Key Insights

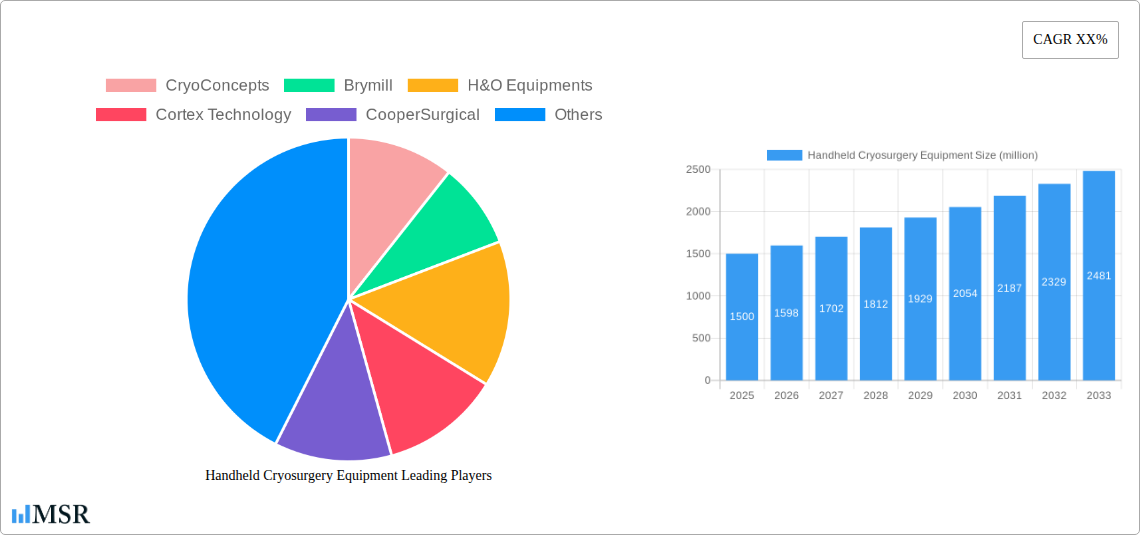

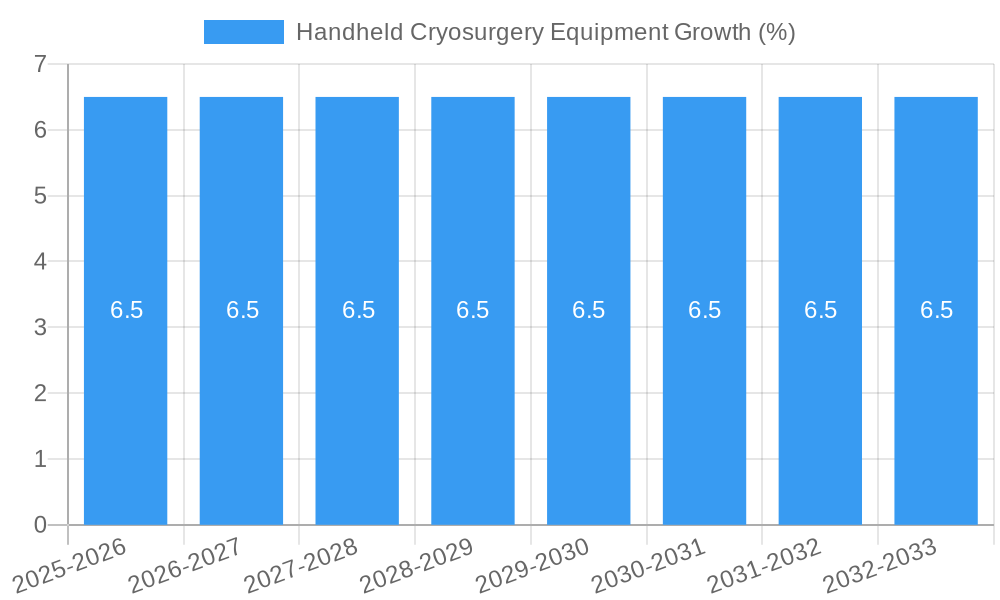

The global Handheld Cryosurgery Equipment market is projected to reach a substantial valuation of approximately $1,500 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 6.5% throughout the forecast period of 2025-2033. This significant market expansion is primarily fueled by the increasing prevalence of dermatological conditions, the rising demand for minimally invasive cosmetic procedures, and the growing adoption of cryosurgery in veterinary medicine for enhanced animal care. The medical industry, particularly dermatology and oncology, represents a dominant application segment due to the effectiveness and safety of cryosurgery in treating various skin lesions, precancerous cells, and certain tumors. The esthetics segment is also experiencing considerable growth, driven by advancements in handheld cryotherapy devices for cosmetic applications like skin rejuvenation and acne treatment. Tissue contact probes, favored for precise lesion targeting, are expected to maintain their leadership within the types segment, while tissue spray probes offer broader application areas, contributing to the market's diversity.

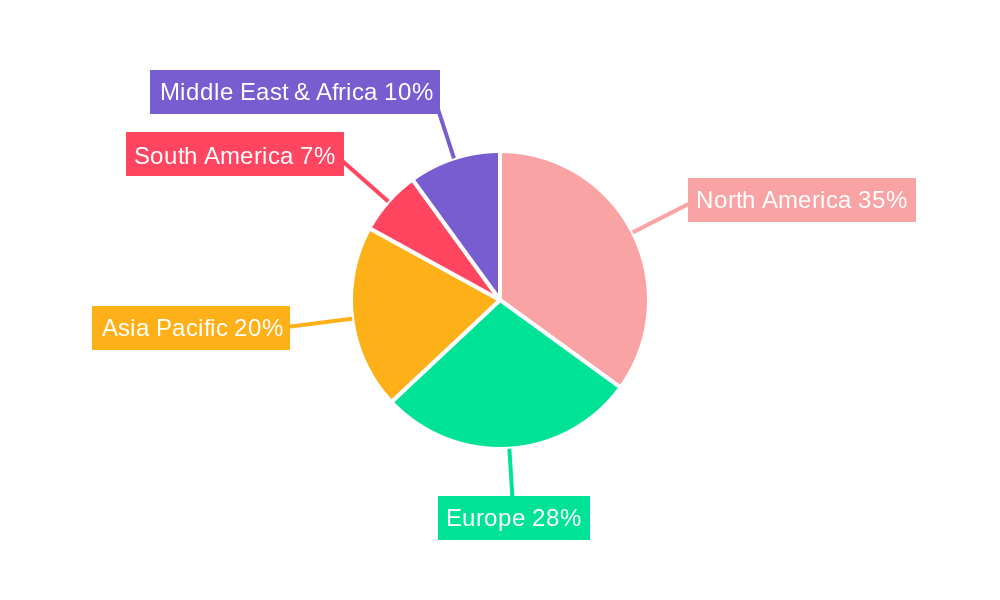

Several key drivers underpin this market's upward trajectory. Technological advancements leading to more portable, user-friendly, and cost-effective handheld cryosurgery devices are expanding accessibility for healthcare professionals. Growing awareness among patients and practitioners regarding the benefits of cryosurgery, including its outpatient applicability, rapid recovery times, and reduced scarring compared to traditional surgical methods, further propels adoption. However, potential restraints include the initial investment cost of advanced equipment and the need for specialized training for optimal use. Regional analysis indicates North America, particularly the United States, is anticipated to hold a significant market share due to advanced healthcare infrastructure and high adoption rates of new medical technologies. Europe and the Asia Pacific region are also poised for substantial growth, driven by increasing healthcare expenditure and a rising number of qualified practitioners. Key players are actively engaged in research and development to innovate and expand their product portfolios, aiming to capture a larger share of this dynamic market.

Handheld Cryosurgery Equipment Market Concentration & Dynamics

The global handheld cryosurgery equipment market is characterized by a moderate concentration, with several key players vying for market share. Leading companies such as CryoConcepts, Brymill, H&O Equipments, Cortex Technology, CooperSurgical, EROND, Toitu, Clinic6, Cryoswiss, Special Medical Technology, CryoIQ, MedGyn, and Bovie Medical (Symmetry Surgical) are actively engaged in innovation and market expansion. The innovation ecosystem is driven by continuous research and development, focusing on enhancing precision, portability, and user-friendliness of cryosurgical devices. Regulatory frameworks, particularly within the medical industry, play a significant role, influencing product approvals and market access. Substitute products, while present in broader dermatological and surgical practices, offer limited direct competition to the specialized applications of handheld cryosurgery. End-user trends are shifting towards minimally invasive procedures, increased demand for cosmetic treatments, and growing adoption in veterinary medicine, all of which are boosting market penetration. Mergers and acquisitions (M&A) activities, while not pervasive, have occurred, consolidating market positions and expanding product portfolios. For instance, a notable M&A deal count of xx was observed in the historical period (2019-2024). The market share distribution indicates that companies specializing in advanced dermatological and minor surgical cryotherapy tools hold a significant portion of the market.

Handheld Cryosurgery Equipment Industry Insights & Trends

The handheld cryosurgery equipment industry is poised for robust growth, projected to witness a market size of US$ 3,500 million by 2025 and expand to US$ 5,900 million by 2033. This represents a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. The primary growth drivers stem from the increasing prevalence of dermatological conditions, such as skin tags, warts, and precancerous lesions, which are effectively treated with cryotherapy. Furthermore, the rising demand for aesthetic procedures, including skin rejuvenation and the treatment of superficial blemishes, is significantly contributing to market expansion. In the veterinary sector, cryosurgery is gaining traction for its efficacy in treating tumors and other lesions in animals, thereby broadening the application spectrum. Technological advancements are central to the industry's trajectory. Innovations are focused on developing more precise and controlled cryosurgical devices, incorporating features like digital temperature control, disposable applicators for enhanced hygiene, and improved ergonomic designs for ease of use by medical professionals. The integration of advanced cooling technologies and the development of specialized probes for different tissue types are also key trends. Evolving consumer behaviors, characterized by a greater preference for minimally invasive treatments with shorter recovery times and reduced scarring, further fuel the demand for handheld cryosurgery equipment. Patients and healthcare providers alike are recognizing the benefits of cryotherapy, including its cost-effectiveness and high success rates for specific indications. The medical industry remains the dominant segment, driven by its established use in dermatology and minor surgical procedures. The esthetics segment is experiencing rapid growth due to the increasing focus on cosmetic treatments and the accessibility of these procedures. The veterinarian segment, while smaller, is exhibiting strong growth potential as awareness and acceptance of cryosurgery in animal care increase.

Key Markets & Segments Leading Handheld Cryosurgery Equipment

The Medical Industry segment consistently leads the handheld cryosurgery equipment market, driven by its extensive applications in dermatology, gynecology, and minor surgical procedures. Within this segment, the treatment of benign skin lesions, such as warts, skin tags, seborrheic keratoses, and actinic keratoses, remains a primary application, contributing to a substantial market share. The increasing incidence of skin cancers and precancerous lesions further bolsters demand for effective and minimally invasive treatment modalities like cryosurgery. Economic growth in developed and developing nations, coupled with improved healthcare infrastructure, facilitates greater access to advanced medical equipment, including handheld cryosurgery devices.

- Drivers of Dominance in the Medical Industry:

- High Incidence of Dermatological Conditions: The prevalence of common skin conditions requiring cryotherapy is a perpetual driver.

- Minimally Invasive Nature: Cryosurgery offers a less invasive alternative to surgical excision, appealing to both patients and practitioners for its reduced recovery time and scarring.

- Cost-Effectiveness: For many superficial lesions, cryosurgery is a more economical treatment option compared to other procedures.

- Technological Advancements: Continuous improvements in cryosurgery devices enhance precision, safety, and ease of use, making them more attractive for clinical settings.

The Esthetics segment is emerging as a significant growth engine. The growing consumer interest in non-surgical cosmetic enhancements, including skin resurfacing, pore reduction, and the treatment of hyperpigmentation, is driving demand for handheld cryosurgery devices. The portability and user-friendliness of these devices make them suitable for aesthetic clinics and spas.

- Drivers of Growth in the Esthetics Segment:

- Rising Disposable Incomes: Increased consumer spending power allows for greater investment in cosmetic treatments.

- Social Media Influence: The emphasis on appearance in social media platforms fuels the demand for aesthetic procedures.

- Accessibility of Treatments: Handheld devices make cryosurgery accessible for a wider range of aesthetic concerns.

In terms of Types, Tissue Contact Probes are widely adopted due to their precision in targeting specific lesions and their effectiveness in treating superficial growths. These probes offer controlled application of cold, minimizing damage to surrounding healthy tissue. Tissue Spray Probes, on the other hand, are favored for treating larger areas or multiple lesions simultaneously, offering rapid coverage. The choice between probe types often depends on the specific application and the practitioner's preference.

Geographically, North America and Europe currently hold the largest market shares due to established healthcare systems, high disposable incomes, and a strong awareness of advanced dermatological treatments. However, the Asia-Pacific region is anticipated to exhibit the fastest growth, driven by a burgeoning healthcare industry, increasing medical tourism, and a growing middle class with greater access to healthcare services.

Handheld Cryosurgery Equipment Product Developments

Recent product developments in handheld cryosurgery equipment are centered on enhancing precision, portability, and user experience. Innovations include the introduction of advanced cooling systems for consistent and controlled temperature application, digital displays for real-time monitoring of temperature and treatment duration, and ergonomic designs for improved maneuverability. Specialized applicators and probes are being developed to cater to a wider range of medical and aesthetic applications, from superficial skin lesions to more targeted treatments. Companies are also focusing on disposable components to ensure sterility and convenience. These advancements are creating a competitive edge by offering practitioners safer, more efficient, and versatile cryosurgical solutions.

Challenges in the Handheld Cryosurgery Equipment Market

Despite its growth, the handheld cryosurgery equipment market faces several challenges. Stringent regulatory approvals, particularly for new and advanced devices, can lead to lengthy development timelines and significant investment. The supply chain for specialized refrigerants and components can be vulnerable to disruptions, impacting product availability and cost. Intense competition among established players and emerging manufacturers also puts pressure on pricing and profit margins. Furthermore, the need for specialized training for healthcare professionals to operate these devices effectively can be a barrier to wider adoption in some regions. The estimated impact of these challenges on market growth is approximately -3% to -5% annually.

Forces Driving Handheld Cryosurgery Equipment Growth

Several key forces are propelling the growth of the handheld cryosurgery equipment market. Technologically, advancements in miniaturization and cooling efficiency are leading to more portable and powerful devices. Economically, increasing healthcare expenditure globally and a rising demand for minimally invasive procedures are creating a favorable market environment. Regulatory bodies are also increasingly recognizing the efficacy and safety of cryosurgery for various applications, streamlining approval processes. The growing awareness among both healthcare providers and patients about the benefits of cryotherapy, such as its speed, effectiveness, and reduced patient discomfort, is a significant market accelerant. The projected increase in market size due to these drivers is estimated to be US$ 1,500 million by 2033.

Challenges in the Handheld Cryosurgery Equipment Market

The long-term growth catalysts for the handheld cryosurgery equipment market lie in continuous innovation and strategic market expansion. The development of novel cryosurgical techniques, such as pulsed cryotherapy, and the integration of artificial intelligence for treatment planning and monitoring, represent significant future growth avenues. Partnerships between equipment manufacturers and healthcare institutions will foster wider adoption and gather crucial clinical data. Expanding into emerging economies with growing healthcare needs and investing in research for new therapeutic applications, beyond dermatology, will unlock substantial market potential. The projected long-term growth contribution from these catalysts is estimated to be US$ 1,200 million by 2033.

Emerging Opportunities in Handheld Cryosurgery Equipment

Emerging opportunities in the handheld cryosurgery equipment market are abundant and diverse. The expanding use of cryosurgery in veterinary oncology and for chronic pain management in humans presents significant untapped potential. The development of portable, point-of-care cryosurgery devices for remote or underserved areas is another promising area. Furthermore, the increasing demand for aesthetic treatments in emerging markets and the integration of smart technologies for remote monitoring and data analytics in cryosurgery devices are creating new avenues for innovation and market penetration. The projected revenue from these emerging opportunities is estimated to reach US$ 800 million by 2033.

Leading Players in the Handheld Cryosurgery Equipment Sector

- CryoConcepts

- Brymill

- H&O Equipments

- Cortex Technology

- CooperSurgical

- EROND

- Toitu

- Clinic6

- Cryoswiss

- Special Medical Technology

- CryoIQ

- MedGyn

- Bovie Medical (Symmetry Surgical)

Key Milestones in Handheld Cryosurgery Equipment Industry

- 2019: Launch of enhanced portable cryosurgery devices with improved temperature control by CryoConcepts.

- 2020: Brymill introduces a new line of disposable cryospray tips, increasing ease of use and hygiene.

- 2021: CooperSurgical acquires a key player in the cryogenic technology space, expanding its portfolio.

- 2022: EROND patents a novel hand-held cryosurgery unit with advanced targeting capabilities.

- 2023: Cortex Technology releases a new generation of cryosurgery probes for specialized dermatological applications.

- 2024: CryoIQ announces significant advancements in its compact cryosurgical systems, targeting general practitioners.

- 2025: Market anticipated to see further integration of digital features and remote monitoring capabilities.

- 2026: Expected new product launches focusing on expanded applications in esthetics and veterinary care.

- 2027: Regulatory approvals for advanced cryosurgical devices for oncology indications are anticipated.

- 2028: Increased M&A activity expected as companies seek to consolidate market share and expand technological offerings.

- 2029-2033: Continued focus on innovation, including AI integration and development for emerging markets.

Strategic Outlook for Handheld Cryosurgery Equipment Market

The strategic outlook for the handheld cryosurgery equipment market is highly positive, driven by sustained demand for minimally invasive treatments and ongoing technological advancements. Growth accelerators will include the expansion of applications in veterinary medicine and esthetics, alongside the increasing adoption in developing economies. Companies that focus on product innovation, strategic partnerships, and a robust distribution network are best positioned for success. The market is expected to witness further consolidation and the emergence of specialized solutions catering to niche applications. Emphasis on user training and post-market surveillance will be crucial for long-term sustainability and market leadership.

Handheld Cryosurgery Equipment Segmentation

-

1. Application

- 1.1. Medical Industry

- 1.2. Esthetics

- 1.3. Veterinarian

-

2. Types

- 2.1. Tissue Contact Probes

- 2.2. Tissue Spray Probes

Handheld Cryosurgery Equipment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Handheld Cryosurgery Equipment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Handheld Cryosurgery Equipment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Industry

- 5.1.2. Esthetics

- 5.1.3. Veterinarian

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tissue Contact Probes

- 5.2.2. Tissue Spray Probes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Handheld Cryosurgery Equipment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Industry

- 6.1.2. Esthetics

- 6.1.3. Veterinarian

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tissue Contact Probes

- 6.2.2. Tissue Spray Probes

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Handheld Cryosurgery Equipment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Industry

- 7.1.2. Esthetics

- 7.1.3. Veterinarian

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tissue Contact Probes

- 7.2.2. Tissue Spray Probes

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Handheld Cryosurgery Equipment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Industry

- 8.1.2. Esthetics

- 8.1.3. Veterinarian

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tissue Contact Probes

- 8.2.2. Tissue Spray Probes

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Handheld Cryosurgery Equipment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Industry

- 9.1.2. Esthetics

- 9.1.3. Veterinarian

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tissue Contact Probes

- 9.2.2. Tissue Spray Probes

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Handheld Cryosurgery Equipment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Industry

- 10.1.2. Esthetics

- 10.1.3. Veterinarian

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tissue Contact Probes

- 10.2.2. Tissue Spray Probes

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CryoConcepts

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Brymill

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 H&O Equipments

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cortex Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CooperSurgical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EROND

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Toitu

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clinic6

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cryoswiss

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Special Medical Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CryoIQ

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MedGyn

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bovie Medical (Symmetry Surgical)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 CryoConcepts

List of Figures

- Figure 1: Global Handheld Cryosurgery Equipment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Handheld Cryosurgery Equipment Revenue (million), by Application 2024 & 2032

- Figure 3: North America Handheld Cryosurgery Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Handheld Cryosurgery Equipment Revenue (million), by Types 2024 & 2032

- Figure 5: North America Handheld Cryosurgery Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Handheld Cryosurgery Equipment Revenue (million), by Country 2024 & 2032

- Figure 7: North America Handheld Cryosurgery Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Handheld Cryosurgery Equipment Revenue (million), by Application 2024 & 2032

- Figure 9: South America Handheld Cryosurgery Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Handheld Cryosurgery Equipment Revenue (million), by Types 2024 & 2032

- Figure 11: South America Handheld Cryosurgery Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Handheld Cryosurgery Equipment Revenue (million), by Country 2024 & 2032

- Figure 13: South America Handheld Cryosurgery Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Handheld Cryosurgery Equipment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Handheld Cryosurgery Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Handheld Cryosurgery Equipment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Handheld Cryosurgery Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Handheld Cryosurgery Equipment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Handheld Cryosurgery Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Handheld Cryosurgery Equipment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Handheld Cryosurgery Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Handheld Cryosurgery Equipment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Handheld Cryosurgery Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Handheld Cryosurgery Equipment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Handheld Cryosurgery Equipment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Handheld Cryosurgery Equipment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Handheld Cryosurgery Equipment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Handheld Cryosurgery Equipment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Handheld Cryosurgery Equipment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Handheld Cryosurgery Equipment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Handheld Cryosurgery Equipment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Handheld Cryosurgery Equipment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Handheld Cryosurgery Equipment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Handheld Cryosurgery Equipment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Handheld Cryosurgery Equipment?

Key companies in the market include CryoConcepts, Brymill, H&O Equipments, Cortex Technology, CooperSurgical, EROND, Toitu, Clinic6, Cryoswiss, Special Medical Technology, CryoIQ, MedGyn, Bovie Medical (Symmetry Surgical).

3. What are the main segments of the Handheld Cryosurgery Equipment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Handheld Cryosurgery Equipment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Handheld Cryosurgery Equipment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Handheld Cryosurgery Equipment?

To stay informed about further developments, trends, and reports in the Handheld Cryosurgery Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence