Key Insights

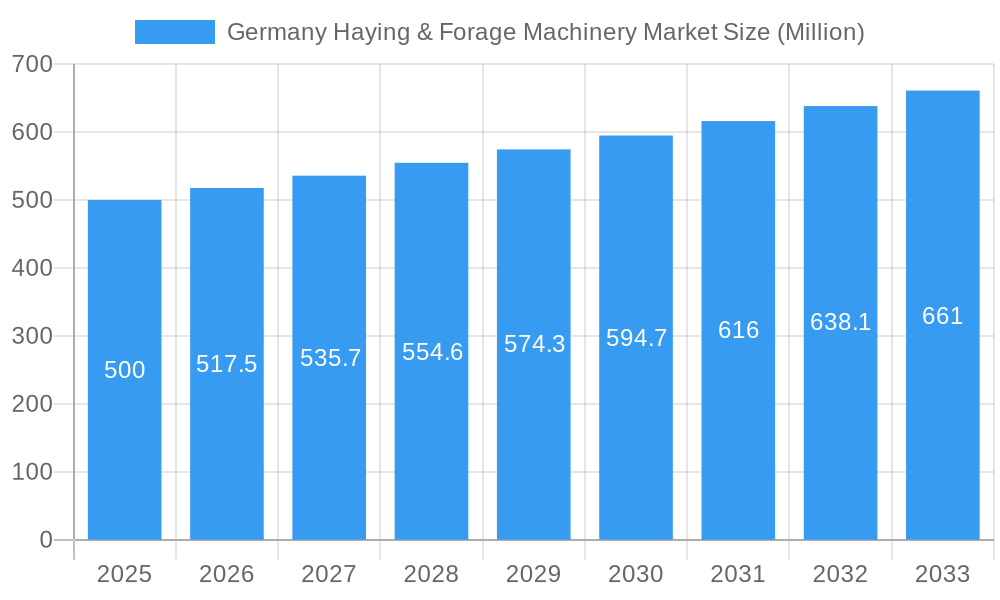

The German Haying & Forage Machinery Market, featuring mowers, balers, and forage harvesters, demonstrates consistent expansion. Valued at €6.07 billion in the base year 2025, the market is forecasted to grow at a compound annual growth rate (CAGR) of 3.7% from 2025 to 2033. Key growth drivers include escalating demand for premium animal feed, propelled by Germany's strong dairy and livestock sector, alongside technological advancements enhancing machinery efficiency. Government initiatives supporting sustainable agriculture also significantly contribute to market expansion. The market is segmented by machinery type, with mowers and balers holding substantial shares due to their widespread application across German farms. Leading manufacturers such as John Deere, CLAAS, Krone, and Kuhn Group are prioritizing innovation and distribution to secure their competitive positions.

Germany Haying & Forage Machinery Market Market Size (In Billion)

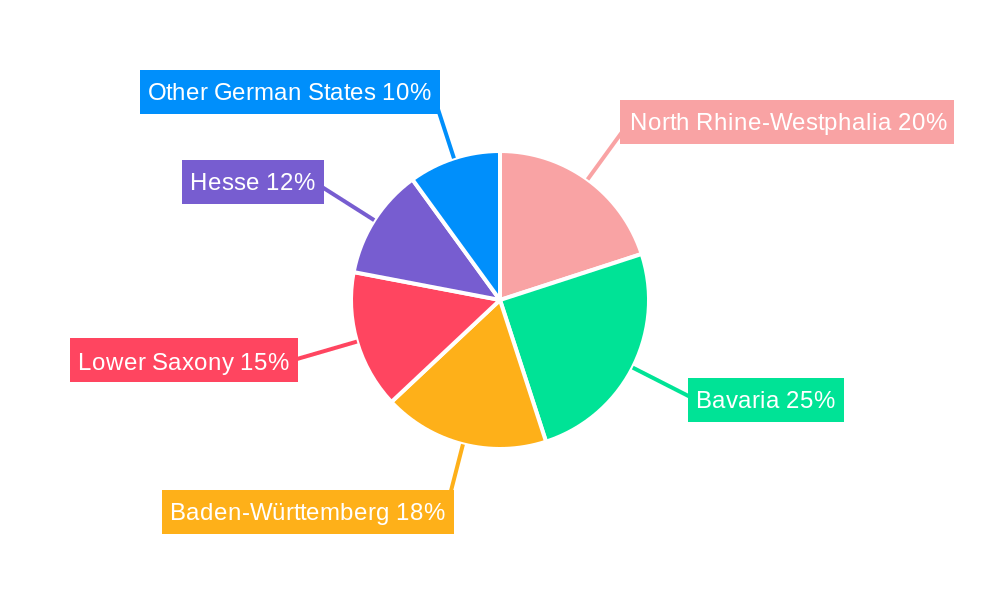

Geographically, market share aligns with Germany's agricultural heartlands, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse. Potential market restraints involve rising machinery costs and volatile raw material prices. Despite these factors, the market outlook is favorable, anticipating considerable growth driven by continuous technological innovation and sustained demand for efficient forage harvesting solutions. This presents significant opportunities for both established and emerging companies, especially those focusing on sustainable and advanced machinery.

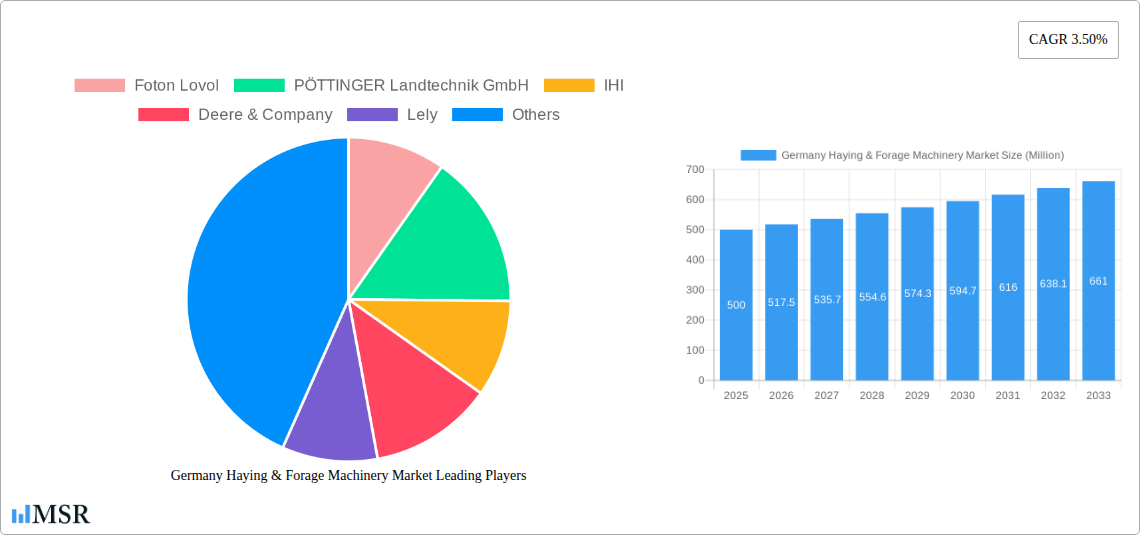

Germany Haying & Forage Machinery Market Company Market Share

Germany Haying & Forage Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Haying & Forage Machinery Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, trends, key players, and future opportunities within the German agricultural landscape. The report leverages extensive research to deliver actionable intelligence, fostering informed strategies for navigating this dynamic market.

Germany Haying & Forage Machinery Market Market Concentration & Dynamics

The German Haying & Forage Machinery market exhibits a moderately concentrated structure, with key players like CLAAS KGaA mbH, Krone North America Inc, and PÖTTINGER Landtechnik GmbH holding significant market share. The market's dynamics are shaped by a complex interplay of factors, including ongoing technological advancements, stringent environmental regulations, and evolving farming practices. Innovation is driven by a robust ecosystem encompassing research institutions, machinery manufacturers, and agricultural technology startups. The regulatory framework, focused on sustainability and precision agriculture, influences product development and adoption. Substitute products, such as alternative feed sources, pose a moderate threat, while end-user trends towards automation and efficiency drive demand for sophisticated machinery. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx deals recorded between 2019 and 2024, primarily driven by consolidation efforts and expansion strategies. Market share distribution is as follows (Estimated 2025):

- CLAAS KGaA mbH: xx%

- Krone North America Inc: xx%

- PÖTTINGER Landtechnik GmbH: xx%

- Other Players: xx%

Germany Haying & Forage Machinery Market Industry Insights & Trends

The German Haying & Forage Machinery market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching an estimated market size of €xx Million in 2025. This growth is primarily attributed to factors such as increasing mechanization in agriculture, a growing demand for high-quality forage, and government initiatives promoting sustainable farming practices. Technological disruptions, including the integration of precision agriculture technologies like GPS guidance and sensor-based monitoring, are transforming the market, leading to improved efficiency and reduced operational costs. Evolving consumer behaviors, characterized by a preference for automated and technologically advanced machinery, further fuel market expansion. The forecast period (2025-2033) projects a CAGR of xx%, driven by continued technological innovation, increasing farm sizes, and a growing focus on optimizing yields and reducing labor costs. The market is expected to reach €xx Million by 2033.

Key Markets & Segments Leading Germany Haying & Forage Machinery Market

Within the German Haying & Forage Machinery market, the Mowers segment holds the largest market share, followed by Balers and Forage Harvesters. The dominance of the Mowers segment is driven by the widespread adoption of mechanized mowing techniques across various farm sizes. Key drivers for this segment include:

- High agricultural productivity in key regions: Strong agricultural output in regions like Bavaria and North Rhine-Westphalia boosts demand for efficient mowing solutions.

- Government support for modernization: Subsidies and incentives for adopting advanced agricultural technologies further stimulate market growth.

- Increased demand for high-quality forage: The focus on improving livestock feed quality necessitates the use of efficient and precise mowing equipment.

The strong performance of the Balers segment is largely attributable to its critical role in efficient hay and silage production. The Forage Harvesters segment is experiencing steady growth due to the increasing adoption of advanced harvesting techniques for maximizing yields and improving feed quality. Overall, the German market is characterized by a preference for high-quality, technologically advanced machinery that optimizes efficiency and productivity.

Germany Haying & Forage Machinery Market Product Developments

Recent product developments within the German Haying & Forage Machinery market have focused on enhancing efficiency, precision, and automation. Manufacturers are integrating advanced technologies like GPS guidance systems, sensor-based monitoring, and automated control systems to optimize harvesting processes and reduce labor costs. These advancements enhance operational efficiency and minimize environmental impact. The integration of data analytics and connectivity features allows farmers to monitor machinery performance in real-time and make informed decisions to improve operational efficiency. These innovations provide manufacturers with a significant competitive edge, allowing them to cater to the growing demand for sophisticated and high-performance machinery.

Challenges in the Germany Haying & Forage Machinery Market Market

The German Haying & Forage Machinery market faces several challenges, including increasing raw material costs, fluctuating fuel prices, and stringent environmental regulations impacting manufacturing processes. Supply chain disruptions, particularly those related to electronic components and specialized materials, have also affected production timelines and overall market stability. Intense competition among established and emerging players creates pricing pressures, impacting profit margins. Furthermore, the volatility of agricultural commodity prices impacts farmer spending on machinery, creating uncertainty in market demand. These factors collectively contribute to potential market volatility and restrain growth.

Forces Driving Germany Haying & Forage Machinery Market Growth

Several factors contribute to the continued growth of the German Haying & Forage Machinery market. Technological advancements, such as the incorporation of automation, precision technologies and data analytics, drive efficiency gains and yield improvements. Economic growth within the agricultural sector, coupled with government support for sustainable agricultural practices and modernization, supports investment in advanced machinery. Favorable policies incentivize farmers to adopt new technologies, enhancing the overall market appeal. These combined factors create a strong foundation for sustained market expansion.

Challenges in the Germany Haying & Forage Machinery Market Market

Long-term growth in the German Haying & Forage Machinery market will depend on continued innovation, strategic partnerships, and market expansion into new segments. Developing advanced features like autonomous operations and improved connectivity will be key for attracting customers. Collaborations between manufacturers and agricultural technology companies will foster technological advancements and integrated solutions. Expanding into new markets, such as precision livestock farming, offers opportunities for growth. These combined efforts will help the industry sustain its long-term growth trajectory.

Emerging Opportunities in Germany Haying & Forage Machinery Market

Emerging opportunities lie in the adoption of precision agriculture techniques, the integration of AI-powered decision support systems, and the development of sustainable and environmentally friendly machinery. The growing demand for data-driven insights and optimized farming practices provides significant opportunities for manufacturers. Developing machinery that reduces environmental impact through lower emissions and reduced fuel consumption will also attract environmentally conscious farmers. Furthermore, exploring new markets such as organic farming and specialized crop production could offer significant potential for growth.

Leading Players in the Germany Haying & Forage Machinery Market Sector

Key Milestones in Germany Haying & Forage Machinery Industry

- 2020: CLAAS launches a new generation of forage harvesters with advanced automation features.

- 2021: PÖTTINGER introduces a new line of self-propelled mowers focusing on sustainability.

- 2022: Krone and a technology startup partner to develop AI-powered yield optimization software.

- 2023: Several manufacturers announce investments in R&D to develop electric and hybrid forage machinery.

- 2024: Regulatory changes introduce stricter emission standards for agricultural machinery.

Strategic Outlook for Germany Haying & Forage Machinery Market Market

The future of the German Haying & Forage Machinery market looks promising, driven by continued technological advancements, increasing demand for efficient and sustainable farming practices, and favorable government policies. The integration of data analytics, AI, and precision agriculture technologies presents significant opportunities for growth. Strategic partnerships and collaborations will be crucial for driving innovation and accelerating market adoption. The market's potential lies in meeting the growing demand for high-performance, sustainable, and cost-effective solutions, contributing significantly to the efficiency and productivity of the German agricultural sector in the years to come.

Germany Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

Germany Haying & Forage Machinery Market Segmentation By Geography

- 1. Germany

Germany Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of Germany Haying & Forage Machinery Market

Germany Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Demand for Forage Feed from Animal Production Industries Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Foton Lovol

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PÖTTINGER Landtechnik GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IHI

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lely

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS KGaA mbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Buhler Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vermee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kverneland Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CNH Industrial

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Krone North America Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KUHN Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AGCO Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Kubota

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Foton Lovol

List of Figures

- Figure 1: Germany Haying & Forage Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Haying & Forage Machinery Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Germany Haying & Forage Machinery Market?

Key companies in the market include Foton Lovol, PÖTTINGER Landtechnik GmbH, IHI, Deere & Company, Lely, CLAAS KGaA mbH, Buhler Industries, Vermee, Kverneland Group, CNH Industrial, Krone North America Inc, KUHN Group, AGCO Corporation, Kubota.

3. What are the main segments of the Germany Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Demand for Forage Feed from Animal Production Industries Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the Germany Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence