Key Insights

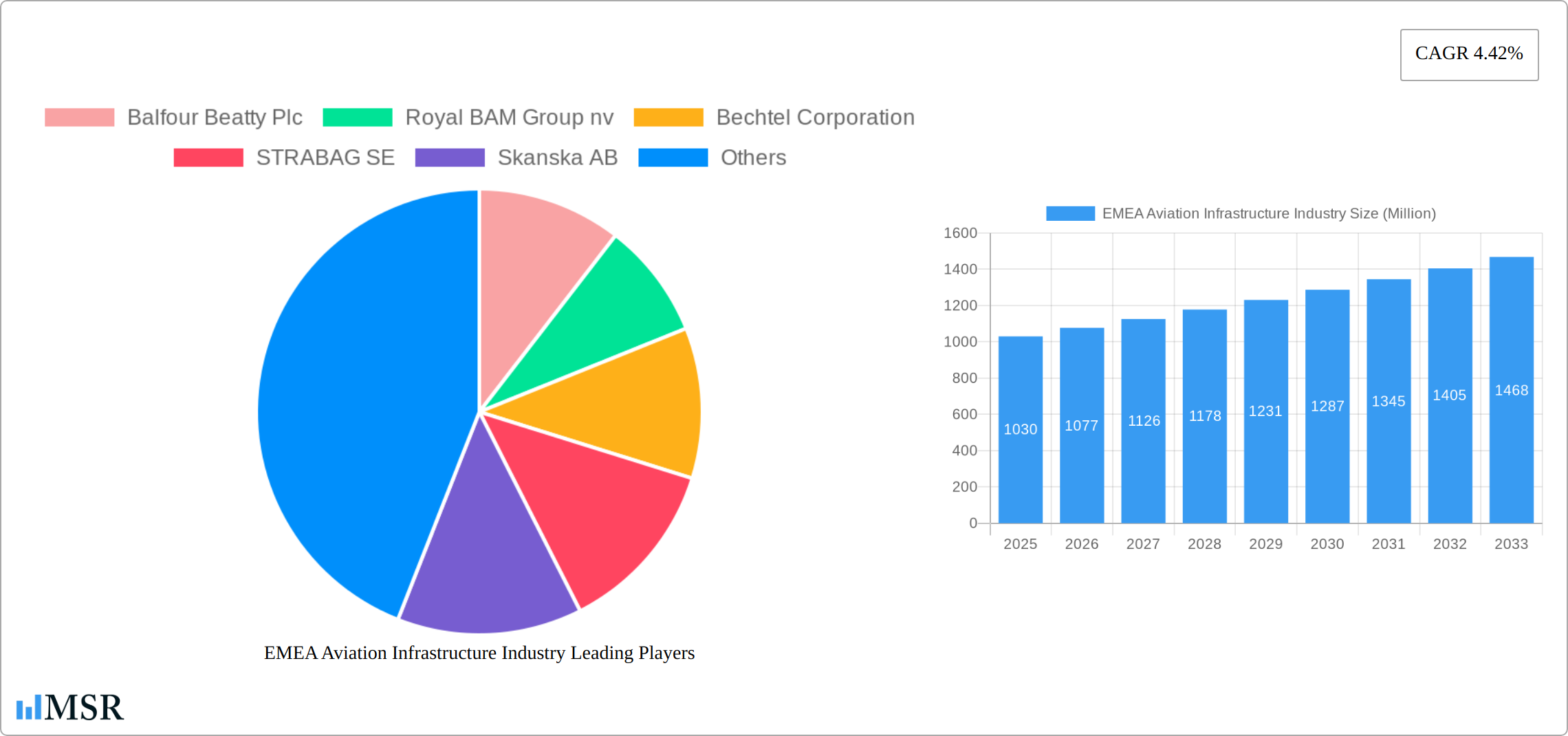

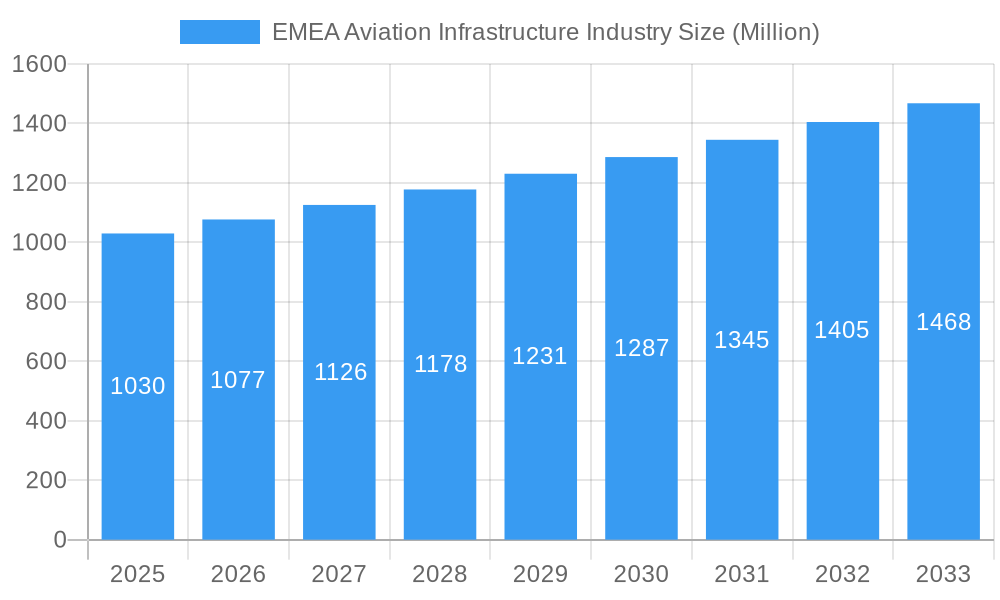

The EMEA (Europe, Middle East, and Africa) aviation infrastructure market, valued at $1.03 billion in 2025, is projected to experience robust growth, driven by increasing passenger traffic, government investments in airport modernization, and the expansion of low-cost carriers. The market's Compound Annual Growth Rate (CAGR) of 4.42% from 2025 to 2033 indicates a steady upward trajectory. Key drivers include the ongoing need for airport capacity expansion to accommodate rising passenger numbers, particularly in rapidly developing economies within the Middle East and Africa. Furthermore, the increasing adoption of advanced technologies, such as intelligent transportation systems and improved security measures, contributes significantly to market expansion. Growth is segmented across various airport types (commercial, military, general aviation) and infrastructure components (terminals, control towers, runways, aprons, hangars). While challenges exist, such as regulatory hurdles and potential economic downturns impacting investment, the long-term outlook for the EMEA aviation infrastructure market remains positive.

EMEA Aviation Infrastructure Industry Market Size (In Billion)

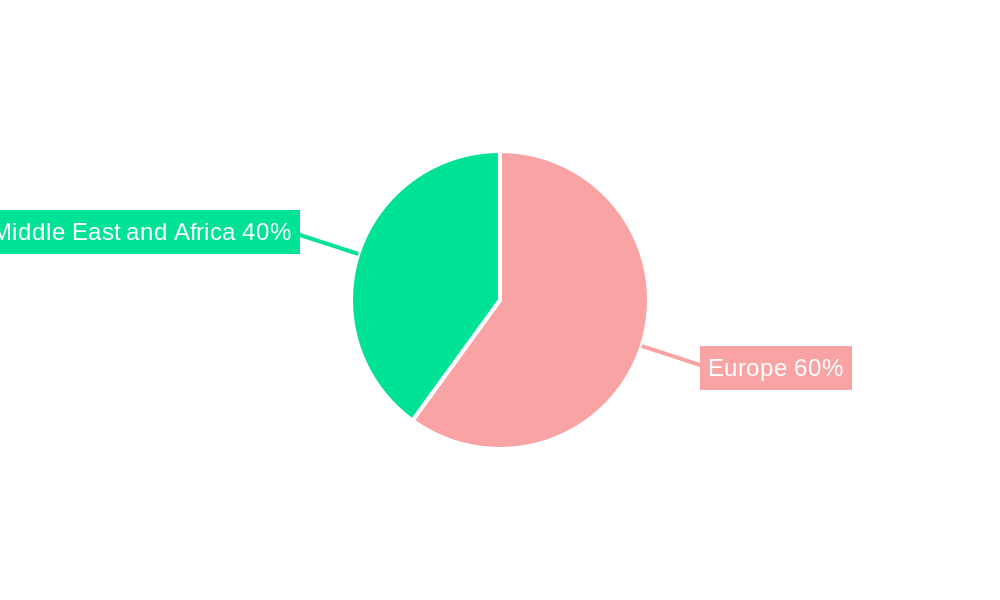

Significant regional variations are expected. The European market, comprising major players like the United Kingdom, Germany, and France, will continue to be a dominant force, though growth rates may be comparatively more moderate due to existing infrastructure. In contrast, the Middle East and Africa region is poised for accelerated growth, fueled by burgeoning tourism, increasing air travel demand, and substantial government investment in new airport construction and upgrades in countries such as Saudi Arabia, the United Arab Emirates, and Qatar. This regional disparity presents lucrative opportunities for infrastructure developers and investors, but requires a nuanced approach considering the unique regulatory landscapes and project timelines inherent in each market. The segment focused on terminal development and modernization is expected to maintain its leading position, reflecting the persistent need to enhance passenger experience and operational efficiency.

EMEA Aviation Infrastructure Industry Company Market Share

EMEA Aviation Infrastructure Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the EMEA Aviation Infrastructure Industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market dynamics, key trends, leading players, and future growth prospects. The report utilizes a robust methodology incorporating historical data (2019-2024) and forward-looking projections, ensuring accuracy and relevance. The market size is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period.

EMEA Aviation Infrastructure Industry Market Concentration & Dynamics

The EMEA aviation infrastructure market exhibits a moderately concentrated landscape, dominated by several multinational giants such as Balfour Beatty Plc, Royal BAM Group nv, and Bechtel Corporation, who collectively hold a significant, albeit fluctuating, market share. However, a vibrant ecosystem of regional players and specialized contractors also contributes substantially to the market's dynamism. This dynamic is further shaped by ongoing mergers and acquisitions (M&A) activity and the disruptive emergence of innovative companies employing cutting-edge technologies and sustainable practices.

- Market Concentration (2025 Estimate): The top 5 players held an estimated [Insert Percentage - e.g., 45%] of the market share in 2025, indicating a moderate level of concentration with opportunities for both established players and emerging companies.

- Innovation Ecosystems: Strategic collaborations between technology providers, engineering firms, airport operators, and financial institutions are accelerating innovation in crucial areas such as smart airport technologies (e.g., AI-driven passenger flow management, predictive maintenance), sustainable infrastructure (e.g., renewable energy integration, carbon-neutral construction), and resilient infrastructure (e.g., climate change adaptation, cybersecurity). These partnerships foster knowledge sharing and technological advancements, leading to more efficient and sustainable airport operations.

- Regulatory Frameworks & Compliance: Stringent safety regulations (e.g., ICAO standards), environmental policies (e.g., EU Green Deal), and increasingly complex permitting processes across diverse EMEA nations significantly influence project timelines, costs, and overall market dynamics. Navigating these varied regulatory landscapes presents both unique challenges and opportunities for specialized expertise.

- Material & Construction Method Innovations: While direct substitutes for core infrastructure components are limited, the market is witnessing a shift towards sustainable and cost-effective alternative materials (e.g., recycled materials, bio-based composites) and advanced construction methods (e.g., modular construction, 3D printing). These innovations are influencing cost structures, sustainability outcomes, and project delivery timelines.

- Evolving End-User Demands: The burgeoning passenger traffic across EMEA, coupled with rising expectations for enhanced passenger experience (e.g., seamless connectivity, personalized services), is a primary driver of market expansion. This demand is further fueled by a growing emphasis on sustainability, digitalization, and operational efficiency across all aspects of airport infrastructure.

- M&A Activity (2019-2024): An average of [Insert Number - e.g., 25] M&A deals per year between 2019 and 2024 reflects the ongoing consolidation and expansion strategies of major players, signifying a competitive landscape where strategic acquisitions play a pivotal role in market positioning.

EMEA Aviation Infrastructure Industry Industry Insights & Trends

The EMEA aviation infrastructure market is experiencing robust growth, fueled by several key factors. Increased air travel demand, particularly in emerging economies, necessitates airport expansion and modernization. Government investments in infrastructure projects across the region further contribute to market expansion. The rise of low-cost carriers has stimulated the development of new airports and increased capacity at existing ones. Technological advancements in areas such as automation, AI, and sustainable materials are transforming the industry, improving efficiency and reducing environmental impact. Consumer expectations for seamless travel experiences are driving the adoption of smart airport technologies. The market size reached xx Million USD in 2025 and is expected to reach xx Million USD by 2033. The forecasted CAGR is expected to be xx%. Further growth is anticipated due to substantial investments planned in countries across the EMEA region and a growing focus on sustainable aviation practices.

Key Markets & Segments Leading EMEA Aviation Infrastructure Industry

The EMEA aviation infrastructure market is significantly driven by the commercial airport segment, fueled by consistently high and growing passenger numbers. Key leading markets include the UK, France, and Germany, characterized by substantial air traffic volumes and ongoing investments in infrastructure upgrades and expansion projects. Beyond these established markets, several other countries across EMEA are experiencing rapid growth and present attractive investment opportunities.

Dominant Segments & Growth Drivers:

- Airport Type: Commercial Airports remain the largest segment, driven by the consistently high passenger traffic and the associated need for substantial infrastructure development to meet growing demands.

- Infrastructure Type: Terminals (passenger processing and handling facilities) and Taxiways & Runways (essential for aircraft operations) represent significant segments, reflecting high demand due to passenger growth and operational requirements. Other key segments include air traffic control systems, ground transportation infrastructure, and supporting utilities.

- Regional Dominance: Western Europe (particularly the UK, France, and Germany) maintains a strong lead due to its high air passenger traffic, robust economic conditions, and considerable investments in airport infrastructure modernization and expansion.

Key Growth Drivers:

- Economic Growth & Investment: Strong GDP growth in key EMEA countries translates directly into increased public and private investments in aviation infrastructure, driving both greenfield and brownfield projects.

- Government Initiatives & Public-Private Partnerships: Government initiatives, strategic partnerships, and public-private partnerships are crucial for funding and accelerating the construction and modernization of airports across the region, facilitating large-scale infrastructure development.

- Tourism Growth & Travel Demand: The burgeoning tourism sector across many EMEA countries directly stimulates the demand for enhanced airport infrastructure, impacting passenger handling capacity, and related facilities.

- Technological Advancements & Operational Efficiency: Innovations in construction materials, technologies, and operational management systems (e.g., automation, data analytics) are improving efficiency, reducing costs, and enhancing the overall passenger experience.

EMEA Aviation Infrastructure Industry Product Developments

Recent product innovations focus on sustainable materials, smart technologies, and improved passenger experience. The integration of AI and automation in airport operations is enhancing efficiency and optimizing resource allocation. Sustainable building materials and design principles are increasingly being adopted to reduce the industry's environmental footprint. This also includes the development of modular and prefabricated components for faster and more cost-effective construction. These advancements provide significant competitive edges for companies that embrace them.

Challenges in the EMEA Aviation Infrastructure Industry Market

Several significant factors impede market growth. Stringent regulatory compliance requirements, lengthy permitting processes, and complex environmental regulations can lead to project delays and cost overruns. Supply chain disruptions (e.g., material shortages, logistical challenges) can impact project schedules and budgets. Furthermore, intense competition among contractors, the scarcity of skilled labor, and geopolitical uncertainties pose additional challenges. These combined factors can negatively impact project profitability and the overall market growth, potentially reducing the annual growth rate by an estimated [Insert Percentage - e.g., 2%].

Forces Driving EMEA Aviation Infrastructure Industry Growth

Several factors drive long-term growth. Government investments in infrastructure projects are a key driver, along with the rise in air passenger traffic and increasing demand for better airport facilities. Technological innovations, such as the use of Building Information Modeling (BIM) and digital twins, also improve efficiency and sustainability. Furthermore, the ongoing focus on improving passenger experience through enhanced technologies is shaping demand.

Long-Term Growth Catalysts in the EMEA Aviation Infrastructure Industry

Long-term growth will be fueled by continued investment in airport expansions and upgrades, particularly in emerging markets. Strategic partnerships between governments and private sector entities will play a crucial role. Focus on sustainable and resilient infrastructure will be paramount. Technological advancements, such as AI-driven predictive maintenance and automation, will significantly improve operational efficiency and reduce costs.

Emerging Opportunities in EMEA Aviation Infrastructure Industry

Emerging opportunities exist in the development of sustainable aviation infrastructure, smart airport technologies, and the expansion of air traffic management systems. Growing demand for enhanced passenger experiences presents opportunities for companies offering innovative services and technologies. Investments in airport security and safety systems also represent a significant market opportunity.

Leading Players in the EMEA Aviation Infrastructure Industry Sector

- Balfour Beatty Plc

- Royal BAM Group nv

- Bechtel Corporation

- STRABAG SE

- Skanska AB

- VINCI Airports

- Limak Group of Companies

- ALEC Engineering & Contracting LL

- BIC Contracting LLC

- Bouygues Construction S A

- TAV Construction

- Eiffage S A

- Impresa Pizzarotti & C S p A

Key Milestones in EMEA Aviation Infrastructure Industry Industry

- May 2023: Poland announces plans for the Solidarity Hub (CPK) airport in Warsaw, a USD 870 Million project.

- February 2023: The Airport Council of Europe allocates USD 440 Million to upgrade Zvartnots International Airport, doubling its capacity.

Strategic Outlook for EMEA Aviation Infrastructure Industry Market

The EMEA aviation infrastructure market is poised for sustained growth, driven by the ongoing increase in air passenger traffic, substantial government investments, and ongoing technological advancements. Strategic partnerships, a strong focus on sustainability (environmental impact reduction, carbon neutrality), and the adoption of innovative technologies (e.g., digital twin technologies, BIM) will be critical for success in this dynamic and increasingly competitive market. Companies that can effectively adapt to evolving market demands, leverage technological advancements, and navigate regulatory complexities are well-positioned to capitalize on the lucrative opportunities presented by this sector.

EMEA Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

EMEA Aviation Infrastructure Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdon

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Denmark

- 1.7. Rest of Europe

-

2. Middle East and Africa

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Egypt

- 2.4. Qatar

- 2.5. Turkey

- 2.6. South Africa

- 2.7. Rest of Middle East and Africa

EMEA Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of EMEA Aviation Infrastructure Industry

EMEA Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Airport to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. Europe EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Middle East and Africa EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Balfour Beatty Plc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Royal BAM Group nv

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Bechtel Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 STRABAG SE

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Skanska AB

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VINCI Airports

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Limak Group of Companies

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 ALEC Engineering & Contracting LL

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 BIC Contracting LLC

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bouygues Construction S A

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 TAV Construction

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Eiffage S A

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Impresa Pizzarotti & C S p A

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Balfour Beatty Plc

List of Figures

- Figure 1: Global EMEA Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdon EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Italy EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Denmark EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 16: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Arab Emirates EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Egypt EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Turkey EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EMEA Aviation Infrastructure Industry?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the EMEA Aviation Infrastructure Industry?

Key companies in the market include Balfour Beatty Plc, Royal BAM Group nv, Bechtel Corporation, STRABAG SE, Skanska AB, VINCI Airports, Limak Group of Companies, ALEC Engineering & Contracting LL, BIC Contracting LLC, Bouygues Construction S A, TAV Construction, Eiffage S A, Impresa Pizzarotti & C S p A.

3. What are the main segments of the EMEA Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Airport to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Poland announced its plans to build a state-of-the-art airport in Warsaw. The Solidarity Hub, or CPK, which will serve as the Central and Eastern European main air transit hub, is scheduled to become operational in the summer of 2028. The CPK, with a price tag of around USD 870 million, is one of the costliest infrastructure projects currently being built in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EMEA Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EMEA Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EMEA Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the EMEA Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence