Key Insights

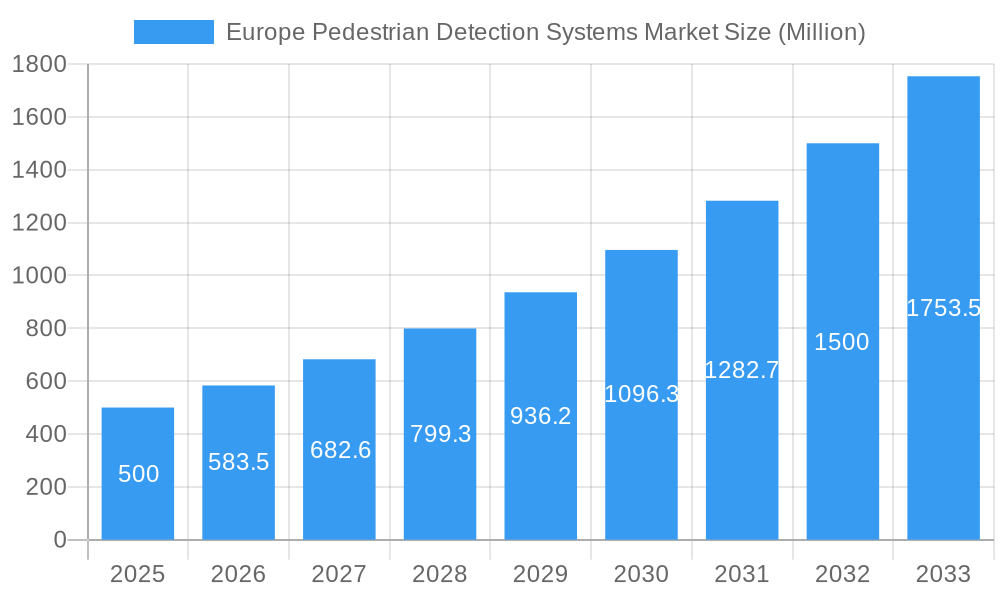

The European pedestrian detection systems market is poised for significant expansion, driven by escalating road safety mandates, regulatory advancements, and innovative sensor technologies. The market, projected to reach $15.46 billion in 2025, is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.15% from 2025 to 2033. This surge is propelled by the widespread integration of Advanced Driver-Assistance Systems (ADAS) and autonomous driving capabilities in both passenger and commercial vehicles. Key market segments encompass video-based, infrared, and hybrid systems, with sensors, radars, and cameras as primary component types. Germany, France, and the UK are key growth drivers due to their high vehicle penetration and robust road safety initiatives.

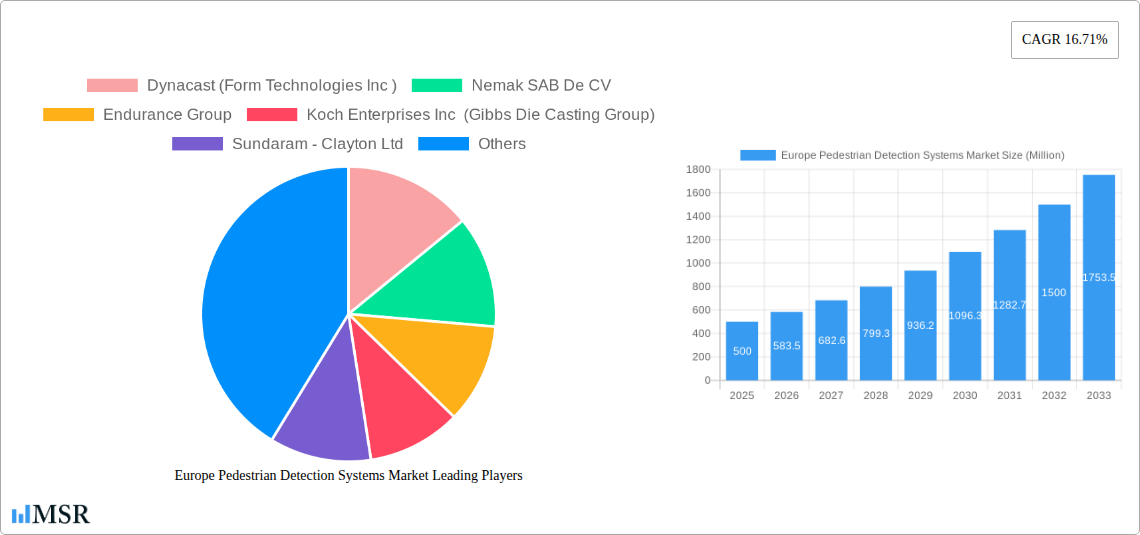

Europe Pedestrian Detection Systems Market Market Size (In Billion)

Market expansion is further supported by integrating pedestrian detection into existing vehicle frameworks and developing more advanced, affordable solutions. However, initial investment costs and the risk of false positives in adverse weather present hurdles. Despite these challenges, the long-term European pedestrian detection systems market forecast remains optimistic, fueled by ongoing technological innovation and a persistent dedication to improving continental road safety. The competitive environment features established automotive suppliers and specialized tech companies competing through R&D and strategic alliances. Future growth will depend on seamless integration into automotive safety systems and the refinement of reliable detection algorithms.

Europe Pedestrian Detection Systems Market Company Market Share

Europe Pedestrian Detection Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Pedestrian Detection Systems Market, offering valuable insights for stakeholders across the automotive, technology, and safety sectors. From market size and growth projections to key players and emerging trends, this report delivers actionable intelligence to navigate this dynamic landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033.

Europe Pedestrian Detection Systems Market Concentration & Dynamics

The Europe Pedestrian Detection Systems Market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. However, the market is experiencing increased competition from emerging technology providers. Innovation is a key driver, with continuous advancements in sensor technology, AI-powered algorithms, and data analytics shaping the market trajectory. Stringent safety regulations across European nations are further fueling market growth, mandating the integration of pedestrian detection systems in new vehicle models and retrofitting older vehicles. Substitute products are limited, with the primary alternatives being traditional driver-based observation and less effective warning systems. End-user trends are shifting towards enhanced safety features and autonomous driving capabilities, further driving demand for sophisticated pedestrian detection systems. M&A activity in the sector has remained moderate, with approximately xx deals recorded in the past five years, indicating a trend toward consolidation and strategic partnerships. Market share amongst the top 5 players is estimated to be approximately xx%.

Europe Pedestrian Detection Systems Market Industry Insights & Trends

The Europe Pedestrian Detection Systems Market is experiencing robust growth, with the market size estimated at €xx Million in 2025 and projected to reach €xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is primarily driven by increasing road accidents, escalating demand for advanced driver-assistance systems (ADAS), and stringent government regulations aimed at improving road safety. Technological advancements like the integration of AI and machine learning into pedestrian detection systems are revolutionizing the industry, enhancing accuracy and reliability. The rising adoption of electric and autonomous vehicles is further boosting market demand, as these vehicles require more sophisticated safety systems. Changing consumer preferences, with a heightened focus on vehicle safety, are also contributing significantly to market expansion.

Key Markets & Segments Leading Europe Pedestrian Detection Systems Market

Dominant Regions and Segments:

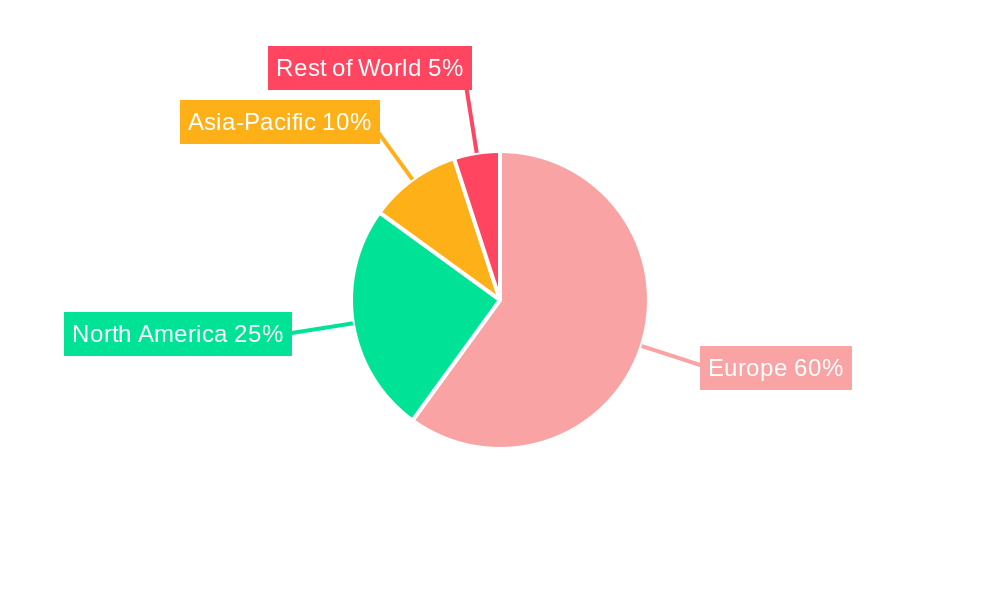

Region: Germany is currently the dominant market in Europe, driven by robust automotive manufacturing and a strong regulatory framework for vehicle safety. Other key markets include the UK, France, and Italy.

Type: Video-based systems currently hold the largest market share due to their relatively lower cost and ease of integration. However, infrared and hybrid systems are gaining traction due to their superior performance in low-light conditions.

Component Type: Sensors form a crucial component of pedestrian detection systems, representing the largest market share. This is further segmented into cameras and radar systems.

Drivers:

Stringent Safety Regulations: The European Union's stringent safety regulations are a primary driver, making pedestrian detection systems mandatory for many vehicle types.

Increasing Urbanization and Traffic Density: Higher population density and increased traffic volume in European cities lead to a higher risk of pedestrian accidents.

Technological Advancements: Ongoing improvements in sensor technology, AI, and machine learning are improving the accuracy and reliability of pedestrian detection systems.

Economic Growth: The overall economic growth in Europe contributes to increased vehicle sales and thus higher demand for safety features.

Germany's dominance stems from its strong automotive industry, a concentration of major automotive manufacturers, and a proactive approach to road safety regulations. The country's robust infrastructure and investment in advanced technologies further support its leading position.

Europe Pedestrian Detection Systems Market Product Developments

Recent years have witnessed significant product innovations in the Europe Pedestrian Detection Systems Market. The integration of advanced sensor fusion techniques, high-resolution cameras, and sophisticated algorithms has led to improved accuracy and reliability in detecting pedestrians, even in challenging conditions. The development of compact and cost-effective systems has expanded their applicability across a broader range of vehicles, including commercial vehicles and two-wheelers. These advancements provide manufacturers with a competitive edge, enabling them to offer enhanced safety features and meet stricter regulatory requirements.

Challenges in the Europe Pedestrian Detection Systems Market Market

The Europe Pedestrian Detection Systems Market faces several challenges. These include the high initial investment cost associated with implementing advanced systems, concerns over data privacy and security, and potential supply chain disruptions impacting the availability of key components. Furthermore, the complexities involved in integrating these systems with existing vehicle architectures pose significant hurdles for some manufacturers. The competitive landscape also presents a challenge, with various companies vying for market share through product differentiation and strategic partnerships. These factors collectively impact market growth by limiting widespread adoption.

Forces Driving Europe Pedestrian Detection Systems Market Growth

Several factors propel the growth of the Europe Pedestrian Detection Systems Market. Technological advancements, like improved sensor technology and AI-driven algorithms, enhance system accuracy and reliability. Stringent government regulations mandating pedestrian detection systems in new vehicles drive significant demand. Increased consumer awareness of road safety and a desire for enhanced vehicle safety features also fuels market expansion. Further, the burgeoning electric vehicle and autonomous driving segments are expected to further enhance the market's growth trajectory.

Long-Term Growth Catalysts in Europe Pedestrian Detection Systems Market

Long-term growth hinges on continued innovation in sensor technologies, particularly those addressing limitations in adverse weather conditions. Strategic partnerships between automotive manufacturers and technology providers will play a crucial role in streamlining integration and driving down costs. Expansion into emerging markets within Europe and the incorporation of pedestrian detection into broader ADAS suites promise sustained market expansion over the long term.

Emerging Opportunities in Europe Pedestrian Detection Systems Market

Emerging opportunities exist in the integration of pedestrian detection systems with other ADAS functionalities, creating comprehensive safety suites. The development of more robust and reliable systems for challenging conditions (e.g., low light, adverse weather) presents a significant opportunity for growth. Finally, the expanding market for commercial vehicles and autonomous delivery robots presents a substantial avenue for expansion and diversification.

Leading Players in the Europe Pedestrian Detection Systems Market Sector

- Dynacast (Form Technologies Inc)

- Nemak SAB De CV

- Endurance Group

- Koch Enterprises Inc (Gibbs Die Casting Group)

- Sundaram - Clayton Ltd

- Georg Fischer AG

- Ryobi Die Casting Inc

- Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- Officine Meccaniche Rezzatesi SpA

- Rockman Industries

- Engtek Group

- Shiloh Industries Ltd

Key Milestones in Europe Pedestrian Detection Systems Market Industry

July 2022: Volvo Trucks launched its Side Collision Avoidance Support system, utilizing twin radars to detect and warn drivers of cyclists and pedestrians entering blind spots. This demonstrates a significant advancement in proactive safety technology.

February 2022: Skoda Auto highlighted its commitment to pedestrian safety with over 200 specific tests during vehicle development, emphasizing a focus on vulnerable body parts during collisions. This signifies a significant investment in rigorous safety testing and development.

January 2022: Ficosa announced plans to replace front mirrors with camera systems in MAN commercial vehicles, improving driver visibility and pedestrian detection, especially during low-speed maneuvers. This showcases the trend toward camera-based systems for improved safety.

Strategic Outlook for Europe Pedestrian Detection Systems Market Market

The future of the Europe Pedestrian Detection Systems Market looks promising, driven by technological innovation, stricter safety regulations, and increasing consumer demand for advanced safety features. Strategic partnerships, focusing on integrating pedestrian detection with other ADAS, will be crucial for long-term growth. The market’s potential is immense, particularly with the rise of autonomous vehicles and the continued focus on improving road safety across Europe.

Europe Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

-

2. Component Type

- 2.1. Sensors

- 2.2. Radars

- 2.3. Cameras

- 2.4. Other Component Types

Europe Pedestrian Detection Systems Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Europe Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of Europe Pedestrian Detection Systems Market

Europe Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of ADAS Systems Driving the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of ADAS Systems Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Sensors

- 5.2.2. Radars

- 5.2.3. Cameras

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Infrared

- 6.1.3. Hybrid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Sensors

- 6.2.2. Radars

- 6.2.3. Cameras

- 6.2.4. Other Component Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Infrared

- 7.1.3. Hybrid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Sensors

- 7.2.2. Radars

- 7.2.3. Cameras

- 7.2.4. Other Component Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Infrared

- 8.1.3. Hybrid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Sensors

- 8.2.2. Radars

- 8.2.3. Cameras

- 8.2.4. Other Component Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Infrared

- 9.1.3. Hybrid

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Sensors

- 9.2.2. Radars

- 9.2.3. Cameras

- 9.2.4. Other Component Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Video

- 10.1.2. Infrared

- 10.1.3. Hybrid

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Sensors

- 10.2.2. Radars

- 10.2.3. Cameras

- 10.2.4. Other Component Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Video

- 11.1.2. Infrared

- 11.1.3. Hybrid

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Component Type

- 11.2.1. Sensors

- 11.2.2. Radars

- 11.2.3. Cameras

- 11.2.4. Other Component Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Video

- 12.1.2. Infrared

- 12.1.3. Hybrid

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Component Type

- 12.2.1. Sensors

- 12.2.2. Radars

- 12.2.3. Cameras

- 12.2.4. Other Component Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dynacast (Form Technologies Inc )

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nemak SAB De CV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Endurance Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Koch Enterprises Inc (Gibbs Die Casting Group)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sundaram - Clayton Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Georg Fischer AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ryobi Die Casting Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Officine Meccaniche Rezzatesi SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rockman Industries

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Engtek Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Shiloh Industries Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Europe Pedestrian Detection Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 9: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 12: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 15: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 18: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 21: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 24: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pedestrian Detection Systems Market?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Europe Pedestrian Detection Systems Market?

Key companies in the market include Dynacast (Form Technologies Inc ), Nemak SAB De CV, Endurance Group, Koch Enterprises Inc (Gibbs Die Casting Group), Sundaram - Clayton Ltd, Georg Fischer AG, Ryobi Die Casting Inc, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Officine Meccaniche Rezzatesi SpA, Rockman Industries, Engtek Group, Shiloh Industries Ltd.

3. What are the main segments of the Europe Pedestrian Detection Systems Market?

The market segments include Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of ADAS Systems Driving the Market.

6. What are the notable trends driving market growth?

Increasing Adoption of ADAS Systems Driving the Market.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

July 2022: Volvo Trucks announced the launch of a new safety technology aimed at improving road safety. The device utilizes twin radars on each side of the truck to recognize when other road users, such as bicycles, enter the danger zone. Known as the Side Collision Avoidance Support system, it alerts the driver by flashing a red light on the appropriate side mirror when something is in the blind spot area. If the driver signals a lane change with the turn signal, the red light starts to flash, and an audible warning sound is emitted from the side of the potential accident. This provides the driver with timely information and the option to apply the brakes, allowing, for example, a bike to safely pass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the Europe Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence