Key Insights

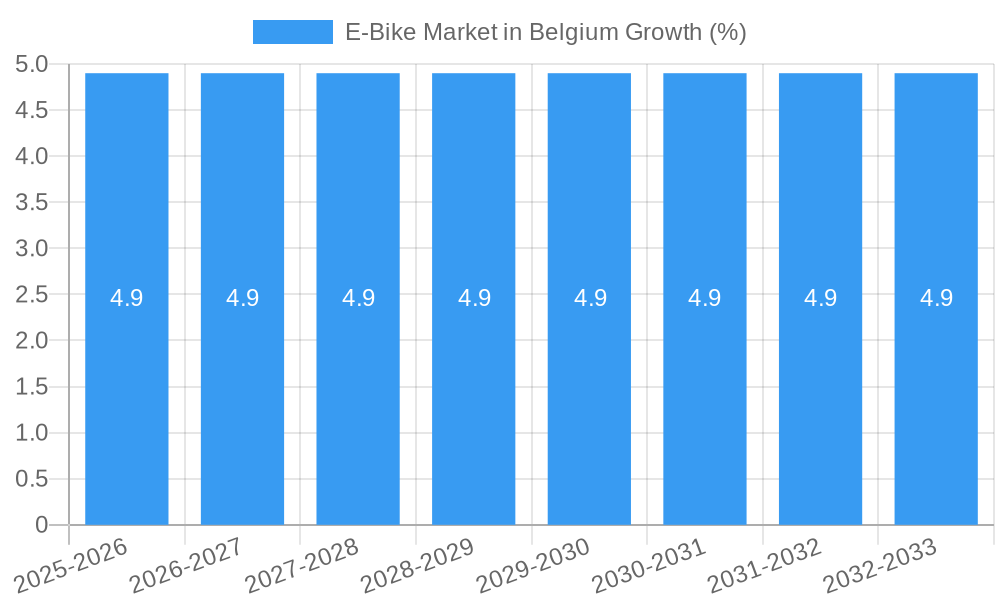

The Belgian e-bike market, valued at approximately €[Estimate based on market size XX and value unit Million. Let's assume XX = 100 for example purposes. This would mean 100 Million Euros in 2025. Adjust this number based on the actual XX value]. in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.90% from 2025 to 2033. This growth is driven by several factors, including increasing environmental awareness, government initiatives promoting sustainable transportation, and rising concerns about traffic congestion and air quality in urban areas like Brussels and Antwerp. The increasing popularity of cycling as a recreational activity also contributes significantly to market expansion. The diverse e-bike segment caters to a broad range of consumer preferences, with pedal-assisted bikes maintaining a significant market share due to their versatility and ease of use. However, speed pedelecs and throttle-assisted models are gaining traction among commuters seeking faster travel options. The shift toward lithium-ion batteries is undeniable, reflecting the advantages of longer range, lighter weight, and faster charging times compared to lead-acid alternatives. The application segments are well-defined, with city/urban e-bikes leading the market due to the dense urban centers and growing need for efficient commuting solutions. Cargo/utility e-bikes represent a steadily expanding niche, driven by the increasing demand for last-mile delivery services and environmentally friendly transportation options for goods. Trekking e-bikes cater to a dedicated segment of recreational cyclists.

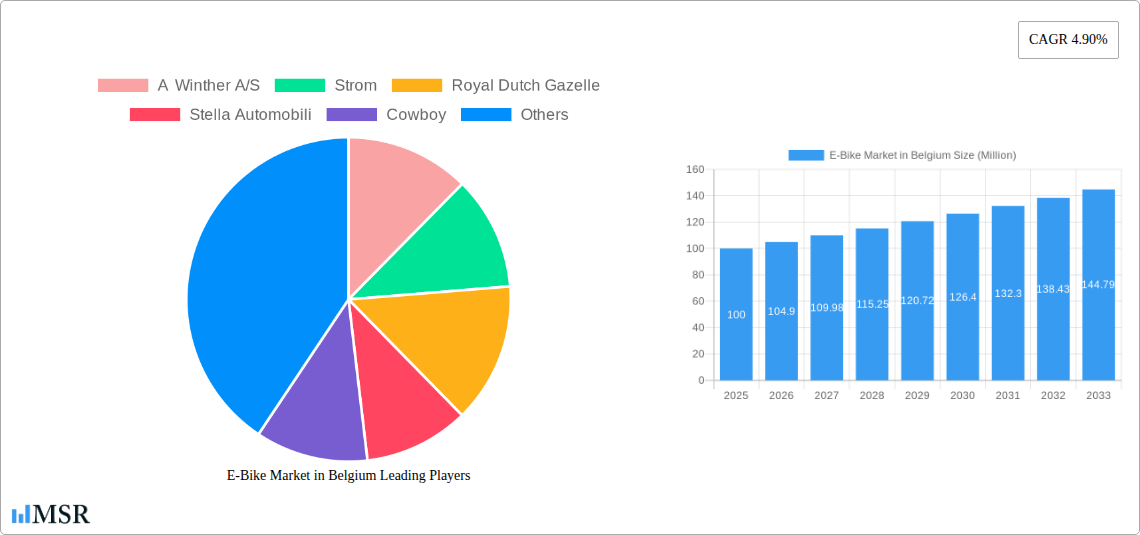

Key players in the Belgian e-bike market, including Winther A/S, Strom, Royal Dutch Gazelle, and others, are constantly innovating to meet the evolving consumer demands. Competition is fierce, leading to advancements in battery technology, motor efficiency, and overall e-bike design. The market’s future growth trajectory depends on several factors, including the continued implementation of supportive government policies, the development of robust charging infrastructure, and the ongoing advancement of e-bike technology to address consumer concerns regarding price, range, and safety. The overall outlook for the Belgian e-bike market remains positive, with significant potential for continued expansion over the forecast period.

E-Bike Market in Belgium: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Belgian e-bike market, offering crucial insights for industry stakeholders, investors, and market entrants. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The report's findings are based on rigorous data analysis and industry expertise, providing actionable intelligence to navigate the evolving landscape of the Belgian e-bike market. The total market size in 2025 is estimated at xx Million EUR, with a projected CAGR of xx% from 2025 to 2033.

E-Bike Market in Belgium Market Concentration & Dynamics

The Belgian e-bike market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the presence of numerous smaller, specialized brands indicates a dynamic competitive environment. Innovation plays a crucial role, with ongoing advancements in battery technology, motor systems, and design driving market growth. The regulatory framework, while supportive of sustainable transportation, faces ongoing evolution to fully optimize the e-bike sector's potential. Substitute products, such as traditional bicycles and public transportation, pose a competitive challenge, influencing consumer choices. End-user trends indicate a growing preference for high-quality, feature-rich e-bikes with integrated technology. M&A activity in the Belgian e-bike market has been relatively limited in recent years, with an estimated xx M&A deals in the historical period (2019-2024). Market share for leading players is as follows (2025 estimate):

- Royal Dutch Gazelle: xx%

- A Winther A/S: xx%

- Cowboy: xx%

- Others: xx%

E-Bike Market in Belgium Industry Insights & Trends

The Belgian e-bike market has experienced significant growth in recent years, driven by several factors. Increasing environmental awareness, coupled with government incentives promoting sustainable transportation, has fueled demand. Technological advancements, particularly in battery technology and motor efficiency, have made e-bikes more affordable and appealing to a wider range of consumers. Changing consumer behaviors, including a preference for convenient and efficient commuting options, contribute to market expansion. The market size reached xx Million EUR in 2024 and is anticipated to reach xx Million EUR by 2033. The market displays robust growth potential, showcasing an impressive CAGR of xx%. This growth trajectory is underpinned by consistent investments in research & development, resulting in improved product quality, functionality, and overall consumer appeal. Furthermore, the integration of smart technologies into e-bikes is enhancing user experience and driving market expansion. The evolution of e-bike designs, particularly the introduction of diverse models catering to various lifestyles (e.g., urban commuting, trekking, cargo transport) further accentuates market expansion.

Key Markets & Segments Leading E-Bike Market in Belgium

The City/Urban segment dominates the Belgian e-bike market, accounting for approximately xx% of the total market share in 2025. This dominance is driven by several factors:

- Drivers for City/Urban Segment:

- Growing urbanization and traffic congestion

- Government initiatives promoting cycling infrastructure

- Rising demand for convenient and efficient commuting solutions

The Lithium-ion Battery segment is the leading battery type, capturing roughly xx% of the market due to its superior energy density, longer lifespan, and improved performance compared to lead-acid batteries. The Pedal Assisted propulsion type maintains a significant market share, appealing to a broad range of users who value a balance of physical exertion and electric assistance. However, the Speed Pedelec segment is experiencing significant growth, driven by its speed and efficiency. The Trekking segment displays substantial potential, aligning with Belgium's extensive cycling network and recreational pursuits.

E-Bike Market in Belgium Product Developments

Recent product innovations in the Belgian e-bike market focus on enhancing functionality, integrating smart technologies, and improving overall user experience. The introduction of foldable e-bikes catering to urban commuters, and cargo e-bikes for families, reflects market demands. The emphasis on improved battery technology, longer ranges, and more sophisticated motor systems are driving competitive differentiation. Lightweight frames, advanced safety features, and connectivity options are also gaining traction, enhancing the appeal of e-bikes.

Challenges in the E-Bike Market in Belgium Market

The Belgian e-bike market faces several challenges. The high initial cost of e-bikes remains a significant barrier for price-sensitive consumers. Supply chain disruptions and the availability of components can impact production and delivery timelines. Competition from established bicycle brands and new market entrants keeps the pressure high. Furthermore, the theft of e-bikes represents a concerning issue, impacting consumer confidence. These challenges exert a collective constraint on overall market expansion.

Forces Driving E-Bike Market in Belgium Growth

Several factors are driving growth in the Belgian e-bike market: Government initiatives promoting cycling through subsidies and infrastructure development play a vital role. The increasing focus on sustainability and reducing carbon emissions is boosting demand. Technological advancements continue to improve the performance and affordability of e-bikes. The growing awareness of the health benefits of cycling contributes to consumer adoption.

Long-Term Growth Catalysts in the E-Bike Market in Belgium

Long-term growth in the Belgian e-bike market is supported by continuous innovation in battery technology, leading to longer ranges and faster charging times. Partnerships between e-bike manufacturers and public transportation providers could offer integrated mobility solutions. Expansion into rural markets, with tailored e-bike models designed for varied terrains, unlocks further market potential.

Emerging Opportunities in E-Bike Market in Belgium

Emerging trends point to substantial growth opportunities. The integration of smart features, such as GPS tracking and connectivity, enhances the user experience and expands market appeal. The development of e-cargo bikes offers new applications in logistics and last-mile delivery services. Targeted marketing campaigns addressing specific consumer needs, such as safety concerns or range anxiety, are crucial to unlock untapped market segments.

Leading Players in the E-bike Market in Belgium Sector

- A Winther A/S

- Strom

- Royal Dutch Gazelle

- Stella Automobili

- Cowboy

- Cortina Bikes

- Principia bikes

- VanMoof B

- BIZBIKE BVBA

- Batavus Intercycle Corporation

Key Milestones in E-Bike Market in Belgium Industry

- December 2022: Stella Cycling launched a new outlet in Nunspeet, expanding its retail presence and market reach.

- December 2022: Stella Cycling introduced the Muto Mutti family e-bike, catering to a growing segment of family-oriented cyclists.

- August 2022: VanMoof released the S3 Aluminum e-bike, showcasing advanced design and high-end features, enhancing its market positioning.

Strategic Outlook for E-Bike Market in Belgium Market

The future of the Belgian e-bike market is promising, with sustained growth expected across various segments. Strategic opportunities lie in leveraging technological advancements, targeting specific consumer segments, and fostering partnerships to integrate e-bikes into broader mobility solutions. Investment in charging infrastructure and marketing campaigns emphasizing the benefits of e-bike ownership will further fuel market expansion. The market's long-term outlook remains positive, driven by increasing consumer adoption and supportive government policies.

E-Bike Market in Belgium Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

E-Bike Market in Belgium Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-Bike Market in Belgium REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade

- 3.3. Market Restrains

- 3.3.1. Surge in Fuel Costs Affecting the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-Bike Market in Belgium Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America E-Bike Market in Belgium Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Speed Pedelec

- 6.1.3. Throttle Assisted

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Cargo/Utility

- 6.2.2. City/Urban

- 6.2.3. Trekking

- 6.3. Market Analysis, Insights and Forecast - by Battery Type

- 6.3.1. Lead Acid Battery

- 6.3.2. Lithium-ion Battery

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America E-Bike Market in Belgium Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Speed Pedelec

- 7.1.3. Throttle Assisted

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Cargo/Utility

- 7.2.2. City/Urban

- 7.2.3. Trekking

- 7.3. Market Analysis, Insights and Forecast - by Battery Type

- 7.3.1. Lead Acid Battery

- 7.3.2. Lithium-ion Battery

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe E-Bike Market in Belgium Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Speed Pedelec

- 8.1.3. Throttle Assisted

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Cargo/Utility

- 8.2.2. City/Urban

- 8.2.3. Trekking

- 8.3. Market Analysis, Insights and Forecast - by Battery Type

- 8.3.1. Lead Acid Battery

- 8.3.2. Lithium-ion Battery

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa E-Bike Market in Belgium Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Speed Pedelec

- 9.1.3. Throttle Assisted

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Cargo/Utility

- 9.2.2. City/Urban

- 9.2.3. Trekking

- 9.3. Market Analysis, Insights and Forecast - by Battery Type

- 9.3.1. Lead Acid Battery

- 9.3.2. Lithium-ion Battery

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific E-Bike Market in Belgium Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Speed Pedelec

- 10.1.3. Throttle Assisted

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Cargo/Utility

- 10.2.2. City/Urban

- 10.2.3. Trekking

- 10.3. Market Analysis, Insights and Forecast - by Battery Type

- 10.3.1. Lead Acid Battery

- 10.3.2. Lithium-ion Battery

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A Winther A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Strom

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Royal Dutch Gazelle

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stella Automobili

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cowboy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cortina Bikes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Principia bikes

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 VanMoof B

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BIZBIKE BVBA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Batavus Intercycle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 A Winther A/S

List of Figures

- Figure 1: Global E-Bike Market in Belgium Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Belgium E-Bike Market in Belgium Revenue (Million), by Country 2024 & 2032

- Figure 3: Belgium E-Bike Market in Belgium Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America E-Bike Market in Belgium Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 5: North America E-Bike Market in Belgium Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 6: North America E-Bike Market in Belgium Revenue (Million), by Application Type 2024 & 2032

- Figure 7: North America E-Bike Market in Belgium Revenue Share (%), by Application Type 2024 & 2032

- Figure 8: North America E-Bike Market in Belgium Revenue (Million), by Battery Type 2024 & 2032

- Figure 9: North America E-Bike Market in Belgium Revenue Share (%), by Battery Type 2024 & 2032

- Figure 10: North America E-Bike Market in Belgium Revenue (Million), by Country 2024 & 2032

- Figure 11: North America E-Bike Market in Belgium Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America E-Bike Market in Belgium Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 13: South America E-Bike Market in Belgium Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 14: South America E-Bike Market in Belgium Revenue (Million), by Application Type 2024 & 2032

- Figure 15: South America E-Bike Market in Belgium Revenue Share (%), by Application Type 2024 & 2032

- Figure 16: South America E-Bike Market in Belgium Revenue (Million), by Battery Type 2024 & 2032

- Figure 17: South America E-Bike Market in Belgium Revenue Share (%), by Battery Type 2024 & 2032

- Figure 18: South America E-Bike Market in Belgium Revenue (Million), by Country 2024 & 2032

- Figure 19: South America E-Bike Market in Belgium Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe E-Bike Market in Belgium Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 21: Europe E-Bike Market in Belgium Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 22: Europe E-Bike Market in Belgium Revenue (Million), by Application Type 2024 & 2032

- Figure 23: Europe E-Bike Market in Belgium Revenue Share (%), by Application Type 2024 & 2032

- Figure 24: Europe E-Bike Market in Belgium Revenue (Million), by Battery Type 2024 & 2032

- Figure 25: Europe E-Bike Market in Belgium Revenue Share (%), by Battery Type 2024 & 2032

- Figure 26: Europe E-Bike Market in Belgium Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe E-Bike Market in Belgium Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa E-Bike Market in Belgium Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 29: Middle East & Africa E-Bike Market in Belgium Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 30: Middle East & Africa E-Bike Market in Belgium Revenue (Million), by Application Type 2024 & 2032

- Figure 31: Middle East & Africa E-Bike Market in Belgium Revenue Share (%), by Application Type 2024 & 2032

- Figure 32: Middle East & Africa E-Bike Market in Belgium Revenue (Million), by Battery Type 2024 & 2032

- Figure 33: Middle East & Africa E-Bike Market in Belgium Revenue Share (%), by Battery Type 2024 & 2032

- Figure 34: Middle East & Africa E-Bike Market in Belgium Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa E-Bike Market in Belgium Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific E-Bike Market in Belgium Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 37: Asia Pacific E-Bike Market in Belgium Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 38: Asia Pacific E-Bike Market in Belgium Revenue (Million), by Application Type 2024 & 2032

- Figure 39: Asia Pacific E-Bike Market in Belgium Revenue Share (%), by Application Type 2024 & 2032

- Figure 40: Asia Pacific E-Bike Market in Belgium Revenue (Million), by Battery Type 2024 & 2032

- Figure 41: Asia Pacific E-Bike Market in Belgium Revenue Share (%), by Battery Type 2024 & 2032

- Figure 42: Asia Pacific E-Bike Market in Belgium Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific E-Bike Market in Belgium Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global E-Bike Market in Belgium Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global E-Bike Market in Belgium Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Global E-Bike Market in Belgium Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Global E-Bike Market in Belgium Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 5: Global E-Bike Market in Belgium Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global E-Bike Market in Belgium Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global E-Bike Market in Belgium Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 8: Global E-Bike Market in Belgium Revenue Million Forecast, by Application Type 2019 & 2032

- Table 9: Global E-Bike Market in Belgium Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 10: Global E-Bike Market in Belgium Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global E-Bike Market in Belgium Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 15: Global E-Bike Market in Belgium Revenue Million Forecast, by Application Type 2019 & 2032

- Table 16: Global E-Bike Market in Belgium Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 17: Global E-Bike Market in Belgium Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global E-Bike Market in Belgium Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 22: Global E-Bike Market in Belgium Revenue Million Forecast, by Application Type 2019 & 2032

- Table 23: Global E-Bike Market in Belgium Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 24: Global E-Bike Market in Belgium Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global E-Bike Market in Belgium Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 35: Global E-Bike Market in Belgium Revenue Million Forecast, by Application Type 2019 & 2032

- Table 36: Global E-Bike Market in Belgium Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 37: Global E-Bike Market in Belgium Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global E-Bike Market in Belgium Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 45: Global E-Bike Market in Belgium Revenue Million Forecast, by Application Type 2019 & 2032

- Table 46: Global E-Bike Market in Belgium Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 47: Global E-Bike Market in Belgium Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific E-Bike Market in Belgium Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-Bike Market in Belgium?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the E-Bike Market in Belgium?

Key companies in the market include A Winther A/S, Strom, Royal Dutch Gazelle, Stella Automobili, Cowboy, Cortina Bikes, Principia bikes, VanMoof B, BIZBIKE BVBA, Batavus Intercycle Corporation.

3. What are the main segments of the E-Bike Market in Belgium?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise of Trade Agreements Between Nations; Increasing Volume of International Trade.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Surge in Fuel Costs Affecting the Market.

8. Can you provide examples of recent developments in the market?

December 2022: E-bike manufacturer Stella Cycling is launced a brand new outlet in Nunspeet.December 2022: E-bike manufacturer Stella Cycling is launching a new family bike, called Muto Mutti . The e-bike is designed to function as a mom's bike (or dad's bike) with innovative functionalities for ultimate ease of use.August 2022: VanMoof released S3 Aluminum, a streamlined, high-end e-bike. It includes raw welding and a brushed metal frame.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-Bike Market in Belgium," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-Bike Market in Belgium report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-Bike Market in Belgium?

To stay informed about further developments, trends, and reports in the E-Bike Market in Belgium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence