Key Insights

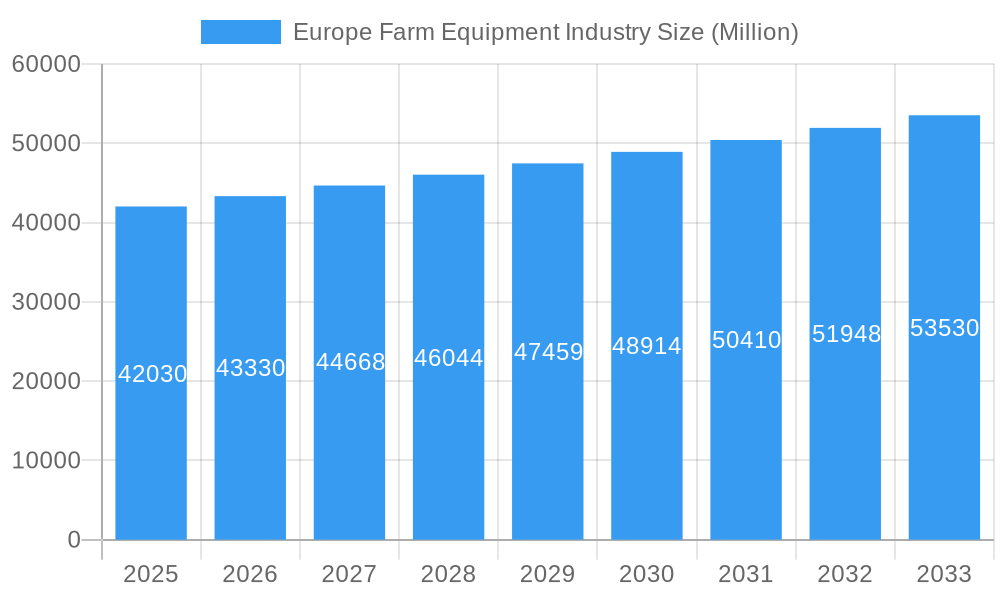

The European farm equipment market, valued at €42.03 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is driven by several key factors. Increased adoption of precision farming technologies, aimed at enhancing efficiency and yield, is a significant driver. Furthermore, the growing demand for sustainable agricultural practices, coupled with supportive government policies promoting modernization within the agricultural sector, fuels market expansion. Specific segments like tractors (particularly those above 150 HP) and machinery for plowing and cultivating are experiencing robust demand, reflecting a shift towards larger-scale operations and intensive farming methods. The market is highly competitive, with key players including Deere & Company, Kubota Corporation, AGCO Corporation, and others actively investing in research and development to enhance product offerings and cater to evolving farmer needs. The rising awareness of climate change and the subsequent need for efficient resource management are also contributing to the market's positive outlook.

Europe Farm Equipment Industry Market Size (In Billion)

However, the market faces certain challenges. Fluctuations in commodity prices and the overall economic climate can impact farmer investment decisions, potentially hindering growth. Additionally, labor shortages in the agricultural sector and increasing regulatory compliance costs represent potential restraints. Despite these challenges, the long-term outlook for the European farm equipment market remains positive, driven by technological advancements, a focus on sustainability, and the ongoing need to increase agricultural productivity to meet growing global food demands. Regional variations exist, with Germany, France, Italy, and the UK representing major markets within Europe. The consistent growth observed in the historical period (2019-2024) suggests a continuation of this trend throughout the forecast period (2025-2033). Competitive pressures will likely lead to further innovation and consolidation within the industry.

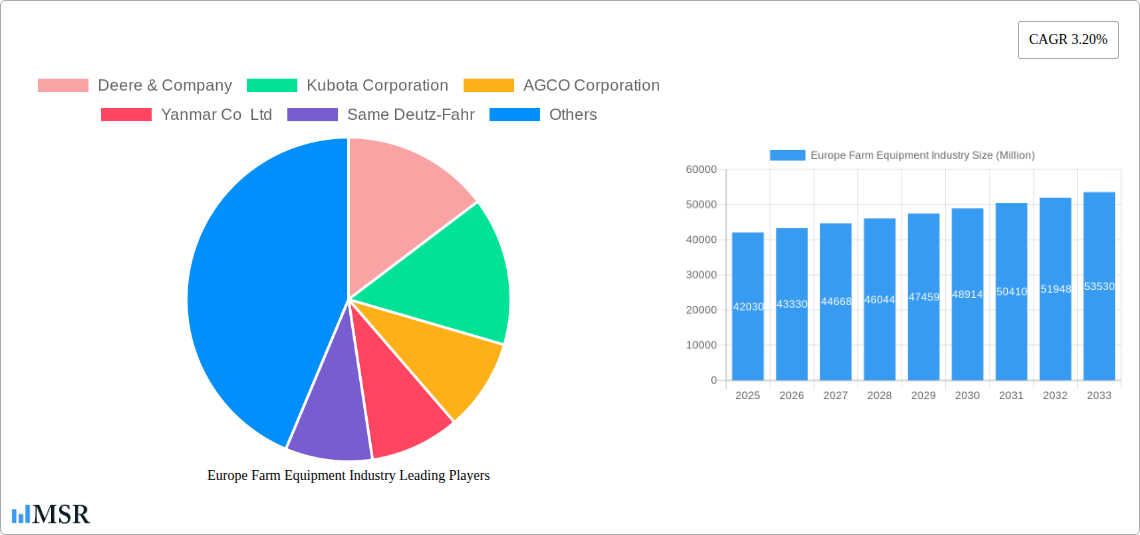

Europe Farm Equipment Industry Company Market Share

Europe Farm Equipment Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European farm equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future growth potential. The analysis encompasses key segments including tractors, harvesting machinery, hay and forage machinery, and irrigation equipment, providing granular data and actionable intelligence. Expect detailed breakdowns of market size (in Millions), CAGR, and market share, fueling your strategic decision-making process.

Europe Farm Equipment Industry Market Concentration & Dynamics

The European farm equipment market is moderately concentrated, with several major players holding significant market share. Deere & Company, Kubota Corporation, AGCO Corporation, and CNH Industrial NV are among the dominant forces, driving innovation and shaping market trends. The competitive landscape is characterized by continuous mergers and acquisitions (M&A) activity, aimed at expanding market reach and technological capabilities. Between 2019 and 2024, approximately xx M&A deals were recorded, signifying a dynamic and evolving market structure. Market share for the top 5 players is estimated at xx% in 2025. Innovation is a key differentiator, with companies investing heavily in precision agriculture technologies, automation, and sustainable solutions. Stringent regulatory frameworks concerning emissions and safety standards further shape the industry landscape. Substitute products, such as drone-based solutions for crop monitoring, pose a growing challenge, although their overall market penetration remains limited. End-user trends are increasingly influenced by factors such as labor shortages, sustainability concerns, and the need for improved efficiency.

- Market Share (2025 Estimate): Top 5 players – xx%

- M&A Activity (2019-2024): Approximately xx deals

- Key Regulatory Factors: Emission standards, safety regulations, and data privacy laws

Europe Farm Equipment Industry Industry Insights & Trends

The European farm equipment market is projected to experience steady growth during the forecast period (2025-2033). The market size in 2025 is estimated at €xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected until 2033. Several factors contribute to this growth. Firstly, increasing demand for food production driven by population growth and changing dietary habits necessitates higher agricultural output, boosting the need for advanced farm equipment. Secondly, technological advancements in precision agriculture, such as GPS-guided machinery, automated systems, and data analytics, improve farm efficiency and productivity, driving adoption rates. Evolving consumer behaviors are also pushing the demand for sustainable and environmentally friendly farming practices, creating opportunities for equipment manufacturers to offer solutions such as reduced-emission machinery and precision fertilization systems. Furthermore, favorable government policies supporting agricultural modernization and technological adoption further propel market growth. However, economic fluctuations and potential disruptions to global supply chains remain potential headwinds.

Key Markets & Segments Leading Europe Farm Equipment Industry

While the entire European market shows robust growth, specific segments and regions demonstrate higher dynamism. The tractor segment, particularly above 150 HP models, remains a dominant force, driven by the increasing adoption of large-scale farming practices. Within the "Other Equipment" category, irrigation machinery exhibits significant growth, owing to increasing water scarcity and the need for efficient water management in agriculture. Germany, France, and Italy remain key markets, benefiting from their substantial agricultural sectors and robust economies.

- Tractors (Above 150 HP): Drivers include large-scale farming operations and increased demand for high-powered equipment.

- Irrigation Machinery: Drivers include water scarcity, increasing adoption of efficient irrigation technologies, and supportive government policies.

- Dominant Regions: Germany, France, and Italy, due to their strong agricultural sectors and economic strength.

Europe Farm Equipment Industry Product Developments

Recent product innovations focus heavily on precision agriculture technologies, automation, and data-driven solutions. The introduction of advanced GPS systems, sensor-based monitoring, and autonomous functionalities improves operational efficiency and reduces labor costs. Manufacturers are also focusing on developing equipment with reduced emissions and enhanced fuel efficiency to meet stringent environmental regulations and the growing demand for sustainable farming practices. Companies are emphasizing connectivity features to allow farmers access to real-time data and remote management capabilities.

Challenges in the Europe Farm Equipment Industry Market

The European farm equipment industry faces various challenges. Stringent emission regulations and safety standards impose high compliance costs, impacting profitability. Supply chain disruptions, particularly regarding electronic components and raw materials, can lead to production delays and increased costs. Intense competition from both domestic and international players, coupled with fluctuating agricultural commodity prices, necessitates continuous innovation and cost optimization strategies. These factors impact profitability and necessitate continuous adaptation. The impact on profitability is estimated at xx Million annually.

Forces Driving Europe Farm Equipment Industry Growth

Several factors fuel the growth of the European farm equipment industry. Technological advancements in precision agriculture, driven by automation, data analytics, and IoT integration, drastically enhance farm productivity and efficiency. Favorable government policies supporting agricultural modernization and technology adoption stimulate investment and innovation. Increasing demand for food, driven by population growth and shifting dietary patterns, creates a sustained need for higher agricultural output. The rising adoption of sustainable farming practices further boosts the demand for equipment that minimizes environmental impact.

Long-Term Growth Catalysts in the Europe Farm Equipment Industry

Long-term growth will be fueled by continued technological innovation, strategic partnerships, and market expansions into new regions. The development of autonomous farming systems and AI-powered decision-support tools will redefine agricultural practices. Collaborations between equipment manufacturers and agricultural technology companies will create synergistic solutions for farmers. Expanding into emerging markets within Europe and exploring export opportunities will further broaden the industry's growth trajectory.

Emerging Opportunities in Europe Farm Equipment Industry

Emerging opportunities lie in precision agriculture technologies, data analytics platforms, and sustainable farming solutions. The integration of AI and machine learning into farm equipment enables improved decision-making, resource optimization, and yield enhancement. Developing data analytics platforms to process and interpret farm data creates actionable insights for improving farm management and optimizing resource allocation. The increasing demand for sustainable agricultural practices opens doors for equipment that minimizes environmental impact and optimizes resource use.

Leading Players in the Europe Farm Equipment Industry Sector

- Deere & Company

- Kubota Corporation

- AGCO Corporation

- Yanmar Co Ltd

- Same Deutz-Fahr

- CNH Industrial NV

- CLAAS KGaA mbH

- Kuhn Group

- Lely France

Key Milestones in Europe Farm Equipment Industry Industry

- November 2023: CNH Industrial NV unveiled the CR11 New Holland combine at Agritechnica '23, showcasing significant advancements in harvesting technology. This launch signals a competitive push in high-capacity combine harvesters.

- November 2023: Yanmar Co. Ltd partnered with International Tractors Limited (ITL), expanding market reach and service capabilities across Europe. This strategic partnership signifies a move towards strengthening market presence and customer service.

- September 2023: John Deere and Yara's partnership improved fertilizer efficiency and crop yields, highlighting the increasing integration of precision agriculture and data-driven solutions. This collaboration underscores the trend of integrating precision technology and agronomic expertise to boost productivity.

Strategic Outlook for Europe Farm Equipment Industry Market

The European farm equipment market holds significant growth potential driven by technological advancements, increasing demand for food, and the need for sustainable farming practices. Strategic opportunities lie in developing innovative solutions that address these evolving needs, focusing on automation, data analytics, and environmentally friendly technologies. Companies that effectively leverage technological advancements, forge strategic partnerships, and adapt to evolving regulatory landscapes will be best positioned for long-term success.

Europe Farm Equipment Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Farm Equipment Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

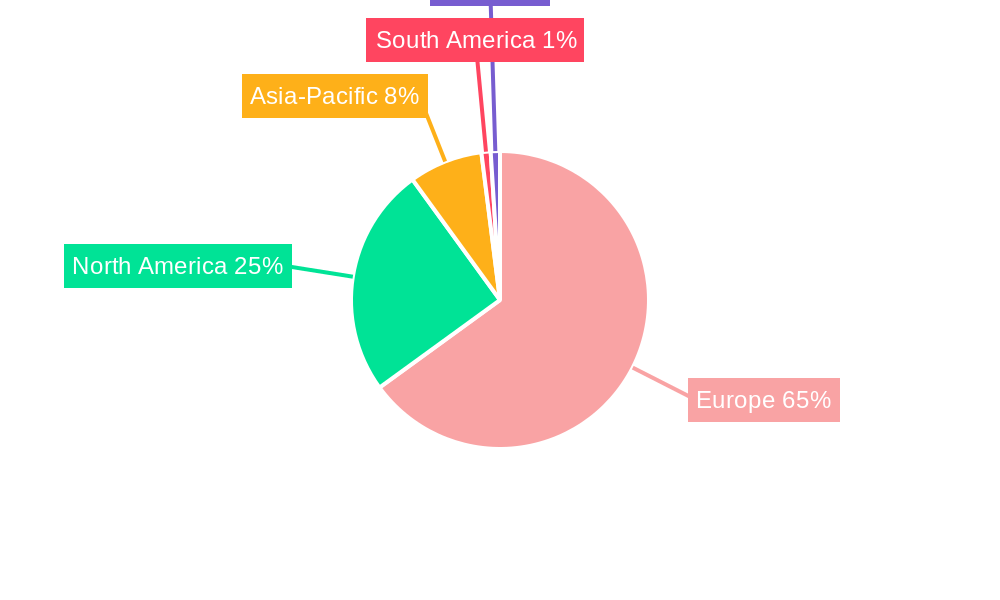

Europe Farm Equipment Industry Regional Market Share

Geographic Coverage of Europe Farm Equipment Industry

Europe Farm Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Shortage of Skilled Labor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deere & Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kubota Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGCO Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yanmar Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Same Deutz-Fahr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CNH Industrial NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CLAAS KGaA mbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuhn Group*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lely France

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Deere & Company

List of Figures

- Figure 1: Europe Farm Equipment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Farm Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Farm Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Farm Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Farm Equipment Industry?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Europe Farm Equipment Industry?

Key companies in the market include Deere & Company, Kubota Corporation, AGCO Corporation, Yanmar Co Ltd, Same Deutz-Fahr, CNH Industrial NV, CLAAS KGaA mbH, Kuhn Group*List Not Exhaustive, Lely France.

3. What are the main segments of the Europe Farm Equipment Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Shortage of Skilled Labor.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

November 2023: CNH Industrial NV unveiled CR11 New Holland combine at Agritechnica '23. Its 775-horsepower C16 engine powers 2x24-inch rotors, while the 567-bushel (20,000-liter) grain tank ensures ample storage capacity. With a rapid six bushels (210 liters) per second unload rate, the CR11 minimizes grain loss.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Farm Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Farm Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Farm Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Farm Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence