Key Insights

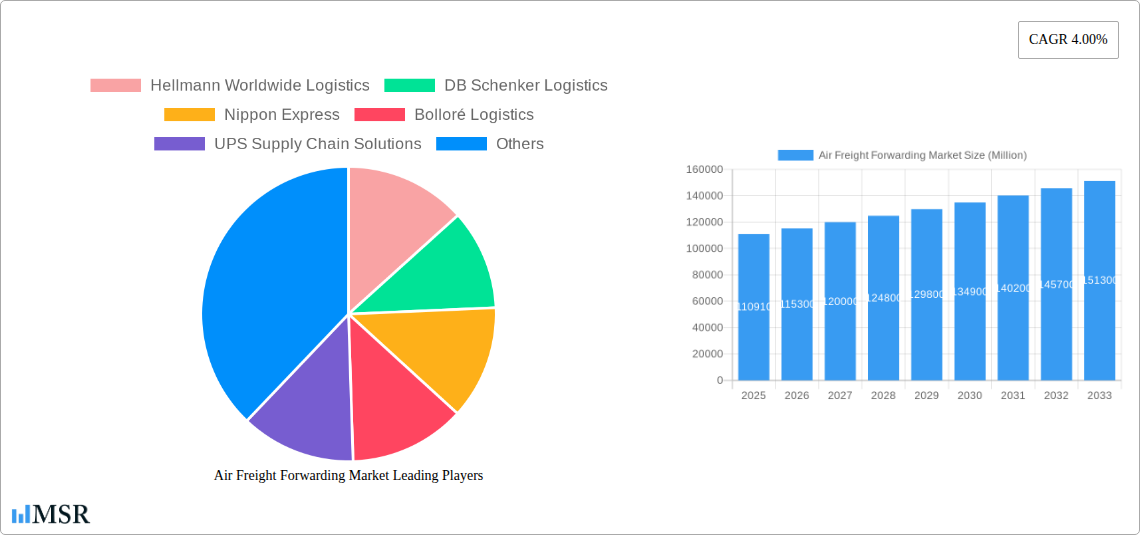

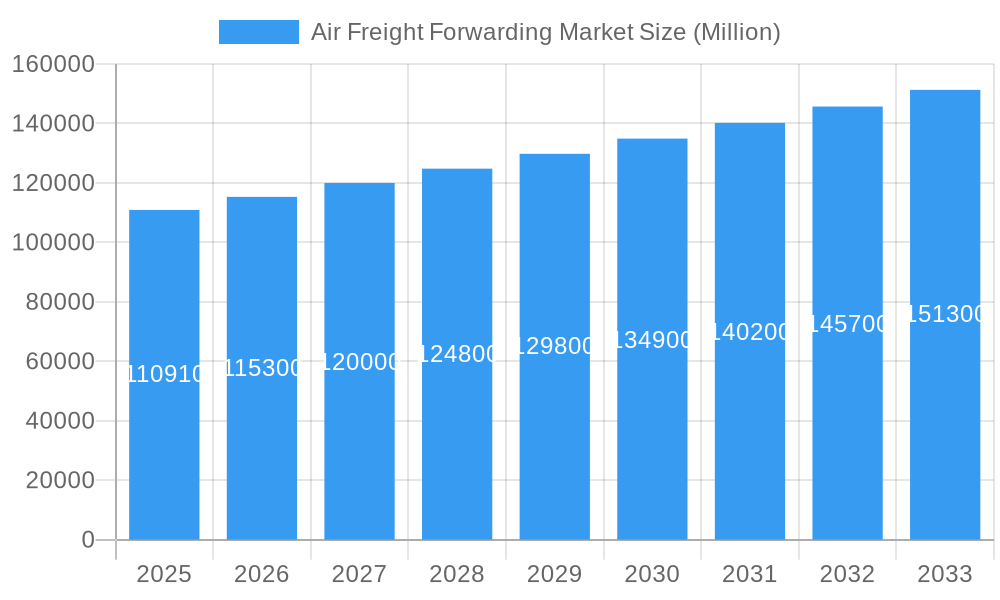

The global air freight forwarding market, valued at $110.91 billion in 2025, is projected to experience robust growth, driven by the expanding e-commerce sector, increasing global trade, and the rising demand for faster and more reliable delivery services. The market's Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033 indicates a steady expansion, with significant opportunities across various segments. The airline segment within the service category is expected to dominate, fueled by increased air cargo capacity and efficient logistical networks. Similarly, international freight forwarding will likely show stronger growth compared to domestic, mirroring the globalized nature of modern business. Growth is anticipated to be particularly strong in regions experiencing rapid economic development, such as Asia-Pacific, driven by burgeoning manufacturing and consumer markets. However, challenges such as fluctuating fuel prices, geopolitical instability, and potential supply chain disruptions could temper growth in certain periods. The competitive landscape is characterized by a mix of large multinational companies like DHL, FedEx, and Kuehne + Nagel, alongside specialized regional players. These companies are continuously investing in technological advancements, such as advanced tracking systems and data analytics, to improve efficiency and enhance customer satisfaction. The increasing integration of technology, a greater focus on sustainability, and stricter regulatory compliance will further shape the market's trajectory in the coming years.

Air Freight Forwarding Market Market Size (In Billion)

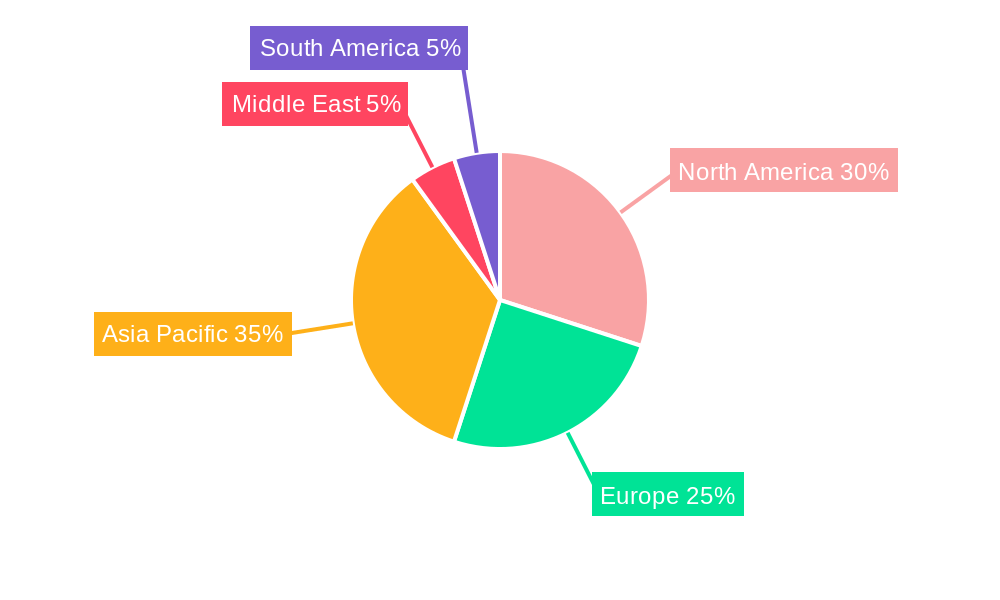

The market segmentation provides a granular understanding of the air freight forwarding industry. The "Other services" segment, while smaller than airlines and mail, presents a substantial opportunity for specialized logistics providers offering niche services. Regional variations in growth are expected; North America and Europe, while mature markets, will still see growth, but Asia-Pacific is likely to display the most significant expansion given its dynamic economic landscape. The competitive dynamics will continue to be intense, requiring companies to innovate and offer value-added services to differentiate themselves and secure market share. Strategic partnerships and mergers and acquisitions will also play a significant role in shaping the industry's consolidation and future growth trajectory. A focus on sustainability and reduced carbon emissions will become increasingly important, driving the adoption of more eco-friendly practices within the industry.

Air Freight Forwarding Market Company Market Share

Air Freight Forwarding Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Air Freight Forwarding Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study unravels market dynamics, key trends, and future growth potential. The report analyzes market concentration, key players, technological advancements, and emerging opportunities within the air freight forwarding sector, projecting significant growth in the forecast period (2025-2033).

Air Freight Forwarding Market Concentration & Dynamics

The global air freight forwarding market exhibits a moderately concentrated landscape, dominated by major players like Hellmann Worldwide Logistics, DB Schenker Logistics, Nippon Express, Bolloré Logistics, UPS Supply Chain Solutions, DHL Supply Chain & Global Forwarding, Expeditors International, Kuehne + Nagel, Kintetsu World Express, and DSV Panalpina. These companies collectively hold a significant market share, estimated at xx%, reflecting their extensive global networks and established client bases. However, the market also accommodates numerous smaller players, fostering competition and innovation.

Market Dynamics:

- Innovation Ecosystems: Continuous technological advancements, such as the adoption of blockchain technology for enhanced transparency and efficiency, drive market innovation. The development of advanced tracking systems and data analytics platforms also play a significant role.

- Regulatory Frameworks: International and national regulations concerning air freight transportation, customs procedures, and safety standards significantly impact market operations. Compliance costs and evolving regulations represent both challenges and opportunities for market participants.

- Substitute Products: While air freight offers unparalleled speed, alternative modes of transportation, such as sea freight and road freight, present viable substitutes, especially for less time-sensitive goods. This competitive landscape necessitates continuous cost optimization and service differentiation.

- End-User Trends: The growth of e-commerce and the increasing demand for faster delivery times fuel the demand for air freight forwarding services. Specific industry sectors such as pharmaceuticals and high-value goods heavily rely on the speed and reliability of air freight.

- M&A Activities: The air freight forwarding market has witnessed notable merger and acquisition (M&A) activity in recent years, reflecting consolidation trends and strategic expansion strategies. The number of M&A deals from 2019 to 2024 is estimated at xx. These activities often result in enhanced market reach and operational efficiency.

Air Freight Forwarding Market Industry Insights & Trends

The global air freight forwarding market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at USD xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the expanding global trade, particularly within the e-commerce sector. The rising demand for faster and more reliable delivery options, especially for time-sensitive goods like pharmaceuticals and perishables, is a significant driver. Technological advancements, including automated warehousing systems, advanced tracking technologies, and data analytics platforms, contribute to enhanced efficiency and customer satisfaction. Furthermore, the increasing adoption of sustainable practices within the air freight industry is driving positive changes within the market. The rise of specialized services catering to specific industry needs, such as temperature-controlled transportation for pharmaceuticals, further contributes to the market's overall expansion. The increasing globalization and cross-border trade necessitate the efficient and reliable services provided by air freight forwarders, hence boosting the market. Fluctuations in fuel prices, geopolitical events, and economic downturns can impact market growth; however, the long-term outlook remains positive.

Key Markets & Segments Leading Air Freight Forwarding Market

The international air freight forwarding segment holds significant dominance within the overall market, driven by the increasing globalization of trade and the growing demand for faster cross-border shipping solutions. The Airlines segment constitutes the largest share within the "By Service" category, as it is the primary mode of transportation for air freight. The North American and Asia-Pacific regions are key drivers of market growth, fueled by robust economic growth, expanding e-commerce markets, and substantial investments in air freight infrastructure.

Drivers of Growth:

- Economic Growth: Strong economic growth in key regions, particularly in Asia-Pacific, stimulates increased trade and air freight demand.

- E-commerce Expansion: The rapid expansion of e-commerce fuels the demand for fast and reliable shipping options, driving air freight volumes.

- Infrastructure Development: Investments in airport infrastructure and logistics hubs in major markets enhance the efficiency and capacity of air freight networks.

- Technological Advancements: Improved tracking and data analytics technology optimizes air freight operations and supply chain management.

Air Freight Forwarding Market Product Developments

Recent years have witnessed significant innovation in air freight forwarding, including the adoption of advanced tracking and monitoring technologies, automated warehousing systems, and digital platforms for improved supply chain management. The integration of blockchain technology enhances transparency and security, while the implementation of artificial intelligence (AI) and machine learning (ML) algorithms optimize routing, scheduling, and predictive analytics, enabling better cost management and improved service delivery. These advancements provide companies with a competitive edge, enhancing efficiency and customer satisfaction.

Challenges in the Air Freight Forwarding Market

The air freight forwarding market faces several challenges, including stringent regulatory compliance requirements, volatile fuel prices impacting operational costs, and increasing competition from both established players and new entrants. Supply chain disruptions, geopolitical instability, and potential labor shortages also pose significant risks, potentially leading to capacity constraints and delays. The impact of these factors can be quantifiable through variations in operational efficiency, profit margins, and customer satisfaction levels. For example, fuel price fluctuations can directly impact operating costs, while supply chain disruptions lead to delayed deliveries and potentially lost revenue.

Forces Driving Air Freight Forwarding Market Growth

Several key factors drive the growth of the air freight forwarding market. Technological advancements, including improved tracking and management systems, enhance efficiency and reduce costs. The growth of e-commerce and the demand for fast delivery fuels the need for reliable air freight services. Favorable economic conditions in key markets boost overall trade and transportation volumes. Furthermore, strategic partnerships and collaborations among players in the air freight ecosystem facilitate efficiency improvements and market expansion.

Long-Term Growth Catalysts in Air Freight Forwarding Market

Long-term growth in the air freight forwarding market will be fueled by ongoing technological innovations, strategic partnerships aimed at enhancing supply chain resilience, and the expansion into new and emerging markets. Investments in sustainable aviation fuels and eco-friendly practices will become increasingly important. The continued integration of data analytics and AI will improve efficiency and predictive capabilities. Expansion into underserved regions and the development of specialized services catering to niche industry needs will also contribute to future growth.

Emerging Opportunities in Air Freight Forwarding Market

Emerging opportunities in the air freight forwarding market include the growth of specialized services such as temperature-controlled transportation for pharmaceuticals and perishable goods, the expansion into emerging markets with rapidly growing economies, and the development of advanced logistics solutions leveraging technologies like AI and blockchain. The increasing demand for sustainable and environmentally responsible logistics solutions presents significant opportunities for companies adopting green practices and innovative technologies.

Leading Players in the Air Freight Forwarding Market Sector

Key Milestones in Air Freight Forwarding Market Industry

- August 2023: National Airlines and Etihad Cargo entered into an Interline Agreement for ICAIR23 program implementation for the U.S. Postal Service, signifying enhanced international collaboration and regulatory compliance.

- April 2022: DHL Supply Chain's strategic partnership with ReverseLogix to automate reverse logistics highlights the growing importance of e-commerce returns management within the air freight sector and shows a 15% annual growth in e-commerce business.

- March 2022: Cargojet's expanded agreement with DHL Express for aircraft leasing reflects the increasing demand for air freight capacity, especially in the Americas.

Strategic Outlook for Air Freight Forwarding Market

The future of the air freight forwarding market is bright, with significant growth potential driven by continued technological advancements, strategic partnerships, and the expansion into new markets. Companies that effectively leverage technological innovations to enhance efficiency, transparency, and sustainability will be well-positioned for success. Strategic collaborations focused on supply chain resilience and the development of specialized services catering to industry-specific needs will also be crucial for capturing market share and driving long-term growth. The focus on sustainable practices and environmentally friendly solutions will play a crucial role in shaping the industry's future.

Air Freight Forwarding Market Segmentation

-

1. Service

- 1.1. Airlines

- 1.2. Mail

- 1.3. Other services

-

2. Destination

- 2.1. Domestic

- 2.2. International

Air Freight Forwarding Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Netherlands

- 2.4. United Kingdom

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. South Korea

- 3.9. Rest of Asia Pacific

- 4. Middle East

-

5. South Africa

- 5.1. Egypt

- 5.2. GCC Countries

- 5.3. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Chile

- 6.3. Rest of South America

Air Freight Forwarding Market Regional Market Share

Geographic Coverage of Air Freight Forwarding Market

Air Freight Forwarding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. Cargo Restrictions

- 3.4. Market Trends

- 3.4.1. The increase in E-Commerce is driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Airlines

- 5.1.2. Mail

- 5.1.3. Other services

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. South Africa

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Airlines

- 6.1.2. Mail

- 6.1.3. Other services

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Airlines

- 7.1.2. Mail

- 7.1.3. Other services

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Airlines

- 8.1.2. Mail

- 8.1.3. Other services

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Airlines

- 9.1.2. Mail

- 9.1.3. Other services

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. South Africa Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Airlines

- 10.1.2. Mail

- 10.1.3. Other services

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. South America Air Freight Forwarding Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Airlines

- 11.1.2. Mail

- 11.1.3. Other services

- 11.2. Market Analysis, Insights and Forecast - by Destination

- 11.2.1. Domestic

- 11.2.2. International

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hellmann Worldwide Logistics

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DB Schenker Logistics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Nippon Express

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bolloré Logistics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 UPS Supply Chain Solutions

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DHL Supply Chain & Global Forwarding

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Expeditors International

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kuehne + Nagel

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kintetsu World Express**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 DSV Panalpina

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hellmann Worldwide Logistics

List of Figures

- Figure 1: Global Air Freight Forwarding Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Freight Forwarding Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Air Freight Forwarding Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Air Freight Forwarding Market Revenue (Million), by Destination 2025 & 2033

- Figure 5: North America Air Freight Forwarding Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America Air Freight Forwarding Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Air Freight Forwarding Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Air Freight Forwarding Market Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe Air Freight Forwarding Market Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Air Freight Forwarding Market Revenue (Million), by Destination 2025 & 2033

- Figure 11: Europe Air Freight Forwarding Market Revenue Share (%), by Destination 2025 & 2033

- Figure 12: Europe Air Freight Forwarding Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Air Freight Forwarding Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Air Freight Forwarding Market Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Pacific Air Freight Forwarding Market Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Air Freight Forwarding Market Revenue (Million), by Destination 2025 & 2033

- Figure 17: Asia Pacific Air Freight Forwarding Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: Asia Pacific Air Freight Forwarding Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Air Freight Forwarding Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Air Freight Forwarding Market Revenue (Million), by Service 2025 & 2033

- Figure 21: Middle East Air Freight Forwarding Market Revenue Share (%), by Service 2025 & 2033

- Figure 22: Middle East Air Freight Forwarding Market Revenue (Million), by Destination 2025 & 2033

- Figure 23: Middle East Air Freight Forwarding Market Revenue Share (%), by Destination 2025 & 2033

- Figure 24: Middle East Air Freight Forwarding Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East Air Freight Forwarding Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Africa Air Freight Forwarding Market Revenue (Million), by Service 2025 & 2033

- Figure 27: South Africa Air Freight Forwarding Market Revenue Share (%), by Service 2025 & 2033

- Figure 28: South Africa Air Freight Forwarding Market Revenue (Million), by Destination 2025 & 2033

- Figure 29: South Africa Air Freight Forwarding Market Revenue Share (%), by Destination 2025 & 2033

- Figure 30: South Africa Air Freight Forwarding Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South Africa Air Freight Forwarding Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Air Freight Forwarding Market Revenue (Million), by Service 2025 & 2033

- Figure 33: South America Air Freight Forwarding Market Revenue Share (%), by Service 2025 & 2033

- Figure 34: South America Air Freight Forwarding Market Revenue (Million), by Destination 2025 & 2033

- Figure 35: South America Air Freight Forwarding Market Revenue Share (%), by Destination 2025 & 2033

- Figure 36: South America Air Freight Forwarding Market Revenue (Million), by Country 2025 & 2033

- Figure 37: South America Air Freight Forwarding Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 3: Global Air Freight Forwarding Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 6: Global Air Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 12: Global Air Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Netherlands Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Italy Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 21: Global Air Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Singapore Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Indonesia Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 32: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 33: Global Air Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 35: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 36: Global Air Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Egypt Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Countries Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Air Freight Forwarding Market Revenue Million Forecast, by Service 2020 & 2033

- Table 41: Global Air Freight Forwarding Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 42: Global Air Freight Forwarding Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Chile Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Air Freight Forwarding Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Freight Forwarding Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Air Freight Forwarding Market?

Key companies in the market include Hellmann Worldwide Logistics, DB Schenker Logistics, Nippon Express, Bolloré Logistics, UPS Supply Chain Solutions, DHL Supply Chain & Global Forwarding, Expeditors International, Kuehne + Nagel, Kintetsu World Express**List Not Exhaustive, DSV Panalpina.

3. What are the main segments of the Air Freight Forwarding Market?

The market segments include Service, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce.

6. What are the notable trends driving market growth?

The increase in E-Commerce is driving the Market.

7. Are there any restraints impacting market growth?

Cargo Restrictions.

8. Can you provide examples of recent developments in the market?

August 2023: National Airlines (NASDAQ: NATUAL), a division of national air cargo group, Inc., and Etihad Cargo (MENA, a.k.a. Etihad Cargo), a dynamic Middle East-based freight carrier, has entered into an Interline Agreement for the successful implementation of the International Civil Aviation Regulations 23rd (ICAIR23) program for the U.S. Postal Service. This interline agreement establishes a unique partnership between National Airlines, which has decades of experience in international freight transportation, and Etihad Cargo, which has a global commercial network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Freight Forwarding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Freight Forwarding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Freight Forwarding Market?

To stay informed about further developments, trends, and reports in the Air Freight Forwarding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence