Key Insights

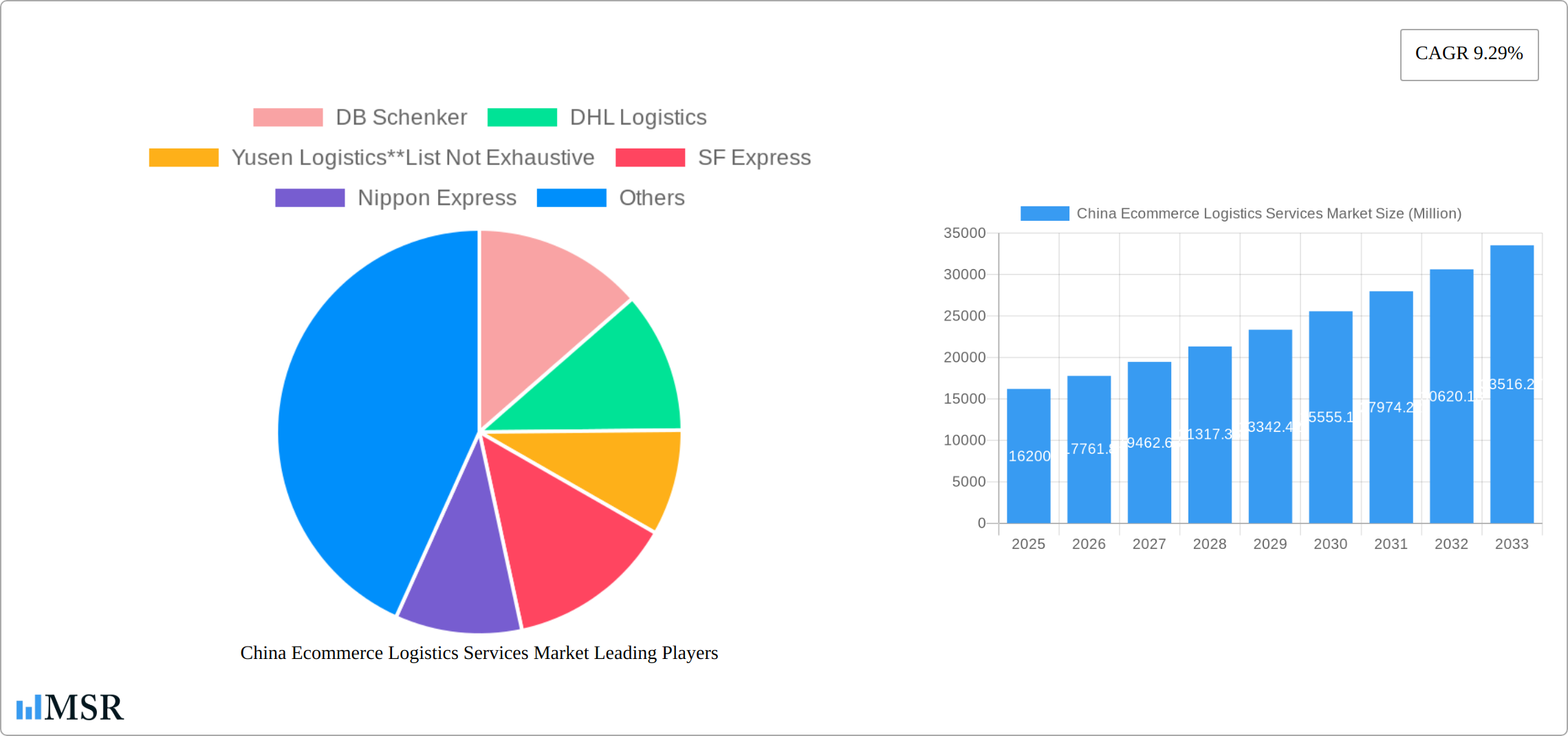

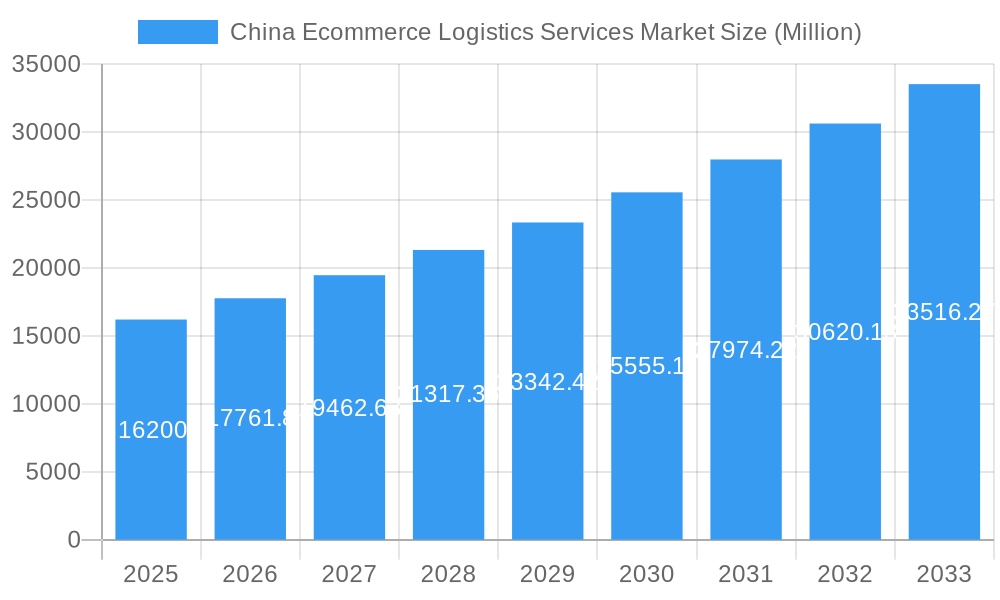

The China e-commerce logistics services market is experiencing robust growth, projected to reach $16.20 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.29% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector in China, fueled by increasing internet and smartphone penetration, coupled with a rising middle class and changing consumer preferences, is a primary driver. The demand for faster and more reliable delivery options, including same-day and next-day delivery, is further accelerating market growth. Expansion of last-mile delivery networks, improvements in logistics infrastructure (such as improved warehousing and transportation networks), and the adoption of advanced technologies like AI and automation in logistics operations are also contributing significantly. The market is segmented by service type (transportation, warehousing, value-added services), business type (B2B, B2C), destination (domestic, international), and product type (fashion, electronics, home appliances, etc.). While the growth trajectory is positive, challenges remain, including increasing labor costs, intense competition among logistics providers, and the need for continuous technological upgrades to maintain efficiency and competitiveness. The dominance of major players like DB Schenker, DHL, and SF Express highlights the consolidated nature of the market, although smaller, specialized providers continue to find niches.

China Ecommerce Logistics Services Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, driven by ongoing e-commerce expansion and technological advancements. However, the market's evolution will likely involve increased consolidation amongst logistics providers as companies strive for economies of scale and enhanced service offerings. The focus on providing customized solutions, such as specialized handling for delicate goods or temperature-sensitive products, will become increasingly important. Government regulations aiming to improve logistics efficiency and transparency will also play a crucial role in shaping the market landscape. The continuous rise in cross-border e-commerce will create new opportunities, but also challenges related to customs clearance and international regulations. Ultimately, the success of logistics providers will depend on their ability to adapt to the rapidly changing dynamics of the e-commerce market, including embracing technological innovation and offering flexible, reliable, and cost-effective solutions.

China Ecommerce Logistics Services Market Company Market Share

China Ecommerce Logistics Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic China Ecommerce Logistics Services Market, covering market size, segmentation, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for businesses operating within or seeking entry into this lucrative market. The report leverages extensive data analysis to deliver a detailed understanding of the market's current state and future trajectory, with a focus on key trends, challenges, and opportunities. This report is essential for investors, industry stakeholders, and strategic decision-makers seeking to navigate the complexities of the Chinese e-commerce logistics landscape. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of xx%.

China Ecommerce Logistics Services Market Concentration & Dynamics

The China ecommerce logistics services market exhibits a moderately concentrated structure, with several large multinational players alongside numerous domestic providers. Market share is concentrated among the leading players, including DB Schenker, DHL Logistics, Yusen Logistics, SF Express, Nippon Express, XPO Logistics, CEVA Logistics, VHK Logistics, CTS International Logistics, and FedEx Express. However, the market also shows significant fragmentation, particularly within the domestic segment. The competitive landscape is further shaped by continuous innovation in technology and services, a rapidly evolving regulatory framework, and the emergence of substitute products and services. Mergers and acquisitions (M&A) play a notable role, with xx M&A deals recorded in the past five years, primarily focused on consolidating market share and expanding service capabilities. End-user trends heavily favor speed, reliability, and advanced technology integration (AI, automation).

- Market Share: Top 5 players account for approximately xx% of the market.

- M&A Activity: xx deals recorded between 2019 and 2024, with an average deal value of xx Million.

- Innovation Ecosystem: Significant investments in technology, particularly in areas like automation, AI, and data analytics.

- Regulatory Framework: Government regulations are constantly evolving, impacting aspects such as cross-border shipping and data privacy.

- Substitute Products: The rise of alternative delivery models and decentralized logistics networks poses a growing challenge.

China Ecommerce Logistics Services Market Industry Insights & Trends

The China e-commerce logistics services market is experiencing phenomenal growth, propelled by the country's unparalleled surge in online retail. The market size, which reached an estimated XX Million in 2024, is forecast to climb to an impressive XX Million by 2025, signaling a substantial upward trajectory. This remarkable expansion is underpinned by a confluence of powerful factors: a burgeoning middle class with increasing disposable incomes, widespread internet and smartphone penetration, and a deeply ingrained consumer preference for online shopping. The industry is undergoing a profound transformation driven by technological innovations, most notably the pervasive integration of automation and artificial intelligence (AI) across warehousing and transportation networks. Furthermore, evolving consumer expectations, characterized by an insatiable demand for expedited delivery times and enhanced supply chain visibility, are actively shaping market dynamics. Projections indicate that the market will sustain a robust Compound Annual Growth Rate (CAGR) of approximately xx% throughout the forecast period of 2025-2033.

Key Markets & Segments Leading China Ecommerce Logistics Services Market

The domestic segment currently dominates the China ecommerce logistics services market, accounting for approximately xx% of the total market value. However, the international/cross-border segment is experiencing rapid growth, driven by the increasing popularity of cross-border e-commerce. Within services, transportation currently holds the largest share, followed by warehousing and inventory management. Value-added services are witnessing significant expansion. The B2C segment is significantly larger than B2B.

Key Growth Drivers:

- Economic Growth: Sustained economic growth in China fuels consumer spending and e-commerce expansion.

- Infrastructure Development: Continuous investments in transportation and logistics infrastructure improve efficiency and connectivity.

- Technological Advancements: Automation, AI, and big data analytics drive operational efficiency and enhance service capabilities.

- Government Support: Supportive government policies stimulate e-commerce growth and improve logistics infrastructure.

- Expanding Middle Class: The growing middle class fuels the demand for a wider array of goods and services delivered online.

Dominance Analysis:

The domestic market is currently dominant due to the sheer volume of e-commerce transactions occurring within China. However, the international/cross-border segment is a rapidly growing area of opportunity, driven by increased global demand for Chinese products and the expansion of Chinese e-commerce giants into international markets.

China Ecommerce Logistics Services Market Product Developments

Recent product and service innovations are at the forefront of transforming the logistics landscape in China. Key advancements include the deployment of AI-powered route optimization software, which dynamically recalibrates delivery paths for maximum efficiency. Automated warehousing systems, leveraging robotics and intelligent sorting, are revolutionizing inventory management and order fulfillment. The pioneering use of drone delivery solutions for last-mile logistics is also gaining traction, particularly in urban areas, promising to overcome traditional delivery challenges. These technological leaps not only boost operational efficiency and reduce costs but also significantly enhance delivery speeds, offering a crucial competitive edge to logistics providers. Beyond technology, the market is witnessing the development of highly specialized logistics services meticulously tailored for distinct product categories. Examples include advanced temperature-controlled transportation solutions vital for the safe delivery of pharmaceuticals and perishable goods, as well as bespoke handling services for high-value items like luxury products, ensuring their security and integrity throughout the supply chain.

Challenges in the China Ecommerce Logistics Services Market

The China ecommerce logistics services market faces several significant challenges, including the complexities of navigating the country's regulatory environment, maintaining efficient supply chain operations, particularly in the face of global disruptions, and sustaining a competitive edge amidst intense competition. These factors contribute to increased operating costs and can hinder profitability. Moreover, infrastructure limitations in certain regions can affect delivery times and overall efficiency.

Forces Driving China Ecommerce Logistics Services Market Growth

Several potent forces are synergistically propelling the growth of the China e-commerce logistics services market. The relentless expansion of the e-commerce sector itself remains the primary engine, fueled by increasing consumer spending power and digital adoption. Consumers' escalating demand for faster, more reliable, and cost-effective delivery options is a critical catalyst. Technological advancements, particularly the widespread integration of Artificial Intelligence (AI) and automation in both warehousing and transportation, are fundamentally reshaping operational capabilities and efficiency. Furthermore, supportive government policies aimed at fostering the development of advanced logistics infrastructure, including smart logistics hubs and efficient transportation networks, are creating a favorable ecosystem for growth. The burgeoning sector of cross-border e-commerce presents a significant and rapidly expanding opportunity, as Chinese consumers increasingly access international products and vice-versa, necessitating sophisticated global logistics solutions.

Challenges in the China Ecommerce Logistics Services Market

Long-term growth hinges on addressing challenges like infrastructure gaps, regulatory complexities, and sustaining innovation to maintain a competitive edge in a rapidly evolving market. Strategic partnerships and technological investments will be crucial to navigating these hurdles and unlocking the full potential of the market.

Emerging Opportunities in China Ecommerce Logistics Services Market

Emerging opportunities include the growth of cross-border e-commerce, the increasing adoption of innovative technologies such as drone delivery and autonomous vehicles, and the expansion of specialized services catering to niche product categories. The potential for expansion into lower-tier cities and rural areas also presents substantial growth opportunities.

Leading Players in the China Ecommerce Logistics Services Market Sector

- DB Schenker

- DHL Logistics (DHL)

- Yusen Logistics

- SF Express (SF Express)

- Nippon Express

- XPO Logistics (XPO Logistics)

- CEVA Logistics (CEVA Logistics)

- VHK Logistics

- CTS International Logistics

- FedEx Express (FedEx)

Key Milestones in China Ecommerce Logistics Services Market Industry

- October 2023: DHL significantly bolstered its operational capabilities and network resilience in China with the inauguration of a new state-of-the-art gateway in Wuxi, Jiangsu Province, coupled with a strategic expansion of its North Asia Hub located in Shanghai.

- May 2023: FedEx Express solidified its commitment to fostering e-commerce growth in Guangzhou through a pivotal partnership with the Guangzhou Municipal Government. This collaboration is designed to streamline customs clearance processes, promote international e-commerce initiatives, and enhance operations at the South China Operations Center (SCOC).

Strategic Outlook for China Ecommerce Logistics Services Market

The China ecommerce logistics services market presents significant long-term growth potential, driven by continued e-commerce expansion, technological advancements, and supportive government policies. Companies that invest in innovation, develop strategic partnerships, and effectively navigate the regulatory landscape will be well-positioned to capitalize on the numerous opportunities within this dynamic market.

China Ecommerce Logistics Services Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory management

- 1.3. Value-Added Services (Labeling, Packaging, etc)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, etc.)

China Ecommerce Logistics Services Market Segmentation By Geography

- 1. China

China Ecommerce Logistics Services Market Regional Market Share

Geographic Coverage of China Ecommerce Logistics Services Market

China Ecommerce Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming mobile commerce; Massive online market

- 3.3. Market Restrains

- 3.3.1. Geographic size and population density; Fragmented supply chain

- 3.4. Market Trends

- 3.4.1. Cross border eCommerce driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Ecommerce Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory management

- 5.1.3. Value-Added Services (Labeling, Packaging, etc)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SF Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 XPO Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VHK Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS International Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FedEx Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Ecommerce Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Ecommerce Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: China Ecommerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: China Ecommerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: China Ecommerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: China Ecommerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: China Ecommerce Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Ecommerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: China Ecommerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: China Ecommerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: China Ecommerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: China Ecommerce Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Ecommerce Logistics Services Market?

The projected CAGR is approximately 9.29%.

2. Which companies are prominent players in the China Ecommerce Logistics Services Market?

Key companies in the market include DB Schenker, DHL Logistics, Yusen Logistics**List Not Exhaustive, SF Express, Nippon Express, XPO Logistics, CEVA Logistics, VHK Logistics, CTS International Logistics, FedEx Express.

3. What are the main segments of the China Ecommerce Logistics Services Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Booming mobile commerce; Massive online market.

6. What are the notable trends driving market growth?

Cross border eCommerce driving the growth of the market.

7. Are there any restraints impacting market growth?

Geographic size and population density; Fragmented supply chain.

8. Can you provide examples of recent developments in the market?

October 2023: DHL inaugurated a new gateway in Wuxi, Jiangsu Province, East China, as part of its ongoing expansion initiatives. Simultaneously, DHL is extending its North Asia Hub in Shanghai Pudong, reinforcing the company's network resilience and service capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Ecommerce Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Ecommerce Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Ecommerce Logistics Services Market?

To stay informed about further developments, trends, and reports in the China Ecommerce Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence