Key Insights

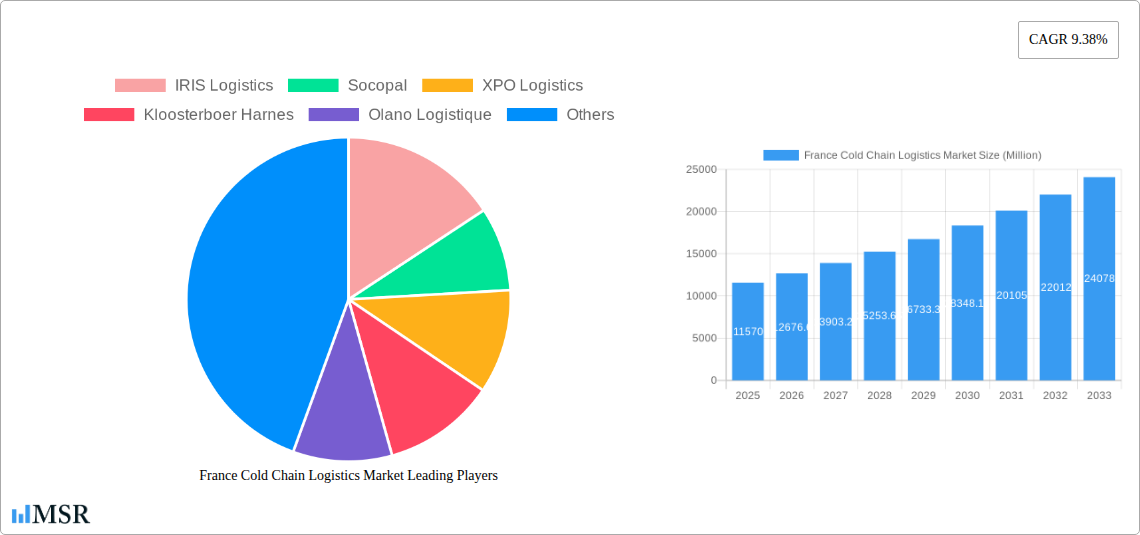

The France cold chain logistics market, valued at €11.57 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 9.38% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for fresh produce, dairy products, meat, fish, and pharmaceuticals necessitates efficient temperature-controlled transportation and storage. Rising consumer awareness of food safety and quality further fuels the market's growth, as cold chain logistics are crucial for maintaining product integrity and extending shelf life. E-commerce expansion and the growth of online grocery delivery services also contribute significantly to the market's upward trajectory. The market is segmented by service type (storage, transportation, value-added services like blast freezing and inventory management), temperature type (chilled and frozen), and application (horticulture, dairy, meat & fish, processed foods, pharmaceuticals, and life sciences). Key players like IRIS Logistics, Socopal, XPO Logistics, and Kuehne + Nagel are actively shaping the market landscape through strategic partnerships, technological advancements, and expansion initiatives. France's strong agricultural sector and robust pharmaceutical industry provide a solid foundation for sustained market growth.

France Cold Chain Logistics Market Market Size (In Billion)

The market's growth, however, faces certain challenges. These include rising fuel costs, stringent regulatory compliance requirements related to food safety and environmental regulations, and the need for continuous investment in advanced cold chain technologies to maintain optimal temperature control throughout the supply chain. Competition among logistics providers is intense, necessitating a focus on operational efficiency, innovation in technology (e.g., IoT-enabled monitoring), and customer-centric service models. Despite these challenges, the long-term outlook for the France cold chain logistics market remains positive, propelled by increasing consumer demand, expanding e-commerce, and ongoing improvements in cold chain infrastructure and technology. The market is expected to see continued consolidation, with larger players acquiring smaller companies to enhance their market share and service offerings.

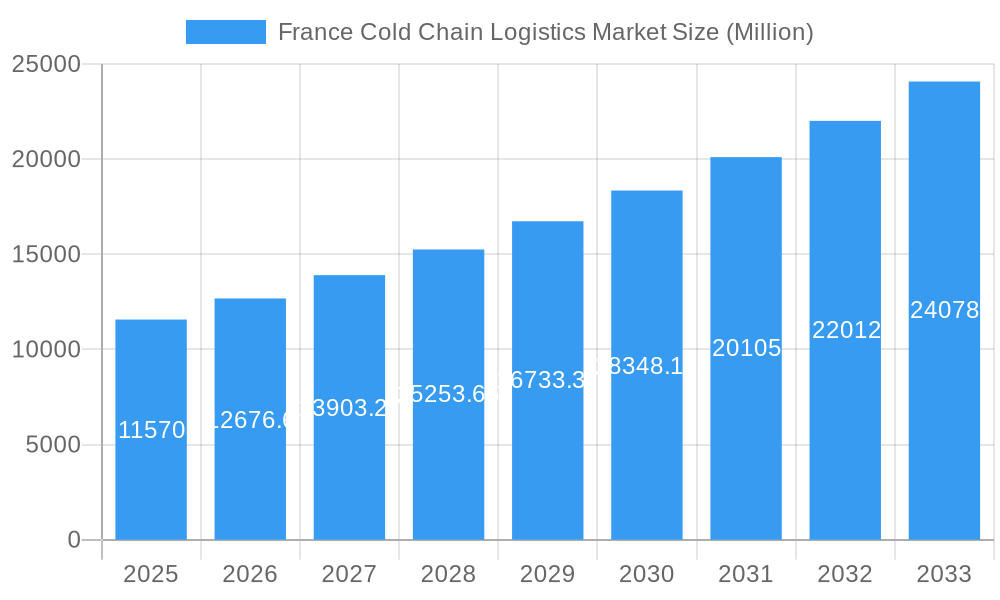

France Cold Chain Logistics Market Company Market Share

France Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France cold chain logistics market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market size is estimated at XX Million in 2025 and is projected to witness a CAGR of XX% during the forecast period.

France Cold Chain Logistics Market Concentration & Dynamics

This section analyzes the competitive landscape, regulatory environment, and market trends shaping the French cold chain logistics industry. The market exhibits a moderately concentrated structure, with key players such as IRIS Logistics, Socopal, XPO Logistics, and Kuehne + Nagel holding significant market share. However, a number of smaller, regional players also contribute significantly, indicating a complex and fragmented ecosystem.

Market Concentration: While precise market share figures for individual companies are proprietary and unavailable for this report, the competitive landscape demonstrates the presence of both large multinational corporations and smaller, regional specialists. M&A activity in the sector is notable, with xx major deals recorded between 2019 and 2024.

Innovation Ecosystems: The sector is characterized by ongoing technological advancements, including automated warehousing, IoT-enabled tracking and monitoring, and the integration of AI and machine learning for improved efficiency and predictive analytics. These innovations are driven by both large players and specialized technology providers.

Regulatory Frameworks: Stringent regulations governing food safety, pharmaceutical handling, and data privacy significantly influence market operations. Compliance with these regulations is crucial for all operators, impacting operational costs and influencing investment decisions.

Substitute Products & Services: The availability of alternative transportation modes and storage solutions introduces competitive pressure; however, the specialized nature of cold chain logistics, requiring precise temperature control and handling, limits the extent of direct substitution.

End-User Trends: The growing demand for fresh produce, processed foods, and pharmaceuticals fuels market growth, with evolving consumer preferences driving the need for sophisticated cold chain solutions ensuring product quality and safety.

M&A Activities: Recent mergers and acquisitions such as the UPS acquisition of Transports Chabas Santé (September 2023) highlight the ongoing consolidation within the industry, aimed at expanding market reach and service offerings.

France Cold Chain Logistics Market Industry Insights & Trends

The French cold chain logistics market is driven by several key factors, including rising disposable incomes leading to increased consumption of temperature-sensitive products, strengthening e-commerce infrastructure for online grocery deliveries, and advancements in cold chain technologies improving efficiency and reducing waste. The market also faces challenges such as fluctuating fuel prices, driver shortages, and the need for substantial infrastructure investments to support growth.

The market size experienced robust growth during the historical period (2019-2024), reaching an estimated XX Million in 2024. This growth trajectory is projected to continue through 2033, driven by the factors mentioned above, resulting in a projected market size of XX Million by 2033. The considerable growth in the e-commerce sector, particularly for grocery and perishables, has significantly boosted demand for cold chain logistics services. Furthermore, increasing consumer awareness of food safety and quality, coupled with stricter regulatory compliance measures, reinforces the importance of reliable cold chain solutions. Technological disruptions such as the widespread adoption of IoT sensors and advanced analytics improve temperature monitoring and traceability, enhancing operational efficiency and minimizing losses.

Key Markets & Segments Leading France Cold Chain Logistics Market

The French cold chain logistics market is segmented by services (storage, transportation, value-added services), temperature type (chilled, frozen), and application (horticulture, dairy, meat & fish, processed food, pharma, life sciences, chemicals, and other).

Dominant Segments:

By Services: Transportation currently holds the largest market share, driven by the extensive distribution networks required for timely delivery of temperature-sensitive goods. Value-added services, such as blast freezing and labeling, are experiencing rapid growth, reflecting increasing customer demand for customized solutions.

By Temperature Type: The frozen segment dominates due to the high demand for frozen food products and pharmaceuticals, while the chilled segment witnesses considerable growth driven by rising consumption of fresh produce and dairy.

By Application: The food and beverage sector remains the largest application segment, encompassing fresh fruits and vegetables, dairy products, meat and fish, and processed foods. The pharmaceutical and life sciences sector is exhibiting strong growth, driven by the increasing demand for temperature-sensitive pharmaceuticals and biological products.

Growth Drivers:

- Economic Growth: Rising disposable incomes and increased consumer spending on temperature-sensitive goods are major growth drivers.

- E-commerce Expansion: The rapid expansion of online grocery delivery services is significantly boosting demand for efficient cold chain logistics.

- Infrastructure Development: Investments in modernized cold storage facilities and transportation infrastructure are crucial for supporting market expansion.

- Technological Advancements: Innovations in temperature control, monitoring, and tracking technologies are improving efficiency and reducing waste.

- Stringent Regulations: The implementation of stricter food safety and pharmaceutical regulations is driving the adoption of advanced cold chain solutions.

France Cold Chain Logistics Market Product Developments

Recent product innovations focus on enhancing temperature control precision, improving traceability through IoT technologies, and optimizing logistics processes through AI-powered route optimization and predictive maintenance. These advancements improve supply chain efficiency, reduce waste, and enhance overall quality and safety of temperature-sensitive products. Competitive advantages are gained by players offering superior technology integration, comprehensive service portfolios, and robust data analytics capabilities.

Challenges in the France Cold Chain Logistics Market Market

The French cold chain logistics market faces several challenges. Stringent regulations and compliance requirements add to operational costs. Fluctuations in fuel prices and driver shortages impact transportation costs and delivery reliability. Increased competition, particularly from larger multinational players, necessitates continuous innovation and cost optimization strategies to maintain profitability. The estimated impact of these challenges on market growth is approximately xx%, requiring strategic adjustments by industry players.

Forces Driving France Cold Chain Logistics Market Growth

Technological advancements such as IoT-enabled monitoring and AI-driven route optimization are streamlining operations and reducing costs. Economic growth and rising consumer spending on temperature-sensitive goods fuel market expansion. Favorable regulatory frameworks supporting food safety and pharmaceutical standards promote industry development.

Long-Term Growth Catalysts in France Cold Chain Logistics Market

Strategic partnerships between cold chain logistics providers and technology companies are creating innovative solutions, enhancing efficiency, and expanding service offerings. Investments in sustainable and eco-friendly cold chain solutions are attracting investment and driving innovation. The expansion of cold chain infrastructure into rural and underserved regions unlocks new market opportunities.

Emerging Opportunities in France Cold Chain Logistics Market

The growing demand for last-mile delivery services, particularly for temperature-sensitive goods, presents significant growth opportunities. The increasing adoption of blockchain technology for enhancing product traceability and supply chain transparency creates new revenue streams. The expansion into specialized cold chain solutions for niche markets, like pharmaceuticals and high-value food products, opens new growth avenues.

Leading Players in the France Cold Chain Logistics Market Sector

- IRIS Logistics

- Socopal

- XPO Logistics

- Kloosterboer Harnes

- Olano Logistique

- Sofrilog

- Kuehne + Nagel

- Seafrigo

- Stef Logistique

- Mutual Logistics

Key Milestones in France Cold Chain Logistics Market Industry

September 2023: UPS acquisition of Transports Chabas Santé's healthcare logistics unit strengthens its temperature-controlled transportation capabilities in Southern France, particularly for pharmaceuticals and healthcare products. This significantly impacts the market by increasing competition and service offerings in the healthcare segment.

May 2023: CMA CGM's acquisition of Bolloré Logistics significantly reshapes the market landscape, creating a major player with expanded reach and capabilities. This deal signals further consolidation within the industry.

Strategic Outlook for France Cold Chain Logistics Market Market

The French cold chain logistics market holds significant growth potential. Strategic investments in technology, infrastructure, and sustainable practices will be crucial for companies to maintain competitiveness and capitalize on emerging opportunities. Focusing on value-added services, customized solutions, and expanding into high-growth sectors like e-commerce and pharmaceuticals will yield significant returns. The market's long-term prospects are positive, driven by increasing consumer demand and technological advancements.

France Cold Chain Logistics Market Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meat and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

France Cold Chain Logistics Market Segmentation By Geography

- 1. France

France Cold Chain Logistics Market Regional Market Share

Geographic Coverage of France Cold Chain Logistics Market

France Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. E- Commerce is Driving the Logistics Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meat and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IRIS Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Socopal

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 XPO Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kloosterboer Harnes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Olano Logistique

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sofrilog

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Seafrigo**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stef Logistique

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mutual Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IRIS Logistics

List of Figures

- Figure 1: France Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: France Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: France Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: France Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: France Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: France Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 6: France Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: France Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: France Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Cold Chain Logistics Market?

The projected CAGR is approximately 9.38%.

2. Which companies are prominent players in the France Cold Chain Logistics Market?

Key companies in the market include IRIS Logistics, Socopal, XPO Logistics, Kloosterboer Harnes, Olano Logistique, Sofrilog, Kuehne + Nagel, Seafrigo**List Not Exhaustive, Stef Logistique, Mutual Logistics.

3. What are the main segments of the France Cold Chain Logistics Market?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.57 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

E- Commerce is Driving the Logistics Sector.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

September 2023: UPS has acquired the healthcare logistics unit of Transports Chabas Santé, expanding its global healthcare network with temperature-controlled transportation solutions for pharmaceutical and healthcare products in Southern France.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the France Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence