Key Insights

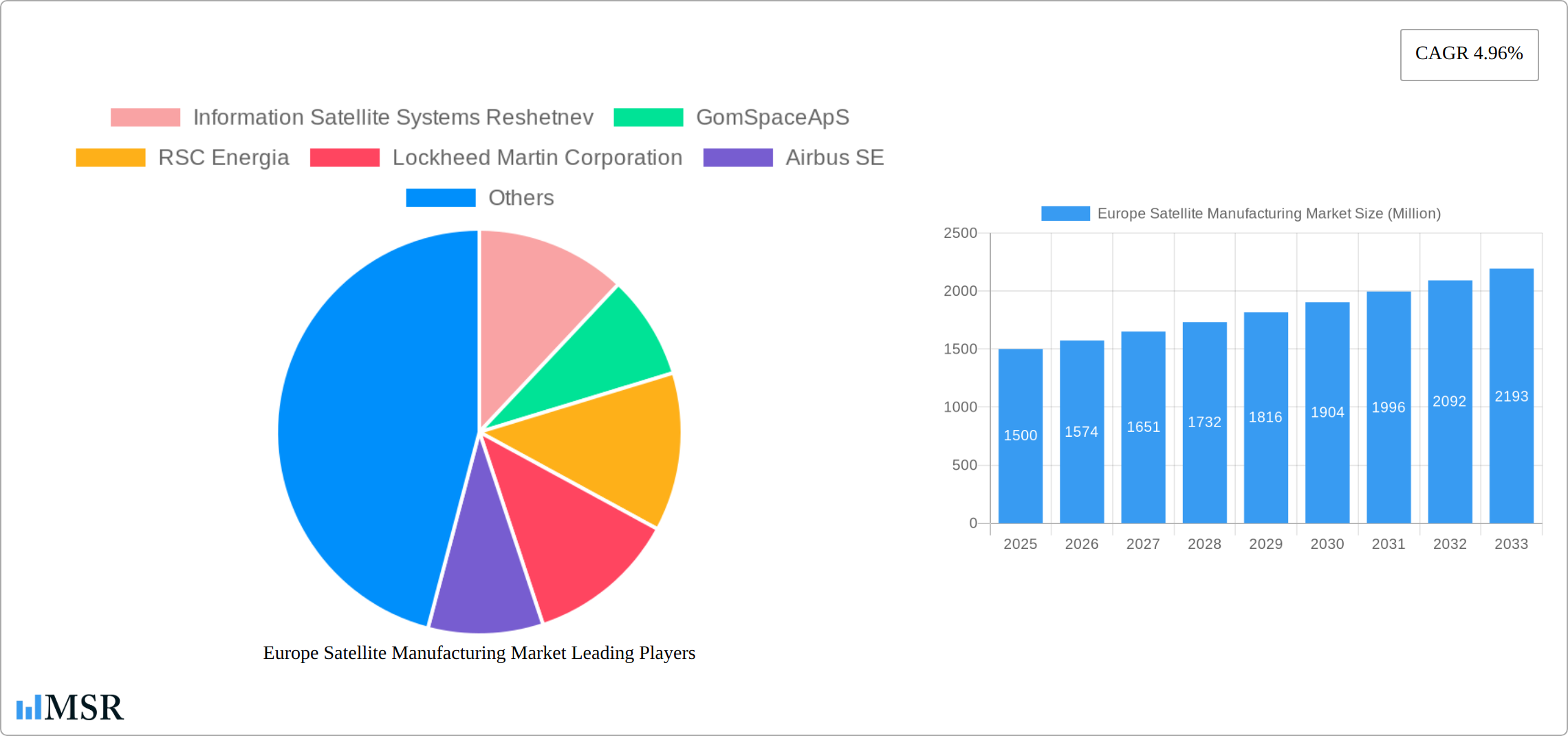

The European satellite manufacturing market, valued at approximately €X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 4.96% and market size 'XX' - a specific value needs to be provided for accurate calculation), is projected to experience robust growth throughout the forecast period (2025-2033). This expansion is fueled by several key drivers, including increasing demand for communication, earth observation, and navigation satellites across various end-user segments—commercial, military & government, and others. Government initiatives promoting space exploration and technological advancements further bolster market expansion. The market's segmentation reveals significant opportunities within satellite subsystems like propulsion hardware, satellite buses, and solar arrays. Electric propulsion technology is gaining traction, driven by its efficiency and cost-effectiveness, while the market also witnesses a significant demand across various satellite mass categories, notably the 100-500kg and 500-1000kg segments, reflecting the diverse applications served. Key players like Airbus SE, OHB SE, and Surrey Satellite Technology Ltd are leveraging technological innovation and strategic partnerships to consolidate their market positions and tap into emerging trends, such as miniaturization and the growing demand for constellations of small satellites.

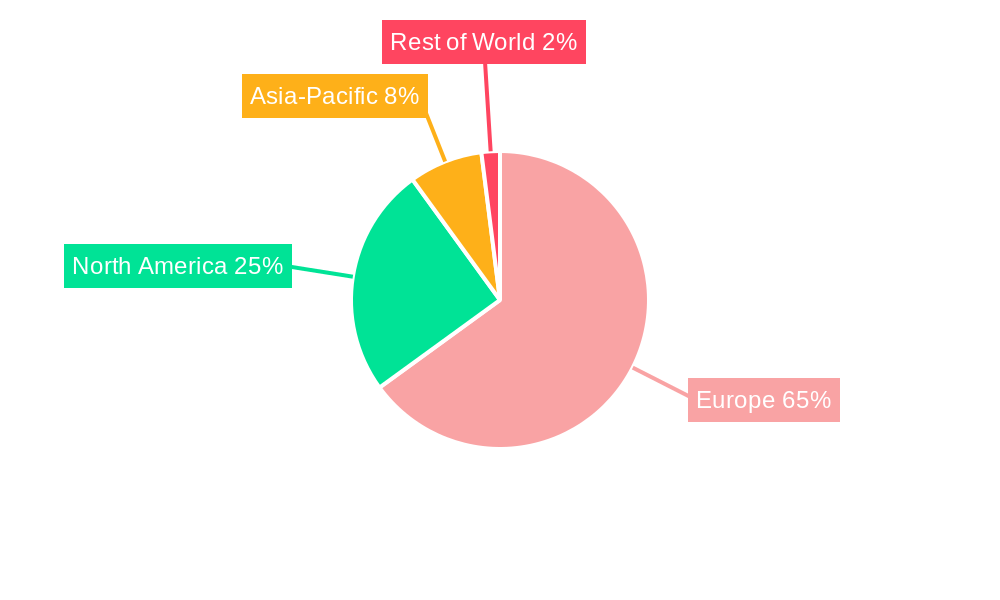

However, challenges remain. The high initial investment required for satellite development and launch presents a significant barrier to entry for smaller companies. Furthermore, intense competition from established players and the complexities associated with regulatory approvals and international collaborations can constrain market growth. The geographical distribution showcases strong participation from countries like Germany, France, and the United Kingdom, highlighting their robust space industries and technological capabilities. Future growth will likely be shaped by advancements in artificial intelligence, big data analytics, and the increasing integration of satellite data into various sectors, creating further opportunities for innovation and market expansion within the European landscape. The ongoing geopolitical landscape may also influence investment and collaborations, impacting the market trajectory over the forecast period.

Europe Satellite Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe satellite manufacturing market, covering market dynamics, key segments, leading players, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for industry stakeholders, investors, and anyone seeking to understand this dynamic and rapidly evolving sector.

Europe Satellite Manufacturing Market Market Concentration & Dynamics

The European satellite manufacturing market presents a moderately concentrated landscape, dominated by several key players commanding significant market share. However, a robust ecosystem of smaller, specialized companies drives innovation and competition. Stringent regulatory frameworks governing space debris mitigation, licensing, and sustainability significantly impact market operations and entry. While terrestrial communication networks offer some level of substitution, the unique capabilities of satellite technology—particularly for remote regions and specialized applications like high-bandwidth connectivity and precise Earth observation—ensure persistent demand. A notable shift in end-user trends favors smaller, more cost-effective satellites, prompting innovation in miniaturization, component efficiency, and streamlined manufacturing processes. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately [Insert Precise Number] deals recorded between 2019 and 2024, largely focused on consolidating specific market segments. Industry giants like Airbus SE and OHB SE maintain substantial market share, exceeding [Insert Precise Percentage] individually. Smaller companies often specialize in niche areas, such as nanosatellite manufacturing or the development of specialized satellite subsystems (e.g., advanced propulsion systems, high-resolution imaging sensors).

- Market Concentration: Moderately concentrated, with a few dominant players and a large number of specialized smaller firms.

- Innovation Ecosystem: Highly active, characterized by continuous advancements in miniaturization, propulsion technologies, and the development of sophisticated satellite constellations.

- Regulatory Framework: Exerts considerable influence on market access, operational procedures, and environmental sustainability initiatives.

- Substitute Products: Terrestrial networks present competitive pressure in some sectors, but satellite technologies remain indispensable for unique applications requiring global coverage or high-bandwidth communication in remote locations.

- End-User Trends: A clear trend towards smaller, more affordable satellites tailored to diverse application needs.

- M&A Activity: Moderate, with approximately [Insert Precise Number] deals recorded between 2019 and 2024, primarily driven by strategic consolidation.

Europe Satellite Manufacturing Market Industry Insights & Trends

The European satellite manufacturing market is experiencing robust growth, driven by increasing demand across various sectors. The market was valued at [Insert Precise Value] Million in 2024 and is projected to reach [Insert Precise Value] Million by 2033, demonstrating a CAGR of [Insert Precise Percentage]% during the forecast period (2025-2033). This expansion is fueled by multiple factors, including escalating communication needs (particularly high-bandwidth requirements), the increasing adoption of Earth observation applications for environmental monitoring, climate change research, and precision agriculture, as well as amplified investment in navigation and space-based infrastructure. Technological advancements, encompassing improvements in electric propulsion, miniaturization techniques, and the integration of AI and machine learning, are further accelerating market growth. Evolving consumer behavior, and the heightened reliance on satellite-based services for communication and navigation, significantly contributes to this trend. The market is also witnessing a notable shift toward constellations of smaller satellites designed to enhance coverage and reduce dependence on large, expensive platforms.

Key Markets & Segments Leading Europe Satellite Manufacturing Market

The United Kingdom and France are currently the leading markets for satellite manufacturing in Europe, driven by strong government support, a robust aerospace industry, and skilled workforce. Germany holds a significant position too.

Dominant Segments:

- End User: The Commercial segment holds the largest share, followed by Military & Government.

- Satellite Subsystem: Satellite Bus & Subsystems accounts for the largest share followed by Propulsion Hardware and Propellant.

- Propulsion Technology: Electric propulsion is gaining traction, with gas-based systems maintaining significant market share.

- Satellite Mass: The 100-500kg segment demonstrates substantial growth.

- Orbit Class: LEO (Low Earth Orbit) is witnessing significant demand.

- Application: Communication and Earth observation are the dominant application segments.

Growth Drivers:

- Economic Growth: Investment in space-based infrastructure and related services.

- Technological Advancements: Miniaturization, improved propulsion systems, and AI integration.

- Government Initiatives: Funding for space exploration and development of national space programs.

- Infrastructure Development: Expansion of ground stations and communication networks.

Europe Satellite Manufacturing Market Product Developments

Recent product innovations in the European satellite manufacturing market include advancements in miniaturized satellites, improved propulsion systems (particularly electric propulsion), and the integration of advanced sensors and communication technologies. These innovations are enabling the development of smaller, more cost-effective satellites, offering increased functionality and competitive advantages in various applications like Earth observation and IoT connectivity. The development of more efficient and longer-lasting solar arrays and power hardware also contributes to extended satellite lifespans and mission capabilities.

Challenges in the Europe Satellite Manufacturing Market Market

The European satellite manufacturing market faces several challenges. These include: stringent regulatory approvals leading to extended launch timelines (xx% delays on average based on recent data), the high cost of manufacturing and launching satellites, reliance on specialized components that can encounter supply chain disruptions causing delays of up to xx weeks, and intense competition from established players and emerging companies, putting pricing pressure and eroding margins by xx% in some segments.

Forces Driving Europe Satellite Manufacturing Market Growth

Several factors are driving growth in the European satellite manufacturing market:

- Technological Advancements: Miniaturization, advanced propulsion, and improved communication technologies are lowering satellite development and launch costs, expanding market access.

- Increased Demand: Growing needs for communication, navigation, and earth observation services fuel market expansion.

- Government Support: Government funding for space programs and national security initiatives provides strong support.

Challenges in the Europe Satellite Manufacturing Market Market

Long-term growth will depend on overcoming challenges including mitigating the environmental impacts of space debris, addressing the high cost of launch services, and fostering collaboration among diverse stakeholders to accelerate technological advancements and market expansion. Innovative partnerships and strategic investments in advanced manufacturing technologies are critical for maintaining competitiveness.

Emerging Opportunities in Europe Satellite Manufacturing Market

Emerging opportunities include the development of constellations of small satellites for improved global coverage, the integration of AI and machine learning for enhanced data processing and autonomy, and the growth of new application areas such as space tourism and in-space manufacturing.

Leading Players in the Europe Satellite Manufacturing Market Sector

- Information Satellite Systems Reshetnev

- GomSpace ApS

- RSC Energia

- Lockheed Martin Corporation (Lockheed Martin)

- Airbus SE (Airbus)

- Astrocast

- OHB SE (OHB SE)

- Surrey Satellite Technology Ltd (Surrey Satellite Technology Ltd)

- SatRev

- ROSCOSMOS

- Thales (Thales)

- Fossa Systems

- Alba Orbital

Key Milestones in Europe Satellite Manufacturing Market Industry

- July 2022: Ericsson, Thales, and Qualcomm announced plans to bring 5G connectivity via LEO satellites, expanding coverage to remote areas.

- September 2022: EECL secured a contract to supply LNAs to Surrey Satellite Technology for the ESA HydroGNSS Scout payload, highlighting advancements in Earth observation technologies.

- January 2023: Lockheed Martin launched the sixth GPS III satellite, demonstrating continued modernization of navigation infrastructure.

Strategic Outlook for Europe Satellite Manufacturing Market Market

The future of the European satellite manufacturing market appears bright, with continued growth fueled by technological advancements, increasing demand across various sectors, and government support. Strategic investments in R&D, partnerships to share resources and expertise, and a focus on sustainable space practices will be critical for long-term success in this dynamic and competitive environment.

Europe Satellite Manufacturing Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

-

5. Satellite Subsystem

- 5.1. Propulsion Hardware and Propellant

- 5.2. Satellite Bus & Subsystems

- 5.3. Solar Array & Power Hardware

- 5.4. Structures, Harness & Mechanisms

-

6. Propulsion Tech

- 6.1. Electric

- 6.2. Gas based

- 6.3. Liquid Fuel

Europe Satellite Manufacturing Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Satellite Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.5.1. Propulsion Hardware and Propellant

- 5.5.2. Satellite Bus & Subsystems

- 5.5.3. Solar Array & Power Hardware

- 5.5.4. Structures, Harness & Mechanisms

- 5.6. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.6.1. Electric

- 5.6.2. Gas based

- 5.6.3. Liquid Fuel

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Satellite Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Information Satellite Systems Reshetnev

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 GomSpaceApS

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 RSC Energia

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Lockheed Martin Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Airbus SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Astrocast

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 OHB SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Surrey Satellite Technology Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SatRev

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 ROSCOSMOS

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Thale

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Fossa Systems

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Alba Orbital

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Europe Satellite Manufacturing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Satellite Manufacturing Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Satellite Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Satellite Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Satellite Manufacturing Market Revenue Million Forecast, by Satellite Mass 2019 & 2032

- Table 4: Europe Satellite Manufacturing Market Revenue Million Forecast, by Orbit Class 2019 & 2032

- Table 5: Europe Satellite Manufacturing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Europe Satellite Manufacturing Market Revenue Million Forecast, by Satellite Subsystem 2019 & 2032

- Table 7: Europe Satellite Manufacturing Market Revenue Million Forecast, by Propulsion Tech 2019 & 2032

- Table 8: Europe Satellite Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Europe Satellite Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Netherlands Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Sweden Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Europe Satellite Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Satellite Manufacturing Market Revenue Million Forecast, by Satellite Mass 2019 & 2032

- Table 19: Europe Satellite Manufacturing Market Revenue Million Forecast, by Orbit Class 2019 & 2032

- Table 20: Europe Satellite Manufacturing Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Europe Satellite Manufacturing Market Revenue Million Forecast, by Satellite Subsystem 2019 & 2032

- Table 22: Europe Satellite Manufacturing Market Revenue Million Forecast, by Propulsion Tech 2019 & 2032

- Table 23: Europe Satellite Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Kingdom Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Germany Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Italy Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Netherlands Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Belgium Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Sweden Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Norway Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Poland Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Denmark Europe Satellite Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Satellite Manufacturing Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Europe Satellite Manufacturing Market?

Key companies in the market include Information Satellite Systems Reshetnev, GomSpaceApS, RSC Energia, Lockheed Martin Corporation, Airbus SE, Astrocast, OHB SE, Surrey Satellite Technology Ltd, SatRev, ROSCOSMOS, Thale, Fossa Systems, Alba Orbital.

3. What are the main segments of the Europe Satellite Manufacturing Market?

The market segments include Application, Satellite Mass, Orbit Class, End User, Satellite Subsystem, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: The sixth Global Positioning System III (GPS III) satellite designed and built by Lockheed Martin has been launched and is entering its operational orbit approximately 12,550 miles from Earth, where it will contribute to the ongoing modernization of the US Space Force's GPS constellation.September 2022: EECL (European Engineering & Consultancy), an engineering company that provides design, manufacturing, and test services to the satellite & aerospace sector, has signed a contract to supply low noise amplifiers (LNA) to Surrey Satellite Technology, for the front-end receiver of the European Space Agency (ESA) HydroGNSS Scout Earth Observation payload.July 2022: Ericsson, Thales, and wireless technology innovator Qualcomm Technologies, Inc. are expected to bring 5G through a network of satellites orbiting the Earth. The benefits of 5G connectivity through Low Earth Orbit (LEO) satellites are expected to include coverage in harsh geographical areas or remote areas of the seas, oceans, and other areas. elsewhere there is no coverage on land.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Satellite Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Satellite Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Satellite Manufacturing Market?

To stay informed about further developments, trends, and reports in the Europe Satellite Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence