Key Insights

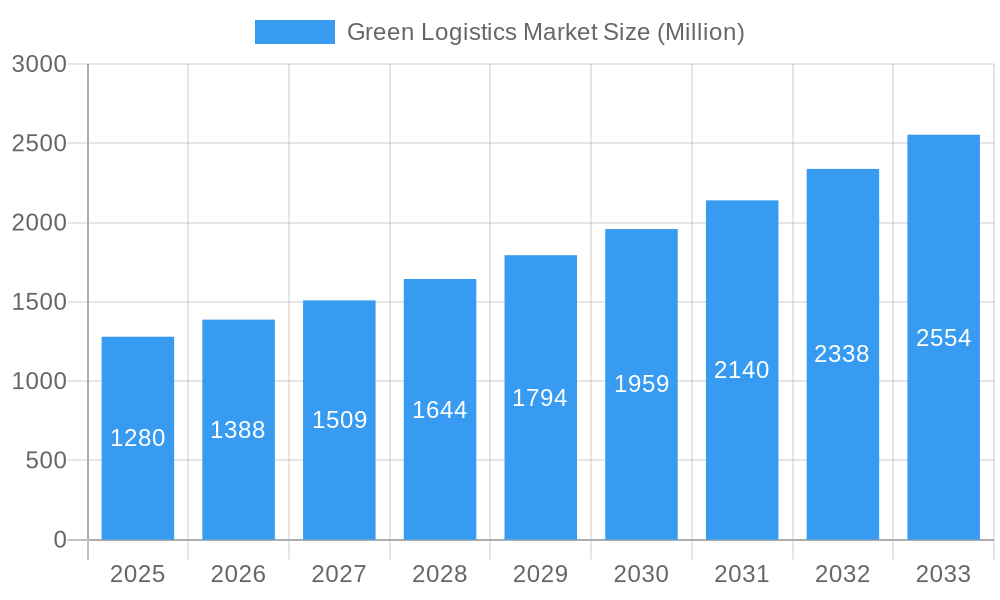

The global green logistics market, valued at $1.28 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.29% from 2025 to 2033. This surge is driven by escalating environmental concerns, stringent government regulations aimed at reducing carbon emissions from transportation and warehousing, and the rising adoption of sustainable practices across various industries. Key drivers include the increasing demand for eco-friendly transportation solutions, such as electric vehicles and alternative fuels, coupled with the growing investment in green technologies like renewable energy sources for logistics operations. Furthermore, the expanding e-commerce sector is fueling the demand for efficient and sustainable last-mile delivery solutions, further bolstering market growth. The market is segmented by end-user (healthcare, manufacturing, automotive, banking & finance, retail & e-commerce, others), business type (warehousing, distribution, value-added services), and mode of operation (storage, roadways, seaways, others). Leading players like Mahindra Logistics, CEVA Logistics, DHL, and UPS are actively investing in green initiatives to enhance their market position and cater to growing customer demand for environmentally responsible logistics services.

Green Logistics Market Market Size (In Billion)

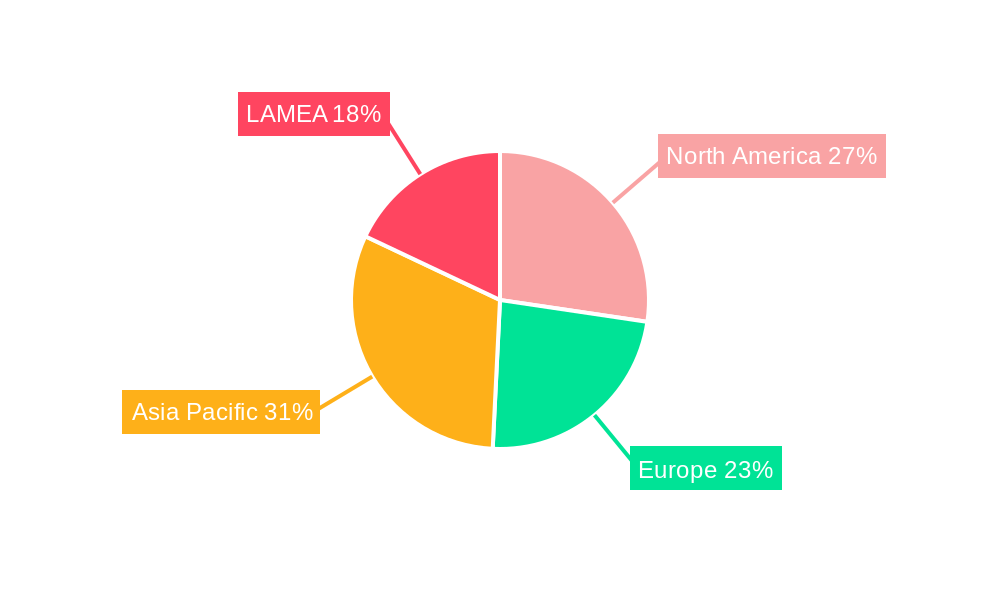

The market's growth trajectory is influenced by several trends, including the increasing adoption of digital technologies for optimizing logistics routes and reducing fuel consumption, the rise of green warehousing solutions focused on energy efficiency and waste reduction, and the growing popularity of carbon offsetting programs. However, challenges remain, such as high initial investment costs associated with green technologies, the lack of standardized green logistics practices across regions, and the limited availability of eco-friendly infrastructure in certain areas. Despite these restraints, the long-term outlook for the green logistics market remains positive, driven by the increasing focus on sustainability across industries and the supportive regulatory environment. The Asia-Pacific region, particularly India and China, is expected to witness significant growth due to rapid economic development and the expanding e-commerce sector. North America and Europe will also remain important markets, driven by strong environmental regulations and corporate sustainability initiatives.

Green Logistics Market Company Market Share

Green Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Green Logistics Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed study period spanning from 2019 to 2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report unveils the market's size, growth trajectory, key segments, leading players, and future prospects. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Green Logistics Market Market Concentration & Dynamics

The Green Logistics market exhibits a moderately concentrated landscape, with key players like Mahindra Logistics Ltd, CEVA Logistics, DHL International GmbH, Al Futtaim Logistics, United Parcel Service, Yusen Logistics Co Ltd, GEODIS, XPO Logistics, Agility Public Warehousing Company K S C P, Bollore Logistics, and Bowling Green Logistics holding significant market share. However, the market is witnessing increasing participation from smaller, specialized firms focusing on niche segments.

Market concentration metrics, such as the Herfindahl-Hirschman Index (HHI), will be calculated and presented in the full report. The market is driven by stringent environmental regulations, growing consumer awareness of sustainability, and technological advancements in areas like electric vehicles and alternative fuels. Innovation is primarily focused on developing greener transportation modes, improving warehouse efficiency, and adopting sustainable packaging solutions. The regulatory landscape is constantly evolving, with various governments implementing policies to promote green logistics, creating both opportunities and challenges. Substitute products include traditional logistics solutions that may lack sustainability, but remain competitive due to cost factors. M&A activity in the sector is robust, with xx deals recorded in the last five years, driving consolidation and expansion into new markets. End-user trends indicate a strong preference for eco-friendly practices, further boosting the demand for green logistics solutions.

Green Logistics Market Industry Insights & Trends

The global green logistics market is experiencing robust growth, fueled by increasing environmental concerns, stringent government regulations, and rising consumer demand for sustainable practices. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is driven by factors such as the increasing adoption of electric vehicles, the development of alternative fuels, improved warehouse management systems, and advancements in transportation technology. Technological disruptions, such as the rise of autonomous vehicles and the implementation of blockchain technology for enhanced supply chain transparency, are significantly impacting the industry. Consumer behavior is also shifting, with an increasing preference for companies with strong environmental, social, and governance (ESG) credentials. This has led to increased investment in green logistics solutions and a greater focus on sustainability throughout the supply chain. The rising popularity of e-commerce and the need for efficient last-mile delivery are also driving the adoption of green logistics practices.

Key Markets & Segments Leading Green Logistics Market

The Retail and E-commerce segment is currently the largest end-user segment in the green logistics market, driven by the need for efficient and sustainable last-mile delivery solutions. Other key segments include Healthcare, Manufacturing, and Automotive. Geographically, North America and Europe are leading the market, primarily due to stricter environmental regulations and higher consumer awareness.

By End User:

- Retail and E-commerce: High growth due to increased demand for sustainable last-mile delivery.

- Healthcare: Stringent regulations and focus on cold chain logistics drive adoption of green solutions.

- Manufacturing: Growing focus on sustainable supply chains pushes adoption of eco-friendly transportation.

- Automotive: Adoption driven by regulations and corporate sustainability initiatives.

By Business Type:

- Warehousing: Increased investment in green warehousing facilities with energy-efficient technologies.

- Distribution: Transition to electric and alternative fuel vehicles.

- Value-Added Services: Growing demand for sustainable packaging and reverse logistics.

By Mode of Operation:

- Roadways Distribution: Significant shift towards electric and hybrid vehicles.

- Seaways Distribution: Growing adoption of fuel-efficient ships and optimization of shipping routes.

Growth Drivers:

- Stringent environmental regulations

- Growing consumer awareness of sustainability

- Technological advancements in green transportation and warehousing

- Increasing investment in renewable energy sources

- Government incentives and subsidies for green logistics

Green Logistics Market Product Developments

Recent product innovations include the introduction of electric and hydrogen-powered vehicles, the development of smart warehousing systems with optimized energy management, and the adoption of sustainable packaging materials. These innovations are enhancing operational efficiency, reducing carbon footprints, and providing a competitive edge for logistics providers. Companies are increasingly adopting technologies such as route optimization software and real-time tracking systems to minimize fuel consumption and improve delivery times. The market is also witnessing the emergence of innovative solutions like drone delivery and autonomous vehicles.

Challenges in the Green Logistics Market Market

Significant challenges include the high initial investment cost of green technologies, the lack of standardized infrastructure for alternative fuel vehicles, and difficulties in integrating sustainable practices across complex supply chains. Regulatory hurdles and inconsistencies across different regions pose further challenges. The limited availability of skilled labor and the competitive pressures from traditional logistics providers also hinder widespread adoption. These challenges can result in increased operational costs and potential delays in project implementation. For example, the transition to electric vehicle fleets requires significant capital investment and the establishment of charging infrastructure.

Forces Driving Green Logistics Market Growth

The market is driven by several key factors: stringent government regulations promoting sustainable transportation, increasing corporate social responsibility initiatives, and advancements in green technologies such as electric vehicles and renewable energy sources. Economic incentives like tax credits and subsidies are further accelerating the adoption of green logistics solutions. The growing demand for efficient and sustainable supply chains, particularly within e-commerce, is a significant driver. Rising consumer awareness of environmental issues also pushes businesses to adopt greener practices.

Long-Term Growth Catalysts in Green Logistics Market

Long-term growth will be fueled by continued innovation in green technologies, strategic partnerships between logistics providers and technology companies, and expansion into emerging markets with growing economies and increasing environmental concerns. The development of advanced data analytics and artificial intelligence will optimize route planning and resource allocation, enhancing efficiency and reducing emissions. Government initiatives to promote sustainable transportation and logistics will continue to drive market growth.

Emerging Opportunities in Green Logistics Market

Emerging opportunities include the development of green cold chain logistics solutions for temperature-sensitive goods, the adoption of autonomous vehicles for last-mile delivery, and the expansion of green logistics services in developing economies. The integration of blockchain technology for improved supply chain transparency and traceability is another significant opportunity. The increasing demand for sustainable packaging materials presents further potential for market growth.

Leading Players in the Green Logistics Market Sector

- Mahindra Logistics Ltd

- CEVA Logistics

- DHL International GmbH

- Al Futtaim Logistics

- United Parcel Service

- Yusen Logistics Co Ltd

- GEODIS

- XPO Logistics

- Agility Public Warehousing Company K S C P

- Bollore Logistics

- Bowling Green Logistics

Key Milestones in Green Logistics Market Industry

- 2020: Several major logistics companies announce ambitious sustainability targets, committing to carbon neutrality.

- 2021: Significant investments in electric vehicle fleets and charging infrastructure by key players.

- 2022: Introduction of innovative sustainable packaging solutions by leading companies.

- 2023: Several mergers and acquisitions aimed at consolidating market share and expanding green logistics capabilities.

- 2024: Increased adoption of blockchain technology for enhancing supply chain transparency.

Strategic Outlook for Green Logistics Market Market

The future of the green logistics market is bright, driven by sustained growth in e-commerce, increasing regulatory pressure, and technological advancements. Strategic opportunities lie in developing innovative solutions, forging strong partnerships, and expanding into new geographic markets. Companies that can effectively integrate sustainability into their operations and offer comprehensive green logistics solutions will be well-positioned for success. The market is poised for continued expansion, with significant potential for growth in both developed and developing economies.

Green Logistics Market Segmentation

-

1. End User

- 1.1. Healthcare

- 1.2. Manufacturing

- 1.3. Automotive

- 1.4. Banking and Financial services

- 1.5. Retail and E-commerce

- 1.6. Others

-

2. Business Type

- 2.1. Warehousing

- 2.2. Distribution

- 2.3. Value-Added Services

-

3. Mode of Operation

- 3.1. Storage

- 3.2. Roadways Distribution

- 3.3. Seaways Distribution

- 3.4. Others

Green Logistics Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. LAMEA

- 4.1. Latin America

- 4.2. Middle East

- 4.3. Africa

Green Logistics Market Regional Market Share

Geographic Coverage of Green Logistics Market

Green Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing adoption of EVs in the logistics industry; Increase in adoption of artificial intelligence (AI) in the global logistics industry

- 3.3. Market Restrains

- 3.3.1 Dependency on fossil fuels

- 3.3.2 majority for transportation; The high costs of implementing green procurement practices discourage potential investors

- 3.4. Market Trends

- 3.4.1. The Demand for Green Warehouses is Rising

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Green Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Healthcare

- 5.1.2. Manufacturing

- 5.1.3. Automotive

- 5.1.4. Banking and Financial services

- 5.1.5. Retail and E-commerce

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Business Type

- 5.2.1. Warehousing

- 5.2.2. Distribution

- 5.2.3. Value-Added Services

- 5.3. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.3.1. Storage

- 5.3.2. Roadways Distribution

- 5.3.3. Seaways Distribution

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. LAMEA

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Green Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Healthcare

- 6.1.2. Manufacturing

- 6.1.3. Automotive

- 6.1.4. Banking and Financial services

- 6.1.5. Retail and E-commerce

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Business Type

- 6.2.1. Warehousing

- 6.2.2. Distribution

- 6.2.3. Value-Added Services

- 6.3. Market Analysis, Insights and Forecast - by Mode of Operation

- 6.3.1. Storage

- 6.3.2. Roadways Distribution

- 6.3.3. Seaways Distribution

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Green Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Healthcare

- 7.1.2. Manufacturing

- 7.1.3. Automotive

- 7.1.4. Banking and Financial services

- 7.1.5. Retail and E-commerce

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Business Type

- 7.2.1. Warehousing

- 7.2.2. Distribution

- 7.2.3. Value-Added Services

- 7.3. Market Analysis, Insights and Forecast - by Mode of Operation

- 7.3.1. Storage

- 7.3.2. Roadways Distribution

- 7.3.3. Seaways Distribution

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Green Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Healthcare

- 8.1.2. Manufacturing

- 8.1.3. Automotive

- 8.1.4. Banking and Financial services

- 8.1.5. Retail and E-commerce

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Business Type

- 8.2.1. Warehousing

- 8.2.2. Distribution

- 8.2.3. Value-Added Services

- 8.3. Market Analysis, Insights and Forecast - by Mode of Operation

- 8.3.1. Storage

- 8.3.2. Roadways Distribution

- 8.3.3. Seaways Distribution

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. LAMEA Green Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Healthcare

- 9.1.2. Manufacturing

- 9.1.3. Automotive

- 9.1.4. Banking and Financial services

- 9.1.5. Retail and E-commerce

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Business Type

- 9.2.1. Warehousing

- 9.2.2. Distribution

- 9.2.3. Value-Added Services

- 9.3. Market Analysis, Insights and Forecast - by Mode of Operation

- 9.3.1. Storage

- 9.3.2. Roadways Distribution

- 9.3.3. Seaways Distribution

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Mahindra Logistics Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CEVA Logistics**List Not Exhaustive 6 3 Other Companie

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DHL International GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AI Futtaim Logistics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 United Parcel Service

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Yusen Logistics Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 GEODIS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 XPO Logistics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Agility Public Warehousing Company K S C P

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bollore Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bowling Green Logistics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Mahindra Logistics Ltd

List of Figures

- Figure 1: Green Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Green Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Green Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Green Logistics Market Revenue Million Forecast, by Business Type 2020 & 2033

- Table 3: Green Logistics Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 4: Green Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Green Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Green Logistics Market Revenue Million Forecast, by Business Type 2020 & 2033

- Table 7: Green Logistics Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 8: Green Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: US Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Green Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: Green Logistics Market Revenue Million Forecast, by Business Type 2020 & 2033

- Table 14: Green Logistics Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 15: Green Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: UK Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Green Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Green Logistics Market Revenue Million Forecast, by Business Type 2020 & 2033

- Table 24: Green Logistics Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 25: Green Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: India Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: China Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Green Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Green Logistics Market Revenue Million Forecast, by Business Type 2020 & 2033

- Table 33: Green Logistics Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 34: Green Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Latin America Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Middle East Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Africa Green Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Logistics Market?

The projected CAGR is approximately 8.29%.

2. Which companies are prominent players in the Green Logistics Market?

Key companies in the market include Mahindra Logistics Ltd, CEVA Logistics**List Not Exhaustive 6 3 Other Companie, DHL International GmbH, AI Futtaim Logistics, United Parcel Service, Yusen Logistics Co Ltd, GEODIS, XPO Logistics, Agility Public Warehousing Company K S C P, Bollore Logistics, Bowling Green Logistics.

3. What are the main segments of the Green Logistics Market?

The market segments include End User, Business Type, Mode of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing adoption of EVs in the logistics industry; Increase in adoption of artificial intelligence (AI) in the global logistics industry.

6. What are the notable trends driving market growth?

The Demand for Green Warehouses is Rising.

7. Are there any restraints impacting market growth?

Dependency on fossil fuels. majority for transportation; The high costs of implementing green procurement practices discourage potential investors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Logistics Market?

To stay informed about further developments, trends, and reports in the Green Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence