Key Insights

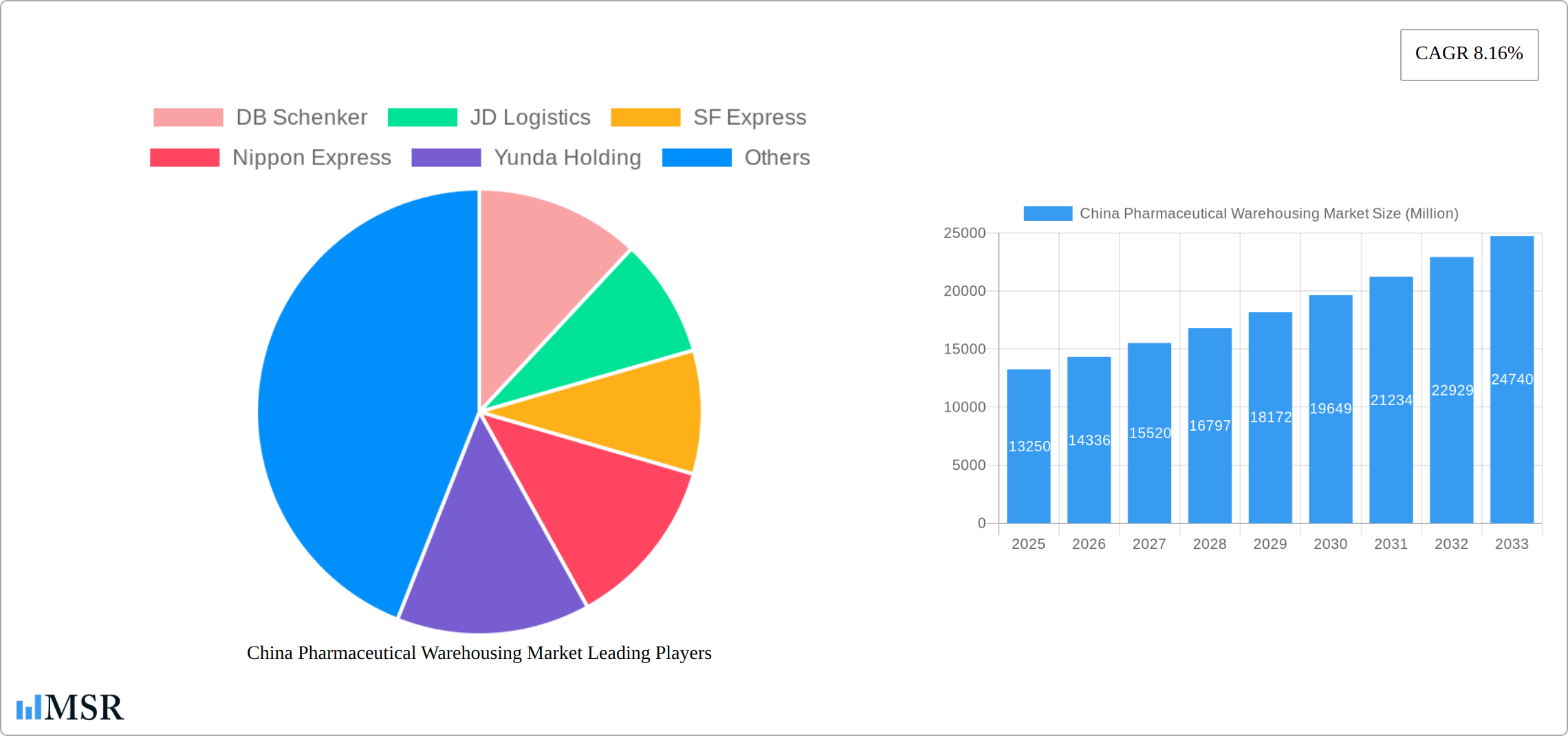

The China pharmaceutical warehousing market, valued at $13.25 billion in 2025, is poised for significant growth, exhibiting a compound annual growth rate (CAGR) of 8.16% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning pharmaceutical industry in China, fueled by increasing healthcare expenditure and a growing aging population, necessitates robust and efficient warehousing solutions. Secondly, stringent regulatory requirements regarding pharmaceutical storage and handling, including the maintenance of cold chain integrity for temperature-sensitive drugs, are driving investment in specialized warehousing facilities. Thirdly, the rise of e-commerce in pharmaceuticals and the increasing demand for faster delivery times are pushing logistics companies to optimize their warehousing networks, leading to further market growth. The market is segmented by application (pharmaceutical factories, pharmacies, hospitals, and others) and type (cold chain and non-cold chain warehouses). Cold chain warehousing is expected to dominate due to the rising demand for temperature-sensitive medications. Competition is fierce, with major players like DB Schenker, JD Logistics, and DHL Supply Chain vying for market share through investments in advanced technology and infrastructure. The continued growth of China’s pharmaceutical sector, coupled with ongoing improvements in logistics infrastructure and technology adoption, will propel further expansion in the pharmaceutical warehousing market throughout the forecast period.

China Pharmaceutical Warehousing Market Market Size (In Billion)

While precise regional breakdowns are not available, China's dominance in the market is evident. The significant market size and CAGR already indicate substantial domestic demand and growth potential. The presence of many Chinese logistics companies among the key players underscores the national focus and the ongoing development of domestic pharmaceutical logistics infrastructure. The restraints on market growth may include challenges related to maintaining regulatory compliance, managing the complexities of cold chain logistics across large geographical areas, and integrating advanced technologies effectively within existing infrastructure. However, these challenges are also likely to stimulate further innovation and investment within the market, ultimately contributing to its continued expansion.

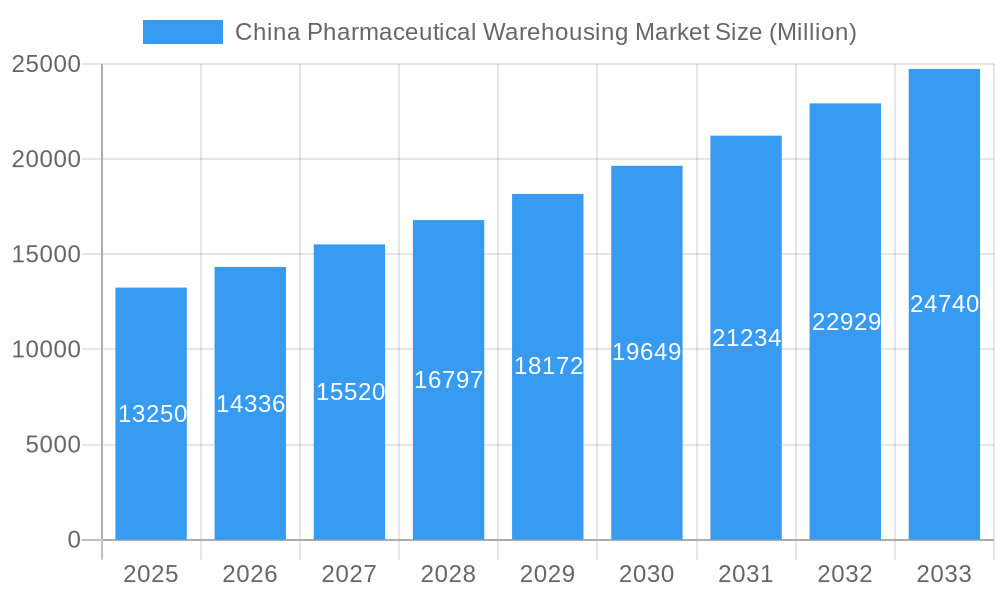

China Pharmaceutical Warehousing Market Company Market Share

China Pharmaceutical Warehousing Market Report: 2019-2033

This comprehensive report offers a detailed analysis of the burgeoning China Pharmaceutical Warehousing Market, providing actionable insights for stakeholders across the pharmaceutical logistics and supply chain ecosystem. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a crucial perspective on market dynamics, growth drivers, and future opportunities. The market size is projected to reach xx Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This report covers key players such as DB Schenker, JD Logistics, SF Express, Nippon Express, Yunda Holding, Kerry Logistics, Yamato Holdings, DHL Supply Chain, Sinopharm Logistics, and CJ Rokin Logistics.

China Pharmaceutical Warehousing Market Concentration & Dynamics

The China pharmaceutical warehousing market displays a moderately concentrated landscape, with a few major players holding significant market share. However, the market is witnessing increased competition from both domestic and international logistics providers. The innovative ecosystem is rapidly evolving, driven by advancements in cold chain technology and digitalization of warehousing operations. Stringent regulatory frameworks, including those related to drug storage and handling, significantly influence market dynamics. Substitute products are limited, primarily due to the specialized nature of pharmaceutical warehousing, especially for temperature-sensitive drugs. End-user trends favor integrated logistics solutions offering greater efficiency and transparency. Mergers and acquisitions (M&A) are relatively frequent, reflecting consolidation efforts within the sector.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Activity: An average of xx M&A deals were recorded annually during the historical period (2019-2024).

- Regulatory landscape: Stringent regulations around temperature control, security and data management are driving adoption of advanced technologies.

China Pharmaceutical Warehousing Market Industry Insights & Trends

The China pharmaceutical warehousing market is experiencing significant growth fueled by several factors. The expanding pharmaceutical industry, increasing demand for temperature-sensitive drugs, and the rising prevalence of chronic diseases are key drivers. Technological advancements, particularly in cold chain logistics and warehouse management systems (WMS), are revolutionizing the sector. Evolving consumer behaviors, including increased online pharmacy usage, are further contributing to growth. The market size reached xx Million in 2025, and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is also propelled by the government's initiatives to improve healthcare infrastructure and logistics efficiency. However, challenges such as infrastructure limitations in certain regions and maintaining stringent quality standards remain.

Key Markets & Segments Leading China Pharmaceutical Warehousing Market

The China pharmaceutical warehousing market is experiencing robust growth, driven primarily by the expanding healthcare sector and the increasing demand for temperature-sensitive pharmaceuticals. The cold chain warehouse segment holds the dominant market share, reflecting the crucial need for precise temperature control in maintaining drug efficacy and safety. Key applications include hospitals, pharmaceutical factories, and pharmacies, each presenting unique warehousing challenges and opportunities. Significant regional variations exist, with the eastern and coastal regions exhibiting faster growth due to superior infrastructure and higher healthcare expenditure. However, development is accelerating in inland regions as well, spurred by government initiatives to improve logistics and healthcare access.

By Application:

- Pharmaceutical Factories: These facilities require large-scale, highly secure warehousing solutions equipped with advanced inventory management systems to support efficient production and distribution processes. The focus is on minimizing waste, ensuring product quality, and optimizing supply chain efficiency.

- Hospitals: Hospitals necessitate specialized storage facilities adhering to strict regulatory guidelines and maintaining the highest hygiene standards. The emphasis is on secure storage, precise temperature control, and efficient inventory management to support patient care.

- Pharmacies (including online pharmacies): The burgeoning online pharmacy sector is driving demand for last-mile delivery solutions integrated with warehousing capabilities. This necessitates efficient order fulfillment, real-time inventory tracking, and reliable delivery networks to meet growing consumer expectations.

- Distribution Centers: Large-scale distribution centers play a vital role in the pharmaceutical supply chain, requiring efficient handling, storage, and redistribution of pharmaceuticals across vast geographical areas. These centers often incorporate advanced technology for inventory management, order tracking, and cold chain monitoring.

By Type:

- Cold Chain Warehouses: This segment remains the dominant force, requiring sophisticated temperature control systems, real-time monitoring technologies (including IoT sensors and data analytics), and robust backup power systems to ensure uninterrupted temperature maintenance. Stringent validation and regulatory compliance are paramount.

- Non-Cold Chain Warehouses: This segment serves the storage needs of non-temperature-sensitive pharmaceuticals and medical supplies. While less complex than cold chain warehousing, it still requires adherence to Good Storage Practices (GSP) and efficient inventory management.

Key Market Drivers:

- Continued robust economic growth in China.

- Ongoing expansion of healthcare infrastructure, including hospitals and clinics.

- Increased government investment in modernizing cold chain logistics infrastructure.

- Rising demand for innovative pharmaceuticals requiring stringent storage conditions.

- Growing adoption of e-commerce and online pharmacy services.

- Stringent regulatory environment driving investments in compliance-focused technologies.

China Pharmaceutical Warehousing Market Product Developments

Technological advancements are significantly shaping the China pharmaceutical warehousing market. Recent innovations focus on improving temperature control precision through advanced refrigeration systems and real-time monitoring. Enhanced traceability systems, utilizing technologies such as RFID and blockchain, ensure product authenticity and track pharmaceuticals throughout the supply chain. Sophisticated Warehouse Management Systems (WMS) integrate seamlessly with other supply chain technologies, streamlining operations, optimizing inventory management, and improving overall efficiency. These advancements are critical for reducing waste, enhancing supply chain transparency, and ensuring compliance with increasingly stringent regulatory requirements. The integration of AI and machine learning is also gaining traction, enabling predictive maintenance, optimized inventory control and improved route planning for delivery. Automated guided vehicles (AGVs) and robotic systems are being deployed in larger facilities to improve efficiency and reduce operational costs.

Challenges in the China Pharmaceutical Warehousing Market

Despite significant growth, the China pharmaceutical warehousing market faces substantial challenges. Maintaining the integrity of the cold chain across vast distances, especially in less developed regions, remains a major hurdle. Stringent regulatory compliance necessitates significant investments in infrastructure and technology, impacting profitability. Intense competition among warehousing providers necessitates continuous innovation and operational excellence. Infrastructure limitations, particularly in the availability of modern, technologically advanced cold chain warehouses in certain regions, contribute to significant product loss. For example, [Insert updated statistic on percentage of cold chain warehouses lacking necessary technology, if available, otherwise remove this example]. Additionally, skilled labor shortages in specialized areas like cold chain management pose a significant challenge for many operators. Addressing these challenges requires collaborative efforts between government, industry players, and technology providers to improve infrastructure, enhance technology adoption, and foster a more efficient and resilient pharmaceutical supply chain.

Forces Driving China Pharmaceutical Warehousing Market Growth

Key drivers include rising healthcare expenditure, government support for cold chain infrastructure development, growing demand for specialty pharmaceuticals, and technological advancements such as automation and AI-powered logistics solutions. These factors collectively contribute to increasing market penetration and expanding market size.

Long-Term Growth Catalysts in China Pharmaceutical Warehousing Market

Long-term growth will be propelled by ongoing investments in cold chain infrastructure, increasing adoption of advanced technologies, and strategic partnerships between pharmaceutical companies and logistics providers. Further expansion into less-developed regions of China, and innovative solutions addressing rural market access, are also key contributors to sustained growth.

Emerging Opportunities in China Pharmaceutical Warehousing Market

Emerging opportunities include the expansion of e-commerce and online pharmacies, creating a demand for last-mile delivery solutions and specialized warehousing. The growing use of big data and AI for predictive maintenance and inventory optimization also presents significant opportunities. Furthermore, the increasing focus on sustainable and environmentally friendly practices offers scope for differentiated services and greater market share.

Leading Players in the China Pharmaceutical Warehousing Market Sector

- DB Schenker

- JD Logistics (JD.com)

- SF Express (SF Express)

- Nippon Express

- Yunda Holding

- Kerry Logistics (Kerry Logistics)

- Yamato Holdings

- DHL Supply Chain (DHL)

- Sinopharm Logistics

- CJ Rokin Logistics

Key Milestones in China Pharmaceutical Warehousing Market Industry

- July 2023: JD Logistics established a 10,000 sq m pharmaceutical warehouse in Shenyang, Liaoning, offering 3PL services and various temperature-controlled storage options, reflecting the growing demand for specialized logistics and integrated supply chain solutions.

- October 2022: China donated a USD 1 Million high-tech pharmaceutical warehouse to Zimbabwe, showcasing technological advancements and international collaborations in the sector, and highlighting the global reach of Chinese pharmaceutical logistics expertise.

- [Add other recent significant milestones with dates and brief descriptions. Examples could include new warehouse openings by major players, significant investments in cold chain technology, regulatory updates impacting the industry, or notable mergers and acquisitions.]

Strategic Outlook for China Pharmaceutical Warehousing Market

The future of the China pharmaceutical warehousing market is exceptionally promising. Continued growth is expected, driven by technological innovations, regulatory advancements, and expanding healthcare needs. Strategic partnerships, investments in advanced infrastructure, and a focus on sustainability will be crucial for success in this dynamic market. The market presents significant opportunities for both established players and new entrants who can adapt to the evolving landscape and leverage emerging technologies.

China Pharmaceutical Warehousing Market Segmentation

-

1. BY Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

China Pharmaceutical Warehousing Market Segmentation By Geography

- 1. China

China Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of China Pharmaceutical Warehousing Market

China Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapidly Expanding Pharmaceutical Industry4.; Population Growth is one of the main drivers for the warehousing market

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management

- 3.4. Market Trends

- 3.4.1. Increase In Population is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JD Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SF Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yunda Holding

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yamato Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Supply Chain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sinopharm Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CJ Rokin Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: China Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 2: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 5: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Pharmaceutical Warehousing Market?

The projected CAGR is approximately 8.16%.

2. Which companies are prominent players in the China Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, JD Logistics, SF Express, Nippon Express, Yunda Holding, Kerry Logistics, Yamato Holdings, DHL Supply Chain, Sinopharm Logistics, CJ Rokin Logistics.

3. What are the main segments of the China Pharmaceutical Warehousing Market?

The market segments include BY Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.25 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapidly Expanding Pharmaceutical Industry4.; Population Growth is one of the main drivers for the warehousing market.

6. What are the notable trends driving market growth?

Increase In Population is driving the market.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management.

8. Can you provide examples of recent developments in the market?

July 2023: JD set up a warehouse in the Shenyang area of Liaoning to handle the growing demand for pharmaceutical products. It's 10,000 sq m and offers 3PL (3rd party logistics) services for medicine, medical equipment, and medical supplies. It's got different temperature levels for different drugs, like cool, room, fridge, and frozen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the China Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence