Key Insights

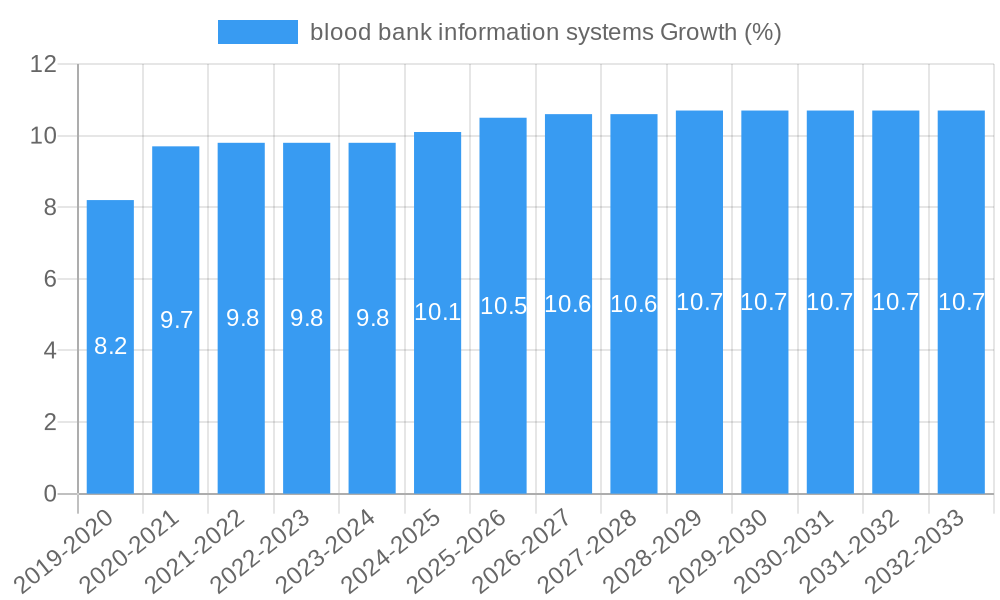

The global blood bank information systems market is poised for substantial growth, projected to reach an estimated market size of $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period of 2025-2033. This expansion is primarily driven by the increasing demand for efficient and accurate blood management solutions, heightened awareness regarding blood donation, and the growing prevalence of chronic diseases and surgical procedures requiring blood transfusions. Advancements in technology, such as cloud-based solutions and integration with electronic health records (EHRs), are further augmenting market adoption. Key applications within hospitals and blood stations are witnessing significant uptake of these systems to streamline donor management, transfusion services, and ensure compliance with stringent regulatory standards. The industry is experiencing a transformative phase, with a strong emphasis on enhancing patient safety, reducing errors, and optimizing the entire blood supply chain.

The market is segmented into specialized modules, including Blood Donor Management Modules and Blood Bank Transfusion Service Modules, catering to the distinct needs of healthcare facilities. While the market exhibits strong growth potential, certain restraints, such as the high initial implementation cost and the need for skilled IT personnel, may present challenges. However, the growing emphasis on data security, interoperability, and the increasing number of strategic collaborations and acquisitions among key players like Roper Industries, Haemonetics, and Cerner Corporation are expected to mitigate these challenges and fuel further innovation. Emerging economies are also expected to contribute significantly to market expansion due to improving healthcare infrastructure and rising awareness about the importance of blood banking services. The market is characterized by a competitive landscape, with companies focusing on developing user-friendly, scalable, and feature-rich information systems.

Comprehensive Blood Bank Information Systems Market Report: Driving Efficiency and Safety in Transfusion Medicine

This in-depth report provides an unparalleled analysis of the blood bank information systems (BBIS) market, offering critical insights for hospital blood banks, blood stations, and industry stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study delves into market dynamics, key trends, product innovations, challenges, and future opportunities. Essential for understanding the evolving landscape of blood transfusion services and blood donor management, this report equips you with actionable intelligence to navigate the competitive blood banking software industry.

blood bank information systems Market Concentration & Dynamics

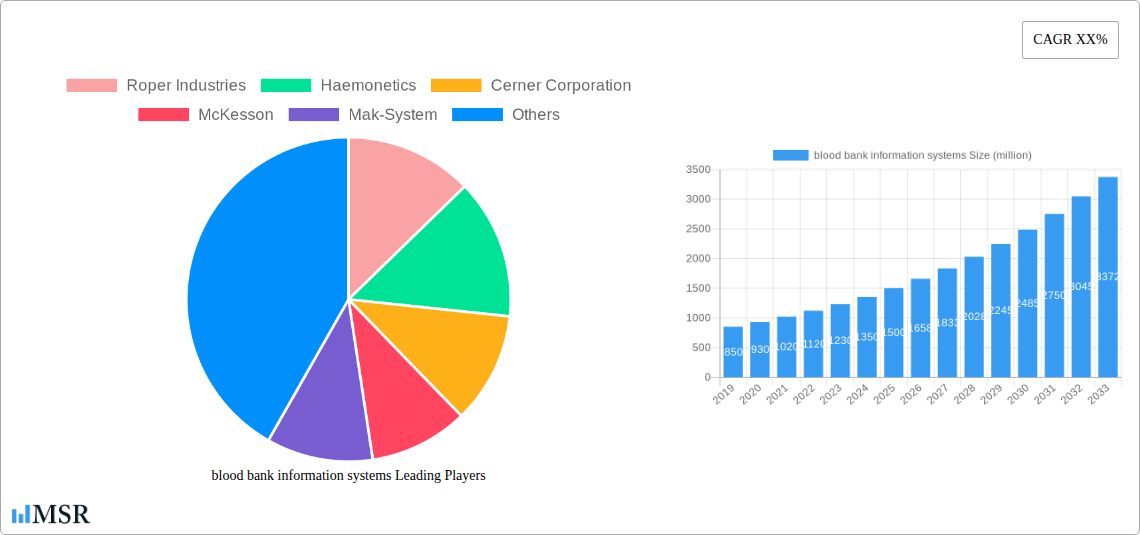

The blood bank information systems market exhibits a moderate to high concentration, with key players like Roper Industries, Haemonetics, Cerner Corporation, McKesson, Mak-System, Integrated Medical Systems, Mediware, Compugroup, SCC Soft Computer, Zhongde Gaoye, Blood Bank Computer Systems, Hemasoft, Jinfeng Yitong, Defeng, IT Synergistics, and Psyche Systems vying for significant market share. Innovation ecosystems are characterized by continuous advancements in data management, automation, and integration capabilities to enhance workflow efficiency and patient safety. Regulatory frameworks, including stringent guidelines from bodies like the FDA and EMA, significantly influence BBIS development and adoption, ensuring compliance and data integrity. The threat of substitute products, such as manual record-keeping or less sophisticated laboratory information systems, is diminishing as the need for comprehensive and interconnected blood bank software solutions grows. End-user trends are leaning towards cloud-based solutions, real-time data analytics, and robust cybersecurity features to manage increasingly complex operations. Merger and acquisition (M&A) activities are observed as companies seek to expand their product portfolios and geographical reach. For instance, historical M&A deal counts have shown a steady increase, indicating a consolidation trend aimed at capturing larger market segments.

blood bank information systems Industry Insights & Trends

The global blood bank information systems market is projected for robust growth, driven by an escalating demand for safe and efficient blood transfusion services worldwide. The market size in 2025 is estimated at approximately 2,500 million, with a projected Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period of 2025–2033. This expansion is fueled by several critical factors. Firstly, the increasing prevalence of chronic diseases, surgical procedures, and trauma cases worldwide necessitates a more organized and technologically advanced approach to blood management. BBIS solutions play a pivotal role in ensuring that the right blood products are available at the right time, minimizing wastage and optimizing inventory. Secondly, a growing awareness regarding blood donation and the critical need for blood supplies in healthcare emergencies contributes to higher demand for blood, consequently boosting the need for sophisticated BBIS to manage this influx. Technological disruptions are continuously reshaping the market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive inventory management, donor suitability assessment, and early detection of potential transfusion reactions is gaining traction. Furthermore, the adoption of cloud-based BBIS platforms is on the rise, offering enhanced scalability, accessibility, and cost-effectiveness compared to traditional on-premise systems. Enhanced data analytics capabilities within these systems allow blood banks to gain deeper insights into their operations, enabling data-driven decision-making and improved resource allocation. Evolving consumer behaviors, particularly among blood donors and healthcare professionals, are also influencing the market. Donors expect seamless and transparent donation experiences, often facilitated by mobile applications linked to BBIS for appointment scheduling and donor history tracking. Healthcare providers demand interoperability between BBIS and other hospital information systems (HIS), Electronic Health Records (EHRs), and Laboratory Information Systems (LIS) to create a cohesive patient care ecosystem. The emphasis on data security and privacy, driven by stringent regulations like GDPR and HIPAA, is also a significant trend, pushing for advanced cybersecurity measures within BBIS.

Key Markets & Segments Leading blood bank information systems

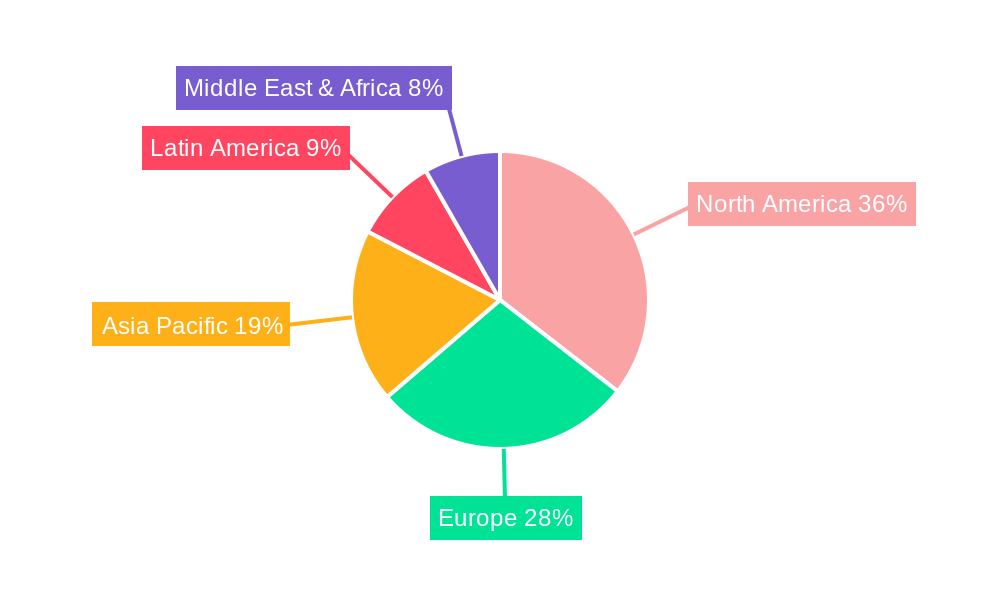

The blood bank information systems market sees significant leadership from the Hospital segment within the Application category, accounting for over 70% of the market share in 2025, projected to reach 1,800 million. This dominance is driven by the critical role hospitals play in direct blood transfusion services, complex patient care, and the sheer volume of blood product utilization. The economic growth and advanced healthcare infrastructure in North America and Europe, with an estimated market size of 800 million and 750 million respectively in 2025, have made these regions key markets for advanced BBIS.

Application: Hospital

- Drivers: High volume of transfusions, complex patient management, integration with existing hospital IT infrastructure, stringent regulatory compliance within hospital settings.

- Dominance Analysis: Hospitals require comprehensive BBIS that can manage everything from donor recruitment and processing to compatibility testing, transfusion reactions, and inventory control, all within a critical care environment. The need for real-time data and seamless integration with Electronic Health Records (EHRs) makes sophisticated hospital-grade BBIS indispensable.

Type: Blood Donor Management Module

- Drivers: Increasing emphasis on donor recruitment and retention, need for efficient screening and tracking of donors, mobile app integration for donor engagement, data analytics for donor demographics and trends.

- Dominance Analysis: This module is foundational for any blood bank, ensuring the integrity of the blood supply chain starting from the donor. Its importance is magnified by public health campaigns and the ongoing need to maintain a stable donor pool.

Type: Blood Bank Transfusion Service Module

- Drivers: Criticality of accurate crossmatching and compatibility testing, patient safety during transfusions, management of transfusion reactions, detailed record-keeping for regulatory audits.

- Dominance Analysis: This module directly impacts patient outcomes and safety. Its intricate functionalities, including the tracking of blood units from collection to administration, are paramount for preventing transfusion-related errors.

Geographically, North America is expected to maintain its leading position in the blood bank information systems market, with an estimated market value of 850 million in 2025. This is attributed to the early adoption of advanced healthcare technologies, a well-established regulatory framework, and a high per capita expenditure on healthcare. The region benefits from a strong presence of leading BBIS vendors and a significant number of accredited blood collection agencies and hospitals.

blood bank information systems Product Developments

Recent product developments in the blood bank information systems market are characterized by a strong focus on enhancing user experience, improving data analytics, and expanding integration capabilities. Innovations include AI-powered predictive analytics for inventory management, enabling blood banks to anticipate demand and optimize stock levels, thereby reducing wastage and ensuring availability. Advanced features like blockchain technology are being explored for enhanced data security and traceability of blood products throughout the supply chain. Furthermore, the development of user-friendly interfaces and mobile-responsive dashboards is improving workflow efficiency for both administrative staff and clinical personnel. The integration of these systems with wearable devices for real-time patient monitoring during transfusions is also an emerging area of innovation.

Challenges in the blood bank information systems Market

The blood bank information systems market faces several significant challenges that can impede widespread adoption and growth. High initial implementation costs for sophisticated BBIS solutions can be a substantial barrier, particularly for smaller blood banks or those in resource-limited regions. The integration of new BBIS with legacy systems within hospitals and blood stations can be complex and time-consuming, often requiring significant IT resources and expertise. Furthermore, data migration from older systems to newer platforms presents a risk of data loss or corruption if not managed meticulously. Stringent and evolving regulatory compliance requirements, while essential for safety, add another layer of complexity and cost to system development and maintenance. Competitive pressures from established players and emerging tech companies also necessitate continuous investment in R&D, impacting profitability.

Forces Driving blood bank information systems Growth

The growth of the blood bank information systems market is propelled by several key forces. Technologically, the increasing demand for automation in blood processing, inventory management, and donor management is a primary driver. The push for enhanced patient safety and the reduction of transfusion errors, coupled with stringent regulatory mandates for accurate record-keeping, further necessitates the adoption of advanced BBIS. Economically, the growing global healthcare expenditure and the continuous need for blood transfusions in managing chronic diseases, surgical interventions, and emergency situations create a sustained demand for efficient blood management solutions. Regulatory frameworks globally are increasingly emphasizing data integrity and audit trails, which advanced BBIS are well-equipped to provide, thereby driving their adoption.

Challenges in the blood bank information systems Market

Long-term growth catalysts for the blood bank information systems market are rooted in continuous innovation and strategic market expansion. The development and adoption of AI and machine learning algorithms for predictive inventory management and donor suitability assessments represent a significant growth accelerator. Furthermore, strategic partnerships between BBIS vendors and healthcare technology providers, as well as with national health organizations, can foster wider adoption and market penetration. Exploring emerging markets with developing healthcare infrastructures and addressing their specific needs for robust and cost-effective BBIS solutions will also be crucial for sustained growth. The increasing focus on personalized medicine and the potential for blood banks to play a role in managing specialized blood products will also open new avenues for growth.

Emerging Opportunities in blood bank information systems

Emerging opportunities in the blood bank information systems market are diverse and promising. The increasing adoption of cloud-based BBIS solutions presents a significant opportunity for vendors to offer scalable, accessible, and cost-effective services, especially to smaller blood banks. The integration of BBIS with advanced analytics and big data capabilities allows for deeper insights into blood utilization patterns, donor demographics, and public health trends, leading to improved blood supply chain management. The development of mobile applications for blood donors, facilitating appointment scheduling, eligibility checks, and donation history tracking, represents another burgeoning opportunity for enhancing donor engagement. Furthermore, the potential for BBIS to support the management of rare blood types and specialized cell therapies offers a niche but high-value market segment.

Leading Players in the blood bank information systems Sector

- Roper Industries

- Haemonetics

- Cerner Corporation

- McKesson

- Mak-System

- Integrated Medical Systems

- Mediware

- Compugroup

- SCC Soft Computer

- Zhongde Gaoye

- Blood Bank Computer Systems

- Hemasoft

- Jinfeng Yitong

- Defeng

- IT Synergistics

- Psyche Systems

Key Milestones in blood bank information systems Industry

- 2019: Increased adoption of cloud-based BBIS solutions, leading to enhanced scalability and accessibility.

- 2020: Significant investment in R&D for AI-driven predictive analytics in inventory management.

- 2021: Mergers and acquisitions aimed at consolidating market share and expanding product portfolios.

- 2022: Enhanced focus on cybersecurity features to protect sensitive donor and patient data.

- 2023: Development of interoperability standards to facilitate seamless integration with hospital EHRs and LIS.

- 2024: Growing interest in blockchain technology for improved blood product traceability and security.

Strategic Outlook for blood bank information systems Market

The strategic outlook for the blood bank information systems market is exceptionally positive, driven by an unwavering demand for safe, efficient, and reliable blood transfusion services. Growth accelerators will include the continued integration of advanced technologies like AI, IoT, and blockchain to optimize operations, enhance donor engagement, and ensure unparalleled patient safety. The global push for standardized healthcare practices and stringent regulatory compliance will further necessitate robust BBIS solutions. Strategic opportunities lie in expanding into emerging markets, offering tailored solutions for diverse healthcare infrastructures, and fostering collaborative ecosystems with healthcare providers and research institutions. The market is poised for sustained growth, with innovation in data analytics and user experience being paramount to capturing market share and driving the future of transfusion medicine.

blood bank information systems Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Blood Station

-

2. Types

- 2.1. Blood Donor Management Module

- 2.2. Blood Bank Transfusion Service Module

- 2.3. Others

blood bank information systems Segmentation By Geography

- 1. CA

blood bank information systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. blood bank information systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Blood Station

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Blood Donor Management Module

- 5.2.2. Blood Bank Transfusion Service Module

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Roper Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haemonetics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cerner Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 McKesson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mak-System

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Integrated Medical Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mediware

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Compugroup

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCC Soft Computer

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zhongde Gaoye

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Blood Bank Computer Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hemasoft

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Jinfeng Yitong

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Defeng

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 IT Synergistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Psyche Systems

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Roper Industries

List of Figures

- Figure 1: blood bank information systems Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: blood bank information systems Share (%) by Company 2024

List of Tables

- Table 1: blood bank information systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: blood bank information systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: blood bank information systems Revenue million Forecast, by Types 2019 & 2032

- Table 4: blood bank information systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: blood bank information systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: blood bank information systems Revenue million Forecast, by Types 2019 & 2032

- Table 7: blood bank information systems Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the blood bank information systems?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the blood bank information systems?

Key companies in the market include Roper Industries, Haemonetics, Cerner Corporation, McKesson, Mak-System, Integrated Medical Systems, Mediware, Compugroup, SCC Soft Computer, Zhongde Gaoye, Blood Bank Computer Systems, Hemasoft, Jinfeng Yitong, Defeng, IT Synergistics, Psyche Systems.

3. What are the main segments of the blood bank information systems?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "blood bank information systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the blood bank information systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the blood bank information systems?

To stay informed about further developments, trends, and reports in the blood bank information systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence