Key Insights

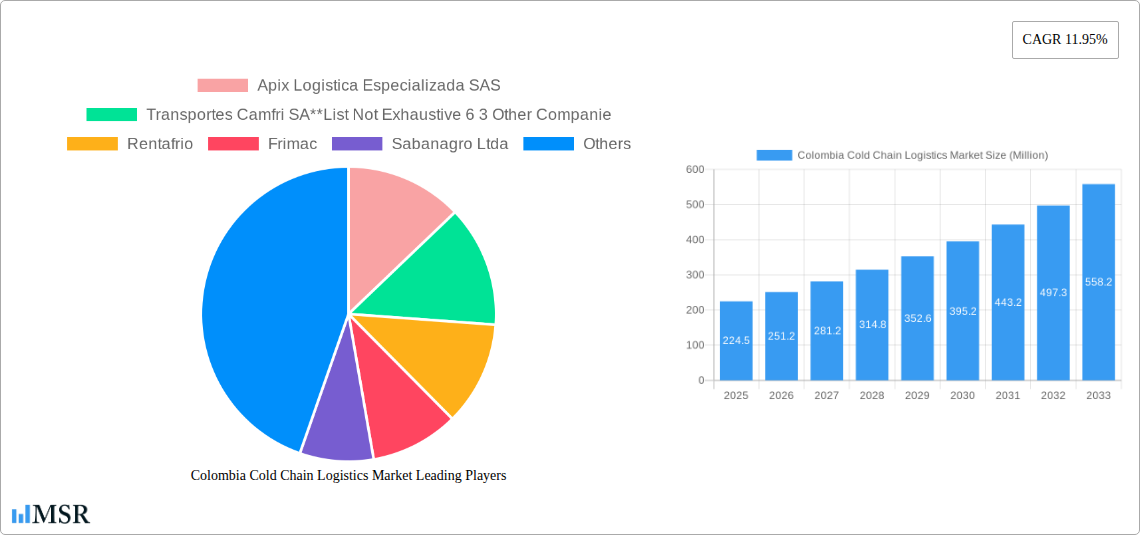

The Colombian cold chain logistics market, valued at $224.5 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 11.95% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning horticulture sector, particularly the export of fresh fruits and vegetables, fuels significant demand for reliable cold chain solutions. Furthermore, increasing per capita consumption of dairy products, meats, and processed foods, coupled with a growing middle class with greater purchasing power, is driving the need for efficient cold chain infrastructure to ensure product quality and safety. The pharmaceutical and life sciences sectors also contribute significantly, requiring stringent temperature-controlled transportation and storage for sensitive goods. Growth is further facilitated by government initiatives promoting food security and infrastructure development, incentivizing investment in modern cold storage facilities and transportation networks. However, challenges remain, including the need for improved infrastructure in certain regions, particularly in rural areas, and the potential impact of fluctuating fuel prices on transportation costs. The market is segmented by temperature type (ambient, chilled, frozen), application (horticulture, dairy, meats, processed foods, pharma, life sciences, chemicals), and services (storage, transportation, value-added services like blast freezing and inventory management). Key players include Apix Logistica Especializada SAS, Transportes Camfri SA, Rentafrio, and others, competing in a market characterized by both established players and emerging smaller companies.

Colombia Cold Chain Logistics Market Market Size (In Million)

The competitive landscape is dynamic, with established players focusing on expanding their service offerings and technological capabilities, while smaller companies leverage regional expertise and niche services. Future growth hinges on continued investment in cold chain infrastructure, the adoption of advanced technologies such as IoT-enabled monitoring and tracking systems, and the implementation of sustainable practices to reduce environmental impact. The increasing demand for e-commerce and online grocery delivery further accelerates the need for efficient and reliable last-mile cold chain delivery solutions. Addressing challenges related to infrastructure gaps and regulatory frameworks will be crucial for maximizing the market's full potential and ensuring sustainable growth over the forecast period. This robust growth trajectory indicates significant investment opportunities for both domestic and international players within the Colombian cold chain logistics sector.

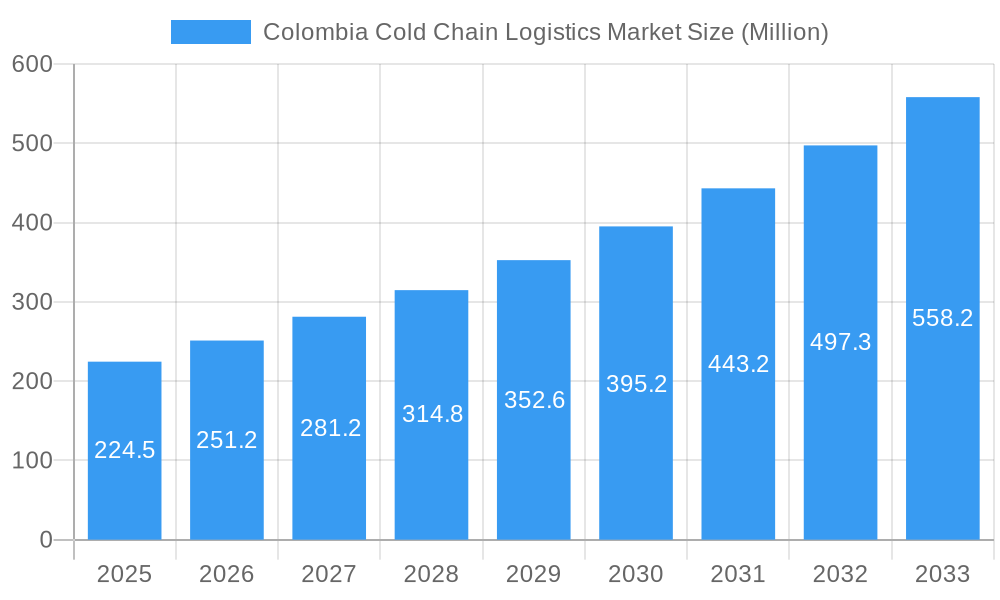

Colombia Cold Chain Logistics Market Company Market Share

Unlock Growth in the Booming Colombia Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Colombia cold chain logistics market, offering invaluable insights for industry stakeholders seeking to capitalize on its significant growth potential. Covering the period from 2019 to 2033, with a base year of 2025, this study meticulously examines market dynamics, key segments, leading players, and emerging trends, offering a robust forecast for the years 2025-2033. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for strategic decision-making.

Colombia Cold Chain Logistics Market Market Concentration & Dynamics

The Colombia cold chain logistics market is characterized by a moderately concentrated landscape, featuring a blend of established major players and a vibrant ecosystem of smaller, specialized companies. This dynamic competitive environment fosters innovation and offers distinct opportunities. As of 2024, the top five dominant entities collectively command an estimated xx% of the market share, indicating substantial runway for emerging and existing players to expand their footprint. The sector's innovation trajectory is prominently shaped by advancements in cutting-edge temperature-controlled transportation and storage technologies, coupled with an intensified emphasis on optimizing supply chain efficiency and championing sustainable practices. The evolving regulatory landscape, while presenting its own set of hurdles, simultaneously offers significant advantages to companies that are steadfast in their commitment to upholding stringent quality and safety protocols. A clear trend towards the adoption of advanced monitoring and tracking systems is superseding traditional methodologies, thereby enhancing operational oversight. Furthermore, end-user demands are increasingly leaning towards comprehensive, integrated logistics solutions that provide end-to-end visibility and granular control across the entire supply chain. Mergers and acquisitions (M&A) activity within the sector remains a steady, moderate force, with approximately xx strategic deals recorded over the past five years, underscoring a mature yet still active market.

- Market Concentration: The top 5 players collectively hold approximately xx% of the market share in 2024.

- Innovation Ecosystem: A strong emphasis on technology-driven solutions, with a growing commitment to sustainability and overarching supply chain efficiency improvements.

- Regulatory Framework: An adaptive regulatory environment that is actively encouraging the adoption of higher industry standards and best practices.

- Substitute Products: The market is witnessing a discernible shift towards advanced tracking and monitoring systems, effectively displacing older, less sophisticated methods.

- End-User Trends: A pronounced and growing preference among end-users for integrated, end-to-end logistics solutions offering seamless management and complete visibility.

- M&A Activity: A total of xx strategic M&A deals have been completed within the last five years.

Colombia Cold Chain Logistics Market Industry Insights & Trends

The Colombian cold chain logistics market is experiencing robust growth, driven by factors such as increasing consumer demand for fresh and processed foods, expansion of the pharmaceutical and life sciences sectors, and rising disposable incomes. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological disruptions, including the adoption of IoT sensors, blockchain technology for enhanced traceability, and automated warehousing systems, are significantly impacting operational efficiency and supply chain visibility. Evolving consumer behaviors, characterized by a preference for convenience and higher quality products, are fueling demand for sophisticated cold chain solutions.

Key Markets & Segments Leading Colombia Cold Chain Logistics Market

The Colombian cold chain logistics market is diverse, with several key segments contributing to its overall growth. The frozen segment dominates by temperature type, driven by increasing demand for frozen foods and the need for efficient cold storage solutions. Within applications, horticulture (fresh fruits and vegetables) and dairy products represent significant market shares, while the pharma and life sciences segment is poised for rapid growth due to increased demand for temperature-sensitive pharmaceuticals. The transportation segment commands a large share of services, yet value-added services like blast freezing and inventory management are gaining traction. Geographically, major urban centers and agricultural hubs are primary growth drivers.

Key Growth Drivers:

- Economic Growth: Rising disposable incomes and increasing consumer spending.

- Infrastructure Development: Investments in transportation networks and cold storage facilities.

- Expanding Food Processing Industry: Growing demand for processed and packaged food products.

- Pharmaceutical and Life Sciences Growth: Increased production and distribution of temperature-sensitive pharmaceuticals.

- Government Initiatives: Support for agricultural development and food security.

Dominance Analysis:

The frozen segment leads by temperature type due to its larger market size and high demand. The horticulture and dairy segments within the applications category drive most of the volume, creating high demand for refrigerated transportation and storage. However, the pharmaceutical and life sciences sectors are predicted to show higher growth rates over the forecast period.

Colombia Cold Chain Logistics Market Product Developments

Recent innovations in the Colombian cold chain logistics market include the adoption of smart containers with real-time temperature monitoring, improved refrigeration technologies that reduce energy consumption, and the integration of AI-powered route optimization systems. These advancements enhance efficiency, traceability, and sustainability, offering competitive advantages to logistics providers.

Challenges in the Colombia Cold Chain Logistics Market Market

The Colombian cold chain logistics market faces challenges, including inadequate infrastructure in certain regions, limited access to financing for small and medium-sized enterprises (SMEs), and high energy costs. Furthermore, maintaining consistent cold chain integrity across the country's diverse geography presents significant logistical obstacles, impacting product quality and shelf life. The total impact of these challenges is estimated to decrease the market growth by xx% in the next 5 years.

Forces Driving Colombia Cold Chain Logistics Market Growth

Several powerful forces are propelling the growth of the Colombian cold chain logistics market. Significant investments are being channeled into infrastructure development, enhancing connectivity and capacity. The burgeoning expansion of e-commerce platforms is creating a robust demand for efficient and reliable cold chain solutions. Complementing these, government initiatives focused on bolstering food safety and security are creating a more favorable operating environment. Moreover, the integration of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) is revolutionizing operational efficiency and optimizing logistics processes.

Challenges in the Colombia Cold Chain Logistics Market Market

Long-term growth is contingent upon sustained investment in infrastructure, overcoming supply chain inefficiencies, and fostering collaboration within the industry. Innovative solutions like blockchain technology can significantly enhance traceability and reduce spoilage.

Emerging Opportunities in Colombia Cold Chain Logistics Market

Emerging opportunities include the growth of specialized services such as temperature-controlled last-mile delivery and value-added services for the pharmaceutical sector. The rising demand for sustainable cold chain solutions opens up avenues for environmentally friendly technologies and practices.

Leading Players in the Colombia Cold Chain Logistics Market Sector

- Apix Logistica Especializada SAS

- Transportes Camfri SA

- Rentafrio

- Frimac

- Sabanagro Ltda

- Ransa Colombia Colfrigos

- Sefarcol SA

- Megafin Logistica Para Alimentos

- Transportes Iceberg De Colombia

- Frigometro

- 63 Other Companies

Key Milestones in Colombia Cold Chain Logistics Market Industry

- September 2023: A.P. Moller Maersk opens a 14,000-square-meter fulfillment center in Colombia, expanding its presence in the region and catering to pharmaceutical and consumer product sectors. This significantly improves logistics capacity for these key industries.

- April 2023: The US Customs and Border Protection agency signs a Mutual Recognition Arrangement (MRA) with Colombia and Guatemala, enhancing security and streamlining cross-border trade. This will contribute to a more efficient and secure supply chain environment.

Strategic Outlook for Colombia Cold Chain Logistics Market Market

The Colombian cold chain logistics market holds immense growth potential, driven by rising consumer demand, technological innovations, and supportive government policies. Strategic partnerships, investments in advanced technologies, and a focus on sustainability will be crucial for companies aiming to capture market share and achieve long-term success in this dynamic sector.

Colombia Cold Chain Logistics Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Others

Colombia Cold Chain Logistics Market Segmentation By Geography

- 1. Colombia

Colombia Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Colombia Cold Chain Logistics Market

Colombia Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Export of Fresh Produce4.; Pharmaceutical Industry Growth

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure Challenges4.; Costs and Investment

- 3.4. Market Trends

- 3.4.1. Rising Consumer Demand For Perishable Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Apix Logistica Especializada SAS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transportes Camfri SA**List Not Exhaustive 6 3 Other Companie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rentafrio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Frimac

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sabanagro Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ransa Colombia Colfrigos

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sefarcol SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Megafin Logistica Para Alimentos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Transportes Iceberg De Colombia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Frigometro

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Apix Logistica Especializada SAS

List of Figures

- Figure 1: Colombia Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Colombia Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Colombia Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Cold Chain Logistics Market?

The projected CAGR is approximately 11.95%.

2. Which companies are prominent players in the Colombia Cold Chain Logistics Market?

Key companies in the market include Apix Logistica Especializada SAS, Transportes Camfri SA**List Not Exhaustive 6 3 Other Companie, Rentafrio, Frimac, Sabanagro Ltda, Ransa Colombia Colfrigos, Sefarcol SA, Megafin Logistica Para Alimentos, Transportes Iceberg De Colombia, Frigometro.

3. What are the main segments of the Colombia Cold Chain Logistics Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 224.5 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Export of Fresh Produce4.; Pharmaceutical Industry Growth.

6. What are the notable trends driving market growth?

Rising Consumer Demand For Perishable Goods.

7. Are there any restraints impacting market growth?

4.; Infrastructure Challenges4.; Costs and Investment.

8. Can you provide examples of recent developments in the market?

September 2023: A.P. Moller Maersk expanded its presence in Latin America and the Caribbean by opening a 14,000-square-meter fulfillment center in Colombia. Customers from the pharmaceutical and consumer products sectors, who have already benefited from these facilities, participated in the inauguration of a new Maersk fulfillment center.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Colombia Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence