Key Insights

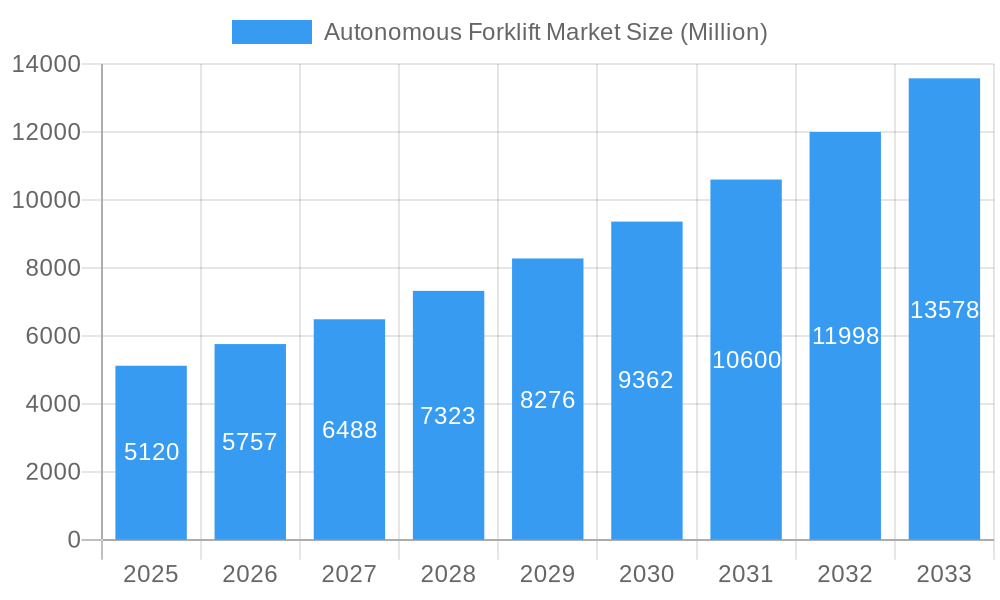

The Autonomous Forklift Market is experiencing robust growth, projected to reach a market size of $5.12 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.25% from 2025 to 2033. This expansion is driven by several key factors. Increased demand for enhanced efficiency and productivity in logistics and warehousing operations is a primary driver, as autonomous forklifts offer significant improvements in speed, accuracy, and safety compared to manually operated counterparts. The rising adoption of Industry 4.0 technologies, including automation and robotics, further fuels market growth. Furthermore, the growing need to reduce labor costs and improve workplace safety, particularly in demanding industrial environments, significantly contributes to the market's expansion. The integration of advanced navigation technologies like laser guidance and vision systems is enhancing the precision and reliability of these machines, making them suitable for complex warehouse layouts and diverse applications.

Autonomous Forklift Market Market Size (In Billion)

Segmentation analysis reveals a dynamic market landscape. The "Above 10 Tons" capacity segment is expected to witness significant growth due to increasing demand in heavy-duty applications within manufacturing and material handling. Similarly, laser and vision guidance systems are gaining traction owing to their enhanced accuracy and adaptability compared to older technologies like optical tape guidance. The logistics and warehousing sector currently holds the largest application share, while the electric propulsion type is witnessing faster adoption driven by sustainability concerns and reduced operational costs. Key players like Jungheinrich AG, Hyster-Yale Group Inc., and Toyota Industries Corporation are strategically investing in research and development to improve autonomous forklift technology, driving innovation and competition within the market. Regional growth will vary, with North America and Asia Pacific anticipated to be key markets given the established industrial infrastructure and significant investments in automation technologies. Growth in developing economies like India and China is also projected to be substantial, driven by increasing manufacturing activity and urbanization.

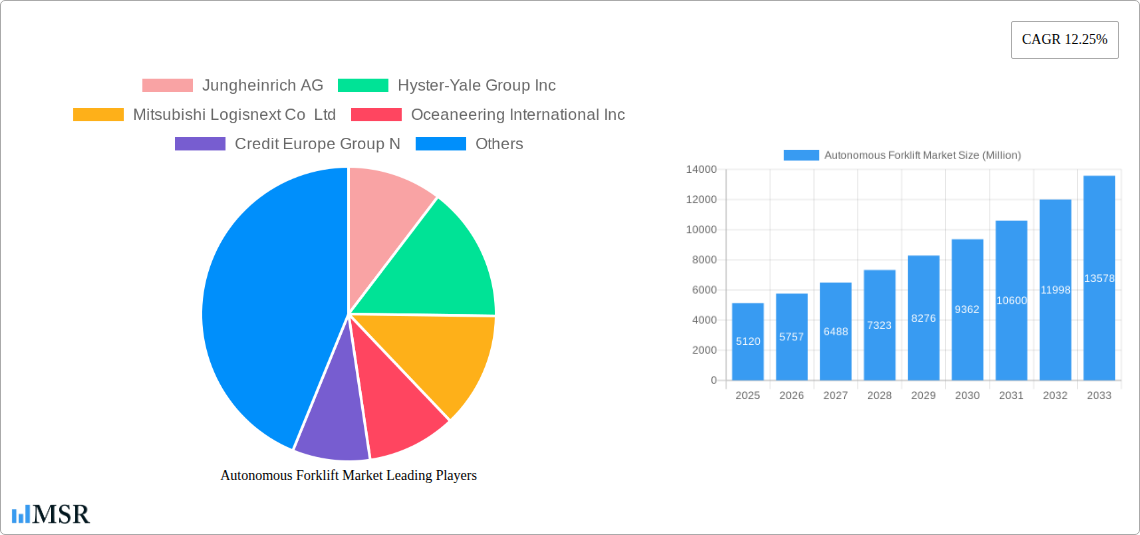

Autonomous Forklift Market Company Market Share

Autonomous Forklift Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Autonomous Forklift Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this rapidly evolving landscape. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis, covering market segmentation, key players, technological advancements, and future growth projections, all while incorporating recent significant industry developments. The market is poised for substantial growth, projected to reach xx Million by 2033, driven by increasing adoption across various sectors and ongoing technological innovation.

Autonomous Forklift Market Concentration & Dynamics

The Autonomous Forklift Market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the emergence of innovative startups and technological advancements is fostering a dynamic competitive environment.

Market Share: The top 5 players account for approximately xx% of the global market share in 2025. This concentration is expected to slightly decrease by 2033 due to increased competition and market entry of new players.

Innovation Ecosystems: The market is characterized by robust R&D activities focused on enhancing navigation technologies (laser, vision, and AI-powered systems), improving battery life and efficiency, and expanding functionalities to meet diverse industry requirements. Collaborative partnerships between established players and technology startups are becoming increasingly prevalent, leading to rapid innovation cycles.

Regulatory Frameworks: Government regulations concerning safety, data privacy, and operational standards for autonomous vehicles are evolving. These regulations present both opportunities and challenges, driving the need for compliance and standardization across the industry.

Substitute Products: Traditional manually operated forklifts remain a significant substitute. However, the increasing economic advantages of automation (reduced labor costs, improved efficiency, and enhanced safety) are driving a transition towards autonomous systems.

End-User Trends: The growing demand for increased efficiency, reduced operational costs, and improved workplace safety in logistics, manufacturing, and warehousing sectors is fueling market growth. E-commerce expansion is a major driver, demanding enhanced automation and speed in fulfillment centers.

M&A Activities: The number of mergers and acquisitions (M&As) in the Autonomous Forklift Market is steadily increasing. Over the historical period (2019-2024), approximately xx M&A deals were recorded. This trend is expected to continue, driven by efforts to expand market share, integrate complementary technologies, and establish stronger competitive positions.

Autonomous Forklift Market Industry Insights & Trends

The global Autonomous Forklift Market is experiencing robust growth, driven by the increasing adoption of automation in various industries. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). This growth can be attributed to several factors, including:

Technological advancements: The development of sophisticated navigation systems, AI-powered decision-making capabilities, and improved battery technology are making autonomous forklifts increasingly reliable, efficient, and cost-effective.

Rising labor costs and shortages: The increasing cost of labor and the difficulty in finding skilled workers are pushing businesses to adopt automation solutions to improve operational efficiency and reduce labor dependency.

Enhanced safety and productivity: Autonomous forklifts contribute to a safer work environment by minimizing the risk of human error, resulting in reduced workplace accidents. They also enhance productivity through optimized material handling and streamlined workflows.

Increased demand from e-commerce: The exponential growth of e-commerce and the need for faster and more efficient order fulfillment are driving the demand for automated material handling solutions, including autonomous forklifts.

Government initiatives and subsidies: Many governments are promoting the adoption of automation technologies through financial incentives and supportive policies, fostering market expansion.

Key Markets & Segments Leading Autonomous Forklift Market

The Autonomous Forklift Market is experiencing significant growth across various segments and regions.

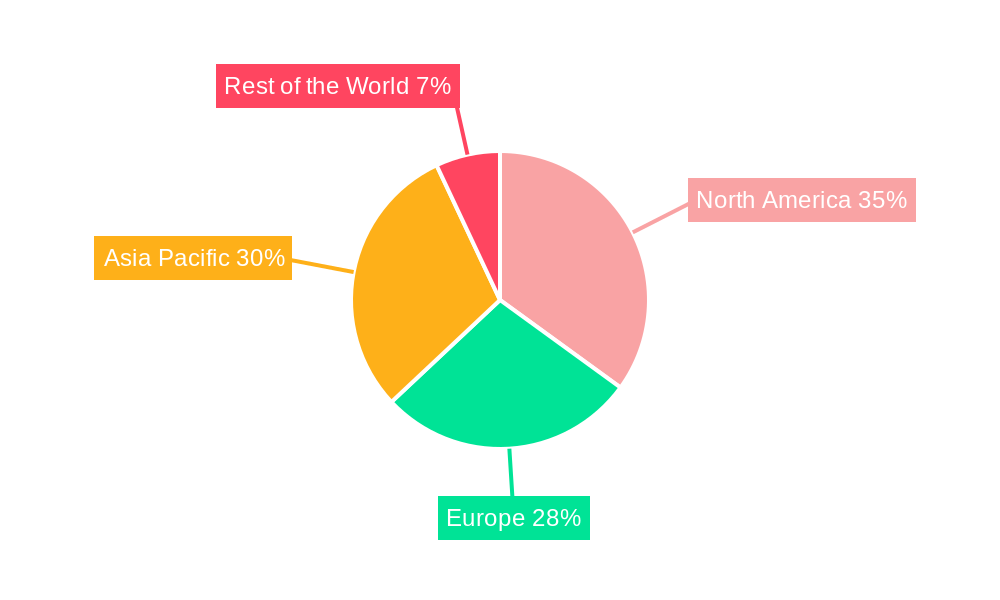

Dominant Regions/Countries: The North American and European regions currently hold the largest market share, driven by high adoption rates in logistics and manufacturing sectors. However, the Asia-Pacific region is expected to witness the fastest growth during the forecast period due to rapidly expanding industrialization and e-commerce penetration.

Dominant Segments:

By Tonnage Capacity: The Below 5 Tons segment currently dominates the market, owing to its widespread applicability in various industries. However, the 5-10 Tons segment is anticipated to exhibit significant growth due to increasing demand for higher payload capacity in large warehouses and manufacturing plants.

By Navigation Technology: Laser Guidance is currently the most prevalent navigation technology due to its accuracy and reliability. However, vision guidance and AI-based systems are gaining traction due to their versatility and adaptability to dynamic environments.

By Application: Logistics and Warehousing is the leading application segment, followed by Manufacturing and Material Handling. The growth of these segments is closely linked to the ongoing automation of supply chains and manufacturing processes.

By Propulsion Type: Electric forklifts are gaining momentum due to environmental concerns and decreasing operational costs. Diesel forklifts still retain a notable market share, particularly in outdoor applications.

By Type: Pallet Truck/Mover/Jack currently holds the largest market share but the Others (Forked AGV) segment is anticipated to grow significantly due to its flexibility in handling complex tasks.

Growth Drivers:

Increased investment in automation: Significant capital investment by companies in automation solutions is accelerating market growth.

Improved infrastructure: The development of smart warehousing and manufacturing facilities facilitates the seamless integration of autonomous forklifts.

Economic growth: Economic expansion in major regions is creating favourable market conditions for investment in automation technologies.

Favorable government policies: Government initiatives supporting automation and digitalization boost market adoption.

Autonomous Forklift Market Product Developments

Recent product innovations demonstrate a significant focus on enhancing navigation precision, payload capacity, and operational flexibility. Seegrid Corporation's Palion Lift CR1, with its 15' lift height and 4,000lb payload capacity, highlights this trend. Furthermore, advancements in AI-powered systems are enabling autonomous forklifts to adapt to increasingly complex environments and tasks, offering enhanced safety features and improved decision-making capabilities. This continuous innovation is creating a competitive edge for manufacturers, leading to a faster transition towards fully autonomous material handling systems.

Challenges in the Autonomous Forklift Market Market

The Autonomous Forklift Market faces several challenges:

High initial investment costs: The significant upfront investment required for purchasing and implementing autonomous forklift systems can pose a barrier for smaller businesses. This factor accounts for approximately xx% of the market entry barriers for smaller companies.

Safety concerns: Concerns about the safety and reliability of autonomous systems persist. Addressing these concerns requires robust testing, certification procedures, and effective safety protocols.

Integration complexities: Integrating autonomous forklifts into existing infrastructure and workflows can be complex and time-consuming, necessitating specialized technical expertise.

Limited skilled labor: The lack of skilled workforce capable of deploying and maintaining autonomous systems presents another hurdle.

Forces Driving Autonomous Forklift Market Growth

Several key factors are driving the growth of the Autonomous Forklift Market:

Technological advancements: Ongoing innovations in AI, sensor technology, and navigation systems are enhancing the capabilities and reliability of autonomous forklifts.

Labor cost optimization: The rising cost of labor makes automation a more cost-effective solution for material handling.

Improved safety records: Autonomous systems significantly reduce workplace accidents, improving overall safety.

Increased efficiency: Autonomous forklifts operate more efficiently than manual counterparts, leading to optimized throughput.

Long-Term Growth Catalysts in the Autonomous Forklift Market

Long-term growth hinges on several strategic developments. Continued investment in R&D, fostering strategic partnerships between technology providers and end-users, and expanding into new geographical markets with emerging economies are crucial for sustained growth. Further, the integration of advanced analytics and predictive maintenance capabilities will enhance the operational efficiency and reliability of autonomous forklifts, driving broader adoption.

Emerging Opportunities in Autonomous Forklift Market

Emerging opportunities include the integration of autonomous forklifts into larger automated warehouse systems and the development of customized solutions for niche industries. The exploration of new navigation technologies like Simultaneous Localization and Mapping (SLAM) further promises to expand market applications. Finally, growing demand for sustainable solutions will drive the development of energy-efficient autonomous forklifts, particularly those powered by renewable sources.

Leading Players in the Autonomous Forklift Market Sector

- Jungheinrich AG

- Hyster-Yale Group Inc

- Mitsubishi Logisnext Co Ltd

- Oceaneering International Inc

- Credit Europe Group N

- HD Hyundai Construction Equipment

- Toyota Industries Corporation

- Balyo

- Vecna AFL

- Agilox Services GmbH

- Hangcha Group Co Ltd

- Kion Group AG

- Otto Motors

- Gridbots Technologies Private Limited

- Swisslog Holding AG

Key Milestones in Autonomous Forklift Market Industry

August 2023: Cyngn Inc. secures a pre-order agreement with Arauco for 100 autonomous electric forklifts, signaling increased industry adoption.

September 2023: Worldwide Flight Services (WFS) initiates a trial using Linde AGV forklifts at Barcelona Airport, potentially expanding autonomous solutions into the aviation sector.

February 2024: Seegrid Corporation launches the Palion Lift CR1, showcasing advancements in payload capacity and lift height for autonomous lift trucks.

Strategic Outlook for Autonomous Forklift Market Market

The future of the Autonomous Forklift Market looks bright, driven by continuous technological advancements, increasing demand for efficient material handling solutions, and supportive regulatory environments. Strategic partnerships, expansion into new markets, and the development of innovative business models will play a critical role in shaping the future trajectory of this dynamic sector. The market's potential for significant growth in the coming years is undeniable.

Autonomous Forklift Market Segmentation

-

1. Tonnage Capacity

- 1.1. Below 5 Tons

- 1.2. 5-10 Tons

- 1.3. Above 10 Tons

-

2. Navigation Technology

- 2.1. Laser Guidance

- 2.2. Vision Guidance

- 2.3. Optical Tape Guidance

- 2.4. Magnetic Guidance

- 2.5. Inductive Guidance

- 2.6. Others (

-

3. Application

- 3.1. Logistics and Warehousing

- 3.2. Manufacturing

- 3.3. Material Handling

- 3.4. Others (Retail, etc.)

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Diesel

- 4.3. Others (CNG, LPG, etc.)

-

5. Type

- 5.1. Pallet Truck/Mover/Jack

- 5.2. Pallet Stackers

- 5.3. Others (Forked AGV, etc.)

Autonomous Forklift Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Autonomous Forklift Market Regional Market Share

Geographic Coverage of Autonomous Forklift Market

Autonomous Forklift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.1.1. Below 5 Tons

- 5.1.2. 5-10 Tons

- 5.1.3. Above 10 Tons

- 5.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 5.2.1. Laser Guidance

- 5.2.2. Vision Guidance

- 5.2.3. Optical Tape Guidance

- 5.2.4. Magnetic Guidance

- 5.2.5. Inductive Guidance

- 5.2.6. Others (

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logistics and Warehousing

- 5.3.2. Manufacturing

- 5.3.3. Material Handling

- 5.3.4. Others (Retail, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Diesel

- 5.4.3. Others (CNG, LPG, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Pallet Truck/Mover/Jack

- 5.5.2. Pallet Stackers

- 5.5.3. Others (Forked AGV, etc.)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6. North America Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6.1.1. Below 5 Tons

- 6.1.2. 5-10 Tons

- 6.1.3. Above 10 Tons

- 6.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 6.2.1. Laser Guidance

- 6.2.2. Vision Guidance

- 6.2.3. Optical Tape Guidance

- 6.2.4. Magnetic Guidance

- 6.2.5. Inductive Guidance

- 6.2.6. Others (

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Logistics and Warehousing

- 6.3.2. Manufacturing

- 6.3.3. Material Handling

- 6.3.4. Others (Retail, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.4.1. Electric

- 6.4.2. Diesel

- 6.4.3. Others (CNG, LPG, etc.)

- 6.5. Market Analysis, Insights and Forecast - by Type

- 6.5.1. Pallet Truck/Mover/Jack

- 6.5.2. Pallet Stackers

- 6.5.3. Others (Forked AGV, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7. Europe Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7.1.1. Below 5 Tons

- 7.1.2. 5-10 Tons

- 7.1.3. Above 10 Tons

- 7.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 7.2.1. Laser Guidance

- 7.2.2. Vision Guidance

- 7.2.3. Optical Tape Guidance

- 7.2.4. Magnetic Guidance

- 7.2.5. Inductive Guidance

- 7.2.6. Others (

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Logistics and Warehousing

- 7.3.2. Manufacturing

- 7.3.3. Material Handling

- 7.3.4. Others (Retail, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.4.1. Electric

- 7.4.2. Diesel

- 7.4.3. Others (CNG, LPG, etc.)

- 7.5. Market Analysis, Insights and Forecast - by Type

- 7.5.1. Pallet Truck/Mover/Jack

- 7.5.2. Pallet Stackers

- 7.5.3. Others (Forked AGV, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8. Asia Pacific Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8.1.1. Below 5 Tons

- 8.1.2. 5-10 Tons

- 8.1.3. Above 10 Tons

- 8.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 8.2.1. Laser Guidance

- 8.2.2. Vision Guidance

- 8.2.3. Optical Tape Guidance

- 8.2.4. Magnetic Guidance

- 8.2.5. Inductive Guidance

- 8.2.6. Others (

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Logistics and Warehousing

- 8.3.2. Manufacturing

- 8.3.3. Material Handling

- 8.3.4. Others (Retail, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.4.1. Electric

- 8.4.2. Diesel

- 8.4.3. Others (CNG, LPG, etc.)

- 8.5. Market Analysis, Insights and Forecast - by Type

- 8.5.1. Pallet Truck/Mover/Jack

- 8.5.2. Pallet Stackers

- 8.5.3. Others (Forked AGV, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9. Rest of the World Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9.1.1. Below 5 Tons

- 9.1.2. 5-10 Tons

- 9.1.3. Above 10 Tons

- 9.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 9.2.1. Laser Guidance

- 9.2.2. Vision Guidance

- 9.2.3. Optical Tape Guidance

- 9.2.4. Magnetic Guidance

- 9.2.5. Inductive Guidance

- 9.2.6. Others (

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Logistics and Warehousing

- 9.3.2. Manufacturing

- 9.3.3. Material Handling

- 9.3.4. Others (Retail, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.4.1. Electric

- 9.4.2. Diesel

- 9.4.3. Others (CNG, LPG, etc.)

- 9.5. Market Analysis, Insights and Forecast - by Type

- 9.5.1. Pallet Truck/Mover/Jack

- 9.5.2. Pallet Stackers

- 9.5.3. Others (Forked AGV, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jungheinrich AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyster-Yale Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Logisnext Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oceaneering International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Credit Europe Group N

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HD Hyundai Construction Equipment

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Industries Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Balyo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vecna AFL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agilox Services GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hangcha Group Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kion Group AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Otto Motors

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Gridbots Technologies Private Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Swisslog Holding AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Autonomous Forklift Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 3: North America Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 4: North America Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 5: North America Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 6: North America Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 9: North America Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: North America Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 15: Europe Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 16: Europe Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 17: Europe Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 18: Europe Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 21: Europe Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Europe Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 27: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 28: Asia Pacific Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 29: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 30: Asia Pacific Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Asia Pacific Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 33: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 34: Asia Pacific Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 39: Rest of the World Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 40: Rest of the World Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 41: Rest of the World Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 42: Rest of the World Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Rest of the World Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Rest of the World Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 45: Rest of the World Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 46: Rest of the World Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 47: Rest of the World Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 48: Rest of the World Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 2: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 3: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Autonomous Forklift Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 8: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 9: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 17: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 18: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Italy Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 28: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 29: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 31: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: China Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Japan Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Korea Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 39: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 40: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 42: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Middle East and Africa Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Forklift Market?

The projected CAGR is approximately 12.25%.

2. Which companies are prominent players in the Autonomous Forklift Market?

Key companies in the market include Jungheinrich AG, Hyster-Yale Group Inc, Mitsubishi Logisnext Co Ltd, Oceaneering International Inc, Credit Europe Group N, HD Hyundai Construction Equipment, Toyota Industries Corporation, Balyo, Vecna AFL, Agilox Services GmbH, Hangcha Group Co Ltd, Kion Group AG, Otto Motors, Gridbots Technologies Private Limited, Swisslog Holding AG.

3. What are the main segments of the Autonomous Forklift Market?

The market segments include Tonnage Capacity, Navigation Technology, Application, Propulsion Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Forklift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Forklift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Forklift Market?

To stay informed about further developments, trends, and reports in the Autonomous Forklift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence