Key Insights

The India battery swapping market for electric two-wheelers is experiencing robust growth, driven by increasing electric two-wheeler adoption, rising fuel costs, and government initiatives promoting electric mobility. The market's Compound Annual Growth Rate (CAGR) of 18% from 2019 to 2024 indicates significant potential. The Pay-Per-Use model currently dominates the service type segment due to its affordability and flexibility, appealing to a wider customer base. However, the Subscription model is gaining traction as consumers become more comfortable with long-term commitments and the convenience it offers. Lithium-ion batteries are progressively replacing lead-acid batteries, reflecting the technological advancements in battery technology leading to higher energy density and longer lifespans. Key players like Okaya Power Group, Ola Electric Mobility, and others are strategically investing in infrastructure development and technological improvements to expand their market share. Regional variations exist, with potentially higher growth in urban centers of North and West India due to higher EV adoption rates and better infrastructure. The market faces challenges such as limited battery swapping infrastructure in certain areas, standardization issues across different battery types and manufacturers, and concerns around battery safety and lifecycle management. Despite these challenges, the long-term outlook remains positive, driven by continued technological innovations, supportive government policies, and increasing consumer awareness regarding environmental sustainability.

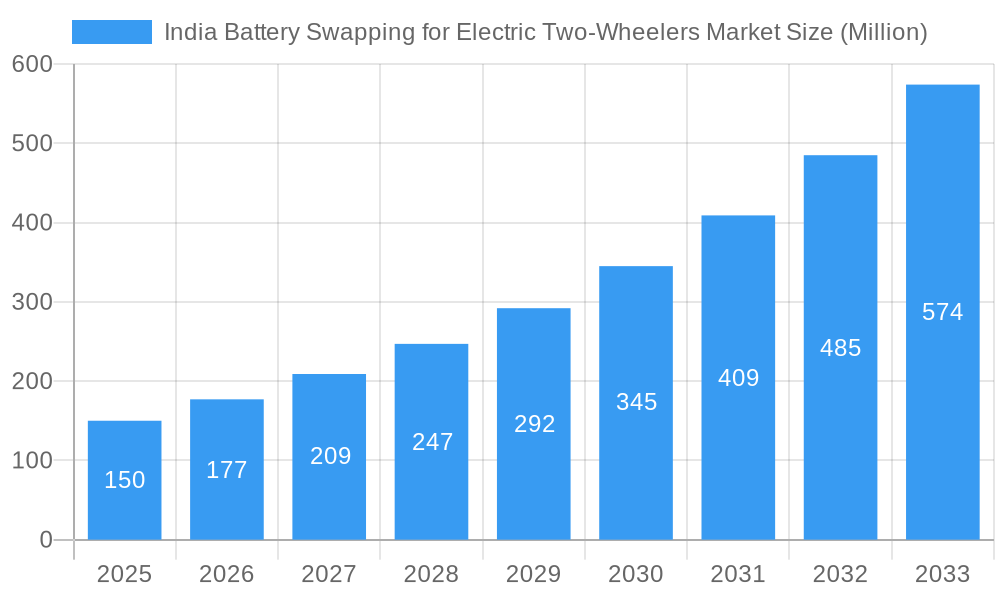

India Battery Swapping for Electric Two-Wheelers Market Market Size (In Million)

The forecast period (2025-2033) anticipates continued expansion, with the market size expected to reach substantial proportions by 2033. This growth will be fueled by improving battery technologies resulting in longer battery life and faster charging times. Increased consumer awareness of the environmental and economic benefits of electric two-wheelers will further propel demand. Successful expansion will hinge on overcoming the existing challenges of infrastructure development, standardization, and safety concerns. A focus on creating a robust and reliable battery swapping network across various regions of India will be critical to capturing the full market potential. Strategic partnerships between battery manufacturers, EV companies, and infrastructure providers are likely to become increasingly important to accelerate the growth of this dynamic market segment.

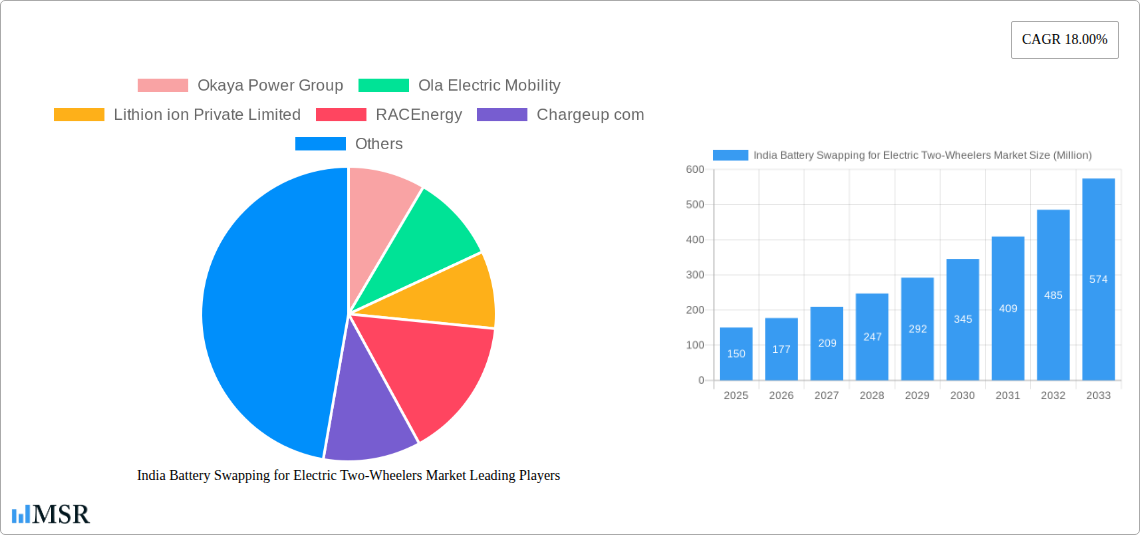

India Battery Swapping for Electric Two-Wheelers Market Company Market Share

India Battery Swapping for Electric Two-Wheelers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning India battery swapping market for electric two-wheelers, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The report examines key players like Okaya Power Group, Ola Electric Mobility, and Sun Mobility, providing crucial data-driven analysis to understand the competitive landscape and potential investment opportunities. Expect detailed breakdowns by service type (Pay-Per-Use, Subscription) and battery type (Lead Acid, Lithium-ion), revealing segment-specific growth trajectories and market dominance.

India Battery Swapping for Electric Two-Wheelers Market Market Concentration & Dynamics

The Indian battery swapping market for electric two-wheelers exhibits a moderately concentrated landscape, with a few major players vying for market share. However, the market is characterized by significant innovation, particularly in battery technology and network infrastructure. The regulatory framework, while evolving, presents both opportunities and challenges. Substitute products, such as traditional petrol-based two-wheelers and electric two-wheelers with conventional charging, still pose a competitive threat. End-user trends show a growing preference for convenient and cost-effective charging solutions, fueling the demand for battery swapping services. Mergers and acquisitions (M&A) activity is expected to increase, with larger players looking to consolidate their position and expand their market reach.

- Market Share: The top 5 players currently hold an estimated xx% of the market share, with Ola Electric and Sun Mobility among the leaders. This is expected to evolve significantly over the forecast period.

- M&A Activity: In the historical period (2019-2024), approximately xx M&A deals were recorded in this sector. The estimated number for 2025 is xx, indicating a dynamic market with significant consolidation potential.

- Innovation Ecosystems: Several startups are driving innovation in battery technology, swapping station design, and software solutions for efficient network management.

- Regulatory Landscape: Government initiatives promoting electric mobility create a favorable regulatory environment. However, standardization and regulatory clarity remain ongoing challenges.

India Battery Swapping for Electric Two-Wheelers Market Industry Insights & Trends

The Indian battery swapping market for electric two-wheelers is experiencing exponential growth, driven by increasing electric two-wheeler adoption, rising fuel costs, and government support for sustainable transportation. Technological disruptions, such as advancements in battery technology and the development of intelligent swapping stations, are accelerating market expansion. Changing consumer behavior, prioritizing convenience and reduced charging time, further fuels the demand. The market size in 2024 is estimated at xx Million USD, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033), reaching xx Million USD by 2033. This impressive growth reflects the market's potential and the increasing acceptance of battery swapping as a viable solution for electric vehicle charging.

Key Markets & Segments Leading India Battery Swapping for Electric Two-Wheelers Market

The Indian battery swapping market shows robust growth across various regions, with urban centers witnessing the highest adoption rates. The Pay-Per-Use model currently dominates the service type segment, owing to its affordability and flexibility. However, subscription models are gaining traction, providing users with predictable costs. Lithium-ion batteries are increasingly replacing lead-acid batteries, driven by their higher energy density and longer lifespan.

Dominant Segments:

- By Service Type: Pay-Per-Use Model holds the largest market share currently, but the subscription model's growth is accelerating.

- By Battery Type: Lithium-ion batteries are gaining rapid adoption due to their superior performance characteristics, although Lead-Acid batteries still have a presence in the lower-cost segment.

Growth Drivers:

- Urbanization and Rising Income Levels: Increased urbanization and disposable incomes are driving demand for personal transportation, including electric two-wheelers.

- Government Initiatives: Government policies promoting electric mobility and battery swapping create favorable conditions for market expansion.

- Technological Advancements: Innovations in battery technology and swapping station infrastructure enhance efficiency and user experience.

- Infrastructure Development: The growing network of battery swapping stations is enhancing the accessibility and convenience of this service.

India Battery Swapping for Electric Two-Wheelers Market Product Developments

Significant product innovations are shaping the battery swapping landscape. These include advancements in battery chemistry for enhanced energy density and lifespan, improved swapping station designs for faster and safer battery exchanges, and sophisticated software solutions for network management and user interface. These technological advancements create competitive edges, driving market competition and providing consumers with more efficient and reliable battery swapping solutions.

Challenges in the India Battery Swapping for Electric Two-Wheelers Market Market

The market faces challenges, including the need for robust infrastructure development, standardization of battery technology, and addressing concerns about battery safety and lifecycle management. Supply chain disruptions and high initial investment costs for setting up swapping stations pose further obstacles. Competitive pressures from traditional charging methods and other emerging technologies also affect market growth. These challenges may impact the market's overall expansion trajectory if not adequately addressed. Lack of standardization across different battery technologies also hinders interoperability.

Forces Driving India Battery Swapping for Electric Two-Wheelers Market Growth

Technological advancements, government incentives, and the increasing affordability of electric two-wheelers are key drivers. The development of standardized battery packs enables interoperability between different manufacturers' vehicles, accelerating adoption. Expanding charging infrastructure and partnerships between manufacturers and battery swapping providers are facilitating market growth. The rising demand for sustainable transportation solutions supports the positive trajectory.

Long-Term Growth Catalysts in India Battery Swapping for Electric Two-Wheelers Market

Long-term growth hinges on overcoming technological limitations, such as improving battery lifespan and reducing costs. Strategic partnerships and collaborations between automakers, battery manufacturers, and infrastructure providers will be crucial. The expansion into new markets and the integration of advanced technologies like AI and IoT for optimized network management will further propel growth.

Emerging Opportunities in India Battery Swapping for Electric Two-Wheelers Market

Opportunities exist in expanding battery swapping networks to smaller cities and towns, integrating battery swapping services with other mobility solutions, and developing innovative business models that cater to diverse customer segments. The focus on creating interoperable battery systems and the utilization of big data for predictive maintenance are further significant potential avenues.

Leading Players in the India Battery Swapping for Electric Two-Wheelers Market Sector

- Okaya Power Group

- Ola Electric Mobility

- Lithion Ion Private Limited

- RACEnergy

- Chargeup com

- Voltup in

- Sun Mobility Private Limited

- Numocity Technologies

- Upgrid solutions Private Limited (Battery Smart)

- Twenty Two Motors Private Limited (Bounce Infinity)

- Esmito Solutions Pvt Ltd

Key Milestones in India Battery Swapping for Electric Two-Wheelers Market Industry

- June 2022: SUN Mobility expands its battery-swapping network to Maharashtra in partnership with Amazon India.

- September 2022: VoltUp partners with Adani Electricity, Hero Electric, and Zomato to establish 500 electric mobility stations in Mumbai.

- November 2022: Gogoro partners with Zypp Electric to launch a battery-swapping pilot program in India.

Strategic Outlook for India Battery Swapping for Electric Two-Wheelers Market Market

The Indian battery swapping market presents significant long-term growth potential. Strategic investments in infrastructure, technological innovation, and the establishment of industry standards will be crucial. The potential for synergies between battery swapping and other sustainable mobility solutions promises further expansion, paving the way for a more sustainable and efficient transportation ecosystem in India.

India Battery Swapping for Electric Two-Wheelers Market Segmentation

-

1. Service Type

- 1.1. Pay-Per-Use Model

- 1.2. Subscription Model

-

2. Battery Type

- 2.1. Lead Acid

- 2.2. Lithium-ion

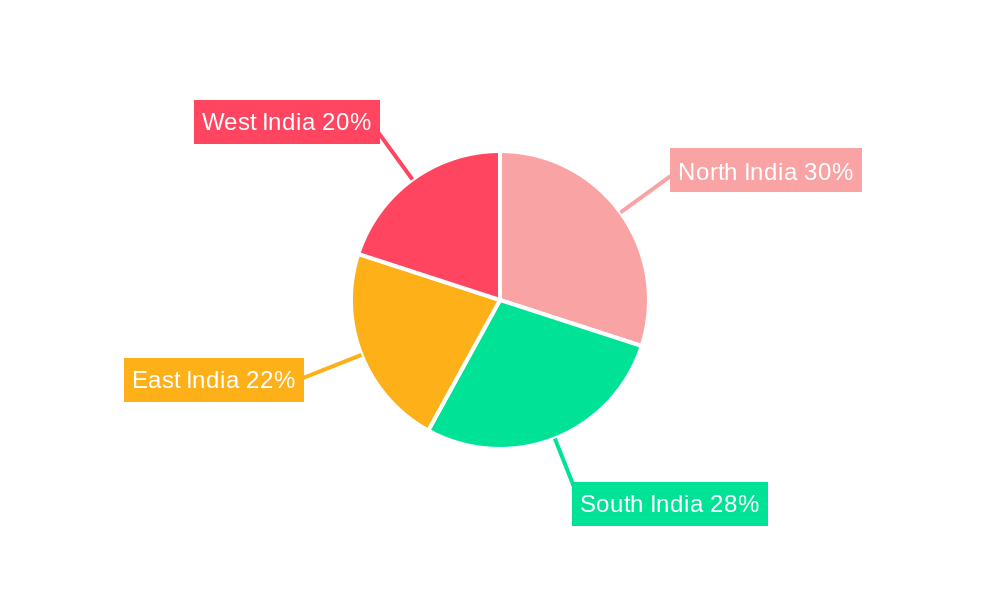

India Battery Swapping for Electric Two-Wheelers Market Segmentation By Geography

- 1. India

India Battery Swapping for Electric Two-Wheelers Market Regional Market Share

Geographic Coverage of India Battery Swapping for Electric Two-Wheelers Market

India Battery Swapping for Electric Two-Wheelers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Focus of Manufacturers on Improving Lithium Ion Batteries Expect to Enhance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Swapping for Electric Two-Wheelers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pay-Per-Use Model

- 5.1.2. Subscription Model

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lead Acid

- 5.2.2. Lithium-ion

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ola Electric Mobility

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lithion ion Private Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RACEnergy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chargeup com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Voltup in

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sun Mobility Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numocity Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Upgrid solutions Private Limited (Battery Smart)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Twenty Two Motors Private Limited (Bounce Infinity

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Esmito Solutions Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Group

List of Figures

- Figure 1: India Battery Swapping for Electric Two-Wheelers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Battery Swapping for Electric Two-Wheelers Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 2: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 3: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 5: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 6: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Swapping for Electric Two-Wheelers Market?

The projected CAGR is approximately 22.7%.

2. Which companies are prominent players in the India Battery Swapping for Electric Two-Wheelers Market?

Key companies in the market include Okaya Power Group, Ola Electric Mobility, Lithion ion Private Limited, RACEnergy, Chargeup com, Voltup in, Sun Mobility Private Limited, Numocity Technologies, Upgrid solutions Private Limited (Battery Smart), Twenty Two Motors Private Limited (Bounce Infinity, Esmito Solutions Pvt Ltd.

3. What are the main segments of the India Battery Swapping for Electric Two-Wheelers Market?

The market segments include Service Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Focus of Manufacturers on Improving Lithium Ion Batteries Expect to Enhance Demand.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Taiwan-based battery-swapping ecosystem leader, Gogoro, announced a B2B partnership with India's EV-as-a-Service platform Zypp Electric to begin its battery-swapping pilot service in the country. Both companies plan to accelerate the shift of last-mile deliveries to electric using battery swapping.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Swapping for Electric Two-Wheelers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Swapping for Electric Two-Wheelers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Swapping for Electric Two-Wheelers Market?

To stay informed about further developments, trends, and reports in the India Battery Swapping for Electric Two-Wheelers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence