Key Insights

The China Digital Freight Forwarding market is poised for significant expansion, driven by a burgeoning e-commerce sector, widespread adoption of digital logistics solutions, and supportive government policies aimed at enhancing supply chain efficiency. The market size was estimated at $4.9 billion in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8%. Key growth drivers include the increasing reliance of both Small and Medium-sized Enterprises (SMEs) and large enterprises on digital platforms to optimize freight operations, leading to cost reductions and improved supply chain visibility. The availability of diverse transportation modes, including ocean, air, road, and rail, provides essential flexibility for varied shipping demands, further stimulating market growth. The integration of advanced technologies such as Artificial Intelligence (AI) and big data analytics is instrumental in streamlining logistics processes, boosting efficiency, and creating new avenues for market participants. Additionally, government investment in digital infrastructure and initiatives promoting e-commerce contribute positively to the market's upward trend.

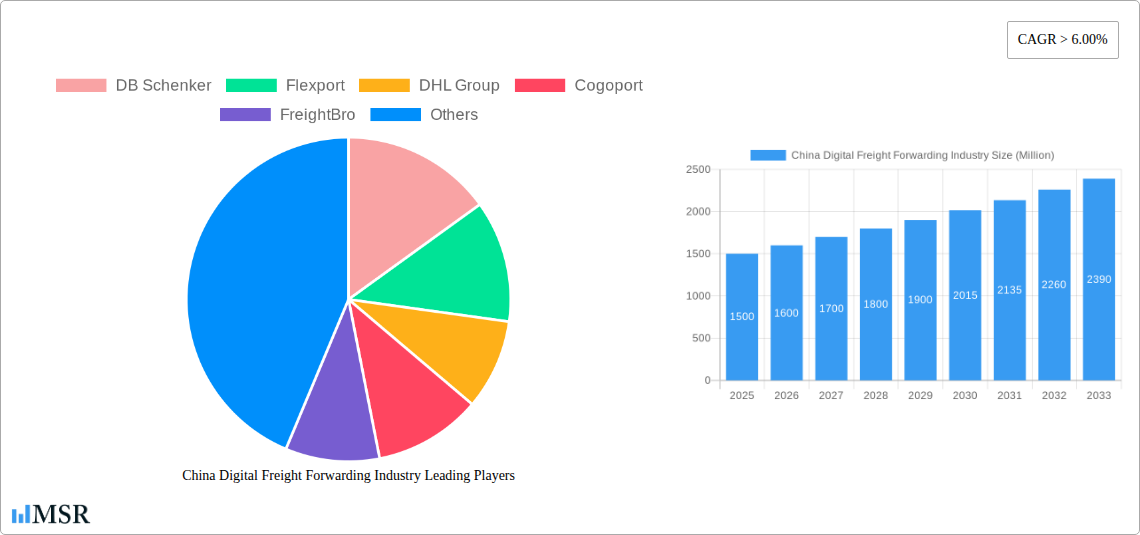

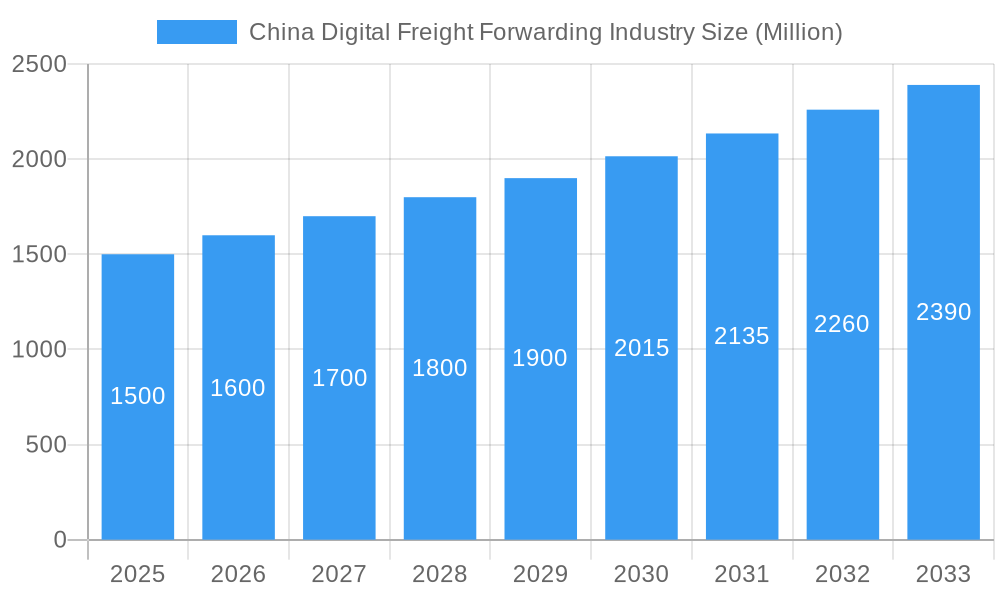

China Digital Freight Forwarding Industry Market Size (In Billion)

Despite the promising outlook, the market faces certain challenges. Infrastructure limitations in specific Chinese regions and cybersecurity concerns related to digital platforms require strategic attention. The competitive environment is highly dynamic, featuring established global logistics providers such as DHL, DB Schenker, and Kuehne + Nagel alongside emerging Chinese innovators like Full Truck Alliance and Cogoport, all competing for market dominance. This intense competition fosters innovation and influences pricing strategies, compelling companies to adapt continuously. Market segmentation by firm type (SMEs, large enterprises, and government) and transportation mode (ocean, air, road, rail) highlights the varied requirements and evolving preferences within China's logistics industry. To achieve success, market players must strategically engage these segments and leverage technological advancements to deliver integrated, efficient, and customized logistics solutions.

China Digital Freight Forwarding Industry Company Market Share

China Digital Freight Forwarding Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China digital freight forwarding industry, offering crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The report leverages robust data analysis to provide actionable intelligence, forecasting a market valued at xx Million by 2033.

China Digital Freight Forwarding Industry Market Concentration & Dynamics

The China digital freight forwarding market is experiencing significant transformation, driven by technological advancements and evolving consumer demands. Market concentration is moderate, with several large players vying for dominance alongside a multitude of smaller, specialized firms. Key players include DB Schenker, Flexport, DHL Group, Cogoport, FreightBro, Kuehne + Nagel International AG, WICE Logistics, SINO SHIPPING, Twill, Youtrans, MOOV, Full Truck Alliance (Manbang group), Freightos, and Agility Logistics Pvt Ltd (Shipa Freight). However, the market remains fragmented, especially within the SME segment.

- Market Share: The top 5 players collectively hold an estimated xx% market share in 2025, with the remaining share distributed among numerous smaller players.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, primarily driven by larger players seeking to expand their market reach and technological capabilities. This trend is expected to continue, albeit at a moderate pace, during the forecast period.

- Innovation Ecosystem: China's robust technological landscape fosters innovation, with numerous FinTech and logistics technology startups contributing to the development of innovative digital freight forwarding solutions.

- Regulatory Framework: Government regulations play a crucial role, focusing on improving efficiency, transparency, and security within the logistics sector. These regulations are likely to evolve further during the forecast period.

- Substitute Products: While digital freight forwarding solutions are gaining traction, traditional methods still hold a significant share. The competitive landscape also includes specialized niche players who target specific segments.

- End-User Trends: The increasing demand for faster, more efficient, and transparent logistics solutions is a major driver of industry growth.

China Digital Freight Forwarding Industry Industry Insights & Trends

The China digital freight forwarding market is poised for robust growth, driven by several key factors. The market size in 2025 is estimated to be xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the rapid expansion of e-commerce, the increasing adoption of digital technologies across supply chains, and the government's initiatives to modernize the logistics sector. Technological disruptions, such as the implementation of blockchain, AI, and IoT, are further enhancing efficiency and transparency. The changing consumer behavior, characterized by a preference for faster delivery and greater transparency, is also driving demand for digital freight forwarding services. The seamless integration of these digital platforms with existing infrastructure and supply chain management systems is also enhancing efficiency. The industry is witnessing a shift towards data-driven decision-making, enabling businesses to optimize their logistics operations.

Key Markets & Segments Leading China Digital Freight Forwarding Industry

The China digital freight forwarding market shows significant regional variation, with coastal provinces and major economic hubs witnessing higher adoption rates. However, the market is expanding rapidly in inland regions as well, driven by improved infrastructure and government investment.

By Firm Type:

- Large Enterprises: This segment constitutes the largest share of the market, primarily due to their higher volumes and greater technological capabilities.

- SMEs: The SME segment presents a significant growth opportunity, with many SMEs adopting digital solutions to improve their operational efficiency. However, cost constraints and lack of technical expertise remain barriers for some SMEs.

- Government: Government initiatives and investments in infrastructure are playing a crucial role in driving market expansion.

By Mode of Transportation:

- Ocean Freight: This segment holds the largest market share, owing to China's dominance in global trade.

- Air Freight: This segment is experiencing rapid growth, driven by the rising demand for faster delivery times.

- Road Freight: The road freight segment is crucial for last-mile delivery and regional transportation.

- Rail Freight: This segment is seeing increasing investment, driven by government initiatives aimed at developing more efficient rail networks.

Drivers:

- Robust economic growth, particularly in e-commerce and manufacturing.

- Continuous improvement in supporting infrastructure, including ports, airports, and roadways.

- Government initiatives to modernize the logistics sector.

China Digital Freight Forwarding Industry Product Developments

The industry is witnessing rapid innovation in digital freight forwarding solutions, with new platforms offering enhanced functionalities such as real-time tracking, automated documentation, and integrated payment gateways. These advancements provide greater transparency, efficiency, and cost savings for businesses. The integration of blockchain technology enhances security and traceability, while AI-powered solutions optimize routing and delivery scheduling. These solutions are improving efficiency, reducing delays, and providing better visibility into logistics operations. The increasing adoption of these sophisticated solutions represents a significant competitive advantage.

Challenges in the China Digital Freight Forwarding Industry Market

The China digital freight forwarding market faces several challenges, including regulatory hurdles, supply chain disruptions (e.g., port congestion, geopolitical uncertainties), and intense competition. These factors can lead to increased costs and operational inefficiencies, impacting overall market growth. The lack of standardized data formats and interoperability between different platforms remains a barrier to seamless integration and data exchange. Cybersecurity concerns also remain significant, requiring robust security measures to protect sensitive data. These challenges are estimated to impact market growth by approximately xx% annually.

Forces Driving China Digital Freight Forwarding Industry Growth

Several factors are driving the growth of the China digital freight forwarding market. Technological advancements, particularly in areas like AI, blockchain, and IoT, are enhancing efficiency and transparency. Government initiatives to promote digitalization and improve infrastructure further bolster industry growth. The continued rise of e-commerce and the increasing demand for faster and more reliable logistics services are key drivers. The focus on reducing carbon emissions is also impacting the industry with sustainable logistics solutions becoming increasingly important.

Long-Term Growth Catalysts in China Digital Freight Forwarding Industry

Long-term growth will be driven by the ongoing adoption of innovative technologies, strategic partnerships between freight forwarders and technology providers, and the expansion into new markets both domestically and internationally. Investments in infrastructure, including the expansion of high-speed rail networks and improved port facilities, are likely to enhance efficiency. The growing importance of supply chain resilience and the adoption of sustainable practices will be essential drivers of long-term growth.

Emerging Opportunities in China Digital Freight Forwarding Industry

Emerging opportunities include the integration of advanced technologies like 5G and the expansion into new markets such as cross-border e-commerce. The development of specialized solutions catering to specific industry needs, such as cold chain logistics, will further fuel growth. The increasing focus on sustainability presents an opportunity for forwarders to offer environmentally friendly solutions. The growth of last-mile delivery services and the integration of drone technology are also emerging avenues for market expansion.

Leading Players in the China Digital Freight Forwarding Industry Sector

- DB Schenker

- Flexport

- DHL Group

- Cogoport

- FreightBro

- Kuehne + Nagel International AG

- WICE Logistics

- SINO SHIPPING

- Twill

- Youtrans

- MOOV

- Full Truck Alliance (Manbang group)

- Freightos

- Agility Logistics Pvt Ltd (Shipa Freight)

Key Milestones in China Digital Freight Forwarding Industry Industry

- 2020: Launch of several new digital freight forwarding platforms.

- 2021: Increased government investment in logistics infrastructure.

- 2022: Significant adoption of blockchain technology for enhanced security and traceability.

- 2023: Several mergers and acquisitions among key players.

- 2024: Growing adoption of AI-powered optimization tools.

Strategic Outlook for China Digital Freight Forwarding Industry Market

The future of the China digital freight forwarding market is bright, with significant growth potential fueled by technological innovation, increasing e-commerce activity, and government support. Companies that successfully adapt to the evolving market dynamics and embrace new technologies are poised for significant success. Strategic partnerships and investments in research and development will be crucial for maintaining a competitive edge. The focus on sustainable practices and robust cybersecurity measures will be essential for long-term growth and sustainability.

China Digital Freight Forwarding Industry Segmentation

-

1. Mode of Transportation

- 1.1. Ocean

- 1.2. Air

- 1.3. Road

- 1.4. Rail

-

2. Firm Type

- 2.1. SMEs

- 2.2. Large Enterprises and Governments

China Digital Freight Forwarding Industry Segmentation By Geography

- 1. China

China Digital Freight Forwarding Industry Regional Market Share

Geographic Coverage of China Digital Freight Forwarding Industry

China Digital Freight Forwarding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Rise in E-Commerce Sector Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Digital Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.1.1. Ocean

- 5.1.2. Air

- 5.1.3. Road

- 5.1.4. Rail

- 5.2. Market Analysis, Insights and Forecast - by Firm Type

- 5.2.1. SMEs

- 5.2.2. Large Enterprises and Governments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flexport

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cogoport

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FreightBro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 WICE Logistics**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SINO SHIPPING

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Twill

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Youtrans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MOOV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Full Truck Alliance (Manbang group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Freightos

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Agility Logistics Pvt Ltd (Shipa Freight)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Digital Freight Forwarding Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Digital Freight Forwarding Industry Share (%) by Company 2025

List of Tables

- Table 1: China Digital Freight Forwarding Industry Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 2: China Digital Freight Forwarding Industry Revenue billion Forecast, by Firm Type 2020 & 2033

- Table 3: China Digital Freight Forwarding Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Digital Freight Forwarding Industry Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 5: China Digital Freight Forwarding Industry Revenue billion Forecast, by Firm Type 2020 & 2033

- Table 6: China Digital Freight Forwarding Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Digital Freight Forwarding Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the China Digital Freight Forwarding Industry?

Key companies in the market include DB Schenker, Flexport, DHL Group, Cogoport, FreightBro, Kuehne + Nagel International AG, WICE Logistics**List Not Exhaustive, SINO SHIPPING, Twill, Youtrans, MOOV, Full Truck Alliance (Manbang group), Freightos, Agility Logistics Pvt Ltd (Shipa Freight).

3. What are the main segments of the China Digital Freight Forwarding Industry?

The market segments include Mode of Transportation, Firm Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Rise in E-Commerce Sector Driving the Market.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Digital Freight Forwarding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Digital Freight Forwarding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Digital Freight Forwarding Industry?

To stay informed about further developments, trends, and reports in the China Digital Freight Forwarding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence