Key Insights

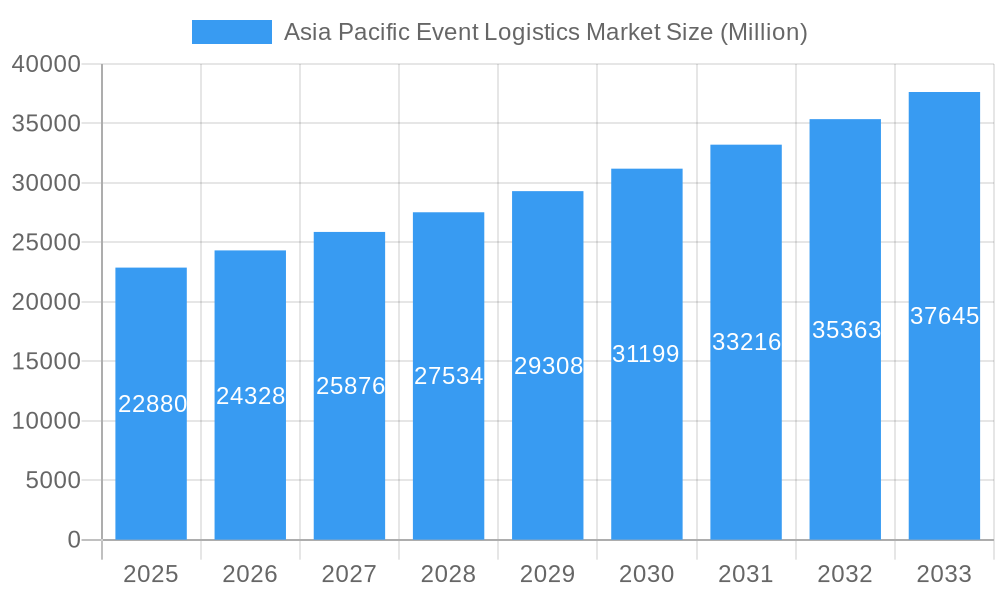

The Asia Pacific event logistics market, valued at $22.88 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning entertainment and sports industries in the region, coupled with the increasing frequency and scale of trade fairs and exhibitions, are significantly boosting demand for efficient and reliable logistics solutions. Furthermore, technological advancements, such as improved inventory management systems and sophisticated distribution networks, are streamlining operations and enhancing overall efficiency. Growth is particularly strong in countries like China, India, and South Korea, driven by rising disposable incomes, a growing middle class, and increasing government support for infrastructure development. However, challenges remain. Geopolitical uncertainties, fluctuating fuel prices, and potential disruptions to global supply chains pose risks to market growth. Competition among established players and new entrants is intensifying, putting pressure on pricing and profit margins. The market is segmented by type (inventory control, distribution systems, logistics solutions) and application (entertainment, sports, trade fairs, others), allowing for tailored solutions and strategic market penetration. The ongoing development of sustainable and environmentally friendly logistics practices presents both a challenge and an opportunity for market players. Companies are increasingly focusing on optimizing their supply chains to reduce carbon emissions and improve their environmental footprint, aligning with growing consumer and regulatory pressure.

Asia Pacific Event Logistics Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued expansion, driven by consistent economic growth in the Asia-Pacific region and the increasing sophistication of event management. The dominance of countries like China and Japan, with their established infrastructure and large event markets, is likely to continue. However, emerging economies like India and South Korea are projected to witness significant growth, presenting substantial opportunities for logistics providers. The competitive landscape is likely to remain dynamic, with established global players facing competition from regional specialists and technology-driven startups. Successful companies will need to adapt to evolving market needs, embrace technological innovation, and prioritize sustainability to secure a leading position in this burgeoning market.

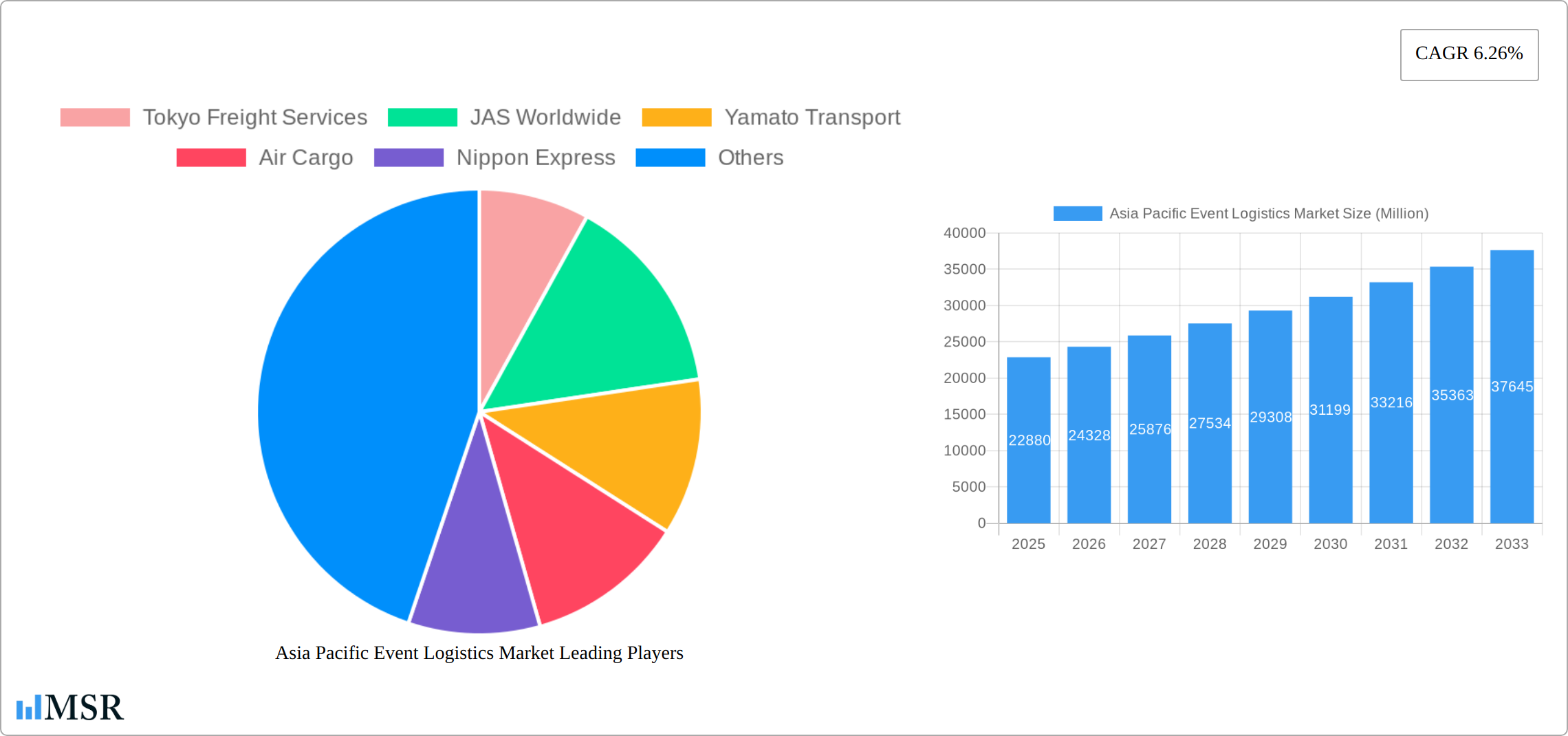

Asia Pacific Event Logistics Market Company Market Share

Asia Pacific Event Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific event logistics market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report examines market dynamics, key segments, leading players, and future growth opportunities. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific Event Logistics Market Market Concentration & Dynamics

The Asia Pacific event logistics market exhibits a moderately concentrated landscape, with a handful of major players commanding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive environment. Innovation is driven by advancements in technology, particularly in areas like inventory management software, real-time tracking systems, and data analytics. Regulatory frameworks vary across countries within the region, impacting operational efficiency and compliance costs. Substitute products, such as independent transportation providers for smaller events, pose a competitive threat, particularly to firms lacking a diversified service portfolio. End-user trends reveal a growing preference for integrated logistics solutions that streamline event planning and execution. Mergers and acquisitions (M&A) activity within the sector is robust, with a total of xx M&A deals recorded between 2019 and 2024. Key players like Nippon Express and Kuehne + Nagel are actively shaping the market through strategic acquisitions and partnerships.

- Market Share: Top 5 players hold approximately xx% of the market share (2024).

- M&A Activity: xx deals in the historical period (2019-2024). A significant increase is expected in the forecast period.

- Key Players' Strategies: Focus on expansion through acquisitions, technological upgrades, and service diversification.

Asia Pacific Event Logistics Market Industry Insights & Trends

The Asia Pacific event logistics market is experiencing robust growth, fueled by a confluence of factors. The region's rapidly expanding economies, particularly in China, India, and South Korea, are driving significant demand for efficient and reliable event logistics services. This surge is further amplified by rising disposable incomes and increased participation in diverse events, including entertainment spectacles, major sporting events, and large-scale trade shows. The integration of cutting-edge technologies, such as artificial intelligence (AI) and blockchain technology, is revolutionizing supply chains, enhancing transparency, and optimizing operational efficiency. Furthermore, evolving consumer preferences for seamless and personalized experiences are pushing logistics providers to develop increasingly customized solutions. Market projections estimate a valuation of xx Million USD in 2025, showcasing a substantial and sustained growth trajectory. Key drivers include substantial investments in infrastructure development, rapid urbanization across the region, and proactive government initiatives designed to bolster the events industry.

Key Markets & Segments Leading Asia Pacific Event Logistics Market

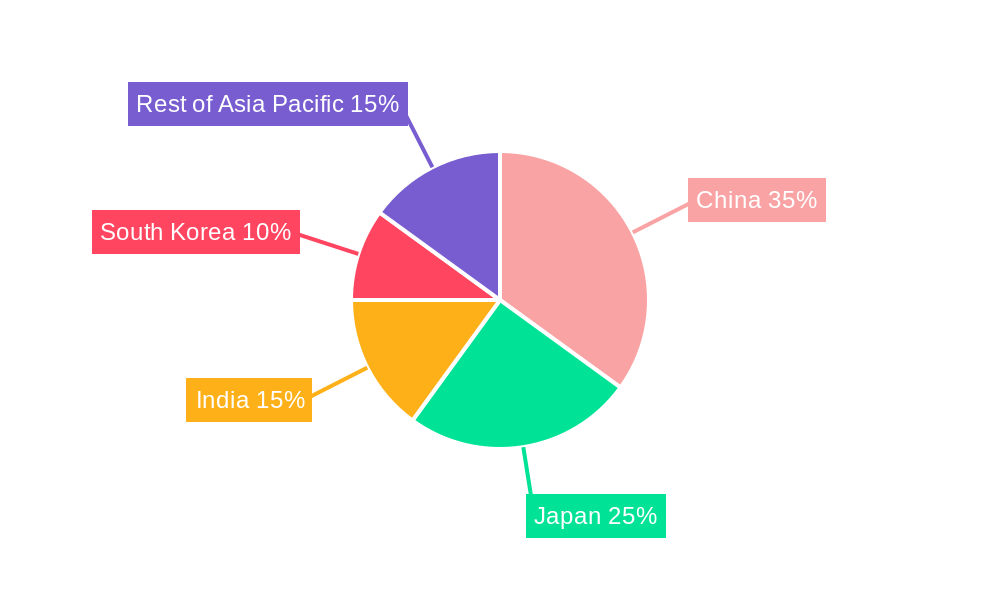

Within the Asia Pacific region, the China event logistics market commands the largest share, followed closely by Japan and India. This dominance stems from a potent combination of robust economic growth, flourishing event industries, and substantial investments in infrastructure development. The market is highly dynamic and segmented across various factors.

By Country:

- China: Characterized by high economic growth, a vast population, and a thriving events sector, creating immense logistical demands.

- Japan: Benefits from a strong infrastructure backbone, sophisticated logistics networks, and the hosting of major global events like the 2025 World Expo, driving substantial growth.

- India: Experiences rapid economic expansion, a burgeoning middle class with increased spending power, and a corresponding rise in demand for comprehensive event management services.

- South Korea: Leverages advanced infrastructure and technological capabilities, complemented by the popularity of K-pop and other cultural events, as well as a dynamic business events scene.

- Rest of Asia Pacific: This segment exhibits significant growth potential, driven by the expansion of emerging economies and a parallel increase in event participation across various sectors.

By Type of Service:

- Integrated Logistics Solutions: This segment shows the fastest growth, fueled by the increasing demand for comprehensive and specialized services that streamline the entire event logistics process.

- Distribution Systems: Experiences robust growth due to the escalating need for efficient and reliable goods movement, ensuring timely delivery to event venues.

- Inventory Management and Control: Demonstrates steady growth driven by the crucial need for efficient inventory management, particularly in large-scale events requiring meticulous tracking and handling of materials and equipment.

By Event Application:

- Trade Fairs and Exhibitions: This remains the largest application segment, reflecting the substantial logistics requirements inherent in managing these complex events.

- Entertainment Events (Concerts, Festivals): Shows strong growth, driven by the rising popularity of music festivals, concerts, and other entertainment events with diverse logistical needs.

- Sporting Events: This segment exhibits consistent growth, mirroring the increasing popularity of sporting events across the region, demanding specialized logistical solutions.

Asia Pacific Event Logistics Market Product Developments

Recent advancements include the implementation of AI-powered route optimization software, real-time tracking and monitoring systems, and drone delivery for specific applications. These innovations enhance efficiency, transparency, and security, creating a competitive edge for logistics providers. The integration of blockchain technology for improved supply chain traceability is gaining traction.

Challenges in the Asia Pacific Event Logistics Market Market

The Asia Pacific event logistics market faces several challenges, including fluctuating fuel prices and transportation costs, increasing regulatory compliance demands, infrastructure limitations in certain regions, and heightened competition among established and emerging players. Supply chain disruptions and natural disasters can also significantly impact operational efficiency and profitability. These factors can lead to increased costs and delays, impacting overall market growth.

Forces Driving Asia Pacific Event Logistics Market Growth

The market's expansion is propelled by several converging factors. These include rising disposable incomes and a burgeoning middle class across numerous countries, significant government investment in crucial infrastructure projects (improved roads, ports, and transportation networks), and the transformative impact of technological advancements such as AI and automation, which drastically enhance efficiency and reduce costs. The ever-increasing popularity of large-scale events further accelerates demand for robust and sophisticated logistics solutions.

Challenges in the Asia Pacific Event Logistics Market Market (Long-Term Growth Catalysts)

Long-term growth is predicated on innovation in technology, strategic partnerships to expand service offerings and geographical reach, and proactive adaptation to evolving customer needs. Focusing on sustainability and environmental responsibility will also be critical for attracting environmentally conscious clients.

Emerging Opportunities in Asia Pacific Event Logistics Market

Significant emerging opportunities exist in the expansion into niche markets, such as the rapidly growing e-sports industry and the increasingly prevalent virtual events, both of which demand specialized logistical support. The growing adoption of sustainable logistics practices, including the utilization of electric vehicle fleets and carbon-neutral shipping options, presents substantial opportunities for environmentally conscious logistics providers. Furthermore, the seamless integration of advanced technologies and the personalization of customer experiences will play a pivotal role in shaping future market dynamics and competitiveness.

Leading Players in the Asia Pacific Event Logistics Market Sector

- Tokyo Freight Services

- JAS Worldwide

- Yamato Transport

- Air Cargo

- Nippon Express

- Kuehne + Nagel

- CEVA Logistics

- YTO Express

- Geodis

- Sagwa Express

- Sankayu Inc

- DP World

Key Milestones in Asia Pacific Event Logistics Market Industry

- November 2023: Global Critical Logistics (GCL) acquires Time Frame Logistics and Xtreme Forwarding in New Zealand, strengthening its position in the live event logistics sector. This acquisition significantly impacts the market by expanding GCL's reach and service capabilities in the Asia Pacific region.

- August 2022: Nippon Express is selected as the official logistics partner for Expo 2025 in Osaka, Japan, highlighting the importance of reliable and large-scale logistics capabilities in major international events. This underscores the significance of strategic partnerships and expertise in handling large-volume cargo for major events.

Strategic Outlook for Asia Pacific Event Logistics Market Market

The Asia Pacific event logistics market presents significant growth potential, driven by favorable economic conditions, technological advancements, and a growing demand for seamless event experiences. Strategic opportunities include investing in technological innovation, expanding service offerings to cater to diverse event types, forging strategic partnerships, and focusing on sustainability. Companies that can successfully adapt to evolving customer needs and leverage technological advancements will be best positioned for future success.

Asia Pacific Event Logistics Market Segmentation

-

1. Type

- 1.1. Inventory Control

- 1.2. Distribution Systems

- 1.3. Logistics Solutions

-

2. Application

- 2.1. Entertainment

- 2.2. Sports

- 2.3. Trade fair

- 2.4. Others

Asia Pacific Event Logistics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Event Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific Event Logistics Market

Asia Pacific Event Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exhibitions and Conferences are driving the market; Sports Events are driving the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Sports Events are Driving the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inventory Control

- 5.1.2. Distribution Systems

- 5.1.3. Logistics Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Entertainment

- 5.2.2. Sports

- 5.2.3. Trade fair

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tokyo Freight Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS Worldwide

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yamato Transport

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Air Cargo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuhene + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YTO Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Geodis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sagwa Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sankayu Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DP World

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tokyo Freight Services

List of Figures

- Figure 1: Asia Pacific Event Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Event Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Event Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Asia Pacific Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Event Logistics Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Asia Pacific Event Logistics Market?

Key companies in the market include Tokyo Freight Services, JAS Worldwide, Yamato Transport, Air Cargo, Nippon Express, Kuhene + Nagel, CEVA Logistics, YTO Express, Geodis, Sagwa Express, Sankayu Inc, DP World.

3. What are the main segments of the Asia Pacific Event Logistics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Exhibitions and Conferences are driving the market; Sports Events are driving the market growth.

6. What are the notable trends driving market growth?

Sports Events are Driving the Market in the Region.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

November 2023: Global Critical Logistics, Asia Pacific’s largest time-critical & live event logistics company, has acquired two New Zealand forwarders. GCL announced the acquisition of Auckland-based time frame logistics and Wellington-based Xtreme forwarding yesterday. Time Frame is a leading provider of live event logistics services and will see its assets and operations transferred to GCL's live event business, Rock-it Global. Xtreme forwarding will now be renamed Rock-it New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Event Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Event Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Event Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Event Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence