Key Insights

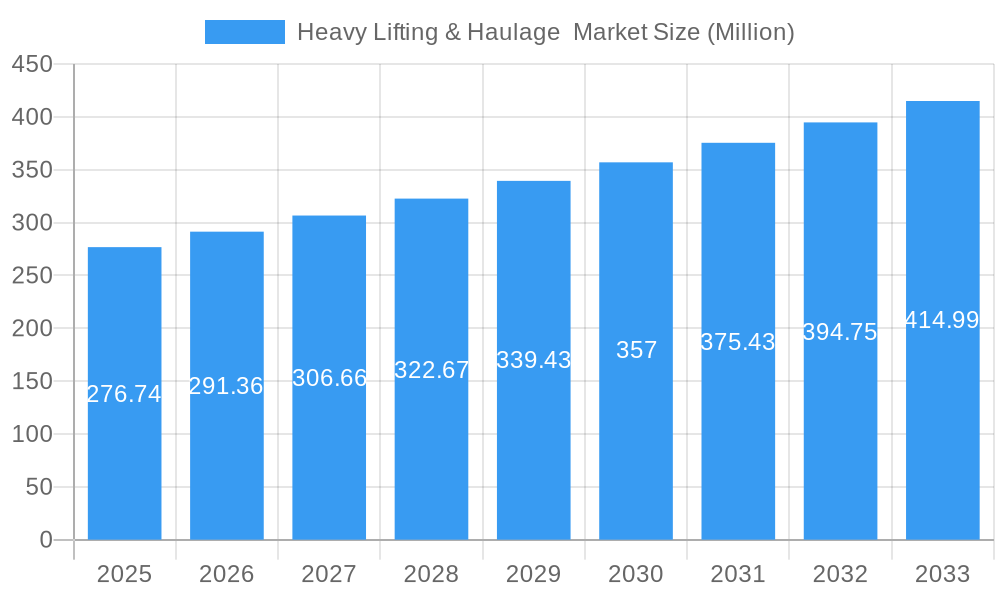

The global heavy lifting and haulage market is experiencing robust growth, projected to reach a significant market size. The market's Compound Annual Growth Rate (CAGR) of 5.17% from 2019 to 2024 indicates a consistent upward trajectory, driven by several key factors. Increased infrastructure development globally, particularly in emerging economies, fuels demand for heavy lifting equipment and specialized haulage services. The growth of renewable energy projects, such as wind farms and solar power plants, also contributes significantly, as these projects require specialized equipment for transporting and installing large components. Furthermore, advancements in technology, such as the development of more efficient and powerful cranes and lifting systems, enhance operational capabilities and drive market expansion. The rise of automation and remote control technologies is further streamlining operations and improving safety, adding to the overall market attractiveness.

Heavy Lifting & Haulage Market Market Size (In Million)

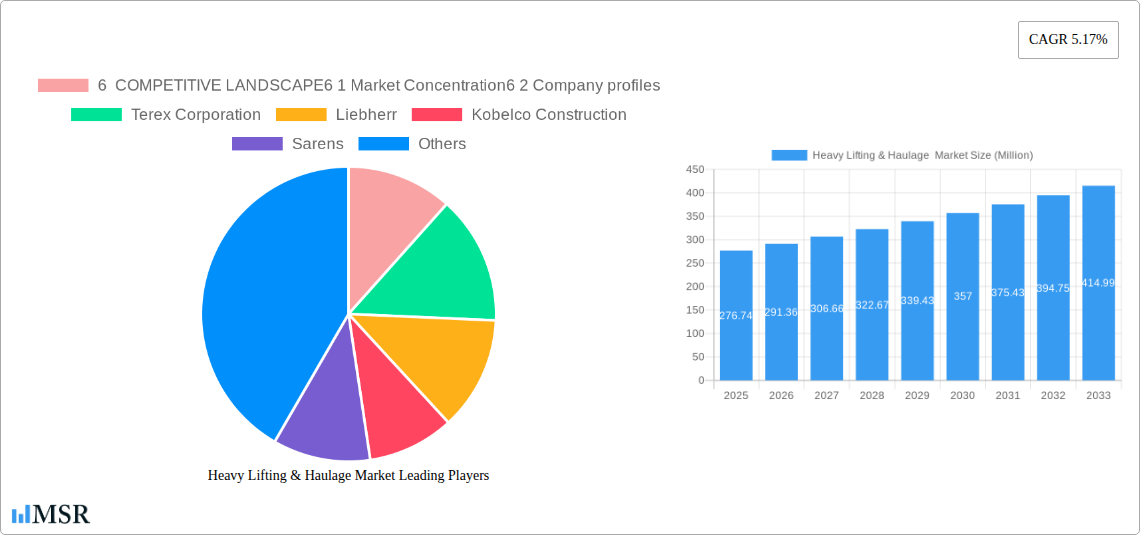

Competition within the heavy lifting and haulage sector is intense, with numerous established players and emerging companies vying for market share. Key players like Terex Corporation, Liebherr, Kobelco Construction, Sarens, and Mammoet hold substantial market positions due to their extensive experience, strong brand recognition, and diverse product portfolios. However, the market is characterized by regional variations, with certain regions experiencing faster growth than others due to factors like economic development and infrastructure investment. The market is also witnessing the rise of specialized service providers catering to niche sectors such as offshore wind energy and industrial manufacturing, indicating a growing level of market segmentation. This increasing demand and sophisticated technology integration forecast sustained expansion throughout the forecast period (2025-2033). Successful companies will need to invest in innovative solutions, optimize operational efficiency, and effectively navigate the complex regulatory landscape to maintain a competitive edge.

Heavy Lifting & Haulage Market Company Market Share

Heavy Lifting & Haulage Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the Heavy Lifting & Haulage Market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. We analyze market dynamics, growth drivers, key players, and emerging trends to paint a clear picture of this vital sector. The report includes detailed analysis of market size (reaching xx Million by 2033), CAGR, and market share for key players, helping you navigate the complexities of this dynamic market.

Heavy Lifting & Haulage Market Market Concentration & Dynamics

The global Heavy Lifting & Haulage Market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller companies fosters competition and innovation. Market concentration is influenced by factors such as technological advancements, regulatory frameworks, and mergers and acquisitions (M&A) activity.

- Market Share: The top 5 players account for approximately xx% of the global market share in 2025, with the remaining share distributed among numerous smaller companies. This indicates a moderately consolidated market.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, indicating a relatively active consolidation phase within the industry. This trend is expected to continue during the forecast period, driven by the need for companies to expand their geographical reach and product portfolios.

- Innovation Ecosystems: Significant investment in R&D and strategic partnerships are driving innovation in areas such as autonomous haulage systems and enhanced safety features. This leads to improved efficiency and productivity.

- Regulatory Frameworks: Stringent safety regulations and environmental concerns impact operational costs and necessitate ongoing compliance efforts. These factors are reshaping the competitive landscape and favor companies that prioritize sustainability.

- Substitute Products: Although limited, alternative transportation methods and lifting technologies, such as specialized rail transport, pose a minor competitive threat. These alternatives might impact niche segments but not significantly change the overall market share of heavy lifting and haulage.

- End-User Trends: Increasing demand from infrastructure projects, particularly in developing economies, fuels market expansion. The construction and mining sectors are the biggest end-users.

Heavy Lifting & Haulage Market Industry Insights & Trends

The Heavy Lifting & Haulage Market is experiencing robust growth, driven by escalating infrastructure development globally and rising demand from various end-use sectors. This trend translates into a market size of xx Million in 2025, projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Several key factors contribute to this expansion:

The increasing demand for heavy lifting and haulage services across diverse industries, including construction, mining, energy, and manufacturing, is a significant market driver. Technological advancements, like the adoption of autonomous vehicles and improved lifting equipment, are enhancing efficiency and safety. The adoption of digital technologies for fleet management and optimized logistics is optimizing operational efficiency, further driving market growth. Evolving consumer behaviors toward prioritizing safety and sustainability are also influencing market dynamics, shaping demand for eco-friendly solutions. Finally, government initiatives focusing on infrastructure development in several regions worldwide bolster market growth projections. These factors collectively contribute to the market's continued expansion.

Key Markets & Segments Leading Heavy Lifting & Haulage Market

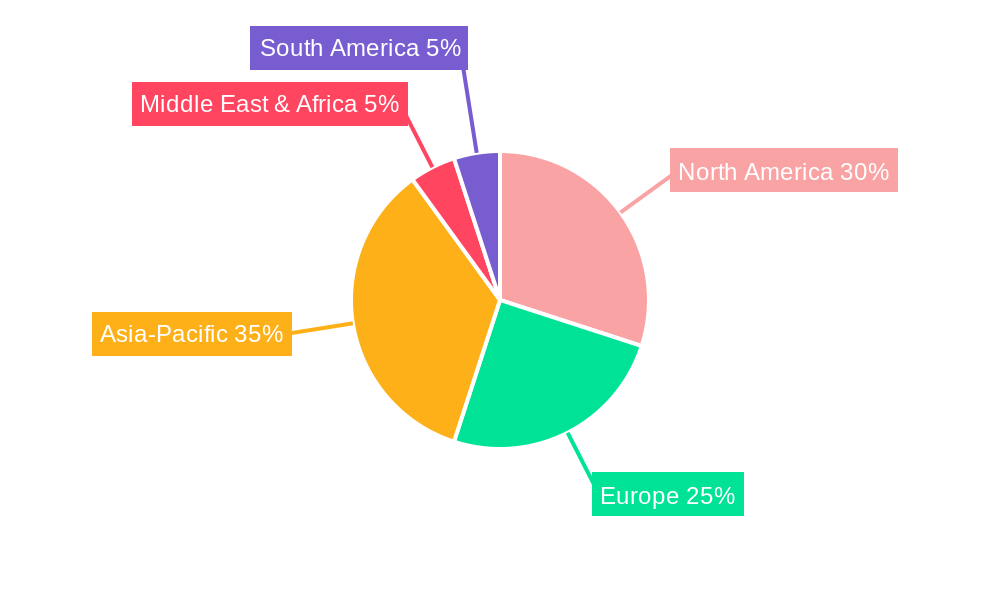

The Asia-Pacific region dominates the Heavy Lifting & Haulage Market, primarily fueled by substantial infrastructure development and booming industrial activities. Significant growth is also witnessed in North America and Europe, driven by renovation and expansion projects.

- Asia-Pacific: This region holds the largest market share due to extensive infrastructure projects and rapid industrialization.

- Drivers: Massive infrastructure spending, rapid urbanization, growth in manufacturing and mining sectors.

- North America: This region witnesses steady growth, primarily driven by refurbishment and modernization activities within existing infrastructure.

- Drivers: Government investment in infrastructure, ongoing construction activities, and a relatively stable economic climate.

- Europe: The European market demonstrates steady growth propelled by ongoing modernization initiatives across infrastructure.

- Drivers: Renewal of aging infrastructure, increased focus on renewable energy projects, and rising demand from industrial sectors.

Heavy Lifting & Haulage Market Product Developments

Recent advancements focus on enhancing safety, efficiency, and environmental sustainability. Autonomous haulage systems, for instance, are revolutionizing mining operations by improving productivity and reducing risks. New cranes with increased lifting capacities and improved maneuverability are becoming more common, expanding application possibilities. Furthermore, the development of lighter-weight yet robust materials in crane construction is improving fuel efficiency and reducing operational costs. These innovations are altering the competitive landscape, placing a premium on technological advancements.

Challenges in the Heavy Lifting & Haulage Market Market

The Heavy Lifting & Haulage Market faces several challenges including:

- Supply Chain Disruptions: Fluctuations in raw material prices and logistics bottlenecks impact operational costs and delivery timelines.

- Regulatory Hurdles: Stringent safety and environmental regulations increase compliance costs and complexities.

- Competitive Pressures: Intense competition necessitates continuous innovation and strategic partnerships to maintain market share.

Forces Driving Heavy Lifting & Haulage Market Growth

Key factors driving market expansion include:

- Technological Advancements: Autonomous vehicles, improved lifting equipment, and digital fleet management systems.

- Infrastructure Development: Government investments in large-scale infrastructure projects globally.

- Economic Growth: Expansion in manufacturing and construction sectors fuels demand for heavy lifting and haulage services.

Long-Term Growth Catalysts in the Heavy Lifting & Haulage Market

Long-term growth hinges on continued innovation, strategic partnerships, and market expansion into developing economies. Strategic alliances focusing on technological advancements and sustainable practices will become crucial for long-term success. Expansion into new markets, particularly those with significant infrastructure development plans, will also be critical for sustainable growth.

Emerging Opportunities in Heavy Lifting & Haulage Market

Emerging opportunities include:

- Expansion into renewable energy: Growing demand for heavy lifting in wind turbine installation and solar farm construction.

- Adoption of automation: Increased adoption of autonomous haulage solutions for improved efficiency and safety.

- Focus on sustainable solutions: Growing demand for environmentally friendly equipment and operational practices.

Leading Players in the Heavy Lifting & Haulage Market Sector

- Terex Corporation (Terex Corporation)

- Liebherr (Liebherr)

- Kobelco Construction

- Sarens

- Mammoet

- Global Rigging & Transport

- HSC Cranes

- Volvo Construction Equipment (Volvo Construction Equipment)

- XCMG Construction (XCMG Construction)

- KATO

- Konecranes (Konecranes)

- Other companies

Key Milestones in Heavy Lifting & Haulage Market Industry

- July 2024: Liebherr and Fortescue partnered to develop an Autonomous Haulage Solution, validating a fleet of autonomous trucks. This signifies a major step towards automation in the heavy lifting and haulage industry.

- June 2024: Terex launched the TRT 80 l rough terrain crane, showcasing advanced features like self-mounting counterweight and improved maneuverability. This product launch enhances the market's technological sophistication and caters to the increasing demand for efficient and user-friendly equipment.

Strategic Outlook for Heavy Lifting & Haulage Market Market

The Heavy Lifting & Haulage Market presents significant growth potential, driven by technological advancements, robust infrastructure development, and rising demand across key sectors. Companies that prioritize innovation, sustainability, and strategic partnerships will be well-positioned to capitalize on this market's immense opportunities. A focus on automation, efficient logistics, and the development of eco-friendly solutions will be key factors in long-term success within this dynamic market.

Heavy Lifting & Haulage Market Segmentation

-

1. End User

- 1.1. Oil and Gas

- 1.2. Mining and Quarrying

- 1.3. Energy and Power

- 1.4. Construction

- 1.5. Manufacturing

- 1.6. Other End Users

Heavy Lifting & Haulage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Egypt

- 5.5. Rest of Middle East and Africa

Heavy Lifting & Haulage Market Regional Market Share

Geographic Coverage of Heavy Lifting & Haulage Market

Heavy Lifting & Haulage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 3.4. Market Trends

- 3.4.1. Increased Demand From Energy and Power Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Oil and Gas

- 5.1.2. Mining and Quarrying

- 5.1.3. Energy and Power

- 5.1.4. Construction

- 5.1.5. Manufacturing

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Oil and Gas

- 6.1.2. Mining and Quarrying

- 6.1.3. Energy and Power

- 6.1.4. Construction

- 6.1.5. Manufacturing

- 6.1.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Oil and Gas

- 7.1.2. Mining and Quarrying

- 7.1.3. Energy and Power

- 7.1.4. Construction

- 7.1.5. Manufacturing

- 7.1.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Oil and Gas

- 8.1.2. Mining and Quarrying

- 8.1.3. Energy and Power

- 8.1.4. Construction

- 8.1.5. Manufacturing

- 8.1.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Oil and Gas

- 9.1.2. Mining and Quarrying

- 9.1.3. Energy and Power

- 9.1.4. Construction

- 9.1.5. Manufacturing

- 9.1.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Heavy Lifting & Haulage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Oil and Gas

- 10.1.2. Mining and Quarrying

- 10.1.3. Energy and Power

- 10.1.4. Construction

- 10.1.5. Manufacturing

- 10.1.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terex Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liebherr

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kobelco Construction

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sarens

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mammoet

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Global Rigging & Transport

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HSC Cranes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Volvo Constructioon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 XCMG Construction

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KATO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Konecranes**List Not Exhaustive 6 3 Other companie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

List of Figures

- Figure 1: Global Heavy Lifting & Haulage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Heavy Lifting & Haulage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 5: North America Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 9: North America Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 12: Europe Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 13: Europe Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 17: Europe Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Asia Pacific Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 21: Asia Pacific Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 29: South America Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million), by End User 2025 & 2033

- Figure 36: Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion), by End User 2025 & 2033

- Figure 37: Middle East and Africa Heavy Lifting & Haulage Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Heavy Lifting & Haulage Market Volume Share (%), by End User 2025 & 2033

- Figure 39: Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Heavy Lifting & Haulage Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Heavy Lifting & Haulage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 3: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United States Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Canada Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Spain Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: China Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: India Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Japan Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Singapore Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Singapore Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 43: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: Brazil Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Brazil Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Mexico Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Mexico Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of South America Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of South America Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by End User 2020 & 2033

- Table 53: Global Heavy Lifting & Haulage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Heavy Lifting & Haulage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Saudi Arabia Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Saudi Arabia Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: United Arab Emirates Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Africa Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Egypt Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Egypt Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Rest of Middle East and Africa Heavy Lifting & Haulage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Middle East and Africa Heavy Lifting & Haulage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Lifting & Haulage Market?

The projected CAGR is approximately 5.17%.

2. Which companies are prominent players in the Heavy Lifting & Haulage Market?

Key companies in the market include 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, Terex Corporation, Liebherr, Kobelco Construction, Sarens, Mammoet, Global Rigging & Transport, HSC Cranes, Volvo Constructioon, XCMG Construction, KATO, Konecranes**List Not Exhaustive 6 3 Other companie.

3. What are the main segments of the Heavy Lifting & Haulage Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 276.74 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services.

6. What are the notable trends driving market growth?

Increased Demand From Energy and Power Segment.

7. Are there any restraints impacting market growth?

4.; Infrastructure growth drives demand for heavy lift and haulage services4.; Industrial Growth Spurs Demand for Heavy Lift and Haulage Services.

8. Can you provide examples of recent developments in the market?

July 2024: Liebherr and Fortescue partnered to develop an Autonomous Haulage Solution. Currently, they are validating a fleet of four T 264 autonomous trucks alongside the AHS at a dedicated facility in Fortescue's Christmas Creek mine. The AHS ecosystem will encompass creating and validating a fleet management system and a machine guidance solution.June 2024: In Italy, Terex Rough Terrain Cranes unveiled its latest offering, the TRT 80 l, boasting an impressive 80-tonne lifting capacity. Terex emphasizes its lifting prowess and transport convenience, which are standout features of this new two-axle model. With a width of 3 m, the TRT 80 l is well-suited for navigating tight spaces and busy job sites. Enhancing its setup efficiency, the crane features a self-mounting counterweight, ensuring quicker assembly and disassembly. With four steering modes, maneuvering and setup become more manageable. Once in place, the TRT 90 l can fully utilize its 47-m telescopic boom, complemented by jib options of 9 and 17 m. With its blend of advanced features and user-centric design, the TRT 80 l stands out as a valuable addition to any fleet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heavy Lifting & Haulage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heavy Lifting & Haulage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heavy Lifting & Haulage Market?

To stay informed about further developments, trends, and reports in the Heavy Lifting & Haulage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence