Key Insights

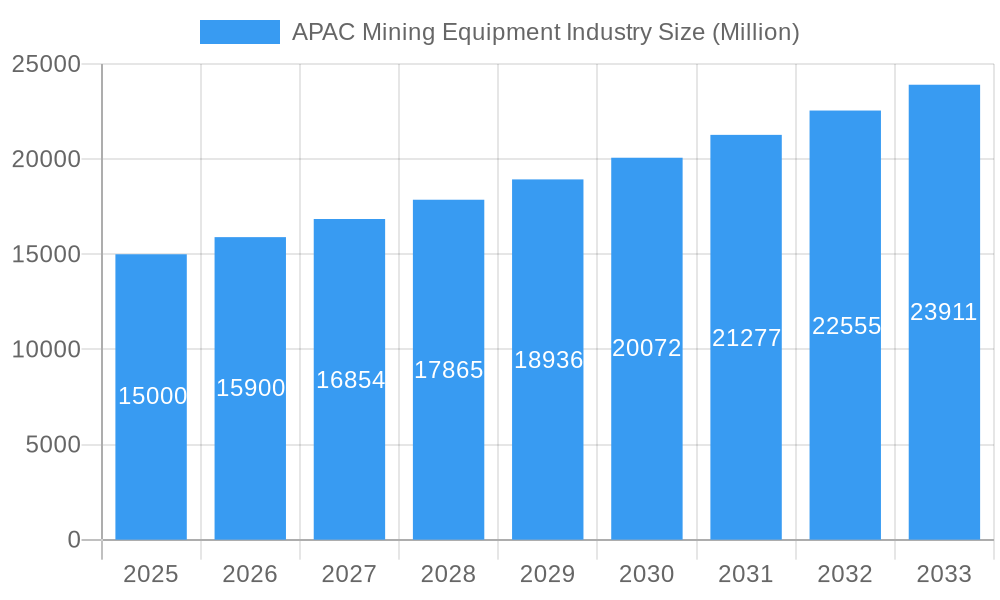

The Asia-Pacific (APAC) mining equipment market is poised for significant expansion, driven by escalating mining activities and robust demand for raw materials. Technological advancements in automation, autonomous systems, and sustainable practices are key growth catalysts. The market is segmented by equipment type and battery technology, with a notable shift towards electric and hybrid solutions influenced by environmental regulations. Key industry players are prioritizing R&D to enhance equipment efficiency and sustainability. Projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8%, the market is forecast to reach substantial value by 2033.

APAC Mining Equipment Industry Market Size (In Billion)

The competitive landscape features dominant global manufacturers alongside agile regional providers offering localized solutions. Continuous infrastructure development, technological innovation, and the adoption of eco-friendly mining methods are expected to fuel market growth. Emphasis on safety and productivity will further drive demand for advanced mining equipment. Evolving segmentation, particularly in battery technology and digital integration, will reshape operational paradigms. The market is projected to experience sustained expansion from 2025 to 2033, building upon a 2025 market size of $88.2 billion.

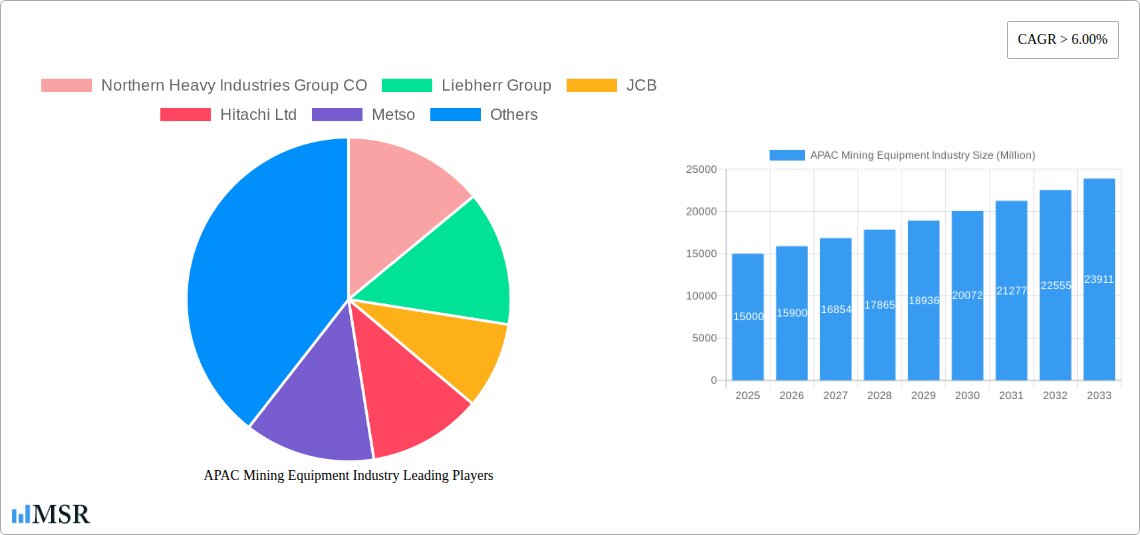

APAC Mining Equipment Industry Company Market Share

APAC Mining Equipment Market Analysis: Growth Drivers, Trends, and Forecast (2025-2033)

This comprehensive report delivers critical insights into the Asia-Pacific (APAC) mining equipment industry for the 2019-2033 period. With a 2025 base year and a 2025-2033 forecast, it details market dynamics, growth drivers, challenges, and opportunities. In-depth analysis of market segments, leading players, and emerging technologies empowers strategic decision-making. The estimated market size for 2025 is $88.2 billion, with an anticipated CAGR of 6.8% for 2025-2033.

APAC Mining Equipment Industry Market Concentration & Dynamics

The APAC mining equipment market exhibits moderate concentration, with key players like Caterpillar Inc, Hitachi Ltd, and Liebherr Group holding significant market share. However, the presence of several regional players and emerging entrants fosters competition. Market share dynamics are significantly influenced by technological innovation, particularly in automation and electrification. Stringent environmental regulations are driving the adoption of cleaner technologies, while fluctuating commodity prices and geopolitical factors contribute to market volatility. The historical period (2019-2024) witnessed XX M&A deals, indicating consolidation efforts within the industry. Substitute products, such as alternative excavation methods, present a moderate challenge. End-user trends show a growing preference for sustainable and efficient equipment.

APAC Mining Equipment Industry Industry Insights & Trends

The APAC mining equipment market is experiencing robust growth, driven by increasing mining activities across the region, fueled by rising demand for minerals and metals. Technological advancements, such as autonomous vehicles and advanced analytics, are transforming operational efficiency and safety standards. The shift towards sustainable mining practices is further accelerating the adoption of electric and hybrid mining equipment. The market size in 2024 was estimated at $XX Million, and a significant expansion is projected during the forecast period. The evolving consumer behavior reflects a preference for technologically advanced, energy-efficient, and environmentally responsible equipment. This trend is further amplified by stricter environmental regulations and a greater focus on corporate social responsibility within the mining industry. The increasing adoption of digital technologies like IoT and AI enhances productivity and reduces operational costs, further driving market growth.

Key Markets & Segments Leading APAC Mining Equipment Industry

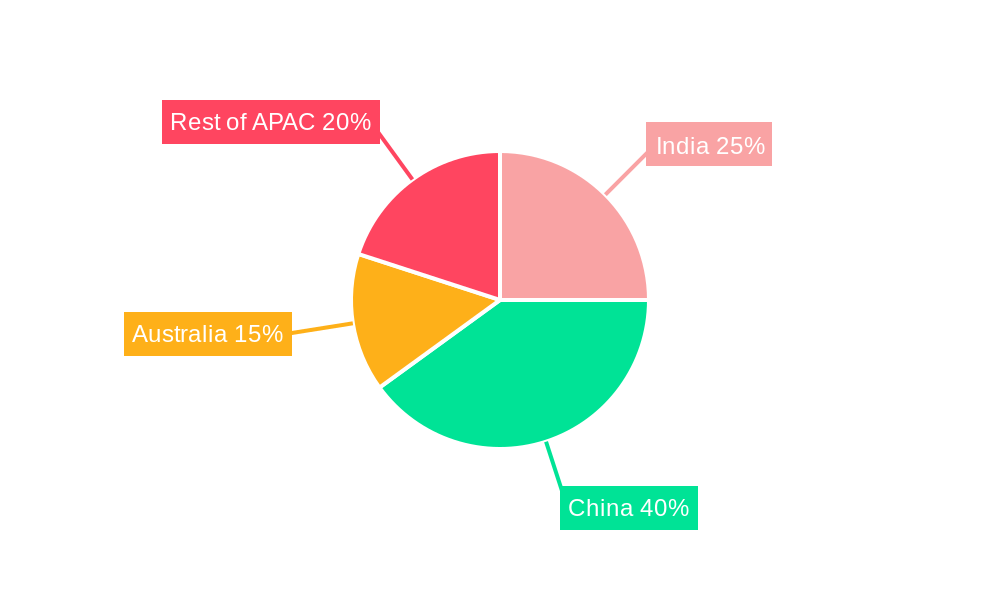

China remains the dominant market in the APAC region, followed by Australia and India. Strong economic growth, coupled with extensive infrastructure development projects in these countries, fuels demand for mining equipment.

- Dominant Region: China

- Key Growth Drivers:

- Robust economic growth

- Extensive infrastructure development

- Rising demand for raw materials

- Government initiatives supporting mining sector modernization

- Vehicle Type: Commercial vehicles dominate the market due to the heavy-duty nature of mining operations. The demand for passenger vehicles within mining operations is relatively small.

- Battery Type: Li-ion batteries are gaining traction due to their superior energy density and performance, despite higher initial costs compared to lead-acid batteries.

The dominance of China stems from its vast mining sector, significant infrastructure investment, and government support for technological advancement within the industry. Australia's strong mining sector and abundant mineral resources also contribute significantly to market demand. India’s growth trajectory is linked to rising infrastructure development and industrialization.

APAC Mining Equipment Industry Product Developments

Recent product innovations focus on enhancing efficiency, safety, and sustainability. Manufacturers are introducing autonomous mining trucks, electric excavators, and advanced monitoring systems. These advancements offer significant competitive advantages through improved productivity, reduced operational costs, and enhanced environmental compliance. The integration of IoT and AI capabilities is further optimizing equipment performance and minimizing downtime. The emphasis on automation is particularly notable, reflecting a broader industry-wide shift towards increased efficiency and reduced reliance on manual labor.

Challenges in the APAC Mining Equipment Industry Market

The APAC mining equipment market faces challenges such as volatile commodity prices, which directly impact investment decisions. Supply chain disruptions and the increasing complexity of regulatory compliance also pose significant hurdles. Intense competition, coupled with the need for continuous technological innovation to maintain a competitive edge, adds pressure on margins. These factors collectively impact market growth and profitability, requiring manufacturers to adopt agile strategies to mitigate risks. Furthermore, infrastructure limitations in certain regions can hinder the timely delivery of equipment and services.

Forces Driving APAP Mining Equipment Industry Growth

Technological advancements, including automation, electrification, and data analytics, are key growth drivers. The increasing demand for minerals and metals, fueled by infrastructure development and industrialization across the APAC region, further accelerates market expansion. Supportive government policies and initiatives aimed at promoting sustainable mining practices are also contributing to growth. For example, government incentives for the adoption of green technologies within the mining sector propel market expansion.

Long-Term Growth Catalysts in the APAC Mining Equipment Industry

Long-term growth hinges on sustained technological innovation, strategic partnerships, and market expansion into new geographies. The development of more sustainable and efficient mining equipment will be critical. Companies are likely to form strategic alliances to access new markets and technologies, driving further growth. Expansion into less explored regions of APAC, particularly in Southeast Asia, offers considerable potential for growth.

Emerging Opportunities in the APAC Mining Equipment Industry

The adoption of digital technologies, such as AI and IoT, presents significant opportunities for enhancing operational efficiency and safety. The growing demand for sustainable mining practices opens avenues for the development and deployment of green technologies. Emerging markets in Southeast Asia offer significant expansion potential, while the increasing focus on data analytics creates opportunities for value-added services. Furthermore, the potential for the development of advanced mining robots is attracting considerable attention.

Leading Players in the APAC Mining Equipment Industry Sector

- Northern Heavy Industries Group CO

- Liebherr Group

- JCB

- Hitachi Ltd

- Metso

- Caterpillar Inc

- Sany Heavy Equipment International Holdings

- Tata Motor

- AB Volvo

Key Milestones in APAC Mining Equipment Industry Industry

- 2020: Introduction of the first fully autonomous mining truck in Australia.

- 2021: Several major mining companies in China announced significant investments in electric mining equipment.

- 2022: A significant merger between two leading mining equipment manufacturers in India.

- 2023: Launch of a new generation of electric excavators with enhanced battery technology.

Strategic Outlook for APAC Mining Equipment Industry Market

The APAC mining equipment market is poised for significant growth over the next decade, driven by sustained demand for minerals and metals, technological advancements, and supportive government policies. Strategic opportunities lie in developing and deploying sustainable and technologically advanced equipment. Companies that successfully adapt to the evolving regulatory landscape and technological disruptions will be best positioned to capitalize on this growth potential. Focus on providing comprehensive solutions that integrate technology, equipment, and services will be crucial for success.

APAC Mining Equipment Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Battery Type

- 2.1. Li-ion

- 2.2. Lead Acid

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. India

- 3.1.2. China

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

APAC Mining Equipment Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

APAC Mining Equipment Industry Regional Market Share

Geographic Coverage of APAC Mining Equipment Industry

APAC Mining Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Increase in number of Mineral Exploration Sites

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Mining Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Li-ion

- 5.2.2. Lead Acid

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. India

- 5.3.1.2. China

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Northern Heavy Industries Group CO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JCB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sany Heavy Equipment International Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tata Motor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AB Volvo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Northern Heavy Industries Group CO

List of Figures

- Figure 1: APAC Mining Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Mining Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 3: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: APAC Mining Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: APAC Mining Equipment Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: APAC Mining Equipment Industry Revenue billion Forecast, by Battery Type 2020 & 2033

- Table 7: APAC Mining Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: APAC Mining Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: India APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: China APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific APAC Mining Equipment Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Mining Equipment Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the APAC Mining Equipment Industry?

Key companies in the market include Northern Heavy Industries Group CO, Liebherr Group, JCB, Hitachi Ltd, Metso, Caterpillar Inc, Sany Heavy Equipment International Holdings, Tata Motor, AB Volvo.

3. What are the main segments of the APAC Mining Equipment Industry?

The market segments include Vehicle Type, Battery Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Increase in number of Mineral Exploration Sites.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Mining Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Mining Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Mining Equipment Industry?

To stay informed about further developments, trends, and reports in the APAC Mining Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence