Key Insights

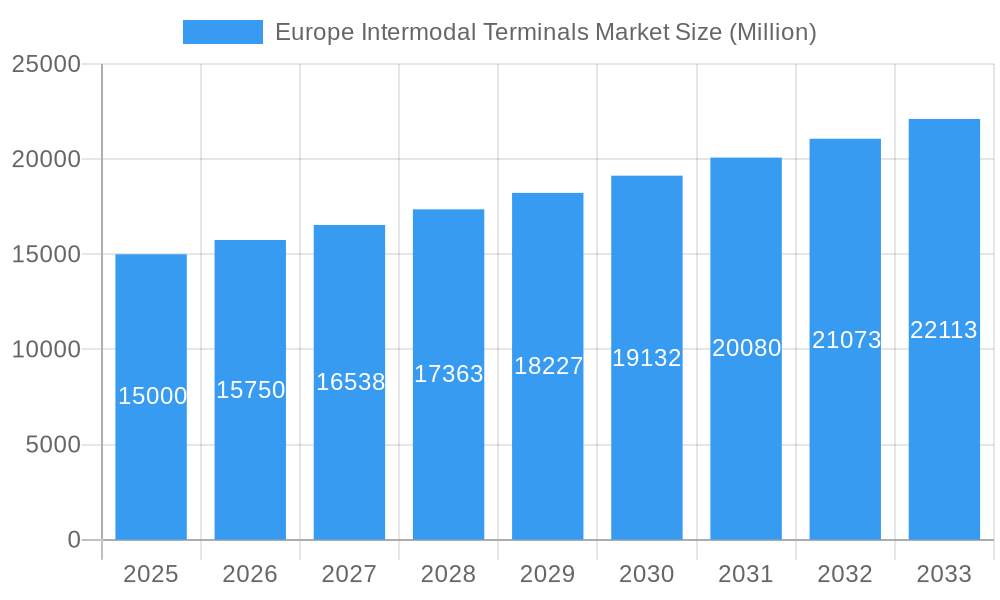

The European intermodal terminals market is poised for significant expansion, driven by escalating e-commerce demand, the imperative for efficient and sustainable logistics, and environmental mandates encouraging modal shifts from road to rail and sea. Projections indicate a Compound Annual Growth Rate (CAGR) of 6.3%, forecasting a market size of 2.33 billion by 2025. Key growth drivers include the manufacturing and automotive sectors, reliant on intermodal transport for just-in-time delivery, and the oil, gas, and mining industries, leveraging terminal capacity and cost-effectiveness for bulk material handling. Infrastructure development, including rail network expansion and government support for sustainable transport, further fuels this growth. Germany, the UK, and the Netherlands are anticipated to lead market performance due to their robust logistics infrastructure and economic vitality.

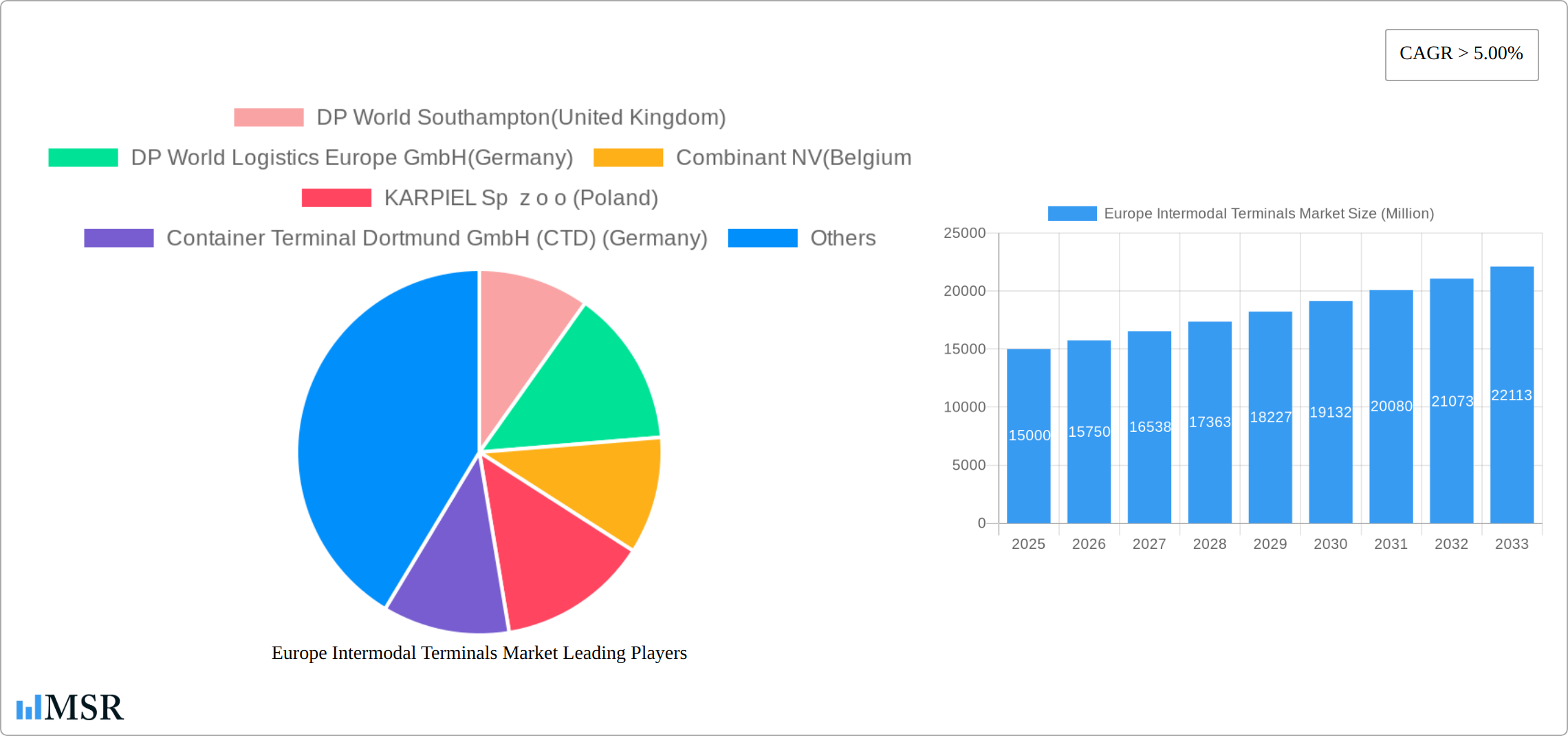

Europe Intermodal Terminals Market Market Size (In Billion)

The competitive landscape is moderately intense, featuring established entities such as DP World, Rail Cargo Group, and COSCO SHIPPING Ports alongside regional players. Strategic investments in terminal modernization, operational efficiency through partnerships, and the integration of advanced technologies like automation and real-time tracking define competitive strategies. Challenges include substantial initial capital investment, volatile fuel prices, and potential labor constraints. Nevertheless, the market's long-term outlook remains optimistic, underpinned by sustained e-commerce and industrial growth, and a growing commitment to eco-friendly transportation solutions.

Europe Intermodal Terminals Market Company Market Share

Europe Intermodal Terminals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Intermodal Terminals Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, growth drivers, key segments, and leading players, equipping you with actionable intelligence to navigate this evolving landscape. The market is expected to reach xx Million by 2033.

Europe Intermodal Terminals Market Market Concentration & Dynamics

The Europe Intermodal Terminals market exhibits a moderately concentrated structure, with several large players holding significant market share. The market share of the top 5 players is estimated at approximately 40%, indicating room for both consolidation and the emergence of new competitors. Innovation is a key driver, with companies continuously investing in technologies to improve efficiency, reduce costs, and enhance service offerings. The regulatory landscape varies across European nations, influencing operational costs and investment decisions. Substitute products, such as dedicated trucking services, pose a competitive threat, particularly for shorter distances. End-user trends, such as the growth of e-commerce and the increasing demand for faster delivery times, are shaping the market.

M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024. These transactions primarily involved smaller players seeking to expand their geographic reach or service offerings. Future M&A activity is likely to be driven by the need for scale, technological integration, and access to new markets.

- Market Concentration: Moderately concentrated, top 5 players hold ~40% market share.

- Innovation Ecosystems: Strong emphasis on technology integration, automation, and digitization.

- Regulatory Frameworks: Vary across European nations, impacting operational costs and investments.

- Substitute Products: Trucking services pose competition, especially for shorter distances.

- End-User Trends: E-commerce growth and demand for faster delivery drive market expansion.

- M&A Activity: Moderate in recent years, with xx deals recorded (2019-2024).

Europe Intermodal Terminals Market Industry Insights & Trends

The Europe Intermodal Terminals Market is experiencing robust growth, driven by several key factors. Increasing global trade, the expansion of e-commerce, and the need for efficient and cost-effective logistics solutions are key contributors. The market size was valued at xx Million in 2024, and is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of smart containers, blockchain technology, and AI-powered optimization tools, are transforming the industry. These advancements are improving efficiency, transparency, and security throughout the supply chain. Changing consumer behaviors, with heightened expectations for speed and reliability, are also pushing for innovation and investment in the sector. Furthermore, rising fuel costs and environmental concerns are influencing the adoption of sustainable practices within the industry.

Key Markets & Segments Leading Europe Intermodal Terminals Market

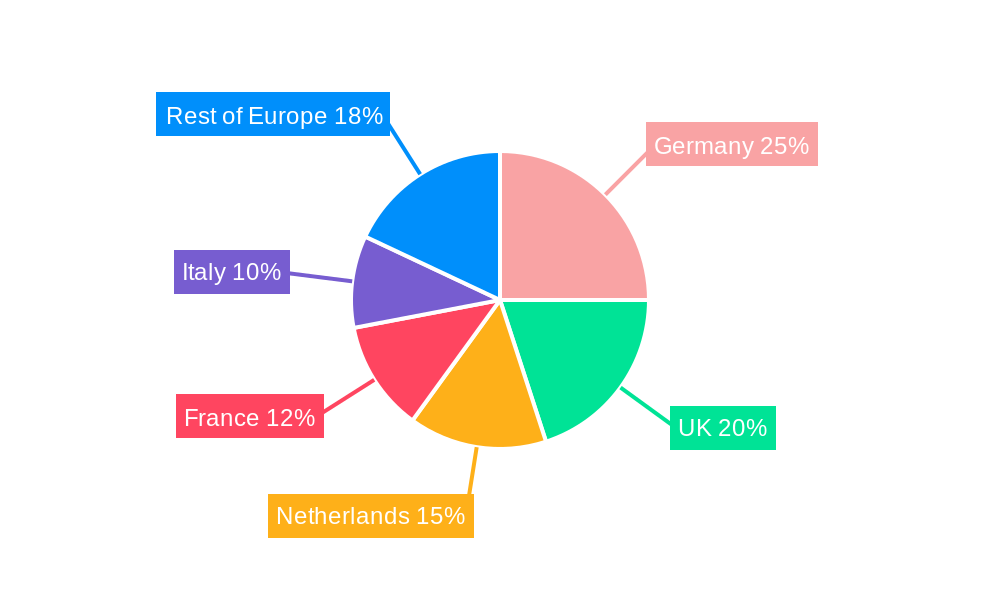

The Europe Intermodal Terminals Market is dynamic, with key contributions from a diverse range of countries and sectors. Geographically, **Germany, the Netherlands, and the United Kingdom** stand out as dominant forces. This leadership is underpinned by their extensive and sophisticated transportation infrastructure, high volumes of international and domestic trade, and crucially, their strategic positions within European logistics networks. These nations serve as vital hubs for the flow of goods across the continent and beyond.

By transportation mode, the "Maritime and Road Transport" segment indisputably leads. This reflects the paramount importance of seaports as the primary gateways for goods entering and leaving Europe. The seamless integration of maritime services with robust road networks is fundamental to efficient intermodal operations.

In terms of end-users, the "Manufacturing and Automotive" segment commands the largest share. This dominance is a direct consequence of the sheer volume and complexity of raw materials, components, and finished products that these industries require to be transported. The intricate supply chains of these sectors necessitate reliable and cost-effective intermodal solutions.

Key Growth Drivers:

- By Transportation Mode:

- Maritime and Road Transport: Remains the cornerstone due to high volumes of seaborne trade and the extensive reach of road networks for last-mile delivery and inland distribution.

- Rail and Road Transport: Witnessing increasing adoption for inland transportation. This mode offers a compelling balance of efficiency, environmental benefits, and capacity, reducing reliance on road-only solutions for longer hauls.

- Air and Road Transport: A vital niche segment catering to time-sensitive shipments, high-value goods, and urgent deliveries where speed is paramount.

- By End-User:

- Manufacturing and Automotive: Continued high demand for the transportation of a vast array of parts, components, and finished vehicles, requiring efficient and specialized intermodal handling.

- Distributive Trade: The burgeoning growth of e-commerce significantly fuels the demand for agile and efficient last-mile delivery solutions, placing greater emphasis on the role of intermodal terminals in the distribution network.

- Oil, Gas, and Mining: These sectors contribute significant volumes of raw materials, bulk commodities, and refined products, necessitating robust intermodal infrastructure for their efficient movement.

- Retail and Consumer Goods: Growing consumer demand and complex retail supply chains are driving increased volumes through intermodal networks.

Dominance Analysis: Germany and the Netherlands continue to lead in terms of infrastructure development, operational efficiency, and overall cargo volume. The United Kingdom, despite facing post-Brexit adjustments, retains a significant share, showcasing the enduring importance of its strategic port locations and established logistics networks.

Europe Intermodal Terminals Market Product Developments

Recent product innovations focus on enhancing efficiency and sustainability. This includes the integration of smart sensors and tracking devices within containers, the adoption of automated guided vehicles (AGVs) in terminal operations, and the implementation of digital platforms for real-time data analysis and supply chain optimization. These advancements provide competitive advantages by streamlining operations, improving visibility, and reducing operational costs.

Challenges in the Europe Intermodal Terminals Market Market

The Europe Intermodal Terminals Market faces several challenges. Regulatory inconsistencies across different European countries create complexities for operators, impacting operational efficiency and investment planning. Supply chain disruptions, particularly those related to port congestion and labor shortages, affect the timely movement of goods. Competition from alternative transport modes, especially road transport for shorter distances, and fluctuations in fuel prices are ongoing pressures. These factors contribute to price volatility and pressure margins. The combined impact of these challenges is estimated to reduce market growth by approximately xx% in the short-term.

Forces Driving Europe Intermodal Terminals Market Growth

Technological advancements in automation, digitalization, and data analytics are significantly driving market growth. The increasing demand for seamless and transparent supply chains, coupled with growing e-commerce, fuels demand. Supportive government policies promoting efficient logistics and sustainable transport contribute to industry growth. Moreover, the rising focus on optimizing supply chain resilience in the face of geopolitical uncertainties contributes to increased investments in intermodal solutions.

Challenges in the Europe Intermodal Terminals Market Market

Long-term growth hinges on continued innovation, strategic partnerships, and market expansion. Investment in advanced technologies and infrastructure development will be key. Collaboration among stakeholders, including terminal operators, transport providers, and technology developers, will be crucial for improving efficiency and sustainability. Expanding into new markets and exploring new service offerings will further drive growth.

Emerging Opportunities in Europe Intermodal Terminals Market

The Europe Intermodal Terminals Market is ripe with emerging opportunities, particularly in the realm of sustainability and technological advancement. A significant area of growth lies in the **development and adoption of sustainable intermodal solutions**. This includes the integration of alternative fuels for transport modes, the optimization of transport routes to minimize carbon footprints, and the implementation of energy-efficient terminal operations. Investment in electric and hydrogen-powered vehicles and trains will be crucial.

The increasing integration of advanced digital technologies presents transformative opportunities. The wider adoption of **blockchain technology** promises enhanced transparency, traceability, and security across the supply chain, reducing fraud and improving data integrity. Simultaneously, the deployment of the **Internet of Things (IoT)** will enable real-time monitoring of cargo and assets, leading to improved tracking, predictive maintenance, and more efficient resource allocation.

Furthermore, there is a substantial opportunity in **expanding services to include value-added logistics solutions**. This could encompass advanced warehousing, inventory management, customs brokerage, packaging, and light manufacturing or assembly activities directly within or adjacent to intermodal terminals. By offering a more comprehensive suite of services, terminals can become more integrated logistics hubs, enhancing their value proposition to customers and capturing a larger share of the logistics spend.

Leading Players in the Europe Intermodal Terminals Market Sector

The Europe Intermodal Terminals Market is characterized by the presence of a diverse range of key players, each contributing to the industry's development and operational capabilities. These companies represent a mix of established global entities and specialized regional operators, driving innovation and efficiency across the continent.

- DP World Southampton (United Kingdom) [Insert DP World global link if available]

- DP World Logistics Europe GmbH (Germany) [Insert DP World global link if available]

- Combinant NV (Belgium)

- KARPIEL Sp z o o (Poland)

- Container Terminal Dortmund GmbH (CTD) (Germany)

- Rail Cargo Group (Austria) [Insert Rail Cargo Group link if available]

- INTERPORT Terminal Kosice (Romania)

- COSCO SHIPPING Ports (Spain) Terminals S L U (Spain) [Insert COSCO SHIPPING Ports link if available]

- EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands)

- Rail Hub Transylvania (Romania)

- Hupac Intermodal (Switzerland)

- CMA CGM Group (France)

- Maersk Group (Denmark)

Key Milestones in Europe Intermodal Terminals Market Industry

The Europe Intermodal Terminals Market is marked by strategic developments and operational achievements that highlight its dynamic nature and commitment to innovation. These milestones demonstrate the industry's capacity to adapt to complex logistical demands and expand its service offerings.

- October 2022: CSP Spain's Valencian terminal achieved a significant operational feat by successfully completing an unprecedented special project involving the unloading of three luxury yachts. This accomplishment underscores the terminal's advanced handling capabilities and its flexibility in managing unique and high-value cargo, showcasing its expertise beyond standard containerized freight.

- November 2022: CSP Spain further demonstrated its commitment to expanding connectivity by inaugurating a new express intermodal service between Spain and Turkey. This new weekly service, utilizing two vessels with a combined capacity of 700 TEU, signifies a growing importance of direct intermodal connections for trade between these regions, reflecting increased trade volumes and strategic market expansion.

- Early 2023: Several key European countries announced significant government investments in rail infrastructure upgrades and the electrification of freight lines, aimed at boosting rail intermodal transport efficiency and sustainability.

- Mid 2023: Leading terminal operators began piloting advanced AI-driven yard management systems, demonstrating a commitment to leveraging technology for improved operational efficiency, reduced turnaround times, and enhanced safety protocols.

Strategic Outlook for Europe Intermodal Terminals Market Market

The Europe Intermodal Terminals Market holds substantial long-term growth potential. Continued investment in technological advancements, infrastructure improvements, and sustainable practices will be crucial. Strategic partnerships and collaborations across the supply chain will enhance efficiency and resilience. Expanding into new markets and developing innovative service offerings will be key to unlocking future growth opportunities. The market is poised for sustained expansion, driven by the unrelenting demand for efficient and reliable logistics solutions within a dynamic global landscape.

Europe Intermodal Terminals Market Segmentation

-

1. Transportation Mode

- 1.1. Rail and Road Transport

- 1.2. Air and Road Transport

- 1.3. Maritime and Road Transport

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Oil, Gas, and Mining

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Others

Europe Intermodal Terminals Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Spain

- 5. Rest of Europe

Europe Intermodal Terminals Market Regional Market Share

Geographic Coverage of Europe Intermodal Terminals Market

Europe Intermodal Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. Growth of Webshop Traffic Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 5.1.1. Rail and Road Transport

- 5.1.2. Air and Road Transport

- 5.1.3. Maritime and Road Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil, Gas, and Mining

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Spain

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6. Germany Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6.1.1. Rail and Road Transport

- 6.1.2. Air and Road Transport

- 6.1.3. Maritime and Road Transport

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Oil, Gas, and Mining

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Construction

- 6.2.5. Distributive Trade

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7. France Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7.1.1. Rail and Road Transport

- 7.1.2. Air and Road Transport

- 7.1.3. Maritime and Road Transport

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Oil, Gas, and Mining

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Construction

- 7.2.5. Distributive Trade

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8. United Kingdom Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8.1.1. Rail and Road Transport

- 8.1.2. Air and Road Transport

- 8.1.3. Maritime and Road Transport

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Oil, Gas, and Mining

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Construction

- 8.2.5. Distributive Trade

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9. Spain Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9.1.1. Rail and Road Transport

- 9.1.2. Air and Road Transport

- 9.1.3. Maritime and Road Transport

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Oil, Gas, and Mining

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Construction

- 9.2.5. Distributive Trade

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10. Rest of Europe Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10.1.1. Rail and Road Transport

- 10.1.2. Air and Road Transport

- 10.1.3. Maritime and Road Transport

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Oil, Gas, and Mining

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Construction

- 10.2.5. Distributive Trade

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DP World Southampton(United Kingdom)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DP World Logistics Europe GmbH(Germany)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Combinant NV(Belgium

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KARPIEL Sp z o o (Poland)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Container Terminal Dortmund GmbH (CTD) (Germany)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rail Cargo Group(Austria)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INTERPORT Terminal Kosice(Romania)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 COSCO SHIPPING Ports (Spain) Terminals S L U (Spain)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rail Hub Transylvania(Romania)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DP World Southampton(United Kingdom)

List of Figures

- Figure 1: Europe Intermodal Terminals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Intermodal Terminals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 2: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Intermodal Terminals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 5: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 8: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 11: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 14: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 17: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Intermodal Terminals Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Intermodal Terminals Market?

Key companies in the market include DP World Southampton(United Kingdom), DP World Logistics Europe GmbH(Germany), Combinant NV(Belgium, KARPIEL Sp z o o (Poland), Container Terminal Dortmund GmbH (CTD) (Germany), Rail Cargo Group(Austria), INTERPORT Terminal Kosice(Romania), COSCO SHIPPING Ports (Spain) Terminals S L U (Spain), EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands), Rail Hub Transylvania(Romania).

3. What are the main segments of the Europe Intermodal Terminals Market?

The market segments include Transportation Mode, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

Growth of Webshop Traffic Drives the Market.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

November 2022: CSP Spain Inaugurated a new express service between Spain and Turkey in the Valencian terminal of CSP Spain. The service is promoted by the company Cordelia Container Shipping Line and among its stops, the Valencian terminal of CSP Spain. It is a weekly service, with two vessels involved with an approximate capacity of 700 TEUS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Intermodal Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Intermodal Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Intermodal Terminals Market?

To stay informed about further developments, trends, and reports in the Europe Intermodal Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence