continuous improvements in sensor resolution, spectral range, and onboard processing capabilities make thermal imagers more potent for military intelligence.

The Civilian Drone segment is experiencing rapid expansion, driven by a diverse range of applications. Within this segment, Portable UAV thermal imaging cameras are gaining substantial traction. The ability to deploy these systems quickly for emergency response, infrastructure inspection (power lines, wind turbines), and agricultural monitoring is a key growth accelerator. The market for civilian drone applications is projected to exceed $2.0 billion in 2025, with portable solutions representing a significant portion of this.

Key Drivers for Civilian Drone and Portable Segment Dominance:

- Infrastructure Inspection: The aging infrastructure globally necessitates regular inspections, where thermal imaging can quickly identify defects, hot spots, and potential failures in bridges, buildings, and power grids.

- Public Safety and Emergency Response: Thermal cameras are invaluable for locating missing persons, assessing fire risks, and monitoring disaster zones, especially in low visibility conditions.

- Agriculture: Precision agriculture benefits from thermal imaging for crop health monitoring, irrigation management, and early disease detection.

- Industrial Monitoring: Predictive maintenance of industrial equipment, identifying overheating components, and ensuring operational safety are key applications.

- Ease of Deployment: Portable thermal imaging cameras offer unparalleled flexibility for field operations, enabling rapid deployment and data acquisition without the need for extensive setup.

UAV Thermal Imaging Camera Product Developments

Recent product developments in UAV thermal imaging cameras are characterized by a relentless pursuit of higher resolution, increased sensitivity, and enhanced integration with intelligent analytics. Companies are focusing on miniaturized, lightweight thermal sensors that can be seamlessly integrated into a wide array of UAV platforms, from micro-drones to heavy-lift industrial drones. Innovations in radiometric thermal cameras are providing more accurate temperature measurements, crucial for applications like predictive maintenance and electrical inspection. Furthermore, the integration of advanced AI algorithms directly onto the camera or the UAV processing unit enables real-time anomaly detection, object recognition, and data analysis, significantly reducing post-mission processing time and providing immediate actionable insights. The development of multi-spectral and hyper-spectral thermal imaging capabilities is also emerging, offering deeper insights into material properties and environmental conditions. For instance, FLIR SYSTEMS has introduced advanced uncooled microbolometer arrays offering improved performance in challenging environments, while DJI Innovations continues to integrate high-resolution thermal sensors into its popular drone lineups, making them accessible to a broader market.

Challenges in the UAV Thermal Imaging Camera Market

The UAV thermal imaging camera market faces several challenges that temper its otherwise robust growth trajectory. Regulatory hurdles remain a significant barrier, with varying and often complex regulations concerning drone operation, flight altitudes, and data privacy across different regions. Supply chain disruptions, particularly for specialized electronic components, can lead to production delays and increased costs. The high initial investment cost for advanced thermal imaging drones and associated software can also be a deterrent for smaller businesses and organizations. Competitive pressures from established players and emerging entrants, coupled with the need for continuous R&D investment to stay ahead of technological advancements, further intensify the market landscape.

Forces Driving UAV Thermal Imaging Camera Growth

Several powerful forces are propelling the growth of the UAV thermal imaging camera market. Technological advancements in sensor technology, miniaturization, and artificial intelligence are making thermal imaging more accessible, affordable, and powerful. The increasing demand for efficient and cost-effective inspection and surveillance solutions across industries like infrastructure, energy, and public safety is a primary economic driver. Favorable government initiatives and defense spending in many countries are significantly boosting the adoption of thermal imaging drones for security and surveillance. Furthermore, the growing awareness of the benefits of predictive maintenance and early anomaly detection, facilitated by thermal imaging, is driving adoption in industrial sectors.

Challenges in the UAV Thermal Imaging Camera Market

Long-term growth catalysts for the UAV thermal imaging camera market are deeply rooted in continuous innovation and market expansion. The development of even more sophisticated sensors with higher resolutions, wider spectral ranges, and improved thermal sensitivity will unlock new applications. Strategic partnerships and collaborations between drone manufacturers, thermal camera providers, and software developers are crucial for creating integrated, end-to-end solutions that address specific industry needs. Furthermore, exploring and penetrating emerging markets in developing economies, where infrastructure development and public safety needs are rapidly growing, presents substantial long-term growth potential. The ongoing advancements in battery technology and autonomous flight capabilities will further enhance the operational scope and attractiveness of thermal imaging drones.

Emerging Opportunities in UAV Thermal Imaging Camera

Emerging opportunities in the UAV thermal imaging camera market are abundant and diverse. The burgeoning fields of smart agriculture and environmental monitoring present significant untapped potential, where thermal imaging can optimize crop yields, detect pollution, and track wildlife. The integration of thermal cameras with advanced AI for autonomous inspection and anomaly detection will revolutionize industries like construction and manufacturing, enabling predictive maintenance and reducing human error. The growth of the public safety sector, particularly in developing nations, offers substantial opportunities for affordable and effective thermal imaging drones for law enforcement and emergency services. Furthermore, the development of specialized thermal imaging solutions for underwater and subterranean inspections is an emerging frontier, opening up new markets.

Leading Players in the UAV Thermal Imaging Camera Sector

- DJI Innovations

- Aerialtronics

- FlyCam UAV

- AiDrones

- Trakka Corp Pty Ltd

- Droneshield

- FLIR SYSTEMS

- Workswell

- Indela

- MikroKopter

- Tor Robotics

- Aaronia AG

- VideoDrone

- Aeryon Labs

- DST CONTROL

Key Milestones in UAV Thermal Imaging Camera Industry

- 2019: FLIR SYSTEMS launches its Vue Pro R compact thermal camera, enhancing the thermal imaging capabilities of smaller drones.

- 2020: DJI Innovations expands its enterprise drone lineup with integrated thermal camera options, broadening market accessibility.

- 2021: Workswell introduces advanced post-processing software specifically for UAV thermal data, streamlining analysis.

- 2022: Aerialtronics partners with a major utility company for large-scale power line inspection using thermal drones, demonstrating commercial viability.

- 2023: The development of AI-powered anomaly detection algorithms specifically for UAV thermal imaging gains significant traction.

- 2024 (Estimated): Increased focus on miniaturization and improved resolution in thermal sensors for integration into an even wider range of drone platforms.

Strategic Outlook for UAV Thermal Imaging Camera Market

- 2019: FLIR SYSTEMS launches its Vue Pro R compact thermal camera, enhancing the thermal imaging capabilities of smaller drones.

- 2020: DJI Innovations expands its enterprise drone lineup with integrated thermal camera options, broadening market accessibility.

- 2021: Workswell introduces advanced post-processing software specifically for UAV thermal data, streamlining analysis.

- 2022: Aerialtronics partners with a major utility company for large-scale power line inspection using thermal drones, demonstrating commercial viability.

- 2023: The development of AI-powered anomaly detection algorithms specifically for UAV thermal imaging gains significant traction.

- 2024 (Estimated): Increased focus on miniaturization and improved resolution in thermal sensors for integration into an even wider range of drone platforms.

Strategic Outlook for UAV Thermal Imaging Camera Market

The strategic outlook for the UAV thermal imaging camera market is overwhelmingly positive, driven by a confluence of technological innovation, increasing demand, and expanding applications. Growth accelerators will include the continued miniaturization and cost reduction of high-performance thermal sensors, enabling wider adoption across all market segments, from consumer-grade to highly specialized military drones. The integration of AI for autonomous data analysis and real-time decision-making will be a key differentiator. Strategic collaborations between drone manufacturers, sensor developers, and software providers will foster the creation of comprehensive solutions tailored to specific industry needs. The expansion of regulatory frameworks to accommodate the growing capabilities and applications of UAV thermal imaging will further fuel market growth. Overall, the market is set to witness sustained expansion, with a strong emphasis on delivering actionable insights and enhancing operational efficiency across diverse sectors.

UAV Thermal Imaging Camera Segmentation

-

1. Application

- 1.1. Military Drone

- 1.2. Civilian Drone

-

2. Types

- 2.1. Flushbonading

- 2.2. Portable

UAV Thermal Imaging Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAV Thermal Imaging Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAV Thermal Imaging Camera Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military Drone

- 5.1.2. Civilian Drone

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Flushbonading

- 5.2.2. Portable

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America UAV Thermal Imaging Camera Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military Drone

- 6.1.2. Civilian Drone

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Flushbonading

- 6.2.2. Portable

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America UAV Thermal Imaging Camera Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military Drone

- 7.1.2. Civilian Drone

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Flushbonading

- 7.2.2. Portable

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe UAV Thermal Imaging Camera Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military Drone

- 8.1.2. Civilian Drone

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Flushbonading

- 8.2.2. Portable

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa UAV Thermal Imaging Camera Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military Drone

- 9.1.2. Civilian Drone

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Flushbonading

- 9.2.2. Portable

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific UAV Thermal Imaging Camera Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military Drone

- 10.1.2. Civilian Drone

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Flushbonading

- 10.2.2. Portable

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DJI Innovations

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aerialtronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FlyCam UAV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AiDrones

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Trakka Corp Pty Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Droneshield

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FLIR SYSTEMS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Workswell

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indela

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MikroKopter

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tor Robotics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aaronia AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 VideoDrone

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Aeryon Labs

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DST CONTROL

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 DJI Innovations

List of Figures

- Figure 1: Global UAV Thermal Imaging Camera Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America UAV Thermal Imaging Camera Revenue (million), by Application 2024 & 2032

- Figure 3: North America UAV Thermal Imaging Camera Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America UAV Thermal Imaging Camera Revenue (million), by Types 2024 & 2032

- Figure 5: North America UAV Thermal Imaging Camera Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America UAV Thermal Imaging Camera Revenue (million), by Country 2024 & 2032

- Figure 7: North America UAV Thermal Imaging Camera Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UAV Thermal Imaging Camera Revenue (million), by Application 2024 & 2032

- Figure 9: South America UAV Thermal Imaging Camera Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America UAV Thermal Imaging Camera Revenue (million), by Types 2024 & 2032

- Figure 11: South America UAV Thermal Imaging Camera Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America UAV Thermal Imaging Camera Revenue (million), by Country 2024 & 2032

- Figure 13: South America UAV Thermal Imaging Camera Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe UAV Thermal Imaging Camera Revenue (million), by Application 2024 & 2032

- Figure 15: Europe UAV Thermal Imaging Camera Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe UAV Thermal Imaging Camera Revenue (million), by Types 2024 & 2032

- Figure 17: Europe UAV Thermal Imaging Camera Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe UAV Thermal Imaging Camera Revenue (million), by Country 2024 & 2032

- Figure 19: Europe UAV Thermal Imaging Camera Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa UAV Thermal Imaging Camera Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa UAV Thermal Imaging Camera Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa UAV Thermal Imaging Camera Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa UAV Thermal Imaging Camera Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa UAV Thermal Imaging Camera Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa UAV Thermal Imaging Camera Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific UAV Thermal Imaging Camera Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific UAV Thermal Imaging Camera Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific UAV Thermal Imaging Camera Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific UAV Thermal Imaging Camera Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific UAV Thermal Imaging Camera Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific UAV Thermal Imaging Camera Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAV Thermal Imaging Camera Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global UAV Thermal Imaging Camera Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global UAV Thermal Imaging Camera Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global UAV Thermal Imaging Camera Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global UAV Thermal Imaging Camera Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global UAV Thermal Imaging Camera Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global UAV Thermal Imaging Camera Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global UAV Thermal Imaging Camera Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global UAV Thermal Imaging Camera Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global UAV Thermal Imaging Camera Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global UAV Thermal Imaging Camera Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global UAV Thermal Imaging Camera Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global UAV Thermal Imaging Camera Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global UAV Thermal Imaging Camera Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global UAV Thermal Imaging Camera Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global UAV Thermal Imaging Camera Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global UAV Thermal Imaging Camera Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global UAV Thermal Imaging Camera Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global UAV Thermal Imaging Camera Revenue million Forecast, by Country 2019 & 2032

- Table 41: China UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UAV Thermal Imaging Camera Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAV Thermal Imaging Camera?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the UAV Thermal Imaging Camera?

Key companies in the market include DJI Innovations, Aerialtronics, FlyCam UAV, AiDrones, Trakka Corp Pty Ltd, Droneshield, FLIR SYSTEMS, Workswell, Indela, MikroKopter, Tor Robotics, Aaronia AG, VideoDrone, Aeryon Labs, DST CONTROL.

3. What are the main segments of the UAV Thermal Imaging Camera?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAV Thermal Imaging Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAV Thermal Imaging Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAV Thermal Imaging Camera?

To stay informed about further developments, trends, and reports in the UAV Thermal Imaging Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence