Key Insights

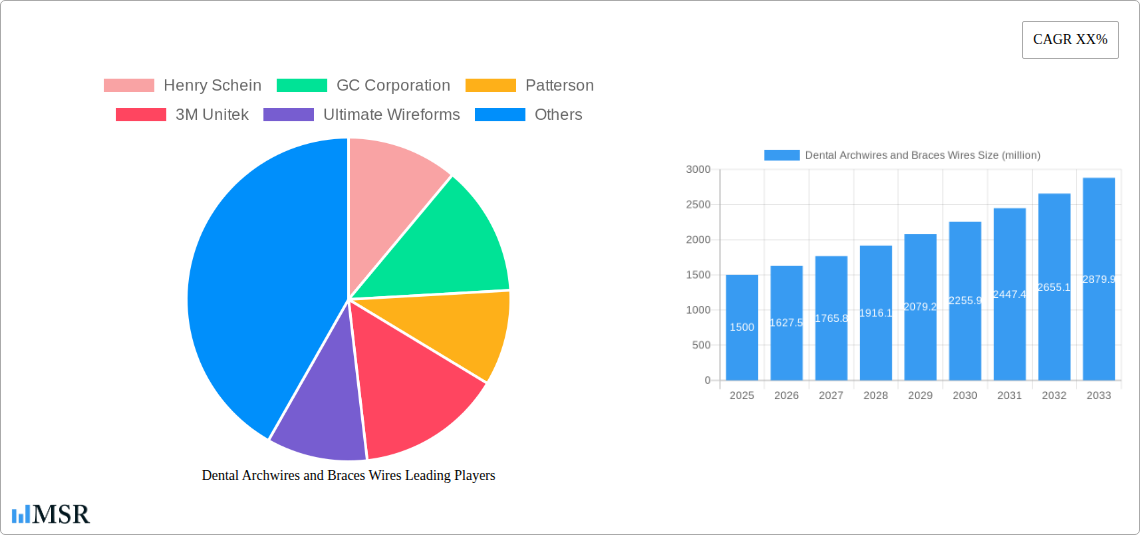

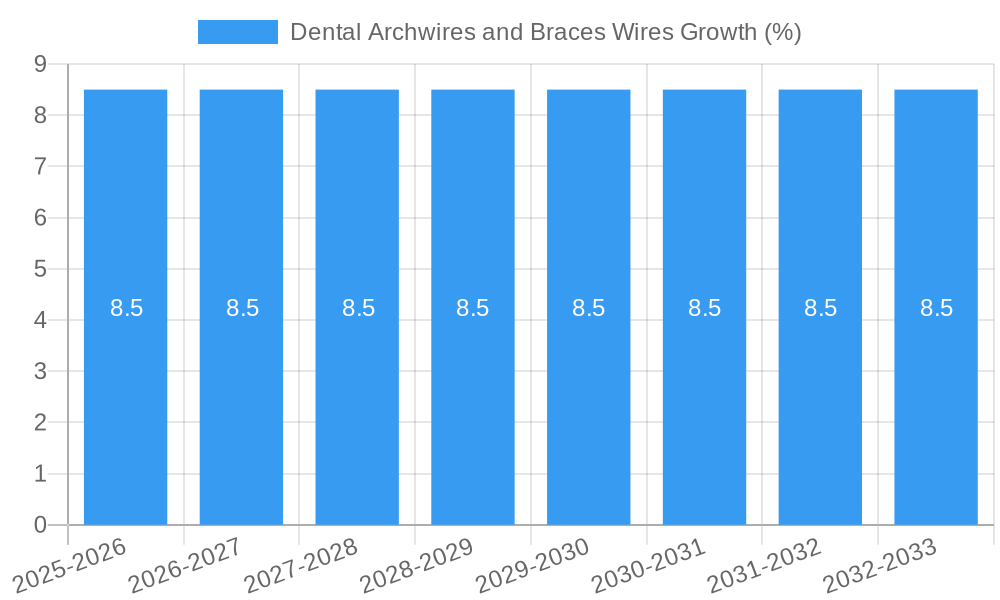

The global dental archwires and braces wires market is poised for significant expansion, projected to reach an estimated market size of $1,500 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025-2033. This impressive growth is primarily fueled by the increasing prevalence of malocclusions and dental alignment issues worldwide, coupled with a rising awareness and demand for orthodontic treatments among a broader demographic. The growing disposable income in emerging economies, alongside advancements in orthodontic technology leading to more comfortable and effective treatments, are key drivers propelling market expansion. Furthermore, the aesthetic appeal of a well-aligned smile is increasingly influencing consumer choices, thereby boosting the demand for orthodontic appliances, including archwires. The market is segmented into various applications, with hospitals and clinics emerging as the dominant end-use segments due to the concentration of orthodontic specialists and advanced treatment facilities in these settings.

The market dynamics are further shaped by evolving consumer preferences and technological innovations. Nickel Titanium (NiTi) archwires, known for their superelasticity and shape memory properties, are gaining substantial traction, offering patients a more comfortable and efficient treatment experience compared to traditional stainless steel wires. Beta Titanium archwires are also carving out a significant niche due to their unique mechanical properties. The competitive landscape is characterized by the presence of numerous global and regional players, including giants like Henry Schein, GC Corporation, Patterson, 3M Unitek, and Dentsply, alongside emerging manufacturers focusing on innovative product offerings and market penetration in high-growth regions. Restraints such as the high cost of advanced orthodontic treatments and the availability of alternative aesthetic solutions like clear aligners are present, but the inherent efficacy and widespread applicability of archwire-based orthodontics are expected to mitigate these challenges, ensuring sustained market growth.

Dental Archwires and Braces Wires Market Concentration & Dynamics

The global dental archwires and braces wires market is characterized by a moderate to high concentration, with key players like Henry Schein, GC Corporation, Patter son, 3M Unitek, Ultimate Wireforms, American Orthodontic, Dentsply, Forestadent, Dentaurum, Ormco, ACME Monaco, Tomy, Dental Morelli, J J Orthodontics, Beijing Smart, Grikin, Shenzhen Super Line, AIC Mondi Material, 3B ortho, and others vying for market share. The estimated market share of the top 5 companies is approximately 65 million. Innovation ecosystems are robust, driven by advancements in material science and manufacturing technologies, particularly in Nickel Titanium Archwire and Beta Titanium Archwire segments. Regulatory frameworks, overseen by bodies like the FDA and EMA, ensure product safety and efficacy, influencing product development cycles. Substitute products, such as clear aligners, present a growing challenge, though archwires and braces wires remain indispensable for complex orthodontic corrections. End-user trends highlight an increasing demand for aesthetically pleasing and minimally invasive orthodontic treatments, pushing manufacturers towards developing advanced, patient-friendly solutions. Merger and acquisition (M&A) activities, totaling an estimated 12 deals in the historical period, have been instrumental in consolidating market power and expanding product portfolios, with an estimated value of xx million.

Dental Archwires and Braces Wires Industry Insights & Trends

The dental archwires and braces wires market is experiencing robust growth, projected to reach a market size of xx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is fueled by several key drivers, including the rising prevalence of malocclusion and dental deformities worldwide, an increasing global focus on dental aesthetics, and the growing adoption of advanced orthodontic treatments. Technological disruptions are at the forefront, with continuous innovation in material science leading to the development of superior archwire materials such as Nickel Titanium Archwire and Beta Titanium Archwire, offering enhanced flexibility, superelasticity, and memory effect. These advancements translate to improved patient comfort, reduced treatment times, and more predictable outcomes, thereby driving demand. Evolving consumer behaviors, characterized by a greater awareness of oral health and a willingness to invest in orthodontic treatments for aesthetic and functional benefits, are further propelling market growth. The aging global population also contributes, as adults increasingly seek orthodontic solutions. Furthermore, the expanding healthcare infrastructure in emerging economies and rising disposable incomes in these regions are creating new avenues for market penetration. The shift towards less visible and more comfortable orthodontic appliances, while not entirely replacing traditional braces, is prompting manufacturers to innovate in wire coatings and designs to meet these evolving patient preferences. The market is also seeing a trend towards customization, with some manufacturers offering tailored wire solutions for specific patient needs.

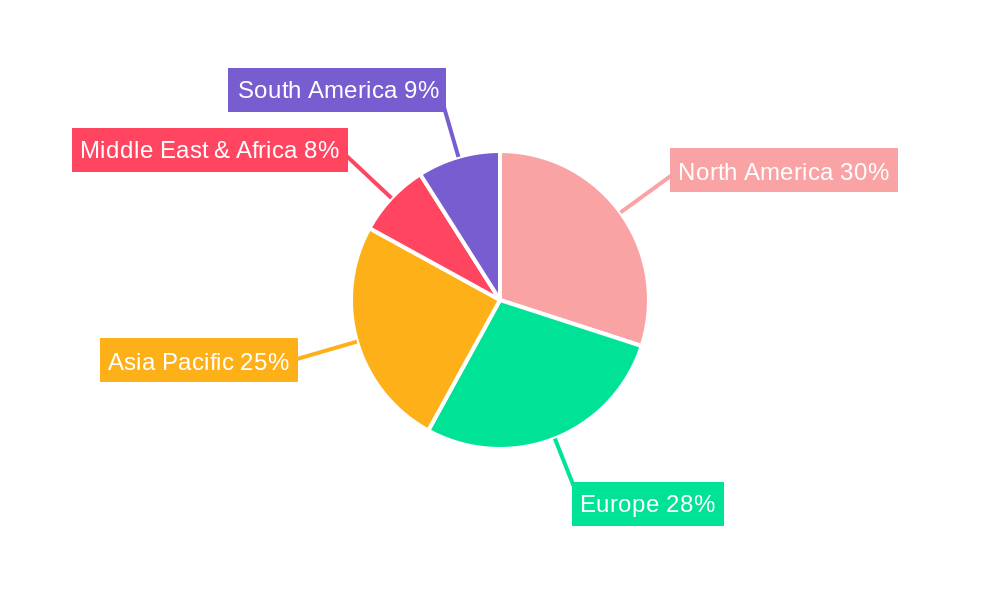

Key Markets & Segments Leading Dental Archwires and Braces Wires

The dental archwires and braces wires market is demonstrating significant dominance in specific regions and segments, driven by a confluence of economic growth, robust healthcare infrastructure, and high adoption rates of advanced orthodontic treatments.

Dominant Region: North America currently leads the dental archwires and braces wires market. This dominance is attributed to several factors:

- High Disposable Income: A large segment of the population possesses the financial capacity to invest in orthodontic treatments.

- Advanced Healthcare Infrastructure: The region boasts well-established dental practices and a high density of orthodontic specialists.

- Early Adoption of Technology: North America has consistently been an early adopter of innovative dental materials and technologies, including advanced archwire formulations.

- Strong Awareness of Dental Aesthetics: A cultural emphasis on appearance fuels demand for orthodontic correction.

Dominant Country: Within North America, the United States stands out as the leading country in the dental archwires and braces wires market. Its market leadership is further bolstered by a substantial patient pool, extensive research and development initiatives by leading companies, and favorable reimbursement policies for certain orthodontic procedures.

Dominant Application Segment: The Clinic segment holds the largest share in the dental archwires and braces wires market.

- High Patient Volume: Dental clinics cater to a vast number of patients seeking orthodontic consultations and treatments.

- Specialized Expertise: Orthodontic clinics are equipped with specialized professionals and technologies essential for fitting and adjusting braces and archwires.

- Focus on Treatment Delivery: Clinics are the primary points of service delivery for orthodontic care, directly utilizing archwires and braces wires.

Dominant Type Segment: Nickel Titanium Archwire is the leading product type in the dental archwires and braces wires market.

- Superior Properties: Nickel Titanium wires offer exceptional properties such as superelasticity, shape memory, and low friction, which are crucial for efficient tooth movement and patient comfort.

- Reduced Treatment Time: Their unique characteristics enable faster and more predictable orthodontic outcomes compared to traditional stainless steel archwires.

- Widespread Adoption by Orthodontists: The benefits of Nickel Titanium Archwires have led to their widespread acceptance and preference among orthodontists globally.

While Stainless Steel Archwire and Beta Titanium Archwire remain vital, especially for specific stages of treatment or for their robustness, Nickel Titanium Archwire's superior performance in addressing patient comfort and treatment efficiency solidifies its leading position in the market.

Dental Archwires and Braces Wires Product Developments

Product innovation in the dental archwires and braces wires market is continuously enhancing patient outcomes and treatment efficiency. Developments are focused on advanced materials with improved superelasticity, shape memory, and reduced friction, notably in Nickel Titanium Archwire and Beta Titanium Archwire segments. Manufacturers are also exploring bio-compatible coatings and aesthetic options to meet patient preferences for less visible and more comfortable orthodontic solutions. These innovations aim to shorten treatment durations, minimize discomfort, and provide orthodontists with greater control and predictability in tooth movement, thereby offering a competitive edge in the dynamic market.

Challenges in the Dental Archwires and Braces Wires Market

The dental archwires and braces wires market faces several challenges that could impede growth.

- Competition from Clear Aligners: The rising popularity of aesthetic clear aligner systems presents a significant substitute threat, particularly for mild to moderate orthodontic cases.

- Regulatory Hurdles: Stringent regulatory approvals for novel materials and manufacturing processes can lead to extended product development timelines and increased costs.

- Price Sensitivity: In certain markets, price remains a critical factor for both dentists and patients, leading to pressure on manufacturers' profit margins.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as witnessed in recent years, can impact the availability and cost of raw materials, affecting production and delivery.

- Skilled Labor Shortage: A potential shortage of skilled professionals in manufacturing and specialized dental technicians can limit production capacity and innovation.

Forces Driving Dental Archwires and Braces Wires Growth

Several key forces are propelling the growth of the dental archwires and braces wires market.

- Increasing Global Incidence of Malocclusion: A rising number of individuals worldwide are experiencing dental misalignments, creating a larger patient pool for orthodontic treatments.

- Growing Emphasis on Dental Aesthetics: Societal trends and increased awareness of the importance of a pleasing smile are driving demand for orthodontic correction across all age groups.

- Technological Advancements in Materials: Innovations in Nickel Titanium Archwire and Beta Titanium Archwire, offering enhanced flexibility, superelasticity, and reduced friction, are improving treatment efficacy and patient comfort.

- Expanding Healthcare Infrastructure in Emerging Economies: As healthcare access improves in developing regions, the demand for advanced dental treatments, including orthodontics, is set to rise significantly.

- Increased Disposable Income: Growing economies are leading to higher disposable incomes, enabling more individuals to afford elective dental procedures like orthodontic treatment.

Challenges in the Dental Archwires and Braces Wires Market

Long-term growth catalysts in the dental archwires and braces wires market are rooted in continuous innovation and strategic market expansion. The development of next-generation materials that offer even greater biocompatibility, reduced treatment times, and enhanced patient comfort will be crucial. Furthermore, strategic partnerships between manufacturers and dental educational institutions can foster the adoption of advanced techniques and materials. Expanding reach into underserved emerging markets through targeted distribution networks and localized product offerings will unlock significant growth potential. The integration of digital technologies in treatment planning and wire manufacturing will also streamline processes and improve precision, further solidifying the market's trajectory.

Emerging Opportunities in Dental Archwires and Braces Wires

Emerging opportunities within the dental archwires and braces wires market are diverse and promising. The development of smart archwires with integrated sensors for real-time monitoring of tooth movement presents a significant technological frontier. There is also a growing demand for customized archwire solutions tailored to individual patient anatomy and treatment plans, opening avenues for mass customization technologies. The increasing geriatric population seeking orthodontic solutions for functional and aesthetic reasons offers a new demographic for market penetration. Furthermore, exploring sustainable manufacturing practices and bio-based materials can appeal to an environmentally conscious consumer base. The integration of AI and machine learning in orthodontic treatment planning, which can optimize archwire selection and usage, represents a future growth area.

Leading Players in the Dental Archwires and Braces Wires Sector

- Henry Schein

- GC Corporation

- Patterson

- 3M Unitek

- Ultimate Wireforms

- American Orthodontic

- Dentsply

- Forestadent

- Dentaurum

- Ormco

- ACME Monaco

- Tomy

- Dental Morelli

- J J Orthodontics

- Beijing Smart

- Grikin

- Shenzhen Super Line

- AIC Mondi Material

- 3B ortho

Key Milestones in Dental Archwires and Braces Wires Industry

- 2019: Introduction of novel Nickel Titanium alloys with enhanced superelasticity by a major player.

- 2020: Increased M&A activity with xx million in reported deals, consolidating market share.

- 2021: Launch of advanced Beta Titanium Archwires offering improved corrosion resistance and strength.

- 2022: Significant advancements in manufacturing automation, leading to increased production efficiency.

- 2023: Growing adoption of aesthetic coatings on archwires to improve patient compliance and satisfaction.

- 2024: Emergence of research into bio-integrated archwire materials for enhanced biocompatibility.

Strategic Outlook for Dental Archwires and Braces Wires Market

- 2019: Introduction of novel Nickel Titanium alloys with enhanced superelasticity by a major player.

- 2020: Increased M&A activity with xx million in reported deals, consolidating market share.

- 2021: Launch of advanced Beta Titanium Archwires offering improved corrosion resistance and strength.

- 2022: Significant advancements in manufacturing automation, leading to increased production efficiency.

- 2023: Growing adoption of aesthetic coatings on archwires to improve patient compliance and satisfaction.

- 2024: Emergence of research into bio-integrated archwire materials for enhanced biocompatibility.

Strategic Outlook for Dental Archwires and Braces Wires Market

The strategic outlook for the dental archwires and braces wires market is characterized by sustained growth driven by innovation and market expansion. Key growth accelerators include the continued development of advanced Nickel Titanium Archwire and Beta Titanium Archwire materials that offer superior patient comfort and treatment efficiency. Manufacturers will focus on expanding their presence in emerging economies, leveraging growing healthcare expenditure and rising disposable incomes. Strategic collaborations and potential acquisitions will play a vital role in consolidating market positions and broadening product portfolios. The emphasis on aesthetic and minimally invasive orthodontic solutions will continue to shape product development, ensuring the market remains dynamic and responsive to evolving patient needs and preferences.

Dental Archwires and Braces Wires Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. Nickel Titanium Archwire

- 2.2. Stainless Steel Archwire

- 2.3. Beta Titanium Archwire

- 2.4. Other Material

Dental Archwires and Braces Wires Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Archwires and Braces Wires REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Archwires and Braces Wires Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Nickel Titanium Archwire

- 5.2.2. Stainless Steel Archwire

- 5.2.3. Beta Titanium Archwire

- 5.2.4. Other Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Archwires and Braces Wires Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Nickel Titanium Archwire

- 6.2.2. Stainless Steel Archwire

- 6.2.3. Beta Titanium Archwire

- 6.2.4. Other Material

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Archwires and Braces Wires Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Nickel Titanium Archwire

- 7.2.2. Stainless Steel Archwire

- 7.2.3. Beta Titanium Archwire

- 7.2.4. Other Material

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Archwires and Braces Wires Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Nickel Titanium Archwire

- 8.2.2. Stainless Steel Archwire

- 8.2.3. Beta Titanium Archwire

- 8.2.4. Other Material

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Archwires and Braces Wires Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Nickel Titanium Archwire

- 9.2.2. Stainless Steel Archwire

- 9.2.3. Beta Titanium Archwire

- 9.2.4. Other Material

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Archwires and Braces Wires Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Nickel Titanium Archwire

- 10.2.2. Stainless Steel Archwire

- 10.2.3. Beta Titanium Archwire

- 10.2.4. Other Material

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Henry Schein

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GC Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Patterson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M Unitek

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ultimate Wireforms

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 American orthodontic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dentsply

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Forestadent

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dentaurum

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ormco

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ACME Monaco

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tomy

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dental Morelli

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 J J Orthodontics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Beijing Smart

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Grikin

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Shenzhen Super Line

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 AIC Mondi Material

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 3B ortho

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Henry Schein

List of Figures

- Figure 1: Global Dental Archwires and Braces Wires Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Dental Archwires and Braces Wires Revenue (million), by Application 2024 & 2032

- Figure 3: North America Dental Archwires and Braces Wires Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Dental Archwires and Braces Wires Revenue (million), by Types 2024 & 2032

- Figure 5: North America Dental Archwires and Braces Wires Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Dental Archwires and Braces Wires Revenue (million), by Country 2024 & 2032

- Figure 7: North America Dental Archwires and Braces Wires Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dental Archwires and Braces Wires Revenue (million), by Application 2024 & 2032

- Figure 9: South America Dental Archwires and Braces Wires Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Dental Archwires and Braces Wires Revenue (million), by Types 2024 & 2032

- Figure 11: South America Dental Archwires and Braces Wires Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Dental Archwires and Braces Wires Revenue (million), by Country 2024 & 2032

- Figure 13: South America Dental Archwires and Braces Wires Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dental Archwires and Braces Wires Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Dental Archwires and Braces Wires Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Dental Archwires and Braces Wires Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Dental Archwires and Braces Wires Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Dental Archwires and Braces Wires Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Dental Archwires and Braces Wires Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dental Archwires and Braces Wires Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Dental Archwires and Braces Wires Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Dental Archwires and Braces Wires Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Dental Archwires and Braces Wires Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Dental Archwires and Braces Wires Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dental Archwires and Braces Wires Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dental Archwires and Braces Wires Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Dental Archwires and Braces Wires Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Dental Archwires and Braces Wires Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Dental Archwires and Braces Wires Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Dental Archwires and Braces Wires Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dental Archwires and Braces Wires Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Archwires and Braces Wires Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Archwires and Braces Wires Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Dental Archwires and Braces Wires Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Dental Archwires and Braces Wires Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Dental Archwires and Braces Wires Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Dental Archwires and Braces Wires Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Dental Archwires and Braces Wires Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Dental Archwires and Braces Wires Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Dental Archwires and Braces Wires Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Dental Archwires and Braces Wires Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Dental Archwires and Braces Wires Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Dental Archwires and Braces Wires Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Dental Archwires and Braces Wires Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Dental Archwires and Braces Wires Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Dental Archwires and Braces Wires Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Dental Archwires and Braces Wires Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Dental Archwires and Braces Wires Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Dental Archwires and Braces Wires Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Dental Archwires and Braces Wires Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dental Archwires and Braces Wires Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Archwires and Braces Wires?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Dental Archwires and Braces Wires?

Key companies in the market include Henry Schein, GC Corporation, Patterson, 3M Unitek, Ultimate Wireforms, American orthodontic, Dentsply, Forestadent, Dentaurum, Ormco, ACME Monaco, Tomy, Dental Morelli, J J Orthodontics, Beijing Smart, Grikin, Shenzhen Super Line, AIC Mondi Material, 3B ortho.

3. What are the main segments of the Dental Archwires and Braces Wires?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Archwires and Braces Wires," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Archwires and Braces Wires report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Archwires and Braces Wires?

To stay informed about further developments, trends, and reports in the Dental Archwires and Braces Wires, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence