Key Insights

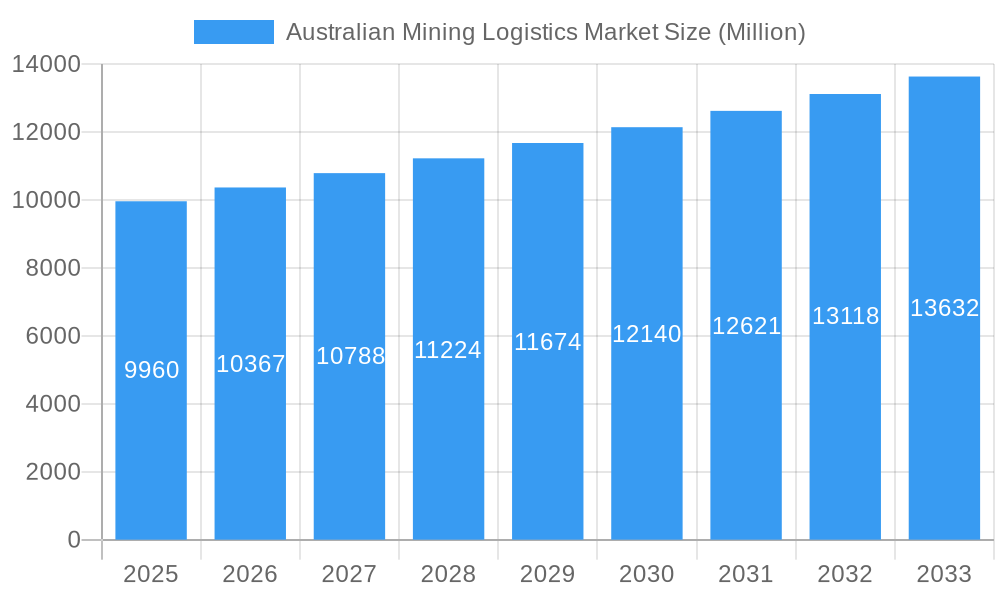

The Australian mining logistics market, valued at $9.96 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.04% from 2025 to 2033. This expansion is fueled by several key factors. Increased mining activity, particularly in iron ore, base metals, and coal, necessitates efficient and reliable transportation and warehousing solutions. The rising demand for value-added services, such as specialized handling and inventory management tailored to the specific needs of mining operations, further contributes to market growth. Government initiatives promoting infrastructure development and sustainable mining practices also play a significant role. However, challenges such as fluctuating commodity prices, labor shortages, and the need for robust cybersecurity measures to protect sensitive supply chain data pose potential restraints on market expansion. The market is segmented by service type (transportation, warehousing, inventory management, and value-added services) and mineral/metal type (iron ore, base metals, coal, gold, and others). Key players include established logistics providers like UC Logistics Australia, SCE Australia, Tranz Logistics, Toll Holdings Limited, ATG Australian Transit Group, Centurion, Campbell Transport, National Group, Linfox Pty Ltd, and mining giants like Vale, Kalari, and Bis Industries. Competition is fierce, with companies focusing on technological advancements, strategic partnerships, and specialized service offerings to gain a competitive edge.

Australian Mining Logistics Market Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continued growth, though the rate might fluctuate based on global economic conditions and the specific performance of various mining sectors. The dominance of iron ore and base metals in the mining logistics sector is expected to persist, however, diversification into other minerals and metals along with the increasing reliance on technology in managing the supply chain will likely alter the market landscape. Companies will be compelled to invest in sustainable practices to meet evolving environmental regulations and client demands, further impacting the market trajectory. The long-term outlook remains positive, with significant potential for further expansion driven by technological innovation, strategic alliances, and the overarching growth of the Australian mining industry.

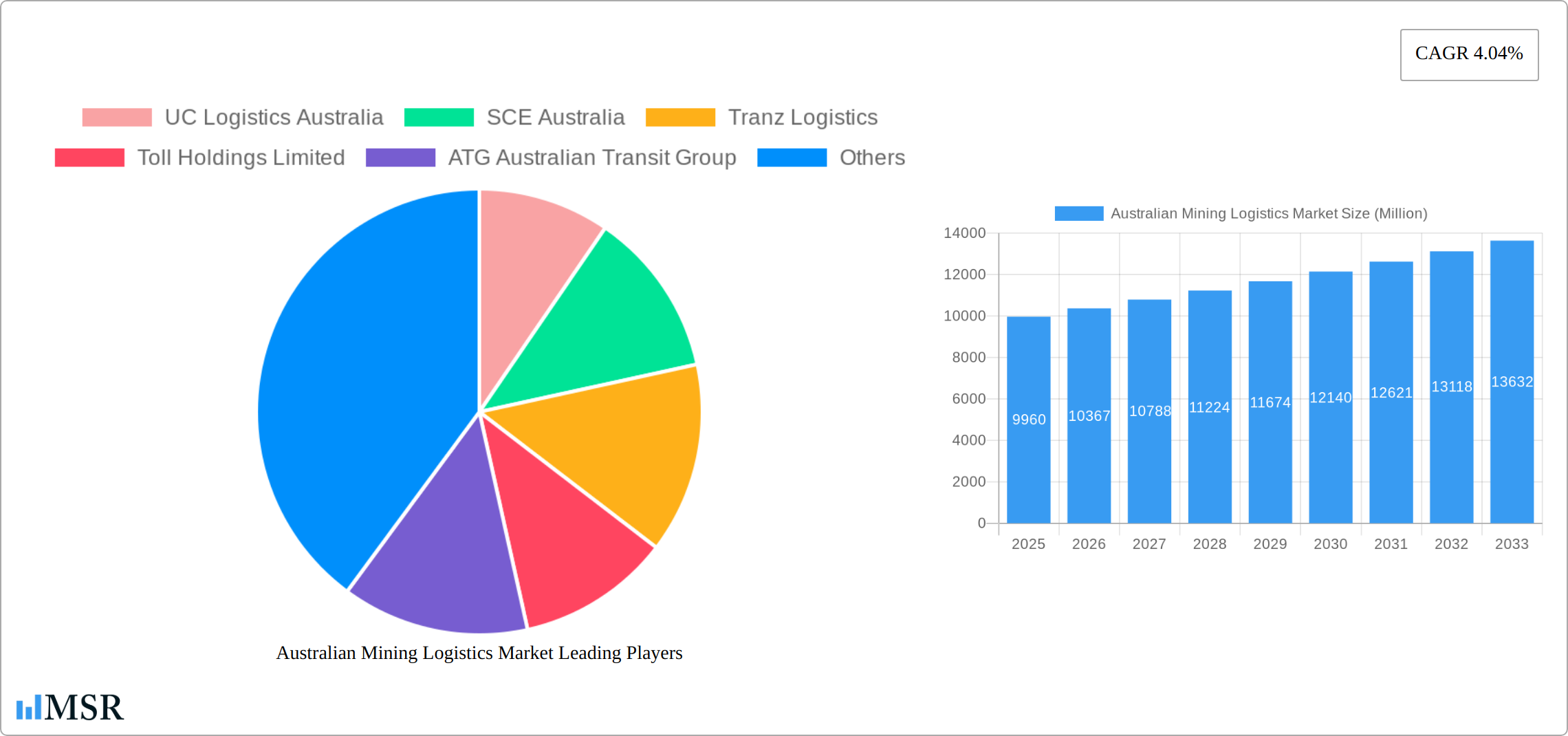

Australian Mining Logistics Market Company Market Share

Australian Mining Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian mining logistics market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market trends, key players, and future growth opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Australian Mining Logistics Market Market Concentration & Dynamics

The Australian mining logistics market exhibits a moderately concentrated landscape, with several large players holding significant market share. However, the presence of numerous smaller, specialized companies fosters competition and innovation. Market share is dynamic, influenced by factors including M&A activity, operational efficiency, and service offerings.

Market Concentration: The top 5 players account for approximately xx% of the market share in 2025. This concentration is expected to remain relatively stable throughout the forecast period, although potential M&A activity could shift the dynamics.

Innovation Ecosystems: The market is witnessing the emergence of innovative technologies, such as AI-powered route optimization and autonomous vehicles, impacting operational efficiency and reducing costs.

Regulatory Frameworks: Stringent environmental regulations and safety standards influence operational practices and investments in sustainable logistics solutions. Compliance is a key factor for market participation.

Substitute Products: Limited viable substitutes exist for specialized mining logistics services, however, increased use of rail transport may present some level of substitution in certain segments.

End-User Trends: Growing demand for efficient and cost-effective logistics solutions from mining companies is a major driver of market growth. Emphasis on sustainable and environmentally responsible practices is also influencing procurement decisions.

M&A Activities: The past five years have seen xx M&A deals, indicating a consolidation trend within the sector. This activity is expected to continue, driven by the pursuit of scale and expanded service offerings.

Australian Mining Logistics Market Industry Insights & Trends

The Australian mining logistics market is experiencing robust growth, driven by the nation's substantial mining sector and its associated resource extraction activities. This expansion is fueled by several key factors:

Market Growth Drivers: Increased mining production, particularly in key commodities like iron ore, coal, and increasingly, critical minerals like lithium and rare earth elements, is a primary driver. Significant infrastructure development projects, coupled with supportive government initiatives aimed at boosting resource extraction and export, further fuel market growth. The global surge in demand for critical minerals used in electric vehicles and renewable energy technologies significantly contributes to the overall market expansion.

Technological Disruptions: Automation and digitalization are revolutionizing the logistics landscape. Real-time tracking systems utilizing GPS and IoT sensors, AI-powered route optimization and predictive maintenance, and the increasing deployment of autonomous vehicles and drones are enhancing efficiency, reducing costs, and improving safety. The adoption rate of these technologies is expected to accelerate significantly in the coming years, driven by both cost-saving pressures and a need for enhanced operational visibility.

Evolving Consumer Behaviors and Sustainability Focus: Mining companies are increasingly prioritizing sustainability and supply chain resilience. This translates into a heightened demand for green logistics solutions, including the use of alternative fuels, optimized routing to minimize emissions, and partnerships with providers committed to environmentally responsible practices. This shift is fundamentally reshaping procurement strategies, impacting service provider selection, and creating a preference for companies demonstrating robust ESG (Environmental, Social, and Governance) performance. Market forecasts project significant growth, with the market value expected to reach [Insert Updated Market Value] by 2033.

Key Markets & Segments Leading Australian Mining Logistics Market

The Australian mining logistics market is geographically diverse, with significant activity across various states. Specific segments within the sector also exhibit robust growth:

Dominant Regions/Segments: Western Australia, Queensland, and New South Wales represent key markets due to high mining activity. Transportation services constitute the largest market segment, followed by warehousing and inventory management.

Growth Drivers (by Segment):

- Transportation: Increased mining production and infrastructure development drive growth.

- Warehousing & Inventory Management: Growing demand for efficient storage and handling solutions for mined materials boosts this segment.

- Value-Added Services: Demand for specialized services like customs brokerage and supply chain optimization is increasing.

- Iron Ore: Remains the dominant mineral, driving significant logistics demand.

- Coal: Continues to contribute significantly despite facing headwinds from global environmental concerns.

- Base Metals: Growing demand for base metals, including copper and nickel, supports logistics growth.

- Gold: The gold mining sector contributes to stable logistics demand.

Australian Mining Logistics Market Product Developments

Technological advancements are continuously refining the efficiency and effectiveness of mining logistics. Key developments include sophisticated real-time tracking systems integrating data from various sources, improved vehicle technologies such as autonomous haul trucks and improved fuel efficiency in existing fleets, and advanced warehousing management systems leveraging AI and machine learning for inventory optimization and predictive analytics. These advancements deliver enhanced visibility across the entire supply chain, reduced transit times, minimized operational costs, and improved overall competitiveness within the industry. The development of specialized transport solutions for handling sensitive or hazardous materials is also a significant area of growth.

Challenges in the Australian Mining Logistics Market Market

The Australian mining logistics market faces several challenges including:

- Regulatory Hurdles: Compliance with environmental regulations and safety standards adds operational complexities and increases costs.

- Supply Chain Issues: Driver shortages, infrastructure limitations, and fluctuating fuel prices disrupt operations and impact cost management.

- Competitive Pressures: The moderately concentrated market fosters competition, requiring providers to offer innovative solutions and efficient operations to remain competitive. The impact of these challenges is estimated to reduce annual growth by approximately xx%.

Forces Driving Australian Mining Logistics Market Growth

Key growth drivers include increasing mining production, infrastructure investments, technological advancements (e.g., automation, digitalization), government support for the mining sector, and rising demand for critical minerals for use in renewable energy technologies. The ongoing exploration of new mining projects will also significantly contribute to future market growth.

Long-Term Growth Catalysts in the Australian Mining Logistics Market

Long-term growth is expected to be driven by the continued expansion of the mining sector, sustained demand for minerals, and ongoing technological innovations in logistics and transportation. Strategic partnerships between logistics providers and mining companies will further streamline operations and enhance efficiency, thus supporting market expansion.

Emerging Opportunities in Australian Mining Logistics Market

Significant opportunities exist for innovative providers, including: the growing demand for sustainable and responsible logistics solutions, the increasing adoption of digital technologies such as blockchain for enhanced traceability and supply chain transparency, the expansion into emerging mining regions and resource projects, and the focus on improving overall supply chain resilience through diversification and risk management. The integration of advanced analytics to optimize logistics networks and predict potential disruptions will also create substantial new business opportunities.

Leading Players in the Australian Mining Logistics Market Sector

- UC Logistics Australia

- SCE Australia

- Tranz Logistics

- Toll Holdings Limited

- ATG Australian Transit Group

- Centurion

- Campbell Transport

- National Group

- Linfox Pty Ltd

- Vale

- Kalari

- Bis Industries

Key Milestones in Australian Mining Logistics Market Industry

- March 2022: Rio Tinto's USD 825 Million acquisition of the Rincon lithium project underscores the significant investment in the battery materials sector, creating substantial demand for efficient and reliable logistics services supporting the entire value chain from extraction to processing and refinement.

- January 2022: Bis Industries' multi-year haulage contract with Hunter Valley Operations exemplifies the ongoing demand for efficient and cost-effective transportation solutions within the coal mining sector, highlighting the importance of strong partnerships and long-term commitments.

- [Add more recent milestones with details and sources] Include at least 2-3 more recent significant developments or announcements, ideally with quantifiable data such as investment figures, contract values, or technological advancements.

Strategic Outlook for Australian Mining Logistics Market Market

The Australian mining logistics market is poised for sustained growth, driven by a combination of factors including increasing mining output, technological advancements, and a focus on sustainability. Companies that adapt to evolving industry trends, embrace innovation, and prioritize operational efficiency will be best positioned to capitalize on the significant growth opportunities within this dynamic sector. The market’s future potential is considerable, particularly given the rising global demand for critical minerals and Australia's significant resource endowment.

Australian Mining Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added Services

-

2. Mineral/Metal

- 2.1. Iron Ore

- 2.2. Base Metals

- 2.3. Coal

- 2.4. Gold

- 2.5. Others

Australian Mining Logistics Market Segmentation By Geography

- 1. Australia

Australian Mining Logistics Market Regional Market Share

Geographic Coverage of Australian Mining Logistics Market

Australian Mining Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Increasing Exports from the Mining Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australian Mining Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Mineral/Metal

- 5.2.1. Iron Ore

- 5.2.2. Base Metals

- 5.2.3. Coal

- 5.2.4. Gold

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UC Logistics Australia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SCE Australia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tranz Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toll Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ATG Australian Transit Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Centurion

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Campbell Transport**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 National Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Linfox Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vale

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kalari

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bis Industries

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 UC Logistics Australia

List of Figures

- Figure 1: Australian Mining Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australian Mining Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Australian Mining Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Australian Mining Logistics Market Revenue Million Forecast, by Mineral/Metal 2020 & 2033

- Table 3: Australian Mining Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australian Mining Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Australian Mining Logistics Market Revenue Million Forecast, by Mineral/Metal 2020 & 2033

- Table 6: Australian Mining Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australian Mining Logistics Market?

The projected CAGR is approximately 4.04%.

2. Which companies are prominent players in the Australian Mining Logistics Market?

Key companies in the market include UC Logistics Australia, SCE Australia, Tranz Logistics, Toll Holdings Limited, ATG Australian Transit Group, Centurion, Campbell Transport**List Not Exhaustive, National Group, Linfox Pty Ltd, Vale, Kalari, Bis Industries.

3. What are the main segments of the Australian Mining Logistics Market?

The market segments include Service, Mineral/Metal.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.96 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Increasing Exports from the Mining Industry.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

March 2022: After approval from Australia's Foreign Investment Review Board, Rio Tinto has completed the USD 825 million acquisition of the Rincon lithium project in Argentina. In a time of limited supply, Rincon positioned Rio Tinto to meet the double-digit growth in lithium demand over the next ten years by strengthening their battery materials business. As they construct this project to the highest ESG standards, they will collaborate with neighborhood residents, the Province of Salta, and the Government of Argentina.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australian Mining Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australian Mining Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australian Mining Logistics Market?

To stay informed about further developments, trends, and reports in the Australian Mining Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence