Key Insights

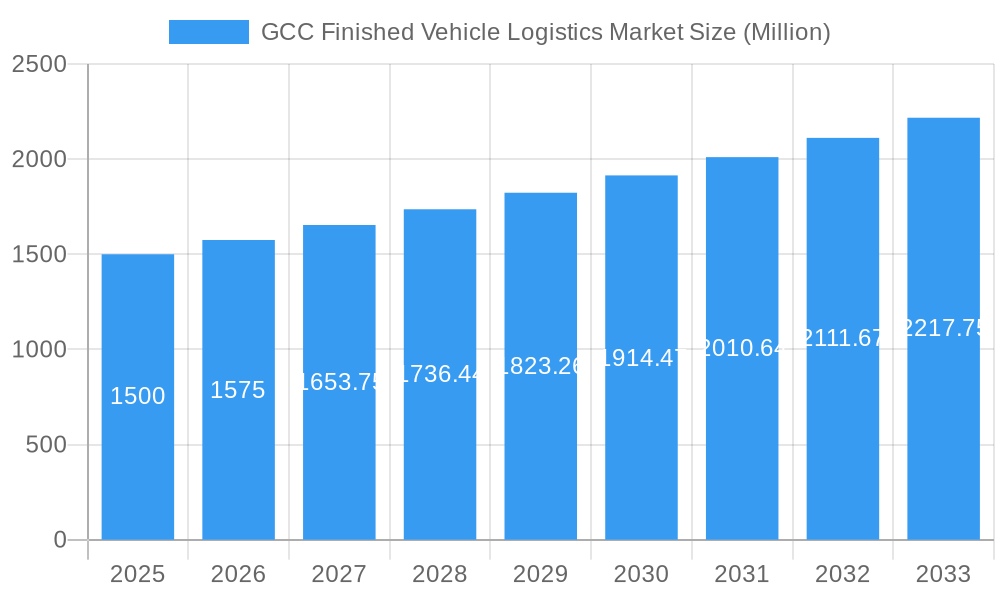

The GCC Finished Vehicle Logistics market is experiencing robust growth, driven by the expanding automotive sector in the region and a surge in vehicle imports and exports. The market's Compound Annual Growth Rate (CAGR) exceeding 5% indicates a consistently positive trajectory projected through 2033. Key drivers include the increasing production capacity of automotive manufacturers in the GCC, a rising middle class fueling consumer demand for new vehicles, and the ongoing development of sophisticated logistics infrastructure, including improved ports and warehousing facilities. Significant growth is anticipated within the transportation and warehousing segments, particularly in the UAE and Saudi Arabia, which are the largest contributors to the market’s overall value. The increasing adoption of advanced technologies like vehicle tracking systems and automated warehousing solutions is further propelling market expansion. While challenges such as fluctuating fuel prices and geopolitical uncertainties may present some headwinds, the overall positive outlook for the automotive industry within the GCC suggests a promising future for the finished vehicle logistics sector.

GCC Finished Vehicle Logistics Market Market Size (In Billion)

The segmentation reveals a significant share held by transportation services, reflecting the core nature of moving vehicles. Airways and warehousing activities represent substantial segments, supporting the overall supply chain's efficiency. While precise market size figures for each segment aren't provided, analysis suggests a sizable contribution from warehousing activities, fueled by the need to efficiently manage high volumes of imported and exported vehicles. The presence of major global logistics players alongside established regional companies indicates a competitive landscape. The continued investment in infrastructure and technology, coupled with the increasing demand for automotive products, promises substantial growth opportunities for businesses operating within the GCC Finished Vehicle Logistics market. This expansion is projected across various GCC countries, with the UAE and Saudi Arabia leading the way, followed by the rest of the GCC nations. Strategic partnerships and expansion plans of key players such as DHL, Kuehne + Nagel, and regional companies, further enhance market dynamics.

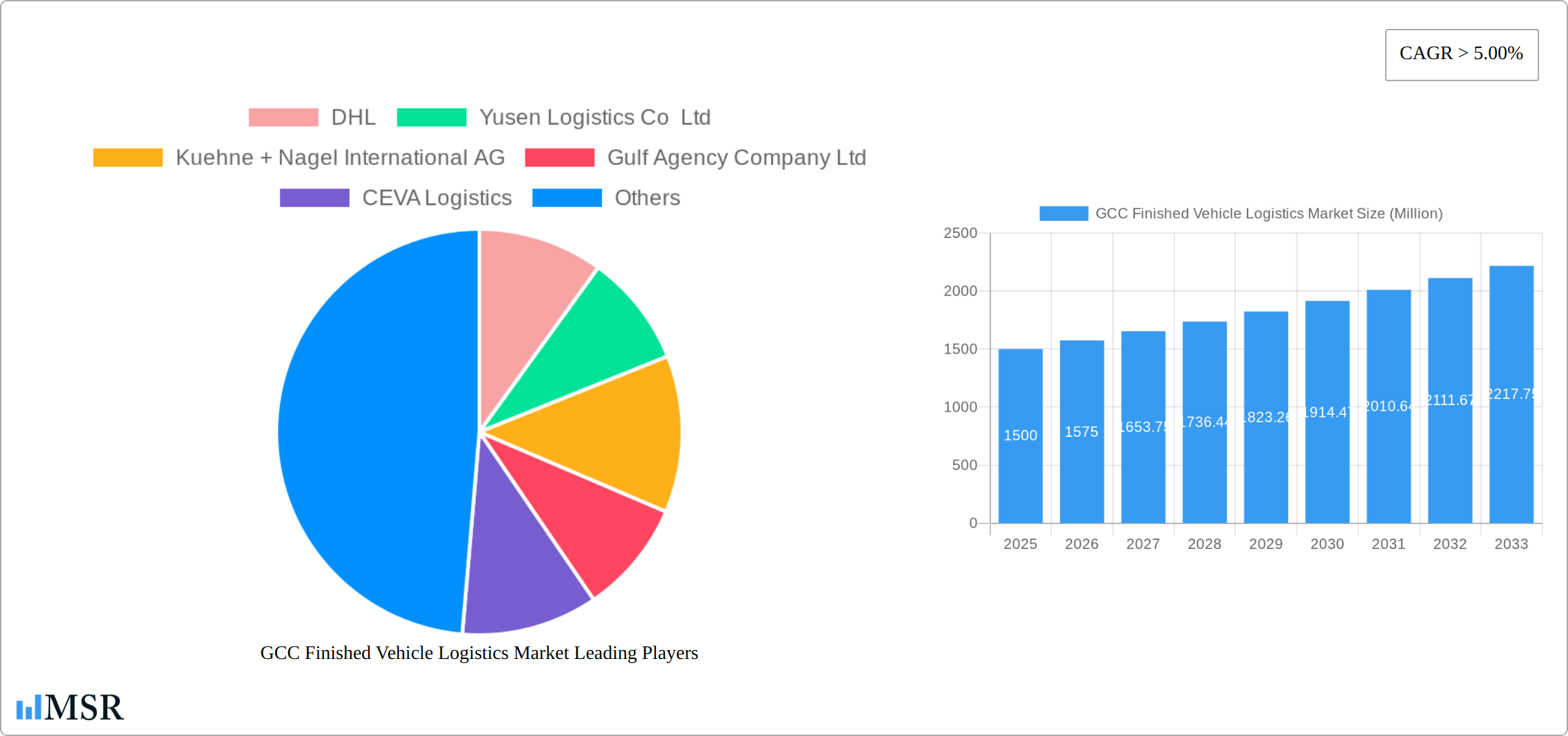

GCC Finished Vehicle Logistics Market Company Market Share

GCC Finished Vehicle Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the GCC Finished Vehicle Logistics Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth prospects. The market is segmented by country (United Arab Emirates, Saudi Arabia, Rest of GCC) and activity (Transportation, Warehousing, Other Value-Added Services). Expect detailed analysis of market size (projected at xx Million by 2025), CAGR, and key growth drivers.

GCC Finished Vehicle Logistics Market Market Concentration & Dynamics

The GCC finished vehicle logistics market exhibits a moderately concentrated structure, with a few major players holding significant market share. Key players like DHL, Yusen Logistics Co Ltd, Kuehne + Nagel International AG, and Gulf Agency Company Ltd dominate the landscape. However, the presence of several regional and specialized logistics providers creates a competitive environment.

- Market Share: The top 5 players collectively hold approximately xx% of the market share (2025 estimate).

- M&A Activity: The past five years have witnessed xx M&A deals, primarily focused on expanding regional reach and service capabilities. Strategic alliances and joint ventures are also prevalent.

- Innovation Ecosystems: The market fosters innovation through collaborations between logistics providers and technology companies, focusing on digitalization, automation, and data analytics.

- Regulatory Frameworks: Government regulations concerning customs, trade, and environmental standards significantly impact operations. Streamlining these processes remains a focus for market participants.

- Substitute Products: Limited direct substitutes exist, but alternative transportation modes (e.g., rail) and supply chain strategies represent indirect competition.

- End-User Trends: The increasing demand for premium vehicles and efficient delivery systems drives market growth. Consumer expectations for transparency and real-time tracking influence logistics service design.

GCC Finished Vehicle Logistics Market Industry Insights & Trends

The GCC finished vehicle logistics market is experiencing robust growth, driven by a surge in vehicle sales, expanding automotive manufacturing activities, and the development of sophisticated logistics infrastructure. The market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period (2025-2033). Key growth drivers include the expansion of free zones, supportive government policies, and rising disposable incomes across the GCC. Technological disruptions, such as the adoption of blockchain technology and AI-powered route optimization, are further enhancing efficiency and transparency. Shifting consumer preferences towards online vehicle purchases and direct-to-consumer models also fuel the market's growth.

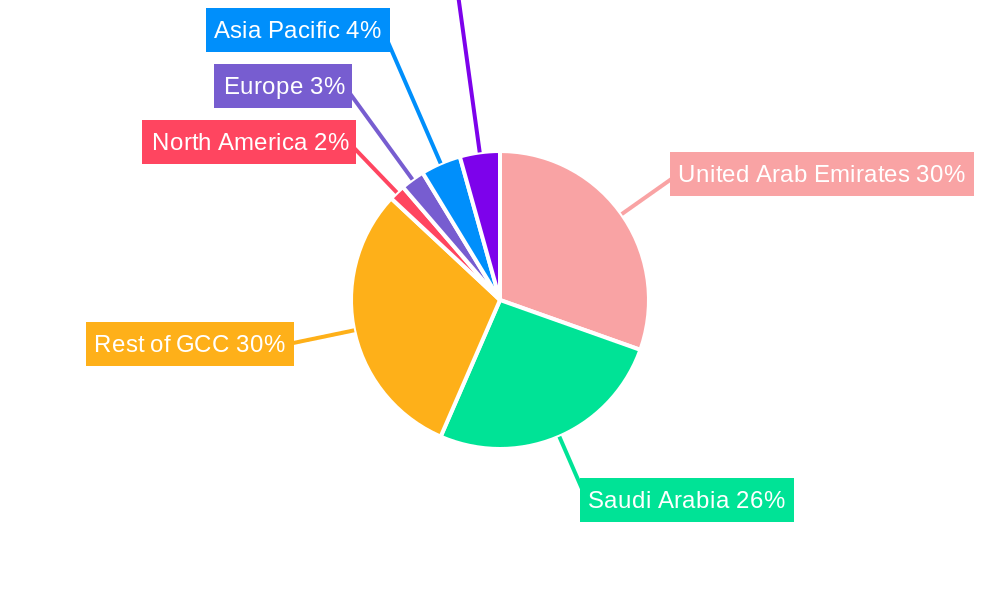

Key Markets & Segments Leading GCC Finished Vehicle Logistics Market

The GCC finished vehicle logistics market is experiencing robust growth, primarily propelled by the dynamic economies of the United Arab Emirates and Saudi Arabia. These nations stand out due to their substantial vehicle sales volumes, well-established and expanding logistics infrastructure, and strategic geographical positioning. The continuous influx of imported vehicles, coupled with a thriving domestic automotive market, underpins the significant demand for efficient finished vehicle logistics services across the region.

By Country:

- United Arab Emirates: As a regional hub for trade and commerce, the UAE benefits from strong economic growth, world-class port facilities, and a high concentration of major automotive manufacturers and distributors. This creates a sustained and substantial demand for specialized finished vehicle logistics solutions, encompassing import, storage, and distribution.

- Saudi Arabia: The Kingdom's ambitious Vision 2030 agenda, focused on economic diversification and large-scale infrastructure development, is a significant catalyst for market expansion. Increasing domestic consumption and a burgeoning automotive sector, including a growing interest in electric vehicles, are driving substantial growth in the finished vehicle logistics market.

- Rest of GCC: While individually smaller in scale, countries like Oman, Kuwait, Qatar, and Bahrain are collectively demonstrating promising growth trajectories. This is attributed to increasing automotive sales driven by population growth and economic development, as well as proactive investments in upgrading and expanding their logistics capabilities and port infrastructure to cater to the rising demand.

By Activity:

- Transportation: This segment remains the cornerstone of the GCC finished vehicle logistics market, accounting for the largest share. The sheer volume of vehicles being transported domestically and internationally, from ports to dealerships and end-consumers, fuels its dominance. Innovations in fleet management and route optimization are key to enhancing efficiency in this segment.

- Warehousing: The demand for sophisticated warehousing solutions is on a significant upward trend. This growth is directly linked to the increasing volume of vehicle imports, the need for secure and efficient inventory management of new and used vehicles, and the establishment of dedicated vehicle processing centers. Advanced inventory tracking and management systems are becoming increasingly critical.

- Other Value-added Services: The complexity of the automotive supply chain is fostering the growth of ancillary services. This includes a strong demand for efficient customs clearance processes, specialized vehicle insurance, pre-delivery inspections (PDI), vehicle tracking, and preparation services. As manufacturers and distributors seek to streamline their operations, these value-added services are becoming integral to the finished vehicle logistics ecosystem.

GCC Finished Vehicle Logistics Market Product Developments

Significant advancements are observed in vehicle tracking systems, warehouse management systems (WMS), and route optimization software. These technologies improve efficiency, reduce costs, and enhance transparency throughout the supply chain. The adoption of automated guided vehicles (AGVs) and robotics in warehousing is also gaining momentum. These innovative solutions provide a significant competitive edge, enabling companies to offer improved services and optimize their operations.

Challenges in the GCC Finished Vehicle Logistics Market Market

The GCC finished vehicle logistics market faces challenges such as fluctuating fuel prices, port congestion, and the complexities of customs procedures. These factors add to operational costs and potentially lead to delivery delays. Furthermore, intense competition among logistics providers necessitates ongoing investments in technology and service improvements to maintain market share. The lack of skilled workforce in some areas also hinders the sector's growth.

Forces Driving GCC Finished Vehicle Logistics Market Growth

Strong economic growth across the GCC region, coupled with rising disposable incomes and increased vehicle sales, are driving significant demand for efficient and reliable vehicle logistics services. Government initiatives focused on infrastructure development and facilitating foreign investment further boost market growth. Technological advancements in areas such as automation, digitalization, and real-time tracking are also key growth catalysts.

Long-Term Growth Catalysts in GCC Finished Vehicle Logistics Market

The long-term growth of the GCC finished vehicle logistics market is poised to be fueled by sustained infrastructure development, expanding e-commerce penetration, and the increasing adoption of advanced technologies like AI and blockchain. Strategic partnerships between logistics providers and automotive manufacturers are anticipated to play a crucial role. The expansion of regional trade networks and the growth of the automotive industry in the region will further stimulate market growth.

Emerging Opportunities in GCC Finished Vehicle Logistics Market

The GCC finished vehicle logistics market is ripe with emerging opportunities, particularly in catering to evolving automotive trends. The rapid global shift towards electric vehicles (EVs) presents a significant chance for logistics providers to develop specialized handling and charging infrastructure solutions. Simultaneously, a growing emphasis on sustainability is driving demand for environmentally conscious logistics practices, such as optimizing routes for fuel efficiency and exploring alternative transportation modes. The escalating demand for efficient and reliable last-mile delivery services, ensuring vehicles reach dealerships and customers promptly and in pristine condition, offers lucrative prospects. Moreover, the continued expansion of the luxury and premium vehicle segments creates a niche for providers specializing in high-value vehicle transportation, storage, and bespoke handling services, demanding meticulous care and security.

Leading Players in the GCC Finished Vehicle Logistics Market Sector

- DHL

- Yusen Logistics Co Ltd

- Kuehne + Nagel International AG

- Gulf Agency Company Ltd

- CEVA Logistics

- Al-Futtaim Logistics

- Almajdouie Logistics

- Gallega Global Logistics

- RSA Global

- GEFCO

List Not Exhaustive

Key Milestones in GCC Finished Vehicle Logistics Market Industry

September 2022: Bahri Logistics and the MOSOLF Group signed a Memorandum of Understanding (MoU) to establish an automotive logistics framework in Saudi Arabia, with plans to expand across the GCC. This signifies a significant step towards strengthening the Kingdom's automotive logistics supply chain and boosting regional collaboration.

March 2022: A.P. Moller - Maersk inaugurated its first Integrated Logistics Centre in Dubai, UAE. This 10,000 sq. m. facility caters to various sectors, including automotive, enhancing warehousing and distribution capabilities within the region.

Strategic Outlook for GCC Finished Vehicle Logistics Market Market

The GCC finished vehicle logistics market is poised for continued expansion, driven by long-term economic growth, infrastructure development, and technological advancements. Strategic partnerships, investments in advanced technologies, and a focus on sustainable practices will be crucial for success. Companies that can effectively adapt to evolving consumer demands and regulatory changes are expected to capture significant market share in the years to come. The market presents attractive opportunities for both established players and new entrants to expand their operations and capitalize on the region's growing automotive sector.

GCC Finished Vehicle Logistics Market Segmentation

-

1. Activity

-

1.1. Transportation

- 1.1.1. Roadways

- 1.1.2. Railways

- 1.1.3. Maritime

- 1.1.4. Airways

- 1.2. Warehousing

- 1.3. Other Value-added Services

-

1.1. Transportation

GCC Finished Vehicle Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Finished Vehicle Logistics Market Regional Market Share

Geographic Coverage of GCC Finished Vehicle Logistics Market

GCC Finished Vehicle Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Perishable Goods; Expanding E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Infrastructure Limitations; Skilled Labor Shortage

- 3.4. Market Trends

- 3.4.1. Growing Automotive Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 5.1.1. Transportation

- 5.1.1.1. Roadways

- 5.1.1.2. Railways

- 5.1.1.3. Maritime

- 5.1.1.4. Airways

- 5.1.2. Warehousing

- 5.1.3. Other Value-added Services

- 5.1.1. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Activity

- 6. North America GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 6.1.1. Transportation

- 6.1.1.1. Roadways

- 6.1.1.2. Railways

- 6.1.1.3. Maritime

- 6.1.1.4. Airways

- 6.1.2. Warehousing

- 6.1.3. Other Value-added Services

- 6.1.1. Transportation

- 6.1. Market Analysis, Insights and Forecast - by Activity

- 7. South America GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 7.1.1. Transportation

- 7.1.1.1. Roadways

- 7.1.1.2. Railways

- 7.1.1.3. Maritime

- 7.1.1.4. Airways

- 7.1.2. Warehousing

- 7.1.3. Other Value-added Services

- 7.1.1. Transportation

- 7.1. Market Analysis, Insights and Forecast - by Activity

- 8. Europe GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 8.1.1. Transportation

- 8.1.1.1. Roadways

- 8.1.1.2. Railways

- 8.1.1.3. Maritime

- 8.1.1.4. Airways

- 8.1.2. Warehousing

- 8.1.3. Other Value-added Services

- 8.1.1. Transportation

- 8.1. Market Analysis, Insights and Forecast - by Activity

- 9. Middle East & Africa GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 9.1.1. Transportation

- 9.1.1.1. Roadways

- 9.1.1.2. Railways

- 9.1.1.3. Maritime

- 9.1.1.4. Airways

- 9.1.2. Warehousing

- 9.1.3. Other Value-added Services

- 9.1.1. Transportation

- 9.1. Market Analysis, Insights and Forecast - by Activity

- 10. Asia Pacific GCC Finished Vehicle Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 10.1.1. Transportation

- 10.1.1.1. Roadways

- 10.1.1.2. Railways

- 10.1.1.3. Maritime

- 10.1.1.4. Airways

- 10.1.2. Warehousing

- 10.1.3. Other Value-added Services

- 10.1.1. Transportation

- 10.1. Market Analysis, Insights and Forecast - by Activity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DHL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yusen Logistics Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kuehne + Nagel International AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gulf Agency Company Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CEVA Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Al-Futtaim Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Almajdouie Logistics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gallega Global Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RSA Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GEFCO**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DHL

List of Figures

- Figure 1: Global GCC Finished Vehicle Logistics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 3: North America GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 4: North America GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 7: South America GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 8: South America GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 11: Europe GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 12: Europe GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 15: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 16: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific GCC Finished Vehicle Logistics Market Revenue (undefined), by Activity 2025 & 2033

- Figure 19: Asia Pacific GCC Finished Vehicle Logistics Market Revenue Share (%), by Activity 2025 & 2033

- Figure 20: Asia Pacific GCC Finished Vehicle Logistics Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific GCC Finished Vehicle Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 2: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 4: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 9: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 14: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 25: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Activity 2020 & 2033

- Table 33: Global GCC Finished Vehicle Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific GCC Finished Vehicle Logistics Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Finished Vehicle Logistics Market?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the GCC Finished Vehicle Logistics Market?

Key companies in the market include DHL, Yusen Logistics Co Ltd, Kuehne + Nagel International AG, Gulf Agency Company Ltd, CEVA Logistics, Al-Futtaim Logistics, Almajdouie Logistics, Gallega Global Logistics, RSA Global, GEFCO**List Not Exhaustive.

3. What are the main segments of the GCC Finished Vehicle Logistics Market?

The market segments include Activity.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Perishable Goods; Expanding E-commerce Market.

6. What are the notable trends driving market growth?

Growing Automotive Industry.

7. Are there any restraints impacting market growth?

Infrastructure Limitations; Skilled Labor Shortage.

8. Can you provide examples of recent developments in the market?

September 2022: Bahri Logistics (a business unit of the national shipping carrier of Saudi Arabia), and the MOSOLF Group (one of the leading system service providers for the automotive industry in Europe) announced the signing of a Memorandum of Understanding (MoU) aims to establish and develop an automotive logistics framework initially focused on Saudi Arabia with plans to expand across the Gulf Cooperation Council (GCC). The MoU between Bahri Logistics and MOSOLF seeks to further fortify the Kingdom's current automotive logistics supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Finished Vehicle Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Finished Vehicle Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Finished Vehicle Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Finished Vehicle Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence