Key Insights

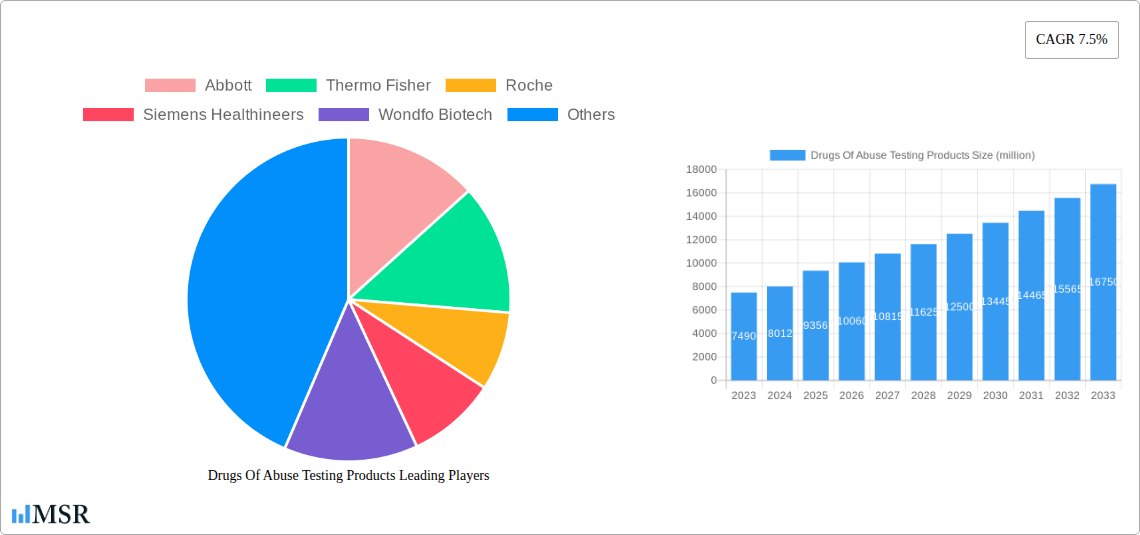

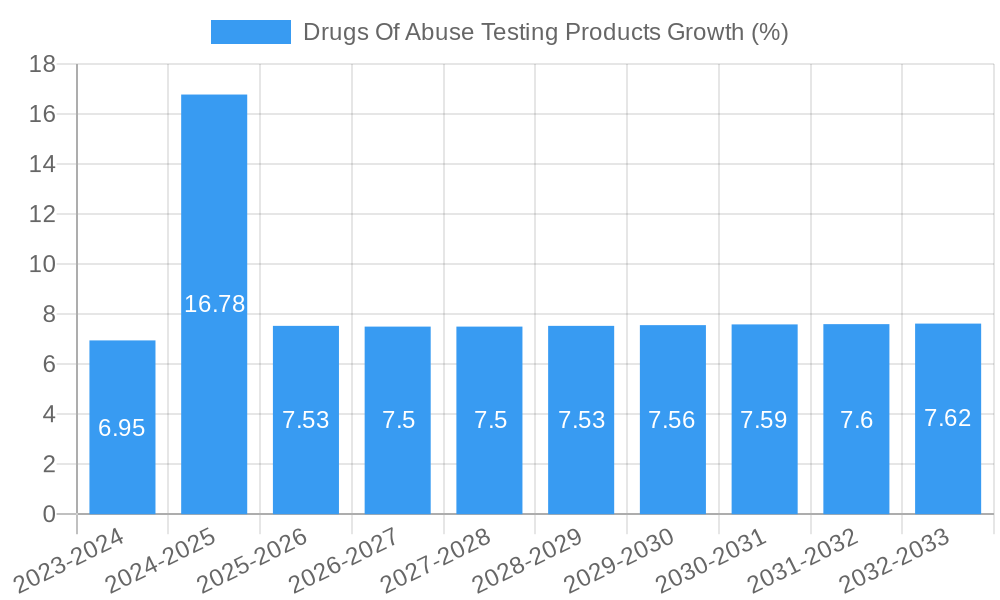

The global Drugs of Abuse Testing Products market is poised for significant expansion, projected to reach approximately USD 9,356 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% anticipated through 2033. This growth is primarily fueled by a heightened awareness of drug abuse's societal impact, stringent government regulations mandating workplace and pre-employment drug screenings, and the increasing adoption of advanced testing technologies for faster and more accurate results. The market is witnessing a paradigm shift towards point-of-care (POC) testing solutions, driven by their convenience and rapid turnaround times, which are particularly crucial in emergency settings and for on-site screenings. Furthermore, the growing prevalence of synthetic drugs and novel psychoactive substances necessitates continuous innovation in detection reagents and equipment, presenting a substantial growth avenue for manufacturers.

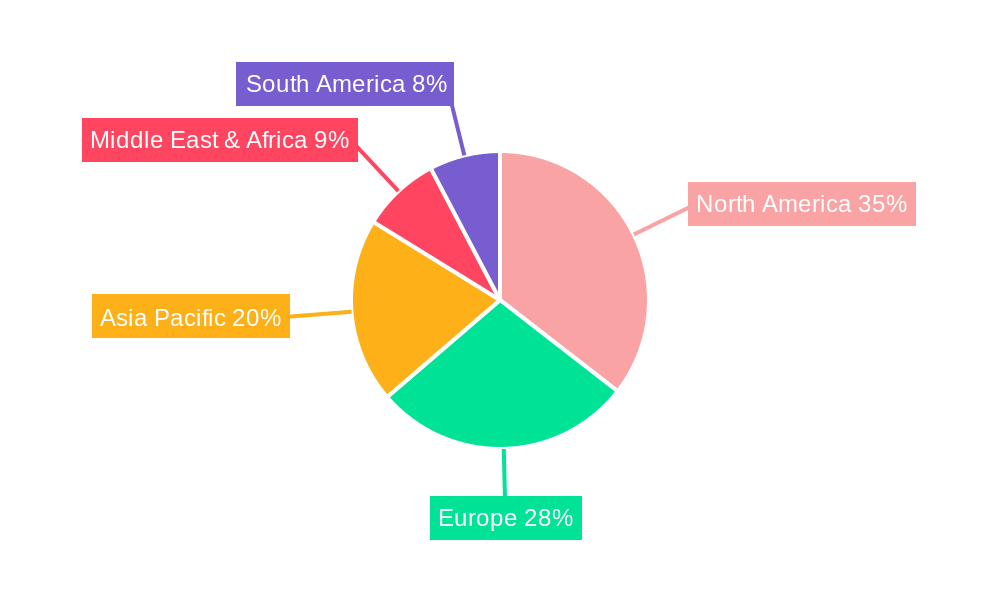

The market is segmented into distinct categories, with 'Drugs of Abuse Detection Reagents' and 'Drug Abuse Testing Equipments' forming the core offerings. Applications span critical sectors such as hospitals, law enforcement agencies, drug treatment centers, and research institutes, with each segment exhibiting unique demand drivers. Hospitals require rapid diagnostic tools for patient care and forensic investigations, while law enforcement relies on accurate and defensible testing for legal proceedings. The increasing emphasis on employee well-being and safety in corporate environments, coupled with escalating healthcare expenditure globally, are further propelling the demand for drug abuse testing solutions. Geographically, North America is expected to lead the market, propelled by well-established healthcare infrastructure, stringent regulations, and high adoption rates of advanced testing technologies. Asia Pacific, however, is anticipated to exhibit the fastest growth, fueled by rapidly developing economies, increasing awareness, and growing government initiatives to combat drug abuse.

Here is an SEO-optimized, engaging report description for Drugs Of Abuse Testing Products, incorporating your specified details and structure.

Report Title: Global Drugs of Abuse Testing Products Market Analysis 2019–2033: Size, Share, Trends, Opportunities, and Competitive Landscape

Report Description: Gain comprehensive insights into the global Drugs of Abuse Testing Products Market, a critical sector projected for substantial growth. This in-depth report analyzes market dynamics, key industry developments, and emerging trends from 2019 to 2033, with a base year of 2025. Discover the market size, projected at USD 5,000 million in the estimated year 2025, and a robust CAGR of 7.5% during the forecast period of 2025–2033. Explore the competitive landscape featuring leading players like Abbott, Thermo Fisher, Roche, and Siemens Healthineers. Uncover regional market dominance, application-specific opportunities in Hospitals, Law Enforcement, and Drug Treatment Centers, and technological advancements in Drugs of Abuse Detection Reagents and Drug Abuse Testing Equipments. This report is essential for stakeholders seeking to understand market concentration, innovation, regulatory frameworks, and strategic growth opportunities within the drug testing market, substance abuse testing, and forensic toxicology.

Drugs Of Abuse Testing Products Market Concentration & Dynamics

The Drugs of Abuse Testing Products Market exhibits moderate concentration, with a few dominant players holding significant market share. Leading companies such as Abbott, Thermo Fisher Scientific, Roche Diagnostics, and Siemens Healthineers consistently invest in research and development, fostering robust innovation ecosystems. Regulatory frameworks, including CLIA, FDA approvals, and country-specific guidelines, play a crucial role in shaping market entry and product standardization. While direct substitute products are limited in their efficacy for definitive testing, advancements in at-home testing kits and the increasing adoption of point-of-care devices represent evolving alternatives. End-user trends show a growing demand for rapid, accurate, and cost-effective solutions across various applications. Mergers and acquisitions (M&A) activities, though not at an extremely high volume, are strategic moves by major players to expand their product portfolios and geographical reach. For instance, an estimated 5 M&A deals have been recorded in the historical period, indicating strategic consolidation. The market share of the top five players is estimated to be around 60%, highlighting the competitive intensity.

- Market Concentration: Moderate, with key players holding substantial share.

- Innovation Ecosystems: Driven by R&D investments in advanced detection technologies.

- Regulatory Frameworks: Impacting product approval and market access.

- Substitute Products: Limited, but evolving with at-home and POC options.

- End-User Trends: Growing demand for speed, accuracy, and cost-effectiveness.

- M&A Activities: Strategic consolidation for portfolio expansion and market penetration.

Drugs Of Abuse Testing Products Industry Insights & Trends

The Drugs of Abuse Testing Products Market is poised for significant expansion, driven by a confluence of escalating global substance abuse concerns, heightened awareness, and advancements in diagnostic technologies. The estimated market size in the base year 2025 is USD 5,000 million, with a projected Compound Annual Growth Rate (CAGR) of 7.5% throughout the forecast period 2025–2033. This robust growth is primarily fueled by the increasing prevalence of opioid addiction, the rise of synthetic drug abuse, and the growing need for effective drug monitoring in healthcare settings, workplaces, and the criminal justice system. Technological disruptions are continuously reshaping the industry, with innovations in immunoassay technology, chromatography-mass spectrometry (GC-MS, LC-MS), and rapid point-of-care (POC) testing devices offering greater sensitivity, specificity, and faster results. Evolving consumer behaviors, including a greater willingness to seek treatment for addiction and the implementation of stricter drug policies, further bolster market demand. The historical period 2019–2024 saw steady growth, laying a strong foundation for future expansion. The increasing adoption of multi-drug testing panels, capable of detecting a wider range of substances simultaneously, is another significant trend contributing to market value. Furthermore, the integration of digital technologies, such as cloud-based data management and mobile connectivity for POC devices, is enhancing user experience and data accessibility, driving efficiency in drug testing workflows. The global emphasis on public health initiatives aimed at combating the opioid crisis and other substance abuse-related issues will continue to be a primary catalyst for the drug testing market.

Key Markets & Segments Leading Drugs Of Abuse Testing Products

North America currently dominates the Drugs of Abuse Testing Products Market, accounting for an estimated 45% of the global market share in 2025. This dominance is attributed to robust healthcare infrastructure, stringent regulatory mandates for drug testing in workplaces and legal proceedings, and a high prevalence of substance abuse issues, particularly the opioid crisis. The United States, in particular, is a key driver of this regional leadership.

In terms of applications, the Law Enforcement segment is a significant contributor, driven by the need for forensic drug testing in criminal investigations, probation monitoring, and parole compliance. This segment is projected to grow at a CAGR of 8.0% from 2025–2033. The Hospital segment also represents a substantial market, fueled by drug screening in emergency departments, pre-surgical assessments, and pain management programs. The increasing focus on patient safety and responsible medication management contributes to its sustained demand.

Regarding product types, Drugs of Abuse Detection Reagents currently hold the largest market share, estimated at 65% in 2025. This is due to their widespread use in both laboratory-based and point-of-care testing. However, Drug Abuse Testing Equipments, including immunoassay analyzers and chromatography systems, are experiencing rapid growth due to advancements in automation, sensitivity, and multiplexing capabilities. The demand for sophisticated equipment that can process a high volume of samples efficiently is steadily increasing.

- Dominant Region: North America

- Drivers: Robust healthcare infrastructure, stringent regulations, high prevalence of substance abuse, significant government funding for addiction treatment and enforcement.

- Country Focus: United States

- Leading Application Segment: Law Enforcement

- Drivers: Increased number of arrests and convictions related to drug offenses, mandatory drug testing for probation and parole, use in forensic investigations.

- Growing Application Segment: Hospital

- Drivers: Pre-operative drug screening, pain management protocols, emergency room toxicology, addiction treatment support.

- Dominant Product Type: Drugs of Abuse Detection Reagents

- Drivers: Cost-effectiveness, ease of use in various testing formats, wide range of drug detection capabilities.

- Fastest Growing Product Type: Drug Abuse Testing Equipments

- Drivers: Technological advancements in automation and sensitivity, demand for higher throughput, integration of advanced analytical techniques like LC-MS/MS.

Drugs Of Abuse Testing Products Product Developments

Recent product developments in the Drugs of Abuse Testing Products Market have focused on enhancing accuracy, speed, and ease of use. Innovations include the development of more sensitive immunoassay reagents that can detect lower concentrations of drugs and their metabolites, reducing the incidence of false negatives. Advanced chromatography-mass spectrometry (LC-MS/MS) systems are becoming more accessible and integrated, offering superior specificity for complex matrices and the detection of novel psychoactive substances. The market is also witnessing a surge in user-friendly point-of-care testing devices and oral fluid testing kits, which offer non-invasive sample collection and rapid results, suitable for on-site screening in various settings. These developments aim to provide more reliable and efficient solutions for healthcare professionals, law enforcement agencies, and employers, thereby strengthening competitive edges in a dynamic market.

Challenges in the Drugs Of Abuse Testing Products Market

Despite robust growth prospects, the Drugs of Abuse Testing Products Market faces several challenges. Stringent regulatory approvals and evolving compliance standards across different regions can be time-consuming and costly for manufacturers. The presence of counterfeit products and inconsistent quality control can undermine market trust and patient safety. Supply chain disruptions, particularly for raw materials and critical components, can impact production volumes and lead times. Moreover, intense competition among established players and emerging startups can lead to price pressures and affect profit margins, necessitating continuous innovation and cost optimization strategies.

- Regulatory Hurdles: Complex and evolving approval processes.

- Counterfeit Products: Threat to market integrity and patient safety.

- Supply Chain Volatility: Potential for disruptions in material availability.

- Competitive Pressures: Intense competition impacting pricing and margins.

Forces Driving Drugs Of Abuse Testing Products Growth

The Drugs of Abuse Testing Products Market is propelled by several key growth drivers. The escalating global incidence of drug abuse, particularly the opioid epidemic and the rise of synthetic drugs, creates an imperative demand for reliable testing solutions. Increased government initiatives and public health campaigns focused on addiction prevention, treatment, and monitoring further stimulate market expansion. Technological advancements in diagnostic methodologies, leading to more accurate, sensitive, and rapid testing capabilities, are transforming the industry. Furthermore, the growing adoption of drug testing in diverse settings, including occupational health, pain management, and criminal justice, amplifies market reach.

Challenges in the Drugs Of Abuse Testing Products Market

Long-term growth in the Drugs of Abuse Testing Products Market will be significantly influenced by continuous innovation and strategic market expansion. The development of novel testing platforms capable of detecting an even wider array of emerging substances with greater speed and accuracy will be crucial. Partnerships between diagnostic companies and healthcare providers or research institutions can accelerate the adoption of new technologies and enhance clinical validation. Expanding into underdeveloped markets with growing awareness of substance abuse issues presents substantial long-term growth opportunities, alongside the increasing integration of artificial intelligence and machine learning for predictive analytics in drug abuse trends.

Emerging Opportunities in Drugs Of Abuse Testing Products

Emerging opportunities in the Drugs of Abuse Testing Products Market lie in the expansion of point-of-care (POC) testing for faster on-site diagnostics, particularly in remote or underserved areas. The development of highly multiplexed assays capable of detecting a broad spectrum of drugs and their metabolites from a single sample represents a significant advancement. Furthermore, the growing demand for personalized medicine and companion diagnostics in addiction treatment creates opportunities for highly specific and sensitive testing solutions. The increasing legalization of cannabis in many regions is also driving the need for accurate and reliable cannabis testing products and methodologies.

Leading Players in the Drugs Of Abuse Testing Products Sector

- Abbott

- Thermo Fisher Scientific

- Roche

- Siemens Healthineers

- Wondfo Biotech

- Randox Laboratories

- OraSure Technologies

- Dragerwerk AG & Co. KGaA

- Labcorp

- Beckman Coulter

- Bruker

- InTec Pharmaceutical

- Orient Gene

- Hangzhou Biotest

- Assure Tech

- Aotai Bio

Key Milestones in Drugs Of Abuse Testing Products Industry

- 2019: Launch of advanced immunoassay panels for synthetic opioids by leading manufacturers.

- 2020: Increased adoption of rapid antigen tests for drug detection in workplace settings due to pandemic-related safety protocols.

- 2021: Significant investment in R&D for LC-MS/MS solutions offering enhanced sensitivity and specificity.

- 2022: Introduction of novel oral fluid testing devices with improved accuracy and user convenience.

- 2023: Expansion of drug testing programs in employee assistance programs (EAPs) and corporate wellness initiatives.

- 2024: Growing focus on the detection of novel psychoactive substances (NPS) with updated reagent kits.

Strategic Outlook for Drugs Of Abuse Testing Products Market

The strategic outlook for the Drugs of Abuse Testing Products Market is exceptionally positive, driven by sustained demand and continuous technological innovation. Key growth accelerators include the expansion of point-of-care testing capabilities for greater accessibility, the development of advanced analytical techniques for detecting emerging synthetic drugs, and the increasing integration of digital health solutions for data management and remote monitoring. Strategic partnerships and collaborations will be vital for market players to enhance their product portfolios, expand geographical reach, and address the evolving needs of diverse end-user segments, ensuring continued market penetration and revenue growth.

Drugs Of Abuse Testing Products Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Law Enforcement

- 1.3. Drug Treatment Center

- 1.4. Research Institute

- 1.5. Others

-

2. Type

- 2.1. Drugs of Abuse Detection Reagents

- 2.2. Drug Abuse Testing Equipments

Drugs Of Abuse Testing Products Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Drugs Of Abuse Testing Products REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drugs Of Abuse Testing Products Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Law Enforcement

- 5.1.3. Drug Treatment Center

- 5.1.4. Research Institute

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Drugs of Abuse Detection Reagents

- 5.2.2. Drug Abuse Testing Equipments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Drugs Of Abuse Testing Products Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Law Enforcement

- 6.1.3. Drug Treatment Center

- 6.1.4. Research Institute

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Drugs of Abuse Detection Reagents

- 6.2.2. Drug Abuse Testing Equipments

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Drugs Of Abuse Testing Products Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Law Enforcement

- 7.1.3. Drug Treatment Center

- 7.1.4. Research Institute

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Drugs of Abuse Detection Reagents

- 7.2.2. Drug Abuse Testing Equipments

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Drugs Of Abuse Testing Products Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Law Enforcement

- 8.1.3. Drug Treatment Center

- 8.1.4. Research Institute

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Drugs of Abuse Detection Reagents

- 8.2.2. Drug Abuse Testing Equipments

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Drugs Of Abuse Testing Products Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Law Enforcement

- 9.1.3. Drug Treatment Center

- 9.1.4. Research Institute

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Drugs of Abuse Detection Reagents

- 9.2.2. Drug Abuse Testing Equipments

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Drugs Of Abuse Testing Products Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Law Enforcement

- 10.1.3. Drug Treatment Center

- 10.1.4. Research Institute

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Drugs of Abuse Detection Reagents

- 10.2.2. Drug Abuse Testing Equipments

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Abbott

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermo Fisher

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Roche

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens Healthineers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wondfo Biotech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Randox

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OraSure

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Drager

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Labcorp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Beckman Coulter

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bruker

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 InTec

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Orient Gene

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hangzhou Biotest

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Assure Tech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Aotai Bio

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Abbott

List of Figures

- Figure 1: Global Drugs Of Abuse Testing Products Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Drugs Of Abuse Testing Products Revenue (million), by Application 2024 & 2032

- Figure 3: North America Drugs Of Abuse Testing Products Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Drugs Of Abuse Testing Products Revenue (million), by Type 2024 & 2032

- Figure 5: North America Drugs Of Abuse Testing Products Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Drugs Of Abuse Testing Products Revenue (million), by Country 2024 & 2032

- Figure 7: North America Drugs Of Abuse Testing Products Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Drugs Of Abuse Testing Products Revenue (million), by Application 2024 & 2032

- Figure 9: South America Drugs Of Abuse Testing Products Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Drugs Of Abuse Testing Products Revenue (million), by Type 2024 & 2032

- Figure 11: South America Drugs Of Abuse Testing Products Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Drugs Of Abuse Testing Products Revenue (million), by Country 2024 & 2032

- Figure 13: South America Drugs Of Abuse Testing Products Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Drugs Of Abuse Testing Products Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Drugs Of Abuse Testing Products Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Drugs Of Abuse Testing Products Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Drugs Of Abuse Testing Products Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Drugs Of Abuse Testing Products Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Drugs Of Abuse Testing Products Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Drugs Of Abuse Testing Products Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Drugs Of Abuse Testing Products Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Drugs Of Abuse Testing Products Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Drugs Of Abuse Testing Products Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Drugs Of Abuse Testing Products Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Drugs Of Abuse Testing Products Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Drugs Of Abuse Testing Products Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Drugs Of Abuse Testing Products Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Drugs Of Abuse Testing Products Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Drugs Of Abuse Testing Products Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Drugs Of Abuse Testing Products Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Drugs Of Abuse Testing Products Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Drugs Of Abuse Testing Products Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Drugs Of Abuse Testing Products Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drugs Of Abuse Testing Products?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Drugs Of Abuse Testing Products?

Key companies in the market include Abbott, Thermo Fisher, Roche, Siemens Healthineers, Wondfo Biotech, Randox, OraSure, Drager, Labcorp, Beckman Coulter, Bruker, InTec, Orient Gene, Hangzhou Biotest, Assure Tech, Aotai Bio.

3. What are the main segments of the Drugs Of Abuse Testing Products?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9356 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drugs Of Abuse Testing Products," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drugs Of Abuse Testing Products report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drugs Of Abuse Testing Products?

To stay informed about further developments, trends, and reports in the Drugs Of Abuse Testing Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence